Professional Documents

Culture Documents

2021 09 Caribbean Monthly Report PDF

Uploaded by

AlanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

2021 09 Caribbean Monthly Report PDF

Uploaded by

AlanCopyright:

Available Formats

WHO WILL DELIVER T&T FROM DISINFORMATION, DEFAULT AND DARKNESS?

Moody’s downgraded the Government of T&T to Ba1 (non-investment grade / ‘junk’) over four years ago (long before COVID)

on April 25, 2017. S&P downgraded the Government of T&T to BBB in 2019 and BBB- (one notch above ‘junk’) in 2020. In

July 2021, S&P put its BBB- rating on negative outlook, which means that a downgrade (in this case, to junk) is their most

likely next ratings action, especially if things continue along the current macroeconomic trajectory. Not one of the rating

agencies’ actions over the past 6 years has been positive, indicating a steadily increasing probability of sovereign default.

On September 18th 2021, the Jamaica Gleaner carried an article quoting the most recent public expression of my view

that The Bahamas and Trinidad & Tobago are the most at-risk of suffering balance of payments crises / sovereign debt

defaults in the Caribbean. It would appear that this may have prompted a reaction from the Minister of Finance in T&T,

who on September 19th tweeted “I have observed some egregious misinformation published in the regional media about

the TT economy. The fact is that through prudent management we have 8.7 months of Import Cover, US$7.1B in Reserves,

US$5.6B in the HSF, AND Investment-Grade Credit Ratings, all amid Covid-19” and “The article in today's Sunday Guardian

which claims that T&T will soon default on its sovereign loans is utter rubbish. One month ago, we affirmed our

Investment Grade Credit Rating with Standard & Poor’s, a premier sovereign credit rating agency. This is irresponsible

journalism.” But by the Minister’s own admission via his tweet on August 24th “T&T's Foreign Reserves have just been

boosted by the equivalent of US$644 Million, as a result of a global distribution by the IMF of Special Drawing Rights

designed to help countries cope with the Forex demands of Covid-19. Our Net Foreign Reserves are now back over US$7

Billion.” Surely the Minister wasn’t attempting to take credit for this boost to reserves by citing his ‘prudent management’.

| Were it not for USD loans, HSF drawdowns, IMF SDRs, reserves would be USD1.85bn

Leaving the Minister’s disinformation aside, the facts are that were it not for Government’s USD borrowing of USD2.5

billion since 2014, drawdowns from the Heritage and Stabilization Fund (HSF) of USD2.1 billion, and the USD644 million IMF

SDR injection, T&T’s foreign reserves would now stand at a mere USD1.85 billion or roughly TWO MONTHS of import cover.

And these USD loans and drawdowns are being used to pay the interest on existing debt and other recurrent expenditure

(Transfers & Subsidies, Wages & salaries in particular), but NOT to pay VAT refunds and other arrears that the Government

continues to accumulate. This is anything BUT prudent management of reserves themselves, nor the way they are spent.

And this haemorrhaging of USD is by no means a pandemic phenomenon, or a recent one for that matter - the Government

has been borrowing and withdrawing from the HSF steadily since 2014. Over the last 12 months alone, we have been

burning through our organic reserves (excluding debt, IMF SDRs and HSF withdrawals) at a pace of about USD133 million

per month, such that T&T has lost 81% of its organic reserves in the last 6 years. The TTD money supply to USD reserve

ratio reached TTD14.56 : USD1.00 in June 2021, versus an official exchange rate of about TTD6.80 : USD1.00, demonstrating

high and mounting pressure on the overvalued TTD / exchange rate. This is all anything BUT ‘prudent management’.

1 SEPT • 2021 | BOOK AN ADVISORY SESSION WITH MARLA AT: www.marladukharan.com/book-marla

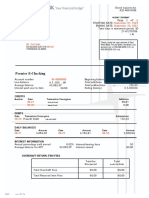

BAHAMAS BARBADOS CAYMAN ISLANDS

General elections on Sept 16 saw a change The IMF’s SDR allocation of USD129 million The Cayman Islands lost roughly 6% of its

in Government, having secured 32 of 39 has boosted net international reserves to population in 2020, returning it to near 2018

seats. The next day, Moody’s downgraded more than USD1.4 billion in August 2021. In levels at 65,786, with the number of

Bahamas’ sovereign rating to ‘Ba3’ (junk) June 2021, average inflation marginally households at 27,084. Preliminary

and maintained its negative outlook, citing increased to 1.5%. Inflationary pressures estimates put GDP per capita down 5.5%

the ongoing effects of the global pandemic continue to be largely driven by y/y to KYD68,674 in 2020. The number of

and Hurricane Dorian. The economy transportation prices up 17% y/y and Trusts and Bank licenses continued to

contracted 14.5% in 2020 with declines in housing/utilities up 6.9% y/y. Clothing decline in 2020 for the 20th consecutive

the tourism and construction sectors prices and household equipment fell 12.9% year, now standing at 227 - only 39% of its

based mainly on pandemic-related y/y and 5.4% y/y, respectively. For the first 2000 level. The number of insurance

measures. In June-July 2021, stayovers seven months of 2021, there was a total of companies improved slightly y/y to 679, but

reached 72% of corresponding 2019 levels. 24,461 unemployment claims received by remains close to 2003 levels. The number

UPDATE

In August 2021, The Bahamas saw its 4th the NIS - a decline of 43% y/y. The IMF of company registrations however, posted

wave of COVID cases. Government debt concluded a virtual staff visit on August 27, continued growth reaching 111,568 in 2020,

reached BSD10.356 billion at end-June 2021, 2021 where they identified that indicative up 1.8% y/y, with new registrations at 11,731

up 16% y/y. External debt rose 44% y/y in targets were met. A combination of smaller - the 9th best level on record. Over the

July 2021 to USD4.36 billion, providing a GDP due to weaker economic activity, and period Jan-Aug 2021, fiscal revenue of

boost to international reserves. An SDR higher debt, led to a rise in the debt/GDP KYD731 million and expenditure of KYD584

allocation of SDR174.8 million added ratio to 151.8% at end-March 2021 vs. 144% million resulted in a fiscal surplus of KYD147

approximately USD247.5 million to at the end-2020. YTD tourism arrivals million - 12% higher than budgeted.

international reserves in August 2021. dropped 87% for January – July 11, 2021. The Proceeds from private fund fees and

International reserves stood at USD2.61 stand-alone month of July 2021 saw a liquidations outweighed the shortfall in

billion in July 2021, up 32% y/y, with usable significantly better result with 10,819 tourism related fiscal revenue. Govt has

reserves at USD1.31 billion. We expect a debt stopover arrivals, up 60% y/y, though only announced that the next phase of border

restructure and an IMF program in the next 18% of July 2019 levels. reopening will no longer take place in 2021,

year or two. based on a resurgence in COVID cases.

Stay-over: Stay-over (est): Stay-over:

TOURISM

2021: 491,355 (July) +35% y/y 2021: 21,704 (mid-July) -87% y/y 2021: 2,085 (Mar) -98.5%

Cruise pax: Cruise pax (est): Cruise pax:

2021: 40,070 (July) -97% y/y 2020: 250,881 (Dec) -64% y/y 2020: 538,140 (Dec) -76%

GROWTH

-14.5% (2020) -17.6% (2020) -6.7% (2020)

External Reserves International Reserves Foreign Reserve Assets

USD Millions (Jan 2010 - July 2021) 2,900 USD Millions (Jan 2010 - May 2021) 1,200 USD Millions (Dec 2017 - Sept 2020) 190

180

1,000

2,400

170

RESERVES

800 160

1,900

150

600

140

1,400

400 130

120

900

200

110

400 0 100

Source: Central Bank of The Bahamas, Marla Dukharan Source: Central Bank of Barbados, Marla Dukharan Source: CIMA, Marla Dukharan

Central Bank estimates the recovery could The Central Bank expects growth in the The Gov’t expects growth for 2021 will be

OUTLOOK

take until 2023 with only incremental range of 1-3% in 2021. IMF forecasts gradual 1.2%, accelerating in 2022 to 4.7% as

growth in 2021. The IMF forecasts growth recovery to begin at 4.1% for 2021. Growth tourism begins to recover. For 2023-2025,

at 2% in 2021, a stronger recovery in 2022 will return to a medium-term average of 2% Gov’t expects growth will average 2.9% per

of 8.5%, and pre-pandemic levels of activity as structural reforms are implemented. annum.

not expected before 2024.

2 SEPT • 2021 | BOOK AN ADVISORY SESSION WITH MARLA AT: www.marladukharan.com/book-marla

CUBA DOMINICAN REPUBLIC GUYANA

New 2021 growth projections released by Tourist arrivals for Jan-Aug 2021 reached Oil exports continue to drive the economy

ECLAC remain the same for Cuba at 2.2%. 2.94 million, and arrivals are projected to with the IDB reporting growth of 43.5% in

The organization forecast inflation in the grow by 65% to over 4.8 million by the end 2020 and a projected 20.9% for 2021. Oil &

triple-digits in 2021 as a result of the of this year. Inflation reached 7.9% y/y in Gas accounted for 64% of total exports for

unification of the two currencies, Inflation August 2021 driven by transport (+14% y/y) Jan-June 2021, bringing in USD1.297 billion in

reached 18.5% at the close of 2020. The and food and beverages (+11% y/y). foreign exchange. In Aug, int’l reserves

devaluation will support external accounts Accumulative economic growth for Jan-July reached USD819.6 million - the highest level

and is expected to widen the current 2021 exceeded 13% y/y, and the Central since Dec 2012. The outlook for the non-oil

account surplus with respect to GDP. Fiscal Bank expects GDP will expand by at least economy remains highly uncertain due to

accounts remain under severe stress with 10% in 2021. For Jan-July 2021, exports rose major floods that began in May 2021.

the fiscal deficit projected to reach 18.3% of 25% y/y to USD7.04 billion. Domestic Roughly 52,000 households were impacted,

GDP this year - sharper than the 17.7% of demand is recovering, with imports rising according to the IDB. Annual inflation

UPDATE

GDP deficit recorded last year. Cuba’s 68% y/y for the month of July. Remittances reached 7.7% in July as food prices surged

population declined in 2020 for the 4th for Jan-Aug 2021 surpassed USD7 billion, up 17%. Prior to the flooding, annual inflation

consecutive year, as the country lost 39% y/y, bringing the total for the last 12 was 2.8% in April, and food prices were up

57,629 residents since 2016. Authorities months to over USD10.1 billion. US stimulus 6.2% y/y. In terms of volume, exports for

expect to lose 83,118 more in population by packages and their economic recovery are Jan-June 2021 declined y/y for all major non-

2035. The aging population is a growing major factors behind this growth, as nearly oil commodities except rum and diamonds,

economic challenge, with the over 60 85% of remittances come from the US, both of which outperformed Jan-Jun 2019

population at 1.36 times the population where over 2 million people of Dominican results as well, by 26% and 16%

under 15. A gradual reopening of borders origin reside. International reserves respectively. Declines were recorded for

and relaxation of COVID protocols is reached USD13 billion, (up USD649 million in sugar (-9% vs 2020, -31% vs 2019), rice (-4%

expected to begin on November 15. Cuba August based on SDRs), providing 7.5 vs 2020, +13% vs 2019), dried bauxite (-10%

received on average 20,000 visitors per months import cover. At the end of August, vs 2020, -72% vs 2019), gold (-22% vs 2020,

month in Jan-July 2021 vis-à-vis 408,000 per the DOP appreciated for the 3rd consecutive -19% vs 2019) and timber (-17% vs 2020, -39%

month for the same period of 2019. month, +2.3% to DOP57.18 : USD1.00. vs 2019).

Stay-over: Stay-over: Stay-over:

TOURISM

2021: 141,316 (Jul) -86% y/y 2021: 1,897,643 (Jun) +36%y/y 2021: 13,599 (Feb) -73% y/y

Cruise pax: Cruise pax: Cruise pax:

2018: 877,500 +43% y/y (*341,005 from USA) 2021: 4,841 (Apr) -99%y/y n/a

GROWTH

-10.9% (2020) -6.7% (2020) 43.4% (2020)

Net International Reserves Net International Reserves

USD Millions (Jan 2010 - Aug 2021) 14,000 USD Millions (Jan 2015 - May 2021) 750

12,000 700

RESERVES

10,000 650

8,000 600

n/a

6,000 550

4,000 500

2,000 450

0 400

Source: Central Bank of the Dominican Republic, Marla Dukharan Source: Bank of Guyana, Marla Dukharan

We expect growth to remain below 3% in Growth is projected to be in the double- The World Bank forecasts 7.8% growth in

OUTLOOK

2021. Recovery beyond this is largely digits, at least 10% for 2021, according to 2021 and 3.6% in 2022. The IMF forecasts

contingent on tourism, investment in the Central Bank. The IMF expects growth 16.4% growth in 2021, 46.5% growth in 2022,

agriculture and power generation, and of 5.5% in 2021, with growth averaging 5% 30.6% in 2023, and 3% average in

improving int’l relations / sanctions. in the medium-term. subsequent years.

3 SEPT • 2021 | BOOK AN ADVISORY SESSION WITH MARLA AT: www.marladukharan.com/book-marla

JAMAICA SURINAME TRINIDAD & TOBAGO

Remittances continue to reach historic A USD175 million SDR allocation from the IMF Economic activity in H1 2021 continued to be

monthly highs, amounting to just over boosted foreign currency reserves, which affected by weak energy sector production,

USD2 billion for the first 7 months of 2021, reached USD610 million in August 2021 - the resulting from domestic natural gas supply

~30% shy of full-year 2020 inflows (the highest level since May 2018. The average issues and pandemic-related constraints.

highest level recorded in 7 years). Prices exchange rate in August was SRD21.53 : The Central Bank’s Quarterly Index of Real

increased slightly in August 2021 m/m by USD1.00, depreciating 65% y/y. Consumer Economic Activity estimates a contraction

0.9% driven by food and transport prices. prices rose 59.8% y/y in August based on in of 7.7% y/y in Q1 2021, following an

Year-on-year, inflation measured 6.1%. Total the pass-through effects of the SRD average -8.7% y/y contraction for the 4

spending on imports and earnings from depreciation. In the 12 months to April, the quarters of 2020. In Q1 2021, activity in the

exports for Jan-May 2021 increased 12% y/y monthly economic activity index declined energy sector declined 13.4% y/y, and

and 24.6% y/y, respectively. Higher imports 11.2% y/y, albeit a slower deterioration than activity in the non-energy sector fell 4.2%

UPDATE

of fuels (+42.7%) and raw materials (+13.8%) the 13.3% y/y contraction in March. Higher y/y. International reserves increased to

largely drove the overall increase in local fuel sales benefitted the trade sector. USD7.13 billion in August 2021 based on a

imports. USA, Brazil, China, Japan and The perceived improvement in manufac- USD644 million SDR allocation. Rising

Colombia accounted for 65.4% of Jamaica’s turing is attributable to the early 2020 Government debt and high fiscal deficits

imports. Reaching JMD148.24 : USD1 on Sept maintenance shutdown at the refinery. A continue to pose downside risks to the

23, the exchange rate appreciated m/m by slower contraction in banana production economy. In August 2021, CariCRIS lowered

3.7% but depreciated 3.8% vs Sept 23, 2020. was also noted for agriculture. Gold its sovereign rating by 1 notch to CariAA

Debt/GDP increased to 106% from 94% in production declined as COVID restrictions from CariAA+ with a stable outlook. A

2020, owing largely to the pandemic’s impacted commuting, and heavy rainfall revised fiscal deficit of 11% of GDP was

effect on GDP. For 2021, growth is forecast affected production at the Rosebel Mine. presented at the mid-year budget review

at 1.5%, and will support a reduction in April 2021 was the 2nd consecutive month to vs. the budgeted 5.6% for FY2020/21. The

debt/GDP to 96.5%. post growth y/y, up 7% with respect to April FY2021/22 budget is expected to be

2020. delivered on October 4th 2021.

Stay-over: Stay-over:

TOURISM

2021: 532,545 (Jun) -8.4% y/y 2021: 2,774 (Jun) -97% y/y

n/a

Cruise pax: Cruise pax:

2020: 449,271 (Dec) -71.1% y/y 2020: 45,580 (Dec) -50% y/y

GROWTH

-10.2% (2020 prelim. est.) -14.5% (2020 prelim. est.) -10% (2020 prelim. est.)

Net International Reserves Foreign Currency Reserves Net Official Reserves

5,000 USD Millions (Jan 2010 - Aug 2021) 800 USD Millions (Jan 2010 - Aug 2021) 12,000

USD Millions (Jan 2010 - Aug 2021)

700

11,000

4,000

RESERVES

600

10,000

500

3,000

400 9,000

2,000 300

8,000

200

1,000

7,000

100

0 0 6,000

Source: Bank of Jamaica, Marla Dukharan Source: Centrale Bank van Suriname, Marla Dukharan Source: Central Bank of Trinidad and Tobago, Marla Dukharan

The EPOC anticipates that the economy will For 2021, the National Planning Office We expect that the economy contracted by

OUTLOOK

recover to pre-pandemic levels in expects a further contraction of 1.9%. The at least 10% in 2020. The IMF forecasts

FY2023/24. The IMF forecasts 1.5% growth Govt has agreed on a program with the IMF growth of only 2.1% in 2021 and 4.1% in 2022.

in 2021, and 5.7% in 2022. Fitch forecasts as a debt / balance of payments crisis is We also expect a balance of payments

growth at 4.5% in 2021 and 5.2% in 2022. underway. The IMF is projecting only 0.7% crisis and an IMF program by 2022, at the

growth for 2021 and 1.5% growth in 2022. latest.

Disclaimer: Marla Dukharan and GNM Group, LLC (herein MD) disclaims any liability for any loss or damages arising from errors, omissions, facts, views, information and opinions in any of our content, reports, presentations or publications. Some information contained in this report was prepared by or obtained from sources that MD believed to

be reliable and accurate at the time of publication. MD has not independently verified all estimates, facts and assumptions contained in this report. MD does not guarantee the accuracy, completeness, fairness or timeliness of the content provided herein. Recipients should not regard the information provided in this presentation, or any other

content produced by MD as a substitute for the exercise of their own judgment. Any recommendations made in the presentation may be unsuitable for certain investors or decision-makers based on their specific investment or business objectives and their financial position. The report has been prepared solely for informational purposes.

Any opinions expressed in this report are subject to change without notice, and MD is under no obligation to update the information contained herein. The information provided by MD as part of this report and online content derived thereafter is the property of MD, and cannot be copied, reproduced, modified, republished, repackaged, posted,

displayed, transmitted, distributed, redistributed or sold in any way, either in whole or in any part without the prior written permission and consent of MD.

4 SEPT • 2021 | BOOK AN ADVISORY SESSION WITH MARLA AT: www.marladukharan.com/book-marla

You might also like

- 310 Catalogue Flutes A Bec FRDocument6 pages310 Catalogue Flutes A Bec FRJilian Dela PenaNo ratings yet

- The Global Financial Crisis: Module 3 Housing and MortgagesDocument30 pagesThe Global Financial Crisis: Module 3 Housing and MortgagesAlanNo ratings yet

- The Global Financial Crisis: Anxiety, Part 1Document36 pagesThe Global Financial Crisis: Anxiety, Part 1AlanNo ratings yet

- From Blackbirding To Blacklisting - The Eu'S Ongoing Subjugation of VanuatuDocument4 pagesFrom Blackbirding To Blacklisting - The Eu'S Ongoing Subjugation of VanuatuAlanNo ratings yet

- Pentatonic Guitar MagicDocument7 pagesPentatonic Guitar MagicTiffany Malone100% (6)

- We must forgive upfront our truly brave and genuine Leaders for their inevitable mistakes nowDocument4 pagesWe must forgive upfront our truly brave and genuine Leaders for their inevitable mistakes nowAlanNo ratings yet

- Llobet El Noi de La MareDocument2 pagesLlobet El Noi de La MareAlanNo ratings yet

- Recording GuitarDocument7 pagesRecording GuitarAna Abigail Cardenas MuñasquiNo ratings yet

- Five Point MatchDocument24 pagesFive Point MatchAlanNo ratings yet

- Turlough O'Carolan (1670-1738) (First Untitled Piece) : © Bradford Werner, 2017. All Rights ReservedDocument2 pagesTurlough O'Carolan (1670-1738) (First Untitled Piece) : © Bradford Werner, 2017. All Rights ReservedCorrado BiermannNo ratings yet

- Kitab I AqdasDocument102 pagesKitab I AqdasAlanNo ratings yet

- Bond Application For DownloadDocument1 pageBond Application For DownloadAlanNo ratings yet

- Carlsen V CarunaDocument7 pagesCarlsen V CarunaAlanNo ratings yet

- IMF Reforms Needed to Avoid BoP Crisis in T&TDocument4 pagesIMF Reforms Needed to Avoid BoP Crisis in T&TAlanNo ratings yet

- Cayman's pandemic response remains gold standard globallyDocument4 pagesCayman's pandemic response remains gold standard globallyAlanNo ratings yet

- Ben Greenfield's Epic Morning RoutineDocument29 pagesBen Greenfield's Epic Morning RoutineAlan80% (10)

- Muhendislik SinavProgrami-Guz 3Document22 pagesMuhendislik SinavProgrami-Guz 3MuratYetkinAslanNo ratings yet

- Hague RulesDocument10 pagesHague RulesIAdinaNo ratings yet

- Fundamentals of Music Theory Lecture - 3Document6 pagesFundamentals of Music Theory Lecture - 3NiminiminiNo ratings yet

- Claimant injured falling down hotel pool stepsDocument13 pagesClaimant injured falling down hotel pool stepsAlanNo ratings yet

- Celebrating The Past, Embracing The FUTURE: The Eastern Caribbean Supreme Court at Fifty, 1967-2017 by Justice Don Mitchell (Ret)Document30 pagesCelebrating The Past, Embracing The FUTURE: The Eastern Caribbean Supreme Court at Fifty, 1967-2017 by Justice Don Mitchell (Ret)AlanNo ratings yet

- The Government Securities Market in Trinidad & TobagoDocument44 pagesThe Government Securities Market in Trinidad & TobagoAlanNo ratings yet

- SpiderIV75 SettingsDocument6 pagesSpiderIV75 SettingsCesar Roberto Romero RodriguezNo ratings yet

- Lunenburg, Fred C. Reciprocal Theory IJSAID V12 N1 2010Document2 pagesLunenburg, Fred C. Reciprocal Theory IJSAID V12 N1 2010AlanNo ratings yet

- Secondary Market Trading Brochure-FrontDocument2 pagesSecondary Market Trading Brochure-FrontAlanNo ratings yet

- Cigars PDFDocument1 pageCigars PDFAlanNo ratings yet

- Fingering Chart RecorderDocument3 pagesFingering Chart RecorderMikeSufi100% (9)

- Microphone BasicsDocument4 pagesMicrophone BasicsAlanNo ratings yet

- The Power of Pawns PDFDocument11 pagesThe Power of Pawns PDFAlan43% (7)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Working Capital Policy Example Problem MDocument23 pagesWorking Capital Policy Example Problem MPeter PiperNo ratings yet

- Module 2-Topic 5Document5 pagesModule 2-Topic 5MILBERT DE GRACIANo ratings yet

- P&G Case StudyDocument5 pagesP&G Case Studystrada_squalo100% (1)

- Merck Innovation Centre Case StudyDocument11 pagesMerck Innovation Centre Case StudyGokul ThilakNo ratings yet

- Ia - Valix2 Problem 20 - 4Document3 pagesIa - Valix2 Problem 20 - 4Parvana NamikazeNo ratings yet

- Plat Bus Checking (... 2179)Document1 pagePlat Bus Checking (... 2179)AmirniteNo ratings yet

- Ashraf - Ali AMU COmmerce CVDocument30 pagesAshraf - Ali AMU COmmerce CVWajid AliNo ratings yet

- Bill of Lading Draft: CarrierDocument2 pagesBill of Lading Draft: Carrierglobal bintan permataNo ratings yet

- 101 - Security Bank and Trust Company, Inc. vs. Cuenca, G.R. No. 138544, 3 October 2000Document2 pages101 - Security Bank and Trust Company, Inc. vs. Cuenca, G.R. No. 138544, 3 October 2000BryanNo ratings yet

- East West Bank StatementDocument1 pageEast West Bank StatementHalon GlenNo ratings yet

- scipg,+Journal+manager,+JABFR 2020 9 (2) 50 56Document7 pagesscipg,+Journal+manager,+JABFR 2020 9 (2) 50 56Alamin Rahman JuwelNo ratings yet

- Reorder PointDocument2 pagesReorder Pointpankaj1230No ratings yet

- Revathy Assg Ratio CalculationDocument2 pagesRevathy Assg Ratio CalculationAishvini ShanNo ratings yet

- Case Study #3 - Gigantone, JustineDocument2 pagesCase Study #3 - Gigantone, JustineJustine LinesNo ratings yet

- Economic GlobalizationDocument2 pagesEconomic GlobalizationFerly Ann BaculinaoNo ratings yet

- Datacamp Python 3Document36 pagesDatacamp Python 3Luca FarinaNo ratings yet

- STEP 1: Setting Up Your UCC Contract Trust Account: (FIRST Package To Treasury)Document2 pagesSTEP 1: Setting Up Your UCC Contract Trust Account: (FIRST Package To Treasury)Jahe El97% (58)

- PFL New Form 4 1Document3 pagesPFL New Form 4 1Neil PilosopoNo ratings yet

- Noa-Iit Ob2320170627071310ufp PDFDocument1 pageNoa-Iit Ob2320170627071310ufp PDFjasper haiNo ratings yet

- Project Report ON Comparative Analysis of Financial Performance of Zomato: A Ratio Analysis ApproachDocument49 pagesProject Report ON Comparative Analysis of Financial Performance of Zomato: A Ratio Analysis Approachsudhanshu jeevtani100% (5)

- Chapter 1 Economic Growth and DevelopmentDocument14 pagesChapter 1 Economic Growth and DevelopmentHyuna KimNo ratings yet

- Question 1 - Sale DeedDocument5 pagesQuestion 1 - Sale DeedYamini GurjarNo ratings yet

- Chapter 10: Lessee Accounting: IFRS 16: New Lease Standard P Resent ValueDocument5 pagesChapter 10: Lessee Accounting: IFRS 16: New Lease Standard P Resent ValueCzar RabayaNo ratings yet

- Topic 1: Aircraft Industry: Pre-Text Task. Theoretical Background A: The Importance of Technical TranslationDocument19 pagesTopic 1: Aircraft Industry: Pre-Text Task. Theoretical Background A: The Importance of Technical TranslationKate BladeNo ratings yet

- Ans: D: Multiple ChoiceDocument14 pagesAns: D: Multiple ChoiceNah HamzaNo ratings yet

- Globalization Opportunities and ChallengesDocument23 pagesGlobalization Opportunities and ChallengesuraneeNo ratings yet

- Global Marketing Channels and Physical DistributionDocument24 pagesGlobal Marketing Channels and Physical DistributiondipanajnNo ratings yet

- Executive SummaryDocument6 pagesExecutive Summaryapi-454213734No ratings yet

- Economics 11th Edition by Arnold ISBN 113318975X Test BankDocument37 pagesEconomics 11th Edition by Arnold ISBN 113318975X Test Bankamber100% (26)

- Tri Merge-Instructions 2Document11 pagesTri Merge-Instructions 2Samson Fortune92% (12)