Professional Documents

Culture Documents

Bank Scan Edited

Uploaded by

Dinesh Patra0 ratings0% found this document useful (0 votes)

32 views20 pages1. The bank had 9 branches and 4 ATMs during the inspection period. It was found to be operating in extended areas without RBI permission and making withdrawals beyond authorized limits from deposit accounts.

2. Multiple withdrawals beyond Rs. 40,000 were allowed from single depositors' accounts in violation of directions. Loans were also adjusted against deposits before receiving permission from RBI.

3. The bank was advised to open an escrow account to properly handle fresh deposits, as per RBI's instructions. However, deficiencies remained in complying with regulatory directions regarding operations and withdrawal limits.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Document1. The bank had 9 branches and 4 ATMs during the inspection period. It was found to be operating in extended areas without RBI permission and making withdrawals beyond authorized limits from deposit accounts.

2. Multiple withdrawals beyond Rs. 40,000 were allowed from single depositors' accounts in violation of directions. Loans were also adjusted against deposits before receiving permission from RBI.

3. The bank was advised to open an escrow account to properly handle fresh deposits, as per RBI's instructions. However, deficiencies remained in complying with regulatory directions regarding operations and withdrawal limits.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

32 views20 pagesBank Scan Edited

Uploaded by

Dinesh Patra1. The bank had 9 branches and 4 ATMs during the inspection period. It was found to be operating in extended areas without RBI permission and making withdrawals beyond authorized limits from deposit accounts.

2. Multiple withdrawals beyond Rs. 40,000 were allowed from single depositors' accounts in violation of directions. Loans were also adjusted against deposits before receiving permission from RBI.

3. The bank was advised to open an escrow account to properly handle fresh deposits, as per RBI's instructions. However, deficiencies remained in complying with regulatory directions regarding operations and withdrawal limits.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 20

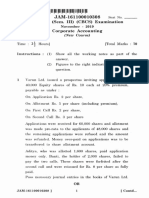

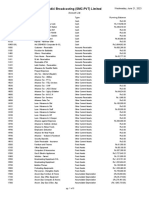

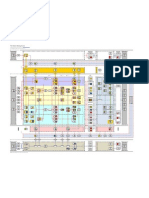

Inspection U/s 365 of the B.R.

Act 1949 (AACS) with reference to its Financial Position

31.03.2017 – Compliance

Para no. .O.'s Observation Compliance

1. Introduction and Overview:

i. The bank's branch network remained unchanged at 9 branches We have already pointed out in

and 4 on-site ATMs (closed after imposition of direction) compliance of this objection that the

during the recent period of review (PPR). The bank was working ii1 extended area of operation will

registered as a co-operative society on May 05,1993 under the be taken after taking.prior approval of RBI.

U.P. Co-operative Societies Act, 1965. It continued to function We have informed RBI that we will not

as a bank based on the latter Ref. No. UBD. BR. 947/C-2(15) operate any activity in extended area of

(A)-85/85 dated June 04, 1985 from RBI, CO indicating operation.

inclusion of the bank's name in the list of primary co-operative

banks in U.P. The bank was later granted a license on July 28,

2008 to carry on banking business. It was categorized as Tire I

bank a on The DPI. The bank had extended its area of operation

to all districts of Kanpur Division by amending its bye-laws on

January 03, 2011 without obtaining RBI permission. The

deficiency had not been rectified despite the same having been

pointed out in successive RBI inspection reports.

2 Issue of All Inclusive Directions(AID)

i. Despite being pointed out in previous inspection report Regarding withdrawal of deposits beyond

regarding withdrawal of deposits beyond the limit in violation the limit we have to submit that as per

of the direction in several accounts withdrawals of more than directions the payment to staff members

40000 were allowed without submitting cases for hardship to was not restricted. The list given in this

RBI. In many of deposit accounts withdrawals of more than para Serial-1 Sunita Gupta has withdrawn

100000 was also allowed. Details are given below:- the amount of Gratuity/PF after death of

Account number Name Remark her husband Shri Anil Gupta who was

(Withdrawn in employee of the bank, Serial-3 Sher

cash) Rs. Bahadur Singh a staff member of the bank,

Saving Account Serial-10 Smt. Geeta Bajpai a staff member

001000327401 Sunita Gupta 4.43 Lakh of the bank, Serial-11 Shashikant Tripathi a

Withdrawn daily deposit agent and has withdrawn the

after directions amount of earned commission. Smt.

001000372601 Shakuntla 1.37 Lakh Shakuntla Devi has withdrawn the amount

Devi Withdrawn with prior permission of RBI. The other

after directions members of this list has withdrawn the

031000483001 Sher Bahadur 1.08 Lakh amount according to which 40,000/- may

Singh Withdrawn be withdrawn from every account.

after directions

041000082701 Mahaveer 1.13 Lakh

Singh Withdrawn

after directions

041000210501 Pavitra Kumar 1.34 Lakh

Tiwari Withdrawn

after directions

041000387101 Pradeep Kumar 2.80 Lakh

Prajapati Withdrawn

after directions

041000611901 Munna Lal 1.03 Lakh

Batham Withdrawn

after directions

041000646401 Phool Chandra 2.00 Lakh

Withdrawn

after directions

051000068901 Munna 1.01 Lakh

Withdrawn

after directions

091000101701 Geeta Bajpai 1.29 Lakh

Withdrawn

after directions

05100026430 Shashi Kant 1.58 Lakh

1 Tripathi withdrawn

after directions

12100066960 Dev Kumar 1.01 Lakh

1 withdrawn

after directions

12100088360 Shiwangi 1.10 Lakh

1 Pandey withdrawn

after directions

12100115470 Kuldeep 1.01 Lakh

1 Singh withdrawn

after directions

12100131470 Serwesh 1.01 Lakh

1 Tiwari withdrawn

after directions

12100119570 Vineeta 1.01 Lakh

1 Kushwaha withdrawn

after directions

12100134940 Dharmraj 1.20 Lakh

1 Singh withdrawn

after directions

12100140050 Champa Devi 1.01 Lakh

1 withdrawn

after directions

Fixed Deposits

041800039801 Himanshu 1.02 Lakh

withdrawn

after directions

041800147401 Bindeshwari 1.20Lakh

withdrawn

afterdirections

ii. Multiple Deposit withdrawal

Despite being pointed out in previous reports, proceeds of As have already mentioned that as per

multiple term deposits standing against the names of single instructions of RBI under directions Rs.

depositors and having cumulative maturity value far exceeding 40,000/- was allowed to be withdrawn from

the enhanced ceiling of Rs 40000/- were paid to the respective every account. Hence these withdrawal

depositor. The bank was knowingly doing it. In some cases, were allowed. Now we are informed that

single cheque/voucher was issued for withdrawal from different only Rs. 40,000/- is allowed to any single

accounts of a particular depositor. Multiple withdrawals were depositors. We have immediately stopped

seen in cases of Ram Prakash Awasthi (17.69 lakhs), Leelawati the previous practice.

(3.2 lakhs), 13al KrishnrGupta (1.6 lakhs), Anamika Gupta(1.6

lakhs), Shvam Kumar Gupta (3 lakhs), R.C Mishra (3.2

lakhs)etc. A detailed list of withdrawals allowed in a few

accounts is given in Annex 1.

iii. Adjusting loan against deposit-

The bank was allowed to adjust loans against term deposit as The RBI has allowed us to adjust loan

per letter dated deposit as letter dated December 30, 2016 against term deposit as per letter mentioned

subject to terms and conditions of the loan agreement. in this para. In this reference we have to

However, it was observed that the bank had already adjusted submit that our request for this purpose was

loans beyond the 40000 limit during the PPR even before it already pending with RBI and we were

received permission from RBI. confident that our this request will be

Sr. Name Account no. Amount Date accepted hence the loan accounts

Adjustment mentioned in this para were adjusted in

(in Lack) interest of the bank prior to permission of

1. Shivendr 00010005900 15.73 October RBI.

a Kumar 31,2015

Tiwari

2. Babu 03400068401 1.22 September

Ram 30,2015

3. Kusum 09040003280 1.46 October

Shukla 12, 2015

IV Fresh deposits in savings and Current Account- Regarding opening of escrow account as

The bank was maintaining a current account with ICICI Bank per advise of RBI we have to submit that

wherein amounts received through RTGS/NEFT were we have informed RBI that bank's current

automatically credited to the accounts of the bank's SB and account are already being operated in

current account holder. Many credits aggregating to Rs. 129.86 HDFC Bank, Corporation Bank, Punjab &

lakh had been received during the period from July 7, 2015 to Sind Bank & ICICI Bank. Hence a new

September 30, 2017 in the accounts after imposition of escrow was not opened and RBI has not

directions through this account and the bank did not take any further pressed for the same. As for as

step to slop these credits. The bank was advised to open an RTGS/NEFT account is concerned we have

escrow account vide RBI letter dated September 18, 2017 for to submit that the Regional Office is

facilitating recovery in case of loans and advances and already aware of the fact in writing.

permissible expenses as per extant guidelines/directions but However, we submit that withdrawals from

same was not done by the bank till the conclusion for present the accounts after crediting the amount

inspection. It was continuing the RTGS/NEFT account with through RTGS/NEFT have not been

ICICI Bank and was allowing direct deposits to savings and allowed.

current accounts.

v) Operations in account with rent-

The normal operations in the savings account of the lessors of We have stopped normal operations of the

the bank branches were observed in violation of the direction. accounts of lessors of bank branches as

However. The bank had stopped normal operations and started mentioned in this para. However, regarding

paying rent through cheque after June 30, 2017. During the the withdrawal of amount excess to rent

period when the rent was being transferred to the saving amount we have to submit that this was

account of the lessors, The depositors was allowed to withdraw withdrawn in lieu of approval for rent

amount more than the rent amount. Details of discrepancies are payment. However, the rent is now being

given below

paid through cheque.

Account name Account Number Remark

Raj Narayan 011000000701 Total Rent credit

Mishra (Kakadeo) in the account

since the date of

direction was Rs.

4.09 lakhs

whereas

withdrawal during

the same period

was Rs. 7.41

lakhs thus bank

had allowed

additional Rs.2.32

lakhs withdrawal

in violation of the

directions.

Sarojini Devi 081000004701 Rent was credited

(lal Bung) to the A/C

allowed to be

withdrawn

Ashtosh Mishra 121001047901 Rent was credited

Huf (CEO) (RL Nagar) to the A/c allowed

to be withdrawn

Saurav Mishra 121001509901 Rent was

(son of CEO) (R L Nagar) credited to the

A/c allowed to be

withdrawn

Saurav Mishra 091000039801 Rent was

(Son of CEO) (Barra) credited to the

A/c allowed to

be withdrawn

Hemant Kumar 001000359901 An amount of Rs.

(Deo Nagar) 94000 was

withdrawn in

violation of AID

over and above

rent credit since

the date of

imposition of

AID.

vi) Operation in account of Staff-

The bank was paying staff salary in the savings account held Regarding operations in account of staff we

within the bank. These accounts were operating normally even have to submit that the salary/wages will be

after the imposition of directions. As in the case of rent paid through cheque to staff members.

accounts, the bank had allowed withdrawal beyond the salary Regarding the previous operations in this

amount credited in the staff account in violation of restrictions account it is to submit that withdrawal in

imposed by RBI. In the savings account of Shyam Bahadur these accounts have taken place in the

Tripathi (121000509501), the bank had transferred matured cover of staff members. Now we strictly

term deposits to this accounts and allow multiple withdrawals assure to comply with RBI guidelines.

of Rs. 40000 from the account besides the withdrawal of salary.

Staff, including the CEO was allowed to withdraw deposits

from multiple accounts and more than the limit of Rs. 40000

which was violation of RBI directives.

S. No. Name Accounts Amount

withdrawn

1 Shyam 121000509501 Rs. 1.72 lakh was

Bahadur withdrawn from

Tripathi May 01, 2016 to

May 6, 2016.

Ashutos 001800218201 Rs. 2.00 lakh

h Mishra 031800293701 withdrawn from

CEO 051800119501 various FDR

081800051801 Accounts.

121801129001

viii) Monthly Progress- Monthly progress report with details of

The bank was not submitting monthly progress with details of share capital account and quarterly

share capital account to RBI thereby violating para (vii) of the progress report on the proposed action plan

directive DCBS.CO.I3SD-IV. No. D-53/12.28.003/2014-15 has been submitted but these were not

dated June 30, 2015. It had not submitted quarterly progress on submitted regularly. However, the

the proposed Action Plan to RBI. information asked by the Regional Office

are being submitted regularly regarding

cash in hand, cash in bank, deposit profile,

Recovery etc. We assure to submit both the

reports regularly from next month.

3. Assessment of Net-Worth.

3.1 Paid up Share Capital:

i) The paid-up share capital (at book value) of the bank had The refund of share capital amountuaK Rsc

increased from Rs. 482.41 lakh as on the DLI to Rs. 488.05 88.p3 lakh as pointed out in this para we

lakh as on the DPI registering an increase of Rs. 5.64 lakh have to submit that this amount was

(1.17%). The share capital had increased due to infusion of refunded at bra pc h J&fel but the same

fresh capital by existing members to the tune of Rs. 5.64 lakh was not adjusted in share capital account at

during the PPR. The bank had refunded share capital of Rs. Head Office due to restriction of refunding

88.53 lakh during the period from April 1, 2015 to March 31, the share capital in positional negative Net-

2017 but the same was not adjusted in the share capital account worth.

of the bank (details as given in Annex-2).

ii) The CL and SCL balances of the share capital account were The balances of share capital account are

not balanced and the GL was showing an excess balance of Rs. balanced manually. The difference of Rs.

2.02 lakh which had been treated as outside liability by the 2.02 lakh is difference in computer system

Inspection Officer. and manual GL on account of some wrong

feeding. The rectification is going on and

we hope this will be tallied shortly. We

have already submitted our this explanation

in previous compliances.

3.3 The CRAR as assessed by the I.O. at (-) 102.05% as on the The bank has prepared a revised action

DPI was less than the regulatory requirement of CRAR at 9%. plan to augment the share capital by way of

The bank had not taken concrete steps for augmenting the conversion of deposits into equity and fresh

capital and improving the CRAR as required. share amount from the existing members of

the bank. Besides this bank has started

recovery proceedings on war footings. The

recovery from Nagar Nigam Kanpur is

being received regularly. All the defaulters

have been covered under legal recovery

proceedings. The bank has taken

concurrent steps to improve the financials

of the bank and to bring the CRAR level up

to prescribed limit.

3.4 The CRAR had deteriorated sharply from (-) 51.88% as on the The bank has informed Regional Office

DLI to (-) 102.05% as on the Dpi mainly due to increase in regarding the re-structuring of the advances

accumulated losses, requirement of additional provision for pertaining to Nagar Nigam Kanpur in

loan losses, reversal of unrealized interest on non-performing which recovery is coming regularly by

loans and advances, provision for other liabilities, erosion in deducting the installment amount from

value of other assets, and de-recognition of share capital their salary. We have requested RBI to

refunded. consider these cases as secured and

standard. These advances to employees of

Nagar Nigam have been sanctioned

according to Section 40 & sub-section 1, 2,

3 of U.P. Cooperative Societies Act, 1965.

On these grounds provision for loan losses

will be minimized. We are seriously

engaged in raising the share capital and

recovery of NPA accounts this will

certainly improve the CRAR of our bank.

Solvency / Net Worth

3.5 The realizable value of assets of the bank as on the DPI after As in para 3.4 above.

making all provisions and depreciation assessed at Rs. 3926.13

lakh was less than the outside liabilities at Rs. 5518.87 lakh as

worked out in Annex VI. The real of exchangeable value of

paid up capital and reserves (net worth) had been assessed at (-)

Rs. 1592.74 lakh. The divergence between the book value and

the assessed value of net worth is analyzed in Annex VI1.

3.6 There had been a decrease of Rs. 434.37 lakh (37.50%) in the As in para 3.4 above.

real or exchangeable value of paid-up capital and reserves since

the DLI when it was placed at (-) Rs. 1158.37 lakh. This

decrease in net worth was mainly due to increase in

accumulated losses, requirement of additional provision for

loan losses, reversal of unrealized interest on non-performing

loans and advances, provision for other liabilities, erosion in

value of other assets and de-recognition of Share capital

refunded.

3.7, 3.7:- With the real or exchangeable value of paid-up share Regarding these paras we have to submit

3.8 & capital and reserves at (-) Rs. 592.74 lakh as on DPI, the bank that our efforts for increasing share capital

3.9 was not considered to have adequate assets to meet its liabilities and recovery of NPA accounts are

as required under Section 22 (3) (a) of the Banking Regulation vigorously continued. However, if our

Act, 1949 (AACS). Further, the bank did not comply with the submissions are accepted by the RBI we

requirement of minimum capital and reserves prescribed under are confident that our financials will be up

Section 11(1) of the Act, ibid. to the mark and CRAR and Net-worth will

convert up to the required level. In this

3.8:- The assessed value of the net worth further showed that context we submit the actual financial

with reference to the book value, paid up share capital of the position of the bank as under:-

bank was totally wiped out and the deposits had also been

eroded to the extent of 30.21% as on the DPI as compared to a)Deposits to be paid to accoymt holders

the deposit erosion of 17.08% as on the DLI. Rs. 4867.11 lakh

b)Our investinenf and advances:

3.9 The net worth and CRAR were assessed by the 1.0. at (-) (i) Investment in Govt. Securities- Rs.

Rs. 1635.92 lakh and (-) 112.45% respectively as on September 1843.40 lakh

30, 2017 i.e. the last date of the month preceding the date of (ii) Cash in Hand and Cash in bank-

commencement of present inspection. Rs. 38.95 lakh and Rs. 255.37 lakh

(iii) Advances to be recovered-

Rs.3367.15 lakh

On the above grounds we have surplus

funds to meet our liabilities.

3.10 The bank in its action plan dated June 13, 2017 had submitted We are confident to increase our share

a list of depositors who had agreed for conversion of deposits capital by way of conversion of deposits

into equity with an amount aggregating to Rs. 100.44 lakh. into equity up to the fixed targets in our

However, after receipt of approval vide letter dated July 12, action plan and by way of increasing share

2017 from RBI the bank had been able to bring in only Rs. 6.53 amount by existing members till March

lakh till September 30, 2017 against its proposal of Rs: 100.44 2018. The conversion process is in the way.

lakh, thereby increasing the paid-up-capital to Rs. 494.58 lakhs Our efforts for increasing share capital and

as on September 30, 2017. The bank had also proposed to bring recovery of NPA accounts is being

in additional capital of Rs. 180.00 lakh by way of conversion of operated on campaign basis.

deposits by September 2017 but could not materialize the same.

3.11 The bank had inflated its capital by an amount of Rs. 88.53 We have mentioned our view point in

lakh as it had refunded share capital amount to members after para 3.1.1 above. We further submit that

April 1, 2015 but had not adjusted the share capital account. our effective steps to increase the share

The amount of Rs. 88.53 lakh was not reconciled and was capital are still going on and we are very

being debited from branch adjustments account (namely Head hopeful to achieve the target of augmenting

Office account). The refunding of share capital of Rs. 88.53 share capital and to convert our Net- worth

lakh was done despite being in negative net-worth. On positive. As our Net-worth turns into

inspecting HO account, it was observed that the amount of Rs. positive we will adjust this amount of share

77.42 lakh out of Rs. 88.53 lakh was received between March capital amounting Rs. 88.53 lakh.

27, 2015 and March 31, 2015. However the same amount was

fully refunded till May 15, 2015 by the branches. It was done to

inflate the paid-up capital as on March 31, 2015. The amount

had not been reconciled in HO account since more than two

years therefore the share capital of the bank is overstated by Rs.

88.53 lakh. The inspecting officer has derecognized the amount

of Rs. 88.53 lakh from share capital. The details of complete

refund of share capital are given in Annex 2 along with one leg

debit transaction narrations (as no credit transaction was done

by the bank).

3.12 The bank had deliberately inflated the share capital to It is not correct that the share capital was

improve the financials as on March 31, 2015 onwards. The raised by debiting CC account. Virtually

modus operandi adopted by the bank in some of the cases was the share capital amount by the persons as

to accept capital from cash credit accounts and refund the same pointed out in this para have deposited

share capital through cash or cheque. The

CC account of Preeti & Neet Kumar have

been adjusted after approval of RBI. Durga

Filling Centre has deposited rest amount

only Rs. 14.18 lakh is debit balance for

which a cheque by another account holder

has deposited to credit in CC account of

Durga Filling Centre. The permission for

after March 31, 2015. The method was executed in CC Account the same is awaited from Regional Office.

of Durga Filling Centre (Mamta Tripathi, Rajiv Tripathi, In the account of Awasthi Bus Centre

Mahima Tripathi and Vikram Tripathi), Awasthi Bus Centre outstanding balance is Rs. 18.23 laWi in

(Manish Awasthi), and Preeti and Neel Kumar. Durga Filing comparison to Rs. 26.22 lakh as on

Centre and Awasthi Bus Centre have been classified as NPA by 3MD.216. Accordingly these two accounts

the IO. should Hot be treated as NPA.

3.13 The bank was having multiple folio accounts for one Regarding the multiple folio accounts we

shareholder. The bank was opening new folio account for have to submit that this discrepancy

existing shareholders also. Therefore, the total percentage of probably has occurred due to wrong

share capital with any individual shareholder could not be feeding in computer system. This is now

checked. A few instances of multiple folio accounts are Brijesh rectified.

Kumar (Folio No.-901401366201, 901401295301), Chandi Lai

(901400754001, 901400754601) and Govind (901400682901,

901400848601).

4. Funds Management & Investments

4.1 The deposits of the bank had decreased from Rs. 6783.31 lakh We have mentioned our view point in

as on the DLI to Rs. 5271.66 lakh as on the DPI registering a above para- 2. Virtually we have followed

decrease of Rs. 1511.65 lakh (22.28%) during the PPR. It had the RBI directions permitting withdrawal

further decreased to Rs. 4955.21 lakh as on September 30, 2017 of 0.40 lakh from every account. As an

(the last day of the month preceding the date of commencement when we were suggested the allow

of the present inspection). The bank had not adhered to the withdrawal of Rs. 0.40 lakh once to a

directions regarding repayment of deposits as explained in individual account holder. We have

detail in Para 2 of this inspection report. During the period from stopped this practice.

the date of imposition of directions to the end of September

2017, the total outflow on account of payments to the

depositors (as per the terms of the directions) as well as on

hardship grounds was to the tune of 4253.49 lakh.

4.1.1 As per the available data, the bank had 1625 overdue time The part payment of Rs. 0.40 lakh has

deposit accounts amounting to 733.59 lakh as on the DPI. The been made in the most of the overdue FDR

bank had not provided interest on these accounts in accordance account. As per RBI guidelines in overdue

with Para 2 (xi) of the RBI Circular UBD. BPD. (PCB). Cir. FDR account interest is to be given on

No. 9/1;3’0l.000/20p8-09 dated September 01, 2008. saving bank interest rate. We have

Accordingly, a provision of 52.32 lakh towards interest payable provisioned Rs. 5.00 lakh for the same. The

on matured term deposits had been suggested as on the DPI. payment of interest will be assured at the

time of payment of the said FDRs.

4.2 The bank did not have a uniform interest rate for deposits of The compounding of interest in FDRs

same period as it was compounding interest quarterly, semi- quarterly and in saving account half yearly

annually and annually in different accounts. This was a is our practice. We strictly follow the

violation of Para 4(b) of Master Direction DCBR. Dir. No. instant guidelines of RBI.

1/13/01.000/2015-16 dated May 12, 2016 on 'Interest Rates on

Rupee Deposits'.

4.3 The bank had not properly allotted the Unique Customer We have explained our view point in

identification Code (UCIC) to its customers as mandated in previous compliances. Virtually the letter

terms of Para 62 of the RBI Master Directions DBR.AML.BC. mentioned in this para was received after

No.81/14.01.001/2015-16 dated Feb. 25, 2016 on 'Know You 7th July, 2015. Hence Unique Customer

Customer (KYC)' dated February 26, 2016. A number of Identification Code was not allotted. Now

customers had been allotted multiple customer IDs and it was we have allotting these codes.

very difficult to ascertain the aggregate balance held by a

particular customer.

4.4 Size and Composition of the Investment Portfolio

4.4.1 The bank's investment in Government and other approved The NDTL as on 30.09.2017 is

securities had decreased from Rs. 2857.69 lakh as on the DLI Rs.4867.11 lakh. The detailed submission

to Rs. 2043.22 lakh as on the DPI forming 37.63% of the bank's has already been given in paras-3.7, 3.8 &

reported NDTL of Rs. 5429.68 lakh applicable for March 31, 3.9 above.

2017. The investment in Government Securities had further

decreased to Rs. 1833.37 lakh as on September 30, 2017.

4.4.3 The bank had transferred an amount of Rs. 1.35 lakh Marking of unclaimed deposits is under

pertaining to 98 accounts on February 27, 2017 to the DEAF process as suggested by IO in this para.

fund. However, the system of identifying such accounts was

not sufficient as IO had further identified 115 term deposits

amounting to Rs. 43.33 lakh as on March 31, 2017 which

should have been transferred to the DEAF fund and were not

marked as unclaimed deposits. This was a violation of the RBI

Circular DBOD. No. DEAF. Cell. BC/114/30.01.002/2013-14

dated May 27, 2014.

4.9 Adherence to Other Regulatory Guidelines: We have explained in previous

The investment transactions were not subjected to compliances that IFR will be created by

internal/concurrent audit during the PPR as required in terms of appropriation of profit at the time of sale in

Para 5.3.6 of the RBI Master Circular DCBR. BPD (PCB). MC. future.

No. 4/16.20.000/2015-16 dated July 01, 2015 'Investment by

Primary UCBs'. The bank was not strictly adhering to the MTM

valuation frequency as prescribed in Para 17.1.3 of the RBI

Master Circular, ibid. As on the DPI, the bank had held

Investment depreciation Reserve (IDR) of '15.59 lakh and

Investment Fluctuation Reserve (IFR) of '3.11 lakh. No

shortfall in provisioning for depreciation in investment was

assessed. The IFR had increased from '0.63 lakh as on March

31, 2013 to 3.11 lakh as on the DPI. However, as the IFR

beyond '0.63 lakh (2.48 lakh) was not created by way of

appropriation of profit but by making provision at the rate of

5% at the time of sale itself, the same was treated as IDR as per

Para 18.8 of the Master Circular ibid.

4.10 Payment of DICGC Premium: The amount of Rs. 0.05 lakh as suggested

The bank had sent the premium to DICGC on time during the by IO is being deposited with DICGC.

PPR. It had also sent the certificate to DICGC duly certified by

the statutory auditors in respect of computation of assessable

deposits as required in terms of DICGC letter No. DICGC

/9943/05.60.999/2011-12 dated September 21, 2011 for the half

year ended September 201b and the year ended March 31,

2017. However, the computation of assessable deposit was

short by '52.32 lakh as the bank had not taken into account the

interest payable of matured term deposits. Accordingly, a

provision of '0.05 lakh was suggested by IO as on the DPI.

5. Loan, Fixed Assets and Other Assets

5.1 Size and Composition of the Loan Portfolio Loans and We are taking effective steps to recover

advances of the bank had decreased from 3569.87 lakh as on the NPA account. We hope after recovery

the DL1 to 3493.46 lakh as on the DPI registering a decrease of of NPA accounts. The OIR certainly will

76.41 lakh (2.14%) during the PPR.lt had decreased marginally decrease.

to '3397.66 lakh as on September 30,2017. However, overdue

Interest Reserve had increased from Rs. 344.43 lakh as on DLI

to Rs.567.02 lakh as on DPI due to increasing NPAs as well as

insufficient recovery in NPA accounts. The OIR as on

September 30, 2017 was Rs.624.07 lakh.

5.2 Connected Lending and Normal Loans Regarding connected lending we have

The bank had reported gross NPAs of '2024.78 lakh as on the already explained in previous compliance.

DPI as against gross NPAs of '792.23 lakh as on the DLI. According to which these advances are not

However, the IO had assessed gross NPAs of '3177.98 lakh as under connected lending. In account of

on the DPI as against the assessed gross NPAs of of'2774.64 Shushma Tripathi we have categorized this

lakh as on the DLI. As per the data furnished by the bank, no account as loss account regarding

loans were outstanding under connected lending, i.e. loans suspected fraud for this account we have to

related to the Directors/ their relatives, the CEO and other top submit that LIC policy amounting Rs. 2.00

executives as on the DPI. However, the IO identified four loan lakh, two vehicles and gratuity and PF

accounts with an outstanding balance of '40.96 lakh as on DPI. amount of Shri K.S. Tripathi her husband is

These were: A/c nos. 000800095701 (Shri A.K. Dwivedi, attached with this loan account. Hence this

outstanding Balance-'9.72 lakh, 090400021601 ( Shri Gaurav account in no way should be treated as

Mishra / Saurav Mishra-son of CEO, outstanding balance- suspected fraud.

’14.17 lakh) , 120400327301- (Smt. Sushma Tripathi Wife of

Branch Manager K.S. Tripathi, outstanding balance - '12.58

lakh) and 000800124901 (AK Dwivedi, outstanding balance -

'4.49 lakh). The remaining balance of '3452.50 lakh pertained

to normal lending. The bank had classified a/c no.

120400327301 as 'Loss'. The account was a case of suspected

fraud as no property documents were taken in the housing loan.

Accordingly, the extent of NPAs under normal loans had been

assessed at '3151.29 lakh and '26.69 lakh respectively.

5.3 Compliance with the prudential Guidelines Regarding

IRAC Norms

i) The bank had not adhered to the prudential norms on income We try to classify NPA on an ongoing

recognition, asset classification and provisioning during the basis. The divergence in classification of

PPR. It was not classifying NPAs on an ongoing basis. A 317 standard accounts for an amount of Rs.

divergence in classification of 317 standard accounts for an 1084.91 lakh is concerned we have to

amount of '1084.91 lakh was identified by the lO. Further, 751 explain that these accounts were heated as

accounts with an outstanding balance of '1752.85 lakh were standard advances on account of assurances

either wrongly classified by the bank or short/nil provisioning to deposit the balance of installments very

was made. 1460 accounts with outstanding balance of Rs- 'Soon by the borrowers. Regarding short

105.84 lakh were identified by IO as Doubtful 1 - unsecured as provisioning we have explained in above

the amount outstanding was equal to the Share Capital paras. 'However, regarding reversal of Rs.

contributed. Further, due to AID it had not refunded/adjusted 244.36 lakh interest charged on NPAs we

capital. Thus, the amount was outstanding on these accounts. have to submit that out of these accounts

No interest was for this amount in the loan accounts which was recovery in most of the accounts have been

a violation of Para 2.1.7 of RBI Master Circular DCBR.BPD. taken place and interest has been

(PCB) MC No. 12/09.14.000/2015-16 dated July 1, 2015 on recovered. At the end of financial year

'incomee Recognition, Asset Classification, Provisioning and 201718 if any such account remains

Other- Related Matters - UCBs'. The details are furnished in without recovery the rest interest amount

Annex. V. A total shortfall of '1699.59 lakh in provisioning had will be reversed.

been identified by the IO. Further, the bank had also taken un-

realized of '244.36 lakh on NPAs to its income which needed to

be reversed.

ii) Despite the same having been pointed out in the last RBI The interest is not being charged in the

inspection report, the bank had continued to charge interest on account mentioned in this para after

loan accounts classified as NPAs as on March 31, 2017 and 31.03.2017.

taken the same to income in many cases, for e.g.083400035301

Ajay Kumar Verm a, 090400032001 Abhay Kumar Shukla,

040400071201 Beena Dwivedi , 083400035301 Ajay Kumar

Verma, 0834000354 Santosh , 083400035501 Sanjeevan Lai,

083400035801 Satendra Kumar Pandia, 083400035901 Yogesh

Kumar etc.

5.5 Main Reasons for Divergence from the Classifications

The main reasons for divergence in asset classification by the The bank has stopped to charge interest in

bank were its reluctance to classify the accounts as non- NPA accounts. Our effective steps for

performing despite apparent irregularities, wrong asset recovery of NPA accounts is continuing on

classification and under provisioning in respect of some war-footing.

Accounts classified as NPAs by the bank. Further, the bank

continued to book interest income on accrual basis as

classifying an account as NPA would result in decrease of

interest income. This would further result in decreased

profit/increased loss.

5.6 NPAs as on the DLI and the DPI:

The assessed gross and net non-performing advances formed As IO has already mentioned in this para

90.97% and 90.30% of the gross and net advances respectively that increase in gross and net NPAs are due

as on the DPI. There had been a deterioration in the quality of to imposition of AID. It is fact that before

loan portfolio as compared to the previous RBI inspection. The imposition of AID, the recovery from

assessed gross and net NPAs had increased from the level of Nagar Nigam employees was fairly very

'2774.64 lakh (77.72%) and '255.46 lakh (76.27%) respectively regular, but restricting the clearing services

as on the DLI to '3177.98 lakh (90.97%) and '2938.80 (90.30%) (ECS) of the bank these accounts were

lakh respectively as on the DPI. The main reason for this shifted to other bank and recovery of our

increase may be attributed to the non-recovery of installments bank was totally disturbed. With our efforts

from the employees of Nagar Nigam due to shifting of their now recovery of Nagar Nigam has turned

salary accounts to other banks. Further, most of the accounts in regular recovery by way of deducting the

installments from the salary of employees.

running satisfactorily had become irregular after imposition of

We have covered other than Nagar Nigam

directions as the bank had failed to ensure recovery in these

advances under legal recovery proceedings.

accounts. The assessed gross and net NPAs and further

Recovery is coming smoothly. We are

increased to '3166.68 lakh and '2927.50 lakh respectively as on

hopeful to minimize the gross and net

September 30, 2017 (the last date of the month preceding the

NPAs in coming months.

date commencement of the present inspection) constituting

93.20% and 92.69% respectively of gross and net advances.

5.7 Profile of NPAs and Adequacy of Provisions

The profile of NPAs, segment-wise break-up and detailed We have restructured the accounts of Nagar

assessment of adequacy of provision for loan losses are given Nigam Kanpur after regular recovery by

in Annexure IV. There was no shortfall in provision for deducting the installments frony thpir

standard assets. However, the bank had not made adequate salary. In this context we have also

provisions for loan losses and a shortfall of '1699.59 lakh was submitted a office note with approval of the

assessed by the I.O. as on the DPI. board to RBI to take these accounts secured

and standard advances. A fair and practical

consideration in the matter the required

provision will certainly be minimized and

we shall in a position to make required

provision for loan losses.

5.8 Assessment of Recovery Policy and Process

i) Loans granted to the employees of the Kanpur Nagar Nigam We are trying our best to receive the

constituted the major portion of the bank's loan portfolio having deducted installments from all account

an outstanding balance of around '1200 lakh (40% of total holders as per our list submitted with Nagar

advances of Rs. 3493.46 lakh) as on the DPI. No installments Nigam. We are confident to succeed in our

were received from Nagar Nigam pertaining to these loans efforts.

during the PPR. The bank had approached the Hon'ble

Allahabad High Court for recovery of these loans. The High

Court, vide its order dated August 18, 2015 had directed the

bank to approach Nagar Nigam authorities with details of such

borrower employees and the Nagar Nigam authorities were

directed to consider and decide the same in accordance with

law by a speaking order. Accordingly, the bank had submitted a

list of 403 accounts (whereas nearly 800 loans A/Cs were

outstanding in the names of Nagar Nigam employees) to the

Nagar Nigam authorities vide its letter dated August 18, 2015.

During the PPR, recovery had completely stopped from these

loan accounts and bank did not receive any installments from

Nagar Nigam. Vide a letter dated June 28, 2017, the Municipal

Health Officer, govt. of UP ordered the Nagar Nigam officials

to deduct and repay the installments of the list of employees

submitted by the bank. Accordingly, two installments were

received in months of July 2017 and August 2017 till

September 30, 2017 in respect of 188 and 266 loans accounts

respectively as against a list of 403 accounts submitted by the

bank. Installments for the month of August 2017 was received

after September 30, 2017 for 243 loans only.

ii) The bank had initiated proceedings under SARFASI Act The proceedings under SARFASI Act

against some defaulting borrowers and an amount of '35.00 against 15 defaulters have been initiated

lakh had been recovered from one account in the name Ajeet which cover approximately Rs. 2.00 crores.

Kumar & Anjani (05040007270) during the PPR. The proceedings are near about complete.

We are hopeful to recover these account up

to 31 March, 2018.

iii) The bank had formulated a recovery policy as a part of its loan The detailed procedure for recovery of

policy duly approved by the Board which was last reviewed on bad debts will be included in the recovery

July 07, 2017. However, detailed procedure for recovery of bad policy of the bank after approval of

debts had not been incorporated in the policy. Regular Managing Committee of the bank.

monitoring of overdue position was not done and list of

potential NPAs was not prepared. Documentation was defective

and securities were not charged properly. Some efforts had

been made to re3cover loan amounts from the Nagar Nigam

employees. However, sufficient efforts were not visible in case

of other accounts. Whatever efforts had been undertaken by the

bank had not helped in reducing the extent of NPAs and its

financials have deteriorated during the PPR.

ii) The bank's system of follow up for recovery of NPAs was As we have already mentioned in above

highly unsatisfactory. As per the data provided by the bank, it paras that our efforts for covering all

had sent registered notice to 801 defaulter borrowers, 21 cases defaulters including NPA accounts under

were under arbitration and awards were pending execution in legal proceedings of arbitration SARFASI

99 cases. Act, and other recovery Act are now

complete. We hope a great success in

recovery of NPA as well cither accounts.

iii) On inspecting loan documentation, it was observed that the The notices to all defaulter accounts are

bank had not sent recovery notice to some of the borrowers being sent.

during PPR. Some of the instances where last communication

was sent in July 2015 were in accounts viz. 040400068701,

040400069701, 040400071201, 083400039101 etc.

5.9.1 The bank had reported recovery of '462.85 lakh as against As have stated in the previous

fresh slippage of '1695.40 lakh during the PPR. However, gross compliances that the accounts in which

under reporting of NPAs was observed as many accounts which recovery is being received regularly have

were identified as NPA by the IO had not been included in the not been included in the list of NPA

statement of NPAs (Statement 3) furnished to the inspecting accounts though these accounts were

officer. Further, the gross NPAs had been assessed at '3177.98 marked under NPA by the IO. Regarding

lakh as against the reported gross NPAs of '2024.78 lakh as on implementation of fixing a staff

the DPI. The bank had a policy for fixing staff accountability accountability we have to submit that the

but the same was not being implemented in case of slippage of recent slippage of account from standard to

loan accounts from standard to NPA categories. This was a NPA is not fault of staff. This slippage has

violation of Para 3.3(iv) of Master Circular - DCBR. BPD. occurred only after imposition of AID and

(PCB) MC No. 12/09.14.000/2015-16 dated July 1, 2015 on suspension of clearing facility.

'Income Recognition, Asset Classification, Provisioning and

Other Related Matters-UCBs’.

5.9.2 The bank was showing recovery in NPAs of Rs. 462.85 Recovery in NPA accounts of Rs. 462.85

during PPR. However, it could not provide separate data lakh is mostly relates to NPA accounts. The

regarding recovery of interest amount and principal amount. separate data regarding recovery of interest

The recovery information was incorrect as several of the and principal is available in system. The

accounts mentioned in the recovery list were classified as recovery from employees of Nagar Nigam

standard by the bank as on DPI. Thus, bank was showing total has started as mentioned by the 10 in this

credit in its loan accounts during the PPR as Recovery in para. Accordingly we have re-structured

NPAs. However, in most of these accounts, these recoveries these accounts and have requested RBI to

would not result in any write back of provisions as there was a consider these accounts as standard

shortfall of'408.76 lakh in provisions as per the bank's own account. The documentation as pointed out

assessment. This shortfall had increased to '1699.59 lakh on in IR have been completed obtaining the

account of divergence identified by the IO. The recovery from required documents.

the loan accounts of Nagar Nigam employees had stopped after

February 2016 and there was no further recovery in these

accounts till June 2017. Two instalments were recovered in the

months of July and August 2017 till September 30, 2017 but

the recovery was not sufficient for write-back of provisions.

Recover}' in other accounts had also become irregular resulting

in the increase in assessed gross NPAs from '2774.64 lakh as on

the DLI to '3177.98 lakh ns on the DPI and a slight decrease to

'3166.68 lakh as on September 30, 2017 due to decrease in total

advances. No efforts had been made by the bank after issue of

Directions for obtaining the documents in the loan accounts

where documentation was defective/ insufficient.

5.9.3 The record of recovery in NPA accounts during the last six We are vigorously engaged in recovery

months (April 2017 to September 2017) was highly NPA accounts as well as in other accounts

dissatisfactory. The bank had submitted a list of 456 accounts by taking these covered under legal

where 117.52 lakh was received after DPI till September 30, recovery proceedings. The major overdue

2017. However, this was due to two installments of Nagar amount pertains to Nagar Nigam Kanpur in

Nigam loan received in July 2017 (188 Accounts- Rs. 12.53 which the recovery is coming regularly.

lakh) and August 2017 (266 Accounts - Rs. 17.83 lakhs). The We hope to receive our target as fixed in

recovery was insufficient to repay the interest due in most of our action plan.

the accounts. As already mentioned above, these recoveries

would not result in any write back of provisions as the same

was already less than the requirement.

5.10 Fixed/Other Assets

i) The bank had not acquired any premises or other fixed assets Proper inventory of the fixed assets is

during the PPR. The amount under 'furniture and fixtures' stood available in record.

at '62.61 lakh as on the DPI as compared to '73.15 lakh as on

the DLI. However, inventory of the fixed assets was not

maintained properly by the bank. As per the Statutory Auditor,

there was no shortfall in depreciation.

ii) The other assets of the bank as on DPI mainly consisted of Regarding other assets we have to submit

stock of stationery ('12.18 lakh) and Sundry Debtors ('2.90 that stationery stock of Rs. 12.18 lakh is

lakh). Out of the total amount of 2.90 lakh under sundry according to bank's expenditure policy and

debtors, the amount of '0.80 lakh were deposited in Labour we have put-up our view point in previous

Court on august 27, 1998/1.07 lakh were given to UTI for compliance in IR. Under sundry debtors

issuance of Pan card to its customers, '0.04 lakh paid as Rs. 1.07 lakh is to be received from UTI as

education fund was paid as key charges to a staff who was not all unused coupons have b^en deposited

in the bank's service as on October 07, 2016 (the last working with UTI. Rs. 0.12 lakh pertaining to key

day preceding the date of commencement of the last charges to staff has been recovered and Rs.

inspection). All these items had been treated as intangible by 0.04 lakh as education fund wrongly

the IO and the bank was required to make provision of '2.03 capitalized has been corrected.

lakh for the same. Further, the amount of '12.18 lakh pertaining

to stationery stock had been treated as intangible for the

purpose of calculation of net worth.

iii) The cash in hand of '39.14 lakh as on the DPI included cash Rs. 5.47 lakh cash shown in branch

amounting to '5.47 lakh in branch ATMs. The ATMs had ATMs is mainly reconciliation matter. We

stopped functioning with effect from the date of imposition of are trying to reconcile the same with the

directions and no cash was available in the ATMs. As such, the help of service provider. Rs. 3.24 lakh has

amount of'5.47 lakh had been treated as intangible by the IO been reconciled rest will be reconcile very

and a provision for the same had been suggested. shortly.

6 Management

6.1 Board of Directors and its Committees

i) As Per available records, the present Board of Directors Sri Laxmi Kant Shukla has not attend the

(BoD) was constitute on December 10, 2012. Shri Brahma mettmg due to his illness. He has duly

Swaroop Mishra (Father of CEO of the bank, Shri Ashutosh informed the Board in writing. The copy of

Mishra) had been continuing as the bank's Chairman since June his latter was given to I/O during the

12, 1998 and after his demise on December 22, 2016, Shri inspection.

Rajesh Chandra Was Appointed as acting Chairman as per

board resolution dated February 16, 2017. There were 9 elected

members in the Board as on the DPI as Shri Ram Sudhar had

resigned and Shri R.S. Gupta had resigned on October 07, 2016

and July 28, 2015 respectively. Shri Pramod Yadav was

removed due to his continuous absence in the Board meetings

on January 10, 2017. The bank had also coopted two Chartered

Accountants as professional Director (Shri Dinesh Chandra

from March 18, 2013 and Shri CB Singh from January 15,

2014). However Shri Laxmi Kant Shukla had not been removed

from board membership even though he had been absent from

more than 3 consecutive meetings without obtaining leave of

absence in violation of para 32 (iii) of by-laws of the bank. The

Board was having adequate representation from SC/ST, OBC

and woman Director. The Annual General Meeting (AGM) of

the bank had not been held during the PPR.

6.2 Chief Executive Officer

i) Shri Ashutosh Mishra S/o Shri Bramha Swaroop Mishra, The deficiencies pointed out by the IO

Chairman was continuing as the Secretary/CEO of the bank have been rectified on practical ground

since May 25, 1998. As per the information provided, he is a only rare deficiencies which are not under

law graduate. His guidance and control over the affairs of the control of the bank are persisting. We are

bank especially with regard to adherence to RBI guidelines, trying our best to rectify these deficiencies.

bank's MIS and CBS system, asset quality, recovery of NPAs, The guidance and control over affairs of

etc. needed improvement. The working of the CEO was not the bank CEO is proper however he has

found satisfactory as most of the deficiencies pointed out in the been asked to improve in this matter as

last RBI inspection report were persisting as on DPI suggested by the IO.

6.3 Adequacy and Effectiveness of reviews/Information

placed before the Top Managcment/Committees/UoD

The review of top 50 NPA accounts was neither placed before Review of the bank functioning was

the Board nor there was any Board discussion found in the taking place regularly in the Board

proceeding book where recovery targets had been assigned. No meetings up to imposition of AID.

effective review of the banks functioning was put up to the However, after imposition of AID the

Board after the imposition of AID. No inputs from the review in Board meetings was mainly

professional directors were on record. It appeared that the focused on recovery of NPA accounts and

Board had lost its effectiveness in controlling the affairs of the to increase capital of the bank. Tire

bank. All the Directors were not found to have signed the discussion and suggestions regarding

proceedings book indicating that the Directors had either lost recovery of NPAs and augmentation of

interest in the functioning and revival of the bank or they were capital, were regularly taking place in

acting merely like figure heads and the Board/meetings were Board meetings' In crucial condition and

held more like a ritual and paper work. Board was completely will tagged hands the effectiveness of

ineffective in ensuring the recovery of NPAs and achieving Board in functioning of the bank and a

action plan. The RBI directives after the imposition of AID achieving the targets is shown ineffective.

were simply put up in the meeting and no review of the However, the Board have been replaced by

adherence was presented in the subsequent board meetings. cooperative department as Election of

This had resulted in major violations of the AID as detailed in Managing Committee is due.

para 2.

6.3.1 Functioning of the Committees

i) The Board had held eighteen meetings after the imposition The action plans submitted with RBI were

and till the date of conclusion of the present inspection. The prepared in guidance and approval of the

Board had failed to come out with a concrete plan for recovery Board. In all Board meetings progress of

of NPAs and revival plan for turning around the bank. The recovery in NPA accounts was discussed.

calendar of review as stipulated in para 5 of the RBI Master The calendar of review as stipulated in Para

Circular DCBR.BPD. (PCB/RCB) Cir. No.2/14.01.062/2015- 5 of RBI Master Circular dated 01.07.2015

16 dated July 01, 2015 on 'Board of Directors' was not followed were regularly followed before imposition

by the Board during the PPR. of AID. However, we assure to follow this

calendar as an when the bank starts its

normal working.

ii) ^ The Audit Committee of tire Board (ACB) had held three We have already mentioned in previous

meetings (02.05.2016, 20.01.2017 and 03.05.2017) during compliances regarding compliance of para-

the .PPR in which the matter regarding appointment of auditors 7.4.2, of RBI Master Circular dated July

land compliance of audit reports etc. were discussed. The ACB 01, 2015 on 'Inspection and Audit Systems

had not undertaken other duties/responsibilities as Enumerated in Primary UCBs'. We have assured to

in Para 7.4.2 of the RBI Master Circular DCBR.CO. BPD. comply with all instructions of this Master

(PCB). MC. No. 3/12.05.001/2015-16 dated July 01, 2015 on Circular as restarts our normal working.

'Inspection and Audit Systems in Primary UCBs.

iv) The bank had also constituted Establishment and Discipline After imposition of AID the meetings of

Committee, Audit Committee, Asset Liabilities Management other subcommittee like the Discipline

Committee (ALCO), Development and Planning Committee. 3 Committee, Development and Planning

meetings of ALCO Committee were held during the PPR. Committee were not needed only meetings

of ALCO committee were convened.

However, all other sub-committees will

meet regularly as an when bank starts its

normal working.

6.4 RBI Inspection- Compliance

The last RBI inspection of the bank was conducted with The bank has not received any paragraphs

respect to its financial position as on March 31, 2016. The First for recompliance from Regional Office

compliance was submitted on July 26, 2017 and the second and after our last compliance dated October 10,

last compliance was submitted on October 10, 2017. Report 2017. Details of deficiencies given in

was yet to be closed as compliances in respect of some the Annexure-VIII are being repeated regularly

paragraphs were yet to be accepted. The compliances were not besides our submission given in previous

found to be sustained as many deficiencies (details given in compliances.

Annex VIII) were persisting.

6.5 Efficacy of the Management This is not correct that bank has neglected

The bank had made some efforts towards recovery of NPAs the loan accounts in which regular recovery

after imposition of direction, it had approached the High Court was received after imposition of AID.

for recovery of Loans from the employees of Kanpur Nagar Virtually a regular recovery in these

Nigam and had succeeded in recovering two instalments from accounts hive disturbed due to stoppage of

in July 2017 and August 2017 from 188 and 266 employees till clearing facility of the bank and miss

September 30, 2017. However, the entire focus had been only understanding of the defaulters regarding

on these Nagar Nigam accounts while other accounts running bank. However, the bank has taken all

these accounts under persona) contact

system are have covered under legal

recovery proceedings. We are still engaged

in raising the share capital and we are sure

the restructure our balance sheet by

conversion of deposit into share capital.

6.6 Functioning of the Screening Committee The Screening Committee of the bank is

The Screening Committee was not functioning efficiently. It functioning as per guidelines of the RBI.

was simply forwarding the application of hardship cases The applications on hardship grounds are

without due diligence resulting into many cases getting rejected being forwarded to Regional Office after

by RBI for want of proper documents. proper scrutiny. Rejection of some

applications is not due to negligence of

Screening Committee.

6.7 Action Plan for Revival of the Bank

i) The bank had submitted its first action plan vide its letter The bank is trying to achieve the targets

dated August 22, 2015 wherein it had planned to augment its mentioned in action plan but achievement

share capital by '600.00 lakh by way of infusion of fresh capital is based on favorable conditions. However,

by its existing members and '100.00 lakh by way of conversion our two branches have been shifted to our

of deposits into share capital, recovery of NPAs to the tune of Deo Nagar branch. We have curtailed our

'500.00 lakh especially from the employees of the Kanpur expenditure. The recovery in NPA accounts

Nagar Nigam, bringing down NPAshelow 7% by March 2017 is being received. We have already

and controlling expenditure by way of closing down four mentioned our position in this reference in

branches. However, it was observed that no progress at all had the above paras of 1R. Regarding

been made by the bank on all the aspects of the plan. The bank submission of quarterly progress report in

had again submitted an Action Plan vide its letter dated August respect of action plan we have mentioned

17, 2016. However, nothing new had been stated in this Action our view point in above para 2 VIII.

Plan and all aspects as mentioned in the previsions Action Plan

had been simply reiterated. The paid-up share capital had

increased by only '17.75 lakh during the period from March 31,

2015 to September 30, 2016. The bank was not sending

quarterly progress report in respect of the action plan.

ii) The bank had again submitted a Revised Revival Action Plan The process of conversion of deposits into

vide its letter dated June 13, 2017. The bank had set a target of equity is still going on. We hope to achieve

raising capital of Rs. 500.00 lakh by March 31, 2018. It had this target very shortly.

also sent a list of 203 depositors whose consent had been

received for conversion of their deposits amounting to Rs.

100.44 into equity. However only Rs. 6.53 lakh of additional

capital was raised till September 30, 2017.

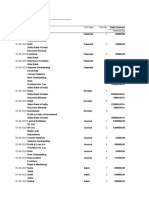

iii) Target vis-a-vis Achievement as per Action Plan - September The targets fixed in action plan are in our

30, 2017: action we have succeeded in shifting our

(Rs. in lakh) two branches in premises of our Deo Nagar

S.No. Item branch and that will result in curtailment of

Target (as Actual

Achievement rent electricity and CBS expenses per

given in

month. Increasing share capital through

Action

conversion of deposits into equity, fresh

Plan)

share capital from existing members,

1 Share Capital 768.49 406.05 recovery of NPAs are included in our

Conversion of 280.44 6.53

campaign and that will convert deposit

2

Deposits into equity erosion into nil.

3 Overdue interest 362.92 624.07

Reserve

4 Goss NPA 52.79% 93.20%

5 Deposit Erosion 0% 31.03%

6 Curtailment of Rent, 1.36 No reduction

Electricity, CBS

Expenses per month

6.8 Comments on Action Plan

The bank had submitted a time bound action plan with monthly Rs. 9.08 lakh loan against deposits have

targets but quarterly progress report in respect of the action been adjusted. The other targets fixed in

plan had not been submitted by the bank. As already detailed in action plan are being persuaded and we are

the above paragraph, the bank had failed to registe4r much hopeful for achievement.

progress in its action plan. Having raised only Rs. 6.53 lakh of

share capital by way of conversion to deposits in three months,

it would be extremely difficult for the bank to achieve the

target of Rs. 500 lakh by March 31, 2018.

The bank has also failed to reduce NPAs, and its OIR is

increasing sharply every month instead of reducing as

envisaged in the Action Plan. Even after some relaxations in

the Directions the bank was not able to show any considerable

progress. The bank was allowed to adjust Loan against Term

Deposits with the consent of depositors. The bank was having

outstanding amount of Rs. 38.36 lakh as on March 31, 2016

Against Deposit'. The bank had adjusted Rs. 29.28 attached

term deposits and was having an outstanding 9.08 lakh of Loan

against deposits despite setting a target of closing these

accounts in the Action Plan.

6.8.1 ABC Analysis

As per the I.O.’s assessment, the gross NPAs stood at ‘3197.29 The recovery of Nagar Nigam employees is

lakh as on September 30, 2017 constituting 93.10% of gross now coming regularly since June 2017. We

advances of ‘3397.66 lakh. The bank was having a BDDR of have restructured these accounts and have

‘239.18 lakh which was much below the required provision of submitted a detailed note with approval of

‘2200.65 lakh. The bank had failed to achieve the target of lakh our Board to Regional Office and a request

from the employees of Kanpur Nagar Nigam. Even if these to consider these advances under standard

loans are fully recovered, there would be no write back of advances and according to provision of

provision as the overall shortfall in provisions was to the tune Section 40 of UP Cooperative Societies

of '2200.65 lakh as on September 30, 2017. Act, 1965 to treat these advances as

secured. Accordingly as these accounts

have been categorized under loss a write

back of 100% provision will available.

6.8.2 Steps taken to reduce establishment cost:

The bank had taken some steps for reduction of its The two branches Naya Ganj & Colonel

establishment cost. The number of regular employees had Ganj have been shifted to Deo Nagar

decreased from 60 as on the DLI to 22 as on the DPI. However, branch and shifting process in CBS have

bank had recruited 18 employees from those removed on been materialized. Now we are able to

contract basis as on March 31, 2017. The number of contractual reduce the expenditure electricity and CBS

employees was considered to be on the higher side taking into charges of these branches. The contractual

account the reduced scale of operation in the bank. The employees are not on the higher side as per

operations of two branches Nava Ganj and Colonal Ganj working of the bank.

shifted to Deo Nagar, but the document shifting and merging in

CBS was pending. The bank may expedite the process of

merger of above mentioned branches to reduce the expenditure

on rent and electricity of these branches was being made which

should have been avoided by the bank. The bank may expedite

the process of merger of above mentioned branches to reduce

the expenditure on rent electricity.

7. Earnings Appraisal

7.1 Comments on the profitability We have submitted our explanation

The bank had reported net profit of '85.73 lakh during the regarding provision for loan losses, interest

year 2016-17 as against a net loss of '23.33 lakh during the year reversal, erosion in other assets and

2015-16. However, this net profit was hugely overstated as the provision for other liabilities in compliance

bank had not made provisions for known loan losses and other of above para.

liabilities. The 1.0. had assessed net loss of' 1918.09 lakh for

the year 2016-17 after taking into account additional provision

required for loan losses ('1699.59 lakh), interest reversal

('244.36 lakh), erosion in other assets ('2.03 lakh), erosion in

cash balances ('5.47 lakh), and provision required for other

liabilities ('52.37 lakh) as shown in Annex II.

7.2 Trend Analysis The bank has to bring down the ratios of

The Net Margin of the bank as per stated financials from (-) staff cost to total income and from total

2.97% during the year 2015-16 to 15.02% during the year expenditure.

201617. The Net Interest Margin (N1M) had also increased

from 3.06% to 5.14% during the corresponding period. The

ratio of staff cost to total income had decreased from 25.13%

during the year 2015-16 to 22.65% during the year 2016-17

whereas the ratio of staff cost to total expenditure had increased

from 24.41% to 27.79% during the corresponding period.

However, both the ratios were considered to be on the higher

side. The ratio of other overheads to total income had slightly

increased from 12.57 % during the year 2015-16 to 14.36 %

during the year 2016-17.

7.3 Segment-wise Details of Income and Expenditures

i) Interest income from loans and advances had decreased by Regarding provisioning for interest on

'69.96 lakh (15.69%) from 445.77 lakh during the year 2015-16 matured term deposit to the tune of Rs.

to '375.81 lakh during the year 2016-17 mainly due to reduction 52.32 lakh we have already put up our

in gross advances. The bank although had classified accounts as position in compliance of para 4.1.3 above.

NPA on March 31, 2017, however, their overdue interest was

taken into income during PPR. Income on investments had

decreased by '131.47 lakh (42.78%) From '307.31 lakh during

the year 2015-16 to '175.84 lakh during the year 2016-17

mainly due to decrease in investments and sale of securities for

meeting the demand of depositors as per the terms of direction

and payment under hardship case. The interest Expenditure on

deposits had also decreased by '259.70 lakh (50.57%) From

'513.52 lakh to '253.82 lakh during the corresponding period

due to decrease in deposit liabilities. Also Bank had several

discrepancies in payment of interest on deposit and was not

paying interest on some running accounts as highlighted in para

4.1.3. The IO had suggested additional provisioning for interest

on matured term deposits to the tune of Rs- 52.32 lakh.

ii) The bank was also required to re-examine the necessity of Process of shifting of two branches Naya

keeping 18 staff on contractual basis. I he operations of two Ganj & Colonel Ganj in CBS has

branches Naya Ganj and Colonal Ganj shifted to Deo Nagar, completed. Virtually the necessity of

but the document shifting and merging in CBS was pending. keeping 18 staff on contractual basis is

need of the bank. However, we will

reexamine the same.

7.4 Adherence to the Statutory Provisions Provisioning regarding interest payable on

The Bank had not made correct provision (assessed by the IO at term deposit matured and remaining un-

' 52.87 lakh )at savings bank rate for interest payable on term paid we have mentioned our view point in

deposits matured and remaining unpaid as on March 31, 2017. compliance of concerned para above.

There was a shortfall of '408.76 lakh in provision for loans However, we again submit that the part

losses as per the bank's own assessment. Further, the amount of payment of Rs. 0.40 lakh has already been

'0.04 lakh pertaining to education fund had been capitalized allowed in these FDRs. We have

instead of being booked as an item of expenditure. provisioned Rs. 5.00 lakh for interest

payable on these FDRs and at the time of

payment of these FDRs we shall credit the

interest on the rate of interest applicable for

saving account. As per our assessment Rs.

408.76 lakh will be provisioned for short

fall in loan losses. The amount of Rs. 0.04

lakh wrongly capitalized have been booked

as an item of expenditure.

7.5 Adequacy of provisions

There was no shortfall in provision for standard assets as on Regarding provisioning for loan losses,

the DPI. However, adequate provisions had not been made for interest reversal, erosion in other assets,

NPAs and other items. There was a shortfall in provision for erosion in cash balances and other

loan losses ('1699.59 lakh), interest reversal ('244.36 lakh), liabilities we have put .up our explanation

erosion in other assets ('2.03 lakh), erosion in cash balances in compliance of the above concerning

('5.47 lakh), and other liabilities ('142.92 lakh), Taking into paras.

account all these items, the net loss and net worth of the bank

had been assessed at '1918.09 lakh and (-) '1592.74 lakh

respectively as on the DPI.

7.6 Assessment of Expenditure Policy One OSD has been appointed for the

The bank had formulated an expenditure policy which was work of account section and to suggest in

last reviewed on July 7, 2017. The powers of various the working of bank. Expenditure policy

authorities to sanction various types of expenditure had not will be reviewed and suggestions given by

been defined in the expenditure policy. Further, various the lO will be included in the policy. The

measure had been enumerated in the policy for controlling the need of 18 contractual staff is per bank

expenditure. However, the same were not followed in letter and requirement. However, we will re-examine

spirit. On the one hand the number of regular employees had the matter.

been reduced with a view to cut the staff expenses but on the

other hand 18 of such employees had been reemployed on

contractual basis. One person had been recruited as OSD

without assigning any specific duly to him.

8 Liquidity

8.3 The total liquidity as on September 30, 2017 (the last daf of The cash balance of Rs. 5.47 lakh

the month preceding the date of commencement of the present pertaining to ATM is being reconciled. Rs.

inspection) had reduced and was to the tune of 12198.03 lakh 3.24 lakh has been reconciled rest will be

including cash in hand - excluding unreconciled ATMs ('31.17 reconcile very shortly.

lakh), balance in current accounts with banks ('333.49 Iakh)and

investment in Government securities ('1833.37 lakh) as against

the total liquidity of'2389.99 lakh including cash in hand

-excluding unreconciled cash in closed ATMs ('33.67 lakh),

balance in current accounts with banks ('313.10 lakh) and

investments in Government securities ('2043.22 lakh) as on

March 31,2017.

8.4 The bank was able to meet the demand of depositors as per The bank is engaged in recovery of NPA

the terms of directions and was also able to make payments and other accounts with its total capability.

under hardship cases. The total outflow on account of payments We hope to increase our ratio of liquid

to the depositors (as per the terms of the directions) as well as assets to short term liabilities. The funding

on hardship grounds was to the tune of '4253.49 lakh. volatility will also be increased to higher

However , on account of these payments, the bank's term side.

deposits worth '1579.18 lakh (as on the march 31,2015) kept

with other banks had been totally wiped out and the

investments in Government securities had decreased from

'2857.69 lakh as on the DLI to '2043.22 lakh as on the DPI and

further to '1833.37 lakh as on September 30,2017. The ratio of

liquid assets to short term liabilities at 59.20% was significantly

low and was decreasing. The funding volatility ratio at 16.21%

was also considered to be on the lower side.

9 Systems and Control

9.1 House keeping

Housekeeping at the Head office as well as at the branches

was highly unsatisfactory as various registers, viz. Stock

Statement Register, Insurance Register, DP Register. Equitable

Mortgage Register, Unit Visit Register, Loan Application

Receipt and Disposal Register, Investment Register, etc. were All the registers pointed out in this para

not maintained. Payment Order/ Demand Draft Register was are being maintained in every branch. After

not maintained properly as the details of the purchase and the imposition of AID the working of bank

mode of issuing the same was not mentioned in the said have been restricted hence these registers

register. Dead Stock Register, Stationery Register and Stock are not updated. All the registers will

Register for blank cheque books, FDRs and POs were also not properly maintained after normal working

maintained properly and were not updated on an ongoing basis. of the bank.

9.1.1 The books of accounts of the bank were balanced as on the The balances of share capital are tallied

DPI except the Share Capital Account wherein a difference of on manual basis. Difference on manual

'2.02 lakh was observed between GL and SGL figures. The ledger and computer system is mainly due

amount shown in ATM of Rs-5.47 lakh was not reconciled to wrong feeding. This will be tallied very

even though ATM operations were stopped after imposition of shortly with the help of our CBS provider.

AID. Reconciliation of Rs. 5.47 lakh cash in

ATM is going on. Rs. 3.24 lakh has been

reconciled the rest will be reconciled very

shortly.

9.1.3 MIS The CBS service provider has been asked

The bank was fully computerized and all the reports could be to see the matter of generated reports from

generated through the system at the H.O level itself. However, the system and our system will be properly

it was observed that important reports like list of NPAs, priority available for generating the,all reports.

sector and weaker section advance, purpose wise list of

advances, list of unsecured advances, etc., were not correct

when generated through the system.

9.1.4 Internal Control Systems As per supervisory instructions the bank

The bank's internal control machinery was very poor as it was has been instructed not to sanction any

unable to check and find out the irregularities in the functioning advance. The bank has upgraded its credit