Professional Documents

Culture Documents

Flagria Bpims Policy

Uploaded by

fredOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Flagria Bpims Policy

Uploaded by

fredCopyright:

Available Formats

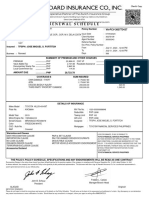

BPI/MS Insurance Corporation

A joint venture of the Bank of the Philippine Islands & Mitsui Sumitomo Insurance

11th, 14th & 16th Floors 6811 BPI-Philam Life Makati

Ayala Ave., Salcedo Village Bel-Air, Makati City 1226

Tel. No. (632) 88409000 ● Fax No. (632) 88409099 ● TIN 000-474-030-000 VAT

www.bpims.com

Policy No.

PERSONAL ACCIDENT POLICY PA620316

ISSUING OFFICE DATE OF ISSUE

HEAD OFFICE 08/16/2021 PREMIUM PHP 429.65

PAYMENT REFERENCE NO. POLICY TYPE DOC. STAMPS 100.00

2021780656203161 ACCIDENT SECURE MAX - BASIC PREMIUM TAX 8.59

POLICY PERIOD 12:01 AM 12:01 AM LOCAL GOVT. TAX 0.86

FROM: 08/17/2021 TO: 08/17/2022

AMOUNT DUE

NAME AND ADDRESS

FREDERICK LAGRIA PHP 539.10

AGENT’S CODE

100 5A SANVILLE, CULIAT, QUEZON CITY, METRO MANILA, PHILIPPINES, 1128

200104 /HO

Schedule of Covered Person/s:

Personal Information:

Name of Insured : LAGRIA, FREDERICK

Date of Birth : 02/14/1992 Age : 29

Occupation : CIVIL ENGINEER

Coverage:

Description Liability

DEATH & PERMANENT DISABLEMENT PHP 500,000

MOTORCYCLING COVERAGE 500,000

MEDICAL EXPENSE REIMBURSEMENT 50,000

BURIAL ASSISTANCE 5,000

EDUCATIONAL ASSISTANCE 25,000

UTILITY BILLS ASSISTANCE 25,000

Other Risk Detail :

PREMIUM

• PRINCIPAL : PHP 599.00 (INCLUDING TAXES)

Risk Endorsements/Warranties/Clauses :

MOTORCYCLING ENDORSEMENT

"IT IS HEREBY DECLARED AND AGREED that the Insured is covered against accident whilst riding, driving, boarding, and

alighting a motorcycle or any two-wheeled motor vehicle, except racing and sports related activities."

MEDICAL EXPENSE REIMBURSEMENT CLAUSE

IT IS HEREBY DECLARED AND AGREED that medical and surgical expenses arising out of the expected perils under the items on

"EXCLUSIONS" of this policy are not compensable. All other terms and conditions remain the same.

BURIAL ASSISTANCE ENDORSEMENT

"IT IS HEREBY DECLARED AND AGREED that the policy extends to cover Burial Assistance for Php 5,000 provided that the cause

of accidental death is covered under the policy."

EDUCATIONAL ASSISTANCE

This Policy is extended to provide Education Benefit up to the Amount Insured stated in the Schedule of Benefits and to the

extent herein limited and provided: If during the Period of Insurance, the Insured Person (Principal) sustains Bodily Injury

which directly causes or results in his/her Accidental Death or Permanent Disablement, the benefit of this Policy shall be

payable.

BPI/MS shall pay the Amount Insured stated in the Schedule of Benefits for the Insured Person's child(ren) or sibling(s) as

an education subsidy. The child(ren) or sibling(s) must be unmarried, unemployed, and studying, age three (3) up to twenty-

two (22).

UTILITY BILLS ASSISTANCE

In the event that the Insured Person (Principal) suffers death and/or permanent disablement resulting from a covered

accident, this policy extends to provide lump sum benefit for utility bills up to the amount stipulated in the Schedule of

Benefits.

Other Policy Details :

1. This Policy is subject to the following attachments:

a. War & Terrorism Exclusion Clause

b. Date Recognition Clause

c. Sanction Limitation and Exclusion Clause

d. Institute Radioactive Contamination, Chemical, Biological, Biochemical and Electromagnetic Weapons Exclusion Clause

e. Medical Expense Reimbursement Endorsement

f. Burial Assistance Endorsement

Transaction No. 2021-PA620316 - PAB 2021-08

BPI/MS Insurance Corporation/08/16/21/1:54 PM //002-02

Client/ Agent Ref. No -

Replaced Pol. FREDERICK LAGRIA - RM No.

Page 1

BPI/MS Insurance Corporation

A joint venture of the Bank of the Philippine Islands & Mitsui Sumitomo Insurance

11th, 14th & 16th Floors 6811 BPI-Philam Life Makati

Ayala Ave., Salcedo Village Bel-Air, Makati City 1226

Tel. No. (632) 88409000 ● Fax No. (632) 88409099 ● TIN 000-474-030-000 VAT

www.bpims.com

g. Motorcycling Endorsement

h. Educational Assistance

i. Utility Bills Assistance

2. Warranted Age Limit: 18 to 65 years old (renewable up to 70)

3. Assignment of beneficiary/ies will be according to the Philippine Civil Law on Succession. Should the Principal Insured

wish to specify the beneficiary of this policy, he/she may request for the same personally from BPI MS Head Office, or

call (02) 8840-9000.

4. Specific exclusions in addition to standard policy exclusions:

i. Kidnap and ransom

ii. Mosquito bites except dengue

5. IT IS HEREBY DECLARED AND AGREED that this Policy shall not be answerable for any medical, surgical, hospital and other

contingent expenses, including death benefits relating to any pre-existing conditions.

6. This policy covers animal bites and mosquito bites limited to dengue.

7. Accidental food poisoning is covered under this policy. (Should not be an isolated case)

8. Warranted that only one policy will respond in the event that an insured person is covered with two or more policies,

whether or not of the same kind.

9. OFWs are not covered under this policy.

10. This policy shall not extend to cover the following:

a. Insured person engaging on the following occupation / activities or possessing any of the following conditions are

not covered:

i. Members of the armed forces or in the military service

Soldier

Police

Secret Service

Detective

Army

Navy

Air Force

Customs Personnel

Firemen

ii. Engaging in or performing any exhaustively physical, extraneous or hazardous sports or activities. Extraneous and

hazardous activities/sports – any activity that involves chance or adventure increasing peril or putting at risk

and in jeopardy the life of an insured person. While exhaustively physical activities are those activities that

excessively require intense physical effort. This includes:

Professional Athletes

Acrobats

Extreme Sportsman

Stuntmen

Automobile Racing Drivers

Aviators

Boiler men

Sawmill Workers

iii. Air and Sea Vessel’s Crew

iv. Occupation engaged on specialized trade or skills involving extraneous and hazardous physical exposure which

could result to sudden and grave physical injury or disability, such as:

Underground and/or underwater operations

Forestry Personnel

Loggers

Asylum Attendants

Laborers erecting or constructing high rise structures

Explosive Makers

Sawmill Workers

Boiler men

v. Accident resulting or caused while the insured is performing or attempting the performance of an unlawful act.

Endorsements/Warranties/Clauses :

WAR & TERRORISM EXCLUSION CLAUSE

The insurance by this policy excludes:

death, disability, loss, damage, destruction, any legal liabilities, cost or expense including consequential loss of

whatsoever nature, directly or indirectly caused by, resulting from or in connection with any of the following regardless of

any other cause or event contributing concurrently or in any other sequence to the loss;

1. war, invasion, acts of foreign enemies, hostilities or warlike operations (whether war be declared or not), civil war,

rebellion, revolution, insurrection, civil commotion assuming the proportions of or amounting to an uprising, military or

usurped power; or

2. any act of terrorism including but not limited to

a. the use or threat of force, violence and/or

b. harm or damage to life or to property (or the threat of such harm or damage) including, but not limited to, nuclear

radiation and/or contamination by chemical and/or biological agents, by any person(s) or group(s) of persons, committed for

political, religious, ideological or similar purposes, express or otherwise, and/or to put the public or any section of the

public in fear; or

3. any action taken in controlling, preventing, suppressing or in any way relating to 1 or 2 above. If the Company alleges

that by reason of this exclusion, any loss, damage, cost or expense is not covered by this insurance the burden of proving

the contrary shall be upon the Assured.

DATE RECOGNITION CLAUSE

There is no insurance under this Policy in respect of any claim of whatsoever nature which arises directly or indirectly

from or consists of the failure or inability of any

(a) electronic circuit, microchip, integrated circuit, microprocessor, embedded system, hardware, software, firmware,

program, computer, data processing equipment, telecommunication equipment or systems, or any similar device

(b) media or systems used in connection with any of the foregoing

Whether the property of the Insured or not, at any time to achieve any or all of the purposes and consequential effects

intended by the use of any number, symbol or word to denote a date including without limitation, the failure or inability to

recognize capture save retain or restore and/or correctly to manipulate, interpret, transmit, return, calculate or process

Transaction No. 2021-PA620316 - PAB 2021-08

BPI/MS Insurance Corporation/08/16/21/1:54 PM //002-02

Client/ Agent Ref. No -

Replaced Pol. FREDERICK LAGRIA - RM No.

Page 2

BPI/MS Insurance Corporation

A joint venture of the Bank of the Philippine Islands & Mitsui Sumitomo Insurance

11th, 14th & 16th Floors 6811 BPI-Philam Life Makati

Ayala Ave., Salcedo Village Bel-Air, Makati City 1226

Tel. No. (632) 88409000 ● Fax No. (632) 88409099 ● TIN 000-474-030-000 VAT

www.bpims.com

any date, data, information, command, logic or instruction as a result of

(i) recognising using or adopting any date, day of the week or period of time, otherwise than as, or other than, the true or

correct date, day of the week or period of the time

(ii) the operation of any command or logic which has been programmed or incorporated into anything referred to in (a) and

(b) above

SANCTION LIMITATION AND EXCLUSION CLAUSE

No (re)insurer shall be deemed to provide cover and no (re)insurer shall be liable to pay any claim or provide any benefit

hereunder to the extent that the provision of such cover, payment of such claim or provision of such benefit would expose

that (re)insurer to any sanction, prohibition or restriction under United Nations Resolutions or the trade or economic

sanctions, laws or regulations of the European Union, United Kingdom or United States of America.

INSTITUTE RADIOACTIVE CONTAMINATION, CHEMICAL, BIOLOGICAL, BIOCHEMICAL AND ELECTROMAGNETIC WEAPONS EXCLUSION CLAUSE

This clause shall be paramount and shall override anything contained in this insurance inconsistent therewith;

1. In no case shall this insurance cover loss damage liability or expense directly or indirectly caused by or contributed

to by or arising from:

1.1 ionising radiations from or contamination by radioactivity from any nuclear fuel or from any nuclear waste or from the

combustion of nuclear fuel

1.2 the radioactive, toxic, explosive or other hazardous or contaminating properties of any nuclear installation, reactor or

other nuclear assembly or nuclear component thereof

1.3 any weapon or device employing atomic or nuclear fission and/or fusion or other like reaction or radioactive force or

matter

1.4 the radioactive, toxic, explosive or other hazardous or contaminating properties of any radioactive matter. The

exclusion in this sub-clause does not extend to radioactive isotopes, other than nuclear fuel, when such isotopes are

being prepared, carried, stored, or used for commercial, agricultural, medical, scientific or other similar peaceful

purposes

1.5 any chemical, biological, bio-chemical, or electromagnetic weapon.

Standard Policy Conditions :

WHEREAS the Insured has by proposal and declaration which are hereby made a part of this policy applied to the BPI/MS Insurance Corporation,

(hereinafter called "the Company") for the insurance hereinafter defined.

NOW THIS POLICY WITNESSETH that, subject to the payment by the Principal Insured of the sum shown in the schedule as the first premium

for the period of insurance stated herein, if at anytime during the said period or any subsequent period for which the Principal Insured shall have

paid and the Company accepted a renewal premium, the Insured persons enumerated in the Schedule shall sustain bodily injury caused by

violent accidental external and visible means which injury shall solely and independently of any other cause result in his death or disablement as

hereinafter defined or necessitate medical surgical treatment as hereinafter defined, the Company will subject to the terms, provisos and

conditions of and endorsed on this Policy (which terms provisos and conditions shall so far as the nature of them respectively will permit be

deemed conditions precedent to the rights to recover under this Policy), pay to the Insured, the sum or sums of money specified in the Schedule.

The Provisions printed and written by the Company on the succeeding pages hereof form a part of this Contract as fully as if stated over the

signature hereto affixed.

PROVISOS

1. This Policy shall not extend to cover:

(a) Death or disablement or medical expenses occasioned by or happening through:

(i) War, Invasion, Act of Foreign Enemy, Hostilities (whether war be declared or not), Civil War, Rebellion, Revolution, Insurrection,

Mutiny, Military or Usurped Power, Violence occurring in any Assembly or Demonstration, Civil Commotion, Riots, Strikes, Military

or Popular Rising.

(ii) Suicide or Attempted Suicide (sane or insane), Hernia, Alcoholism, Venereal Disease, or Insanity, or Acquired Immune Deficiency

Syndrome (AIDS).

(iii) Earthquake, Volcanic Eruption, or Tidal Wave.

(iv) Any weapon or instrument employing atomic fission or radioactive force, whether in time of peace or war.

(b) Death or disablement or medical expense caused by murder or assault or any attempt thereat. However, unprovoked murder or

assault maybe covered for and in consideration of premium in addition to basic premium.

(c) Death or disablement or medical expense occurring whilst the Insured is traveling in an aircraft other than one licensed for public

passenger service and operated by a regular Air Line on a published scheduled flight over a regular air route between two definitely

establishment airports and in which the Insured is traveling as a ticket-holding passenger.

(d) Death or disablement or medical expense consequent upon the Insured engaging, whether for sport or otherwise, in hunting, racing of

all kinds, steeple chasing, polo playing, motor cycling (including pillion riding and/or driving a motor cycle, motor scooter, motor

bicycle or any other twowheeled motor vehicle having one or more riding saddles), mountaineering, winter sports, ice hockey, football,

or yachting, or using wood working machinery driven by mechanical power.

(e) Death or disablement or medical expense occasioned by or happening through pregnancy or childbirth with respect to women.

(f) Death or disablement or medical expense caused while the Insured is performing or attempting the performance of an unlawful act

2. Compensation shall be payable only when the entire amount of the claim shall have been ascertained and proved to the satisfaction of the

Company.

3. In the event of the death of the Insured all sums of money payable under this Policy shall be paid to the legal personal representatives of

the Insured except that compensation for death under benefit A of table of benefits I shall be paid to the Beneficiary(ies) designated in the

Schedule hereto whose receipt for such compensation for death shall be final and full discharge of the liability of the Company therefor.

Transaction No. 2021-PA620316 - PAB 2021-08

BPI/MS Insurance Corporation/08/16/21/1:54 PM //002-02

Client/ Agent Ref. No -

Replaced Pol. FREDERICK LAGRIA - RM No.

Page 3

BPI/MS Insurance Corporation

A joint venture of the Bank of the Philippine Islands & Mitsui Sumitomo Insurance

11th, 14th & 16th Floors 6811 BPI-Philam Life Makati

Ayala Ave., Salcedo Village Bel-Air, Makati City 1226

Tel. No. (632) 88409000 ● Fax No. (632) 88409099 ● TIN 000-474-030-000 VAT

www.bpims.com

CONDITIONS

1. Written notice shall be given to the Company without unnecessary delay but in any event within three weeks of the occurrence of the injury

in respect of which a claim is to be made. In the event of accidental death, immediate notice thereof must be given to the Company.

2. All certificates, information and evidence required by the Company shall be furnished at the expense of the Insured or his legal personal

representatives and shall be in such form and of such nature as the Company may prescribe. The insured as often as required shall submit

to medical examination on behalf of the Company at its own expense in respect of any alleged bodily injury. The Company shall in case of

the death of the Insured be entitled to have a post mortem examination at its own expense. The insured shall as soon as possible after the

occurrence of any injury, obtained and follow the advice of a duly qualified medical practitioner and the Company shall not be liable for any

consequences arising by reason of the Insured's failure to obtain or follow such advice and use such appliances or remedies as maybe

prescribed.

3. The Insured shall give immediate notice in writing to the Company of any change in his address or in his profession or occupation or of the

effecting of other Insurances except Coupon against accident, disease or sickness and on tendering any premium for the renewal of this

Policy shall give notice in writing to the Company of any disease or sickness and on tendering any premium for the renewal of this Policy

shall give notice in writing to the Company of any disease, sickness physical defect or infirmity with which he has become affected or of

which has become aware since the payment of the preceding premium.

4. This policy may be renewed from term to term, subject to consent of the Company, by issue of renewal certificate by the Company and by

payment of the premium in advance at the Company's premium rate in force at time of renewals. The Policy shall not be renewable after

the end of the period of Insurance during which the Insured attains the age of 70 years. The Company may at any time give notice to the

Insured to terminate this Policy forthwith without prejudice to the rights of the Insured in respect of prior injury provided that the company

return to the Insured the then last premium paid by him less a pro rata part thereof for the period of the year for which the Policy has been

in force. Notice to be given by the Company may be given personally to the Insured in writing or sent by registered post addressed to him at

his last address known to the Company. By like notice to the Company the Insured may at any time terminate and cancel this Policy in

which case the Company will retain the customary short period rate for the time the Policy has been in force.

5. No assignment of the benefits of this policy shall be binding upon the Company unless and until the originals or a duplicate thereof is filed

with the Company. The Company does not assume any responsibility for the validity of any assignment. No change of beneficiary under

this policy shall bind the Company unless consent thereto is formally endorsed hereon by the Company.

6. If any difference or dispute shall arise with respect to the amount of the Company's liability under this Policy, the same shall be referred to

the decision of a single arbitrator to be agreed upon by both parties, or, failing such agreement of a single arbitrator, to the decision of two

arbitrators, one to be appointed in writing by each of the parties within two calendar months after having been required in writing to do so

by either of the parties, and in case of disagreement between the arbitrators, to the decision of an umpire who shall have been appointed in

writing by the arbitrators before entering on the reference, and the costs of and incidental to the reference shall be dealt with in the award.

And it is hereby expressly, stipulated and declared that it shall be a condition precedent to any right of action or suit upon this Policy that

the award by such arbitrator, arbitrators or umpire on the amount of the Company's liability hereunder, if disputed, shall be first obtained. If

a claim be made and rejected and an action or suit be riot commenced within twelve months after such rejection or (in case of an

arbitration taking place as provided herein) within twelve months after the arbitrators or umpire shall have made their award, then the claim

shall for all purposes be deemed to have been abandoned and shall not hereafter be recoverable hereunder.

7. IT IS HEREBY DECLARED AND AGREEDthat the provision of Article 1250 of the Civil Code of the Philippines (Republic Act No.386) which

reads: "In case an extraordinary inflation or deflation of the currency stipulated should supervene, the value of the currency at the time of

the establishment of the obligation shall be the basis of payment"...shall not apply in determining the extent of liability under the provisions

of this policy.

8. RENEWAL CLAUSE - Unless the Company at least forty five (45) days in advance of the end of policy period mails or delivers to the Assured

at the address shown in the policy notice of its intention not to renew, or to condition its renewal upon reduction of the limits or elimination

of coverages, the Assured shall be entitled to renew the policy upon payment of the premium due on the effective date of renewal.

PERSONAL ACCIDENT TABLE OF BENEFITS

TABLE OF BENEFITS - I

BODILY INJURY caused by violent external and visible means which injury shall solely and independently of any other cause result in:

A. Death - occurring within twelve calendar months of bodily injury as aforesaid..

B. Permanent Disablement occurring within twelve calendar months of bodily injury as aforesaid and not followed within twelve calendar

months of the said bodily injury, by the death of the insured:

the percentages in the Table of Benefits II of

C. 1. Total Disablement temporarily from engaging in or giving attention to profession or occupation:

Weekly Compensation for such disablement at the rate of….….

2. Partial Disablement temporarily from engaging in or giving attention to profession or occupation:

Weekly compensation for such disablement at the rate of one-third of benefit C 1.

D. Medical and Surgical treatment for such injury: Indemnity for the expenses of such treatment incurred by the Insured subject to a Limit in

respect of Any One Accident……….

Compensation under Benefits C 1 and C 2 either separately or together shall not be payable for a longer period than 100 weeks in respect of any

one injury calculated from the date the Insured was first examined by a duly qualified Medical Practitioner.

Transaction No. 2021-PA620316 - PAB 2021-08

BPI/MS Insurance Corporation/08/16/21/1:54 PM //002-02

Client/ Agent Ref. No -

Replaced Pol. FREDERICK LAGRIA - RM No.

Page 4

BPI/MS Insurance Corporation

A joint venture of the Bank of the Philippine Islands & Mitsui Sumitomo Insurance

11th, 14th & 16th Floors 6811 BPI-Philam Life Makati

Ayala Ave., Salcedo Village Bel-Air, Makati City 1226

Tel. No. (632) 88409000 ● Fax No. (632) 88409099 ● TIN 000-474-030-000 VAT

www.bpims.com

The insured shall for the purpose of this Policy be considered partially disabled under Benefit C 2 when able to attend to some extent to his

profession or occupation but unable to attend to a substantial part thereof.

TABLE OF BENEFITS II

DESCRIPTION OF DISABLEMENT PERCENTAGE OF THE SUM

PERMANENT DISABLEMENT SPECIFIED IN BENEFIT B OF

TABLE OF BENEFITS I

Loss of two limbs 100%

Loss of both hands, or all fingers and both thumbs 100%

Loss of both feet 100%

Total loss of sight of both eyes 100%

Injuries resulting in being permanently bedridden 100%

Any other injury causing permanent total disablement 100%

Loss of arm at or above elbow 70%

Loss of arm between elbow and wrist 50%

Loss of hand 42 ½%

Loss of four fingers and thumb on one hand 42 ½%

Loss of four fingers 35%

Loss of thumb 15%

Loss of index finger 10%

Loss of middle finger 6%

Loss of ring finger 5%

Loss of little finger 4%

Loss of metacarpals – first or second (additional) 3%

Third, fourth or fifth (additional) 2%

Loss of leg at or above knee 60%

Loss of leg below knee 40%

Loss of one foot 40%

Loss of toes - all of one foot 15%

Loss of Big Toe 5%

Loss of any toe other than Big Toe, each 1%

Loss of sight of one eye. 30%

Loss of hearing - both ears. 50%

One ear 7%

Total Permanent loss of the use of a member shall be treated as loss of such member.

The loss of the first joint of the thumb or of any finger or of any toe shall be considered as equal to the loss of one-half of the thumb or finger toe

and the benefit shall be one-half of the benefit above specified for the loss of the thumb or finger or toe.

The loss of more than one phalange of the thumb or of any other finger or any toe shall be treated as loss of the entire thumb or finger or toe.

Where, however, there is loss of two or more parts of the hand, the percentage payable shall not be more than the loss of the whole hand.

the injury is not specified the Company will adopt a percentage of disablement, which in its opinion is not inconsistent with the provisions of this

table.

The aggregate of all percentages payable in respect of anyone accident shall not exceed 100%.

This contract shall terminate in the event of accidental death as provided therein or upon its expiry.

In any policy year, the aggregate benefits payable under this contract in respect of anyone accident resulting in loss(es) within 180 days from

date of accidents(s) shall not exceed the principal sum (e.g. loss of life, loss of both hands and feet, loss of sight of both eyes and either hand or

foot).

In any policy year, the aggregate benefits under the Dismemberment/Disability Benefits of this contract in respect of one or more accident(s)

resulting in loss(es) within 180 days from date of accident(s) shall not exceed the principal sum [i.e., for subsequent accident resulting in any

loss(es) which would make the aggregate benefits exceed the principal sum, be amount(s) payable under the Dismemberment/Disability Benefit

shall be the principal less the amount(s) paid for previous loss(es)]. However, the payment of the principal sum for such loss(es) shall not

terminate the contract in so far as accidental death benefit is concerned.

In any policy year, the amount of benefit payable for loss of life, arising from independent/unrelated accident/event shall always be the principal

sum.

Any partial benefit already paid for any loss(es) shall not be carried over in the subsequent policy year (i.e., the amount of benefits to be paid In

the succeeding policy year shall not be reduced by any amount paid in the preceding year).

SHORT PERIOD RATES SCALE

The following scale of rates shall apply to Policies issued or renewed for less than one year and shall also be used in calculating return

premiums on Policies cancelled and not replaced:-

Transaction No. 2021-PA620316 - PAB 2021-08

BPI/MS Insurance Corporation/08/16/21/1:54 PM //002-02

Client/ Agent Ref. No -

Replaced Pol. FREDERICK LAGRIA - RM No.

Page 5

BPI/MS Insurance Corporation

A joint venture of the Bank of the Philippine Islands & Mitsui Sumitomo Insurance

11th, 14th & 16th Floors 6811 BPI-Philam Life Makati

Ayala Ave., Salcedo Village Bel-Air, Makati City 1226

Tel. No. (632) 88409000 ● Fax No. (632) 88409099 ● TIN 000-474-030-000 VAT

www.bpims.com

No. of Month/s 1 2 3 4 5 6 7 8 9 10 11

Percentage 20 30 40 50 60 70 75 80 85 90 95

IN WITNESS WHEREOF, The Company has caused this Policy to be signed by its duly authorized officer/representative.

Documentary Stamps to the value stated in the Schedule have been affixed and

properly cancelled on the office copy of this Policy.

BPI/MS Insurance Corporation

IMPORTANT NOTICE

The Insurance Commissioner with offices in Manila, Cebu and Davao, is the Government

official in charge of the enforcement of all laws relating to insurance and has

supervision over insurance companies. He is ready at all times to render assistance in

settling any controversy between an Insurance Company and a policy holder relating to TAIZO KOMATSU

insurance matters. For your own protection you are requested to read this Policy in full, PRESIDENT

including its conditions, and, if it is not in accordance with your intentions to return it

immediately for correction.

Transaction No. 2021-PA620316 - PAB 2021-08

BPI/MS Insurance Corporation/08/16/21/1:54 PM //002-02

Client/ Agent Ref. No -

Replaced Pol. FREDERICK LAGRIA - RM No.

Page 6

You might also like

- 2866100498386100000Document4 pages2866100498386100000E-World Cyber ZoneNo ratings yet

- Personal Auto Declaration: Policy Premium Total $1,314.00Document2 pagesPersonal Auto Declaration: Policy Premium Total $1,314.00Albenys AlonsoNo ratings yet

- Commercial ContractDocument2 pagesCommercial ContractThủy NguyễnNo ratings yet

- CPD Council accredited CPD programs for civil engineersDocument184 pagesCPD Council accredited CPD programs for civil engineersdiane terolNo ratings yet

- Personal Accident Policy: Kristy Edgie Dingal AlburoDocument6 pagesPersonal Accident Policy: Kristy Edgie Dingal AlburoJames BastatasNo ratings yet

- Insuring T&Cs - Accident Secure Max (Family) - PrimeDocument8 pagesInsuring T&Cs - Accident Secure Max (Family) - PrimeTolits MillabasNo ratings yet

- Domingo O. Ignacio - 3251892000309Document10 pagesDomingo O. Ignacio - 3251892000309Roberto IgnacioNo ratings yet

- Versosarichard SindejasDocument1 pageVersosarichard SindejasDorothy NaongNo ratings yet

- 1202401004229Document9 pages1202401004229Daryl Kim Ivan PascoNo ratings yet

- PDF DocumentDocument3 pagesPDF DocumentdrjasonellisNo ratings yet

- 3004_A_328039707_00_B00Document3 pages3004_A_328039707_00_B00l48117733No ratings yet

- The Oriental Insurance Company LimitedDocument4 pagesThe Oriental Insurance Company LimitedchiragpramodwaghelaNo ratings yet

- DP 790457Document1 pageDP 790457Nelson D. HampacNo ratings yet

- 2nd Flr, Marzo De Ocho Bldg. 2, Calicanto Batangas City, Batangas, Region IV - Policy Schedule - Private Car - Non-FleetDocument3 pages2nd Flr, Marzo De Ocho Bldg. 2, Calicanto Batangas City, Batangas, Region IV - Policy Schedule - Private Car - Non-FleetKimberly Kate FajaritoNo ratings yet

- QwebgDocument2 pagesQwebgJayden EnzoNo ratings yet

- Neon Muthoni PaDocument2 pagesNeon Muthoni PamuthoniNo ratings yet

- OIKEADocument1 pageOIKEAcailinghoneygenNo ratings yet

- ICICI Lombard General Insurance Company ProfileDocument6 pagesICICI Lombard General Insurance Company ProfileSURAJ PratapNo ratings yet

- Badhkummed Indane Gramin Vitark-21-22Document9 pagesBadhkummed Indane Gramin Vitark-21-22gera 0734No ratings yet

- Summary of InsuranceDocument9 pagesSummary of InsuranceAltaf AdilNo ratings yet

- Roberto Estevez Baez Insurance InfoDocument18 pagesRoberto Estevez Baez Insurance Infoelisvanrodriguez072082No ratings yet

- LuzvimindaDocument1 pageLuzvimindajuvypearl29No ratings yet

- Sub: Risk Assumption Letter: Insured & Vehicle DetailsDocument3 pagesSub: Risk Assumption Letter: Insured & Vehicle DetailsSHUBHAM KUMAR JHANo ratings yet

- Insurance FatemaDocument4 pagesInsurance FatemaMd. Shariful Islam RazuNo ratings yet

- United India Insurance Company Limited: M/S Kadambri InternationalDocument8 pagesUnited India Insurance Company Limited: M/S Kadambri InternationalReema KhatiNo ratings yet

- Tata AigDocument3 pagesTata AigAshik IkbalNo ratings yet

- Dec PG CarlockDocument2 pagesDec PG Carlockrizkhyarie01No ratings yet

- ICICI Lombard Risk Assurance LetterDocument3 pagesICICI Lombard Risk Assurance LetterRajkamal RajaNo ratings yet

- 58213566Document2 pages58213566anshiNo ratings yet

- 091BUQVE2108: Non-Land Transportation Operator'S VehicleDocument2 pages091BUQVE2108: Non-Land Transportation Operator'S VehicleJayson GuerreroNo ratings yet

- A Joint Venture Between Allahabad Bank, Sompo Japan Nipponkoa Insurance Inc., Indian Overseas Bank, Karnataka Bank and Dabur InvestmentsDocument2 pagesA Joint Venture Between Allahabad Bank, Sompo Japan Nipponkoa Insurance Inc., Indian Overseas Bank, Karnataka Bank and Dabur Investmentscommission sompoNo ratings yet

- 3004_A_328317255_00_B00Document3 pages3004_A_328317255_00_B00l48117733No ratings yet

- AnticipatedLapseReport 70049122 20200205Document1 pageAnticipatedLapseReport 70049122 20200205Kin BangeroNo ratings yet

- A Joint Venture Between Allahabad Bank, Sompo Japan Nipponkoa Insurance Inc., Indian Overseas Bank, Karnataka Bank and Dabur InvestmentsDocument2 pagesA Joint Venture Between Allahabad Bank, Sompo Japan Nipponkoa Insurance Inc., Indian Overseas Bank, Karnataka Bank and Dabur Investmentscommission sompoNo ratings yet

- 19614619892_20227633460Document3 pages19614619892_20227633460SagarNo ratings yet

- 3004_A_328119876_00_B00Document3 pages3004_A_328119876_00_B00l48117733No ratings yet

- Policy Owner Service Review - J774022099Document2 pagesPolicy Owner Service Review - J774022099mertra246No ratings yet

- Sub: Risk Assumption Letter: Insured & Vehicle DetailsDocument3 pagesSub: Risk Assumption Letter: Insured & Vehicle Detailsnikhilkadam2583No ratings yet

- The Oriental Insurance Company Limited: Agent/BrokerDocument3 pagesThe Oriental Insurance Company Limited: Agent/Brokerfirozthavakkal323No ratings yet

- Fortitch Compre 2Document7 pagesFortitch Compre 2uas.jlagroupNo ratings yet

- 3004_A_329323685_00_B00Document3 pages3004_A_329323685_00_B00l48117733No ratings yet

- Icici Lombard Mh!49966Document3 pagesIcici Lombard Mh!49966suresh sivadasanNo ratings yet

- 3004_A_328253569_00_B00Document3 pages3004_A_328253569_00_B00l48117733No ratings yet

- Pagagcert 202212060304892 UnDocument4 pagesPagagcert 202212060304892 UnSardar DwivediNo ratings yet

- HDFC ERGO renews Optima Restore Floater Insurance Policy for Preeti BajpaiDocument4 pagesHDFC ERGO renews Optima Restore Floater Insurance Policy for Preeti BajpaiHoooooNo ratings yet

- 300532410626700B00 PolicyDocument3 pages300532410626700B00 Policynecolatesla45No ratings yet

- Sub: Risk Assumption Letter: Insured & Vehicle DetailsDocument3 pagesSub: Risk Assumption Letter: Insured & Vehicle DetailsSudheer singhNo ratings yet

- Jade InsuranceDocument1 pageJade Insurancejasminejazz54321No ratings yet

- Sbi So 2019 0801191801 Detailed-Ad-EnglishDocument1 pageSbi So 2019 0801191801 Detailed-Ad-EnglishHarika VenuNo ratings yet

- Sub: Risk Assumption Letter: Insured & Vehicle DetailsDocument3 pagesSub: Risk Assumption Letter: Insured & Vehicle DetailsRehan KahnNo ratings yet

- Sub: Risk Assumption Letter: Insured & Vehicle DetailsDocument3 pagesSub: Risk Assumption Letter: Insured & Vehicle DetailsNandeeshNo ratings yet

- Policy 468140003 1899483072595Document1 pagePolicy 468140003 1899483072595Ishan AnandNo ratings yet

- Insurance J Oijoi JDocument3 pagesInsurance J Oijoi JjamlarambNo ratings yet

- Private Passenger Automobile Declarations PageDocument2 pagesPrivate Passenger Automobile Declarations Pageabad0574No ratings yet

- Welcome To The ICICI Lombard Family!: Dear Mrs Rashmi Choudhury, We Hope This Communication Finds You in Good HealthDocument4 pagesWelcome To The ICICI Lombard Family!: Dear Mrs Rashmi Choudhury, We Hope This Communication Finds You in Good HealthSanjay SharmaNo ratings yet

- Renewal of Your Optima Restore Floater Insurance PolicyDocument4 pagesRenewal of Your Optima Restore Floater Insurance PolicyNikky KapoorNo ratings yet

- PolicySchedule 308975156 PDFDocument3 pagesPolicySchedule 308975156 PDFAmit DasNo ratings yet

- Certificate of InsuranceDocument1 pageCertificate of Insuranceganesh gaddeNo ratings yet

- Sotica Dec PageDocument32 pagesSotica Dec PageHermelinda LinoNo ratings yet

- CGL InsuranceDocument1 pageCGL InsuranceMine MinisoNo ratings yet

- New Business Policy Summary for Accident Guard PlusDocument7 pagesNew Business Policy Summary for Accident Guard PlusSneha BhosaleNo ratings yet

- PricewaterhouseCoopers' Guide to the New Tax RulesFrom EverandPricewaterhouseCoopers' Guide to the New Tax RulesNo ratings yet

- B.bulacan - Ds With Air WelDocument1 pageB.bulacan - Ds With Air WelfredNo ratings yet

- Rectification and Waterproofing Old BuildingDocument1 pageRectification and Waterproofing Old BuildingfredNo ratings yet

- Contract Agreement: Item Designation Work InclusionDocument2 pagesContract Agreement: Item Designation Work InclusionfredNo ratings yet

- B.bulacan - Ds With Air VentDocument1 pageB.bulacan - Ds With Air VentfredNo ratings yet

- Second Floor Plan Ground Floor Plan: Scale: Mts. 1:100 Scale: Mts. 1:100Document1 pageSecond Floor Plan Ground Floor Plan: Scale: Mts. 1:100 Scale: Mts. 1:100fredNo ratings yet

- Rev2 Cabadsan 2Document1 pageRev2 Cabadsan 2fredNo ratings yet

- Guide To Filling Out The Personal Data Sheet (PDS) WarningDocument4 pagesGuide To Filling Out The Personal Data Sheet (PDS) WarningfredNo ratings yet

- Cabinet Ravelos ModelDocument1 pageCabinet Ravelos ModelfredNo ratings yet

- B.bulacan - Ds With Air WelDocument1 pageB.bulacan - Ds With Air WelfredNo ratings yet

- For TarpDocument4 pagesFor TarpfredNo ratings yet

- National Capital Region:: Mr. Antonio A. Salamat, Jr. / Ms. Angelica Fullero / Ms. Lualhati A. ZuñigaDocument19 pagesNational Capital Region:: Mr. Antonio A. Salamat, Jr. / Ms. Angelica Fullero / Ms. Lualhati A. ZuñigafredNo ratings yet

- How To Consume Philippine Geoportal Layers in ArcgisDocument2 pagesHow To Consume Philippine Geoportal Layers in ArcgisfredNo ratings yet

- Ground Floor Plan Second Floor Plan: Scale: Mts. 1:100 Scale: 1:100 MtsDocument1 pageGround Floor Plan Second Floor Plan: Scale: Mts. 1:100 Scale: 1:100 MtsfredNo ratings yet

- Construction-Project-Management Points To StudyDocument9 pagesConstruction-Project-Management Points To Studyfred100% (1)

- Engineering Econ Lab - Week 1Document2 pagesEngineering Econ Lab - Week 1Zac QuezonNo ratings yet

- 14 330SoilClassification PDFDocument40 pages14 330SoilClassification PDFMartin Andrade100% (2)

- 1.0.soil Texture-Triangl3Document1 page1.0.soil Texture-Triangl3fredNo ratings yet

- Bidding Form No. 5 Bill of Materials - 0Document6 pagesBidding Form No. 5 Bill of Materials - 0Kim Aljon CalveloNo ratings yet

- Alternative Dispute ResolutionDocument18 pagesAlternative Dispute ResolutionKajal MhasalNo ratings yet

- A 739 N 90 ApplicationDocument2 pagesA 739 N 90 ApplicationGorishsharmaNo ratings yet

- 10NM60Document17 pages10NM60Jose Barroso GuerraNo ratings yet

- Asif Hameed v. State of J & KDocument17 pagesAsif Hameed v. State of J & Kswastik groverNo ratings yet

- Gujarat HC Order on Anticipatory Bail ApplicationDocument11 pagesGujarat HC Order on Anticipatory Bail ApplicationSreejith NairNo ratings yet

- HALL TICKET FOR SUMMER 2021 of 2000130177Document1 pageHALL TICKET FOR SUMMER 2021 of 2000130177Tejas ShivalkarNo ratings yet

- ST-100A ST-200A: Operation ManualDocument148 pagesST-100A ST-200A: Operation ManualsunhuynhNo ratings yet

- CLS-HLL Company Secretary and Head of LegalDocument1 pageCLS-HLL Company Secretary and Head of LegalAspire SuccessNo ratings yet

- School Rules and Regulation Agreement With The ParentsDocument15 pagesSchool Rules and Regulation Agreement With The ParentsJulie Ann SuarezNo ratings yet

- Notice of Removal No JurisdictionDocument2 pagesNotice of Removal No JurisdictionNoble BernisEarl McGill El BeyNo ratings yet

- Sindh Empowerment of PWD Act XLVIII of 2018 June 11 2018Document26 pagesSindh Empowerment of PWD Act XLVIII of 2018 June 11 2018Syed Kashif SyedNo ratings yet

- Risk assessment form templateDocument2 pagesRisk assessment form templateRajendraNo ratings yet

- Interpretation of Statutes: Problems and Limitations in Applying The Mischief RuleDocument7 pagesInterpretation of Statutes: Problems and Limitations in Applying The Mischief RuleAjit Singh Parihar100% (1)

- Police System ProjectDocument17 pagesPolice System Projectkartik kasniaNo ratings yet

- Extra Judicial With Waiver of RightsDocument3 pagesExtra Judicial With Waiver of RightsKEICHIE QUIMCONo ratings yet

- IRAC in Class Assn.Document2 pagesIRAC in Class Assn.Nicholas HidalgoNo ratings yet

- MOOT COURT AssignmentDocument14 pagesMOOT COURT AssignmentTushti DhawanNo ratings yet

- Research Project (Hemant Singh)Document23 pagesResearch Project (Hemant Singh)hemant singhNo ratings yet

- APS GLOBAL GLIMPSE TOURS PRIVATE LIMITED - Company, Directors and Contact Details - Zauba Corp PDFDocument6 pagesAPS GLOBAL GLIMPSE TOURS PRIVATE LIMITED - Company, Directors and Contact Details - Zauba Corp PDFprabhat mehtoNo ratings yet

- Lawphil - G.R. No. 171468 August 24, 2011Document8 pagesLawphil - G.R. No. 171468 August 24, 2011teepeeNo ratings yet

- Law and Procedure of Meetings - Docx Notes PDFDocument6 pagesLaw and Procedure of Meetings - Docx Notes PDFJaber RahmanNo ratings yet

- Notes On Special Corporations (INCLUDE OPC and CVPI)Document13 pagesNotes On Special Corporations (INCLUDE OPC and CVPI)charmagne cuevasNo ratings yet

- (G.R. No. 251995, January 26, 2021) Rhodora J. Cadiao, Petitioner, vs. Commission On Audit, Respondent. Decision Carandang, J.Document11 pages(G.R. No. 251995, January 26, 2021) Rhodora J. Cadiao, Petitioner, vs. Commission On Audit, Respondent. Decision Carandang, J.Ruby Anna TorresNo ratings yet

- Human Rights LawDocument4 pagesHuman Rights LawMano Felix100% (1)

- OCA Circular No. 98 2022 Compressed 1Document9 pagesOCA Circular No. 98 2022 Compressed 1Danica CruzNo ratings yet

- Bibliography: BooksDocument7 pagesBibliography: BooksDilip KumarNo ratings yet

- Dungo V PPDocument3 pagesDungo V PPapril75No ratings yet

- PNB v. Tejano, JR., G.R. No. 173615Document10 pagesPNB v. Tejano, JR., G.R. No. 173615The Money FAQsNo ratings yet

- Deepaksindhu Ipr 21 Sem-IxDocument29 pagesDeepaksindhu Ipr 21 Sem-IxDevendra DhruwNo ratings yet