Professional Documents

Culture Documents

L4 Graded Test

Uploaded by

Garp BarrocaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

L4 Graded Test

Uploaded by

Garp BarrocaCopyright:

Available Formats

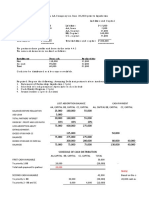

ACCTG21 STATEMENT OF CASH FLOWS

Multiple Choice

Identify the choice that best completes the statement or answers the question.

____ 1. Lax Company provied the following information during the current year.

Dividend received 500,000

Dividend paid 1,000,000

Cash received from cutomers 9,000,000

Proceeds from issuing share capital 1,500,000

Interest received 200,000

Proceeds from sale of long term investments 2,000,000

Cash paid on long term debt 6,000,000

Interest paid on ong term debt 400,000

Income taxes oaid 300,000

Cash balance, January 1 1,800,000

What is the net cash provided by operating activities for the current year using direct method?

a. 3,000,000 c. 2,700,000

b. 3,300,000 d. 2,000,000

____ 2. Lax Company provied the following information during the current year.

Dividend received 500,000

Dividend paid 1,000,000

Cash received from cutomers 9,000,000

Proceeds from issuing share capital 1,500,000

Interest received 200,000

Proceeds from sale of long term investments 2,000,000

Cash paid on long term debt 6,000,000

Interest paid on ong term debt 400,000

Income taxes oaid 300,000

Cash balance, January 1 1,800,000

What is the net cash provided by investing activities?

a. 2,500,000 c. 2,200,000

b. 2,000,000 d. 0

____ 3. Lax Company provied the following information during the current year.

Dividend received 500,000

Dividend paid 1,000,000

Cash received from cutomers 9,000,000

Proceeds from issuing share capital 1,500,000

Interest received 200,000

Proceeds from sale of long term investments 2,000,000

Cash paid on long term debt 6,000,000

Interest paid on ong term debt 400,000

Income taxes oaid 300,000

Cash balance, January 1 1,800,000

What is the net cash provided by financing activities?

a. 1,500,000 c. 500,000

b. 1,000,000 d. 0

____ 4. Star Company provided the following data for the preparation of statement of cash flows for the current year

usinf the direct method:

Cash balance, beginnig 1,500,000

Cash paid to purchase inventory 7,800,000

Cash received from sale of trading securities 2,500,000

Cash paid for interest 450,000

Cash paid to repay a loan 1,000,000

Cash collected from customers 10,000,000

Cash received from issuance of ordinary shares 1,200,000

Cash paid for dividend 2,000,000

Cash paid for income taxes 1,350,000

Cash paid to purchase trading securities 1,000,000

What is the net cash provided by operating activities?

a. 1,900,000 c. 2,350,000

b. 2,900,000 d. 400,000

____ 5. Star Company provided the following data for the preparation of statement of cash flows for the current year

usinf the direct method:

Cash balance, beginnig 1,500,000

Cash paid to purchase inventory 7,800,000

Cash received from sale of trading securities 2,500,000

Cash paid for interest 450,000

Cash paid to repay a loan 1,000,000

Cash collected from customers 10,000,000

Cash received from issuance of ordinary shares 1,200,000

Cash paid for dividend 2,000,000

Cash paid for income taxes 1,350,000

Cash paid to purchase trading securities 1,000,000

What is the net cash used in financial activities?

a. 3,000,000 c. 1,800,000

b. 2,000,000 d. 4,200,000

____ 6. Star Company provided the following data for the preparation of statement of cash flows for the current year

usinf the direct method:

Cash balance, beginnig 1,500,000

Cash paid to purchase inventory 7,800,000

Cash received from sale of trading securities 2,500,000

Cash paid for interest 450,000

Cash paid to repay a loan 1,000,000

Cash collected from customers 10,000,000

Cash received from issuance of ordinary shares 1,200,000

Cash paid for dividend 2,000,000

Cash paid for income taxes 1,350,000

Cash paid to purchase trading securities 1,000,000

What is the cash balance at year-end?

a. 3,400,000 c. 1,400,000

b. 1,600,000 d. 2,400,000

____ 7. Fragile Company used the direct method to prepare the statement of cash flows. the entity had the following

cash flows during the current year:

Cash receipt from issuance of ordinary shares 4,000,000

Cash receipt from customers 2,000,000

Cash receipt fro dividends on long-term investments 300,000

Cash receipt from repayment of loan made to another entity 2,200,000

Cash payments for wages and other operation expenses 1,200,000

Cash payments for insurance 100,000

Cash payment for dividends 200,000

Cash payments for taxes 400,000

Cash payment to purchase land 800,000

Cash balance - beginning 3,500,000

What is the net cash provided by operating activities?

a. 600,000 c. 300,000

b. 400,000 d. 200,000

____ 8. Fragile Company used the direct method to prepare the statement of cash flows. the entity had the following

cash flows during the current year:

Cash receipt from issuance of ordinary shares 4,000,000

Cash receipt from customers 2,000,000

Cash receipt fro dividends on long-term investments 300,000

Cash receipt from repayment of loan made to another entity 2,200,000

Cash payments for wages and other operation expenses 1,200,000

Cash payments for insurance 100,000

Cash payment for dividends 200,000

Cash payments for taxes 400,000

Cash payment to purchase land 800,000

Cash balance - beginning 3,500,000

What is the net cash provieded by investing activites?

a. 2,200,000 c. 3,000,000

b. 1,400,000 d. 800,000

____ 9. Fragile Company used the direct method to prepare the statement of cash flows. the entity had the following

cash flows during the current year:

Cash receipt from issuance of ordinary shares 4,000,000

Cash receipt from customers 2,000,000

Cash receipt fro dividends on long-term investments 300,000

Cash receipt from repayment of loan made to another entity 2,200,000

Cash payments for wages and other operation expenses 1,200,000

Cash payments for insurance 100,000

Cash payment for dividends 200,000

Cash payments for taxes 400,000

Cash payment to purchase land 800,000

Cash balance - beginning 3,500,000

What is the net cash provided by financing activities?

a. 4,000,000 c. 3,800,000

b. 6,000,000 d. 6,200,000

____ 10. Fragile Company used the direct method to prepare the statement of cash flows. the entity had the following

cash flows during the current year:

Cash receipt from issuance of ordinary shares 4,000,000

Cash receipt from customers 2,000,000

Cash receipt fro dividends on long-term investments 300,000

Cash receipt from repayment of loan made to another entity 2,200,000

Cash payments for wages and other operation expenses 1,200,000

Cash payments for insurance 100,000

Cash payment for dividends 200,000

Cash payments for taxes 400,000

Cash payment to purchase land 800,000

Cash balance - beginning 3,500,000

What is the cash balance at year-end?

a. 3,500,000 c. 5,500,000

b. 9,300,000 d. 5,800,000

You might also like

- Make Money With Dividends Investing, With Less Risk And Higher ReturnsFrom EverandMake Money With Dividends Investing, With Less Risk And Higher ReturnsNo ratings yet

- Aac M 2 Cash Flow Prob Answer 1 5Document11 pagesAac M 2 Cash Flow Prob Answer 1 5Micah Danielle S. TORMON0% (1)

- PAS 7 Statement of Cash FlowsDocument7 pagesPAS 7 Statement of Cash Flowspanda 1100% (6)

- Proof of Cash - DrillDocument3 pagesProof of Cash - DrillMark Domingo Mendoza100% (1)

- Star Company Statement of Cash Flow AnalysisDocument3 pagesStar Company Statement of Cash Flow AnalysisMarian grace DivinoNo ratings yet

- IA 3 AssignmentDocument2 pagesIA 3 AssignmentToni Rose Hernandez LualhatiNo ratings yet

- 6937 - Statement of Cash FlowsDocument2 pages6937 - Statement of Cash FlowsAljur SalamedaNo ratings yet

- Statement of CashflowDocument2 pagesStatement of CashflowAna Marie IllutNo ratings yet

- Cash Flow QuizDocument1 pageCash Flow QuizDan David FLoresNo ratings yet

- CPA Review School Philippines Financial ReportingDocument2 pagesCPA Review School Philippines Financial ReportingAljur SalamedaNo ratings yet

- Cash Flow Problems - Group 1Document7 pagesCash Flow Problems - Group 1TrixieNo ratings yet

- ACCTGREV1 - 009.1 Statement of Cash Flows Part 1Document1 pageACCTGREV1 - 009.1 Statement of Cash Flows Part 1Jeremiah David0% (1)

- Cuenco, Julie Ann (Bsa 1-1) Activity #7 CfasDocument2 pagesCuenco, Julie Ann (Bsa 1-1) Activity #7 CfasJulie Ann CuencoNo ratings yet

- Answer Key Fa RemDocument4 pagesAnswer Key Fa RemMac b IBANEZNo ratings yet

- CHAPTER 11 Statement of Cash FlowDocument2 pagesCHAPTER 11 Statement of Cash FlowMark IlanoNo ratings yet

- Statement of Cash FlowsDocument6 pagesStatement of Cash FlowsLuiNo ratings yet

- Star Company 2021 Statement of Cash FlowDocument1 pageStar Company 2021 Statement of Cash FlowFretchie Anne C. LauroNo ratings yet

- CFAS - Review Net Cash FlowsDocument15 pagesCFAS - Review Net Cash FlowsRyou ShinodaNo ratings yet

- Cash-Flow-Online-April-6-2024-for-studentsDocument5 pagesCash-Flow-Online-April-6-2024-for-studentsraven.jumaoas.eNo ratings yet

- Financial Statement Analysis for Entity Providing Trial BalanceDocument3 pagesFinancial Statement Analysis for Entity Providing Trial BalanceMansour HamjaNo ratings yet

- ACC 110 - Cash Flow Sample Problems Solution - Briones1Document2 pagesACC 110 - Cash Flow Sample Problems Solution - Briones1Erica BrionesNo ratings yet

- FS to RECEIVABLE - Petty Cash, Accounts Receivable, Shareholders' EquityDocument31 pagesFS to RECEIVABLE - Petty Cash, Accounts Receivable, Shareholders' EquityWillen Christia M. MadulidNo ratings yet

- Drill 4 FSUU AccountingDocument6 pagesDrill 4 FSUU AccountingRobert CastilloNo ratings yet

- Las#3 - (Ia3) STATEMENT OF CASH FLOWS PDFDocument6 pagesLas#3 - (Ia3) STATEMENT OF CASH FLOWS PDFStella MarieNo ratings yet

- Cash Price EquivalentDocument4 pagesCash Price Equivalent밀크milkeuNo ratings yet

- Valix Vol. 3 2014 edition problem analysisDocument10 pagesValix Vol. 3 2014 edition problem analysisJenyl Mae NobleNo ratings yet

- IA3 Chapter 12 21Document12 pagesIA3 Chapter 12 21ZicoNo ratings yet

- Cpa Review School of The Philippines ManilaDocument3 pagesCpa Review School of The Philippines ManilaAljur SalamedaNo ratings yet

- CMA Part 1Document7 pagesCMA Part 1Aaron AbanoNo ratings yet

- CMA Part 1Document11 pagesCMA Part 1Aaron Abano100% (1)

- 7295 - Single EntryDocument2 pages7295 - Single EntryJulia MirhanNo ratings yet

- Financing Equity ProblemsDocument14 pagesFinancing Equity ProblemsIris MnemosyneNo ratings yet

- Indirect Method Cash Flow Statement for Hill CompanyDocument6 pagesIndirect Method Cash Flow Statement for Hill CompanyJessbel MahilumNo ratings yet

- Acctg 100C 25 PDFDocument2 pagesAcctg 100C 25 PDFQuid DamityNo ratings yet

- Name: - Date: - Grade Level & SectionDocument11 pagesName: - Date: - Grade Level & SectionCynthia Santos100% (1)

- Cashflow Statement Problems & SolutionsDocument2 pagesCashflow Statement Problems & SolutionsHaidee Flavier Sabido100% (1)

- 6728 Statement of Comprehensive IncomeDocument4 pages6728 Statement of Comprehensive IncomeJane ValenciaNo ratings yet

- Covid Company Statement of Cash FlowsDocument3 pagesCovid Company Statement of Cash FlowsChristine Joy MoralesNo ratings yet

- FM Quiz Set ADocument3 pagesFM Quiz Set AShaira Mae TomasNo ratings yet

- SCI Handout 1 PDFDocument4 pagesSCI Handout 1 PDFhairu keyansamNo ratings yet

- PDF May 2017 - CompressDocument7 pagesPDF May 2017 - Compresscasual viewerNo ratings yet

- Finals Quiz 2Document9 pagesFinals Quiz 2Shane TorrieNo ratings yet

- MidtermDocument9 pagesMidtermThanh PhamNo ratings yet

- Basic Accounting - With AnswersDocument12 pagesBasic Accounting - With AnswersMarie MeridaNo ratings yet

- FARAP-4518Document3 pagesFARAP-4518Accounting StuffNo ratings yet

- P1 - ReviewDocument14 pagesP1 - ReviewEvitaAyneMaliñanaTapit0% (2)

- Age No 5Document126 pagesAge No 5Deeran DhayanithiRPNo ratings yet

- 7160 - FAR Preweek ProblemDocument14 pages7160 - FAR Preweek ProblemMAS CPAR 93No ratings yet

- Acc 109 P3 Quiz No 2Document2 pagesAcc 109 P3 Quiz No 2Wilmz SalacsacanNo ratings yet

- May 2017 PDF FreeDocument7 pagesMay 2017 PDF FreeJorenz UndagNo ratings yet

- May 2017 PDF FreeDocument7 pagesMay 2017 PDF FreeJorenz UndagNo ratings yet

- May 2017Document7 pagesMay 2017Patrick Arazo0% (1)

- Cash Flow Statement QuizDocument7 pagesCash Flow Statement QuizAngelo HilomaNo ratings yet

- Star and LaceDocument4 pagesStar and LaceAlthea Y. BositoNo ratings yet

- Problems - Cash FlowDocument5 pagesProblems - Cash FlowKevin JoyNo ratings yet

- Review - SFP To Interim ReportingDocument3 pagesReview - SFP To Interim ReportingAna Marie IllutNo ratings yet

- CASH FLOW STATEMENT THEORY and PROBLEMDocument3 pagesCASH FLOW STATEMENT THEORY and PROBLEMGlen Javellana67% (3)

- 13. Single EntryDocument24 pages13. Single Entrylascona.christinerheaNo ratings yet

- FFS - NumericalsDocument5 pagesFFS - NumericalsFunny ManNo ratings yet

- Consolidation at The Date of Acquisition Problems Problem IDocument2 pagesConsolidation at The Date of Acquisition Problems Problem ISean Sanchez0% (1)

- Partnership FormationDocument51 pagesPartnership FormationGarp BarrocaNo ratings yet

- Accounting For Special Transactions First Grading ExaminationDocument22 pagesAccounting For Special Transactions First Grading Examinationaccounts 3 life94% (18)

- 85184767Document9 pages85184767Garp BarrocaNo ratings yet

- Ans Key Inst Liq4Document7 pagesAns Key Inst Liq4Garp BarrocaNo ratings yet

- Identify The Letter of The Choice That Best Completes The Statement or Answers The QuestionDocument14 pagesIdentify The Letter of The Choice That Best Completes The Statement or Answers The QuestionheyheyNo ratings yet

- The Accounting EquationDocument8 pagesThe Accounting EquationGarp BarrocaNo ratings yet

- 52055576Document1 page52055576Garp BarrocaNo ratings yet

- Admission LectureDocument7 pagesAdmission LectureGarp BarrocaNo ratings yet

- Included Investment Related Problems/questionsDocument22 pagesIncluded Investment Related Problems/questionsJanine LerumNo ratings yet

- Cash and Cash Equivalents: Answer: CDocument142 pagesCash and Cash Equivalents: Answer: CGarp BarrocaNo ratings yet

- Identify The Letter of The Choice That Best Completes The Statement or Answers The QuestionDocument14 pagesIdentify The Letter of The Choice That Best Completes The Statement or Answers The QuestionheyheyNo ratings yet

- Prelim Graded Exercises 0007Document2 pagesPrelim Graded Exercises 0007Garp BarrocaNo ratings yet

- St. Paul University PhilippinesDocument4 pagesSt. Paul University PhilippinesGarp BarrocaNo ratings yet

- 85560539Document2 pages85560539Garp BarrocaNo ratings yet

- Acctg13 Midterm Exam TQ 2021 2022 2nd SemDocument6 pagesAcctg13 Midterm Exam TQ 2021 2022 2nd SemGarp BarrocaNo ratings yet

- Lease Accounting Problems SolutionsDocument5 pagesLease Accounting Problems SolutionsGarp BarrocaNo ratings yet

- Admission LectureDocument7 pagesAdmission LectureGarp BarrocaNo ratings yet

- GTZ Phils SME Policy ReviewDocument119 pagesGTZ Phils SME Policy Reviewalexi59No ratings yet

- Identify The Letter of The Choice That Best Completes The Statement or Answers The QuestionDocument14 pagesIdentify The Letter of The Choice That Best Completes The Statement or Answers The QuestionheyheyNo ratings yet

- InstructionsDocument7 pagesInstructionsGarp BarrocaNo ratings yet

- Prelim Exercises Pretest Partnership OperationDocument2 pagesPrelim Exercises Pretest Partnership OperationGarp BarrocaNo ratings yet

- Prelim Graded Exercises 0007Document2 pagesPrelim Graded Exercises 0007Garp BarrocaNo ratings yet

- InstructionsDocument7 pagesInstructionsGarp BarrocaNo ratings yet

- To Accrue Advertising Expense: I PXRXTDocument6 pagesTo Accrue Advertising Expense: I PXRXTShane Nayah78% (9)

- Journal Entries for Entity A's Business TransactionsDocument3 pagesJournal Entries for Entity A's Business TransactionsGarp BarrocaNo ratings yet

- Name: Mariel B. GustaoDocument1 pageName: Mariel B. GustaoGarp BarrocaNo ratings yet

- PDF Advanced Accounting Chapter 1 DDDocument20 pagesPDF Advanced Accounting Chapter 1 DDGarp BarrocaNo ratings yet

- Accounting 13 - Accounting For Partnerhsip and Corporation Prelim QuizDocument1 pageAccounting 13 - Accounting For Partnerhsip and Corporation Prelim QuizGarp BarrocaNo ratings yet

- Law2 Ass Midterm Singson 1Document1 pageLaw2 Ass Midterm Singson 1Garp BarrocaNo ratings yet

- Ramon Magsaysay Memorial Colleges Accountancy Program Prelim QuizDocument5 pagesRamon Magsaysay Memorial Colleges Accountancy Program Prelim QuizGarp BarrocaNo ratings yet

- VAHAN 4.0 (Citizen Services) Onlineapp02 150 8015Document1 pageVAHAN 4.0 (Citizen Services) Onlineapp02 150 8015jack sonNo ratings yet

- Four Examples of Effects of TransactionsDocument9 pagesFour Examples of Effects of TransactionsGURUNo ratings yet

- Memo - Standard Operating Procedure For Transactions in Suspense AccountsDocument2 pagesMemo - Standard Operating Procedure For Transactions in Suspense AccountsSairajesh GourishettyNo ratings yet

- Reimbursement - IBS1311173 and PH1361146Document9 pagesReimbursement - IBS1311173 and PH1361146nikie galvezNo ratings yet

- Secretary Position at Histeria Distro CompanyDocument3 pagesSecretary Position at Histeria Distro CompanyRossa Pamela YunitaNo ratings yet

- Philippine Business Registration Requirements GuideDocument2 pagesPhilippine Business Registration Requirements Guiderenz riveraNo ratings yet

- Biscuit SCM ProjectDocument32 pagesBiscuit SCM Projectsuyog_manwatkar100% (6)

- GXT 225R Mobile Shear: Parts ManualDocument53 pagesGXT 225R Mobile Shear: Parts ManualPrudzNo ratings yet

- Payment Receipt 40 CharactersDocument2 pagesPayment Receipt 40 CharactersSrinivas SandurNo ratings yet

- EBS 122 Cum RCD FINDocument112 pagesEBS 122 Cum RCD FINmohamed-mofNo ratings yet

- Bureau of Internal RevenueDocument13 pagesBureau of Internal Revenuenathalie velasquezNo ratings yet

- Purchase Request RequisitionDocument16 pagesPurchase Request RequisitionNaja GamingNo ratings yet

- OPD Form IHealthcare-2Document2 pagesOPD Form IHealthcare-2Masoom Kazmi100% (1)

- SAP MM Stock Transport Order With Delivery Via ShippingDocument13 pagesSAP MM Stock Transport Order With Delivery Via ShippingislamelshahatNo ratings yet

- Configuration Steps in SAP FICADocument33 pagesConfiguration Steps in SAP FICAMinh Khoa100% (1)

- Oracle Fusion Example of Consigned Inventory AccountingDocument5 pagesOracle Fusion Example of Consigned Inventory AccountingrowentanNo ratings yet

- Paragon C3 Corvette Parts CatalogDocument200 pagesParagon C3 Corvette Parts Catalogdott.kara.laszloNo ratings yet

- PUP FMO Advisory No. 2 S. 2020 Online Payment Procedure For Clients of The Fund Management Office (Cashier)Document5 pagesPUP FMO Advisory No. 2 S. 2020 Online Payment Procedure For Clients of The Fund Management Office (Cashier)Omar Al ShibiNo ratings yet

- mr11 Grir Clearing Account Maintenance PDFDocument9 pagesmr11 Grir Clearing Account Maintenance PDFSowmyaNo ratings yet

- Oracle General Ledger ConfigurationDocument34 pagesOracle General Ledger Configurationb0bb1No ratings yet

- CUNA Stryker FL19Document64 pagesCUNA Stryker FL19lucas beckerNo ratings yet

- Chapter 9Document10 pagesChapter 9Kanton FernandezNo ratings yet

- 10 - Variance AnalysisDocument48 pages10 - Variance AnalysisLuba27No ratings yet

- SCM Cloud Using ShippingDocument52 pagesSCM Cloud Using Shippingمحمد سفيان أفغوليNo ratings yet

- NEXON - Price - List 14 09 2023 1Document2 pagesNEXON - Price - List 14 09 2023 1mandapatiNo ratings yet

- 10 BugasPangcaPonceRoxasZeta PrintingPressDocument11 pages10 BugasPangcaPonceRoxasZeta PrintingPressJeepee JohnNo ratings yet

- R&P 1983 Rules Wise & GAR FormsDocument8 pagesR&P 1983 Rules Wise & GAR FormsSebastian Mangneo KukiNo ratings yet

- VAHAN 4.0 (Citizen Services)~onlineapp02~150~8013 HDocument1 pageVAHAN 4.0 (Citizen Services)~onlineapp02~150~8013 Hmdneyaz9831No ratings yet

- The Sales Tax Rules 2006Document99 pagesThe Sales Tax Rules 2006Hassan RazaNo ratings yet

- Receipt For Payment of Bills/Demand Notes. This Receipt Is Generated From I.E. BSNL PortalDocument1 pageReceipt For Payment of Bills/Demand Notes. This Receipt Is Generated From I.E. BSNL PortalsukujeNo ratings yet