Professional Documents

Culture Documents

Prelim Quiz 1

Uploaded by

Garp BarrocaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Prelim Quiz 1

Uploaded by

Garp BarrocaCopyright:

Available Formats

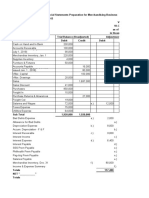

ROCK AUTO HORN AUTO

DEBIT CREDIT DEBIT CREDIT

CASH P 20,000 P 40,000

ACCOUNTS RECEIVABLE 80,000 160,000

ALLOWANCE FOR DOUBTFUL ACCOUNTS 8,000 16,000

NOTES RECEIVABLE 10,000 20,000

MERCHANDISE INVENTORY 60,000 120,000

STORE EQUIPMENT 40,000 80,000

ACCUM. DEPN 10,000 20,000

ACCOUNTS PAYABLE 25,000 50,000

LOANS PAYABLE 100,000

ROCK, CAPITAL 167,000

HORN, CAPITAL 234,000

TOTAL 210,000 210,000 420,000 420,000

ACCOUNTING 13 – ACCOUNTING FOR PARTNERHSIP AND CORPORATION

PRELIM QUIZ

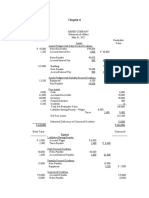

Before they transfer their businesses to the partnership, they agreed on the following capital adjustments:

a. The allowance for doubtful accounts of Rock should be increased to 8% of Accounts receivable while Horn’s

allowance for doubtful accounts should be decreased by 2% of accounts receivable.

b. The merchandise inventory of Rock is undervalued by 20% while the merchandise inventory of Horn should be

decreased by 5%.

c. According to a professional appraiser, the store equipment of Rock is over-depreciated by P 8,000 while that of

Horn, the store equipment should be revalued to P 76,000.

d. Rock has not recorded the interest on a 30 day 16% promissory note with a face value of P 10,000 from Mr.

Dokling, a trade customer dated April 1, 2021. Also, unrecorded, is the unpaid salaries of some employees as of

November 30, 2021 amounting to P 1.200.

e. Horn on the other hand, has an unrecorded interest on Loans payable to PNB, amounting to P 100,000 dated

March 1, 2021 at 24% interest per annum. Also, an unpaid Meralco bill amounting to P 1,900.

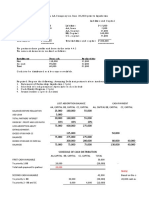

1. Compute the net (debit) credit adjustment for Rocky and Hiro.

2. The adjusted capital of Rocky and Hiro would be:

3. How much total liabilities does the partnership have after formation?

4. How much total assets does the partnership have after formation?

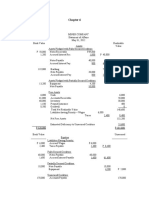

For item nos. 5 to 10. Using information presented above, prepare the opening entries in the book of the new

partnership on November 30,2021 ( 2 pts)

You might also like

- The Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeFrom EverandThe Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeNo ratings yet

- Accounting 13 - Accounting For Partnerhsip and Corporation Prelim QuizDocument1 pageAccounting 13 - Accounting For Partnerhsip and Corporation Prelim QuizGarp BarrocaNo ratings yet

- PartnershipDocument7 pagesPartnershipShane Nayah100% (2)

- Partnership FormationDocument5 pagesPartnership FormationIce Voltaire Buban GuiangNo ratings yet

- Partnership Formation and Valuation GuideDocument6 pagesPartnership Formation and Valuation GuideLeah CalataNo ratings yet

- 16 UNIT III LiquidationDocument20 pages16 UNIT III LiquidationLeslie Mae Vargas ZafeNo ratings yet

- 4 - Dissolution IllustrationDocument14 pages4 - Dissolution IllustrationAlrac GarciaNo ratings yet

- Cash Flow Statement Numericals QDocument3 pagesCash Flow Statement Numericals QDheeraj BholaNo ratings yet

- Accounting for Partnership FormationDocument9 pagesAccounting for Partnership FormationNa JaeminNo ratings yet

- Therese Zyra Lipang - Worksheet Activity - 10 Column WsDocument4 pagesTherese Zyra Lipang - Worksheet Activity - 10 Column WsJuvelyn Repaso100% (1)

- Partnership FormationDocument6 pagesPartnership FormationXajimarie StylesNo ratings yet

- Accounting For Partnership Formation Activity 2 - Sole Proprietors Form A Partnership Gab BusinessDocument3 pagesAccounting For Partnership Formation Activity 2 - Sole Proprietors Form A Partnership Gab BusinessChinee CastilloNo ratings yet

- To Record The Purchase of EquipmentDocument13 pagesTo Record The Purchase of EquipmentShane Nayah100% (1)

- Formation and Operations of Partnership Agreement Between Mr. A and Ms. BDocument12 pagesFormation and Operations of Partnership Agreement Between Mr. A and Ms. BShane TorrieNo ratings yet

- Illustration: Formation of Partnership Valuation of Capital A BDocument2 pagesIllustration: Formation of Partnership Valuation of Capital A BArian AmuraoNo ratings yet

- Quiz 2.1 AccountingDocument4 pagesQuiz 2.1 AccountingColine DueñasNo ratings yet

- Steps in Consolidation Working Papers On The Date of AcquisitionDocument3 pagesSteps in Consolidation Working Papers On The Date of AcquisitionPinky DaisiesNo ratings yet

- Bsba Acc C101-101T, Module#5.1Document14 pagesBsba Acc C101-101T, Module#5.1Martin CruzNo ratings yet

- Partnership RequirementDocument6 pagesPartnership RequirementAlyssa Marie Miguel100% (1)

- Accounting For Partnership and Corporation Solman Baysa Lupisan 2014 Chapter 2Document9 pagesAccounting For Partnership and Corporation Solman Baysa Lupisan 2014 Chapter 2Thamuz Lunox67% (3)

- Assignment July 2022Document6 pagesAssignment July 2022Dusabamahoro JoniveNo ratings yet

- Abyas Amalgamation IPCC G 1 & 2Document34 pagesAbyas Amalgamation IPCC G 1 & 2Caramakr ManthaNo ratings yet

- APC Ch2solDocument9 pagesAPC Ch2solFaith LacreteNo ratings yet

- Partnership Home WorkDocument3 pagesPartnership Home WorkVinay KumarNo ratings yet

- Illustration: Formation of Partnership Valuation of Capital A BDocument2 pagesIllustration: Formation of Partnership Valuation of Capital A BArian AmuraoNo ratings yet

- Accounting - Page 333 - WorksheetDocument3 pagesAccounting - Page 333 - WorksheetEmerson MinaNo ratings yet

- Nature and Formation of A PartnershipDocument10 pagesNature and Formation of A PartnershipHans ManaliliNo ratings yet

- Jawaban TugasDocument23 pagesJawaban TugasRusnawati Nur AminahNo ratings yet

- Answers On Quiz 6 and 7 For DiscussionDocument34 pagesAnswers On Quiz 6 and 7 For Discussionglenn langcuyan71% (7)

- Sample P-FDocument3 pagesSample P-FMYDMIOSYL ALABENo ratings yet

- Sol DissolutionDocument40 pagesSol DissolutionBlastik FalconNo ratings yet

- Exercise 7.3 (2023)Document1 pageExercise 7.3 (2023)Clarisha fritzNo ratings yet

- Partnership PQ SolDocument18 pagesPartnership PQ SolvedthkNo ratings yet

- Partnership ActivityDocument12 pagesPartnership ActivityTeresa Pantallano DivinagraciaNo ratings yet

- Answer KeyDocument10 pagesAnswer KeyEvelina Del RosarioNo ratings yet

- DB6 - Worksheet & FS Prep For Merchandising BusinessDocument4 pagesDB6 - Worksheet & FS Prep For Merchandising BusinessArrianeNo ratings yet

- Problem 2.3.Document4 pagesProblem 2.3.ArtisanNo ratings yet

- Business Administration, Managemnt& Commercial Sciences Accounting 512 Assignment 2 SEMESTER - 2017Document6 pagesBusiness Administration, Managemnt& Commercial Sciences Accounting 512 Assignment 2 SEMESTER - 2017NomaSonto NaMakoNo ratings yet

- Acctg Problem 7Document4 pagesAcctg Problem 7Salvie Perez Utana57% (14)

- Learning Exercises Bsa 3101 Corporate LiquidationDocument2 pagesLearning Exercises Bsa 3101 Corporate LiquidationRachel Mae FajardoNo ratings yet

- Advacc 1 Millan 2019 Advac 1 Special Transactions 2019Document11 pagesAdvacc 1 Millan 2019 Advac 1 Special Transactions 2019Charlene BolandresNo ratings yet

- Estimated gross loss on asset dispositionDocument21 pagesEstimated gross loss on asset dispositionRujean Salar AltejarNo ratings yet

- Partnership Formation and Capital AccountsDocument14 pagesPartnership Formation and Capital AccountsCasper John Nanas MuñozNo ratings yet

- Answer To Sample Question 2Document3 pagesAnswer To Sample Question 2Farid AbbasovNo ratings yet

- Partnership Liquidation Statement and ScheduleDocument14 pagesPartnership Liquidation Statement and ScheduleLaina Recel NavarroNo ratings yet

- Far Activity LavadoDocument14 pagesFar Activity LavadoPamela AbenirNo ratings yet

- Partnership RequirementDocument6 pagesPartnership RequirementLeanah TorioNo ratings yet

- Cash Flow Statement Problems PDFDocument32 pagesCash Flow Statement Problems PDFnsrivastav180% (30)

- Fabm OutputsDocument3 pagesFabm OutputsElaine Joyce GarciaNo ratings yet

- Part and Corporation Formation 1Document17 pagesPart and Corporation Formation 1Maila LoquincioNo ratings yet

- Basic Accounting Midterm ExamDocument11 pagesBasic Accounting Midterm ExamC J A SNo ratings yet

- Assigment 1Document3 pagesAssigment 1Muhd Zulhusni MusaNo ratings yet

- Problem 1Document13 pagesProblem 1Caila Nicole ReyesNo ratings yet

- Advanced Accounting Part 1 Dayag 2015 Chapter 6Document13 pagesAdvanced Accounting Part 1 Dayag 2015 Chapter 6Mazikeen DeckerNo ratings yet

- Solution Chapter 6Document17 pagesSolution Chapter 6Mazikeen DeckerNo ratings yet

- Exercise No.2Document4 pagesExercise No.2Jeane Mae BooNo ratings yet

- Exercise No.2Document4 pagesExercise No.2Jeane Mae BooNo ratings yet

- Laban-Lang Washing Service Trial BalanceDocument9 pagesLaban-Lang Washing Service Trial BalanceBomon-as LebeaNo ratings yet

- Corporate Bonds and Structured Financial ProductsFrom EverandCorporate Bonds and Structured Financial ProductsRating: 5 out of 5 stars5/5 (1)

- 85184767Document9 pages85184767Garp BarrocaNo ratings yet

- Admission LectureDocument7 pagesAdmission LectureGarp BarrocaNo ratings yet

- Identify The Letter of The Choice That Best Completes The Statement or Answers The QuestionDocument14 pagesIdentify The Letter of The Choice That Best Completes The Statement or Answers The QuestionheyheyNo ratings yet

- Accounting For Special Transactions First Grading ExaminationDocument22 pagesAccounting For Special Transactions First Grading Examinationaccounts 3 life94% (18)

- Partnership FormationDocument51 pagesPartnership FormationGarp BarrocaNo ratings yet

- Ans Key Inst Liq4Document7 pagesAns Key Inst Liq4Garp BarrocaNo ratings yet

- St. Paul University PhilippinesDocument4 pagesSt. Paul University PhilippinesGarp BarrocaNo ratings yet

- Identify The Letter of The Choice That Best Completes The Statement or Answers The QuestionDocument14 pagesIdentify The Letter of The Choice That Best Completes The Statement or Answers The QuestionheyheyNo ratings yet

- Cash and Cash Equivalents: Answer: CDocument142 pagesCash and Cash Equivalents: Answer: CGarp BarrocaNo ratings yet

- Lease Accounting Problems SolutionsDocument5 pagesLease Accounting Problems SolutionsGarp BarrocaNo ratings yet

- 85560539Document2 pages85560539Garp BarrocaNo ratings yet

- 52055576Document1 page52055576Garp BarrocaNo ratings yet

- InstructionsDocument7 pagesInstructionsGarp BarrocaNo ratings yet

- The Accounting EquationDocument8 pagesThe Accounting EquationGarp BarrocaNo ratings yet

- Admission LectureDocument7 pagesAdmission LectureGarp BarrocaNo ratings yet

- Acctg13 Midterm Exam TQ 2021 2022 2nd SemDocument6 pagesAcctg13 Midterm Exam TQ 2021 2022 2nd SemGarp BarrocaNo ratings yet

- Included Investment Related Problems/questionsDocument22 pagesIncluded Investment Related Problems/questionsJanine LerumNo ratings yet

- Prelim Graded Exercises 0007Document2 pagesPrelim Graded Exercises 0007Garp BarrocaNo ratings yet

- Identify The Letter of The Choice That Best Completes The Statement or Answers The QuestionDocument14 pagesIdentify The Letter of The Choice That Best Completes The Statement or Answers The QuestionheyheyNo ratings yet

- GTZ Phils SME Policy ReviewDocument119 pagesGTZ Phils SME Policy Reviewalexi59No ratings yet

- To Accrue Advertising Expense: I PXRXTDocument6 pagesTo Accrue Advertising Expense: I PXRXTShane Nayah78% (9)

- Name: Mariel B. GustaoDocument1 pageName: Mariel B. GustaoGarp BarrocaNo ratings yet

- InstructionsDocument7 pagesInstructionsGarp BarrocaNo ratings yet

- Ramon Magsaysay Memorial Colleges Accountancy Program Prelim QuizDocument5 pagesRamon Magsaysay Memorial Colleges Accountancy Program Prelim QuizGarp BarrocaNo ratings yet

- Prelim Graded Exercises 0007Document2 pagesPrelim Graded Exercises 0007Garp BarrocaNo ratings yet

- Journal Entries for Entity A's Business TransactionsDocument3 pagesJournal Entries for Entity A's Business TransactionsGarp BarrocaNo ratings yet

- PDF Advanced Accounting Chapter 1 DDDocument20 pagesPDF Advanced Accounting Chapter 1 DDGarp BarrocaNo ratings yet

- Law2 Ass Midterm Singson 1Document1 pageLaw2 Ass Midterm Singson 1Garp BarrocaNo ratings yet

- Prelim Exercises Pretest Partnership OperationDocument2 pagesPrelim Exercises Pretest Partnership OperationGarp BarrocaNo ratings yet

- Yamuna Express AuthorityDocument14 pagesYamuna Express Authoritydeepagautam1907No ratings yet

- PM Debug InfoDocument294 pagesPM Debug InfoCheeeviiitaasNo ratings yet

- Abrar Resume May - 2020new PDFDocument1 pageAbrar Resume May - 2020new PDFMohammed MohiuddinNo ratings yet

- 5035.assignment 1 Frontsheet (2021 - 2022)Document9 pages5035.assignment 1 Frontsheet (2021 - 2022)Nguyen Vo Minh Anh (FGW DN)No ratings yet

- One X Communicator Client 6 1 SP9 Release NotesDocument26 pagesOne X Communicator Client 6 1 SP9 Release NotesErika Julieth Guatama MedinaNo ratings yet

- Who Will Teach Silicon Valley To Be Ethical?: Status Author Publishing/Release Date Publisher LinkDocument4 pagesWho Will Teach Silicon Valley To Be Ethical?: Status Author Publishing/Release Date Publisher LinkElph Music ProductionNo ratings yet

- Chapter 1 NDocument53 pagesChapter 1 NShuvagata Das ShuvoNo ratings yet

- Lean Management Metode Carl Dan IshikawaDocument8 pagesLean Management Metode Carl Dan IshikawaVirghost14 WNo ratings yet

- Instant Download Ebook PDF Fundamentals of Corporate Finance 5th Canadian Edition PDF ScribdDocument41 pagesInstant Download Ebook PDF Fundamentals of Corporate Finance 5th Canadian Edition PDF Scribdlauryn.corbett387100% (42)

- Dappie Saln-2023Document3 pagesDappie Saln-2023Shrun ShrunNo ratings yet

- Judgement-Tat No. 86 of 2019 - Ruaraka Diversified Investments Limited-Vs-commissioner of Domestic TaxesDocument20 pagesJudgement-Tat No. 86 of 2019 - Ruaraka Diversified Investments Limited-Vs-commissioner of Domestic TaxesPhilip MwangiNo ratings yet

- Marketing Plan Nanaimo CanadaDocument84 pagesMarketing Plan Nanaimo Canadalizzie13No ratings yet

- Nash Finch's Foreign Segment in USA MarketDocument2 pagesNash Finch's Foreign Segment in USA MarketSheikh Humayoun Farid67% (3)

- Pengantar Hukum Dagang Introduction To CommercialDocument2 pagesPengantar Hukum Dagang Introduction To CommercialAngela TambunanNo ratings yet

- Hi Smith, Learn About US Sales Tax ExemptionDocument2 pagesHi Smith, Learn About US Sales Tax Exemptionsmithmvuama5No ratings yet

- Carlson School Corporate Investment Decisions Spring 2017Document12 pagesCarlson School Corporate Investment Decisions Spring 2017Novriani Tria PratiwiNo ratings yet

- Vendor Master Form - v2 (IDX)Document1 pageVendor Master Form - v2 (IDX)jaguar proNo ratings yet

- Quiz-1-Agricultural CooperativeDocument8 pagesQuiz-1-Agricultural CooperativeMD. IBRAHIM KHOLILULLAHNo ratings yet

- Manage Customer Relationships Through Quality ServiceDocument10 pagesManage Customer Relationships Through Quality ServiceEzrella ValeriaNo ratings yet

- Five Forces Analysis Sido MunculDocument5 pagesFive Forces Analysis Sido MunculAndreas Audi KemalNo ratings yet

- Improvement of Construction Procurement System ProcessesDocument121 pagesImprovement of Construction Procurement System ProcessesBeauty SairaNo ratings yet

- Eco Clothesline Query AssignmentDocument2 pagesEco Clothesline Query AssignmentthetechbossNo ratings yet

- Sincronicas Con Cover Actualizado 2023 JasonDocument58 pagesSincronicas Con Cover Actualizado 2023 JasonSebastian QuintanaNo ratings yet

- HBA - 25 Lakhs Order PDFDocument4 pagesHBA - 25 Lakhs Order PDFkarik1897No ratings yet

- Hidden Privatization Trends Threaten Public EducationDocument110 pagesHidden Privatization Trends Threaten Public EducationEmilianoHernandezNo ratings yet

- Managerial Economics NotesDocument19 pagesManagerial Economics NotesPavithra GovindarajNo ratings yet

- Grammer SeatsDocument36 pagesGrammer SeatsSNS EQUIPMENTNo ratings yet

- File - 20200905 - 105458 - Jsa Wind PowerDocument10 pagesFile - 20200905 - 105458 - Jsa Wind PowerMon Trang NguyễnNo ratings yet

- Birch Paper Company: Case AnalysisDocument7 pagesBirch Paper Company: Case AnalysisGino Gabriel de GuzmanNo ratings yet

- Ontel v. Shop LC - ComplaintDocument29 pagesOntel v. Shop LC - ComplaintSarah BursteinNo ratings yet