Professional Documents

Culture Documents

For Periodic Inventory System: What Is The CASE 2.1 CASE 2.2 CASE 2.3

Uploaded by

Lalaine0 ratings0% found this document useful (0 votes)

1K views2 pagesOriginal Title

Adjusting Entries

Copyright

© © All Rights Reserved

Available Formats

DOC, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

1K views2 pagesFor Periodic Inventory System: What Is The CASE 2.1 CASE 2.2 CASE 2.3

Uploaded by

LalaineCopyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

You are on page 1of 2

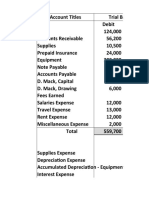

For Periodic Inventory System

2.1. Bdo, a bank lent P 100,000 to a customer on December 1 that

required the customer to pay an annual percentage rate (APR) of

12% on the amount of the loan. The loan is due in six months and

no payment of interest or principal is to be made until the note is

due on May 31. BDO prepares monthly financial statement at the

end of each calendar month. Provide an answer for March only.

2.2. On December 1, AXA Insurance Co. Received P2,400 from

your company for the annual premium covering the twelve-month

period beginning on December 1. AXA Insurance Co. Recorded

the P2,400 receipt as of December 1 with a debit to the current

asset Cash and a credit to the current liability Unearned

Revenues. AXA Insurance Co. Prepares monthly financial

statements at the end of each calendar month. Provide an answer

for April only.

2.3. On December 1, FORTUNE comp[any began operations. On

December 4 it purchased P1,500 of supplies and recorded the

transaction with a debit to the balance sheet account Supplies and

a credit to the current liability accounts payable. FORTUNE

company prepares monthly financial statements at the end of each

calendar month. At the end of the day on December 31,

FORTUNE company estimated the P700 of the supplies were still

on hand in the supply room. The following questions pertain to the

adjusting entry that should be entered by FORTUNE company.

What is the… CASE 2.1 CASE 2.2 CASE 2.3

Date of the 31-Mar 30-Apr 31-Dec

adjusting entry

Debit account Interest Unearned Supplies

title Receivable Revenue Expense

Credit account Interest Revenue Supplies

title Income

Debit and P 1,000 P 200 P 800

Credit amount

You might also like

- Mathematical Skills and Accounting ProfDocument33 pagesMathematical Skills and Accounting ProfK-phrenCandariNo ratings yet

- Quiz Bee ReviewerDocument6 pagesQuiz Bee ReviewerFeliz Victoria CañezalNo ratings yet

- Dec 31 Interest Expense 4,000 Interest Payable 4,000Document2 pagesDec 31 Interest Expense 4,000 Interest Payable 4,000Glecy AdrianoNo ratings yet

- ServiceDocument37 pagesServiceDanica Balleta0% (2)

- ActivitiesDocument3 pagesActivitiesRaul Soriano Cabanting50% (2)

- Tesda Perpetual GuidelinesDocument12 pagesTesda Perpetual GuidelinesMichael Angelo Laguna Dela FuenteNo ratings yet

- Chapter 3 Evaluation and ScoringDocument1 pageChapter 3 Evaluation and ScoringYenzy HebronNo ratings yet

- Davao Commercial Center Chart of AccountsDocument2 pagesDavao Commercial Center Chart of AccountsFrancis Raagas67% (3)

- Marketing ResearchDocument62 pagesMarketing ResearchAngel Lowe Angeles BalinconganNo ratings yet

- Quiz 021612Document2 pagesQuiz 021612kattNo ratings yet

- RBSG Distributors Statement of Cash Flow As of MAY 31 20xx (In Pesos)Document5 pagesRBSG Distributors Statement of Cash Flow As of MAY 31 20xx (In Pesos)Nashley Trina100% (1)

- Factors Affecting The Academic Performance of BS AccountancyDocument27 pagesFactors Affecting The Academic Performance of BS AccountancyAyenna LumanglasNo ratings yet

- PortfolioDocument40 pagesPortfolioJomar MendrosNo ratings yet

- L2: The Accounting Cycle (AJPUAFCPR) : Accounting For Service and Merchandising Entities ACC11Document12 pagesL2: The Accounting Cycle (AJPUAFCPR) : Accounting For Service and Merchandising Entities ACC11Rose LaureanoNo ratings yet

- It FinalsDocument11 pagesIt FinalsHea Jennifer AyopNo ratings yet

- Business Finance: Current Ratio CurrentDocument2 pagesBusiness Finance: Current Ratio CurrentJohnrick RabaraNo ratings yet

- Dellosa Cleaners Adjusting Entry For The Year Ended September 30, 2022. Accounts Debit CreditDocument6 pagesDellosa Cleaners Adjusting Entry For The Year Ended September 30, 2022. Accounts Debit CreditJaira AsuncionNo ratings yet

- ABM+2 Learning+Material+No.+4Document3 pagesABM+2 Learning+Material+No.+4Gelesabeth GarciaNo ratings yet

- Cebu Car-Tech CenterDocument17 pagesCebu Car-Tech CenterAlbert Moreno100% (2)

- Lesson 6 Accounting For Merchandising Business Part 2 ExercisesDocument9 pagesLesson 6 Accounting For Merchandising Business Part 2 ExercisesTalented Kim SunooNo ratings yet

- Accounting 2Document4 pagesAccounting 2Jocelyn Delacruz50% (2)

- Quizzes - Chapter 6 - Accounting Books - Journal and LedgerDocument5 pagesQuizzes - Chapter 6 - Accounting Books - Journal and LedgerAmie Jane MirandaNo ratings yet

- AEC - 12 - Q1 - 0401 - AK - Investments, Interest Rate, and Rental Concerns of Filipino EntrepreneursDocument6 pagesAEC - 12 - Q1 - 0401 - AK - Investments, Interest Rate, and Rental Concerns of Filipino EntrepreneursVanessa Fampula FaigaoNo ratings yet

- Lopez, Ella Marie - Quiz 2 FinanarepDocument4 pagesLopez, Ella Marie - Quiz 2 FinanarepElla Marie Lopez0% (1)

- FABM 2 Worksheet 1 Q4Document4 pagesFABM 2 Worksheet 1 Q4Darwin MenesesNo ratings yet

- Budgeting Financial ControllershipDocument14 pagesBudgeting Financial ControllershipKate Madrona100% (2)

- FAR1 ASN02 Financial Transaction WorksheetDocument2 pagesFAR1 ASN02 Financial Transaction WorksheetPatricia Camille AustriaNo ratings yet

- Weighted Average Method Process Costing CalculationDocument2 pagesWeighted Average Method Process Costing CalculationLouise0% (2)

- Short Case ActivitiesDocument2 pagesShort Case ActivitiesRaff LesiaaNo ratings yet

- Trial Balance Accounting RecordsDocument8 pagesTrial Balance Accounting RecordsKevin Espiritu100% (1)

- Andrea Bonito 2Document3 pagesAndrea Bonito 2Lemar Joy B. EugenioNo ratings yet

- ROCO - SCI Unit TestDocument9 pagesROCO - SCI Unit TestRaymond Roco100% (1)

- Abm TheoryDocument3 pagesAbm TheoryHanny Purnamasari100% (1)

- Bookkeeping NC III Assessment Tool Part 2Document1 pageBookkeeping NC III Assessment Tool Part 2Donalyn BannagaoNo ratings yet

- Chapters 1,2&3Document33 pagesChapters 1,2&3Erika BuenaNo ratings yet

- Cash Balance Per Bank Versus Per BookDocument6 pagesCash Balance Per Bank Versus Per BookSyrill CayetanoNo ratings yet

- FAR Chapter 3 RevisedDocument36 pagesFAR Chapter 3 RevisedDanica TorresNo ratings yet

- Sample Problem Case 2Document54 pagesSample Problem Case 2MAKI100% (1)

- CHAPTER 2 Vertical-AnalysisDocument1 pageCHAPTER 2 Vertical-AnalysisAiron BendañaNo ratings yet

- General Journal: Date Account Titles and Explanation Ref Debit CreditDocument17 pagesGeneral Journal: Date Account Titles and Explanation Ref Debit CreditPrecious NosaNo ratings yet

- QUIZ BEE BusinessDocument32 pagesQUIZ BEE BusinessEllen Mae PrincipeNo ratings yet

- Guanlao Post Test ReviewsDocument2 pagesGuanlao Post Test Reviewslena cpaNo ratings yet

- AccDocument13 pagesAccFrancis V MaestradoNo ratings yet

- Post-Closing Trial BalanceDocument5 pagesPost-Closing Trial BalanceIsaac RiñaNo ratings yet

- Introduction to Financial Management ConceptsDocument14 pagesIntroduction to Financial Management ConceptsAiron BendañaNo ratings yet

- BMSH2003 Business Transactions and Adjusting EntriesDocument2 pagesBMSH2003 Business Transactions and Adjusting EntriesLaisan SantosNo ratings yet

- Illustrative ProblemDocument7 pagesIllustrative ProblemKim Patrick VictoriaNo ratings yet

- Review of Accounting Cycle Review of Accounting CycleDocument4 pagesReview of Accounting Cycle Review of Accounting CycleJerome BaluseroNo ratings yet

- Elements of The Statement of Financial Position (SFP) : Lesson 1Document25 pagesElements of The Statement of Financial Position (SFP) : Lesson 1Charissa Jamis Chingwa100% (1)

- EDUC 101 Unit 1Document21 pagesEDUC 101 Unit 1Ldln ChbNo ratings yet

- CC Case Study No 1Document8 pagesCC Case Study No 1Mylene Santiago0% (1)

- ACC111Document2 pagesACC111Angeline Mae Dapar LungtadNo ratings yet

- Decision Making Using Probabilities IDocument25 pagesDecision Making Using Probabilities IChristine Abordo50% (2)

- NC-III Bookkeeping Reviewer NC-III Bookkeeping ReviewerDocument34 pagesNC-III Bookkeeping Reviewer NC-III Bookkeeping ReviewerSheila Mae Lira100% (2)

- Teves Company Sample Problem (Perpetual) DocxDocument2 pagesTeves Company Sample Problem (Perpetual) DocxCoolveticaNo ratings yet

- Business Finance - Horizontal AnalysisDocument2 pagesBusiness Finance - Horizontal AnalysisAnon0% (1)

- Calamansi Smoothie Juice Business PlanDocument8 pagesCalamansi Smoothie Juice Business PlanJEAN KATHLEEN SORIANONo ratings yet

- Shifter Accountancy Working Student Self Efficacy and Their Academic PerformanceDocument50 pagesShifter Accountancy Working Student Self Efficacy and Their Academic Performanceanale candameNo ratings yet

- Activity 1 - Audit of LiabilitiesDocument2 pagesActivity 1 - Audit of LiabilitiesChristian AbieraNo ratings yet

- Periodic TransactionDocument2 pagesPeriodic TransactionMoon BinnNo ratings yet

- Korean DistributorsDocument33 pagesKorean DistributorsLalaineNo ratings yet

- Homeroom Guidance Learners Development Assessment Junior High School 1Document3 pagesHomeroom Guidance Learners Development Assessment Junior High School 1LalaineNo ratings yet

- Perez Distributors PeriodicDocument28 pagesPerez Distributors PeriodicLalaineNo ratings yet

- Homeroom Guidance Learners Development Assessment Junior High School 1Document3 pagesHomeroom Guidance Learners Development Assessment Junior High School 1LalaineNo ratings yet

- QUIZ 1 English Quarter 4Document1 pageQUIZ 1 English Quarter 4Lalaine100% (1)