Professional Documents

Culture Documents

An Introduction To Portfolio Management: True False

Uploaded by

Christy Mae EderOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

An Introduction To Portfolio Management: True False

Uploaded by

Christy Mae EderCopyright:

Available Formats

CHAPTER 7 An Introduction to Portfolio

Management

TRUE

1. Risk means the uncertainty of the future FALSE

outcomes

1. Investors are basically risk averse, meaning

2. One of the several assumptions regarding that given a choice one asset with equal rate

investor behavior is Investors estimate the of return.

risk of the portfolio on the basic of the

variability of expected returns. 2. The basic portfolio model was developed by

Henry Markowitz

3. One of the best-known measures of risk is

the variance, or standard deviation of 3. The measure that only considers deviation

expected returns. below the mean is variance.

4. The measures of risk assume that the 4. The alternative definition of risk might be

investors want to minimize the damage from the improbability of an adverse outcome.

returns less than some target rate.

5. The Magnitude of the covariance is not

5. The measure of the degree to which two depends on the variances of the individual

variables move together relative to their return series, as well as on the relationship

individual mean values overtime is called between the series.

Covariance.

6. Covariance and correlation covariance is not

6. Covariance has 2 types positive and affected by the variability of the two

negative. individual return indexes.

7. The potential source of error that arises from 7. The number of correlation estimates cannot

these approximations is referred to as be significant.

estimation risk.

8. A demonstration of what occurs with a

8. It is important to keep in mind that the three-asset portfolio is not useful because it

results of the portfolio asset allocation shows the dynamics of the portfolio process

depend in the accuracy of the statistical when assets are added.

inputs.

9. Utility curves do not determine which

9. Two investors will choose the same particular portfolio on the efficient frontier

portfolio from the efficient set only if their best suits an individual investor.

utility curves are identical

10. All portfolios on the efficient frontier can

10. The optimal portfolio is the efficient dominate any other portfolio on the efficient

portfolio that has the highest utility for a frontier.

given investor.

You might also like

- Capital Asset Pricing Model: Make smart investment decisions to build a strong portfolioFrom EverandCapital Asset Pricing Model: Make smart investment decisions to build a strong portfolioRating: 4.5 out of 5 stars4.5/5 (3)

- Chapter 3 - Portfolio ManagementDocument113 pagesChapter 3 - Portfolio ManagementTín TrungNo ratings yet

- Corporate Finance HW 10Document4 pagesCorporate Finance HW 10RachelNo ratings yet

- Corporate Finance HW 10Document4 pagesCorporate Finance HW 10RachelNo ratings yet

- Chapter 3 Portfolio Selection PDFDocument6 pagesChapter 3 Portfolio Selection PDFMariya BhavesNo ratings yet

- Rangkuman Bab 8 Portfolio Selection and Asset AllocationDocument3 pagesRangkuman Bab 8 Portfolio Selection and Asset Allocationindah oliviaNo ratings yet

- Risk and Rates of ReturnDocument33 pagesRisk and Rates of ReturnLeyla MalijanNo ratings yet

- Unit 5 Portfolio Management I. Portfolio Construction:: ApproachDocument18 pagesUnit 5 Portfolio Management I. Portfolio Construction:: ApproachJ. KNo ratings yet

- Topic: Markowitz Theory (With Assumptions) IntroductionDocument3 pagesTopic: Markowitz Theory (With Assumptions) Introductiondeepti sharmaNo ratings yet

- Capital Asset Pricing Model PDFDocument6 pagesCapital Asset Pricing Model PDFhenryNo ratings yet

- 6053 LecturesDocument17 pages6053 Lecturesapi-3699305No ratings yet

- Risk & ReturnDocument11 pagesRisk & ReturnMD RakibulNo ratings yet

- Chapter 8 Self Test QestionnaireDocument1 pageChapter 8 Self Test QestionnaireCATHNo ratings yet

- Lecture - CAPITAL ALLOCATION TO RISKY ASSESTSDocument40 pagesLecture - CAPITAL ALLOCATION TO RISKY ASSESTSНаиль ИсхаковNo ratings yet

- Summary of Part 4 (Risk and Returns)Document3 pagesSummary of Part 4 (Risk and Returns)Justz LimNo ratings yet

- Inv & Portfolio Mng. SlideDocument15 pagesInv & Portfolio Mng. SlideRiajul IslamNo ratings yet

- 7 2Document37 pages7 2Rahul KadamNo ratings yet

- Portofolio OptimalDocument6 pagesPortofolio Optimalmamih baekNo ratings yet

- Lesson 35Document4 pagesLesson 35mc200401256 SHAHBAZ MEHMOODNo ratings yet

- Capm FinalDocument74 pagesCapm Finalggaba10No ratings yet

- Answers To Concepts in Review: S R R NDocument5 pagesAnswers To Concepts in Review: S R R NJerine TanNo ratings yet

- Financial Management: Topic: Risk & ReturnDocument4 pagesFinancial Management: Topic: Risk & ReturnIris FenelleNo ratings yet

- Powerpoint Concept Smjhne Security-Analysis-and-Portfolo-Management-Unit-4-Dr-Asma-KhanDocument66 pagesPowerpoint Concept Smjhne Security-Analysis-and-Portfolo-Management-Unit-4-Dr-Asma-KhanShailjaNo ratings yet

- Chap 3-Corporate FinanceDocument34 pagesChap 3-Corporate FinanceNguyệt Anh NguyễnNo ratings yet

- Portfolio TheoryDocument78 pagesPortfolio TheoryAmit PrakashNo ratings yet

- Investement Analysis and Portfolio Management Chapter 6Document12 pagesInvestement Analysis and Portfolio Management Chapter 6Oumer ShaffiNo ratings yet

- Narrative Report Introduction To Portfolio ManagementDocument3 pagesNarrative Report Introduction To Portfolio ManagementMary Joy AlbandiaNo ratings yet

- Chapter 7Document6 pagesChapter 7Muhammed YismawNo ratings yet

- Chapter 6Document10 pagesChapter 6Seid KassawNo ratings yet

- 08 Risk and ReturnDocument11 pages08 Risk and Returnddrechsler9No ratings yet

- Portfolio Theory: Dealing With UncertaintyDocument28 pagesPortfolio Theory: Dealing With Uncertaintyoxana azzahraNo ratings yet

- Portfolio Theory - Ses2Document82 pagesPortfolio Theory - Ses2Vaidyanathan Ravichandran100% (1)

- Quantitative Methods: "Crafting Your Cfa Triumph With Effective Summaries."Document10 pagesQuantitative Methods: "Crafting Your Cfa Triumph With Effective Summaries."Huỳnh HuỳnhNo ratings yet

- Unit4 SAPMDocument11 pagesUnit4 SAPMBhaskaran BalamuraliNo ratings yet

- 09 Porfolio AnalysisDocument56 pages09 Porfolio AnalysisFaheem KhanNo ratings yet

- Markowitz Sys & UnsysDocument2 pagesMarkowitz Sys & UnsysArunava BanerjeeNo ratings yet

- Cheats 3Document2 pagesCheats 3ShaileshNo ratings yet

- NPTEL Course: Course Title: Security Analysis and Portfolio Management Course Coordinator: Dr. Jitendra MahakudDocument9 pagesNPTEL Course: Course Title: Security Analysis and Portfolio Management Course Coordinator: Dr. Jitendra MahakudPavan KumarNo ratings yet

- CAPM, Arbitrage and Linear Factor Models George Pennacchhi: Presented by Raja Reddy (FB14004)Document15 pagesCAPM, Arbitrage and Linear Factor Models George Pennacchhi: Presented by Raja Reddy (FB14004)Raja SNo ratings yet

- L4 Understanding RiskDocument5 pagesL4 Understanding RiskvivianNo ratings yet

- Unit-2 Portfolio Analysis &selectionDocument64 pagesUnit-2 Portfolio Analysis &selectiontanishq8807No ratings yet

- Modern ApproachesDocument23 pagesModern Approachesjoeljose2019jjNo ratings yet

- Need To RephraseDocument7 pagesNeed To RephraseMushtaq Hussain KhanNo ratings yet

- Chapter 8 AssignmentDocument7 pagesChapter 8 AssignmentFatima AnsariNo ratings yet

- Topic: Explain CAPM With Assumptions. IntroductionDocument3 pagesTopic: Explain CAPM With Assumptions. Introductiondeepti sharmaNo ratings yet

- Objective of Study Concepts Investment Options Data Collection Analysis Recommendation Limitations ReferencesDocument26 pagesObjective of Study Concepts Investment Options Data Collection Analysis Recommendation Limitations Referenceshtikyani_1No ratings yet

- An Introduction To Portfolio ManagementDocument32 pagesAn Introduction To Portfolio Managementch_arfan2002No ratings yet

- Understanding Financial Management: A Practical Guide: Guideline Answers To The Concept Check QuestionsDocument9 pagesUnderstanding Financial Management: A Practical Guide: Guideline Answers To The Concept Check QuestionsManuel BoahenNo ratings yet

- IT&P 2024 Set 3 - Managing and Evaluation of Portfolio Performance2Document57 pagesIT&P 2024 Set 3 - Managing and Evaluation of Portfolio Performance2babie naaNo ratings yet

- Risk and Company InvestmentDocument11 pagesRisk and Company InvestmenttruthoverloveNo ratings yet

- Risk and ReturnDocument32 pagesRisk and Returnmogibol791No ratings yet

- Chapter 8 - Introduction To Asset Pricing ModelsDocument53 pagesChapter 8 - Introduction To Asset Pricing Modelsmustafa-memon-7379100% (3)

- 1 Key Concepts: Midterm Review Questions Foundations of Corporate FinanceDocument2 pages1 Key Concepts: Midterm Review Questions Foundations of Corporate FinanceVaibhav MittalNo ratings yet

- Corporate Finance Individual AssignmentDocument9 pagesCorporate Finance Individual AssignmentchabeNo ratings yet

- Modern Portfolio Theory (Markowitz)Document6 pagesModern Portfolio Theory (Markowitz)Millat AfridiNo ratings yet

- 05-Risk and ReturnsDocument28 pages05-Risk and ReturnsJean Jane EstradaNo ratings yet

- Portfolio SelectionDocument6 pagesPortfolio SelectionAssfaw KebedeNo ratings yet

- Modern Portfolio TheoryDocument9 pagesModern Portfolio TheoryRedNo ratings yet

- 2 ABBOT VS. NLRC G.R. No. 76959 October 12, 1987Document2 pages2 ABBOT VS. NLRC G.R. No. 76959 October 12, 1987Kornessa ParasNo ratings yet

- Exam Chap 13Document60 pagesExam Chap 13asimNo ratings yet

- Brandistic Eagle LTD Revoult StatementDocument1 pageBrandistic Eagle LTD Revoult Statementproposed6No ratings yet

- Interview Experiences 2024Document3 pagesInterview Experiences 2024Shourya PanchalNo ratings yet

- Creating Advertising Programe Message, Headlines, Copy, LogoDocument18 pagesCreating Advertising Programe Message, Headlines, Copy, LogoHiren ShahNo ratings yet

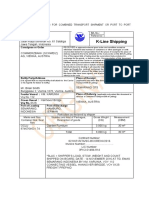

- Bill of Lading AustriaDocument2 pagesBill of Lading AustriaTitik KurniyatiNo ratings yet

- Leadership of Woman President in The Philippine State Universities and CollegesDocument14 pagesLeadership of Woman President in The Philippine State Universities and CollegesAPJAET JournalNo ratings yet

- Igc1 Element 2 - Rev 0Document5 pagesIgc1 Element 2 - Rev 0VickyJee50% (2)

- Chapter 1 - Fundamentals of ManagementDocument38 pagesChapter 1 - Fundamentals of ManagementabdulfetahNo ratings yet

- Bentley Civil User Accreditation: Program OverviewDocument9 pagesBentley Civil User Accreditation: Program OverviewRenukadevi RptNo ratings yet

- A Popular HR Chief Burned To Death: People Management Dynamics atDocument8 pagesA Popular HR Chief Burned To Death: People Management Dynamics at20PGPIB064AKSHAR PANDYA100% (2)

- CH 01Document34 pagesCH 01Bena JagonobNo ratings yet

- The Role of Power in LeadershipDocument4 pagesThe Role of Power in LeadershipVahanNo ratings yet

- Od 123557026424340000Document1 pageOd 123557026424340000Sahil HasanNo ratings yet

- Case Questions Excel SheetDocument8 pagesCase Questions Excel SheetMustafa MahmoodNo ratings yet

- 43.MBA Corporate SecretaryshipDocument56 pages43.MBA Corporate SecretaryshipVj EnthiranNo ratings yet

- BIZPLANDocument6 pagesBIZPLANGwen MañegoNo ratings yet

- Measuring Innovation: A New PerspectiveDocument24 pagesMeasuring Innovation: A New PerspectiveJoshua RitongaNo ratings yet

- Final Output OjTDocument8 pagesFinal Output OjTMatthew FerrerNo ratings yet

- Neelima Prabhala - IndiaDocument3 pagesNeelima Prabhala - Indiadharmendratyagi232No ratings yet

- Price Per Visit Quantity Demanded Quantity SuppliedDocument4 pagesPrice Per Visit Quantity Demanded Quantity SuppliedGrace FranzNo ratings yet

- Name: Student ID: 19P00024 Subject: Date: Submitted To: Ume LailaDocument6 pagesName: Student ID: 19P00024 Subject: Date: Submitted To: Ume LailaUmme Laila JatoiNo ratings yet

- Problem 5-19Document5 pagesProblem 5-19Phuong ThaoNo ratings yet

- CHPT 1...... The Foundations of EntrepreneurshipDocument62 pagesCHPT 1...... The Foundations of EntrepreneurshipHashim MalikNo ratings yet

- Supplier Code of ConductDocument6 pagesSupplier Code of ConductsureshNo ratings yet

- Health & Wellbeing Programmes: Royal Mail GroupDocument15 pagesHealth & Wellbeing Programmes: Royal Mail GroupLiam BrewsterNo ratings yet

- Guidelines For National RolloutDocument84 pagesGuidelines For National Rolloutsumit.aryanNo ratings yet

- HSE Essay LCC Vers.13 PDFDocument18 pagesHSE Essay LCC Vers.13 PDFEduardo CassengaNo ratings yet

- MSS SP 6-2017Document10 pagesMSS SP 6-2017elciolbezerraNo ratings yet

- Audit Programme 1Document27 pagesAudit Programme 1I am JacobNo ratings yet