Professional Documents

Culture Documents

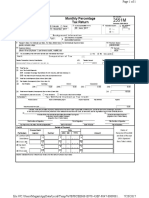

Percentage Tax Return: BIR Form No

Uploaded by

Lorraine Steffany BanguisOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Percentage Tax Return: BIR Form No

Uploaded by

Lorraine Steffany BanguisCopyright:

Available Formats

birlogo

Percentage Tax

BIR Form No.

Republika ng Pilipinas

Kagawaran ng Pananalapi 2552

Kawanihan ng Rentas

Internas Return July 1999 (ENCS)

For Transactions Involving Shares of Stock Listed and Traded Through the Local

Stock Exchange or Through Initial and/or Secondary Public Offering

Date of Transaction or Date of Listing of 2 Amended Return? 3 No. of Sheets Attached?

1 Shares of Stock in the Stock Exchange (MM/DD/YYYY)

Yes No

0

##txtDa

##txtForY

Part I Background Information

TIN ##txtTIN1 ##txtTIN2 ##txtTIN3 5 RDO Code ##txtRDO 6 Telephone Number ##txtTelNum##

4

##txtBran

7 Name of Stockbroker/Issuing Corporation (For Individual) (Last Name, First Name, Middle Name s) /(For Non-Individual)(Registered Name for Non-Individuals)

##txtNameStockBrocker##

8 Registered Address 8A Zip Code

##txtAddress## ##txtZipCode##

9 Are you availing of tax relief under an International Tax Treaty or If yes, specify

Special law?

Yes No

10 Kind of Transaction 10A Shares of Stock Listed and Traded through LSE 10B Initial Public Offering Primary Secondary

11 For Initial Public Offering 11A No. of Shares Sold, Bartered, or Exchanged ##txt11A##

11B Total Outstanding Shares of Stocks after Listing in the LSE ##txt11B##

Part II C o m p u t a t i o n o f Ta x

Taxable Base (Gross Selling Tax Rate Tax Due

Taxable Transaction ATC

Price/Gross Value)

12 12A 12D

Sale, Barter or Exchange of Shares of Stock

##txtTaxBase12B## 12C 1/2 of 1%

Listed and Traded through LSE PT200 ##txtTaxDue12D##

13 Sale/Exchange of Shares of Stock through 13A ##txtTaxBase13B## 13D

Primary Public Offering up to 25%over 25% but 13C 4%

not over 33 1/3% over 33 1/3% PT201 ##txtTaxDue13D##

##txtTaxBase13E## 13F 2% 13G

##txtTaxDue13G##

##txtTaxBase13H## 13J

13I 1%

##txtTaxDue13J##

14 Sale/Exchange of Shares of Stock through 14A 14D

Secondary Public Offering up to 25% over 25% ##txtTaxBase14B## 14C 4%

but not over 33 1/3% over 33 1/3% PT202 ##txtTaxDue14D##

14F 2% 14G

##txtTaxBase14E##

##txtTaxDue14G##

14I 1% 14J

##txtTaxBase14H##

##txtTaxDue14J##

15 Total Tax Due 15

##txt15##

16 Less : Tax Credits/Payments

16A

16A Tax Paid in Return Previously Filed, if this is an Amended Return

##txt16A##

16B

16B Creditable Tax Withheld Per BIR Form 2307

##txt16B##

16C

16C Total Tax Credits/Payments (Sum of Items 16A & 16B)

##txt16C##

17

17 Total Tax Still Due/(Overpayment) (Item 15 less Item 16C)

##txt17##

18 Add: Penalties

Surcharge Interest Compromise

18B 18C 18D

18A ##txt18A##

##txt18B## ##txt18C## ##txt18D##

19

19 Total Amount Payable/(Overpayment) (Sum of 17 & 18D)

##txt19##

If Overpayment, mark one box only:

To be Refunded To be issued a Tax Certificate To be Carried over as a tax credit next year/quarter

Part III S u m m a r y o f Tr a n s a c t i o n s n o t s u b j e c t t o Ta x

Transaction Classification Amount Involved

Details of Taxable Transaction

Schedule 1 Computation of Minimum Corporate Income Tax (MCIT) for the Quarter(s)

Issuing Number of Taxable Tax

Date Seller Buyer Rate

Corporation Shares Base Due

Total ##txtTaxDueTotal##

Details of Transaction not subject to Percentage Tax

Date Seller Buyer Issuing Corporation Number of Shares

You might also like

- BIR Form No. 2551Document1 pageBIR Form No. 2551Lorraine Steffany BanguisNo ratings yet

- Percentage Tax Return: BIR Form NoDocument2 pagesPercentage Tax Return: BIR Form NoRichard Rhamil Carganillo Garcia Jr.No ratings yet

- Percentage Tax Return: BIR Form NoDocument2 pagesPercentage Tax Return: BIR Form NoLele CaparasNo ratings yet

- Assign 4 6Document11 pagesAssign 4 6Wonwoo JeonNo ratings yet

- GLO 2014 Audited FSDocument129 pagesGLO 2014 Audited FSJoe CaliNo ratings yet

- THQInc 10K 20100604Document169 pagesTHQInc 10K 20100604Brandon WellsNo ratings yet

- Applicaation For Drone RegistrationDocument4 pagesApplicaation For Drone RegistrationDimuth Disk - තැටියNo ratings yet

- 2020 Mu PLC Form 20 FDocument179 pages2020 Mu PLC Form 20 FFrank PereiraNo ratings yet

- Burger King Holdings IncDocument146 pagesBurger King Holdings IncmscarreraNo ratings yet

- 1600-PT 0322Document3 pages1600-PT 0322Mishelle RamosNo ratings yet

- Total Form 20-FDocument424 pagesTotal Form 20-FedgarmerchanNo ratings yet

- Feb - English - JDA - 202203 - Power Trading-1Document1 pageFeb - English - JDA - 202203 - Power Trading-1PowerNo ratings yet

- ST MARY LAND & EXPLORATION CO 10-K (Annual Reports) 2009-02-24Document145 pagesST MARY LAND & EXPLORATION CO 10-K (Annual Reports) 2009-02-24http://secwatch.comNo ratings yet

- United Paragon Mining Corp. SEC 23-B FAO ASC For Feb2022Document4 pagesUnited Paragon Mining Corp. SEC 23-B FAO ASC For Feb2022Julius Mark Carinhay TolitolNo ratings yet

- Stock StatementDocument4 pagesStock StatementRAJEEV BHATIANo ratings yet

- 2020 Total Form 20 FDocument510 pages2020 Total Form 20 FJohnNo ratings yet

- Documentary Stamp Tax Declaration/Return: Fill in All Applicable Spaces. Mark All Appropriate Boxes With An "X"Document3 pagesDocumentary Stamp Tax Declaration/Return: Fill in All Applicable Spaces. Mark All Appropriate Boxes With An "X"Jansen SantosNo ratings yet

- Personal Record Form CompleteDocument5 pagesPersonal Record Form CompleteFrank BloomfieldNo ratings yet

- Icot) - : Val': BhiaDocument2 pagesIcot) - : Val': BhiaDipak PArmarNo ratings yet

- Autozone IncDocument90 pagesAutozone Incaedcbf123No ratings yet

- 1 GJQ 1 LVLF 4 J 9 dpgÅŠDocument161 pages1 GJQ 1 LVLF 4 J 9 dpgÅŠWilliam BlairNo ratings yet

- RLX 2020 Annual ReportDocument202 pagesRLX 2020 Annual ReportFaris RahmanNo ratings yet

- 2009 10 15 - DR SfaDocument1 page2009 10 15 - DR SfaZach EdwardsNo ratings yet

- " Part-II A: Return of Total Income/Statement of Final TaxationDocument7 pages" Part-II A: Return of Total Income/Statement of Final TaxationNomanAliNo ratings yet

- RGD Receipt 115823592203Document1 pageRGD Receipt 115823592203Gaia Wellness CompanyNo ratings yet

- Annual FilingDocument146 pagesAnnual FilingDiego BrandeauNo ratings yet

- Cooper 2018Document154 pagesCooper 2018pajak sapphireNo ratings yet

- Tenaris Sa: FORM 20-FDocument182 pagesTenaris Sa: FORM 20-FWili Nur RahmanNo ratings yet

- 17-A (Final)Document117 pages17-A (Final)dina maryanaNo ratings yet

- Thermo Fisher Scientific Inc.: United States Securities and Exchange CommissionDocument63 pagesThermo Fisher Scientific Inc.: United States Securities and Exchange CommissionJinye LiangNo ratings yet

- Mosaic K-10Document195 pagesMosaic K-10Tricky Dicky TwoNo ratings yet

- Quill Capita Trust: Flattish 3Q10 Numbers - 20/10/2010Document3 pagesQuill Capita Trust: Flattish 3Q10 Numbers - 20/10/2010Rhb InvestNo ratings yet

- MiggMatugas 1701Q 1st Quarter 2023P1Document2 pagesMiggMatugas 1701Q 1st Quarter 2023P1stillwinmsNo ratings yet

- Baba 20F 2020Document596 pagesBaba 20F 2020James HNo ratings yet

- ACT FormDocument1 pageACT Formnurul ibrahimNo ratings yet

- RGD Receipt 214002233695Document1 pageRGD Receipt 214002233695Shaquille LeeNo ratings yet

- Form 20-F 2018Document292 pagesForm 20-F 2018BayuɳtaraNo ratings yet

- Celgene Annual Report 2018Document516 pagesCelgene Annual Report 2018Samiya HassanNo ratings yet

- "4" Amnesty On: Tax De!Inqllencies IlllDocument2 pages"4" Amnesty On: Tax De!Inqllencies IlllRonald Allan Valdez Miranda Jr.No ratings yet

- Capital Gains Tax Return: Fill in All Applicable Spaces. Mark All Appropriate Boxes With An "X"Document2 pagesCapital Gains Tax Return: Fill in All Applicable Spaces. Mark All Appropriate Boxes With An "X"GSAFINNo ratings yet

- Annual Report ENI 2016Document423 pagesAnnual Report ENI 2016edgarmerchanNo ratings yet

- Bid SheetDocument6 pagesBid SheetVi KraNo ratings yet

- Monthly Percentage Tax Return: 12 - December 06 - JuneDocument1 pageMonthly Percentage Tax Return: 12 - December 06 - JuneDana PardeNo ratings yet

- 1702RT SYNERGETIC TRADING 2023 pg1Document1 page1702RT SYNERGETIC TRADING 2023 pg1RACHEL DAMALERIONo ratings yet

- Capital Gains Tax Return: Fill in All Applicable Spaces. Mark All Appropriate Boxes With An "X"Document2 pagesCapital Gains Tax Return: Fill in All Applicable Spaces. Mark All Appropriate Boxes With An "X"GSAFINNo ratings yet

- FORM 20-F: United States Securities and Exchange Commission Washington, DC 20549Document145 pagesFORM 20-F: United States Securities and Exchange Commission Washington, DC 20549Hasibuan WildanNo ratings yet

- BMS34A146Document3 pagesBMS34A146Rohit Parmar (Computer Operator, Bangalore)No ratings yet

- Eaton Corp PLC: FORM 10-QDocument48 pagesEaton Corp PLC: FORM 10-QBenny JojoNo ratings yet

- A. Soriano Corporation Amended Articles of IncorporationDocument11 pagesA. Soriano Corporation Amended Articles of IncorporationNovilyn LeonardoNo ratings yet

- United States Securities and Exchange Commission Washington, D.C. 20549 FORM 10-QDocument68 pagesUnited States Securities and Exchange Commission Washington, D.C. 20549 FORM 10-QJinye LiangNo ratings yet

- Galileo PDFDocument198 pagesGalileo PDFLiberty AlbaniaNo ratings yet

- Syyrtt Yig/Useful Tips:: Date of LsnformDocument1 pageSyyrtt Yig/Useful Tips:: Date of LsnformShilpa.kNo ratings yet

- Floo& Towe&: Government Pakistan Directorate General Intelligence Tnvestigation (IR) Emigration Mauve Area, G-8/IDocument2 pagesFloo& Towe&: Government Pakistan Directorate General Intelligence Tnvestigation (IR) Emigration Mauve Area, G-8/IAdnan AqeelNo ratings yet

- 2009 10 9 - AmendedDocument2 pages2009 10 9 - AmendedZach EdwardsNo ratings yet

- PermenkeuDocument148 pagesPermenkeufaisal majidNo ratings yet

- Colgate 10K 2017 PDFDocument155 pagesColgate 10K 2017 PDFManuel CámacNo ratings yet

- Tax Declaration of Real Property: Republic of The Philippines Proyince of AlbayDocument2 pagesTax Declaration of Real Property: Republic of The Philippines Proyince of AlbayQuentine TarantinoNo ratings yet

- Deductions Under Chapter VI A (Section)Document2 pagesDeductions Under Chapter VI A (Section)Dharmendra SinghNo ratings yet

- How To Diy - of - BGDocument26 pagesHow To Diy - of - BGLorraine Steffany BanguisNo ratings yet

- BIR Form No. 2551MDocument1 pageBIR Form No. 2551MLorraine Steffany BanguisNo ratings yet

- BIR Form No. 1600Document2 pagesBIR Form No. 1600Lorraine Steffany BanguisNo ratings yet

- BIR Form No. 0605Document1 pageBIR Form No. 0605Lorraine Steffany BanguisNo ratings yet

- 01 03 Accretion Dilution AfterDocument3 pages01 03 Accretion Dilution AfterДоминик КоббNo ratings yet

- Case Digest - Trans Pacific v. CA, 235 SCRA 494Document2 pagesCase Digest - Trans Pacific v. CA, 235 SCRA 494Audrey MNo ratings yet

- NHB Vishal GoyalDocument24 pagesNHB Vishal GoyalSky walkingNo ratings yet

- To Enroll A Merchant Via BPI Online, Please Follow The Procedure BelowDocument7 pagesTo Enroll A Merchant Via BPI Online, Please Follow The Procedure BelowLeoncio LibuitNo ratings yet

- Dispute Claim Form: Personal InformationDocument1 pageDispute Claim Form: Personal InformationOptimiNo ratings yet

- Financial Accounting SyllabusDocument2 pagesFinancial Accounting Syllabusp.sankaranarayananNo ratings yet

- Final Project NPA MANAGEMENT IN BANKSDocument88 pagesFinal Project NPA MANAGEMENT IN BANKSmanish223283% (18)

- Credit ReportDocument34 pagesCredit ReportsophiaNo ratings yet

- The EXPLOITATION of Security Mispricing inDocument13 pagesThe EXPLOITATION of Security Mispricing inJorge J MoralesNo ratings yet

- Afar 08Document14 pagesAfar 08RENZEL MAGBITANGNo ratings yet

- SABIC (Detailed Analysis)Document17 pagesSABIC (Detailed Analysis)Mirza Zain Ul AbideenNo ratings yet

- Basel3 QIS 202004 PDFDocument198 pagesBasel3 QIS 202004 PDFsh_chandraNo ratings yet

- Concepts in Financial ManagementDocument3 pagesConcepts in Financial ManagementfeilohNo ratings yet

- Exercise Invesment Financial AccountingDocument7 pagesExercise Invesment Financial Accountingukandi rukmanaNo ratings yet

- CC and CSDocument45 pagesCC and CSIsaack MgeniNo ratings yet

- Bond Portfolio Management StrategiesDocument23 pagesBond Portfolio Management Strategiesashudadhich100% (2)

- Opportunities and Development in The Current Global Crisis: Ute Kochlowski-Kadjaia, Euler Hermes RussiaDocument33 pagesOpportunities and Development in The Current Global Crisis: Ute Kochlowski-Kadjaia, Euler Hermes RussiaSentthil KumarNo ratings yet

- Wk8 Laura Martin REPORTDocument18 pagesWk8 Laura Martin REPORTNino Chen100% (2)

- Financial Services QBDocument89 pagesFinancial Services QBVimal RajNo ratings yet

- BackOffice ManualDocument141 pagesBackOffice ManualJAGM1505100% (1)

- A. Presysler Trading Answer SheetDocument6 pagesA. Presysler Trading Answer SheetGabriel XuNo ratings yet

- Investors Awareness Regarding Depository in India: Taranjeet Kaur MBA3rd 1272395Document31 pagesInvestors Awareness Regarding Depository in India: Taranjeet Kaur MBA3rd 1272395Raman RandhawaNo ratings yet

- RBI Branch and ATM Expansion LiberalizedDocument9 pagesRBI Branch and ATM Expansion LiberalizedbistamasterNo ratings yet

- History of EXIM BankDocument54 pagesHistory of EXIM BankMasood PervezNo ratings yet

- National Income: Learning ObjectivesDocument30 pagesNational Income: Learning Objectivesmuhammedsadiq abdullaNo ratings yet

- Chapter # 6 Departmental AccountDocument36 pagesChapter # 6 Departmental AccountRooh Ullah KhanNo ratings yet

- 2 Oid Method 1Document2 pages2 Oid Method 1sc100% (6)

- Summer Internship ProjectDocument90 pagesSummer Internship ProjectAchyut Saxena40% (5)

- Report Myanmar Financial Sector - A Challenging Environment For Banks Nov2013Document56 pagesReport Myanmar Financial Sector - A Challenging Environment For Banks Nov2013THAN HANNo ratings yet