Professional Documents

Culture Documents

Units-Roots and Broken Trends

Units-Roots and Broken Trends

Uploaded by

Pierre Chavez Alcoser0 ratings0% found this document useful (0 votes)

4 views6 pagesOriginal Title

Units-roots and Broken Trends

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

4 views6 pagesUnits-Roots and Broken Trends

Units-Roots and Broken Trends

Uploaded by

Pierre Chavez AlcoserCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 6

Time Series Econometrics

Unit-roots and broken trends

Walter Sosa Escudero

Universidad de San Andr¶

es y UNLP

Unit-roots and trend breaks

Traditional view of the economic cycle:

yt = a + bt + "t

Trend stationary (TS): a stationary °uctuation "t around

the time trend a + bt. yt is obviously non-stationary.

Stationarity is easily achieved by `removing the trend'

Competing model:

yt = a + yt¡1 + "t

Random walk with drift (RWD): It is a di®erence stationary

(DS) process. This model represents the `unit-root

hypothesis'.

Walter Sosa Escudero. Time Series Econometrics (Econ472) 2

Nesting model:

yt = a + bt + Áyt¡1 + "t

The null hypothesis that the process is characterized by the

random walk can be evaluated by Á = 1 in the OLS

estimation using the Dickey-Fuller procedure.

² Nelson and Plosser (1982): most US macroeconomic time

series seems to be better characterized by a unit-root

process (accept null).

Walter Sosa Escudero. Time Series Econometrics (Econ472) 3

² Perron (1989): a more appropriate model is:

yt = a + dt + bt + "t

where:

8

< a) 1 if t < k , 0 otherwise

dt =

: b)t ¡ k if t ¸ k , 0 otherwise

that is, a trend-stationary model in which the variable dt

allows for a deterministic break in the trend at moment k .

² Case (a): change in intercept of the trend (shift in mean)

² Case (b): change in slope of the trend without any

sudden change in the moment of the break (shift in trend).

Walter Sosa Escudero. Time Series Econometrics (Econ472) 4

² All innovations have temporary e®ect except for the

one that changes the trend at time k , and it turns out

to be the only shock in the process that has a

permanent e®ect

² Standard unit root tests confuse this with a unit root

and hence is biased towards accepting the null!!.

² Perron's transformed uroot test: account for break and

test. The null of a unit-root can be rejected in most

cases in the Nelson-Plosser data when a break is

allowed

Walter Sosa Escudero. Time Series Econometrics (Econ472) 5

Doubts on Perron's conclusion

² Break point (k) is determined exogenously in Perron's

analysis.

² If this is in°uenced by observation of the data, it

introduces a pre-test bias that favors rejecting the

no-break null hypothesis.

² Intuition: choice of a breakpoint based on prior

observation of the data is inconsistent with a testing

procedure based on a distribution that is claimed to be

data independent.

Solution: a data-dependent algorithm to ¯nd the

break-point endogenously and then to evaluate the unit-root

hypothesis using distributional results that take into

account this data-dependence to avoid the pre-test bias.

Walter Sosa Escudero. Time Series Econometrics (Econ472) 6

Test statistics (Banerjee, et.al.(1992))

ADF regression:

yt = a + bt + Áyt¡1 + ¯(L)¢yt¡1 + "t

¯(L) is a lag polynomial of order p.

² 1. Recursive tests: recursive DF t statistic with

subsamples t = 1; : : : ; k where k = ko ; ko+1 ; :::; T . Evaluate

the maximum and minimum DF test.

² 2. Rolling tests: DF based on subsample of ¯xed size

Ts , rolling through the sample. Evaluate maximum and

minimum DF.

Walter Sosa Escudero. Time Series Econometrics (Econ472) 7

² 3. Sequential tests: estimate

yt = a + bt + cdt + Áyt¡1 + "t

allowing for a possible single shift or break at every

point in the sample.

Statistics considered are:

² Maximum F -statistic evaluating c = 0.

² DF statistic evaluated at the period in which the

F -statistic evaluating c = 0 is maximum.

² Minimum DF statistic evaluating u = 1

Two sets of sequential statistics are evaluated, one allowing

for a change in mean (case (a)) and another one allowing

for a change in the slope of the trend (case (b)).

Walter Sosa Escudero. Time Series Econometrics (Econ472) 8

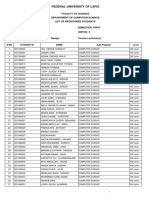

Empirical results for Argentina

TABLE 1: Summary of Statistics. Annual Data (1900-1993)

Statistic Period Crit.Val (10%)

Full Sample Statistics

-DF -2.8339 -3.15

-Phillips-Perron -2.9132 -3.15

Recursive

-Min DF -3.6293 1980 -4.00

-Max DF -1.9619 1934 -1.73

Rolling

-Min DF -4.3392 1964 -4.71

-Max DF -0.3382 1989 -1.31

Quandt test 14.3100 1917 23.86

Trend-Shift

-Max F 11.0637 1981 16.20

-DF at F max -4.3984 -4.52

-Min DF -4.3984 1981 -4.54

Mean Shift

-Max F 6.8685 1975 13.64

-DF at F max -3.9269 -4.19

-Min DF -3.9269 1975 -4.20

Walter Sosa Escudero. Time Series Econometrics (Econ472) 9

² DF and Phillips Perron: do not reject the null.

² Recursive: minimum and maximum DF statistics are -3.6293 and

-1.9619 at 1980 and 1934 respectively. Do not reject null.

² Rolling: DF statistics are -4.3392 and -0.3382 at periods 1964 and

1989 respectively. Do not reject null.

² Sequential statistics: Change in the intercept of the trend (case (a)):

maximum F is observed in 1981, with value 11.0637, lower than the

critical value reported by Banerjee, et. al (1992). Hence, we do not

reject the null of no change in the intercept of the trend. Sequential DF

tests computed under case (a). The minimum DF test gives a value of

-4.3984, greater than the critical value in Banerjee, et al. (-4.52)

suggesting not rejecting the null hypothesis of a unit-root. This

minimum DF test is observed at the same period in which the F

statistic achieves its maximum value. Similar results hold for case (b)

Walter Sosa Escudero. Time Series Econometrics (Econ472) 10

Graphical results

Walter Sosa Escudero. Time Series Econometrics (Econ472) 11

² Perron's modi¯ed DF test (break determined exogenously)

If we treat the break periods 1975 and 1981 as determined

exogenously for cases (a) and (b), then our DF statistics

are both lower than Perron's critical values at 10%

suggesting that the unit-root hypothesis should be rejected.

² Results are consistent recent ¯ndings: after we eliminate

the pre-test bias using distributional results consistent with

a data-dependent time break the unit-root hypothesis

cannot be rejected.

² Conclusion: The null hypothesis of the presence of a

unit-root in the stochastic process governing argentine real

GDP cannot be rejected using a conservative size of 10%.

In all cases we considered the possibility of an endogenously

determined break in the deterministic trend as a possible

characterization.

Walter Sosa Escudero. Time Series Econometrics (Econ472) 12

You might also like

- Boehmer E - Event-Study Methodology Under Conditions of Event-Induced VarianceDocument20 pagesBoehmer E - Event-Study Methodology Under Conditions of Event-Induced VariancesergiosiadeNo ratings yet

- Description Total Price (Taka) Qty SL No. VAT Amount (Taka) Supply Unit SD (Taka) VAT Rate Total Price (Taka) Per Unit Price (Taka) SDDocument1 pageDescription Total Price (Taka) Qty SL No. VAT Amount (Taka) Supply Unit SD (Taka) VAT Rate Total Price (Taka) Per Unit Price (Taka) SDSaimus SadatNo ratings yet

- P1.T2. Quantitative Analysis Bionic Turtle FRM Practice Questions Reading 13Document12 pagesP1.T2. Quantitative Analysis Bionic Turtle FRM Practice Questions Reading 13Ravi Chandra0% (1)

- Dev GuideDocument117 pagesDev GuideNigthstalkerNo ratings yet

- RSK TestDocument5 pagesRSK TestMaria HossainNo ratings yet

- StasioneritasDocument32 pagesStasioneritasBojes WandiNo ratings yet

- Phillips & Perron - Biometrika - 1988 - Unit Root TestDocument13 pagesPhillips & Perron - Biometrika - 1988 - Unit Root TestLAURA VALENTINA RIQUETH PACHECONo ratings yet

- Mann Kendall Analysis 1 PDFDocument7 pagesMann Kendall Analysis 1 PDFEng AlwardiNo ratings yet

- Paper EconometricaDocument37 pagesPaper EconometricaAlissa BarnesNo ratings yet

- Enders Lee April 18 2010Document33 pagesEnders Lee April 18 2010Kamel KamelNo ratings yet

- Testing of Normality: Peter Luk January 17, 2009Document20 pagesTesting of Normality: Peter Luk January 17, 2009donttellyouNo ratings yet

- Seasonality Time-SeriesDocument33 pagesSeasonality Time-SeriesHaNo ratings yet

- Chapter 4Document102 pagesChapter 4berhanu seyoumNo ratings yet

- An Empirical Note About Additive Outliers and Nonstationarity in Latin-American in Ation SeriesDocument12 pagesAn Empirical Note About Additive Outliers and Nonstationarity in Latin-American in Ation SeriesAngel GuillenNo ratings yet

- The Distribution and Properties of A Weighted Sum of Chi SquaresDocument44 pagesThe Distribution and Properties of A Weighted Sum of Chi SquaresMarwan HammoudaNo ratings yet

- Cointegration Analysis and ECM: Spurious Regression PhenomenaDocument32 pagesCointegration Analysis and ECM: Spurious Regression Phenomenaazi RadiantoNo ratings yet

- Unit Root Testing: ° Physica-Verlag 0, ISSN 0002-6018Document16 pagesUnit Root Testing: ° Physica-Verlag 0, ISSN 0002-6018aaditya01No ratings yet

- Cips TestDocument14 pagesCips TestSeydou OumarouNo ratings yet

- Scenario Tree GenerationDocument25 pagesScenario Tree GenerationAmalia ChrNo ratings yet

- H1: Steady, Uniform Flow in An Open-Ended Channel: 4.1 Problem SpecificationDocument13 pagesH1: Steady, Uniform Flow in An Open-Ended Channel: 4.1 Problem SpecificationHendra Daniswara ImmanuelNo ratings yet

- Cointegration Analysis and ECM: Spurious Regression PhenomenaDocument32 pagesCointegration Analysis and ECM: Spurious Regression Phenomenaafri09No ratings yet

- Experimental DesignDocument15 pagesExperimental DesignElson Antony PaulNo ratings yet

- Control Engineering Practice: Mauricio G. Cea, Graham C. GoodwinDocument9 pagesControl Engineering Practice: Mauricio G. Cea, Graham C. GoodwinAaron FultonNo ratings yet

- Cointegration Analysis and ECM: Spurious Regression PhenomenaDocument33 pagesCointegration Analysis and ECM: Spurious Regression PhenomenaYogi Maxy AntonyNo ratings yet

- Demand Forecasting InformationDocument66 pagesDemand Forecasting InformationAyush AgarwalNo ratings yet

- Acp 2022 316Document17 pagesAcp 2022 316Oussama EchateNo ratings yet

- Test For Stationarity and StablityDocument79 pagesTest For Stationarity and StablityTise TegyNo ratings yet

- Hypothesis Tests and Confidence Intervals in Multiple RegressionDocument44 pagesHypothesis Tests and Confidence Intervals in Multiple RegressionRa'fat JalladNo ratings yet

- Kpss PDFDocument20 pagesKpss PDFMarcos PoloNo ratings yet

- Transforming Time SeriesDocument8 pagesTransforming Time SeriesZenzen MiclatNo ratings yet

- Chi SquareDocument17 pagesChi SquareJazzmin Angel ComalingNo ratings yet

- Batten 2005Document12 pagesBatten 2005Graphix GurujiNo ratings yet

- Zivot - Lectures On Structural Change PDFDocument14 pagesZivot - Lectures On Structural Change PDFPär SjölanderNo ratings yet

- Capitulo 4 Primera EdicionDocument29 pagesCapitulo 4 Primera EdicionShey HuarcayaNo ratings yet

- Exchange Rate Returns Standardized by Realized Volatility Are (Nearly) GaussianDocument22 pagesExchange Rate Returns Standardized by Realized Volatility Are (Nearly) GaussiankshitijsaxenaNo ratings yet

- The Binomial, Poisson, and Normal DistributionsDocument39 pagesThe Binomial, Poisson, and Normal DistributionsGianna FaithNo ratings yet

- Bruno (2005) Approximating The Bias of The LSDV Estimator For Dynamic Unbalanced Panel Data ModelsDocument6 pagesBruno (2005) Approximating The Bias of The LSDV Estimator For Dynamic Unbalanced Panel Data Modelsvincus27No ratings yet

- Stata Lab4 2023Document36 pagesStata Lab4 2023Aadhav JayarajNo ratings yet

- To Be Able To Simulate These Frequency Deviations in Our Simulation, A Common Oscillator Model Is Used (17) - Using This ModelDocument14 pagesTo Be Able To Simulate These Frequency Deviations in Our Simulation, A Common Oscillator Model Is Used (17) - Using This ModelArezo ShafieeNo ratings yet

- Chap1 Introduction - pt1 StudentDocument11 pagesChap1 Introduction - pt1 StudentKerel Anson WarrickNo ratings yet

- Small sample power of tests of normality when the alternative is an α-stable distributionDocument51 pagesSmall sample power of tests of normality when the alternative is an α-stable distributionlacisagNo ratings yet

- Sbolboaca@umfcluj - Ro: Pearson-Fisher StatisticDocument8 pagesSbolboaca@umfcluj - Ro: Pearson-Fisher StatisticDan MaliwatNo ratings yet

- Singh AsymptoticAccuracyEfrons 1981Document10 pagesSingh AsymptoticAccuracyEfrons 1981thyagosmesmeNo ratings yet

- Forecasting ModelsDocument12 pagesForecasting ModelsAnuj SinghNo ratings yet

- Inferences For Two Population Standard DeviationsDocument19 pagesInferences For Two Population Standard DeviationsParul MittalNo ratings yet

- The Analysis of Black-Scholes Option Pricing: Wen-Li Tang, Liang-Rong SongDocument5 pagesThe Analysis of Black-Scholes Option Pricing: Wen-Li Tang, Liang-Rong SongDinesh KumarNo ratings yet

- Spurious Regression and Residual-Based Tests For CDocument46 pagesSpurious Regression and Residual-Based Tests For CSERGIO REQUENANo ratings yet

- Formula de WeissDocument17 pagesFormula de WeissJorgeIndNo ratings yet

- Analysis of Financial Time SeriesDocument13 pagesAnalysis of Financial Time SeriesZacharia Ombati NyabutoNo ratings yet

- The Kaplan-Meier Estimate of The Survival FunctionDocument23 pagesThe Kaplan-Meier Estimate of The Survival Functionrodicasept1967No ratings yet

- Probability DistributionDocument15 pagesProbability Distribution04 Shaina SachdevaNo ratings yet

- Notes For Applied Health Physics (Tae Young Kong)Document106 pagesNotes For Applied Health Physics (Tae Young Kong)silent_revolution100% (1)

- Unit Root Test and ApplicationsDocument11 pagesUnit Root Test and ApplicationsNaresh SehdevNo ratings yet

- Empirical Distributions & Prediction of ReturnsDocument14 pagesEmpirical Distributions & Prediction of Returnsz_k_j_vNo ratings yet

- FCM2063 Printed Notes.Document129 pagesFCM2063 Printed Notes.Didi AdilahNo ratings yet

- L13 T0distrb Chi Square ExamDocument12 pagesL13 T0distrb Chi Square ExamShouharda GhoshNo ratings yet

- Biometrical J - 1990 - Chen - A Study of Distribution Free Tests For Umbrella AlternativesDocument11 pagesBiometrical J - 1990 - Chen - A Study of Distribution Free Tests For Umbrella AlternativesJames Opoku-AgyapongNo ratings yet

- Lecture 3 Stats Cven2002Document41 pagesLecture 3 Stats Cven2002Seanam DMNo ratings yet

- Spectral method for fatigue damage estimation with non-zero mean stressFrom EverandSpectral method for fatigue damage estimation with non-zero mean stressNo ratings yet

- Phase Transformations and Material Instabilities in SolidsFrom EverandPhase Transformations and Material Instabilities in SolidsMorton GurtinNo ratings yet

- An Introduction to Probability and StatisticsFrom EverandAn Introduction to Probability and StatisticsRating: 4 out of 5 stars4/5 (1)

- MGF2661 Human Resource Management: Week 3 Employee Engagement Technological Disruption and HRM DR Susan MaysonDocument27 pagesMGF2661 Human Resource Management: Week 3 Employee Engagement Technological Disruption and HRM DR Susan MaysonJaneNo ratings yet

- Success Factors in Mergers and Acquisitions - Complexity Theory ADocument158 pagesSuccess Factors in Mergers and Acquisitions - Complexity Theory AMohamed Aly100% (1)

- Harvard Applied Mathematics 205 Homework 1Document6 pagesHarvard Applied Mathematics 205 Homework 1J100% (2)

- English 3 Periodical Exam Reviewer With AnswerDocument3 pagesEnglish 3 Periodical Exam Reviewer With AnswerPandesal UniversityNo ratings yet

- De-Mystifying Semiotics: Some Key Questions Answered: Rachel LawesDocument9 pagesDe-Mystifying Semiotics: Some Key Questions Answered: Rachel LawesminglessisNo ratings yet

- Differential CalculusDocument28 pagesDifferential CalculusRaju SinghNo ratings yet

- GeeksForGeeks C++ ProgramDocument24 pagesGeeksForGeeks C++ ProgramAndy HartonoNo ratings yet

- Sterile Water For InjectionDocument1 pageSterile Water For InjectionsiroratssNo ratings yet

- Milling MachinesDocument10 pagesMilling MachinesHuma ArfanNo ratings yet

- Hull Pic - HUMAN FACTOR, The Double Side EffectDocument16 pagesHull Pic - HUMAN FACTOR, The Double Side EffectMatteoNo ratings yet

- Competitiveness of Garment Technology As A CourseDocument11 pagesCompetitiveness of Garment Technology As A CourseMargie Ballesteros ManzanoNo ratings yet

- Fuji Xerox Device - Fault Codes - Xeretec HelpdeskDocument54 pagesFuji Xerox Device - Fault Codes - Xeretec HelpdeskJirawat KonanonNo ratings yet

- Disney+ Hotstar Mobile 1 Year: Grand Total 0.00Document3 pagesDisney+ Hotstar Mobile 1 Year: Grand Total 0.00Bala VarmaNo ratings yet

- Ucmp NotesDocument46 pagesUcmp NotesAnonymous fowICTKNo ratings yet

- IP Rating Chart - DSMTDocument18 pagesIP Rating Chart - DSMTAbi Putra100% (1)

- Corporate Innovation Basic & Intrapreneur: For AmoebaDocument4 pagesCorporate Innovation Basic & Intrapreneur: For AmoebaHammamMuhammadIrfantoroNo ratings yet

- Setup and Hold Time CalculationsDocument33 pagesSetup and Hold Time CalculationsRashmi Periwal100% (11)

- Heat, Light, SoundDocument31 pagesHeat, Light, SoundLen B RoxasNo ratings yet

- Hut310 Management For Engineers, May 2023Document3 pagesHut310 Management For Engineers, May 2023ckbhagath2003No ratings yet

- Module Answers For Earth & Life ScienceDocument11 pagesModule Answers For Earth & Life ScienceKarylle Mish GellicaNo ratings yet

- Request For Proposal Writing GuideDocument3 pagesRequest For Proposal Writing GuideSunilBhandari100% (1)

- UNC25 Sound Curtain Datasheet1 PDFDocument1 pageUNC25 Sound Curtain Datasheet1 PDFNguyễn LinhNo ratings yet

- Activity 1: A. What Are Organizational Development Techniques?Document12 pagesActivity 1: A. What Are Organizational Development Techniques?Jacklei MendozaNo ratings yet

- CSC 316Document5 pagesCSC 316Kc MamaNo ratings yet

- Biostatistics and Epidemiology Syllabus-1Document7 pagesBiostatistics and Epidemiology Syllabus-1Dehnzel de LeonNo ratings yet

- Load Balancing ApproachDocument5 pagesLoad Balancing ApproachsampathaboNo ratings yet

- Queisser 1998Document6 pagesQueisser 1998Christian RuizNo ratings yet

- Behaviour of Composite Haunched Beam Connection - 2002 - Engineering Structures PDFDocument13 pagesBehaviour of Composite Haunched Beam Connection - 2002 - Engineering Structures PDFHugo Ramirez CarmonaNo ratings yet