Professional Documents

Culture Documents

6 Chapter 4

Uploaded by

Keanlyn UnwinOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

6 Chapter 4

Uploaded by

Keanlyn UnwinCopyright:

Available Formats

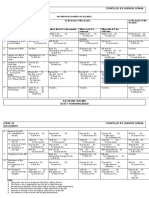

CHAPTER 4: Elements of Financial Statements

Asset : a present economic resource controlled by the entity as a result of past events

- Economic resource: a RIGHT that has the potential TO PRODUCE ECONOMIC BENEFITS

*Economic assets’ only requirement is its economic resources be controlled. Thus, it can’t be owned by

the entity yet still be considered as an economic asset. As long as an entity has control over it, even

though it’s not fully 100% control, it is still and will be considered as an asset.

RIGHT: rights that have the potential to produce economic benefits take many forms

FORMS OF RIGHT

1.Rights that CORRESPOND TO AN OBLIGATION of another party

rights to receive cash (cash receivables)

rights to receive goods or services (Other receivables such as Accounts receivable, etc.)

rights to exchange economic resources with another party on favorable terms (Financial

Instruments such Equity Investments and Debt Investments)

rights to benefit from an obligation of another party to transfer an economic resource if a

specified uncertain future event occurs (Right of Used Asset, leases)

2. Rights that DO NOT CORRESPOND TO AN OBLIGATION of another party

rights over physical objects, such as property, plant and equipment or inventories.

Example of rights: right to use a physical object or a right to benefit from the residual value of a leased

object

rights to use intellectual property

THE RIGHTS

Paragraph 4.8 : An entity’s right TO OBTAIN THE ECONOMIC BENEFITS produced by such goods

or services “exists momentarily until the entity consumes the goods or services”

Paragraph 4.9: NOT ALL of an entity’s rights are assets of that entity

* There are instances that assets are held for control but not owned.

Paragraph 4.10: An entity CANNOT HAVE A RIGHT TO OBTAIN ECONOMIC BENEFITS from itself.

- Example: Reacquisition of trade securities / debt securities since when we reacquire this, there is a

decrease to assets

Paragraph 4.11 : In principle, EACH OF AN ENTITY’S RIGHTS is a “separate asset”. However FOR

ACCOUNTING PURPOSES, “related rights” are often treated as a single unit of account that is a

single asset.

Paragraph 4.12 : In many cases, the set of RIGHTS arising from LEGAL OWNERSHIP of a physical

object is accounted for as a SINGLE ASSET. Conceptually, the ECONOMIC RESOURCES is the “set

of rights”, not the physical object.

Paragraph 4.13: In some cases, “it is uncertain whether a right exists”. Until that existence

uncertainty is resolved – for ex. by “court ruling” – it is uncertain whether the entity has a right

and, consequently, whether an asset exists.

- No right = No existence of asset. Thus, it must be resolved and confirmed that there is right. If

confirmed, HAVING RIGHTS = HAVING LEGAL EXISTENCE OF ASSETS

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5796)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (589)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Coping With Institutional Order Flow Zicklin School of Business Financial Markets SeriesDocument208 pagesCoping With Institutional Order Flow Zicklin School of Business Financial Markets SeriesRavi Varakala100% (5)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Oracle Revenue Ion Problems PDFDocument15 pagesOracle Revenue Ion Problems PDFMike JonesNo ratings yet

- Asb CX 13 Disclosure RequirementsDocument94 pagesAsb CX 13 Disclosure RequirementsTara RizviNo ratings yet

- JPDocument48 pagesJPmarosalaNo ratings yet

- 2Document3 pages2hidden heroNo ratings yet

- Plunkett Analytics Financial Benchmarks Report SampleDocument64 pagesPlunkett Analytics Financial Benchmarks Report SampleYeshwanth BabuNo ratings yet

- Betting Against BetaDocument82 pagesBetting Against BetaXad3rNo ratings yet

- (1011) Quiz 2 - With AnswersDocument16 pages(1011) Quiz 2 - With Answershatdognamaycheese123No ratings yet

- Tech Presentation VFinal 21stNov2016-FinalDocument40 pagesTech Presentation VFinal 21stNov2016-FinalSarthak GoelNo ratings yet

- Municipality of Tampilisan - ZN: Responsibily Center Accounts and Explanations Account Code PR Debit CreditDocument9 pagesMunicipality of Tampilisan - ZN: Responsibily Center Accounts and Explanations Account Code PR Debit CreditMary Jane Katipunan CalumbaNo ratings yet

- Debit Card SkimmingDocument2 pagesDebit Card SkimmingBeldon GonsalvesNo ratings yet

- A Study of Capital Structure in Extremely Different EnvironmentsDocument101 pagesA Study of Capital Structure in Extremely Different EnvironmentsSandeep BhatiaNo ratings yet

- "A Study On Challenges Faced by Indian Banking System DuringDocument48 pages"A Study On Challenges Faced by Indian Banking System DuringPriti DuttaNo ratings yet

- Case Study:: Axis REITDocument9 pagesCase Study:: Axis REITAhmad Mustaqim SulaimanNo ratings yet

- A Research Study On Awareness Regarding Crypto Currency Among InvestorsDocument12 pagesA Research Study On Awareness Regarding Crypto Currency Among InvestorsresearchparksNo ratings yet

- Payroll and PayslipDocument2 pagesPayroll and PayslipKrisha TubogNo ratings yet

- Auditor Changes and Discretionary Accruals DeFond and Subramanyam 1998Document33 pagesAuditor Changes and Discretionary Accruals DeFond and Subramanyam 1998goyal mitraNo ratings yet

- Franchise (Applied Auditing)Document4 pagesFranchise (Applied Auditing)Abraham Jr. Manansala100% (3)

- Fnstpb402 Task 2Document19 pagesFnstpb402 Task 2Rabin BidariNo ratings yet

- Industry MultiplesDocument49 pagesIndustry MultiplesArjun M PNo ratings yet

- Chap. 7-9 Summary For Written ReportDocument22 pagesChap. 7-9 Summary For Written ReportMJNo ratings yet

- Ifrs10 SNDocument5 pagesIfrs10 SNjohny SahaNo ratings yet

- 001 Add New Course - Fba RizalDocument8 pages001 Add New Course - Fba RizalMiauriz RizNo ratings yet

- How To Write The Best Business Plan - 2021 Complete GuideDocument5 pagesHow To Write The Best Business Plan - 2021 Complete GuideRandy Bayu TrisnandiNo ratings yet

- Taxmann BooksDocument12 pagesTaxmann BooksKranthi Prasad100% (1)

- Cbse Xi Compiled by Sudhir Sinha AccountsDocument2 pagesCbse Xi Compiled by Sudhir Sinha AccountsSudhir SinhaNo ratings yet

- Cankids... Kidscan Donation Form: Donor DetailsDocument2 pagesCankids... Kidscan Donation Form: Donor DetailsdpfsopfopsfhopNo ratings yet

- Nectar Lifesciences LTD Company ProfileDocument17 pagesNectar Lifesciences LTD Company ProfileDiksha SharmaNo ratings yet

- TMF382 ShortTermLoanRemittanceForm V04Document3 pagesTMF382 ShortTermLoanRemittanceForm V04Ahl IntongNo ratings yet

- Normal DistributionDocument11 pagesNormal Distributionkingmaker6126No ratings yet