Professional Documents

Culture Documents

End Term ACF 2021 Set 2

End Term ACF 2021 Set 2

Uploaded by

pranita mundraCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

End Term ACF 2021 Set 2

End Term ACF 2021 Set 2

Uploaded by

pranita mundraCopyright:

Available Formats

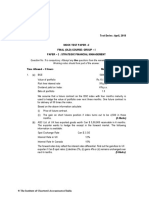

All questions are compulsory.

………………………………………………………………...…………………………

Questions.1 (6 Marks)

Zydus Ltd. has issued 8% debentures of Rs. 50000000, each of Rs. 1000. Term to maturity is 10 years. HCL has

also issued 8% debenture of Rs. 10 crore, each of Rs.1000. Term to maturity for these bonds is 20 years. After 2

years, yield to maturity decreases by 1%. Determine new prices of the bond after 3 years and also find out

which bond price will be largely impacted and why? You may assume redeemable value equal to face value.

Questions.2 (8 Marks)

Rajesh, a manager at Infosys Technologies Limited, received 2000 shares of company stock as part of his

compensation package. The stock currently sells for Rs. 3000 a share. Rajesh would like to defer selling the

stock until the next January. In February, however, he will need to sell all his holdings to provide for a down

payment on his new house. Rajesh is worried about the price risk involved in keeping his shares. If the value of

his stock holdings falls below Rs. 55,00,000, his ability to come up with the necessary down payment would be

jeopardized. On the other hand, if the stock value rises to Rs. 65,00,000, he would be able to make a small cash

reserves even after making the down payment. Rajesh considers the Strategy to buy February put options on

Infosys with strike price Rs. 2750. These options also sell for Rs. 100 each.

Evaluate this strategy with respect to Rajesh’s investment goals. What are the advantages and disadvantages of

this strategy.

Questions.3 (a) (9 Marks)

Sun Pharma, with its need to grow and maintain its leadership position in the industry, is planning to

acquire ABTCPL. The recent financial details of the two companies are as follows:

Sun Pharma ABTCPL

Profit after tax Rs.2,200 Rs.40

lakh lakh

Market price per share (face value Rs.200 Rs.24

Rs.10)

P/E Ratio 18.18 12

Projected growth rates (p.a.) 9% 5%

There are two views expressed by two leading consultants on the benefits due to synergy, one arguing

that there can be no benefit from synergy while the other predicts a 3% increase in earnings after the

acquisition.

a. If ABTCPL’s shareholders want an exchange ratio of 0.4 (i.e. 0.4 shares of Sun

Pharma for 1 share of ABTCPL), would that be acceptable to the shareholders of

Sun Pharma if

i. There is no synergy due to the merger?

ii. There is an increase in earnings of the merged entity by 3% due to synergy?

b. If Sun Pharma accepts an exchange ratio of 0.4 and synergy benefits are not

realized, will there be any dilution in EPS of Sun Pharma? If so, when will the

dilution be wiped off?

Questions.3 (b) (5 Marks)

As the finance manager of Al Hasan International, you are investigating the acquisition of Starlight

Company. The following facts are given.

Al Hasan Starlight

Earning per share Rs.6.75 Rs.2.5

Dividend per share Rs.3.25 Rs.1.00

Price per share Rs.48 Rs.15

Number of shares 60,00,000 20,00,000

Investors currently expect the dividends and earnings of Starlight to grow a steady rate of 7%. After

acquisition this growth rate would increase to 8% without any additional investment.

Required:

a. What is the benefit of this acquisition?

b. What is the cost of this acquisition to Al Hasan if it pays (i) Rs.17 per share

compensation (cash) to Starlight and (ii) offers one share for every 3 shares of

Starlight?

Questions.4 (6 Marks)

On January 2 of a particular year, an American Firm decided to close out its account at a Canadian bank on

February 28. The firm is expected to have 5 million Canadian dollars in the account at the time of withdrawal. It

would convert the funds to U.S.Dollars and transfer them to a New York bank. The relevant spot exchange rate

was $0.7564. The March Canadian dollar futures contract priced at $0.7541. Determine the outcome of a

future hedge if on February 28 the spot rate was $0.7207 and the future rate was).7220. All prices are in US

Dollars per Canadian dollar. The Canadian dollar futures contract covers CD 1, 00,000.

Students are required to provide step wise calculation with logical explanation.

Questions.5 (6 Marks)

Company P wants a loan of Rs.10 million. Its bankers have told the company that a fixed interest loan can be

sanctioned at 10% interest, while a floating interest rate can be sanctioned at the LIBOR + 1 %. Another

company Q is also looking for a Rs.10 million loan. Its bankers have given it a quote of 11 % for a fixed interest

loan and LIBOR + 3 % for a floating interest loan. Explain how the swap can be arranged through financial

intermediary which charges 20 basis points.

Students are required to provide flow chart for the process. No marks will be awarded

without flow chart.

You might also like

- Sadaqat InternshipDocument39 pagesSadaqat InternshipUsama JuttNo ratings yet

- R&D Procedure - Product - Development - HandbookDocument45 pagesR&D Procedure - Product - Development - HandbooksumanNo ratings yet

- SFM RTP Nov 22Document16 pagesSFM RTP Nov 22Accounts PrimesoftNo ratings yet

- TEST Paper 1Document7 pagesTEST Paper 1Abhu ArNo ratings yet

- Problems On MergerDocument7 pagesProblems On MergerSUNILABHI_APNo ratings yet

- SFM Test 3 Ques1652597579Document3 pagesSFM Test 3 Ques1652597579Nakul GoyalNo ratings yet

- Model Paper Financial ManagementDocument6 pagesModel Paper Financial ManagementSandumin JayasingheNo ratings yet

- Question No. 1 Is Compulsory. Attempt Any Five Questions From The Remaining Six Questions. Working Notes Should Form Part of The AnswerDocument5 pagesQuestion No. 1 Is Compulsory. Attempt Any Five Questions From The Remaining Six Questions. Working Notes Should Form Part of The AnswerCA Dipesh JainNo ratings yet

- 6 Financial Markets Institutions and Services - Prof. Vinay DuttaDocument3 pages6 Financial Markets Institutions and Services - Prof. Vinay DuttaParas KhuranaNo ratings yet

- Macr Important Questions 2020Document4 pagesMacr Important Questions 2020Abhishek Daniel100% (1)

- M&a QuesDocument4 pagesM&a QuesRiya GargNo ratings yet

- Merger & AcqitisionDocument5 pagesMerger & AcqitisiontruesoulwhispersNo ratings yet

- Merger AcquistionDocument37 pagesMerger AcquistionManjari KumariNo ratings yet

- MBA 5109 - Financial Management (MBA 2020-2022)Document6 pagesMBA 5109 - Financial Management (MBA 2020-2022)sreekavi19970120No ratings yet

- FM Test Paper B Com HonsDocument1 pageFM Test Paper B Com HonsAvinash Pandey 1658No ratings yet

- CA Final Paper 2Document32 pagesCA Final Paper 2MM_AKSINo ratings yet

- CF Question Paper t2Document3 pagesCF Question Paper t2KUSHI JAINNo ratings yet

- Dividend Policy - Problems For Class DiscussionDocument5 pagesDividend Policy - Problems For Class Discussionchandel08No ratings yet

- SFM QuesDocument5 pagesSFM QuesAstha GoplaniNo ratings yet

- November 2010 NewDocument35 pagesNovember 2010 Newwijewi2529No ratings yet

- 2015 12 SP Accountancy Unsolved 07Document6 pages2015 12 SP Accountancy Unsolved 07BhumitVashishtNo ratings yet

- Gujarat Technological UniversityDocument3 pagesGujarat Technological UniversityAmul PatelNo ratings yet

- Assignment: Advanced Financial Management and Policy Code: MCCC 204 UPC 324101204Document2 pagesAssignment: Advanced Financial Management and Policy Code: MCCC 204 UPC 324101204Ramesh Chand GuptaNo ratings yet

- The Excel File and Rename The Excel File With Your Roll Number - Name. Save The File in Every 10minutesDocument14 pagesThe Excel File and Rename The Excel File With Your Roll Number - Name. Save The File in Every 10minutesShriman MantriNo ratings yet

- 820003Document3 pages820003Minaz VhoraNo ratings yet

- Security Analysis and Valuation Blue Red Ink (1) - WatermarkDocument22 pagesSecurity Analysis and Valuation Blue Red Ink (1) - WatermarkKishan RajyaguruNo ratings yet

- Paper - 2: Management Accounting and Financial Analysis Questions SwapDocument31 pagesPaper - 2: Management Accounting and Financial Analysis Questions Swapअंजनी श्रीवास्तवNo ratings yet

- Valuation19 Jan 2022Document10 pagesValuation19 Jan 2022Mayuri ZileNo ratings yet

- Special Issues in Corporate FinanceDocument6 pagesSpecial Issues in Corporate FinanceMD Hafizul Islam HafizNo ratings yet

- Importanat Questions - Doc (FM)Document5 pagesImportanat Questions - Doc (FM)Ishika Singh ChNo ratings yet

- Gujarat Technological UniversityDocument3 pagesGujarat Technological UniversityAmul PatelNo ratings yet

- Super 60 Questions CA Final AFM For MAy 24 ExamsDocument42 pagesSuper 60 Questions CA Final AFM For MAy 24 ExamsHenry HundersonNo ratings yet

- 1.3 M1 - Dividends Question SetDocument3 pages1.3 M1 - Dividends Question Setshyla negiNo ratings yet

- SFM MTP - May 2018 QuestionDocument6 pagesSFM MTP - May 2018 QuestionMajidNo ratings yet

- SFM New Sums AddedDocument78 pagesSFM New Sums AddedRohit KhatriNo ratings yet

- FFTFMDocument5 pagesFFTFMKaran NewatiaNo ratings yet

- Dividend Policy and Firm Value Assignment 2Document2 pagesDividend Policy and Firm Value Assignment 2riddhisanghviNo ratings yet

- Pen & Paper Final Group I SFM April 10 Test 1Document4 pagesPen & Paper Final Group I SFM April 10 Test 1rbhadauria_1No ratings yet

- Question No. 1 Is Compulsory. Attempt Any Five Questions From The Remaining Six Questions. Working Notes Should Form Part of The AnswerDocument17 pagesQuestion No. 1 Is Compulsory. Attempt Any Five Questions From The Remaining Six Questions. Working Notes Should Form Part of The AnswerMajidNo ratings yet

- Shareholder Value Practice QuestionsDocument6 pagesShareholder Value Practice Questionsavinashchoudhary2043No ratings yet

- Sample Paper 2013 Class XII Subject Accountancy: Time: 3hours Maximum Marks: 80 General InstructionsDocument8 pagesSample Paper 2013 Class XII Subject Accountancy: Time: 3hours Maximum Marks: 80 General Instructions9chand3No ratings yet

- Quiz 4Document1 pageQuiz 4Hanny chandraNo ratings yet

- Topic 4 - Practice QuestionsDocument2 pagesTopic 4 - Practice QuestionsDr-Wasim Abbas ShaheenNo ratings yet

- Stock Valuation ProblemsDocument1 pageStock Valuation ProblemsJosine JonesNo ratings yet

- BS Case StudiesDocument6 pagesBS Case StudiesAnisha RohatgiNo ratings yet

- Gujarat Technological UnversityDocument20 pagesGujarat Technological UnversityUrvashi RNo ratings yet

- Sample Paper 2013 Class XII Subject Accountancy: Time: 3hours Maximum Marks: 80 General InstructionsDocument11 pagesSample Paper 2013 Class XII Subject Accountancy: Time: 3hours Maximum Marks: 80 General InstructionsSikha KaushikNo ratings yet

- Important Practical Questions New Syllabus SFM by Aaditya Jain SirDocument72 pagesImportant Practical Questions New Syllabus SFM by Aaditya Jain SirVijayaNo ratings yet

- Review of Bond & StockDocument3 pagesReview of Bond & StockbalachmalikNo ratings yet

- ACF - End Term PaperDocument4 pagesACF - End Term PaperAkshat JainNo ratings yet

- Question SFM GMDocument10 pagesQuestion SFM GMPraDeepMspNo ratings yet

- Business Finance Assignment EnaaDocument4 pagesBusiness Finance Assignment EnaaEna Bandyopadhyay100% (1)

- Gujarat Technological UniversityDocument2 pagesGujarat Technological UniversityIsha KhannaNo ratings yet

- SFM QDocument4 pagesSFM QriyaNo ratings yet

- FB Practice Test 1 Set 2 SolutionsDocument11 pagesFB Practice Test 1 Set 2 SolutionsShivam Mehta100% (6)

- Problems On Cost of CapitalDocument3 pagesProblems On Cost of Capital766 Rutu KhadapkarNo ratings yet

- Capital StructureDocument2 pagesCapital StructureSahil RupaniNo ratings yet

- Capital StructureDocument2 pagesCapital StructureSahil RupaniNo ratings yet

- Capital StructureDocument2 pagesCapital StructureSahil RupaniNo ratings yet

- Gujarat Technological University: InstructionsDocument3 pagesGujarat Technological University: Instructionssiddharth devnaniNo ratings yet

- Mutual Funds in India: Structure, Performance and UndercurrentsFrom EverandMutual Funds in India: Structure, Performance and UndercurrentsNo ratings yet

- DIVIDEND INVESTING: Maximizing Returns while Minimizing Risk through Selective Stock Selection and Diversification (2023 Guide for Beginners)From EverandDIVIDEND INVESTING: Maximizing Returns while Minimizing Risk through Selective Stock Selection and Diversification (2023 Guide for Beginners)No ratings yet

- Instructions: This Paper Has Three (3) Pages and Six (6) Questions. You Are Required To Answer All Questions Based On The Caselet Given BelowDocument4 pagesInstructions: This Paper Has Three (3) Pages and Six (6) Questions. You Are Required To Answer All Questions Based On The Caselet Given Belowpranita mundraNo ratings yet

- GEP JD - KS - Sourcing Analyst 2021-22Document2 pagesGEP JD - KS - Sourcing Analyst 2021-22pranita mundraNo ratings yet

- Industry AnalysisDocument22 pagesIndustry Analysispranita mundraNo ratings yet

- Questions MADocument20 pagesQuestions MApranita mundraNo ratings yet

- ACF Project ReportDocument17 pagesACF Project Reportpranita mundraNo ratings yet

- Individual Write UpDocument2 pagesIndividual Write Uppranita mundraNo ratings yet

- Customer Value Driven Marketing Strategy Developing An Integrated Marketing MixDocument10 pagesCustomer Value Driven Marketing Strategy Developing An Integrated Marketing Mixpranita mundraNo ratings yet

- Information Systems For Management: PGDM Term - III, Batch 2020-22 Session - I - X - NMDocument198 pagesInformation Systems For Management: PGDM Term - III, Batch 2020-22 Session - I - X - NMpranita mundraNo ratings yet

- Understandin G Marketing: Session 1. (Fundamentals of Marketing)Document12 pagesUnderstandin G Marketing: Session 1. (Fundamentals of Marketing)pranita mundraNo ratings yet

- Regulated by SEBI, The FPI Regime Is A Route For Foreign Investment in IndiaDocument3 pagesRegulated by SEBI, The FPI Regime Is A Route For Foreign Investment in Indiapranita mundraNo ratings yet

- Facts of CaseDocument45 pagesFacts of Casepranita mundraNo ratings yet

- Peppa Game Toy - Google SearchDocument1 pagePeppa Game Toy - Google SearchhienvvuNo ratings yet

- Business Facilitation Act 2022Document27 pagesBusiness Facilitation Act 2022LIFE WITH TORINo ratings yet

- FactSet Bank Tracker 31-JulDocument8 pagesFactSet Bank Tracker 31-JulBrianNo ratings yet

- 301 Process Financial Transactions and Extract Interim ReportsDocument49 pages301 Process Financial Transactions and Extract Interim Reportsabelu habite neri100% (1)

- USA INC Corp Registration in DelwareDocument6 pagesUSA INC Corp Registration in DelwareAmerican Kabuki100% (9)

- CMB Closing Call Script 5.0Document9 pagesCMB Closing Call Script 5.0Fitness ChiselersNo ratings yet

- Idea Nuova ComplaintDocument25 pagesIdea Nuova ComplaintSarah BursteinNo ratings yet

- Pautang AuditDocument4 pagesPautang AuditWyeth Earl Padar EndrianoNo ratings yet

- Far 340: Financial Analysis Statement Petronas Gas BerhadDocument26 pagesFar 340: Financial Analysis Statement Petronas Gas BerhadaishahNo ratings yet

- Iesco Online BillDocument2 pagesIesco Online BillahsanNo ratings yet

- City Bank Annual Report 2021Document478 pagesCity Bank Annual Report 2021Shadat Rahman 1731419No ratings yet

- Project Report Format: Front Page & Certificate Should Be in Color Print Only With BordersDocument22 pagesProject Report Format: Front Page & Certificate Should Be in Color Print Only With BordersNikhil SemlaniNo ratings yet

- AICTBM-2018-4 Amir BadshaDocument15 pagesAICTBM-2018-4 Amir BadshaAhmad kamalNo ratings yet

- Trusts Bar OutlineDocument4 pagesTrusts Bar OutlineJohn RisvoldNo ratings yet

- Form 31Document2 pagesForm 31riyu4393No ratings yet

- D) All of These (Answer All)Document9 pagesD) All of These (Answer All)Kavita VermaNo ratings yet

- Light Coral Modern Chic Vintage Product Marketing PresentationDocument15 pagesLight Coral Modern Chic Vintage Product Marketing PresentationLina NurkhasanahNo ratings yet

- INVOICE 035 - MergedDocument4 pagesINVOICE 035 - Mergedrzkyntohw028No ratings yet

- Worksheet 5Document14 pagesWorksheet 5HiraiNo ratings yet

- Economic System Notes Uitm Eco162Document2 pagesEconomic System Notes Uitm Eco162NUREEN IRDINA JAPRIDINNo ratings yet

- Electronics vs. Non-Electronic Voucher Card Systems in Ethio-Telecom: Implication To Service Accessibility and Customer SatisfactionDocument110 pagesElectronics vs. Non-Electronic Voucher Card Systems in Ethio-Telecom: Implication To Service Accessibility and Customer SatisfactionBK ICTNo ratings yet

- GENLEAP - Siddharth TripathiDocument6 pagesGENLEAP - Siddharth TripathiSiddharth TripathiNo ratings yet

- Bangladesh Army University of Science and Technology Bachelor of Business Administration (BBA)Document4 pagesBangladesh Army University of Science and Technology Bachelor of Business Administration (BBA)Shahadat Hossain SourovNo ratings yet

- Nissan Automobile: Case Study AssignmentDocument39 pagesNissan Automobile: Case Study Assignmentpulith udaveenNo ratings yet

- The Influence of Perceived Entrepreneurship Education On InnovationDocument7 pagesThe Influence of Perceived Entrepreneurship Education On InnovationArafatNo ratings yet

- Introduction To Global International TradeDocument2 pagesIntroduction To Global International TradeMisshtaCNo ratings yet

- Marginal and Absorption CostingDocument21 pagesMarginal and Absorption Costingkelvin mboyaNo ratings yet

- Quiz 2.2Document6 pagesQuiz 2.2els emsNo ratings yet