Professional Documents

Culture Documents

Break-Even Analysis: Example 2. Example 4

Uploaded by

Queen Onde0 ratings0% found this document useful (0 votes)

5 views1 pageOriginal Title

BREAKEVEN ANALYSIS

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

5 views1 pageBreak-Even Analysis: Example 2. Example 4

Uploaded by

Queen OndeCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

BREAK-EVEN ANALYSIS Example 2. Example 4.

A company manufactures bookcases that Determine the break-even quantity per

Break-even analysis is a method sell 65.00 each. Annual operation month using the following data:

of determining costs exactly equal to expenses is at 35,000.00 and production of Selling price per 600.00

revenue. If the manufactured quantity is one bookcase costs 50.00. How many unit

less than the breakeven quantity, a loss bookcases must be sold to avoid taking Monthly Expenses 428,000.00

is incurred. If the manufactured quantity losses? Labor Cost 115.00

Given: Cost of materials 76.00

is greater than the breakeven quantity,

fixed cost, f = 35,000.00 per annum Other variable 2.32

a profit is incurred.

marginal cost, a = 50.00 costs

selling price per unit, p = 65.00 Given:

Break-even also refers to the Required: break-even quantity

situation where the sales generated fixed cost, f = 428,000.00 monthly

Sol’n: marginal cost, a = 115+76+2.32 = 193.32

(INCOME) is just enough to cover the Assuming there is no change in inventory, selling price per unit, p = 600.00

fixed and variable cost (EXPENSES) .The the break-even point is: Required: break-even quantity

level of production where the total Example 1. Cost, C = Revenue, R Sol’n:

income is equal to the total expenses is The cost of producing computer diskettes N = Assuming there is no change in inventory,

known as break-even point. is as follows: material cost is 7.00 each, the break-even point is:

labor cost 2.00 each, and other expenses N = Cost, C = Revenue, R

is 1.50 each. If the fixed expenses is

N=

WORKING FORMULAS: 69,000.00 per month, how many diskettes N = 2,333.33 Ans.

R = pN must be produced each month for thus, the company needs to produce N=

breakeven if each diskette is worth 45.00? approximately 2,334 bookcases annually.

Given: N = 1,052.42 or 1053 pcs approx. Ans.

C = f + aN

fixed cost, f = 69,000.00 monthly Example 3.

marginal cost, a = 7.00+2.00+1.50 = 10.50 A company that manufactures electric

Where;

selling price per unit = 45.00 motors has a production capacity of 200

R = total revenue

Required: N = ? motors a month. The variable costs are

p = incremental revenue or selling

Sol’n: 150.00 per motor. The average selling

price per unit

Assuming there is no change in inventory, price is 275.00. Fixed cost of the company

N = break-even point or quantity

the break-even point is: is 20,000.00 per month which includes

produced and sold for break-

N= taxes. The number of motors that must be

even

sold each month to break-even is closest

a = an incremental cost which is N= to:

the cost to produce one

N = 2,000.00 Ans. Given:

additional item. It may also be

fixed cost, f = 20,000.00 monthly

called the marginal cost or

Thus, the company needs to sell at least variable cost, a = 150.00

differential cost.

2,000 diskettes per month. selling price per unit, p = 275.00

f = fixed cost which does not vary

Required: break-even quantity

with production

Sol’n:

C = total cost

Assuming there is no change in inventory,

the break-even point is:

Assuming there is no change in inventory,

Cost, C = Revenue, R

the break-even point can be found from:

Cost, C = Revenue, R N=

f + aN = pN N=

N= N = 160 pcs Ans.

You might also like

- PD 1096-CH 2Document7 pagesPD 1096-CH 2Queen OndeNo ratings yet

- National Building Code of The PhilippinesDocument4 pagesNational Building Code of The PhilippinesQueen OndeNo ratings yet

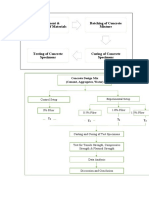

- Procurement & Preparation of Materials Batching of Concrete MixtureDocument4 pagesProcurement & Preparation of Materials Batching of Concrete MixtureQueen OndeNo ratings yet

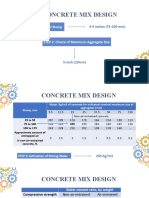

- Concrete Mix Design: STEP 1: Choice of SlumpDocument12 pagesConcrete Mix Design: STEP 1: Choice of SlumpQueen OndeNo ratings yet

- Compressive Strength of ConcreteDocument12 pagesCompressive Strength of ConcreteQueen OndeNo ratings yet

- 2020 Monthly Calendar Landscape 08Document12 pages2020 Monthly Calendar Landscape 08VIKAS MauryaNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Pengembangan Berbasis WEB Untuk Menunjang Kinerja Pengusaha Truk DI Sumatera UtaraDocument10 pagesPengembangan Berbasis WEB Untuk Menunjang Kinerja Pengusaha Truk DI Sumatera UtaraDeni WijanantoNo ratings yet

- CHAPTER 4: Differential Cost Analysis (Relevant Costing) KaebDocument6 pagesCHAPTER 4: Differential Cost Analysis (Relevant Costing) KaebMark Gelo WinchesterNo ratings yet

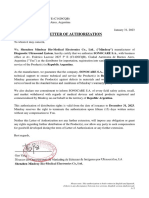

- 阿根廷代理商SONOCARE授权函 AutorizaciónDocument2 pages阿根廷代理商SONOCARE授权函 AutorizaciónAdmin DGIESNo ratings yet

- ASM1 - 530 - Global Business EnvironmentDocument19 pagesASM1 - 530 - Global Business EnvironmentBảo Trân Nguyễn NgọcNo ratings yet

- TLA 1: Mini-Case Discussion: Health Care Tourism (Segmenting)Document4 pagesTLA 1: Mini-Case Discussion: Health Care Tourism (Segmenting)Marc Agustin Cainglet50% (2)

- MFT PRES 402 en Ghana Project Launch 2011 01Document114 pagesMFT PRES 402 en Ghana Project Launch 2011 01Chan AyeNo ratings yet

- Kgomotso Nathan Xhakaza: EducationDocument2 pagesKgomotso Nathan Xhakaza: EducationkgomotsoNo ratings yet

- Customer Satisfaction Coca-ColaDocument47 pagesCustomer Satisfaction Coca-ColaOm Prakash57% (7)

- Sunshine DeveloperDocument12 pagesSunshine DeveloperBabulesh YadavNo ratings yet

- Process Flow - RKL - Procurement To PayDocument8 pagesProcess Flow - RKL - Procurement To PayRaul KarkyNo ratings yet

- BM Module 1 CommissionsDocument15 pagesBM Module 1 CommissionsHp laptop sorianoNo ratings yet

- SV Exercises FA1Document13 pagesSV Exercises FA1Nguyễn Văn AnNo ratings yet

- Task 2 - Process Letter v3Document4 pagesTask 2 - Process Letter v3Siddhant Aggarwal100% (1)

- Prayagraj Diagnostic Study ReportDocument75 pagesPrayagraj Diagnostic Study ReportAbhijeet Kumar100% (1)

- CAJES 04 Quiz 01Document2 pagesCAJES 04 Quiz 01Kyl ReamonNo ratings yet

- Close Out ReportDocument16 pagesClose Out ReportAriff MuhamadNo ratings yet

- Market Gap Analysis TemplateDocument2 pagesMarket Gap Analysis TemplateZeshanNo ratings yet

- Department of Management Studies: Question BankDocument12 pagesDepartment of Management Studies: Question BankDr.Satish RadhakrishnanNo ratings yet

- Project HSE Plan UNDOF IsraelDocument29 pagesProject HSE Plan UNDOF IsraelWinnie EldamaNo ratings yet

- Specs For Exec BioDocument16 pagesSpecs For Exec Biomalik_saleem_akbarNo ratings yet

- FLW00005 - Disbursement Transaction Cycle 2Document2 pagesFLW00005 - Disbursement Transaction Cycle 2Rafael SampayanNo ratings yet

- Mkm05 ReviewerDocument8 pagesMkm05 ReviewerSamantha PaceosNo ratings yet

- Part IV Case ApplicationDocument3 pagesPart IV Case ApplicationsengpisalNo ratings yet

- Bakon-Pulsar Import PI20210914JDocument1 pageBakon-Pulsar Import PI20210914Jluis palominoNo ratings yet

- PasswordsDocument20 pagesPasswords739589asdalkom.liveNo ratings yet

- Set Up Electronic Payments: Make Checks Payable ToDocument2 pagesSet Up Electronic Payments: Make Checks Payable Tokathyta03No ratings yet

- Ch10 Mankiw Externalities-WOALDocument42 pagesCh10 Mankiw Externalities-WOALHanif NugrahadiNo ratings yet

- Forex Spectrum - Highly Converting Forex ProductDocument39 pagesForex Spectrum - Highly Converting Forex ProductAlexandra Loayza HidalgoNo ratings yet

- COMPLEX Procurement White Paper PDFDocument13 pagesCOMPLEX Procurement White Paper PDFDock N DenNo ratings yet

- Kelp 4 - Thyrocare - Disrupting The Indian Medical Diagnostic IndustryDocument18 pagesKelp 4 - Thyrocare - Disrupting The Indian Medical Diagnostic IndustryErro Jaya RosadyNo ratings yet