Professional Documents

Culture Documents

Comprehensive Activity

Uploaded by

Sofia Lynn Rico Rebancos0 ratings0% found this document useful (0 votes)

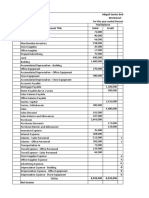

31 views2 pagesThis document is a worksheet for Dr. Nick Marasigan's medical practice for the month of October 2021. It includes a trial balance, adjustments, adjusted trial balance, income statement and balance sheet. The trial balance shows assets of $2,423,000 and liabilities/equity of $2,423,000. After adjustments, the adjusted trial balance has total debits of $2,516,000 and total credits of $2,516,000. The income statement shows revenues of $464,000 and expenses of $243,667, resulting in a profit of $220,333. The balance sheet lists total assets of $2,272,333 and total liabilities/equity of $2,

Original Description:

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document is a worksheet for Dr. Nick Marasigan's medical practice for the month of October 2021. It includes a trial balance, adjustments, adjusted trial balance, income statement and balance sheet. The trial balance shows assets of $2,423,000 and liabilities/equity of $2,423,000. After adjustments, the adjusted trial balance has total debits of $2,516,000 and total credits of $2,516,000. The income statement shows revenues of $464,000 and expenses of $243,667, resulting in a profit of $220,333. The balance sheet lists total assets of $2,272,333 and total liabilities/equity of $2,

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

31 views2 pagesComprehensive Activity

Uploaded by

Sofia Lynn Rico RebancosThis document is a worksheet for Dr. Nick Marasigan's medical practice for the month of October 2021. It includes a trial balance, adjustments, adjusted trial balance, income statement and balance sheet. The trial balance shows assets of $2,423,000 and liabilities/equity of $2,423,000. After adjustments, the adjusted trial balance has total debits of $2,516,000 and total credits of $2,516,000. The income statement shows revenues of $464,000 and expenses of $243,667, resulting in a profit of $220,333. The balance sheet lists total assets of $2,272,333 and total liabilities/equity of $2,

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You are on page 1of 2

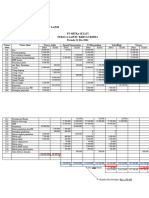

Dr. Nick Marasigan, M.D.

Worksheet

For the Month Ended Oct. 31,2021

Trial Balance Adjustments

No. Account Title Debit Credit Debit Credit

110 Cash 114,000

120 Accounts Receivable 204,000

130 Medical Supplies 56,000 35,000

140 Prepaid Insurance 20,000 1,667

150 Land 250,000

160 Medical Building 1,000,000

165 Accumulated Depreciation - Medical Building 5,000

170 Medical Equipment 465,000

175 Accumulated Depriciation - Medical Equipment 9,000

210 24% Note Payable 400,000

220 20% Note Payable 1,200,000

230 Accounts Payable 49,000

240 Salaries Payable 51,000

250 Interest Payable 28,000

260 Unearned Research Revenues 90,000 30,000

310 Marasigan, Capital 250,000

320 Marasigan, Withdrawals 200,000

410 Medical Revenues 434,000

420 Research Revenues 30,000

510 Salaries Expense 73,000 51,000

520 Insurance Expense 1,667

530 Repairs Expense 23,000

540 Supplies Expense 35,000

550 Association Dues Expense 15,000

560 Telephone Expense 3,000

570 Depreciation Expense -Building 5,000

580 Depreciation Expense -Equipment 9,000

590 Interest Expense 28,000

2,423,000 2,423,000 159,667 159,667

Profit

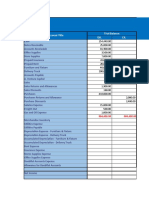

ck Marasigan, M.D.

Worksheet

nth Ended Oct. 31,2021

Adjusted Trial Balance Income Statement Balance Sheet

Debit Credit Debit Credit Debit Credit

114,000 114,000

204,000 204,000

21,000 21,000

18,333 18,333

250,000 250,000

1,000,000 1,000,000

5,000 5,000

465,000 465,000

9,000 9,000

400,000 400,000

1,200,000 1,200,000

49,000 49,000

51,000 51,000

28,000 28,000

60,000 60,000

250,000 250,000

200,000 200,000

434,000 434,000

30,000 30,000

124,000 124,000

1,667 1,667

23,000 23,000

35,000 35,000

15,000 15,000

3,000 3,000

5,000 5,000

9,000 9,000

28,000 28,000

2,516,000 2,516,000 243,667 464,000 2,272,333 2,052,000

220,333 220,333

464,000 464,000 2,272,333 2,272,333

You might also like

- Dr. Nick Marasigan Trial Balance AdjustmentsDocument2 pagesDr. Nick Marasigan Trial Balance Adjustmentskianna doctoraNo ratings yet

- Chapter 6Document10 pagesChapter 6SabNo ratings yet

- Accounting - Trial BalanceDocument1 pageAccounting - Trial Balancefranchesca.dejesus.educNo ratings yet

- YARADocument5 pagesYARAMischa Bianca BesmonteNo ratings yet

- Adjusted Trial BalanceDocument2 pagesAdjusted Trial BalanceJerrica Rama100% (1)

- Profit 220,333.3 3 220,333.33Document1 pageProfit 220,333.3 3 220,333.33CookiemonsterNo ratings yet

- FAR2 WorksheetDocument37 pagesFAR2 Worksheetrj aNo ratings yet

- Book 111111Document3 pagesBook 111111Janet AnotdeNo ratings yet

- Worksheet Problem #5Document104 pagesWorksheet Problem #5Gutierrez Ronalyn Y.No ratings yet

- Name: Edmalyn R. Canton - BSA 1 - BE 302 Morning Subject/course: 892 - Acc 111 Activity 34Document6 pagesName: Edmalyn R. Canton - BSA 1 - BE 302 Morning Subject/course: 892 - Acc 111 Activity 34Adam CuencaNo ratings yet

- EKO4 Marsya As - 12ipa3 - 16Document4 pagesEKO4 Marsya As - 12ipa3 - 16Marsya AlyssaNo ratings yet

- Seatwork 5Document2 pagesSeatwork 5Jasmine ManingoNo ratings yet

- Arguelles Medical ClinicDocument3 pagesArguelles Medical ClinicPJ PoliranNo ratings yet

- Teresita Buenaflor CompanyDocument18 pagesTeresita Buenaflor CompanyLera Acuzar100% (1)

- Jansen Balance SheetDocument3 pagesJansen Balance SheetRowella Mae VillenaNo ratings yet

- LECTURE Jan. 3 2023Document17 pagesLECTURE Jan. 3 2023lheamaecayabyab4No ratings yet

- Worksheet MerchandisingDocument3 pagesWorksheet MerchandisingLyca MaeNo ratings yet

- Accounting RefresherDocument2 pagesAccounting RefresherAlbert MorenoNo ratings yet

- Worksheet MerchandisingDocument6 pagesWorksheet MerchandisingLyca Mae CubangbangNo ratings yet

- Sample Woksheet For Service ConcernDocument1 pageSample Woksheet For Service ConcernEzekiel LapitanNo ratings yet

- Problems 7 10Document19 pagesProblems 7 10Margiery GannabanNo ratings yet

- Past Paper Answers - 2017 (B) : Business Name:-NM Company LTDDocument42 pagesPast Paper Answers - 2017 (B) : Business Name:-NM Company LTDName of RoshanNo ratings yet

- WorksheetDocument4 pagesWorksheetHumaira NomanNo ratings yet

- Accounting ProjectDocument135 pagesAccounting ProjectMylene SalvadorNo ratings yet

- Clenneth CompanyDocument21 pagesClenneth CompanyRich ann belle AuditorNo ratings yet

- Unadjusted Trial Balance to Adjusted Trial Balance and Financial StatementsDocument2 pagesUnadjusted Trial Balance to Adjusted Trial Balance and Financial StatementsOmelkhair YahyaNo ratings yet

- Unadjusted Trial Balance Adjusting EntriesDocument3 pagesUnadjusted Trial Balance Adjusting EntriesCj BarrettoNo ratings yet

- Abigail Santos Boutique, Worksheet and Financial Statement For MerchandisingDocument9 pagesAbigail Santos Boutique, Worksheet and Financial Statement For MerchandisingFeiya LiuNo ratings yet

- Accounts Trial Balance DebitDocument8 pagesAccounts Trial Balance Debitmaria bianca palmaNo ratings yet

- Activity (Worksheet Preparation)Document3 pagesActivity (Worksheet Preparation)Lehnard Delos Reyes GellorNo ratings yet

- Accbp100 3rd Exam AnswersDocument8 pagesAccbp100 3rd Exam AnswersAlthea Marie OrtizNo ratings yet

- DeceVid Company Final Worksheet PDFDocument1 pageDeceVid Company Final Worksheet PDFAngel Nhova Pepito OmalayNo ratings yet

- Leah May Santiago Information System Worksheet December 31, 2021 Trial Balance Adjustments Account Titles Debit Credit Debit CreditDocument5 pagesLeah May Santiago Information System Worksheet December 31, 2021 Trial Balance Adjustments Account Titles Debit Credit Debit CreditJoy Santos80% (10)

- Group 6 Drill WS & FSDocument12 pagesGroup 6 Drill WS & FSSheilla Dela Torre PaderangaNo ratings yet

- MZM Grocery Store Financial StatementsDocument9 pagesMZM Grocery Store Financial StatementsRica Ann RoxasNo ratings yet

- Assignment No. 6Document14 pagesAssignment No. 6Angela MacailaoNo ratings yet

- John Bala Company Worksheet: Unadjusted Trial Balance DebitDocument9 pagesJohn Bala Company Worksheet: Unadjusted Trial Balance DebitJekoeNo ratings yet

- ULOa Let's Analyze Week 8 9Document4 pagesULOa Let's Analyze Week 8 9emem resuentoNo ratings yet

- Annual Depreciation 8333.33333333333 Monthly Depreciation 41666.65Document7 pagesAnnual Depreciation 8333.33333333333 Monthly Depreciation 41666.65Kristine Lei Del MundoNo ratings yet

- Acctg Midterms-CosicoDocument6 pagesAcctg Midterms-CosicoKyla Marie BayanNo ratings yet

- MZM Grocery Income StatementDocument7 pagesMZM Grocery Income StatementIphegenia DipoNo ratings yet

- Quiz8 Ruby SaludaresDocument12 pagesQuiz8 Ruby SaludaresBhy Juarte SaludaresNo ratings yet

- Principles of Accounting Problem 5Document7 pagesPrinciples of Accounting Problem 5Carlo AbrinaNo ratings yet

- Doris PatenoDocument13 pagesDoris PatenoASHANTI JANE EREDIANONo ratings yet

- BFARChapter 8Document19 pagesBFARChapter 8Herah SexyNo ratings yet

- Marian A. Polanco Journal EntriesDocument14 pagesMarian A. Polanco Journal EntriesMarian Augelio PolancoNo ratings yet

- Christine Sousa BagsDocument8 pagesChristine Sousa BagsKaila Clarisse Cortez100% (5)

- Unadjust Adjustments Dr. (CR.) Dr. (CR.) : Prime Realty Trial BalanceDocument2 pagesUnadjust Adjustments Dr. (CR.) Dr. (CR.) : Prime Realty Trial BalanceFederick Parayaoan JrNo ratings yet

- Illustration PRAC - AUD Page 13Document4 pagesIllustration PRAC - AUD Page 13The BoxNo ratings yet

- Account Title Unadjusted Trial Balance AdjustmentsDocument5 pagesAccount Title Unadjusted Trial Balance AdjustmentsJohn Paul TomasNo ratings yet

- Quiz FS MerchandisingDocument3 pagesQuiz FS Merchandisingchey dabestNo ratings yet

- 10 Column Heavy BombersDocument3 pages10 Column Heavy BombersVince Ferdinand Pajanustan100% (1)

- WORKSHEET (Lembar Jawaban)Document10 pagesWORKSHEET (Lembar Jawaban)I Gede Wahyu krisna DarmaNo ratings yet

- ACCTG A Final ExamDocument2 pagesACCTG A Final ExamheyheyNo ratings yet

- WorksheetDocument3 pagesWorksheetRonnie Lloyd Javier100% (3)

- John Bala Maps Worksheet December 31, 2015 Account Title Unadjusted Trial Balance Adjustments Debit Credit Debit CreditDocument3 pagesJohn Bala Maps Worksheet December 31, 2015 Account Title Unadjusted Trial Balance Adjustments Debit Credit Debit CreditJessie ForpublicuseNo ratings yet

- Giotech Corporation Trial BalanceDocument3 pagesGiotech Corporation Trial BalanceMarites AmorsoloNo ratings yet

- John Bala MapsDocument3 pagesJohn Bala MapsJayson80% (10)

- John Bala MapsDocument3 pagesJohn Bala MapsRonnie Lloyd Javier71% (14)

- Wiley Practitioner's Guide to GAAS 2006: Covering all SASs, SSAEs, SSARSs, and InterpretationsFrom EverandWiley Practitioner's Guide to GAAS 2006: Covering all SASs, SSAEs, SSARSs, and InterpretationsRating: 2 out of 5 stars2/5 (2)

- NSTPDocument2 pagesNSTPSofia Lynn Rico RebancosNo ratings yet

- Water Bottles, Boxes, and StyrofoamDocument2 pagesWater Bottles, Boxes, and StyrofoamSofia Lynn Rico RebancosNo ratings yet

- Weddingsrus WorksheetDocument2 pagesWeddingsrus WorksheetSofia Lynn Rico RebancosNo ratings yet

- REBANCOS, S.L.R. - Activity 1 - NSTPDocument2 pagesREBANCOS, S.L.R. - Activity 1 - NSTPSofia Lynn Rico RebancosNo ratings yet

- Assignment On Economic DevelopmentDocument2 pagesAssignment On Economic DevelopmentSofia Lynn Rico RebancosNo ratings yet

- Rebancos EconDevActivityDocument2 pagesRebancos EconDevActivitySofia Lynn Rico RebancosNo ratings yet

- Weddingsrus WorksheetDocument2 pagesWeddingsrus WorksheetSofia Lynn Rico RebancosNo ratings yet

- Chapter 1 ReviewerDocument14 pagesChapter 1 ReviewerSofia Lynn Rico RebancosNo ratings yet

- RebancosDocument7 pagesRebancosSofia Lynn Rico RebancosNo ratings yet

- Grade 12 First Semester Report CardDocument2 pagesGrade 12 First Semester Report CardSofia Lynn Rico RebancosNo ratings yet

- RebancosDocument7 pagesRebancosSofia Lynn Rico RebancosNo ratings yet

- Acctg 11A Financial Accounting and Reporting Partnership Accounting 3Document3 pagesAcctg 11A Financial Accounting and Reporting Partnership Accounting 3Sofia Lynn Rico RebancosNo ratings yet

- Weddingsrus WorksheetDocument2 pagesWeddingsrus WorksheetSofia Lynn Rico RebancosNo ratings yet

- Lesson 1 - Mgt. 21Document12 pagesLesson 1 - Mgt. 21Sofia Lynn Rico RebancosNo ratings yet

- Principles of AccountingDocument1 pagePrinciples of AccountingSofia Lynn Rico RebancosNo ratings yet

- EOC1 Rebancos 1D CorrectedDocument12 pagesEOC1 Rebancos 1D CorrectedSofia Lynn Rico RebancosNo ratings yet

- EOC4 Rebancos 1dcheckedDocument23 pagesEOC4 Rebancos 1dcheckedSofia Lynn Rico RebancosNo ratings yet

- CFAS The Accountancy ProfessionDocument22 pagesCFAS The Accountancy ProfessionSofia Lynn Rico RebancosNo ratings yet

- Module 1: Basic Concepts and Principles: Nature of EconomicsDocument10 pagesModule 1: Basic Concepts and Principles: Nature of EconomicsSofia Lynn Rico RebancosNo ratings yet

- SMCDocument37 pagesSMCAmalina ZainalNo ratings yet

- NuisancesDocument64 pagesNuisancesMicah Jamero FelisildaNo ratings yet

- Friends discuss comedy and plan to see a comic showDocument2 pagesFriends discuss comedy and plan to see a comic showПолина НовикNo ratings yet

- Post Graduate Medical (Government Quota) Course Session:2021 - 2022 List of Candidates Allotted On - 04.03.2022 (Round 2)Document104 pagesPost Graduate Medical (Government Quota) Course Session:2021 - 2022 List of Candidates Allotted On - 04.03.2022 (Round 2)Aravind RaviNo ratings yet

- Identify statements that match birthday party picturesDocument1 pageIdentify statements that match birthday party picturesprotogina100% (1)

- Rdbms (Unit 2)Document9 pagesRdbms (Unit 2)hari karanNo ratings yet

- M-Commerce Seminar ReportDocument13 pagesM-Commerce Seminar ReportMahar KumarNo ratings yet

- Here The Whole Time ExcerptDocument18 pagesHere The Whole Time ExcerptI Read YA100% (1)

- Sinha-Dhanalakshmi2019 Article EvolutionOfRecommenderSystemOv PDFDocument20 pagesSinha-Dhanalakshmi2019 Article EvolutionOfRecommenderSystemOv PDFRui MatosNo ratings yet

- FPSC@FPSC - Gove.pk: Sector F-5/1, Aga Khan Road, Islamabad Email: UAN:-051-111-000-248Document9 pagesFPSC@FPSC - Gove.pk: Sector F-5/1, Aga Khan Road, Islamabad Email: UAN:-051-111-000-248Ayaz AliNo ratings yet

- Senguntha KshatriyaDocument34 pagesSenguntha Kshatriyabogar marabuNo ratings yet

- Capstone PosterDocument1 pageCapstone Posterapi-538849894No ratings yet

- Intro To Rhetorical FunctionDocument28 pagesIntro To Rhetorical FunctiondianNo ratings yet

- Communicating EffectivelyDocument7 pagesCommunicating EffectivelyPaulo LewisNo ratings yet

- The Plight of ABS CBN by Justice Noel Gimenez Tijam Ret.Document26 pagesThe Plight of ABS CBN by Justice Noel Gimenez Tijam Ret.Rhege AlvarezNo ratings yet

- GNM 10102023Document118 pagesGNM 10102023mohammedfz19999No ratings yet

- Assignment ON Facility ManagementDocument10 pagesAssignment ON Facility ManagementVikram MayuriNo ratings yet

- A Dose of Emptiness PDFDocument304 pagesA Dose of Emptiness PDFEliza KarpNo ratings yet

- Activity Completion IN School-Based Seminar ON National Drug Education ProgramDocument12 pagesActivity Completion IN School-Based Seminar ON National Drug Education ProgramFATIMA APILADONo ratings yet

- Snorkel: Rapid Training Data Creation With Weak SupervisionDocument17 pagesSnorkel: Rapid Training Data Creation With Weak SupervisionStephane MysonaNo ratings yet

- Analysis of Scenario/Issues: Requirement To Have Image RightsDocument5 pagesAnalysis of Scenario/Issues: Requirement To Have Image RightsAsra Tufail DahrajNo ratings yet

- англійська 11 final altered PDFDocument192 pagesанглійська 11 final altered PDFАнна НазаренкоNo ratings yet

- 15-5240 enDocument14 pages15-5240 enRafa Lopez PuigdollersNo ratings yet

- Beautiful Fighting Girl - Book ReviewDocument3 pagesBeautiful Fighting Girl - Book ReviewCharisse Mae Berco - MaribongNo ratings yet

- Bovee, Arens 150-170Document32 pagesBovee, Arens 150-170Mădălina-Cristiana PaţachiaNo ratings yet

- Math 8 Q3 Module 1 With Answer KeyDocument16 pagesMath 8 Q3 Module 1 With Answer KeyginaNo ratings yet

- Online Reading Test 2 Practice QuestionsDocument16 pagesOnline Reading Test 2 Practice QuestionsThu Cúc VũNo ratings yet

- CPE655 Solid Waste ManagementDocument108 pagesCPE655 Solid Waste ManagementAmirah SufianNo ratings yet

- A Simple Gesture RomanDocument2 pagesA Simple Gesture Romanapi-588299405No ratings yet

- Grammar Marwa 22Document5 pagesGrammar Marwa 22YAGOUB MUSANo ratings yet