Professional Documents

Culture Documents

Notes 2, April 30, 2021 Send To Students

Uploaded by

Shubham Bhai0 ratings0% found this document useful (0 votes)

8 views3 pagesThe document discusses the profit and loss appropriation account, which shows how net profit is distributed among partners. It transfers the credit balance from the profit and loss account. This amount is then used to provide interest on partner capital, salaries, commissions, transfers to reserves, and distributions of profit to partners based on profit sharing ratios. The document also provides journal entries for preparing partner capital accounts and the profit and loss appropriation account.

Original Description:

Original Title

Notes 2, April 30, 2021 Send to Students

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document discusses the profit and loss appropriation account, which shows how net profit is distributed among partners. It transfers the credit balance from the profit and loss account. This amount is then used to provide interest on partner capital, salaries, commissions, transfers to reserves, and distributions of profit to partners based on profit sharing ratios. The document also provides journal entries for preparing partner capital accounts and the profit and loss appropriation account.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

8 views3 pagesNotes 2, April 30, 2021 Send To Students

Uploaded by

Shubham BhaiThe document discusses the profit and loss appropriation account, which shows how net profit is distributed among partners. It transfers the credit balance from the profit and loss account. This amount is then used to provide interest on partner capital, salaries, commissions, transfers to reserves, and distributions of profit to partners based on profit sharing ratios. The document also provides journal entries for preparing partner capital accounts and the profit and loss appropriation account.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 3

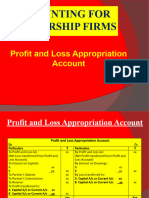

PROFIT AND LOSS APPROPRIATION ACCOUNT

This is a nominal account prepared to show how net profit has

been distributed among the partners. It is the extension of profit and

loss account and therefore, the credit balance of the Profit and Loss

Account is transferred to Profit and Loss Appropriation Account. Such

amount is then utilized for the following:

Interest on the capitals of partners, if provided by the partnership

deed.

Salaries or commissions to partners, if provided by the

partnership deed.

Transferring part of profit to Reserve.

Distribution of profit among the partners in their profit-sharing

ratio.

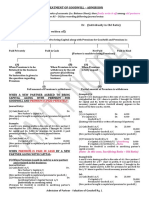

Journal Entries for Preparing Partner’s Capital/ Current Account and

Profit and Loss Appropriation A/c

1. For Capital Brought in by a Partner

Bank/Cash A/c Dr.

To Partner’s Capital A/c

2. For transferring the balance in Profit and Loss Account:

a) If Profit and Loss Account shows a credit balance (net profit)

Profit and Loss A/c Dr.

To Profit and Loss Appropriation A/c

b) If Profit and Loss Account shows a debit balance (net loss)

Profit and Loss Appropriation A/c Dr.

To Profit and Loss A/c.

3. Interest on Partner’s Capital:

a) For Interest Allowed on Partner’s Capital

Interest on Capital A/c Dr.

To Partner’s Capital/ Current A/c (individually)

NOTES PREPARED BY ARUN KIZHAKKEYIL FOR THE STUDENTS OF CHAVARA VIDYAPEETH 4

VIDYAPEARSINGHPUR

b) For transferring interest on capital to Profit and Loss

Appropriation Account :

Profit and Loss Appropriation A/c Dr.

To Interest on Capital A/c

4. Drawings made by Partners

Partner’s Capital/Current A/c’s (individually) Dr.

To Drawings A/c

5. Interest on Drawings:

a) For charging interest on drawings to partners’ capital

accounts

Partner’s Capital/Current A/c’s (individually) Dr.

To Interest on Drawings A/c

b) For transferring interest on drawings to Profit and Loss

Appropriation Account:

Interest on Drawings A/c Dr.

To Profit and Loss Appropriation A/c

6. Partner’s Salary:

a) For crediting partner’s salary to partner’s capital account :

Salary to Partner A/c Dr.

To Partner’s Capital/Current A/c (individually)

b) For transferring partner’s salary to Profit and Loss

Appropriation Account:

Profit and Loss Appropriation A/c Dr.

To Salary to Partner’s A/c

7. Partner’s Commission:

a) For crediting commission to a partner to partner’s capital

account.

Commission to Partner A/c Dr.

To Partner’s Capital/ Current A/c’s (individually)

NOTES PREPARED BY ARUN KIZHAKKEYIL FOR THE STUDENTS OF CHAVARA VIDYAPEETH 5

VIDYAPEARSINGHPUR

b) For transferring commission paid to partners to Profit and

Loss Appropriation Account.

Profit and Loss Appropriation A/c Dr.

To Commission to Partners Capital/ Current A/c

8. Share of Profit or Loss to Partners after appropriations

a) If Profit: (Credit Balance of P&L App. A/c)

Profit and Loss Appropriation A/c Dr.

To Partner’s Capital/Current A/c’s (individually)

b) If Loss: (Debit Balance of P&L App. A/c)

Partner’s Capital/Current A/c (individually) Dr.

To Profit and Loss Appropriation A/c

FORMAT OF PROFIT AND LOSS APPROPRIATION ACCOUNT

Profit and Loss Appropriation Account

Dr. for the Year Ended DD/MM/YYYY Dr.

Particulars Rs. Particulars Rs.

To Profit and Loss A/c xxx By Profit and Loss A/c 92,000

(Net loss) (Net Profit)

To Interest on Capitals: By Interest on Drawings:

A 6,000 A 3,000

B 7,500 13,500 B 4,500 7,500

To A’s Salaries 24,000

To B’s Commissions 10,000

To Reserve 25,000

To Profit transferred to:

A’s Capital A/c 9,000

B’s Capital A/c 18,000 27,000

99,500 99,500

NOTES PREPARED BY ARUN KIZHAKKEYIL FOR THE STUDENTS OF CHAVARA VIDYAPEETH 6

VIDYAPEARSINGHPUR

You might also like

- Jenni Rivera Estate Vs Cintas AcuarioDocument37 pagesJenni Rivera Estate Vs Cintas AcuarioBillboardNo ratings yet

- Amalgamation of Partnership FirmsDocument36 pagesAmalgamation of Partnership FirmsAkhilLabs50% (2)

- AC Sample Paper 3 Unsolved-1Document10 pagesAC Sample Paper 3 Unsolved-1Appharnha Rs0% (1)

- 2 Fundamentals of PartnershipDocument11 pages2 Fundamentals of PartnershipKartik JainNo ratings yet

- 12 AccountancyDocument4 pages12 AccountancyAbhishek DhillonNo ratings yet

- 1 - Accounting For Partnership Firms - FundamentalsDocument12 pages1 - Accounting For Partnership Firms - FundamentalsAnkit Roy100% (1)

- Partnership Firms Part 2 Appropriation of ProfitDocument14 pagesPartnership Firms Part 2 Appropriation of ProfitDeepti BistNo ratings yet

- Accounts Class 12Document12 pagesAccounts Class 12Bhanu PratapNo ratings yet

- 20 Admission of PartnerDocument12 pages20 Admission of PartnerNadeem Manzoor100% (1)

- Journal EntriesDocument19 pagesJournal EntriesSarah AliNo ratings yet

- Chapter - 2: 14 15 Accounts-XII Quick Revision 14 15 Accounts-XII Quick RevisionDocument4 pagesChapter - 2: 14 15 Accounts-XII Quick Revision 14 15 Accounts-XII Quick RevisionIqra MughalNo ratings yet

- Admission of A PartnerDocument5 pagesAdmission of A PartnerHigreeve SrudhiNo ratings yet

- Partnership Firms - Part5 Guarantee and Past AdjustmentDocument15 pagesPartnership Firms - Part5 Guarantee and Past AdjustmentDeepti BistNo ratings yet

- Change in PSR NotesDocument10 pagesChange in PSR Noteskapilbishnoi.10a.svnNo ratings yet

- Ad Acc As QusDocument196 pagesAd Acc As QusRadhika GargNo ratings yet

- Change in Profit-Sharing RatioDocument3 pagesChange in Profit-Sharing RatioPainNo ratings yet

- Partnership Accounts: Chapter - 8Document46 pagesPartnership Accounts: Chapter - 8Biju PerinkottilNo ratings yet

- Practical Oriented Questions and AnswersDocument11 pagesPractical Oriented Questions and AnswersAshok dore Ashok doreNo ratings yet

- Methods of Redemption-2Document11 pagesMethods of Redemption-2Akash RanjanNo ratings yet

- Amalgamation of Partnership FirmDocument14 pagesAmalgamation of Partnership FirmCopycat100% (1)

- 12 Accountancy sp08Document15 pages12 Accountancy sp08sneha muralidharanNo ratings yet

- Free Sample PaperDocument30 pagesFree Sample PapervanshpmlNo ratings yet

- Dissolution of Partnership FirmDocument17 pagesDissolution of Partnership FirmRenu Bala JainNo ratings yet

- Admission of A PartnerDocument4 pagesAdmission of A PartnerPainNo ratings yet

- 12 AccountancyDocument6 pages12 AccountancygattulokhandeNo ratings yet

- Mycbseguide: Class 12 - Accountancy Sample Paper 01Document15 pagesMycbseguide: Class 12 - Accountancy Sample Paper 01Rohan RughaniNo ratings yet

- Partnership Accounts.Document24 pagesPartnership Accounts.Bilal AhmedNo ratings yet

- Additional Questions-2Document6 pagesAdditional Questions-2NDA AspirantNo ratings yet

- Mycbseguide: Class 12 - Accountancy Sample Paper 07Document15 pagesMycbseguide: Class 12 - Accountancy Sample Paper 07sneha muralidharanNo ratings yet

- Question Bank - XII Accounts MCQDocument192 pagesQuestion Bank - XII Accounts MCQHarshal KaramchandaniNo ratings yet

- Internal ReconstructionDocument9 pagesInternal ReconstructionBashu GuragainNo ratings yet

- Module 2Document3 pagesModule 2vandhanaNo ratings yet

- Accountancy 12 KVS Study Material 2024Document79 pagesAccountancy 12 KVS Study Material 2024Parth AgrawalNo ratings yet

- Zq2.Change in Profit Sharing Ratio of The ExistingDocument20 pagesZq2.Change in Profit Sharing Ratio of The ExistingAaditya SaratheNo ratings yet

- 12 Accountancy ImpQ CH05 Retirement and Death of A Partner 01Document18 pages12 Accountancy ImpQ CH05 Retirement and Death of A Partner 01praveentyagiNo ratings yet

- CH 01 Accounting For Partnership - Basic ConceptsDocument11 pagesCH 01 Accounting For Partnership - Basic ConceptsMahathi AmudhanNo ratings yet

- Amalgamation of PartnershipDocument5 pagesAmalgamation of Partnershipmillicent odhiamboNo ratings yet

- Wa0017Document94 pagesWa0017Ananda ShingadeNo ratings yet

- 12 Accountancy sp04 230604 170905Document27 pages12 Accountancy sp04 230604 170905RishiNo ratings yet

- 4 General Accounts of Partnership FirmDocument16 pages4 General Accounts of Partnership FirmNisarga T DaryaNo ratings yet

- ALL JOURNAL ENTRIES - CMA-Executive-RevisionDocument13 pagesALL JOURNAL ENTRIES - CMA-Executive-RevisionRevanthi DNo ratings yet

- Interest On Drawings 1Document10 pagesInterest On Drawings 1giennachemparathyNo ratings yet

- 12 Accountancy sp04Document26 pages12 Accountancy sp04vivekdaiv55No ratings yet

- Fundamentals PDFDocument103 pagesFundamentals PDFDhairya JainNo ratings yet

- MLM Xii Accountancy 22-23 PDFDocument34 pagesMLM Xii Accountancy 22-23 PDFayush5sharma805No ratings yet

- AIS 23.05.2018 Treatment of Goodwill - AdmissionDocument4 pagesAIS 23.05.2018 Treatment of Goodwill - AdmissionAnuj Kumar SinghNo ratings yet

- Retirement or Death of Partner NewDocument5 pagesRetirement or Death of Partner NewAnkit Roy100% (1)

- Cbleacpu 02Document10 pagesCbleacpu 02mehtayogesh476No ratings yet

- Cbleacpu 01Document10 pagesCbleacpu 01tripatjotkaur757No ratings yet

- Chapter 6: Appropriation of Profits: Rohit AgarwalDocument4 pagesChapter 6: Appropriation of Profits: Rohit AgarwalbcomNo ratings yet

- ch1 AdditionalandMissingValueQuestionsDocument9 pagesch1 AdditionalandMissingValueQuestionsneervaan.dagar1No ratings yet

- Partnership - Admission of Partner - DPP 04 (Of Lecture 06) - (Kautilya)Document6 pagesPartnership - Admission of Partner - DPP 04 (Of Lecture 06) - (Kautilya)DevanshuNo ratings yet

- Chapter - 3: 18 19 Accounts-XII Quick Revision 18 19 Accounts-XII Quick RevisionDocument5 pagesChapter - 3: 18 19 Accounts-XII Quick Revision 18 19 Accounts-XII Quick Revisions_shreya955122No ratings yet

- Journal Entries 1Document3 pagesJournal Entries 1Joe MajchrzakNo ratings yet

- Accounts XII CancellationsDocument2 pagesAccounts XII Cancellationskrish bhatiaNo ratings yet

- Accounts IDocument8 pagesAccounts ISaheli BanerjeeNo ratings yet

- Admission of PartnersDocument11 pagesAdmission of Partnerssneha sasidharanNo ratings yet

- Accounts Class 12th English MediumDocument27 pagesAccounts Class 12th English Mediumas5634703No ratings yet

- The Entrepreneur’S Dictionary of Business and Financial TermsFrom EverandThe Entrepreneur’S Dictionary of Business and Financial TermsNo ratings yet

- Chapter 4 Planning 1.3Document4 pagesChapter 4 Planning 1.3Shubham BhaiNo ratings yet

- Notes 3, May 03, 2021 Send To StudentsDocument2 pagesNotes 3, May 03, 2021 Send To StudentsShubham BhaiNo ratings yet

- Notes 4, May 06, 2021 Send To StudentsDocument5 pagesNotes 4, May 06, 2021 Send To StudentsShubham BhaiNo ratings yet

- Cash Flow Statement Full TheoryDocument3 pagesCash Flow Statement Full TheoryShubham BhaiNo ratings yet

- Titan: The General Manager, DCS - CRD BSE LimitedDocument305 pagesTitan: The General Manager, DCS - CRD BSE LimitedShubham BhaiNo ratings yet

- Human Rights Defense Center v. MCCA Self-Funded Risk Management PoolDocument18 pagesHuman Rights Defense Center v. MCCA Self-Funded Risk Management PoolMaine Trust For Local NewsNo ratings yet

- United States v. Brockington, 4th Cir. (1998)Document2 pagesUnited States v. Brockington, 4th Cir. (1998)Scribd Government DocsNo ratings yet

- Tomas Lao Construction vs. NLRCDocument21 pagesTomas Lao Construction vs. NLRCFelix TumbaliNo ratings yet

- TAX Quiz 1Document12 pagesTAX Quiz 1Ednalyn CruzNo ratings yet

- حه - وته - وانه - فه - رهه - نگی ئینگلیزی كوردی فارسی 2Document1,146 pagesحه - وته - وانه - فه - رهه - نگی ئینگلیزی كوردی فارسی 2Karmand ArkanNo ratings yet

- IKSP - October 24, 2018 by Atty MaDocument27 pagesIKSP - October 24, 2018 by Atty MaJenefer TionganNo ratings yet

- L114 - Criminal LawDocument5 pagesL114 - Criminal LawLubombaNo ratings yet

- TroubleDocument15 pagesTroubleOliver TabagNo ratings yet

- Cojuangco, Jr. Vs Roxas Case DigestDocument2 pagesCojuangco, Jr. Vs Roxas Case DigestRaje Paul ArtuzNo ratings yet

- 14th AmendmentDocument2 pages14th AmendmentNext Day SportsNo ratings yet

- On-Line Application For TNPSC RegistrationDocument3 pagesOn-Line Application For TNPSC RegistrationVignesh WaranNo ratings yet

- Law of Sedition in India: Constitutional ArticulationDocument61 pagesLaw of Sedition in India: Constitutional ArticulationSandeep ChawdaNo ratings yet

- 78.) SANTOS Vs SANTOSDocument7 pages78.) SANTOS Vs SANTOSThomas LannisterNo ratings yet

- Hwang and Chung (2009) Defining The Indefinable - Practical Problems of Confidentiality in ArbitrationDocument37 pagesHwang and Chung (2009) Defining The Indefinable - Practical Problems of Confidentiality in ArbitrationcontestantlauNo ratings yet

- FSSC 22000 V. 5 Gap AnalysisDocument3 pagesFSSC 22000 V. 5 Gap AnalysisMarc Dennis Angelo UgoyNo ratings yet

- Long Questions & Answers: Law of PropertyDocument29 pagesLong Questions & Answers: Law of PropertyPNR AdminNo ratings yet

- SHARE CAPITAL.1pptDocument68 pagesSHARE CAPITAL.1pptIreneNo ratings yet

- Transimex VS MafreDocument1 pageTransimex VS MafreSheila GarciaNo ratings yet

- 2022-2023 Odu Fasa ConstitutionDocument15 pages2022-2023 Odu Fasa Constitutionapi-263682600No ratings yet

- Zwds ... Check 07 Feng Shui PDFDocument53 pagesZwds ... Check 07 Feng Shui PDFSuherman Dharma100% (1)

- (JULY 2020-JUNE 2021) : Registration Form For Membership Drive Phase-IiDocument12 pages(JULY 2020-JUNE 2021) : Registration Form For Membership Drive Phase-IiSaad JafriNo ratings yet

- Henry FayolDocument13 pagesHenry FayolMilljan Delos ReyesNo ratings yet

- Ra 9483Document24 pagesRa 9483Jaybel Ng BotolanNo ratings yet

- Gujarat Police Academy: GandhinagarDocument4 pagesGujarat Police Academy: GandhinagarPragneshh M PatelNo ratings yet

- SF 6 Summarized Report On Promotion and Level of ProficiencyDocument1 pageSF 6 Summarized Report On Promotion and Level of ProficiencyRommel Urbano YabisNo ratings yet

- 2019-01 Guidelines To Complete - Assess WHAP 2.0Document6 pages2019-01 Guidelines To Complete - Assess WHAP 2.0Phuong Trang TranNo ratings yet

- 3.7 Cash Flow Practice QuestionsDocument2 pages3.7 Cash Flow Practice QuestionsJavi MartinezNo ratings yet

- TSCPRJ01-SCA-036 - Atak - Design Approval and Electrical BuildingDocument12 pagesTSCPRJ01-SCA-036 - Atak - Design Approval and Electrical BuildingRAMESHNo ratings yet

- Womens Police Journal Issue 46Document44 pagesWomens Police Journal Issue 46Alexander DarlingNo ratings yet