CHAPTER 9

RISK ASSESSMENT – PART I

Answers to Questions

1. In their investigation of a prospective client, the CPAs should assess the

backgrounds and reputations of the prospect and its major shareholders,

directors, and officers. Thus, inquiries are made of underwriters,

bankers, and attorneys that conduct business with the prospective client.

Also, the CPAs are required to make inquiries of the prospect's

predecessor auditors to obtain information that might enter into the

acceptance decision, such as information regarding the integrity of

management. The prospect's financial reports, SEC filings, credit reports,

and tax returns are used as sources of financial background information.

2. An engagement letter is sent to the client by the auditors to make clear

the nature of the engagement, any limitations on the scope of the audit,

work to be performed by the client's staff, and the basis for computing

the auditors' fee. The engagement letter represents the written contract

for the engagement, and its primary objective is to prevent possible

misunderstandings between the client and the auditors. It constitutes an

executory contract between the auditors and the client.

3. “Shopping for accounting principles” is a practice whereby management

changes auditors to a CPA firm that is more likely to allow an accounting

principle that has been the subject of dispute with the company’s prior

auditors. A number of mechanisms serve to discourage the practice,

including: (1) the requirements under PAS for the successor auditors to

inquire of the predecessors about the reasons for the change in auditors,

(2) the SEC requirements for management to report the reasons for a

change in auditors which also require the auditors to express their

agreement with the details, and (3) the requirements under PAS that

require accountants who are being asked to provide a report on the

accounting treatment of an prospective or completed transaction to

consult with the client’s auditors to ensure that they have a complete

understanding of the form and substance of the transaction. In addition,

the SEC requires the audit committee to assume responsibility for

engaging, compensating, and overseeing the auditors.

4. The approach described in the statement is not appropriate. Materiality

depends on both the peso amount and the nature of the item. For

9-1

� example, auditors apply a more rigorous standard of materiality in

evaluating transactions between related parties and potentially illegal acts

than they apply to misstatements in accounts.

5. The two types of misstatements due to fraud are (1) misstatements

arising from fraudulent financial reporting, and (2) misstatements arising

from misappropriation of assets (sometimes referred to as defalcation).

Fraudulent financial reporting is of more concern to the auditors because

it typically results in effects that are much more material to the financial

statements. Defalcations often are not material to the financial

statements.

6. A business risk is a threat to achieving management’s objectives. There

are many examples of business risks that may result in a risk of material

misstatement of the financial statements. Two are shown below:

Business Risk Risk of Material Misstatement

Rapidly changing technology in Inventory may be overvalued

the client’s industry may threaten because it is not valued at net

to cause the client’s products to realizable value.

become obsolete.

Economic conditions in the Accounts receivable may be

industry may result in significant overvalued because the allowance

uncollectible accounts receivable. for uncollectible accounts is not

adequate.

7. The audit procedures to be followed in a given engagement depend upon

such factors as the risks of material misstatement of the financial

statements, the assumption about the effectiveness of internal control, the

auditors' estimates of materiality, the nature of the accounting records,

the caliber of accounting personnel, and any special objectives of the

engagement. Consequently, a separate, tailor-made audit program

should be prepared for each audit engagement.

8. The quotation is misleading because it implies that an audit program is

no more than a checklist of instructions for inexperienced auditors.

Actually, audit programs are essential to assessing that all work is

performed and are used on virtually all audit engagements regardless of

9-2

� the amount of experience of the auditor. Also, a written audit program is

required for all audits.

9. The risk of material misstatement is the probability that an account, class

of transactions, or disclosure is materially misstated. It consists of

inherent risk (the risk of material misstatement without considering

internal control) and control risk (the risk that internal control will fail to

prevent or detect and correct the material misstatement).

10. Significant risks often relate to nonroutine transactions and estimation

transactions. Such transactions typically involve more subjective

judgment than routine transactions and, therefore, they often have a

higher risk of material misstatement. Significant risks may also be fraud

risks.

11. Factors which may cause an audit engagement to exceed the original

time estimate include the following:

(1) Accounting records may not be up to date and complete.

(2) Inadequacies in internal control may be discovered necessitating

a more detailed audit than anticipated.

(3) A significant risk, such as a fraud risk, may be discovered

requiring an extension of audit procedures.

(4) Fraud may be discovered, and an extended investigation may be

authorized by the client to clarify the situation.

(5) Inadequate supervision of audit staff may permit unnecessary or

misdirected work to be performed.

(6) Findings during the course of the audit may cause the client to

request extension of the scope of the work.

In some engagements, clients are charged at agreed daily or hourly rates

for the time used to perform the audit. The difficulty of forecasting time

requirements is a principal reason for the use of per diem rates rather

than quoting a fee for the entire engagement. For many engagements, a

maximum fee is agreed upon; this plan may, of course, force the auditing

firm to absorb part of the cost of unexpected amounts of work. A

decision as to charging the client for unusual amounts of time will

involve consideration of all aspects of the engagement and prior relations

9-3

� with the client. Generally, however, the client should not be billed for

excessive time attributed to audit inefficiencies (e.g. item (5) above).

12. Underreporting of time results in the CPA firm not billing the client for

all of the time actually involved in rendering the professional services.

Thus, the firm's revenue is being restricted. In addition, the

underreporting will cause the firm to underestimate the amount of time

required for future engagements. Thus, auditors on future engagements

will be expected to perform audit procedures in an unrealistically short

period of time. This interferes with the performance of an effective audit

as well as the realistic evaluation of firm personnel.

13. The overall audit strategy, audit plan, and the time budget are developed

to help insure compliance with the generally accepted auditing standards

documentation requirements. The overall audit strategy addresses overall

characteristics of the audit which demine its scope such as industry

reporting requirements. The audit plan is more detailed than the audit

strategy and includes the nature, timing and extent of audit procedures to

be performed. The time budget is constructed by estimating the time

required for each step in the audit plan.

14. The purpose of the team meeting on fraud risk is designed to allow the

more experienced team members to share insights and exchange ideas

about how and where the entity’s financial statements might be

susceptible to material misstatement due to fraud, to discuss how to

design appropriate procedures to detect the misstatements, and to

emphasize the importance of maintaining the proper degree of

professional skepticism regarding the possibility of fraud.

15. During the planning process, the auditors make preliminary estimates of

both risk and materiality for the engagement. The auditors must plan

their engagements to reduce the audit risk of issuing an unqualified

opinion on materially misstated financial statements to a relatively low

level. At the account balance level, audit risk actually has three

components: (1) inherent risk, (2) control risk, and (3) detection risk.

On audits where the risk of misstatement is relatively high, the auditors

must compensate by increasing the effectiveness of their audit

procedures. They may design more effective procedures, increase the

number of items selected for testing, or perform more procedures at the

balance sheet date rather than at an interim date. They may also add an

element of unpredictability to the procedures.

9-4

� The auditors' preliminary estimates of levels of materiality also affect the

nature, timing, and extent of their planned procedures. Materiality levels

determine which accounts are significant enough to require audit, affect

the size of the test samples, and determine the peso amount of individual

items that warrant examination.

Answers to Multiple Choice Questions

1. C

2. D

3. D

4. C

5. C

6. D

7. B

8. C

9. B

Answers to Cases

Case 1

a. Prior to acceptance of the engagement, Argante & Tan should have

communicated with the predecessor auditor regarding:

Facts that might bear on the integrity of management.

Disagreements with management concerning accounting

principles, auditing procedures, or other significant matters.

The predecessor’s understanding about the reason for the

change.

Any other information that may be of assistance in

determining whether to accept the engagement.

b. The form and content of engagement letters may vary, but they

would generally contain information regarding:

The objective of the audit.

The estimated completion date.

Management’s responsibility for the financial statements.

The scope of the audit.

Other communication of the results of the engagement.

9-5

� The fact that because of the test nature and other inherent

limitations of any system of internal control, there is an

unavoidable risk that even some material misstatement may

remain undiscovered.

Access to whatever records, documentation, and other

information may be requested in connection with the audit.

Arrangements with respect to client assistance in the

performance of the audit engagement.

Expectation of receiving from management written

confirmation concerning representations made in connection

with the audit.

Notification of any changes in the original arrangements that

might be necessitated by unknown or unforeseen factors.

Request for the client to confirm the terms of the

engagement by acknowledging receipt of the engagement

letter.

The basis on which fees are computed and any billing

arrangements.

Case 2

a. Typical engagement letter generally includes the following:

The name and address of the person or persons who retained

the auditor to perform the auditing services.

An opening paragraph that confirms the understanding of the

auditor and the client.

A summary of significant events that lead to the retention of

the services of the auditor.

A general description of the CPA firm that will conduct the

examination.

A statement that the examination will be performed in

accordance with auditing standards.

A description of the scope of the services to be rendered,

which should establish the nature of the engagement.

Any scope restrictions or special limitations and their effect

on the auditor’s report.

A statement regarding the auditor’s responsibility for the

detection of fraud.

An indication of the possible use of client personnel in

connection with the audit work to be performed.

9-6

� A statement that the auditor will provide a management

letter if required in the circumstances.

The method and timing of billings as well as billing rates and

fee arrangements.

Space for the client representative’s signature, which

indicates “acceptance” of the letter and the understandings,

therein.

b. The benefits of preparing an engagement letter include the avoidance

of possible problems between the CPA and the client concerning (1)

the scope of the work, (2) the service to be rendered, and (3) the

audit fee. In addition, the “in-charge” auditor conducting the

examination can avoid misunderstanding the nature and scope of the

engagement if the engagement letter is included in the permanent

section of the audit working papers. The letter should eliminate

misunderstandings and confusion about the type of financial

statements to be examined, the estimated report date, and the type of

opinion expected. In addition to avoiding possible

misunderstandings, any legal problems relating to the auditor’s

failure to perform certain procedures can be reviewed with reference

to the contractual commitment assumed. (For example, if scope

limitations prevent the auditor from performing normal audit

procedures, the auditor cannot be legally responsible if an

irregularity is not detected when clearly it would have been detected

if such procedures were performed.)

The engagement letter is also useful as a reference document when

preparing for future engagements.

c. The CPA usually prepares the engagement letter as a follow-up to a

verbal understanding that he and his client have reached. It is

desirable that the client endorse and return an approved copy of the

engagement letter to the CPA. It also is acceptable for the client to

prepare his own letter summarizing his understanding of the nature

of the engagement.

d. Preferably the engagement letter should be sent at the beginning of

the engagement so that misunderstandings, if any, can be remedied.

9-7

� e. Obviously, the engagement letter will be most useful in clarifying

misunderstandings on a first engagement. But it is desirable that the

letter be renewed periodically. Client personnel or the nature of the

engagement may change, and the resubmission of the letter gives

both parties an opportunity to review the circumstances.

Accordingly, for recurring examinations of financial statements, it is

appropriate to prepare an engagement letter at the start of each

examination. For other continuing engagements, the engagement

letter also should be updated periodically – probably on a yearly

basis.

Case 3

a. The procedures that Francis should follow prior to accepting the

engagement include the following:

(1) Francis should explain to Nikolai the need to inquire of Jo and

should request permission to make such inquiries.

(2) Francis should request that Nikolai authorize Jo to respond fully

to all of Francis’ inquiries since Jo would be prohibited from

disclosing confidential information obtained in the course of his

professional engagement with Nikolai.

(3) Francis should advise Jo of Nikolai’s decision to change auditors

as an act of professional courtesy.

(4) Francis should make reasonable inquiries of Jo regarding matters

that will aid in deciding whether to accept the engagement.

(Francis’ inquiries should include questions regarding facts

which might bear on the integrity of management, disagreements

with management as to accounting principles, auditing

procedures or other significant matters, and Jo’s understanding

of the reason(s) for the change of auditors.)

(5) Francis should weigh all the information received from Jo. If Jo

does not respond fully to Francis’ questions, Francis should

consider the implications of the limited response in deciding

whether to accept the engagement.

(6) After weighing all information received from Jo, Francis should

inform Nikolai that a first-time audit is more time-consuming

than a recurring audit because the new auditor is generally

9-8

� unfamiliar with client’s operations and does not have the benefit

of past knowledge of company affairs to use a guide.

(7) A discussion with Nikolai of the estimated required audit time

and fee arrangement should be coordinated with a clear

explanation of the purpose and scope of the audit. Any work

that can be done by client personnel should also be discussed so

that excess audit time might be eliminated and proposed report

deadlines can be reasonably met.

(8) To satisfy Francis’ quality control objectives, Francis should use

procedures such as reviewing the financial statements of Nikolai;

inquiring of third parties such as Nikolai’s banks, legal counsel,

investment bankers, and others in the business community as to

Nikolai’s reputation; and evaluating his ability to serve Nikolai

properly with reference to industry expertise, size of

engagement, and available staff.

(9) If Francis has no reservations, after all significant factors have

been considered, discussed, and agreed to, Francis should accept

the engagement and confirm the understanding in an engagement

letter.

b. Francis’ procedures on this first-time audit should include the

following:

(1) Francis should review the workpapers of Jo to obtain

information that will help plan the audit work.

(2) Francis should make arrangements as early as possible for the

initial meeting with “key” company personnel who will be

contacted throughout the engagement.

(3) Since basic information about the company is not readily

available to Francis on this first-time audit, information of a

general nature should be obtained as early in the planning stage

as possible. (Such information should include company history,

nature of the business, credit policies, financing methods, sales

methods and terms, seasonal business patterns, products,

services, plant locations, internal procedures, accounting

policies, tax status, etc. Client procedures manuals and manuals

of accounts should be read to obtain such information.)

(4) Francis should immediately start obtaining the data needed to

create a permanent working paper file. (The file should include

9-9

� items such as articles of incorporation, minutes, internal audit

reports, deeds of trust, pension agreements, loan agreements,

leases, important contracts, and other pertinent data.)

(5) Francis must determine the scope of work necessary to verify the

opening balances. Such balances must be reviewed to determine

whether they are stated on a basis comparable with those of the

period under review. If Francis cannot verify the opening

balances, Francis should consider disclaiming an opinion on the

earnings statement and statement of changes in financial

position.

(6) The composition of all important accounts should be reviewed.

Francis should limit his examination of prior period accounts to a

review or survey of such accounts, without a detailed

examination, unless the results of Francis’ survey and analyses

indicate the need for further investigation of accounting methods

in the prior years.

(7) Francis must consider whether the financial statements are

prepared using financial reporting standards that were

consistently applied. If, after performing necessary audit

procedures, Francis cannot be satisfied as to consistency,

considerations must be given to qualifying the auditor’s report as

to consistency.

Francis should use professional judgment to determine the extent of

reliance that should be placed on the work of Jo. The scope of

Francis’ work may be reduced as a result of Francis’ consultation

with Jo and a review of the prior-year workpapers of Jo.

Case 4

a. A CPA can use the following sources of information to help decide

whether to accept a new audit client.

Financial information prepared by the prospective client:

Annual reports to shareholders

Interim financial statements

Securities registration statements

Annual report on SEC

Reports to regulatory agencies

9 - 10

� Inquiries directed to the prospect’s business associates:

Banker

Legal counsel

Underwriter

Other persons, e.g., customers, suppliers

Predecessor auditor, if any, communication, re:

Integrity of management, Disagreements with management

Analysis:

Special or unusual risk related to the prospect

Need for special skills (e.g., computer or industry expertise)

Internal search for relationships that would comprise independence

b. Students can decide this acceptance question either way, although

the brief facts prejudice the conclusion toward nonacceptance. The

CPA’s own firm decided to resign only 10 years ago, presumably

over matters of owner-manager integrity. Yet, Mr. Sello appears to

be a respected member of his new community. Maybe his “fast and

loose” accounting past is behind him. Maybe not.

Case 5

Benefits of engagement letters are:

Helps establish an understanding between client and auditor of the

terms of the engagement and the nature of the work.

Helps avoid quarrels and misunderstandings between client and

auditor.

Helps avoid disputes over the audit fee.

Helps avoid legal liability assertions based on failure to do work that

the CPA may not have contemplated or agreed to do.

9 - 11

�Case 6

Students may arrive at a variety of estimates. Those suggested in the text

include:

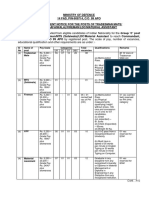

(a) (b)

Franklin Co. Tyler Co.

Rules of Thumb:

5 percent of net income before taxes P 800,000 P 45,000

10 percent of net income before taxes 1,600,000 90,000

1/2 percent of total assets 1,745,000 135,000

1 percent of total assets 3,490,000 270,000

1/2 percent of total revenues 1,480,000 225,000

1 percent of total revenues 2,960,000 450,000

1 percent of total equity 1,380,000 100,000

(c) Characteristics of a small misstatement that might render it

qualitatively material include misstatements of the financial

statements that (5 required):

Affect a company's compliance with a contractual

agreement.

Reverse a trend of earnings (or other trends).

Cause a company not to make the consensus earnings per

share.

Arise from an item capable of precise measurement.

Changes a loss into income, or vice versa.

Concerns a segment or other portion of a company's business

that has been identified as significant to operations or

profitability.

Affects compliance with regulatory requirements.

Affects compliance with loan covenants.

Increases management's compensation.

Involves concealment of an unlawful transaction.

9 - 12