Professional Documents

Culture Documents

Quiz No. 3 AFAR

Uploaded by

Philip Laroza0 ratings0% found this document useful (0 votes)

6 views3 pagesCopyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

6 views3 pagesQuiz No. 3 AFAR

Uploaded by

Philip LarozaCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 3

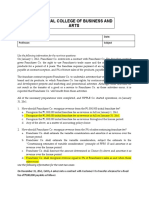

Quiz No.

3 AFAR

Write your answer in a piece of paper with solution.

1. JUMBO Corp. uses the percentage-of-completion method of revenue recognition in

accounting for its long-term construction contracts. JUMBO Corp.’s progress billings

account is a

a. Revenue account

b. Non-current liability account

c. Contra current asset account

d. Contra non-current asset account

2. Franchise fees are properly recognized as revenue

a. when received in cash

b. when a contractual agreement has been signed.

c. after the franchise business has begun operations.

d. after the franchiser has substantially performed its service.

3. Holmes Corporation started operations on January 1, 2016 selling home appliances and

furniture sets both for cash and on installment basis. Data on the installment basis sales

operations of the Company gathered for the years ending December 31, 2016 and 2017

were as follows:

2016 2017

Installment sales 400,000.00 500,000.00

Cost of installment basis 240,000.00 350,000.00

Cash collected on installment sales:

2016 installment sales 210,000.00 150,000.00

2017 installment sales 300,000.00

Additional information:

On January 5, 2018, an installment sales on 2016 was defaulted and the merchandise with

an appraised value of ₱5,000 was repossessed. Related installment receivable balance on

January 5, 2018 was ₱8,000.

Recording the repossessed merchandise at its appraised value, gain or loss on the

repossession should be:

a. No gain or loss

b. ₱200 gain

c. ₱1,800 gain

d. ₱3,000 loss

4. On January 1, 2018, Augustus Company sold land that cost ₱60,000 for ₱80,000, receiving

a note bearing interest at 10%. The note will be paid in three annual installments of ₱32,170

starting on December 31, 2018. Because collection of the note is very uncertain, Colt will

use the cost recovery method. How much revenue (profit from sale and interest) from this

sale should Colt recognize in 2018?

a. ₱0

b. ₱6,000

c. ₱8,000

d. ₱20,000

5. Zero, Inc. was involved in two default and repossession cases during the year:

I. A refrigerator was sold to Sweet Sixteen for P 18,000, including a 35% mark up on

selling price. Sweet made a down payment of 20%, four of the remaining 16 equal

payments, and then defaulted on further payments. The refrigerator was repossessed,

at which time the fair value was determined to be P 6,000.

II. An oven that cost P 12,000 was sold to Teen Eighteen for P 16,000 on the installment

basis. Teen made a down payment of P 2,400 and paid P 800 a month for six months,

after which he defaulted. The oven was repossessed and the estimated value at the time

of repossession was determined to be P 7,500.

What is the gain or loss on repossession that Zero, Inc. must report for financial reporting

purposes?

a. P1,100 loss

b. P1,020 loss

c. P 900 gain

d. P 120 loss

6. On December 31, 2017, Joseph Inc. signed an agreement authorizing Bernard company to

operate as a franchise for an initial franchisee fee of P 50,000. Of this amount, P 20,000

was received upon signing of the agreement and the balance is due in three annual

payments of P 10,000 each beginning December 2018. The agreement provides that the

down payment (representing a fair measure of the services already performed by Nike,

Inc.) is not refundable and substantial services are required of Joseph. Bernard Company’s

credit rating is such that collection of the note is reasonably assured. The present value at

December 31, 2017 of the three annual payments discounted at 14% (the implicit rate for

a loan of this type) is P 23,220.

On December 31, 2017, Bernard Company should record unearned franchise fees of:

a. 50,000

b. 30,000

c. 43,220

d. 23, 220

7. On March 1, 2016, Cameron Construction Company was contracted to construct a

townhouse for Will Company for a total contact price of P 8,400,000. The building was

completed by October 31, 2018. The annual contract costs incurred, estimated costs to

complete the contract, and billings for 2016, 2017 and 2018 are giving below:

The entry to record the recognized profit in 2018 includes a credit to:

a. Construction revenue P 1,680,000

b. Construction in progress 230,000

c. Construction revenue 1,700,000

d. Construction in progress 1,450,000

8. Under PFRS 15, when shall the consignor recognizes the revenue from consignment sales

arrangement?

a. From the moment of the remittance of the consignee.

b. From the moment of the collection of the consignee of the sales of the products

c. From the moments the consignor delivers the goods to the consignee.

d. From the moment the consignee sells the goods to the final customer.

9. Under Installment Method of recognition of gross profit from Installment Sales, what is

the proper classification of deferred gross profit in the entity’s statement of financial

position?

a. Deferred Revenue Account

b. Deferred Cost Account

c. Unearned Revenue Account

d. Contra-Installment Receivable Account

10. What method shall be employed by a franchisor in the recognition of gross profit from

initial franchise fee when its payment is deferred but the probability of its collection is

reasonably assured?

a. Installment basis

b. Cost recovery basis

c. Accrual basis

d. Zero profit basis

You might also like

- MODULE 3 - Installment SalesDocument8 pagesMODULE 3 - Installment SalesEdison Salgado Castigador50% (2)

- AFAR - Installment, Customer, ConsignmentDocument3 pagesAFAR - Installment, Customer, ConsignmentJoanna Rose DeciarNo ratings yet

- 06 Correction of Errors PDFDocument5 pages06 Correction of Errors PDFRoxanneNo ratings yet

- Book 2 Discussion ProblemsDocument22 pagesBook 2 Discussion ProblemsElsie GenovaNo ratings yet

- AFAR - Revenue Recognition, JointDocument3 pagesAFAR - Revenue Recognition, JointJoanna Rose DeciarNo ratings yet

- Quiz Franchise and ConsignmentDocument2 pagesQuiz Franchise and ConsignmentMergierose DalgoNo ratings yet

- Acttg Process QstnsDocument4 pagesActtg Process QstnsMicheleNo ratings yet

- Financial Accounting and ReportingDocument26 pagesFinancial Accounting and ReportingJanaela89% (45)

- ReceivableDocument3 pagesReceivableBellaNo ratings yet

- Prelim Lecture 1 Assignment: Multiple ChoiceDocument4 pagesPrelim Lecture 1 Assignment: Multiple Choicelinkin soyNo ratings yet

- Accountancy FundasDocument14 pagesAccountancy FundasDeepak Kumar PandaNo ratings yet

- QuestionsDocument8 pagesQuestionsHannah AbeloNo ratings yet

- AfarDocument18 pagesAfarFleo GardivoNo ratings yet

- Identify The Choice That Best Completes The Statement or Answers The QuestionDocument8 pagesIdentify The Choice That Best Completes The Statement or Answers The QuestionBlanch DizonNo ratings yet

- Review Materials The Accounting Process To Accounts ReceivableDocument7 pagesReview Materials The Accounting Process To Accounts ReceivableMarin, Nicole DondoyanoNo ratings yet

- Answers R41920 Acctg Varsity Basic Acctg Level 1Document6 pagesAnswers R41920 Acctg Varsity Basic Acctg Level 1John AceNo ratings yet

- Set A Review Quiz QuestionsDocument7 pagesSet A Review Quiz QuestionsJan Allyson BiagNo ratings yet

- AFAR FinalMockBoard BDocument11 pagesAFAR FinalMockBoard BCattleyaNo ratings yet

- Seatwork 1Document2 pagesSeatwork 1Killjoy HeinbergNo ratings yet

- Ia 2 Compilation of Quiz and ExercisesDocument16 pagesIa 2 Compilation of Quiz and ExercisesclairedennprztananNo ratings yet

- Adv Assign 2Document5 pagesAdv Assign 2alemayehuNo ratings yet

- Installment SalesDocument5 pagesInstallment SalesMarianne LanuzaNo ratings yet

- Local Media271226407970108268Document17 pagesLocal Media271226407970108268Jana Rose PaladaNo ratings yet

- Chapter 4: Installment Sales (Ias 18) : Part 1: Theory of AccountsDocument4 pagesChapter 4: Installment Sales (Ias 18) : Part 1: Theory of AccountsKeay ParadoNo ratings yet

- ACC 122 General Review - AKDocument11 pagesACC 122 General Review - AKJaselle SanchezNo ratings yet

- Correction of ErrorsDocument15 pagesCorrection of ErrorsEliyah Jhonson100% (1)

- NOTES PROBLEMS ACCTG-323-newDocument3 pagesNOTES PROBLEMS ACCTG-323-newJoyluxxiNo ratings yet

- FAR Qualifying Examination ReviewerDocument5 pagesFAR Qualifying Examination Reviewertutorjaime05No ratings yet

- Trade and Other Receivables (IA)Document6 pagesTrade and Other Receivables (IA)pcdesktop.brarNo ratings yet

- AFAR FinalMockBoard ADocument11 pagesAFAR FinalMockBoard ACattleyaNo ratings yet

- Quizzer Answers KeyDocument4 pagesQuizzer Answers KeyDaneen GastarNo ratings yet

- Financial Accounting 2 QuizDocument4 pagesFinancial Accounting 2 QuizDez ZaNo ratings yet

- Week 2Document6 pagesWeek 2Maryane AngelaNo ratings yet

- Quiz - Chapter 1 - The Accounting ProcessDocument4 pagesQuiz - Chapter 1 - The Accounting ProcessJoseph Docto100% (2)

- Revenue Recognition: FranchiseDocument4 pagesRevenue Recognition: FranchiseJoeNo ratings yet

- Intermediate Accounting 1Document12 pagesIntermediate Accounting 1Walter Peralta100% (1)

- Exercises. Correction of ErrorsDocument7 pagesExercises. Correction of ErrorsGia Sarah Barillo BandolaNo ratings yet

- Exam For Business TaxDocument3 pagesExam For Business TaxJenyll MabborangNo ratings yet

- Quiz On LiabilitiesDocument5 pagesQuiz On LiabilitiesDewdrop Mae RafananNo ratings yet

- QUIZ-current Liability TEACHERDocument3 pagesQUIZ-current Liability TEACHERpadayonmhieNo ratings yet

- PRACTICAL ACCOUNTING I Quiz No. 2Document6 pagesPRACTICAL ACCOUNTING I Quiz No. 2ROB1015120% (2)

- Midterms Part 1Document3 pagesMidterms Part 1Chris CastleNo ratings yet

- Asset To LiabDocument25 pagesAsset To LiabHavanaNo ratings yet

- AFARDocument10 pagesAFARKawaii SevennNo ratings yet

- AC 1 2 Final Exam 1Document7 pagesAC 1 2 Final Exam 1christine anglaNo ratings yet

- Final Exam AC 1 2 Answer KeyDocument7 pagesFinal Exam AC 1 2 Answer KeyBill VilladolidNo ratings yet

- Accounting Sample ProblemsDocument9 pagesAccounting Sample Problemsjoong wanNo ratings yet

- Buss. Combi PrelimDocument8 pagesBuss. Combi PrelimPhia TeoNo ratings yet

- Buss. Combi PrelimDocument8 pagesBuss. Combi PrelimPhia TeoNo ratings yet

- National College of Business and Arts: Name: Date: Professor: SubjectDocument8 pagesNational College of Business and Arts: Name: Date: Professor: SubjectAngelica CerioNo ratings yet

- AccountingDocument4 pagesAccountingTk KimNo ratings yet

- Quiz-Current Liability MULTIPLE CHOICE. Select The Best Answer For Each of The Following QuestionsDocument3 pagesQuiz-Current Liability MULTIPLE CHOICE. Select The Best Answer For Each of The Following QuestionsNicole Anne Santiago Sibulo0% (1)

- Accounting For Merchandising BusinessDocument6 pagesAccounting For Merchandising BusinessElla Acosta100% (1)

- Orca Share Media1605010109407 6731900321930361605Document37 pagesOrca Share Media1605010109407 6731900321930361605MARY JUSTINE PAQUIBOTNo ratings yet

- IA AssignmentDocument1 pageIA AssignmentMusfiqur Rahman RummanNo ratings yet

- FAR-01 Trade & Other PayableDocument3 pagesFAR-01 Trade & Other PayablehIgh QuaLIty SVT100% (1)

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- CFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)From EverandCFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)Rating: 4.5 out of 5 stars4.5/5 (5)

- SIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)From EverandSIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)Rating: 5 out of 5 stars5/5 (1)

- Computerised Accounting Practice Set Using Xero Online Accounting: Australian EditionFrom EverandComputerised Accounting Practice Set Using Xero Online Accounting: Australian EditionNo ratings yet

- Program of ActivitiesDocument2 pagesProgram of ActivitiesPhilip LarozaNo ratings yet

- Template NewDocument3 pagesTemplate NewPhilip LarozaNo ratings yet

- KJSS 01 Template-of-Cover-letter KJSSDocument4 pagesKJSS 01 Template-of-Cover-letter KJSSPhilip LarozaNo ratings yet

- KJSS 02 Sample of Title Page KJSSDocument1 pageKJSS 02 Sample of Title Page KJSSPhilip LarozaNo ratings yet

- Authorization LetterDocument1 pageAuthorization LetterPhilip LarozaNo ratings yet

- KJSS 03 Template-Of-Manuscript KJSSDocument6 pagesKJSS 03 Template-Of-Manuscript KJSSPhilip LarozaNo ratings yet

- KJSS 02 Template of Title Page KJSSDocument1 pageKJSS 02 Template of Title Page KJSSPhilip LarozaNo ratings yet

- SQUACKERSDocument25 pagesSQUACKERSPhilip LarozaNo ratings yet

- Recommendation LetterDocument1 pageRecommendation LetterPhilip LarozaNo ratings yet

- Course ProjectDocument14 pagesCourse ProjectPhilip LarozaNo ratings yet

- Recommendation LetterDocument1 pageRecommendation LetterPhilip LarozaNo ratings yet

- FormulaDocument1 pageFormulaPhilip LarozaNo ratings yet

- Tool 1 Example Risk Analysis For Financial StatementsDocument7 pagesTool 1 Example Risk Analysis For Financial StatementsGretchen RicafrenteNo ratings yet

- Local Media8709482405663461679Document21 pagesLocal Media8709482405663461679Philip LarozaNo ratings yet

- NLMDocument4 pagesNLMsappy2shailNo ratings yet

- Calculation of Production Costs and Operating Profit of MSME in Terms of Accounting StandardsDocument5 pagesCalculation of Production Costs and Operating Profit of MSME in Terms of Accounting StandardsAdi Budi PurnomoNo ratings yet

- Financial ManagementDocument2 pagesFinancial ManagementsaquibkNo ratings yet

- ABC Analysis and Process Costing MCQsDocument8 pagesABC Analysis and Process Costing MCQsMantasha ShaikhNo ratings yet

- Retail Assets: Product Manager: Key ResponsibilitiesDocument5 pagesRetail Assets: Product Manager: Key ResponsibilitiesNitin MandavkarNo ratings yet

- Financial ServicesDocument3 pagesFinancial ServicesAnZeerNo ratings yet

- Starbucks Strategic PlanDocument32 pagesStarbucks Strategic Planfelix tibawenNo ratings yet

- Larsen and Toubro ReportDocument37 pagesLarsen and Toubro ReportKarthick MuraliNo ratings yet

- Economics Study Guide Chapter Summary Varian For Midterm 2Document6 pagesEconomics Study Guide Chapter Summary Varian For Midterm 2Josh SatreNo ratings yet

- Quiz EiDocument3 pagesQuiz EiJOY LYN REFUGIONo ratings yet

- Question: The Crimson Press Curriculum Center ... : SearchDocument3 pagesQuestion: The Crimson Press Curriculum Center ... : SearchSebastian StanNo ratings yet

- Airline Business - Plan OutlineDocument5 pagesAirline Business - Plan Outlineeduzie100% (1)

- Quiz 07Document15 pagesQuiz 07Ije Love100% (1)

- SPM CH 02 - 1 - Corporate Level StrategyDocument7 pagesSPM CH 02 - 1 - Corporate Level StrategyHelmy Fitria SagitaNo ratings yet

- Add A Footer 1Document16 pagesAdd A Footer 1Prince AlbutraNo ratings yet

- Chapter 15 Parkin PowerPointDocument16 pagesChapter 15 Parkin PowerPointAsandeNo ratings yet

- Eureka Forbes Case AnalysisDocument3 pagesEureka Forbes Case AnalysisDiksha TanejaNo ratings yet

- Auditing and Assurance Services Louwers 6th Edition Solutions ManualDocument20 pagesAuditing and Assurance Services Louwers 6th Edition Solutions ManualRichardThomasrfizy100% (36)

- High Probability Trading Setups For The Currency MarketDocument102 pagesHigh Probability Trading Setups For The Currency Marketrichardsonfx89% (28)

- CRC Sublimis Promotion PlanDocument33 pagesCRC Sublimis Promotion PlanAnkit DuttNo ratings yet

- Microeconomics SalvatoreDocument55 pagesMicroeconomics SalvatoreSwapnil ShethNo ratings yet

- Assignment 1 SCMDocument4 pagesAssignment 1 SCMAdityaGoenka83% (6)

- MAN 6617 Case 2Document1 pageMAN 6617 Case 2CharityNo ratings yet

- Control AccountDocument10 pagesControl AccountTeo Yu XuanNo ratings yet

- Porter Competitive StrategyDocument1 pagePorter Competitive StrategyamiNo ratings yet

- Om DraftDocument7 pagesOm DraftLester PioquintoNo ratings yet

- Corndog CostingDocument3 pagesCorndog CostingSharah QuilarioNo ratings yet

- Reviewer 5Document14 pagesReviewer 5Cyrene CruzNo ratings yet

- Akl1 CH09Document41 pagesAkl1 CH09Candini NoviantiNo ratings yet

- SCM Overview Introduction Lab 1Document27 pagesSCM Overview Introduction Lab 1Evgeny MarkinNo ratings yet