100% found this document useful (3 votes)

3K views7 pagesAccounting Case Study

This document provides a case study and financial analysis of Highland Malt, a Scottish whiskey company. It includes assumptions, financial statements for 2019 including an income statement, balance sheet, and cash flow statement. It also calculates financial ratios for Highland Malt and compares them to industry averages. Journal entries for 2018 and 2019 are presented. In its analysis, it finds that Highland Malt has strong liquidity but low profit margins. It recommends changing Spencer's commission structure and selling whiskey as single bottles to increase profits.

Uploaded by

ankit131189Copyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOCX, PDF, TXT or read online on Scribd

100% found this document useful (3 votes)

3K views7 pagesAccounting Case Study

This document provides a case study and financial analysis of Highland Malt, a Scottish whiskey company. It includes assumptions, financial statements for 2019 including an income statement, balance sheet, and cash flow statement. It also calculates financial ratios for Highland Malt and compares them to industry averages. Journal entries for 2018 and 2019 are presented. In its analysis, it finds that Highland Malt has strong liquidity but low profit margins. It recommends changing Spencer's commission structure and selling whiskey as single bottles to increase profits.

Uploaded by

ankit131189Copyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOCX, PDF, TXT or read online on Scribd

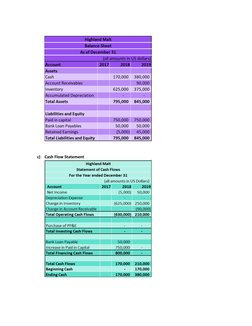

- Balance Sheet and Cash Flow: Provides the balance sheet and cash flow statement for Highland Malt as of December 31 for the years 2017 and 2018, tracking changes in financial position.

- Assumptions and Financial Statements: Presents the basic assumptions underlying the financial analysis and provides an initial financial statement overview, setting the stage for detailed analysis.

- Calculation of Financial Ratios: Analyzes liquidity, leverage, profitability, and efficiency ratios, deriving insights into the company's financial health from 2018 to 2019.

- Industry Comparison: Compares Highland Malt's financial ratio performance against industry averages over five years to benchmark success.

- Journal Entries and Recommendations: Summarizes journal entries for 2018-2019 and proposes business recommendations based on financial health assessments and product pricing strategies.