Professional Documents

Culture Documents

SMS Life Sciences India Limited Financial Report

Uploaded by

saikiran reddyOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

SMS Life Sciences India Limited Financial Report

Uploaded by

saikiran reddyCopyright:

Available Formats

Press Release

SMS Life sciences India Limited

April 20, 2020

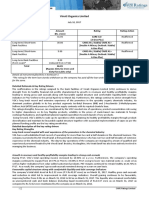

Ratings

Amount

Instrument Ratings Rating Action

(Rs. Crore)

CARE BBB+;

Placed on credit watch

24.50 (Triple B Plus)

Long-term Bank Facilities with developing

[Under credit watch with

implications

developing implications]

CARE A2

Placed on credit watch

0.32 [A Two]

Short-term Bank Facilities with developing

[Under credit watch with

implications

developing implications]

CARE BBB+; /CARE A2

Placed on credit watch

Long-term Bank Facilities/ 30.00 (Triple B Plus /A Two)

with developing

Short-term Bank Facilities [Under credit watch with

implications

developing implications]

54.82

Total (Rs. Fifty Four crore and

Eighty Two lakh only)

Details of facilities in Annexure-1

Detailed Rationale & Key Rating Drivers

CARE has placed the ratings assigned to the bank facilities of SMS Lifesciences India Limited (SMS Life) on ‘Credit watch with

developing implications’ subsequent to the press release issued by USFDA stating manufacturers to withdraw all prescription

and over-the-counter (OTC) ranitidine drugs from the market immediately as the agency has determined that the impurity

(NDMA) in some ranitidine products increases over time and when stored at higher than room temperatures and may result

in consumer exposure to unacceptable levels of this impurity.. Ranitidine along with its intermediates contributed about 48%

and 51% of gross sales during FY19 and 9MFY20 in SMS life, however the contribution of same towards USA and Europe is less

than 1%. The company vide its press release conveyed that the company is waiting for the guidance of health authorities of

Rest of the world (ROW)/domestic market. CARE is in the process of evaluating the impact of the above developments along

with the lockdown due to COVID19 on the credit quality of SMS Life and would take a view on the rating when the exact

implications of the above are clear.

The ratings assigned to the bank facilities of SMS Lifesciences India Limited (SMS Life) continues to derive strength from

experienced promoters and directors with a strong established track record in the pharmaceutical industry, well-equipped

manufacturing facilities with regulatory approvals to cater to the semi-regulated and domestic market, improvement in total

operating income and profitability margins during FY19 (refers to the period April 1 to March 31), established presence in anti-

ulcer segment, diversified and reputed client base with stable flow of repeat business, continued comfortable capital structure,

synergy derived from its group company and stable industry outlook. The ratings also factor in the acquisition of Mahi Drugs

Private Limited (Mahi Drugs) enabling SMS Life in expansion of capacities. The rating strengths are however, tempered by

subdued financial performance during 9MFY20 (refers to period April 01 to December 31), product concentration risk, working

capital intensive nature of business with moderate operating cycle, ongoing debt funded capex and presence in the highly

fragmented and competitive bulk drug industry along with exposure to regulatory and foreign exchange fluctuation risk.

Rating Sensitivities

Positive Factors

Diversification in its product portfolio, wherein no single product contributes over 20% of total gross sales.

Improvement in scale of operations and profitability margins.

Negative Factors

Overall gearing of the company going above 1.00x.

Elongation of working capital cycle to more than 90 days on a continuous basis.

Detailed description of the key rating drivers

Key Rating Strengths

Experienced promoters and directors with a strong track record in the pharmaceutical industry

SMS Life, originally promoted by Mr. Hari Kishore Potluri, Ms. Potluri Hima Bindu and their family members as private limited

company in the name of Potluri Real Estate Private Limited and subsequently changed its name to Potluri Packaging Industries

Private Limited on November 6, 2013 and to SMS Lifesciences India Private Limited in August 4, 2014. Post demerger, SMS Life

is a separate entity operating independently in semi-regulated markets. The current promoters of SMS Life are Mr. P Ramesh

Babu (Chairman and Managing Director of SMS) and Mr. TVVSN Murthy (Managing Director). Mr. P Ramesh Babu has over 30

1 CARE Ratings Limited

Press Release

years of experience in the pharmaceutical industry. He has worked for various reputed pharmaceutical companies as a Director

(Overall Business Development & Supervision and Marketing).

Acquisition of Mahi Drugs Private Limited

The company has acquired 100% stake in Mahi Drugs Private Limited (Mahi Drugs) as on September 17, 2018. With this total

stake of the company as on date in Mahi Drugs is 100% and has become wholly owned subsidiary of SMS Life. The total cost of

acquisition is of Rs.25.93 crore which has been funded by way of Un-secured loans from promoters to the tune of Rs.4.95 crore

and balance by way of internal accruals available with the company. (Rs.4.95 crore was invested in FY18 and balance was

invested in FY19). In order to enable growth of SMS Life, instead of putting up a green field project which would take 2-3 years,

the management has decided to take the acquisition route. This is expected to help SMS Life in quick expansion of capacities

and also increase sales. Mahi Drugs is a new facility (established 5 years back) and has an existing business of around Rs.30

crore with 2 production blocks situated at Visakhapatnam and capacity of 90 KLPA.

Synergy derived from SMS group

SMS Life is part of SMS group. The company was demerged on May 17, 2017 with effect from April 01, 2016. The semi-regulated

units of SMS Pharma were transferred to SMS Life along with its assets and liabilities. SMS Life derives benefit as being part of

the SMS group. SMS Pharma promoters have experience of around 3 decades and are involved in day-to-day affairs of the

company. SMS Life is able to cater to clients which have long term relation with SMS group resulting strong customer base for

SMS Life.

Manufacturing facility with various regulatory certifications for domestic and semi-regulated markets

SMS Life has three manufacturing units namely; Unit I – (Kazipally unit), Unit II – (Jeedimetla unit) and Unit III – (Bollaram unit)

in Hyderabad and one R&D facility. During FY17, SMS Life completed Korean Food and Drug Administration (KFDA) audit for

Unit-I. Further, the Company has successfully completed USFDA audit during April, 2018 and received EIR report against

Kazipally Facility (Unit I). All three units also meet World Health Organization (WHO) cGMP standards. Apart from that, the

company’s subsidiary i.e. Mahi Drugs Private Limited has one manufacturing facility located in J. N. Pharma City, Parawada,

Visakhapatnam.

Diversified and reputed client base with stable flow of repeat business

The company (consol.) has diversified revenue with top 6 clients contributing 44% (28% in FY18) of the gross sales in FY19

increasing client concentration risk. These clients have long standing relation with an average age of 17 years of association

with the group. Top five clients of the company during FY19 were Uquifa - Union Quimico Farmaceutica, S.A. (Spain based),

Orchev Pharma Pvt Ltd (manufacturing Ranitidine Hydrochloride), Helm De Mexico S.A, Sun Pharmaceutical Industries Limited

and Mylan Laboratories Limited which are globally well renowned innovator in pharma and research.

Significant improvement in total operating income and profitability margins during FY19

The total operating income (TOI) of SMS Life, at consolidated level, improved significantly by 76.38% from Rs.215.47 crore

during FY18 to Rs.380.06 crore during FY19. Out of the revenue earned during FY19, Mahi Drugs Private Limited constitute to

around 9%. PBILDT margin (consol.) has improved significantly by 245 bps from 7.30% in FY18 to 9.75% in FY19 on account of

better margins earned from new products launched during the year. In line with improved PBILDT level, PAT margin (Consol.)

also improved by 168 bps from 3.02% during FY18 to 4.70% during FY19.

Continued comfortable capital structure and satisfactory debt coverage

SMS Life (consol.) continues to have comfortable capital structure, although deteriorated, with debt to equity and overall

gearing below unity at 0.38x and 0.53x as on March 31, 2019 (0.24x and 0.31x as on March 31, 2018 respectively) owing to

increase in term loan and working capital borrowing during the year. Further, the PBILDT interest coverage and Total debt/GCA

both improved during the year on account of better profitability margins. The PBILDT interest coverage and Total debt/GCA

improved to 6.73x and 1.87x (3.76x and 2.33x respectively for FY18) during FY19.

During 9MFY20, the PBILDT interest coverage (consol.) deteriorated to 5.44x vis-à-vis 6.73x in FY19 on account of decrease in

PBILDT level

Comfortable working capital cycle of the company

The operating cycle of the company, at consol. level, improved from 47 days in FY18 to 25 days in FY19 mainly due to

improvement in average inventory period and average collection period. The average inventory period of the company

improved to 70 days in FY19 (86 days in FY18). The average collection period of the company also improved to 30 days in FY19

(51 days in FY18). The company generally extends 30 to 45 days credit period to its customers. The company’s average working

capital utilization (consolidated) remained moderate at around 43.61% for the 12 months period ended November 2019.

2 CARE Ratings Limited

Press Release

Stable pharma industry outlook

Pharma exports are expected to grow by 8%-10% on a y-o-y basis and are likely to reach the level of USD 20.7 billion-USD 21.1

billion during FY20. The increase in exports will be backed by higher exports to USA, pharmemerging nations, developed nations

and other nations. A stabilising price erosion environment is likely to aid pharma exports to USA. Moreover, the need for

affordable healthcare in pharmemerging and developed nations are likely to support exports of branded generics to these

countries. Also, rising per capita incomes in pharmemerging nations will contribute to the rise in branded generics exports from

India.

On the domestic front, the industry is expected to grow at around 10%-12% and reach the level of USD 20.4 billion-USD 20.8

billion during FY20. This will be backed by growth in presence of chronic diseases, increasing per capita income, improvement

in access to healthcare facilities and penetration of health insurance.

Considering the growth in domestic and export pharma market, we expect Indian pharma industry outlook to remain stable

and to grow by about 9%-11% to USD 41.1 billion-USD 41.9 billion by FY20.

Key Rating Weaknesses

Subdued financial performance during 9MFY20.

During 9MFY20, the company (consol.) has earned a revenue of Rs.212.05 crore with PBILDT margin at 10.12% and PAT margin

at 3.62%.The growth rate of the company declined by 14.00% during 9MFY20 as against 9MFY19 on account of decline in

revenue from Ranitidine HCL which contributed around 36% of total revenue as there was a worldwide issue of NDMA in

respect of Rantidine HCL and lack of clarity from regulatory authorities about its permissible level, its impact and about its

carcinogenic effect on prolonged usage.

Established presence in Anti–ulcer (GAS) therapeutic segment albeit high product concentration

SMS Life, at standalone level, has a portfolio of more than 12 APIs with an established presence in GAS segment followed by

Anti-erectile dysfunction (EDF) therapeutic segment. The top 7 products of the portfolio accounted for 78% in FY19 (83% in

FY18). Ranitidine HCL (Anti –ulcer (GAS) therapeutic segment) is the main product of the portfolio with 35.75% of contribution

to gross sales in FY19 resulting in single product concentration risk. Though, the company faces product concentration risk with

respect to Ranitidine HCL, SMS Life is one of the single largest manufacturers of Ranitidine and therefore enjoys a good market

share with respect to the same. Demand for Ranitidine has been increasing over the years and so has its revenue share.

Revenue from Ranitidine registered y-o-y growth of 16.91% to Rs.132.62 crore for FY19 (Rs. 113.44 crore in FY18) for SMS Life.

Debt funded capex

The company has undertaken expansion project at Kazipally to increase the additional capacities for various products as well

as renovation of the facility to meet the current regulatory compliances. The total project cost is estimated to be Rs.26.12 crore

and is being funded with internal accruals of Rs.6.12 crore and term loan of Rs. 20 crore.

During FY18, the company has incurred around Rs.8.30 crore (Out of Rs.26.12 crore) funded by way of internal accruals (part

of which was reimbursed by term loan subsequently). Balance Rs.17.82 crore capex has been incurred in FY19 and 7MFY20 and

was funded by way term loan. Further, the company has completed the capex in the month of October 2019. However, term

loan to the extent of Rs.1 crore is expected to be disbursed by end of February 2020.

Apart from the aforesaid capex, Mahi Drugs is also carrying out capacity expansion at Parawada unit. The total project cost for

the same is Rs.26.67 crore which will be funded through term loan to the extent of Rs.20 crore and balance Rs.6.67 crore

through internal accruals. Till December 23, 2019, the company has incurred around Rs.10.04 crore which was funded through

term loan to the extent of Rs.5.83 crore and balance through internal accruals of Rs.4.21 crore. The expected COD for the said

project is by September 2020.

Impact of Ranitidine issue on financial performance and the current status

On September 13, 2019, USFDA issued a statement stating that some ranitidine medicines contain a nitrosamine impurity

called N-nitrosodimethylamine (NDMA) at low levels. NDMA is classified as a probable human carcinogen (a substance that

could cause cancer) based on results from laboratory tests. NDMA is a known environmental contaminant and found in water

and foods, including meats, dairy products, and vegetables. Post to this, the company reduced the production and held back

any finished stock of Ranitidine available with them. Further, the company carried out test on the Ranitidine internally as well

as through third party labs to validate the presence of NDMA. Thereafter, on November 01, 2019, USFDA vide its press stated

that consuming up to 0.096 micrograms or 0.32 parts per million (ppm) of NDMA per day is considered reasonably safe for

human ingestion based on lifetime exposure. Through their testing so far, they have found levels of NDMA in Ranitidine HCL

that are similar to the levels expected in common foods like grilled or smoked meats. On April 01, 2020, the USFDA vide its

press release announced that it is requesting manufacturers withdraw all prescription and over-the-counter (OTC) ranitidine

drugs from the market immediately as the agency has determined that the impurity (NDMA) in some ranitidine products

increases over time and when stored at higher than room temperatures and may result in consumer exposure to unacceptable

levels of this impurity. The director of USFDA has also commented stating that, “We didn’t observe unacceptable levels of

3 CARE Ratings Limited

Press Release

NDMA in many of the samples that we tested. However, since we don’t know how or for how long the product might have

been stored, we decided that it should not be available to consumers and patients unless its quality can be assured”. On April

09, 2020, SMS Life vide its press release stated that the company does not have any Ranitidine API sales to US market either

directly or indirectly, however, the company need to wait for the guidance of health authorities of ROW / domestic markets.

As the company has been deriving majority of its revenue from sale of Ranitidine, the aforementioned development has led to

subdued performance of overall revenue during Q3FY20.

Highly fragmented and competitive bulk drug industry

Indian pharmaceutical industry is highly fragmented with presence of more than thousands of players in APIs and formulations.

It manufactures about 60,000 generic brands across 60 different therapeutic categories, about 1,500 bulk drugs and almost

the entire range of formulations. The industry is highly fragmented with around 20,000 players, of which, around 250 in the

organized sector primarily in formulations control over 70% of the total domestic market.

Exposure to regulatory and foreign exchange fluctuation risk

The company is exposed to regulatory risk with its operations centered majorly into manufacturing pharmaceutical APIs. In

India, the government also controls the prices of pharmaceutical products through the drug price control order (DPCO) under

price control mechanism. Besides, the pharmaceutical industry is highly regulated in many other countries and requires various

approvals, licenses, registrations and permissions for business activities. The approval process for a new product registration

is complex, lengthy and expensive. The time taken to obtain approval varies by country but generally takes from six months to

several years from the date of application. Any delay or failure in getting approval for new product launch could adversely

affect the business prospect of the company.

SMS Life is exposed to foreign exchange fluctuation risk in view of large volume and high value transactions of export and

import, a phenomenon common to the players in the industry. However, for SMS Life, the risk gets mitigated to certain extent

due to natural hedging through netting off the imports of raw materials majorly from China to the extent of Rs.100.83 crore

and exports to different countries to the extent of Rs.166.68 crore.

Liquidity – Adequate

The liquidity position of the company, at consolidated level, remain adequate marked by the current ratio of 1.13x as on March

31, 2019. SMS Life at consolidated level has undertaken capex for capacity expansion of Kazipally unit (project cost of Rs.26.12

crore) and in Mahi Drugs (Project cost of Rs.26.62 crore). The cost of the entire project amounts to Rs.52.74 crore. Out of the

said project cost, around Rs.7.71 crore of internal accruals is committed towards the capex during FY20. Further, the company

has already incurred Rs.4.21 crore till December 31, 2019. Further, the company (consol.) has generated GCA of Rs.25.15 crore

during FY19 and Rs.13.82 crore during 9MFY20 coupled with cash balance of Rs.0.33 crore as on December 31, 2019. The

company has already paid the current maturities of Rs 5.12 crore during FY20 and has opted for moratorium of three months

only for principal payment of term loan from EXIM bank of Rs 1.99 crore, however, the company has not opted for moratorium

in RBL Bank and is servicing the interest obligations as per schedule.

Analytical approach: Standalone to Consolidated; the consolidated business and financial risk profiles of SMS Life and its

subsidiaries namely Mahi Drugs Private Limited has been considered as this company is a subsidiary of SMS Life which operate

in the same line of business and have financial and operational linkages. Earlier CARE has considered in its analysis the

Standalone approach as SMS Life didn’t had any subsidiaries. However with acquisition of entire stake by SMS life in Mahi

Drugs Private Limited which would act as backward integration unit for SMS Life, along with considering operational, financial

and management being fungible the analytical approach has been changed to Consolidated.

Applicable criteria

Criteria on assigning Outlook to Credit Ratings

CARE’s Policy on Default Recognition

Criteria for Short term Instruments

Rating Methodology: Consolidation and Factoring Linkages in Ratings

Rating Methodology – Manufacturing Companies

Rating Methodology – Pharmaceutical

Financial ratios – Non-Financial Sector

About the company

SMS Lifesciences India Limited (SMS Life) was originally incorporated in May, 2006 by Mr. Hari Kishore Potluri, Ms. Potluri Hima

Bindu and their family members as private limited company in the name of Potluri Real Estate Private Limited and subsequently

changed its name to Potluri Packaging Industries Private Limited on November 6, 2013. Thereafter, the company has changed

its name to SMS Lifesciences India Limited in August 4, 2014. SMS Life was a Wholly Owned Subsidiary (WOS) of SMS

4 CARE Ratings Limited

Press Release

Pharmaceuticals Limited (SMS) till May 17, 2017. Pursuant to the scheme of Arrangement approved by National Company Law

Tribunal (NCLT), SMS is the Demerged Company and SMS Life is the Resulting Company vide order dated May 15, 2017. The

scheme became effective from May 17, 2017. With view to reduce the impact of semi regulated units on regulated units, SMS

has demerged its semi-regulated units under Food and Drug administration (FDA) (i.e. Unit I-Kazipally unit (erstwhile unit I of

SMS) Unit II-Jeedimetla unit (erstwhile unit IV of SMS) and Unit III-Bollaram unit (erstwhile unit V of SMS) and one R&D facility

along with other assets, liabilities and investments and transferred to SMS Life. The company primarily caters to semi-regulated

markets across India, Europe, Asia and has product base of more than 12 products under various therapeutic segments.

Covenants of rated instrument / facility: Detailed explanation of covenants of the rated instruments/facilities is given in

Annexure-3

Brief Financials (Rs. crore) FY18 (A) FY19 (A)

Standalone Consolidated

Total operating income 215.47 380.06

PBILDT 15.72 37.05

PAT 6.50 17.85

Overall gearing (times) 0.31 0.53

PBILDT Interest coverage (times) 3.76 6.73

PBIT Interest Coverage (times) 2.40 5.31

A: Audited

Status of non-cooperation with previous CRA: Not Applicable.

Any other information: Not Applicable.

Rating History for last three years: Please refer Annexure-2

Annexure-1: Details of Instruments/Facilities

Name of the Date of Coupon Maturity Size of the Rating assigned along with

Instrument Issuance Rate Date Issue Rating Outlook

(Rs. crore)

Fund-based - LT-Term - - - 4.50 CARE BBB+ (Under Credit

Loan watch with Developing

Implications)

Non-fund-based - ST- - - - 0.32 CARE A2 (Under Credit

BG/LC watch with Developing

Implications)

Fund-based - LT/ ST- - - - 30.00 CARE BBB+ / CARE A2

Packing Credit in Foreign (Under Credit watch with

Currency Developing Implications)

Fund-based - LT-Term - - - 20.00 CARE BBB+ (Under Credit

Loan watch with Developing

Implications)

5 CARE Ratings Limited

Press Release

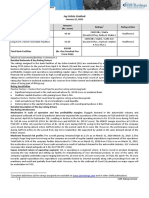

Annexure-2: Rating History of last three years

Sr. Name of the Current Ratings Rating history

No. Instrument/Bank Type Amount Rating Date(s) & Date(s) & Date(s) & Date(s) &

Facilities Outstanding Rating(s) Rating(s) Rating(s) Rating(s)

(Rs. crore) assigned in assigned in 2019- assigned in assigned in

2020-2021 2020 2018-2019 2017-2018

1. Fund-based - LT-Term LT 4.50 CARE BBB+ - 1)CARE BBB+; 1)CARE 1)CARE

Loan (Under Credit Stable BBB+; BBB+;

watch with (11-Feb-20) Stable Stable

Developing 2)CARE BBB+ (31-Oct-18) (18-Sep-17)

Implications) (Under Credit 2)CARE

watch with BBB+;

Developing Stable

Implications) (03-Oct-18)

(07-Oct-19)

2. Non-fund-based - ST- ST 0.32 CARE A2 (Under - 1)CARE A2 1)CARE A2 1)CARE A2

BG/LC Credit watch (11-Feb-20) (31-Oct-18) (18-Sep-17)

with Developing 2)CARE A2 2)CARE A2

Implications) (Under Credit (03-Oct-18)

watch with

Developing

Implications)

(07-Oct-19)

3. Fund-based - LT/ ST- LT/ST 30.00 CARE BBB+; - 1)CARE BBB+; 1)CARE 1)CARE

Packing Credit in Stable / CARE A2 Stable / CARE A2 BBB+; BBB+;

Foreign Currency Under Credit (11-Feb-20) Stable / Stable /

watch with 2)CARE BBB+ / CARE A2 CARE A2

Developing CARE A2 (Under (31-Oct-18) (18-Sep-17)

Implications) Credit watch with 2)CARE

Developing BBB+;

Implications) Stable /

(07-Oct-19) CARE A2

(03-Oct-18)

4. Fund-based - LT-Term LT 20.00 CARE BBB+; - 1)CARE BBB+; 1)CARE -

Loan Stable Stable BBB+;

Under Credit (11-Feb-20) Stable

watch with 2)CARE BBB+ (31-Oct-18)

Developing (Under Credit 2)CARE

Implications) watch with BBB+;

Developing Stable

Implications) (03-Oct-18)

(07-Oct-19)

5. Non-fund-based - LT/ LT/ST - - - 1)Withdrawn 1)CARE -

ST-Loan Equivalent Risk (11-Feb-20) BBB+;

2)CARE BBB+ / Stable /

CARE A2 (Under CARE A2

Credit watch with (31-Oct-18)

Developing 2)CARE

Implications) BBB+;

(07-Oct-19) Stable /

CARE A2

(03-Oct-18)

6 CARE Ratings Limited

Press Release

Annexure-3: Detailed explanation of covenants of the rated instrument / facilities - NA

Note on complexity levels of the rated instrument: CARE has classified instruments rated by it on the basis of complexity. This

classification is available at www.careratings.com. Investors/market intermediaries/regulators or others are welcome to write

to care@careratings.com for any clarifications.

Contact us

Media Contact

Mradul Mishra

Contact no. – +91-22-6837 4424

Email ID – mradul.mishra@careratings.com

Analyst Contact

Group Head Name – D Naveen Kumar

Group Head Contact no. - 040-67937416

Group Head Email ID - dnaveen.kumar@careratings.com

Relationship Contact

Name: Ramesh Bob

Contact no. : +91 90520 00521

Email ID: ramesh.bob@careratings.com

About CARE Ratings:

CARE Ratings commenced operations in April 1993 and over two decades, it has established itself as one of the leading credit

rating agencies in India. CARE is registered with the Securities and Exchange Board of India (SEBI) and also recognized as an

External Credit Assessment Institution (ECAI) by the Reserve Bank of India (RBI). CARE Ratings is proud of its rightful place in

the Indian capital market built around investor confidence. CARE Ratings provides the entire spectrum of credit rating that

helps the corporates to raise capital for their various requirements and assists the investors to form an informed investment

decision based on the credit risk and their own risk-return expectations. Our rating and grading service offerings leverage our

domain and analytical expertise backed by the methodologies congruent with the international best practices.

Disclaimer

CARE’s ratings are opinions on the likelihood of timely payment of the obligations under the rated instrument and are not

recommendations to sanction, renew, disburse or recall the concerned bank facilities or to buy, sell or hold any security.

CARE’s ratings do not convey suitability or price for the investor. CARE’s ratings do not constitute an audit on the rated

entity. CARE has based its ratings/outlooks on information obtained from sources believed by it to be accurate and reliable.

CARE does not, however, guarantee the accuracy, adequacy or completeness of any information and is not responsible for

any errors or omissions or for the results obtained from the use of such information. Most entities whose bank

facilities/instruments are rated by CARE have paid a credit rating fee, based on the amount and type of bank

facilities/instruments. CARE or its subsidiaries/associates may also have other commercial transactions with the entity. In

case of partnership/proprietary concerns, the rating /outlook assigned by CARE is, inter-alia, based on the capital deployed

by the partners/proprietor and the financial strength of the firm at present. The rating/outlook may undergo change in case

of withdrawal of capital or the unsecured loans brought in by the partners/proprietor in addition to the financial

performance and other relevant factors. CARE is not responsible for any errors and states that it has no financial liability

whatsoever to the users of CARE’s rating.

Our ratings do not factor in any rating related trigger clauses as per the terms of the facility/instrument, which may involve

acceleration of payments in case of rating downgrades. However, if any such clauses are introduced and if triggered, the

ratings may see volatility and sharp downgrades.

7 CARE Ratings Limited

You might also like

- Securitization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsFrom EverandSecuritization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsNo ratings yet

- Max Healthcare Institute Limited-11-04-2020Document6 pagesMax Healthcare Institute Limited-11-04-2020max joharNo ratings yet

- 04102022073602_Divis_Laboratories_LimitedDocument7 pages04102022073602_Divis_Laboratories_Limiteddivygupta198No ratings yet

- Bharat Hotels LimitedDocument7 pagesBharat Hotels LimitedjagadeeshNo ratings yet

- Gujarat Themis Biosyn LimitedDocument5 pagesGujarat Themis Biosyn LimitedAshwani KesharwaniNo ratings yet

- 3i Infotech LimitedDocument5 pages3i Infotech LimitedPratik SuranaNo ratings yet

- 10102022062806_Myra_Hygiene_Products_Private_LimitedDocument7 pages10102022062806_Myra_Hygiene_Products_Private_Limitedanuj7729No ratings yet

- Care Rating Sterling - Addlife - India - Private - LimitedDocument6 pagesCare Rating Sterling - Addlife - India - Private - Limitedrahul.tibrewalNo ratings yet

- Samunnati Rating Rationale b764561b41Document8 pagesSamunnati Rating Rationale b764561b41PratyushNo ratings yet

- Vinati Organics Ratings Reaffirmed by CARE Despite Planned CapexDocument5 pagesVinati Organics Ratings Reaffirmed by CARE Despite Planned CapexmgrreddyNo ratings yet

- Saraf Chemicals Private LimitedDocument6 pagesSaraf Chemicals Private LimitedCedric KerkettaNo ratings yet

- Best Finance Corporation Limited: Facilities/Instruments Amount (Rs. Crore) Rating Rating ActionDocument5 pagesBest Finance Corporation Limited: Facilities/Instruments Amount (Rs. Crore) Rating Rating ActionKarthikeyan RK SwamyNo ratings yet

- Press Release Gravita India Limited: Ratings Facilities Amount (Rs. Crore) Ratings Rating ActionDocument7 pagesPress Release Gravita India Limited: Ratings Facilities Amount (Rs. Crore) Ratings Rating ActionhamsNo ratings yet

- R. K. Marble Private Limited-12!30!2020Document6 pagesR. K. Marble Private Limited-12!30!2020Brajpal JhalaNo ratings yet

- Housing Development Finance Corporation LimitedDocument6 pagesHousing Development Finance Corporation LimitedTejpal SainiNo ratings yet

- Welcon Chemicals (PVT.) Limited: Rating ReportDocument5 pagesWelcon Chemicals (PVT.) Limited: Rating ReportM TayyabNo ratings yet

- Sunlex Fabrics Private Limited - Care RatingsDocument6 pagesSunlex Fabrics Private Limited - Care RatingsManeet GoyalNo ratings yet

- SMFG India Credit Company LimitedDocument9 pagesSMFG India Credit Company Limitedvatsal sinhaNo ratings yet

- Ganesh Benzoplast LTD (GBL)Document7 pagesGanesh Benzoplast LTD (GBL)Positive ThinkerNo ratings yet

- Incred Financial Services Limited Press+ReleaseDocument7 pagesIncred Financial Services Limited Press+ReleaseGautam MehtaNo ratings yet

- Future Retail Limited: Carved Out of Working Capital Limits Details of Instruments/facilities in Annexure-1Document9 pagesFuture Retail Limited: Carved Out of Working Capital Limits Details of Instruments/facilities in Annexure-1Nostalgic MediatorNo ratings yet

- DHFL Annual Report 2019-20Document292 pagesDHFL Annual Report 2019-20hyenadogNo ratings yet

- Press Release Mehul Construction Company Private Limited: Details of Instruments/facilities in Annexure-1Document5 pagesPress Release Mehul Construction Company Private Limited: Details of Instruments/facilities in Annexure-1tejasNo ratings yet

- Amarth Ifestyle RetailingDocument5 pagesAmarth Ifestyle Retailingheera lal thakurNo ratings yet

- Central Bank of IndiaDocument21 pagesCentral Bank of IndiaNitinAgnihotriNo ratings yet

- RACL Geartech ratings reaffirmedDocument4 pagesRACL Geartech ratings reaffirmedSourav DuttaNo ratings yet

- Press Release Tab India Granites Private LimitedDocument6 pagesPress Release Tab India Granites Private LimitedRavi BabuNo ratings yet

- Press Release DFM Foods Limited: Details of Facilities in Annexure-1Document4 pagesPress Release DFM Foods Limited: Details of Facilities in Annexure-1Puneet367No ratings yet

- Rajendra Singh Bhamboo Infra Private LimitedDocument5 pagesRajendra Singh Bhamboo Infra Private LimitedBABU LAL CHOUDHARYNo ratings yet

- PSK Engineering Construction & Co-08-06-2020Document5 pagesPSK Engineering Construction & Co-08-06-2020The JdNo ratings yet

- CRISIL Rating Metro April18Document3 pagesCRISIL Rating Metro April18pankaj_xaviersNo ratings yet

- Vardhman Pharma Distributors Private Limited-10-01-2020Document6 pagesVardhman Pharma Distributors Private Limited-10-01-2020Saifuddin LalaNo ratings yet

- Press Release Airo Lam Limited: Details of Instruments/facilities in Annexure-1Document4 pagesPress Release Airo Lam Limited: Details of Instruments/facilities in Annexure-1flying400No ratings yet

- Prayag Polymers Private LimitedDocument4 pagesPrayag Polymers Private Limitednandinimishra6168No ratings yet

- Jay Ushin Limited: Rationale-Press ReleaseDocument4 pagesJay Ushin Limited: Rationale-Press Releaseravi.youNo ratings yet

- Microfinance Private LimitedDocument5 pagesMicrofinance Private LimitedsantoshbsantuNo ratings yet

- PR ARCL Organics 31jan22Document7 pagesPR ARCL Organics 31jan22anady135344No ratings yet

- Pan Healthcare Private Limited (PHCPL) October 12, 2020Document5 pagesPan Healthcare Private Limited (PHCPL) October 12, 2020Sachin DhorajiyaNo ratings yet

- Antony Waste Handling Cell LimitedDocument5 pagesAntony Waste Handling Cell Limitedsoumyadwip samantaNo ratings yet

- 3F Oil Palm Agrotech Private Limited-02-27-2020 PDFDocument4 pages3F Oil Palm Agrotech Private Limited-02-27-2020 PDFData CentrumNo ratings yet

- Press Release Vijay Sales (India) Private Limited: Experienced PromotersDocument4 pagesPress Release Vijay Sales (India) Private Limited: Experienced PromoterssriharikosaNo ratings yet

- Ian Renewable Energy Development Agency Limited - IPO NoteDocument11 pagesIan Renewable Energy Development Agency Limited - IPO NotedeepaksinghbishtNo ratings yet

- Biocon LimitedDocument9 pagesBiocon Limitednayabrasul208No ratings yet

- Ajanta Soya 13may2021Document7 pagesAjanta Soya 13may2021praveen kumarNo ratings yet

- Mahindra & Mahindra LimitedDocument6 pagesMahindra & Mahindra Limitedjerin jNo ratings yet

- Credit Rating Report G.P. 2 PDFDocument16 pagesCredit Rating Report G.P. 2 PDFMohammad AdnanNo ratings yet

- Credit CARE in Cement IndustryDocument21 pagesCredit CARE in Cement IndustryShobhit ChandakNo ratings yet

- CSL Finance Limited NCD Rating Press ReleaseDocument4 pagesCSL Finance Limited NCD Rating Press ReleasePositive ThinkerNo ratings yet

- Technico Industries LimitedDocument4 pagesTechnico Industries Limitedshankarravi8975No ratings yet

- Tarsons Products LimitedDocument5 pagesTarsons Products LimitedujjwalgoldNo ratings yet

- Press Release Adani Agri Logistics (Harda) Limited: Details of Facilities in Annexure-1Document3 pagesPress Release Adani Agri Logistics (Harda) Limited: Details of Facilities in Annexure-1surprise MFNo ratings yet

- Press Release RACL Geartech LTDDocument4 pagesPress Release RACL Geartech LTDSourav DuttaNo ratings yet

- Optus Laminates Private Limited-04!02!2018 2Document4 pagesOptus Laminates Private Limited-04!02!2018 2jainam.gargNo ratings yet

- Bansal Pathways Habibganj Private LimitedDocument5 pagesBansal Pathways Habibganj Private LimitedKapil PadlakNo ratings yet

- IOL Chemicals and Pharmaceuticals Limited-07-07-2020Document4 pagesIOL Chemicals and Pharmaceuticals Limited-07-07-2020Jeet SinghNo ratings yet

- Ganga Rasayanie Private Limited-R-10102019Document7 pagesGanga Rasayanie Private Limited-R-10102019DarshanNo ratings yet

- AETHER Industries LTD - 2020 Credit RatingDocument5 pagesAETHER Industries LTD - 2020 Credit RatingEast West Strategic ConsultingNo ratings yet

- Climate Change Risks and Opportunities at Kotak Mahindra BankDocument45 pagesClimate Change Risks and Opportunities at Kotak Mahindra BankLande AshutoshNo ratings yet

- S. Jogani Exports Private LimitedDocument6 pagesS. Jogani Exports Private Limitedarc14consultantNo ratings yet

- AU Small Finance Bank OverviewDocument4 pagesAU Small Finance Bank Overviewsahil sharmaNo ratings yet

- Signode India Financial ReportDocument5 pagesSignode India Financial Reportsaikiran reddyNo ratings yet

- Loyal Textile Mills Limited press release ratings reaffirmedDocument5 pagesLoyal Textile Mills Limited press release ratings reaffirmedsaikiran reddyNo ratings yet

- Jeevaka Industries PVT R 06042020Document7 pagesJeevaka Industries PVT R 06042020saikiran reddyNo ratings yet

- Sree Akkamamba Textiles - R - 13032020Document7 pagesSree Akkamamba Textiles - R - 13032020saikiran reddyNo ratings yet

- Vinayak Steels Limited Financial ReportDocument7 pagesVinayak Steels Limited Financial Reportsaikiran reddyNo ratings yet

- Jeevaka Industries PVT Company ProfileDocument7 pagesJeevaka Industries PVT Company Profilesaikiran reddyNo ratings yet

- Sree Akkamamba Textiles - R - 13032020Document7 pagesSree Akkamamba Textiles - R - 13032020saikiran reddyNo ratings yet

- Sree Akkamamba Textiles - R - 13032020Document7 pagesSree Akkamamba Textiles - R - 13032020saikiran reddyNo ratings yet

- SILLIMAN UNIVERSITY MEDICAL SCHOOL CASEDocument10 pagesSILLIMAN UNIVERSITY MEDICAL SCHOOL CASEjoyce ramirezNo ratings yet

- 2001 AnnualDocument78 pages2001 Annualrizaldi rahmatullahNo ratings yet

- Ranitidine NewDocument9 pagesRanitidine NewSabhaya ChiragNo ratings yet

- Git MCQDocument27 pagesGit MCQPadmavathi C100% (8)

- Case Study in PPHDocument16 pagesCase Study in PPHMar Ordanza0% (1)

- RanitidineDocument1 pageRanitidineliza sian100% (1)

- Efficacy of Proton Pump Inhibitors and H2 Blocker in The Treatment of Symptomatic Gastroesophageal Reflux Disease in InfantsDocument5 pagesEfficacy of Proton Pump Inhibitors and H2 Blocker in The Treatment of Symptomatic Gastroesophageal Reflux Disease in InfantsAndhika DNo ratings yet

- Chapter-16 Chemistry in Everyday LifeDocument9 pagesChapter-16 Chemistry in Everyday LifeDeva RajNo ratings yet

- ANVISA GudianceDocument32 pagesANVISA GudianceTanvirNo ratings yet

- Ketorolac tromethamine NSAID pain management short-termDocument4 pagesKetorolac tromethamine NSAID pain management short-termx483xDNo ratings yet

- Case Study Presentation - Nephrotic SyndromeDocument56 pagesCase Study Presentation - Nephrotic SyndromeVivien Marie89% (27)

- Basic Marketing PlanDocument16 pagesBasic Marketing PlanmarabillaNo ratings yet

- Advanced Marketing Strategy: ZantacDocument6 pagesAdvanced Marketing Strategy: ZantacAALOK SINGLANo ratings yet

- DRUG ANALYSIS TABLEDocument10 pagesDRUG ANALYSIS TABLEChanel BalinbinNo ratings yet

- IV Compatibility ChartDocument6 pagesIV Compatibility ChartMae Quenie Abadingo Tiro75% (4)

- FIIIIIINAAAAALLLLLLDocument132 pagesFIIIIIINAAAAALLLLLLJohn Remy HerbitoNo ratings yet

- Ranitidine Hydrochloride: Generic Name Therapeutic Actions Indications Side Effects Nursing ActionsDocument5 pagesRanitidine Hydrochloride: Generic Name Therapeutic Actions Indications Side Effects Nursing ActionsAyanne ArcenaNo ratings yet

- DRUGS and DOSAGES for Pediatric Analgesics and AntimicrobialsDocument4 pagesDRUGS and DOSAGES for Pediatric Analgesics and Antimicrobialssharmee sarmientaNo ratings yet

- Case Study 1 - Head InjuryDocument9 pagesCase Study 1 - Head InjuryTara McNeillNo ratings yet

- Pharm Finals ProjDocument26 pagesPharm Finals ProjIrene HontiverosNo ratings yet

- Pharmacology Bullet ReviewDocument342 pagesPharmacology Bullet ReviewBenjamin Joel BreboneriaNo ratings yet

- 10.1.5 - Anti-H2 Agents (2007-Jan2016) - 1Document14 pages10.1.5 - Anti-H2 Agents (2007-Jan2016) - 1Gabrielle NnomoNo ratings yet

- Pepcid Case AnalysisDocument6 pagesPepcid Case AnalysisessNo ratings yet

- ANTI Ulcer DrugsDocument1 pageANTI Ulcer Drugsapi-3739910100% (1)

- Class Notes On Questionnaires For Pharmacology in The Gastrointestinal TractDocument12 pagesClass Notes On Questionnaires For Pharmacology in The Gastrointestinal TractMarqxczNo ratings yet

- NCP and DSDocument6 pagesNCP and DSfranzcatchie100% (1)

- Why We Classify Drugs DifferentlyDocument13 pagesWhy We Classify Drugs DifferentlyChuck BartaoskiNo ratings yet

- RLE 118 REVISED Case Scenario No. 10 Anaphylactic ShockDocument2 pagesRLE 118 REVISED Case Scenario No. 10 Anaphylactic ShockKiara Denise TamayoNo ratings yet

- Consumer Medicine Information Arrow - Ranitidine: What Is in This LeafletDocument8 pagesConsumer Medicine Information Arrow - Ranitidine: What Is in This LeafletmustikaarumNo ratings yet

- Rani Ti Dine Tramadol Ketorolac in Paracetamol Drug StudyDocument10 pagesRani Ti Dine Tramadol Ketorolac in Paracetamol Drug StudyIv'z TandocNo ratings yet