Professional Documents

Culture Documents

Mahindra & Mahindra Limited

Uploaded by

jerin jOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Mahindra & Mahindra Limited

Uploaded by

jerin jCopyright:

Available Formats

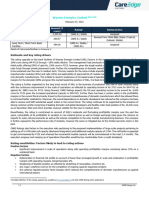

Press Release

Mahindra & Mahindra Limited (Revised)

October 10, 2022

Ratings

Rating

Facilities/Instruments Amount (₹ crore) Rating1

Action

CARE AAA; Stable

Long Term Bank Facilities 786.95 (Triple A; Outlook: Reaffirmed

Stable)

CARE AAA; Stable /

Long Term / Short Term Bank CARE A1+

600.00 Reaffirmed

Facilities (Triple A; Outlook:

Stable/ A One Plus)

CARE A1+

Short Term Bank Facilities 53.58 Reaffirmed

(A One Plus)

Long Term Bank Facilities - - Withdrawn

1,440.53

Total Bank Facilities (₹ One Thousand Four Hundred Forty

Crore and Fifty-Three Lakhs Only)

Details of instruments/facilities in Annexure-1.

Detailed rationale and key rating drivers

The assigned ratings for the bank facilities of Mahindra & Mahindra (M&M) continues to factor strong market position and

leadership in domestic tractor industry, Light Commercial Vehicles (LCV) segment and EV-three-wheeler segment, well diversified

business profile and experienced management. The ratings also consider the robust financial risk profile driven by strong capital

structure and debt coverage metrics, along with financial flexibility supported by large un-encumbered cash and liquid

investments. CARE also notes that M&M holds investments in some of the listed group entities where the market value of

investments is higher than book value thus providing additional financial flexibility.

The rating strengths are tempered by exposure of the company to inherent cyclicality of the automobile industry and increasing

competition in Utility Vehicle segment which is mitigated to an extent through diversified business portfolio. The Company is

also exposed to risks on account of investments in subsidiaries/ joint ventures; however, CARE has taken cognizance of the

management’s strategy on appropriate capital allocation across group companies.

During FY22, M&M recorded a healthy revenue growth of 28.7% in FY22 driven by volume growth of 30.7% and higher

realizations. The market share for domestic tractor improved to 40% (PY: 38.2%) in FY22 and further grew to 42.7% in Q1FY23

while LCV Goods market share was 37.8% in FY22. The operating margins*, however, saw a dip of 247.48 bps in FY22 owing to

significant surge in raw material prices though there was improvement in Q1FY23. Going forward, M&M is expected to maintain

its growth momentum and with the raw material prices softening, the margins are expected to recover.

Rating sensitivities

Negative factors – Factors that could lead to negative rating action/downgrade:

• Any large debt funded organic or inorganic investment leading to deterioration in the overall gearing on a sustained

basis

• Significant deterioration in the volumes of core business segments coupled with deterioration in free cashflow generation

on a sustained basis

Detailed description of the key rating drivers

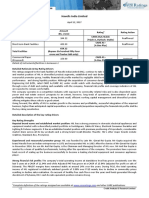

Key rating strengths

Strong market position:

M&M continues to be the market leader in the tractor segment in India; with a market share of around 40% (PY: 38.2%) as on

March 31, 2022 and 42.7% in Q1FY23. The company continues to be in the leadership position for 39 consecutive years. Despite

increasing inflation, the rising input cost of tractors, farm machinery, seeds etc, the rural sentiment saw a respite owing to the

3 consecutive years of good monsoon. M&M’s market share in the UV segment increased to 15% in FY22 (PY: 14.7%) and

further to 16.2% in Q1FY23 owing to the launch of re-branded XUV700 which garnered 1,00,000 bookings in first 4 months and

the iconic Thar which crossed 1,00,000 booking in FY22. In the LCV<3.5T segment M&M has retained #1 position for 8

1Complete definition of the ratings assigned are available at

www.careedge.in and other CARE Ratings Ltd.’s publications

1 *As per CARE’s Methodology CARE Ratings Ltd.

Press Release

consecutive years (LCV<3.5T accounts for 59.1% of the total CV industry); M&M is also a leader in the Pick-up segment (LCV

goods 2 to 3.5T) for 20 years and holds 55% market share.

Strong operating performance with improvement in margins to continue

The auto industry has been facing headwinds since the past couple of years due to economic slowdown and regulatory changes

like axle load norms and transition to BS VI, which was further exacerbated by the onslaught of COVID-19 and the supply chain

disruptions caused by Russia-Ukraine war. However, the company reported 28.1% (including exports) YoY growth in automotive

volumes due to good monsoon and improving consumer sentiment. The auto segment reported 44.86% YoY growth in value

and 61.79% YoY growth in PBIT in FY22. Diversification in the revenue across auto and farm has helped the company to maintain

stability in its operating performance despite challenges.

However, the operating margin dipped slightly from 17.58% in FY21 to 15.11%* in FY22 primarily on account of increase in the

material cost. Severe supply chain constraints resulted increase in prices of raw materials like casting, forging, steel sheets and

precious metals etc. However, during Q1FY23 margins have improved to 16.22% and with softening of commodity prices margins

are expected to remain at healthy levels*.

Robust financial risk profile combined with high cash and liquid investments

M&M had robust capital structure and debt coverage indicators marked by overall gearing of 0.21x (PY:0.26x) at the end of

FY22, owing to repayment of term loan and reduction in stake of loss-making companies as a part of the Capital Allocation

Strategy. This combined with cash and liquid investment to the tune of Rs. 11,964 crores in FY22 have made the company net-

debt free. The company plans to incur capex and investments of Rs 15075 crs over FY22-FY24. The capex is towards electric

platform development, new product development and capacity expansion in the auto and farm segments and investments in

group companies would majorly be funded through internal accruals. Care believes M&M’s financial risk profile despite the capex

execution would continue to remain robust and net debt free over the medium term.

Highly experienced promoters and management:

M&M is the flagship company of the Mahindra group with the track record of more than 75 years of operations. This group via

its subsidiaries and joint venture is present in 20 industries, across 10 sectors including farm equipment, automotive, financial

services, leisure and hospitality, real estate, logistics among others. The Non Executive Chairman of the company, Mr. Anand

Mahindra, has significant experience within the industry and is assisted by team of senior and seasoned professionals like Dr.

Anish Shah, Managing Director and CEO. Dr. Anish Shah has worked across multiple industries. Along with strong competent

management team with a long track record in the industry, the company has ensured strong corporate governance practices

and a prudent approach to management with an operational oversight of its group companies.

Key rating weaknesses

Auto business prone to macro-economic factors, inherent cyclicality as well as competition

The CV business of M&M (especially MHCV) is highly correlated with economic cycles and hence displays significant variation in

revenues over economic cycles. The passenger vehicle business, although more stable in comparison, impacted by rising fuel

prices and increasing inflation has affected the sentiments of buyers which has adversely impacted the sale of auto segment.

CARE Ratings notes that these risks are to an extent mitigated by the relatively more stable sales in the tractor segment, where

the key demand driver is the level of rural incomes which in turn is tied to adequacy of rainfall and farm output.

M&M has been adversely impacted by the significant increase in competition especially in the UV segment, especially with the

introduction of compact SUVs by international competitors. In order to combat this, the company has made new launches in UV

which has resulted in improved market share to 16.2% in Q1FY23 (FY22:15%) while M&M has the highest revenue market in

SUV of 17.1% in Q1FY23. It also has a pipeline of new models to be launched in the course of next couple of years. CARE

Ratings believes that while new models launches will help the company boost volumes, over the long term, M&M would continue

to be exposed to the intense competition in the auto sector.

Exposure to group companies

The company has adopted a calibrated approach towards investment in subsidiaries and accordingly has identified companies

which would continue to be investible [companies yielding at-least 18% Return on Equity (RoE) or those which are strategic in

nature]. Over FY22-FY24 the company has provided guidance for investment outlay of Rs.1,500 crore in auto and farm companies

and Rs.2,700 crore in other group companies. Higher than envisaged investment would continue to remain a rating monitorable.

Liquidity: Strong

M&M continues to have a strong liquidity position with significant cash and cash equivalents to tune of Rs 11,964 crs as on 31st

March 2022 and unutilized fund based bank lines of Rs 2561 crs. M&M also holds large investment in group companies (listed)

having high market value. M&M reported cashflow from operations of Rs. 7,093.69 crores in FY22 as against Rs. 9,953 crores in

FY21 mainly led by slow-moving inventory owing to disruptions in supply chain and increase in debtors. The liquidity profile is

expected to remain strong despite the planned capex and investment of Rs.15,075 crore over FY22-FY24 which are expected to

be met through internal accruals. M&M enjoys strong financial flexibility with easy access to market and large investments in its

group companies (listed).

2 *As per CARE’s Methodology CARE Ratings Ltd.

Press Release

Analytical approach: Standalone

CARE has adopted a Standalone approach for arriving at the ratings of M&M. CARE has also factored in the support required to

be extended by M&M to its group companies

Applicable criteria

Criteria on assigning ‘outlook’ and ‘credit watch’ to Credit Rating

CARE’s Policy on Default Recognition

Criteria for Short Term Instruments

Liquidity Analysis of Non-Financial Sector Entities

Financial ratios – Non-Financial Sector

Rating Methodology - Manufacturing Companies

Rating Methodology - Commercial Vehicle Industry

Policy on Withdrawal of rating

About the company

Incorporated in 1945, Mahindra & Mahindra Limited (M&M) is the flagship company of the Mahindra group. The group, via various

subsidiaries and joint ventures, is present in 20 industries, across 10 sectors. Its core businesses include manufacture of Auto

[Passenger Vehicles (PV) {Utility Vehicles (UVs), passenger cars], Commercial Vehicles (CV) [Light Commercial Vehicles (LCV),

pick-ups, Medium & Heavy Commercial Vehicles (MHCV)}, three-wheelers, two-wheelers etc.], Farm Equipment (tractors and

other farm equipment) etc. M&M enjoys a dominant position in its leading business segments. It is the largest tractor company

in India with a market share of 40% in tractor segment in India in FY22.

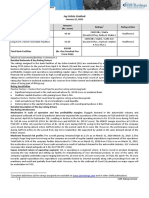

Brief Financials (₹ crore) * FY21 FY22 Q1FY23

Total operating income 45,708.18 59,372.41 19,851.22

PBILDT 8,035.79 8,968.73 3,219.27

PAT 984.16 4,935.22 1,430.16

Overall gearing (times) 0.26 0.21 -

Interest coverage (times) 20.28 40.22 46.13

*Based on CARE’s Methodology

Status of non-cooperation with previous CRA: Not Applicable

Any other information: Not Applicable

Rating history for the last three years: Please refer Annexure-2

Covenants of the rated instruments/facilities: Detailed explanation of covenants of the rated instruments/facilities is

given in Annexure-3

Complexity level of various instruments rated for this company: Annexure-4

Annexure-1: Details of instruments/facilities

Coupon Maturity Size of Rating Assigned

Name of the Date of Issuance

ISIN Rate Date (DD- the Issue along with Rating

Instrument (DD-MM-YYYY)

(%) MM-YYYY) (₹ crore) Outlook

Non-fund-based - ST-

- - - 38.58 CARE A1+

BG/LC

Fund-based - LT-Cash

- - - 547.45 CARE AAA; Stable

Credit

Fund-based - LT-Term

- - June 2025 0.00 Withdrawn

Loan- #

3 *As per CARE’s Methodology CARE Ratings Ltd.

Press Release

Coupon Maturity Size of Rating Assigned

Name of the Date of Issuance

ISIN Rate Date (DD- the Issue along with Rating

Instrument (DD-MM-YYYY)

(%) MM-YYYY) (₹ crore) Outlook

Fund-based - LT/ ST- CARE AAA; Stable /

- - - 600.00

Working Capital Limits CARE A1+

Fund-based - ST-

- - - 15.00 CARE A1+

Working Capital Limits

Non-fund-based - LT-

- - - 239.50 CARE AAA; Stable

BG/LC

# 1250 Cr term loan has been pre paid in August 2022

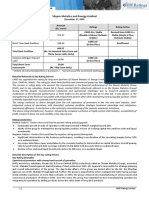

Annexure-2: Rating history for the last three years

Current Ratings Rating History

Date(s) Date(s) Date(s) Date(s)

Name of the

Sr. and and and and

Instrument/Bank Amount

No. Rating(s) Rating(s) Rating(s) Rating(s)

Facilities Type Outstanding Rating

assigned assigned assigned assigned

(₹ crore)

in 2022- in 2021- in 2020- in 2019-

2023 2022 2021 2020

1)CARE 1)CARE

A1+ A1+

1)CARE

(23-Dec-20) (07-Jan-20)

Non-fund-based - CARE A1+

1 ST 38.58 -

ST-BG/LC A1+ (03-Aug-

2)CARE 2)CARE

21)

A1+ A1+

(02-Dec-20) (05-Apr-19)

1)CARE 1)CARE

AAA; Stable AAA; Stable

1)CARE

CARE (23-Dec-20) (07-Jan-20)

Fund-based - LT- AAA; Stable

2 LT 547.45 AAA; -

Cash Credit (03-Aug-

Stable 2)CARE 2)CARE

21)

AAA; Stable AAA; Stable

(02-Dec-20) (05-Apr-19)

1)CARE

AAA; Stable

1)CARE

(23-Dec-20)

Fund-based - LT- AAA; Stable

3 LT - - - -

Term Loan (03-Aug-

2)CARE

21)

AAA; Stable

(02-Dec-20)

CARE 1)CARE

Fund-based - LT/ AAA; AAA; Stable

4 ST-Working Capital LT/ST* 600.00 Stable / - / CARE A1+ - -

Limits CARE (03-Aug-

A1+ 21)

1)CARE

Fund-based - ST-

CARE A1+

5 Working Capital ST 15.00 - - -

A1+ (03-Aug-

Limits

21)

1)CARE

CARE

Non-fund-based - AAA; Stable

6 LT 239.50 AAA; - - -

LT-BG/LC (03-Aug-

Stable

21)

*Long term/Short term.

Annexure-3: Detailed explanation of the covenants of the rated instruments/facilities – Not Applicable

4 *As per CARE’s Methodology CARE Ratings Ltd.

Press Release

Annexure-4: Complexity level of various instruments rated for this company

Sr. No. Name of Instrument Complexity Level

1 Fund-based - LT-Cash Credit Simple

2 Fund-based - LT-Term Loan Simple

3 Fund-based - LT/ ST-Working Capital Limits Simple

4 Fund-based - ST-Working Capital Limits Simple

5 Non-fund-based - LT-BG/LC Simple

6 Non-fund-based - ST-BG/LC Simple

Annexure-5: Bank lender details for this company

To view the lender wise details of bank facilities please click here

Note on complexity levels of the rated instruments: CARE Ratings has classified instruments rated by it on the basis of

complexity. Investors/market intermediaries/regulators or others are welcome to write to care@careedge.in for any clarifications.

5 *As per CARE’s Methodology CARE Ratings Ltd.

Press Release

Contact us

Media contact

Name: Mradul Mishra

Phone: +91-22-6754 3596

E-mail: mradul.mishra@careedge.in

Analyst contact

Name: Arti Roy

Phone: 9819261115

E-mail: arti.roy@careedge.in

Relationship contact

Name: Saikat Roy

Phone: +91-98209 98779

E-mail: saikat.roy@careedge.in

About us:

Established in 1993, CARE Ratings is one of the leading credit rating agencies in India. Registered under the Securities and

Exchange Board of India, it has been acknowledged as an External Credit Assessment Institution by the RBI. With an equitable

position in the Indian capital market, CARE Ratings provides a wide array of credit rating services that help corporates raise capital

and enable investors to make informed decisions. With an established track record of rating companies over almost three decades,

CARE Ratings follows a robust and transparent rating process that leverages its domain and analytical expertise, backed by the

methodologies congruent with the international best practices. CARE Ratings has played a pivotal role in developing bank debt

and capital market instruments, including commercial papers, corporate bonds and debentures, and structured credit.

Disclaimer:

The ratings issued by CARE Ratings are opinions on the likelihood of timely payment of the obligations under the rated instrument

and are not recommendations to sanction, renew, disburse, or recall the concerned bank facilities or to buy, sell, or hold any

security. These ratings do not convey suitability or price for the investor. The agency does not constitute an audit on the rated

entity. CARE Ratings has based its ratings/outlook based on information obtained from reliable and credible sources. CARE Ratings

does not, however, guarantee the accuracy, adequacy, or completeness of any information and is not responsible for any errors

or omissions and the results obtained from the use of such information. Most entities whose bank facilities/instruments are rated

by CARE Ratings have paid a credit rating fee, based on the amount and type of bank facilities/instruments. CARE Ratings or its

subsidiaries/associates may also be involved with other commercial transactions with the entity. In case of partnership/proprietary

concerns, the rating/outlook assigned by CARE Ratings is, inter-alia, based on the capital deployed by the partners/proprietors

and the current financial strength of the firm. The ratings/outlook may change in case of withdrawal of capital, or the unsecured

loans brought in by the partners/proprietors in addition to the financial performance and other relevant factors. CARE Ratings is

not responsible for any errors and states that it has no financial liability whatsoever to the users of the ratings of CARE Ratings.

The ratings of CARE Ratings do not factor in any rating-related trigger clauses as per the terms of the facilities/instruments, which

may involve acceleration of payments in case of rating downgrades. However, if any such clauses are introduced and triggered,

the ratings may see volatility and sharp downgrades.

For the detailed Rationale Report and subscription information,

please visit www.careedge.in

6 *As per CARE’s Methodology CARE Ratings Ltd.

You might also like

- Maithan Alloys LimitedDocument6 pagesMaithan Alloys Limiteddrkashish1989No ratings yet

- Tarsons Products LimitedDocument6 pagesTarsons Products LimitedRAROLINKSNo ratings yet

- Technico Industries LimitedDocument4 pagesTechnico Industries Limitedshankarravi8975No ratings yet

- Kalpataru Power Transmission LimitedDocument8 pagesKalpataru Power Transmission LimitedjayNo ratings yet

- RACL Geartech ratings reaffirmedDocument4 pagesRACL Geartech ratings reaffirmedSourav DuttaNo ratings yet

- Press Release RACL Geartech LTDDocument4 pagesPress Release RACL Geartech LTDSourav DuttaNo ratings yet

- Radico Khaitan LimitedDocument6 pagesRadico Khaitan LimitedHarminder Singh BajwaNo ratings yet

- Press Release Adani Agri Logistics (Harda) LimitedDocument5 pagesPress Release Adani Agri Logistics (Harda) Limitedsurprise MFNo ratings yet

- 06012022070753_IMC_LimitedDocument5 pages06012022070753_IMC_LimitedMayank AgarwalNo ratings yet

- Tarsons Products LimitedDocument5 pagesTarsons Products LimitedujjwalgoldNo ratings yet

- 2nd DocumentDocument14 pages2nd DocumentSanjay GulatiNo ratings yet

- Subros LimitedDocument8 pagesSubros LimitedrajpersonalNo ratings yet

- TGV SRAAC LimitedDocument6 pagesTGV SRAAC Limitedjayadeep akasamNo ratings yet

- 10102022062806_Myra_Hygiene_Products_Private_LimitedDocument7 pages10102022062806_Myra_Hygiene_Products_Private_Limitedanuj7729No ratings yet

- Press Release Gravita India Limited: Ratings Facilities Amount (Rs. Crore) Ratings Rating ActionDocument7 pagesPress Release Gravita India Limited: Ratings Facilities Amount (Rs. Crore) Ratings Rating ActionhamsNo ratings yet

- Udaipur Cement Works receives rating reaffirmationDocument6 pagesUdaipur Cement Works receives rating reaffirmationflying400No ratings yet

- T V Sundram Iyengar-R-16022018Document7 pagesT V Sundram Iyengar-R-16022018AGN YaNo ratings yet

- CARE_Sunflag_4.01.2024Document9 pagesCARE_Sunflag_4.01.2024Swapnil SomkuwarNo ratings yet

- Thriveni Earthmovers Private LimitedDocument9 pagesThriveni Earthmovers Private Limitedarc14consultantNo ratings yet

- Unit OperatorDocument7 pagesUnit OperatorJimmyNo ratings yet

- Care Rating Sterling - Addlife - India - Private - LimitedDocument6 pagesCare Rating Sterling - Addlife - India - Private - Limitedrahul.tibrewalNo ratings yet

- SMFG India Credit Company LimitedDocument9 pagesSMFG India Credit Company Limitedvatsal sinhaNo ratings yet

- 07022023063446_Waaree_Energies_LimitedDocument6 pages07022023063446_Waaree_Energies_LimitedHasik JainNo ratings yet

- Press Release Adani Agri Logistics (Harda) Limited: Details of Facilities in Annexure-1Document3 pagesPress Release Adani Agri Logistics (Harda) Limited: Details of Facilities in Annexure-1surprise MFNo ratings yet

- Rating Definitions - 19 July 2018Document4 pagesRating Definitions - 19 July 2018SushantNo ratings yet

- Rating Rationale - Adani Wilmar LimitedDocument13 pagesRating Rationale - Adani Wilmar LimitedAnjum SamiraNo ratings yet

- Roots Industries India Limited: Facilities/Instruments Amount (Rs. Crore) Rating Rating ActionDocument4 pagesRoots Industries India Limited: Facilities/Instruments Amount (Rs. Crore) Rating Rating ActionKarthikeyan RK SwamyNo ratings yet

- Export-Import Bank of India: Summary of Rated InstrumentsDocument12 pagesExport-Import Bank of India: Summary of Rated InstrumentsSakthi GaneshNo ratings yet

- La Opala RG LimitedDocument5 pagesLa Opala RG LimitedAshwani KesharwaniNo ratings yet

- Press Release Irb Invit Fund: Complete Definition of The Ratings Assigned Are Available at and Other Care PublicationsDocument5 pagesPress Release Irb Invit Fund: Complete Definition of The Ratings Assigned Are Available at and Other Care PublicationsANUBHAVCFANo ratings yet

- Coptech Wire IndustryDocument4 pagesCoptech Wire IndustryKarthi KarthiNo ratings yet

- Credit Rating - Jun 2021 - Atmastco - LimitedDocument4 pagesCredit Rating - Jun 2021 - Atmastco - LimitedSaurav GanguliNo ratings yet

- Press Release Mehul Construction Company Private Limited: Details of Instruments/facilities in Annexure-1Document5 pagesPress Release Mehul Construction Company Private Limited: Details of Instruments/facilities in Annexure-1tejasNo ratings yet

- Jay Ushin Limited: Rationale-Press ReleaseDocument4 pagesJay Ushin Limited: Rationale-Press Releaseravi.youNo ratings yet

- Aachi Masala Foods-R-28092018 PDFDocument7 pagesAachi Masala Foods-R-28092018 PDFபாரத் அச்சுNo ratings yet

- SREI INFRASTRUCTURE FINANCE RATINGS REVALIDATEDDocument5 pagesSREI INFRASTRUCTURE FINANCE RATINGS REVALIDATEDpassitsNo ratings yet

- R. K. Marble Private Limited-12!30!2020Document6 pagesR. K. Marble Private Limited-12!30!2020Brajpal JhalaNo ratings yet

- Press Release Adani Agri Logistics (Harda) Limited: Rating Sensitivities: Positive Factors: Negative FactorsDocument4 pagesPress Release Adani Agri Logistics (Harda) Limited: Rating Sensitivities: Positive Factors: Negative Factorssurprise MFNo ratings yet

- AETHER Industries LTD - 2020 Credit RatingDocument5 pagesAETHER Industries LTD - 2020 Credit RatingEast West Strategic ConsultingNo ratings yet

- Press Release Airo Lam Limited: Details of Instruments/facilities in Annexure-1Document4 pagesPress Release Airo Lam Limited: Details of Instruments/facilities in Annexure-1flying400No ratings yet

- 04102022073602_Divis_Laboratories_LimitedDocument7 pages04102022073602_Divis_Laboratories_Limiteddivygupta198No ratings yet

- 24/7 Customer Private Limited withdraws ratingsDocument4 pages24/7 Customer Private Limited withdraws ratingsData CentrumNo ratings yet

- Ramani Cars Private Limited 2023Document6 pagesRamani Cars Private Limited 2023Karthikeyan RK SwamyNo ratings yet

- Coral AssociatesDocument5 pagesCoral AssociatesFunny CloudsNo ratings yet

- Press Release Om Logistics Limited: Details of Instruments/facilities in Annexure-1Document6 pagesPress Release Om Logistics Limited: Details of Instruments/facilities in Annexure-1Sinius InfracomNo ratings yet

- Raymond Limited - (CARE) 18th November 2019Document7 pagesRaymond Limited - (CARE) 18th November 2019Moin KhanNo ratings yet

- Housing Development Finance Corporation LimitedDocument6 pagesHousing Development Finance Corporation LimitedTejpal SainiNo ratings yet

- MSL Driveline Systems - R - 16102020Document8 pagesMSL Driveline Systems - R - 16102020DarshanNo ratings yet

- Shyam Metalics and Energy Limited-12-17-2020Document7 pagesShyam Metalics and Energy Limited-12-17-2020Parth PatelNo ratings yet

- Ganga Rasayanie Private Limited-R-10102019Document7 pagesGanga Rasayanie Private Limited-R-10102019DarshanNo ratings yet

- Press Release Tab India Granites Private LimitedDocument6 pagesPress Release Tab India Granites Private LimitedRavi BabuNo ratings yet

- Akar Auto Industries LimitedDocument5 pagesAkar Auto Industries Limitedkrushna.maneNo ratings yet

- Piramal Pharma LimitedDocument6 pagesPiramal Pharma Limitedsoumyadwip samantaNo ratings yet

- Amarth Ifestyle RetailingDocument5 pagesAmarth Ifestyle Retailingheera lal thakurNo ratings yet

- Tata Advanced Materials-R-28062019Document7 pagesTata Advanced Materials-R-28062019shoaib merchantNo ratings yet

- 03102022060503 Tamilnadu Newsprint & Papers LimitedDocument5 pages03102022060503 Tamilnadu Newsprint & Papers LimitedspipsmailNo ratings yet

- Antony Waste Handling Cell LimitedDocument5 pagesAntony Waste Handling Cell Limitedsoumyadwip samantaNo ratings yet

- Mamta Transformers-R-19102020Document7 pagesMamta Transformers-R-19102020DarshanNo ratings yet

- Majesco Software and Solutions India Private Limited: Summary of Rated InstrumentsDocument7 pagesMajesco Software and Solutions India Private Limited: Summary of Rated InstrumentsJatin SoniNo ratings yet

- Vinaytech - Power Bi - Demo - Conclusion - Important - TermsDocument19 pagesVinaytech - Power Bi - Demo - Conclusion - Important - TermsSsNo ratings yet

- Aquatic Animal Protection Act 2017 1960Document8 pagesAquatic Animal Protection Act 2017 1960Subham DahalNo ratings yet

- Registered Architects 2019 Grade 1Document3 pagesRegistered Architects 2019 Grade 1santosh bharathy100% (1)

- 25 0 - Command RefDocument632 pages25 0 - Command RefVitaly KroivetsNo ratings yet

- Tall Buildings Case Studies of John Hancock Centre and Sears TowerDocument75 pagesTall Buildings Case Studies of John Hancock Centre and Sears TowerShanikAromgottilNo ratings yet

- Billy: Bookcase SeriesDocument4 pagesBilly: Bookcase SeriesDImkaNo ratings yet

- International SellingDocument28 pagesInternational SellingShoaib ImtiazNo ratings yet

- Automatic Railway Gate ControlDocument6 pagesAutomatic Railway Gate ControlRithesh VRNo ratings yet

- Balara - Mechanical Drawings - IFC PDFDocument6 pagesBalara - Mechanical Drawings - IFC PDFjomer john estoneloNo ratings yet

- Scratch 2Document45 pagesScratch 2Mihai Alexandru Tuțu0% (1)

- GSN April Meeting Explores Tasiast Gold Deposit DiscoveryDocument18 pagesGSN April Meeting Explores Tasiast Gold Deposit DiscoveryarisNo ratings yet

- Ravi KantDocument1 pageRavi KanthimeltoujoursperitusNo ratings yet

- Practical Units for fps, mks, and cgs Systems Comparison ChartDocument2 pagesPractical Units for fps, mks, and cgs Systems Comparison ChartRohail HussainNo ratings yet

- Republic Act No. 7611Document27 pagesRepublic Act No. 7611Paul John Page PachecoNo ratings yet

- Certificates Search For King and Queen 2019Document13 pagesCertificates Search For King and Queen 2019Kebu YenNo ratings yet

- Computerized Scholarship Monitoring SystemDocument11 pagesComputerized Scholarship Monitoring SystemCharles VegasNo ratings yet

- Timor-1 CFSPP Project Supporting Dokumen: Doc No.: 003.SD/ENC-UBE/TIMOR1/III/2021 Ref No. 0Document2 pagesTimor-1 CFSPP Project Supporting Dokumen: Doc No.: 003.SD/ENC-UBE/TIMOR1/III/2021 Ref No. 0Hendra AwanNo ratings yet

- Minutes of 7th AC MeetingDocument4 pagesMinutes of 7th AC Meetingganesh15100% (1)

- Kami Export - Year 11 Spring Break RevisionDocument90 pagesKami Export - Year 11 Spring Break Revisionbkhmnrq4d6No ratings yet

- Azure FaDocument4 pagesAzure Faanurag pattanayakNo ratings yet

- Artificer Infusions: Boots of The Winding PathDocument6 pagesArtificer Infusions: Boots of The Winding PathKylisseNo ratings yet

- Project Report TemplateDocument9 pagesProject Report TemplatePriyasha BanerjeeNo ratings yet

- Shades of White: Rendering in WatercolorDocument4 pagesShades of White: Rendering in WatercolorMichael Reardon100% (4)

- Feed Management of Sheep and Goats Formulation, Ingredients, Organic, DIY Feed Mix, and Feeding PracticesDocument6 pagesFeed Management of Sheep and Goats Formulation, Ingredients, Organic, DIY Feed Mix, and Feeding PracticesAdusumelli AkshayNo ratings yet

- Freshwater Pollution in Some Nigerian Local Communities, Causes, Consequences and Probable SolutionsDocument8 pagesFreshwater Pollution in Some Nigerian Local Communities, Causes, Consequences and Probable SolutionsZari Sofia LevisteNo ratings yet

- Demise of Blockbuster - A Case Study ReviewDocument13 pagesDemise of Blockbuster - A Case Study ReviewYash MudliarNo ratings yet

- L46 - Whitefield Lab Home Visit Sy No. 18/1B, K R Puram, Hobli, Sree Sai Harsha Tower, White FieldDocument4 pagesL46 - Whitefield Lab Home Visit Sy No. 18/1B, K R Puram, Hobli, Sree Sai Harsha Tower, White FieldSayantan BanerjeeNo ratings yet

- DMC500 ManualDocument16 pagesDMC500 Manualroops04No ratings yet

- TENDA Wifi RepeaterDocument45 pagesTENDA Wifi RepeaterZsolt MarkóNo ratings yet