Professional Documents

Culture Documents

Tamilnadu Newsprint & Papers Limited

Uploaded by

spipsmailOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tamilnadu Newsprint & Papers Limited

Uploaded by

spipsmailCopyright:

Available Formats

Press Release

Tamilnadu Newsprint & Papers Limited

October 03, 2022

Ratings

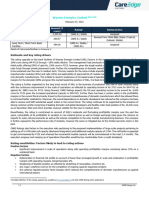

Facilities/Instruments Amount (₹ crore) Rating1 Rating Action

CARE A; Stable

1,672.53 Reaffirmed; Outlook

Long Term Bank Facilities (Single A; Outlook:

(Enhanced from 1,638.70) revised from Negative

Stable )

CARE A; Stable /

Long Term / Short Term Bank CARE A1 Reaffirmed; Outlook

350.00

Facilities (Single A ; Outlook: revised from Negative

Stable/ A One )

1,745.41 CARE A1

Short Term Bank Facilities Reaffirmed

(Enhanced from 1,275.00) (A One )

3,767.94

(₹ Three Thousand Seven Hundred

Total Bank Facilities

Sixty-Seven Crore and Ninety-Four

Lakhs Only)

Details of instruments/facilities in Annexure-1.

Detailed rationale and key rating drivers

The ratings assigned to the bank facilities of Tamil Nadu Newsprint and Papers Limited (TNPL) continue to factor in the strong

operational track record with TNPL being one of the largest integrated players with a well-established distribution network in

Print and Writing Paper (PWP) segment, strong raw material sourcing capabilities and improving capacity utilization at paper

board plant every year. The ratings further derive strength from improved operational and financial performance of TNPL during

FY22 (refers to the period April 1 to March 31) with recovery in demand from major consumption centres and the backward

integration achieved at unit II with operationalization of pulp mill in Q1FY23. The rating also factors in prepayment of debt done

in FY22 and Q1FY23 which improved debt metrics moderately and with no major capex planned in FY23, debt metrics are

expected to improve further. Care ratings expects profitability margins of TNPL to improve in packaging board segment going

forward with the commissioning of new pulp mill at unit-2 which is expected to reduce the dependency on high cost imported

pulp. The ratings are however constrained by the leveraged capital structure with a large debt funded capital expenditure

undertaken in the recent past and exposure of TNPL to volatility in raw material prices and forex rates. Nevertheless, CARE

Ratings notes the financial flexibility that TNPL enjoys, with track record of raising debt at competitive rates to ease out

repayments.

Rating sensitivities

Positive factors – Factors that could lead to positive rating action/upgrade:

• Deriving benefits from the capital expenditure that is being incurred with resultant improvement in profitability of the

paper board segment to above 15% on continuous basis

• Reduction in leverage levels with overall gearing around unity

Negative factors – Factors that could lead to negative rating action/downgrade:

• Any moderation in profitability leading to lower accruals resulting in Total debt to PBILDT of above 4.75x on

continuous basis

• Underutilization of capacity at paper mill below 80% on continuous basis

Detailed description of the key rating drivers

Key rating strengths

Strong operational track record in PWP industry with integrated nature of operations

TNPL has been operational for over four decades and has emerged as one of the leading manufacturers of Printing and Writing

Paper (PWP) in India. TNPL operates an integrated pulp and paper mill (Unit I) at Karur District of Tamil Nadu with three paper

machines aggregating to a total installed capacity of 4 lakh Tonnes Per Annum (TPA). Unit I has a pulping capacity of 1,180 tpd

as on March 31, 2022, including hardwood pulping capacity of 330 tpd, chemical bagasse pulping capacity of 550 tpd and de-

inking pulp plant with a capacity of 300 tpd. The company also developed captive power plants along with this unit with a

capacity of 103.62 MW as on March 31, 2022. Unit I is self-sufficient in terms of both its pulp and power requirements. This unit

also has an in-house cement plant which uses lime sludge waste and fly ash produced during the paper production to produce

1

Complete definition of the ratings assigned are available at www.careedge.in and other CARE Ratings Ltd.’s publications

CARE Ratings Ltd.

1

Press Release

cement. Besides this, the company also has wind farms with a capacity of 35.50 MW located in Tirunelveli district of Tamil

Nadu. The company has significant presence in the domestic PWP market supported by network of dealers across India. Being

one of the largest players in the domestic paper industry along with long track record, TNPL has been able to establish strong

relationship with its customers. TNPL also acts a key supplier for paper for textbooks and other material to the Government of

Tamil Nadu.

During FY22, due to improved demand on account of opening of school/offices and major consumption centers for the

company, capacity utilization at Unit I improved to 97% as against 81% in FY21. Careedge expects the improved demand to

sustain in the medium term.

Strong raw material sourcing capabilities

TNPL sources bagasse which is the primary raw material from local sugar mills on barter basis in exchange for coal which is

used to produce steam used in these sugar mills. Long-term agreements have been entered into with eight sugar mills in Tamil

Nadu for sourcing bagasse in exchange for coal supplied for generation of steam. Shortfall is met through open market

purchases and temporary tie-up arrangements with sugar mills. The share of bagasse in the overall raw material mix has

remained fairly stable around 50% in the past three years. Wood pulp contributes to the remaining share in the overall raw

material mix and the company procures a major share of pulpwood from Tamil Nadu Forest Plantation Corporation Limited

(TAFCON). TNPL has entered into an MOU with TAFCON for pulpwood supplies for 15 years, and the balance pulpwood

requirement is generally met through private purchases and contract farming/farm forestry. TNPL also has in-house

biotechnology and bio-energy research centres to develop tissue culture seedlings, which are used as mother plants in its

plantation schemes. As on March 31, 2022, the company had established pulpwood plantations in total of 211280 acres from

2004-05 (1,87,680 acres as on March 31, 2021) under its captive plantation and farm forestry scheme.

Improving capacity utilization and profit margins in paperboard segment

TNPL operates a multilayer double coated board plant (Unit II) with an annual capacity of 2 lakh TPA which was set up as a

green field project in Manaparai taluk, Trichy district. In Q1FY23, the pulp mill at Unit II became fully operational with a

capacity of 1.45 lakh tpa equivalent to almost 400 tpd. This is expected to bring down TNPL’s dependency on imported pulp

requirement as well as maintain consistency in raw material quality. Overall capacity utilization in board plant during FY22 has

improved to 92% as against 86% in FY21 due to healthy demand. Sales realization from board plant stood at Rs. 1128 crore in

FY22 as against Rs. 837 crore in FY21. However, PBILDT margins in paper board segment moderated to 8.9% in FY22 (PY:

14.5%) due to increase in variable costs (raw materials, power & fuel etc.) from 75% of revenues in FY21 to 80% of revenues

in FY22. However, in Q1FY23, paper board segment witnessed improved PBILDT margins of 20.9% mainly due to the in-house

pulp which was used from the new pulp mill

Improvement in business performance in FY22 due to recovery in demand

TOI of the company during FY22 has improved by 45% to Rs. 4036 crore as against Rs. 2784 crore in FY21 on account of

recovery in demand both domestic and export. Overall capacity utilization in paper mill has improved to 97% in FY22 (PY: 81%)

and capacity utilization in board plant stood at 92% (PY: 86%). Though PBILDT margin moderated in FY22 by 64 bps in

absolute terms PBILDT level has improved owing to 45% increase in TOI. This led to increased cash accruals of the company in

FY22. The company reported significant Y-o-Y improvement in Q1FY23 performance by reporting TOI of Rs. 1128 crore as

compared to Rs. 632 crore reported in Q1FY22.

Key rating weaknesses

Improved but leveraged capital structure; however, the company enjoys high refinancing capability

The company’s capital structure though improved but continues to remain leveraged with an overall gearing of 1.77x as on

March 31, 2022 compared with 1.92x as on March 31, 2021. Debt funded capacity expansions in the recent past have impacted

debt protection metrics. However, with improved FY22 performance and debt prepayment in FY22 and Q1FY23, debt metrics

have improved as comparison to previous year, though still highly leveraged. The company’s Total debt/GCA was 11.33x as on

March 31, 2022 as against 22.42x as on March 31, 2021. Interest coverage ratio stood at 2.39x as on in FY22 as against 1.55x

in FY21. The company is contemplating about the phase II of the expansion plan and no major capex is expected to be carried

out in FY23. Enhancement in debt levels associated with implementation of phase II capex in the future and its impact on debt

metrics of the company would remain a key monitorable in the future.

TNPL enjoys strong financial flexibility with track record of availing debt of longer tenures to ease out repayments. High cost

loans are replaced with lower cost loans on regular basis. Continuous monitoring and readjusting of loan portfolio have enabled

the company to keep the cost of borrowing at the minimum level. Apart from regular Repayment, TNPL has prepaid Rs 391 Cr

during FY22. The company has strong refinancing capability to raise fresh term loans to fund any shortfalls.

Exposure to volatility in raw material and fuel prices

The company is exposed to volatility associated with the raw material prices and fuel prices. The company obtains bagasse

through barter arrangement with sugar mills in exchange for steam. The steam is produced in the power boilers of the

company. The company imports coal and any volatility in coal price can affect the profitability margins and to partially offset

this risk, the company had started utilising internally generated agro fuels such as pith wood dust bark as fuel in power boilers

reducing dependency on imported coal. The company also imports pulp, and any steep fluctuations could affect the profitability

levels of the company.

CARE Ratings Ltd.

2

Press Release

Liquidity: Adequate

TNPL’s liquidity is expected to be adequate mainly due to its financial flexibility which is evident from the ability of the company

to raise longer tenure loans from various lender at competitive interest rates. TNPL’s long term debt repayment obligations are

sizeable at Rs. 243 crore in FY23 and Rs. 316 crore in FY24 against which the company is expected to generate cash accruals in

excess of Rs. 300 crore in the coming years. The company’s average working capital utilization was moderate at 65% for the

past twelve months ended June 2022. The company had a moderate cash balance of Rs. 12 crore as on March 31, 2022.

Analytical approach

Standalone

Applicable criteria

Policy on default recognition

Financial Ratios – Non financial Sector

Liquidity Analysis of Non-financial sector entities

Rating Outlook and Credit Watch

Short Term Instruments

Manufacturing Companies

Paper Industry

Policy on Withdrawal of Ratings

About the company

TNPL was promoted by the Government of Tamil Nadu (GoTN) and the Industrial Development Bank of India (IDBI) in 1979 to

manufacture Newsprint / Printing & Writing paper (PWP) using bagasse as the primary raw material. In 2004, IDBI offloaded its

stake in TNPL and since then GoTN has become the single largest stake holder in the company. GoTN holds 35.32% stake as

on June 30, 2022. The company now operates two plants and has presence in the PWP and packaging board business and is

one of the largest players in the domestic paper and paper products industry. The company has a strong management team

wherein the CMD is appointed by the Government of Tamil Nadu and he is supported by well-experienced executives handling

key functions in the organization.

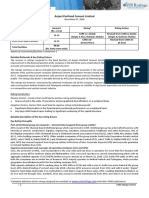

Brief Financials (₹ crore) March 31, 2021 (A) March 31, 2022 (A) Q1FY23 (UA)

Total operating income 2,784.18 4,036.29 1128.29

PBILDT 276.62 374.38 176.39

PAT -65.11 14.33 60.40

Overall gearing (times) 1.92 1.77 NA

Interest coverage (times) 1.43 2.39 6.58

A: Audited, UA: Unaudited, NA: Not Available

Status of non-cooperation with previous CRA:

Not applicable

Any other information:

Disclosure of Interest of Independent/Non-Executive Directors of CARE Ratings Ltd.:

Name of Director Designation of Director

V. Chandrasekaran Non-Executive -Non-Independent Director

Mr. V. Chandrasekaran who is Non-Executive Independent Director on the Board of Tamilnadu Newsprint & Papers Limited is

Non-Executive, Non-Independent Director of CARE. Independent/Non-executive Directors of CARE are not a part of CARE's

Rating Committee and do not participate in the rating process.

Rating history for the last three years: Please refer Annexure-2

Covenants of the rated instruments/facilities: Detailed explanation of covenants of the rated instruments/facilities is

given in Annexure-3

CARE Ratings Ltd.

3

Press Release

Complexity level of various instruments rated for this company: Annexure-4

Annexure-1: Details of instruments/facilities

Coupon Maturity Size of the Rating Assigned

Name of the Date of Issuance

ISIN Rate Date (DD- Issue along with Rating

Instrument (DD-MM-YYYY)

(%) MM-YYYY) (₹ crore) Outlook

Fund-based - LT-Term

- - - 01/11/2029 1672.53 CARE A; Stable

Loan

Fund-based - LT/ ST- CARE A; Stable / CARE

- - - - 350.00

CC/PC/Bill Discounting A1

Non-fund-based - ST-

- - - - 350.00 CARE A1

BG/LC

Fund-based/Non-fund-

- - - - 375.00 CARE A1

based-Short Term

Fund-based/Non-fund-

- - - - 1020.41 CARE A1

based-Short Term

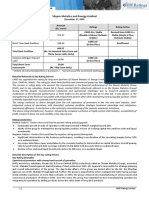

Annexure-2: Rating history for the last three years

Current Ratings Rating History

Date(s) Date(s) Date(s) Date(s)

Name of the

Sr. and and and and

Instrument/Bank Amount

No. Rating(s) Rating(s) Rating(s) Rating(s)

Facilities Type Outstanding Rating

assigned assigned assigned assigned

(₹ crore)

in 2022- in 2021- in 2020- in 2019-

2023 2022 2021 2020

1)CARE A; 1)CARE A; 1)CARE A;

Fund-based - LT- CARE A;

1 LT 1672.53 - Negative Stable Stable

Term Loan Stable

(09-Sep-21) (07-Dec-20) (15-Nov-19)

CARE A; 1)CARE A; 1)CARE A; 1)CARE A;

Fund-based - LT/

Stable / Negative / Stable / Stable /

2 ST-CC/PC/Bill LT/ST* 350.00 -

CARE CARE A1 CARE A1 CARE A1

Discounting

A1 (09-Sep-21) (07-Dec-20) (15-Nov-19)

Non-fund-based - CARE 1)CARE A1 1)CARE A1 1)CARE A1

3 ST 350.00 -

ST-BG/LC A1 (09-Sep-21) (07-Dec-20) (15-Nov-19)

Fund-based/Non-

CARE 1)CARE A1 1)CARE A1 1)CARE A1

4 fund-based-Short ST 375.00 -

A1 (09-Sep-21) (07-Dec-20) (15-Nov-19)

Term

Fund-based/Non-

CARE 1)CARE A1 1)CARE A1 1)CARE A1

5 fund-based-Short ST 1020.41 -

A1 (09-Sep-21) (07-Dec-20) (15-Nov-19)

Term

*Long term/Short term.

Annexure-3: Detailed explanation of the covenants of the rated instruments/facilities – Not applicable

Annexure-4: Complexity level of various instruments rated for this company

Sr. No. Name of Instrument Complexity Level

1 Fund-based - LT-Term Loan Simple

2 Fund-based - LT/ ST-CC/PC/Bill Discounting Simple

CARE Ratings Ltd.

4

Press Release

Sr. No. Name of Instrument Complexity Level

1 Fund-based - LT-Term Loan Simple

3 Fund-based/Non-fund-based-Short Term Simple

4 Non-fund-based - ST-BG/LC Simple

Annexure-5: Bank lender details for this company

To view the lender wise details of bank facilities please click here

Note on complexity levels of the rated instruments: CARE Ratings has classified instruments rated by it on the basis of

complexity. Investors/market intermediaries/regulators or others are welcome to write to care@careedge.in for any

clarifications.

Contact us

Media contact

Name: Mradul Mishra

Phone: +91-22-6754 3596

E-mail: mradul.mishra@careedge.in

Analyst contact

Name: Naveen Kumar Dhondy

Phone: 8886097382

E-mail: dnaveen.kumar@careedge.in

Relationship contact

Name: Pradeep Kumar V

Phone: +91-98407 54521

E-mail: pradeep.kumar@careedge.in

About us:

Established in 1993, CARE Ratings is one of the leading credit rating agencies in India. Registered under the Securities and

Exchange Board of India, it has been acknowledged as an External Credit Assessment Institution by the RBI. With an equitable

position in the Indian capital market, CARE Ratings provides a wide array of credit rating services that help corporates raise

capital and enable investors to make informed decisions. With an established track record of rating companies over almost

three decades, CARE Ratings follows a robust and transparent rating process that leverages its domain and analytical expertise,

backed by the methodologies congruent with the international best practices. CARE Ratings has played a pivotal role in

developing bank debt and capital market instruments, including commercial papers, corporate bonds and debentures, and

structured credit.

Disclaimer:

The ratings issued by CARE Ratings are opinions on the likelihood of timely payment of the obligations under the rated instrument and are not recommendations to

sanction, renew, disburse, or recall the concerned bank facilities or to buy, sell, or hold any security. These ratings do not convey suitability or price for the investor.

The agency does not constitute an audit on the rated entity. CARE Ratings has based its ratings/outlook based on information obtained from reliable and credible

sources. CARE Ratings does not, however, guarantee the accuracy, adequacy, or completeness of any information and is not responsible for any errors or omissions

and the results obtained from the use of such information. Most entities whose bank facilities/instruments are rated by CARE Ratings have paid a credit rating fee,

based on the amount and type of bank facilities/instruments. CARE Ratings or its subsidiaries/associates may also be involved with other commercial transactions

with the entity. In case of partnership/proprietary concerns, the rating/outlook assigned by CARE Ratings is, inter-alia, based on the capital deployed by the

partners/proprietors and the current financial strength of the firm. The ratings/outlook may change in case of withdrawal of capital, or the unsecured loans brought

in by the partners/proprietors in addition to the financial performance and other relevant factors. CARE Ratings is not responsible for any errors and states that it

has no financial liability whatsoever to the users of the ratings of CARE Ratings. The ratings of CARE Ratings do not factor in any rating-related trigger clauses as

per the terms of the facilities/instruments, which may involve acceleration of payments in case of rating downgrades. However, if any such clauses are introduced

and triggered, the ratings may see volatility and sharp downgrades.

For the detailed Rationale Report and subscription information,

please visit www.careedge.in

CARE Ratings Ltd.

5

You might also like

- Mortgages 2019Document60 pagesMortgages 2019Ivana JayNo ratings yet

- Lean and Green Banking in India 2012Document20 pagesLean and Green Banking in India 2012Prof Dr Chowdari Prasad100% (2)

- Chap 017Document37 pagesChap 017Izzy Cohn0% (1)

- Inflation in ZimbabweDocument18 pagesInflation in ZimbabweKhairul Imran100% (1)

- 142 International Corporate Bank Vs Gueco 351 Scra 516Document2 pages142 International Corporate Bank Vs Gueco 351 Scra 516Alan GultiaNo ratings yet

- Bookkeeping Problems Batch 1Document2 pagesBookkeeping Problems Batch 1lanz kristoff racho100% (1)

- Unit OperatorDocument7 pagesUnit OperatorJimmyNo ratings yet

- Thriveni Earthmovers Private LimitedDocument9 pagesThriveni Earthmovers Private Limitedarc14consultantNo ratings yet

- Jodhani Papers Private LimitedDocument5 pagesJodhani Papers Private LimitedPunit PansariNo ratings yet

- Mahindra & Mahindra LimitedDocument6 pagesMahindra & Mahindra Limitedjerin jNo ratings yet

- Kalpataru Power Transmission LimitedDocument8 pagesKalpataru Power Transmission LimitedjayNo ratings yet

- Radico Khaitan LimitedDocument6 pagesRadico Khaitan LimitedHarminder Singh BajwaNo ratings yet

- Amman TRY Sponge and Power Private LimitedDocument4 pagesAmman TRY Sponge and Power Private LimitedKathiresan Mathavi's SonNo ratings yet

- TGV SRAAC LimitedDocument6 pagesTGV SRAAC Limitedjayadeep akasamNo ratings yet

- Tarsons Products LimitedDocument5 pagesTarsons Products LimitedujjwalgoldNo ratings yet

- Cleanmax IPP 2 Private LimitedDocument5 pagesCleanmax IPP 2 Private LimitedDhawal VasavadaNo ratings yet

- CARE Sunflag 4.01.2024Document9 pagesCARE Sunflag 4.01.2024Swapnil SomkuwarNo ratings yet

- Press Release Tab India Granites Private LimitedDocument6 pagesPress Release Tab India Granites Private LimitedRavi BabuNo ratings yet

- Greentech Power Private Limited-01-06-2020 PDFDocument4 pagesGreentech Power Private Limited-01-06-2020 PDFMukesh TodiNo ratings yet

- Toyo Engineering India Private LimitedDocument4 pagesToyo Engineering India Private LimitedWaseem AnsariNo ratings yet

- The Tata Power Company Limited 202214Document11 pagesThe Tata Power Company Limited 202214pratik567No ratings yet

- PR ARCL Organics 31jan22Document7 pagesPR ARCL Organics 31jan22anady135344No ratings yet

- Research Paper - Rashmi Sponge Iron & Power Industries LTDDocument6 pagesResearch Paper - Rashmi Sponge Iron & Power Industries LTDSoumyakanti S. Samanta (Pgdm 09-11, Batch II)No ratings yet

- Waaree Energies LimitedDocument6 pagesWaaree Energies LimitedHasik JainNo ratings yet

- Maithan Alloys LimitedDocument6 pagesMaithan Alloys Limiteddrkashish1989No ratings yet

- IMC LimitedDocument5 pagesIMC LimitedMayank AgarwalNo ratings yet

- Press Release Udaipur Cement Works LimitedDocument6 pagesPress Release Udaipur Cement Works Limitedflying400No ratings yet

- Ganesha Ecosphere Limited-01-29-2019Document6 pagesGanesha Ecosphere Limited-01-29-2019gangashaharNo ratings yet

- Technico Industries LimitedDocument4 pagesTechnico Industries Limitedshankarravi8975No ratings yet

- Press Release Suzlon Energy Limited: Details of Instruments/facilities in Annexure-1Document5 pagesPress Release Suzlon Energy Limited: Details of Instruments/facilities in Annexure-1Thakur Anmol RajputNo ratings yet

- KPR Care Rating Jan 21Document4 pagesKPR Care Rating Jan 21V KeshavdevNo ratings yet

- Press Release Anjani Portland Cement LimitedDocument5 pagesPress Release Anjani Portland Cement LimitedSandy SanNo ratings yet

- Antony Waste Handling Cell LimitedDocument5 pagesAntony Waste Handling Cell Limitedsoumyadwip samantaNo ratings yet

- Triveni ICRA March 2024Document9 pagesTriveni ICRA March 2024Puneet367No ratings yet

- Press Release RACL Geartech LTDDocument4 pagesPress Release RACL Geartech LTDSourav DuttaNo ratings yet

- Emcer Tiles Private LimitedDocument4 pagesEmcer Tiles Private LimitedRudra RoyNo ratings yet

- Sri Balamurugan Modern Rice MillDocument4 pagesSri Balamurugan Modern Rice MillDon't knowNo ratings yet

- Press Release RACL Geartech LTDDocument4 pagesPress Release RACL Geartech LTDSourav DuttaNo ratings yet

- Press Release Tarsons Products Private Limited: Details of Instruments/facilities in Annexure-1Document4 pagesPress Release Tarsons Products Private Limited: Details of Instruments/facilities in Annexure-1hussainNo ratings yet

- Thriveni Sainik Mining Private Limited 2023Document8 pagesThriveni Sainik Mining Private Limited 2023Karthikeyan RK SwamyNo ratings yet

- Press Release Adani Agri Logistics (Harda) LimitedDocument5 pagesPress Release Adani Agri Logistics (Harda) Limitedsurprise MFNo ratings yet

- Mega Steel IndustriesDocument4 pagesMega Steel IndustrieshseckalpeshNo ratings yet

- Tata Advanced Materials-R-28062019Document7 pagesTata Advanced Materials-R-28062019shoaib merchantNo ratings yet

- Gujarat State Fertilizers & Chemicals LimitedDocument6 pagesGujarat State Fertilizers & Chemicals LimitedGopal PatelNo ratings yet

- Shyam Metalics and Energy Limited-12-17-2020Document7 pagesShyam Metalics and Energy Limited-12-17-2020Parth PatelNo ratings yet

- Naresh Kumar and Company Private LimitedDocument5 pagesNaresh Kumar and Company Private LimitedKunalNo ratings yet

- Press Release Gravita India Limited: Ratings Facilities Amount (Rs. Crore) Ratings Rating ActionDocument7 pagesPress Release Gravita India Limited: Ratings Facilities Amount (Rs. Crore) Ratings Rating ActionhamsNo ratings yet

- Rating Rationale - Adani Wilmar LimitedDocument13 pagesRating Rationale - Adani Wilmar LimitedAnjum SamiraNo ratings yet

- 108 Emergency Medical Transport ServicesDocument4 pages108 Emergency Medical Transport ServicesData CentrumNo ratings yet

- Press Release Pennar Industries Limited: Details of Instruments/facilities in Annexure-1Document4 pagesPress Release Pennar Industries Limited: Details of Instruments/facilities in Annexure-1Radha MohanNo ratings yet

- Roots Industries India Limited: Facilities/Instruments Amount (Rs. Crore) Rating Rating ActionDocument4 pagesRoots Industries India Limited: Facilities/Instruments Amount (Rs. Crore) Rating Rating ActionKarthikeyan RK SwamyNo ratings yet

- PR Mahamaya Sponge Iron 8jan24Document9 pagesPR Mahamaya Sponge Iron 8jan24Rohit MotapartiNo ratings yet

- La Opala RG LimitedDocument5 pagesLa Opala RG LimitedAshwani KesharwaniNo ratings yet

- Press Release Deccan Industries: Positive FactorsDocument4 pagesPress Release Deccan Industries: Positive FactorsHARI HARANNo ratings yet

- Press Release Panoli Intermediates (India) Private Limited: Details of Instruments/ Facilities in Annexure-1Document6 pagesPress Release Panoli Intermediates (India) Private Limited: Details of Instruments/ Facilities in Annexure-1Patel ZeelNo ratings yet

- K.P.R. Sugar Mill LimitedDocument7 pagesK.P.R. Sugar Mill LimitedKarthikeyan RK SwamyNo ratings yet

- Sunlex Fabrics Private Limited - Care RatingsDocument6 pagesSunlex Fabrics Private Limited - Care RatingsManeet GoyalNo ratings yet

- Filatex India Limited PDFDocument6 pagesFilatex India Limited PDFfatNo ratings yet

- Emami Paper Mills Limited-08-19-2019 PDFDocument7 pagesEmami Paper Mills Limited-08-19-2019 PDFAdhiraj BNo ratings yet

- Pump DesignDocument4 pagesPump Designmarathasanatani6No ratings yet

- T V Sundram Iyengar-R-16022018Document7 pagesT V Sundram Iyengar-R-16022018AGN YaNo ratings yet

- Press Release Aro Granite Industries Limited: Details of Instruments/facilities in Annexure-1Document4 pagesPress Release Aro Granite Industries Limited: Details of Instruments/facilities in Annexure-1Ravi BabuNo ratings yet

- Tarsons Products LimitedDocument6 pagesTarsons Products LimitedRAROLINKSNo ratings yet

- Gujarat Themis Biosyn LimitedDocument5 pagesGujarat Themis Biosyn LimitedAshwani KesharwaniNo ratings yet

- Myra Hygiene Products Private LimitedDocument7 pagesMyra Hygiene Products Private Limitedanuj7729No ratings yet

- Usury and Unconscionable Interest RatesDocument6 pagesUsury and Unconscionable Interest RatesClauds GadzzNo ratings yet

- List of LedgersDocument5 pagesList of Ledgersripon_84No ratings yet

- Edge Cities or Edge Suburbs?Document25 pagesEdge Cities or Edge Suburbs?Urbam RedNo ratings yet

- Aira Gene Meneses - Pretest-On-Identifying-Threats-To-IndependenceDocument2 pagesAira Gene Meneses - Pretest-On-Identifying-Threats-To-IndependenceAira Gene MenesesNo ratings yet

- Financial Literacy Scavenger HuntDocument3 pagesFinancial Literacy Scavenger HuntDIEGO ALEJANDRO VELEZ AQUINONo ratings yet

- Working Capital MGTDocument76 pagesWorking Capital MGTNSRanganathNo ratings yet

- Ansbacher Cayman Report Appendix Volume 10Document719 pagesAnsbacher Cayman Report Appendix Volume 10thestorydotieNo ratings yet

- Mircofinance Control Prooflist Dec. 2014Document3 pagesMircofinance Control Prooflist Dec. 2014ShanelleSeanAlexanderNo ratings yet

- A.C. No. 7353 NELSON P. VALDEZ, Petitioner, Atty. Antolin Allyson Dabon, JR., RespondentDocument5 pagesA.C. No. 7353 NELSON P. VALDEZ, Petitioner, Atty. Antolin Allyson Dabon, JR., RespondentkennethpenusNo ratings yet

- Intern Report of Audit FirmDocument28 pagesIntern Report of Audit FirmTahsin ChowdhuryNo ratings yet

- Nova Scotia Nominee Program NSNP 100 - Application Form For The Principal ApplicantDocument25 pagesNova Scotia Nominee Program NSNP 100 - Application Form For The Principal ApplicantAnaBejucNo ratings yet

- Inflation of BhutanDocument12 pagesInflation of BhutanMarkWeberNo ratings yet

- Salomon V SalomonDocument6 pagesSalomon V Salomonjeff omangaNo ratings yet

- Internship Report: On National Bank of PakistanDocument71 pagesInternship Report: On National Bank of PakistanChaudaxy XUmarNo ratings yet

- What Is Financial Inclusion?: Providing Formal Credit AvenuesDocument5 pagesWhat Is Financial Inclusion?: Providing Formal Credit AvenuesRahul WaniNo ratings yet

- Securitization Manual Final DraftDocument119 pagesSecuritization Manual Final DraftSameer MalikNo ratings yet

- Clarissa Computation StramaDocument29 pagesClarissa Computation StramaZejkeara ImperialNo ratings yet

- Arcega Vs CADocument3 pagesArcega Vs CAJesa BayonetaNo ratings yet

- Ch3 Solutions To The ExercisesDocument3 pagesCh3 Solutions To The ExercisesNishant Sharma0% (1)

- Growth of State Bank of IndiaDocument8 pagesGrowth of State Bank of IndiaAkchat JainNo ratings yet

- Gagoomal vs. Spouses VillacortaDocument11 pagesGagoomal vs. Spouses VillacortaVincent Ong100% (1)

- Partnership AccountingDocument64 pagesPartnership AccountingKashifntcNo ratings yet

- What Is Engineering EconomyDocument1 pageWhat Is Engineering EconomyAndrea BaltazarNo ratings yet

- IIBPS PO DI English - pdf-38 PDFDocument11 pagesIIBPS PO DI English - pdf-38 PDFRahul GaurNo ratings yet