Professional Documents

Culture Documents

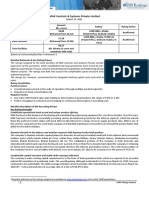

Roots Industries India Limited: Facilities/Instruments Amount (Rs. Crore) Rating Rating Action

Uploaded by

Karthikeyan RK SwamyOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Roots Industries India Limited: Facilities/Instruments Amount (Rs. Crore) Rating Rating Action

Uploaded by

Karthikeyan RK SwamyCopyright:

Available Formats

Press Release

Roots Industries India Limited

March 07, 2022

Ratings

Amount

Facilities/Instruments Rating1 Rating Action

(Rs. crore)

51.99 CARE A; Stable

Long Term Bank Facilities Reaffirmed

(Enhanced from 44.35) (Single A; Outlook: Stable )

Short Term Bank CARE A1

2.50 Reaffirmed

Facilities (A One )

54.49

Total Bank Facilities (Rs. Fifty-Four Crore and Forty-Nine

Lakhs Only)

Details of instruments/facilities in Annexure-1

Detailed Rationale & Key Rating Drivers

The ratings assigned to the bank facilities of Roots Industries India Limited (RIIL) continue to derive strength from the vast

experience of the promoters, well-established image of the “Roots” brand in the electronic horn segment along with dominant

share in the replacement market supported by an extensive dealer network and RIIL’s exclusive supplier status to reputed

international original equipment manufacturers (OEMs). The ratings also factor in RIIL’s stable operational performance with

improved revenues from HPED division, comfortable financial risk profile & debt coverage indicators.

The ratings are, however, constrained by the small revenue base with considerable dependence on a single product basket,

presence of large number of unorganised players in the replacement market, exposure to volatility in raw material prices and

elongated receivables period.

Rating Sensitivities

Positive Factors

• Consistent growth in the scale of operations with diversification into multiple product segments

• Sustainable improvement in operating margins upwards of 13%-14% by focusing on higher margin products

Negative Factors

• Decline in profit margins on a consistent basis

• Any large debt-funded capex leading to deterioration in capital structure or increase in leverage ratios above the range of 0.5-

0.75x

Detailed description of the key rating drivers

Key Rating Strengths

Established track record of the promoter

RIIL is part of the Roots group, which has a track record of over four decades. Roots group is one of the leading business houses

in Coimbatore, with ten companies under its umbrella, manufacturing diverse auto ancillary products which include horns,

aluminium castings, plastic components, precision components, cleaning equipment etc. RIIL is led by Mr K Ramasamy, a first-

generation entrepreneur and technocrat.

Dominant share in the electric horn replacement market with strong dealer network

RIIL is one of the leading manufacturers and a well-established player in the electric horns market in India, with a wide range of

products. The company manufactures about 15 families of horns of differing types (more than 700 variants), sizes and

performance. The company has a strong distribution network of over 40 distributors, 3320 dealers and offers after-sales service

in around 170 service centres all over India.

Reputed international OEM clients:

The company has reputed international OEMs in its client portfolio, which includes Harley Davidson Motor Company (exclusive

supplier for its worldwide operations), Navistar Trucks, Daimler Chrysler, Mitsubishi, Nissan among others for many of whom RIIL

is the exclusive supplier, reflecting on its capabilities and quality standards. The top 10 customers (Horns +HPED) contributed to

44.52% of total income in FY21 as against 33.78% in FY20.

Stable operational performance supported by improved contribution from the HPED division

The total operating income of the company witnessed a growth of 19% from Rs.273.90 crore in FY20 to Rs.326.73 crore in FY21

on back of revenue growth in HPED segment. The revenue generated from the High Precision Engineering Division (HPED) has

been consistently growing year on year with the company catering to majorly medical equipment manufacturers. With a revenue

1

Complete definition of the ratings assigned are available at www.careedge.in and other CARE Ratings Ltd.’s publications

1 CARE Ratings Ltd.

Press Release

share of 15% in FY16, the division contributed 37.3% in FY21. Post the outbreak of Covid-19, there had been a significant surge

in orders received under this division as RIIL manufactures oxygen regulators and cart assembly for ventilators.

Despite the significant de growth in the auto sector and continuous slowdown for the past two years, the company has been able

to maintain its stable performance year on year due to its mix of replacement & OEM as well as growing sales from other divisions.

Comfortable Financial risk profile & debt coverage indicators

With conservative debt funded capex in the past, the capital structure remains comfortable with overall gearing of 0.18x (PY:

0.20x) as on March 31, 2021. The debt coverage indicators stood comfortable with total debt/ GCA of 0.79 years as on March 31,

2021, and interest coverage of 17.65x in FY21.

Key Rating Weaknesses

Small revenue base with considerable dependence on a single product basket

Though the company had been operational for nearly 3 decades, the scale of operations stood relatively smaller with total

operating income of Rs.326 crore in FY21 (PY: Rs.273 crore). The sales are concentrated towards horns contributing to 57.8%

(PY: 72.30%) of total revenue in FY21.

Volatile margins susceptible to fluctuations in raw material prices & foreign exchange risk

The PBILDT margins of the company have exhibited volatility in the past and have remained in the range of 13-15% in the last

three years. Raw material prices (mainly consisting of Cold rolled carbon steel (CRCS), Grill and copper wire) have been volatile

in the past. As the company caters predominantly to the replacement market, it has some pricing flexibility to pass on the increase

in raw material costs unlike sales to OEMs. The company’s margins are also exposed to foreign currency fluctuations since it has

both exports as well as imports. Foreign exposure is hedged by way of forward contracts and natural hedge and the balance 50%

remains open.

Liquidity: Adequate

Liquidity is adequate marked by healthy cash accruals of Rs. 36.44 crore and debt repayment obligations of Rs. 5.17 crore for

FY22. As on March 31, 2021, the current ratio of the company stood comfortable to 1.80 times (PY: 2.08x). The average working

capital utilization of the company for the twelve months ended January 2022 was 50%. The operating cycle of the company

improved to 128 days for FY21 mainly on account of improved collections. The receivables period stood moderately high at 94

days because, the replacement market sales which comprises of company’s 70% income, happens through dealers and distributors

who gets extended credit period compared to OEM sales. However, the company had not faced any collection issues in its

replacement market even during the Covid times. The company had a free cash and bank balance of Rs. 19.80 crore as on

December 31, 2021 (PY: Rs.25.76 crore). Going forward, RIIL’s liquidity is expected to remain comfortable on the back of healthy

cash accruals.

Analytical approach: Standalone.

Applicable Criteria

Policy on default recognition

Financial Ratios – Non financial Sector

Liquidity Analysis of Non-financial sector entities

Rating Outlook and Credit Watch

Short Term Instruments

Auto Ancillary Companies

Manufacturing Companies

About the Company

RIIL is a Coimbatore-based company engaged in manufacture of electric horns for automobiles. RIIL was incorporated as a private

limited company in 1990 to take over the operations of American Auto Service, another group firm started by the group’s chairman,

Mr K Ramasamy, in 1970. RIIL was subsequently converted to a public limited company in 1994. The company also caters to the

requirements of medical equipment manufacturers in the healthcare industry out of its High Precision Engineering Components

Division (HPED) and is engaged in the trading of automobile parts and manufacturing of furniture.

Brief Financials (Rs. crore) FY20 (A) FY21 (A) 9MFY22(UA)

Total operating income 273.90 326.73 287.93

PBILDT 38.29 49.07 34.20

PAT 16.32 24.88 16.74

Overall gearing (times) 0.20 0.18 NA

Interest coverage (times) 10.88 17.65 16.52

A-Audited; UA- Unaudited.

2 CARE Ratings Ltd.

Press Release

Status of non-cooperation with previous CRA: Not Applicable.

Any other information: Not Applicable

Rating History for last three years: Please refer Annexure-2

Covenants of rated instrument / facility: Detailed explanation of covenants of the rated instruments/facilities is given in

Annexure-3

Complexity level of various instruments rated for this company: Annexure 4

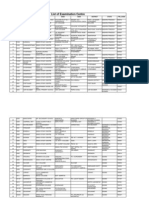

Annexure-1: Details of Instruments/Facilities

Size of the

Name of the Date of Coupon Maturity Rating assigned along

ISIN Issue

Instrument Issuance Rate Date with Rating Outlook

(Rs. crore)

Fund-based - LT-Cash

- - - 42.00 CARE A; Stable

Credit

Non-fund-based - ST-

- - - 1.75 CARE A1

Bank Guarantee

Non-fund-based - ST-

- - - 0.75 CARE A1

Letter of credit

Fund-based - LT-Term

- - Mar 2024 9.99 CARE A; Stable

Loan

Annexure-2: Rating History of last three years

Current Ratings Rating history

Date(s) & Date(s) & Date(s) &

Name of the Date(s) &

Sr. Amount Rating(s) Rating(s) Rating(s)

Instrument/Bank Rating(s)

No. Type Outstanding Rating assigned assigned assigned

Facilities assigned in

(Rs. crore) in 2021- in 2019- in 2018-

2020-2021

2022 2020 2019

CARE 1)CARE A; 1)CARE A; 1)CARE A;

Fund-based - LT-

1 LT 42.00 A; - Stable Stable Positive

Cash Credit

Stable (26-Mar-21) (06-Mar-20) (14-Mar-19)

Non-fund-based - CARE 1)CARE A1 1)CARE A1 1)CARE A1

2 ST 1.75 -

ST-Bank Guarantee A1 (26-Mar-21) (06-Mar-20) (14-Mar-19)

Non-fund-based - CARE 1)CARE A1 1)CARE A1 1)CARE A1

3 ST 0.75 -

ST-Letter of credit A1 (26-Mar-21) (06-Mar-20) (14-Mar-19)

Fund-based - ST- 1)Withdrawn 1)CARE A1 1)CARE A1

4 ST - - -

EPC/PSC (26-Mar-21) (06-Mar-20) (14-Mar-19)

CARE 1)CARE A; 1)CARE A; 1)CARE A;

Fund-based - LT-

5 LT 9.99 A; - Stable Stable Positive

Term Loan

Stable (26-Mar-21) (06-Mar-20) (14-Mar-19)

* Long Term / Short Term

Annexure 3: Detailed explanation of covenants of the rated facilities: Not Applicable

Annexure 4: Complexity level of various instruments rated for this company

Sr. No Name of instrument Complexity level

1 Fund-based - LT-Cash Credit Simple

2 Fund-based - LT-Term Loan Simple

3 Non-fund-based - ST-Bank Guarantee Simple

4 Non-fund-based - ST-Letter of credit Simple

Annexure 5: Bank Lender Details for this Company

To view the lender wise details of bank facilities please click here

Note on complexity levels of the rated instrument: CARE Ratings Ltd. has classified instruments rated by it on the basis of

complexity. Investors/market intermediaries/regulators or others are welcome to write to care@careedge.in for any clarifications

3 CARE Ratings Ltd.

Press Release

Contact us

Media Contact

Name: Mradul Mishra

Contact no.: +91-22-6754 3573

Email ID: mradul.mishra@careedge.in

Analyst Contact

Name: Swathi Subramanian

Contact no.: 9444234834

Email ID: swathi.subramanian@careedge.in

Relationship Contact

Name: Pradeep Kumar V

Contact no.: +91-98407 54521

Email ID: pradeep.kumar@careedge.in

About CARE Ratings Limited:

Established in 1993, CARE Ratings Ltd. is one of the leading credit rating agencies in India. Registered under the Securities and

Exchange Board of India (SEBI), it has also been acknowledged as an External Credit Assessment Institution (ECAI) by the

Reserve Bank of India (RBI). With an equitable position in the Indian capital market, CARE Ratings Limited provides a wide array

of credit rating services that help corporates to raise capital and enable investors to make informed decisions backed by knowledge

and assessment provided by the company.

With an established track record of rating companies over almost three decades, we follow a robust and transparent rating process

that leverages our domain and analytical expertise backed by the methodologies congruent with the international best practices.

CARE Ratings Limited has had a pivotal role to play in developing bank debt and capital market instruments including CPs,

corporate bonds and debentures, and structured credit.

Disclaimer

The ratings issued by CARE Ratings Limited are opinions on the likelihood of timely payment of the obligations under the rated

instrument and are not recommendations to sanction, renew, disburse or recall the concerned bank facilities or to buy, sell or

hold any security. These ratings do not convey suitability or price for the investor. The agency does not constitute an audit on

the rated entity. CARE Ratings Limited has based its ratings/outlooks based on information obtained from reliable and credible

sources. CARE Ratings Limited does not, however, guarantee the accuracy, adequacy or completeness of any information and

is not responsible for any errors or omissions and the results obtained from the use of such information. Most entities whose

bank facilities/instruments are rated by CARE Ratings Limited have paid a credit rating fee, based on the amount and type of

bank facilities/instruments. CARE Ratings Limited or its subsidiaries/associates may also be involved with other commercial

transactions with the entity. In case of partnership/proprietary concerns, the rating /outlook assigned by CARE Ratings Limited

is, inter-alia, based on the capital deployed by the partners/proprietor and the current financial strength of the firm. The

rating/outlook may undergo a change in case of withdrawal of capital or the unsecured loans brought in by the

partners/proprietor in addition to the financial performance and other relevant factors. CARE Ratings Limited is not responsible

for any errors and states that it has no financial liability whatsoever to the users of CARE Ratings Limited’s rating.

Our ratings do not factor in any rating related trigger clauses as per the terms of the facility/instrument, which may involve

acceleration of payments in case of rating downgrades. However, if any such clauses are introduced and if triggered, the

ratings may see volatility and sharp downgrades.

**For detailed Rationale Report and subscription information, please contact us at www.careedge.in

4 CARE Ratings Ltd.

You might also like

- Accounting Ratios FormulasDocument2 pagesAccounting Ratios Formulastuku67No ratings yet

- Motor Load and Efficiency PDFDocument16 pagesMotor Load and Efficiency PDFwfjerrNo ratings yet

- DC Fundamentals Handbook Electrical Science Volume 3 of 4Document119 pagesDC Fundamentals Handbook Electrical Science Volume 3 of 4Sk RajNo ratings yet

- MB0045 Financial Management Answer KeyDocument21 pagesMB0045 Financial Management Answer Keysureshganji06No ratings yet

- Financial MGT Module 1Document24 pagesFinancial MGT Module 1Anjelika ViescaNo ratings yet

- Factors Affecting Cost of CapitalDocument40 pagesFactors Affecting Cost of CapitalKartik AroraNo ratings yet

- AC Induction Motor FundamentalsDocument24 pagesAC Induction Motor Fundamentalsrohtahir100% (3)

- Problem Set Capital StructureQADocument15 pagesProblem Set Capital StructureQAIng Hong100% (1)

- Division of Taxpayers - CentreDocument1,451 pagesDivision of Taxpayers - Centresundar111167% (3)

- Technico Industries LimitedDocument4 pagesTechnico Industries Limitedshankarravi8975No ratings yet

- Press Release RACL Geartech LTDDocument4 pagesPress Release RACL Geartech LTDSourav DuttaNo ratings yet

- Jay Ushin Limited: Rationale-Press ReleaseDocument4 pagesJay Ushin Limited: Rationale-Press Releaseravi.youNo ratings yet

- Press Release RACL Geartech LTDDocument4 pagesPress Release RACL Geartech LTDSourav DuttaNo ratings yet

- Press Release Deccan Industries: Positive FactorsDocument4 pagesPress Release Deccan Industries: Positive FactorsHARI HARANNo ratings yet

- PR ARCL Organics 31jan22Document7 pagesPR ARCL Organics 31jan22anady135344No ratings yet

- Tarsons Products LimitedDocument5 pagesTarsons Products LimitedujjwalgoldNo ratings yet

- Prayag Polymers Private LimitedDocument4 pagesPrayag Polymers Private Limitednandinimishra6168No ratings yet

- Maithan Alloys LimitedDocument6 pagesMaithan Alloys Limiteddrkashish1989No ratings yet

- Press Release: Positive Factors - Factors That Could Lead To Positive Rating Action/upgradeDocument4 pagesPress Release: Positive Factors - Factors That Could Lead To Positive Rating Action/upgradeACE CONSULTANTSNo ratings yet

- IMC LimitedDocument5 pagesIMC LimitedMayank AgarwalNo ratings yet

- Press Release Pennar Industries Limited: Details of Instruments/facilities in Annexure-1Document4 pagesPress Release Pennar Industries Limited: Details of Instruments/facilities in Annexure-1Radha MohanNo ratings yet

- Myra Hygiene Products Private LimitedDocument7 pagesMyra Hygiene Products Private Limitedanuj7729No ratings yet

- Amarth Ifestyle RetailingDocument5 pagesAmarth Ifestyle Retailingheera lal thakurNo ratings yet

- Rating Definitions - 19 July 2018Document4 pagesRating Definitions - 19 July 2018SushantNo ratings yet

- Shaily Engineering Plastics Limited-09-25-2019Document4 pagesShaily Engineering Plastics Limited-09-25-2019Ashutosh Gupta100% (1)

- Press Release Panoli Intermediates (India) Private Limited: Details of Instruments/ Facilities in Annexure-1Document6 pagesPress Release Panoli Intermediates (India) Private Limited: Details of Instruments/ Facilities in Annexure-1Patel ZeelNo ratings yet

- Emcer Tiles Private LimitedDocument4 pagesEmcer Tiles Private LimitedRudra RoyNo ratings yet

- Sunlex Fabrics Private Limited - Care RatingsDocument6 pagesSunlex Fabrics Private Limited - Care RatingsManeet GoyalNo ratings yet

- IOL Chemicals and Pharmaceuticals Limited-07-07-2020Document4 pagesIOL Chemicals and Pharmaceuticals Limited-07-07-2020Jeet SinghNo ratings yet

- Continental Carbon India LimitedDocument4 pagesContinental Carbon India LimitedKamaldeep MaanNo ratings yet

- Care Rating Sterling - Addlife - India - Private - LimitedDocument6 pagesCare Rating Sterling - Addlife - India - Private - Limitedrahul.tibrewalNo ratings yet

- Radico Khaitan LimitedDocument6 pagesRadico Khaitan LimitedHarminder Singh BajwaNo ratings yet

- Akar Auto Industries LimitedDocument5 pagesAkar Auto Industries Limitedkrushna.maneNo ratings yet

- Mega Steel IndustriesDocument4 pagesMega Steel IndustrieshseckalpeshNo ratings yet

- Ace Designers Limited: Summary of Rated InstrumentsDocument7 pagesAce Designers Limited: Summary of Rated InstrumentskachadaNo ratings yet

- TGV SRAAC LimitedDocument6 pagesTGV SRAAC Limitedjayadeep akasamNo ratings yet

- Waaree Energies LimitedDocument6 pagesWaaree Energies LimitedHasik JainNo ratings yet

- Press Release Airo Lam Limited: Details of Instruments/facilities in Annexure-1Document4 pagesPress Release Airo Lam Limited: Details of Instruments/facilities in Annexure-1flying400No ratings yet

- Shri Balaji Rollings Private LimDocument4 pagesShri Balaji Rollings Private LimData CentrumNo ratings yet

- Raymond Limited - (CARE) 18th November 2019Document7 pagesRaymond Limited - (CARE) 18th November 2019Moin KhanNo ratings yet

- Optus Laminates Private Limited-04!02!2018 2Document4 pagesOptus Laminates Private Limited-04!02!2018 2jainam.gargNo ratings yet

- Press Release Nahar Poly Films LimitedDocument5 pagesPress Release Nahar Poly Films LimitedHarshit SinghNo ratings yet

- Press Release Amkette Analytics Limited: Details of Instruments/facilities in Annexure-1Document5 pagesPress Release Amkette Analytics Limited: Details of Instruments/facilities in Annexure-1Data CentrumNo ratings yet

- R. K. Marble Private Limited-12!30!2020Document6 pagesR. K. Marble Private Limited-12!30!2020Brajpal JhalaNo ratings yet

- Press Release Mehul Construction Company Private Limited: Details of Instruments/facilities in Annexure-1Document5 pagesPress Release Mehul Construction Company Private Limited: Details of Instruments/facilities in Annexure-1tejasNo ratings yet

- Bharat Gears LimitedDocument7 pagesBharat Gears LimitedjagadeeshNo ratings yet

- Oriental Rubber Industries Pvt. LTDDocument7 pagesOriental Rubber Industries Pvt. LTDPriya VijiNo ratings yet

- Press Release Om Logistics Limited: Details of Instruments/facilities in Annexure-1Document6 pagesPress Release Om Logistics Limited: Details of Instruments/facilities in Annexure-1Sinius InfracomNo ratings yet

- CARE Sunflag 4.01.2024Document9 pagesCARE Sunflag 4.01.2024Swapnil SomkuwarNo ratings yet

- PR Chennai Rice 24june22Document8 pagesPR Chennai Rice 24june22RaviNo ratings yet

- Bharat Forge LimitedDocument7 pagesBharat Forge LimitedjagadeeshNo ratings yet

- Arya Steels Rolling (India) LimiteDocument4 pagesArya Steels Rolling (India) LimiteData CentrumNo ratings yet

- Press Release Adani Agri Logistics (Harda) LimitedDocument5 pagesPress Release Adani Agri Logistics (Harda) Limitedsurprise MFNo ratings yet

- Super Spinning Mills Limited-09-08-2020Document4 pagesSuper Spinning Mills Limited-09-08-2020Positive ThinkerNo ratings yet

- Bharat Petroleum Corporation LimitedDocument9 pagesBharat Petroleum Corporation LimitedjagadeeshNo ratings yet

- La Opala RG LimitedDocument5 pagesLa Opala RG LimitedAshwani KesharwaniNo ratings yet

- Divis Laboratories LimitedDocument7 pagesDivis Laboratories Limiteddivygupta198No ratings yet

- Filatex India Limited PDFDocument6 pagesFilatex India Limited PDFfatNo ratings yet

- Ace Designers-R-05042018 PDFDocument7 pagesAce Designers-R-05042018 PDFkachadaNo ratings yet

- Coral AssociatesDocument5 pagesCoral AssociatesFunny CloudsNo ratings yet

- 3F Oil Palm Agrotech Private Limited-02-27-2020 PDFDocument4 pages3F Oil Palm Agrotech Private Limited-02-27-2020 PDFData CentrumNo ratings yet

- KPR Care Rating Jan 21Document4 pagesKPR Care Rating Jan 21V KeshavdevNo ratings yet

- Antony Waste Handling Cell LimitedDocument5 pagesAntony Waste Handling Cell Limitedsoumyadwip samantaNo ratings yet

- Press Release Tarsons Products Private Limited: Details of Instruments/facilities in Annexure-1Document4 pagesPress Release Tarsons Products Private Limited: Details of Instruments/facilities in Annexure-1hussainNo ratings yet

- Jupiter International LimitedDocument6 pagesJupiter International LimitedRahul syalNo ratings yet

- Sun Home Appliances Private - R - 25082020Document7 pagesSun Home Appliances Private - R - 25082020DarshanNo ratings yet

- Ginni Filaments Limited-09!07!2020Document4 pagesGinni Filaments Limited-09!07!2020Saurabh AgarwalNo ratings yet

- Braced for Impact: Reforming Kazakhstan's National Financial Holding for Development Effectiveness and Market CreationFrom EverandBraced for Impact: Reforming Kazakhstan's National Financial Holding for Development Effectiveness and Market CreationNo ratings yet

- Christy Apparels-RA-10-03-2023Document10 pagesChristy Apparels-RA-10-03-2023Karthikeyan RK SwamyNo ratings yet

- Former Judges Madras High CourtDocument11 pagesFormer Judges Madras High CourtKarthikeyan RK SwamyNo ratings yet

- Shree Kongu Velalar Educational TrustDocument3 pagesShree Kongu Velalar Educational TrustKarthikeyan RK SwamyNo ratings yet

- Best Finance Corporation Limited: Facilities/Instruments Amount (Rs. Crore) Rating Rating ActionDocument5 pagesBest Finance Corporation Limited: Facilities/Instruments Amount (Rs. Crore) Rating Rating ActionKarthikeyan RK SwamyNo ratings yet

- Details of Sugar Industries in Tamil NaduDocument3 pagesDetails of Sugar Industries in Tamil NadugouthamNo ratings yet

- Electricity 02 00009 v2Document15 pagesElectricity 02 00009 v2Karthikeyan RK SwamyNo ratings yet

- Sakthi Finance: (Stock Code: 511066)Document144 pagesSakthi Finance: (Stock Code: 511066)Karthikeyan RK SwamyNo ratings yet

- MAK Controls & Systems Private LimitedDocument4 pagesMAK Controls & Systems Private LimitedKarthikeyan RK SwamyNo ratings yet

- MAK Controls & Systems Private LimitedDocument4 pagesMAK Controls & Systems Private LimitedKarthikeyan RK SwamyNo ratings yet

- Sakthi Finance Limited: March 30, 2016Document276 pagesSakthi Finance Limited: March 30, 2016Karthikeyan RK SwamyNo ratings yet

- Time: 2 Hours Maximum Marks: 70 Note: Attempt Any Five (5) Questions. All Questions Carry Equal Marks. Question - 1 Is CompulsoryDocument5 pagesTime: 2 Hours Maximum Marks: 70 Note: Attempt Any Five (5) Questions. All Questions Carry Equal Marks. Question - 1 Is CompulsoryKarthikeyan RK SwamyNo ratings yet

- Raghuram Rajan TOI ArticleDocument2 pagesRaghuram Rajan TOI ArticleKarthikeyan RK SwamyNo ratings yet

- Industrial Drives BIEEE-016Document2 pagesIndustrial Drives BIEEE-016Dawit Shimeles TesfayeNo ratings yet

- B.Tech. in Electrical Engineering (Btelvi) : BIEEE-016 No. of Printed Pages: 2Document2 pagesB.Tech. in Electrical Engineering (Btelvi) : BIEEE-016 No. of Printed Pages: 2Karthikeyan RK SwamyNo ratings yet

- Examination Centre ListDocument54 pagesExamination Centre Listrkthbd58450% (3)

- Training Hand-Out-1Document8 pagesTraining Hand-Out-1Karthikeyan RK SwamyNo ratings yet

- Important: Two Demand Drafts: All The Existing Registered Students (Document3 pagesImportant: Two Demand Drafts: All The Existing Registered Students (Karthikeyan RK SwamyNo ratings yet

- B.Tech. Electrical Engineering (Btelvi) Term-End Examination June, 2013 Biee-018 High Voltage EngineeringDocument2 pagesB.Tech. Electrical Engineering (Btelvi) Term-End Examination June, 2013 Biee-018 High Voltage EngineeringKarthikeyan RK SwamyNo ratings yet

- Application Form For Re-Evaluation of Answer ScriptsDocument3 pagesApplication Form For Re-Evaluation of Answer ScriptsarijitnirmalNo ratings yet

- Basics of Electricity: Siemens STEP 2000 CourseDocument44 pagesBasics of Electricity: Siemens STEP 2000 CourseEveraldo SantanaNo ratings yet

- State Income PDFDocument15 pagesState Income PDFDhivya NarayananNo ratings yet

- Xi Jinping Needs A Trade Deal Just As Much As Donald Trump DoesDocument4 pagesXi Jinping Needs A Trade Deal Just As Much As Donald Trump DoesKarthikeyan RK SwamyNo ratings yet

- Karthikeyan K: Job ObjectiveDocument3 pagesKarthikeyan K: Job ObjectiveKarthikeyan RK SwamyNo ratings yet

- Which Post-Pandemic Government?: Raghuram G. RajanDocument4 pagesWhich Post-Pandemic Government?: Raghuram G. RajanKarthikeyan RK SwamyNo ratings yet

- Chapter 16 Revised 2022Document48 pagesChapter 16 Revised 2022SSNo ratings yet

- Risk, Cost of Capital, and ValuationDocument54 pagesRisk, Cost of Capital, and ValuationKrishna AgarwalNo ratings yet

- Jntu Mba SyllabusDocument77 pagesJntu Mba SyllabusyepurunaiduNo ratings yet

- Capital StructureDocument69 pagesCapital StructureRadha ChoudhariNo ratings yet

- Liquidity Management and Corporate Profitability: Case Study of Selected Manufacturing Companies Listed On The Nigerian Stock ExchangeDocument16 pagesLiquidity Management and Corporate Profitability: Case Study of Selected Manufacturing Companies Listed On The Nigerian Stock ExchangeAta Ullah MukhlisNo ratings yet

- Notes Financial Management Unit 1Document11 pagesNotes Financial Management Unit 1DBZ VëgîtõNo ratings yet

- FINANCIAL MANAGEMENT FULL CHAPTER Part 1Document8 pagesFINANCIAL MANAGEMENT FULL CHAPTER Part 1DIVEY KocharNo ratings yet

- Lecture 6 - Profitability AnalysisDocument21 pagesLecture 6 - Profitability AnalysisTrang Bùi HàNo ratings yet

- A'lla Zahwa Andewi Nugraheni - 464977 - Tugas FM CH 14 & 15Document7 pagesA'lla Zahwa Andewi Nugraheni - 464977 - Tugas FM CH 14 & 15PRA MBANo ratings yet

- Factors Affecting Cost of CapitalDocument11 pagesFactors Affecting Cost of CapitalGairik Deb100% (4)

- Journal of Financial Economics: Francesco D'Acunto, Ryan Liu, Carolin P Ueger, Michael WeberDocument23 pagesJournal of Financial Economics: Francesco D'Acunto, Ryan Liu, Carolin P Ueger, Michael WebersreedharbharathNo ratings yet

- Principles of Corporate Finance 10th Edition Brealey Test BankDocument38 pagesPrinciples of Corporate Finance 10th Edition Brealey Test Bankhoadieps44ki100% (25)

- Project SynopsisDocument6 pagesProject SynopsisAnika MunjalNo ratings yet

- Capital Structure Policy: Fourth EditionDocument48 pagesCapital Structure Policy: Fourth EditionNatasya FlorenciaNo ratings yet

- Unit 11: Assessing Long-Term Debt, Equity, and Capital Structure - Chapter 16Document34 pagesUnit 11: Assessing Long-Term Debt, Equity, and Capital Structure - Chapter 16tanning zhuNo ratings yet

- Importance of Cost of CapitalDocument3 pagesImportance of Cost of CapitalmounicaNo ratings yet

- Cost of Capital NotesDocument6 pagesCost of Capital NotesAmy100% (1)

- Capital Structure DecisionDocument10 pagesCapital Structure DecisionMunni FoyshalNo ratings yet

- Financial ManagementDocument248 pagesFinancial ManagementMadhurjya BoruahNo ratings yet

- Problems-Financial ManagementDocument13 pagesProblems-Financial ManagementGajendra Singh Raghav50% (2)

- Solutions BD3 SM14 GEDocument9 pagesSolutions BD3 SM14 GEAgnes Chew100% (1)

- PHD Corp Fin Syllabus - 2015 PDFDocument11 pagesPHD Corp Fin Syllabus - 2015 PDFMacarenaAntonioNo ratings yet

- Ebit EpsDocument19 pagesEbit EpsPrashant SharmaNo ratings yet

- Liv PDFDocument24 pagesLiv PDFravi sharmaNo ratings yet

- Pengaruh Transfer Pricing, ROA, Firm Size Terhadap Income ShiftingDocument16 pagesPengaruh Transfer Pricing, ROA, Firm Size Terhadap Income ShiftingDuta FickyNo ratings yet