Professional Documents

Culture Documents

Bharat Petroleum Corporation Limited

Uploaded by

jagadeeshOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Bharat Petroleum Corporation Limited

Uploaded by

jagadeeshCopyright:

Available Formats

Press Release

Bharat Petroleum Corporation Limited

August 10, 2023

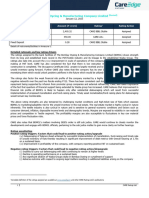

Facilities/Instruments Amount (₹ crore) Rating1 Rating Action

Non-convertible debentures 1,000.00 CARE AAA; Stable Reaffirmed

Non-convertible debentures 500.00 CARE AAA; Stable Reaffirmed

Non-convertible debentures 1,995.20 CARE AAA; Stable Reaffirmed

Non-convertible debentures 435.61 CARE AAA; Stable Reaffirmed

500.00

Non-convertible debentures (Reduced from CARE AAA; Stable Reaffirmed

2,000.00)

Non-convertible debentures 69.19 CARE AAA; Stable Reaffirmed

2,500.00

Commercial paper (Reduced from CARE A1+ Reaffirmed

5,000.00)

4,000.00

Commercial Paper (Reduced from CARE A1+ Reaffirmed

6,500.00)

Details of instruments in Annexure-1.

Rationale and key rating drivers

The ratings assigned to the debt instruments of Bharat Petroleum Corporation Limited (BPCL) continue to derive strength from

its strong parentage, the company being a Maharatna Central Public Sector Enterprise (CPSE) controlled by the Government of

India (GoI), its high strategic importance to the GoI, and the company’s strong operating profile, backed by a sizeable oil

refining capacity and an established marketing and distribution network. The ratings also derive strength from the company’s

healthy financial risk profile, marked by a comfortable capital structure along with strong liquidity.

The rating strengths are, however, tempered by the inherent vulnerability of the company’s profits to the volatility in crack

spreads and crude oil prices, apart from project-implementation risks due to the sizeable capital expenditure (capex) plans, as

well as the increasing competition among its public sector undertaking (PSU) peers as well as from private players and the

competitive industry scenario.

Rating sensitivities: Factors likely to lead to rating actions

Positive factors: Not applicable

Negative factors

• Dilution in the GoI’s stake in BPCL to less than 50% or reduction in its strategic importance to the GoI.

• Sustained weakening of operational performance, marked by lower throughputs and gross refining margins (GRMs).

Analytical approach: Consolidated

For arriving at the ratings, CARE Ratings Limited (CARE Ratings) has considered the consolidated financials of BPCL, owing to

the financial and operational linkages as well as fungible cash flows between the parent and the subsidiaries and joint ventures

(JVs). Moreover, government notching has also been considered, owing to BPCL’s parentage and strategic importance to the

GoI. List of entities whose financials have been consolidated has been placed at Annexure-6.

Outlook: Stable

The ‘Stable’ outlook on the rating reflects that the rated entity shall continue to remain a dominant player in the oil refining and

marketing business, underpinning its strategic importance to the GoI which should help it in maintaining its strong credit profile.

Detailed description of the key rating drivers

Key strengths

1

Complete definition of the ratings assigned are available at www.careedge.in and other CARE Ratings Ltd.’s publications

1 CARE Ratings Ltd.

Press Release

Strong parentage and strategic importance to the GoI

BPCL is majority owned by the GoI (52.98% as on June 30, 2023) and is strategically important to the GoI for achieving its

socio-economic goals. Oil marketing companies (OMCs) have a dominant position in the domestic market for key petroleum

products such as high-speed diesel (HSD), motor spirit (MS), superior kerosene oil (SKO) and liquefied petroleum gas (LPG).

OMCs serve critical policy functions for the supply of fuel throughout the country and these companies have been consistently

supported by the GoI by way of absorbing a good portion of their sales-related under-recoveries through subsidies. During

FY23, the GoI supported BPCL through a one-time grant of ₹5,582 crore for under recoveries suffered by the company in its

marketing segment.

Sizeable refining capacity and a leading OMC

BPCL is India’s second-largest OMC, with a domestic sales volume of over 48.92 million metric tonne (MMT) in FY23 (refers to

the period from April 1 to March 31) and is India’s third-largest refining company with a total refining capacity of 35.30 MMT

(on a consolidated basis) as on March 31, 2023, representing around 14.13% of India's total refining capacity. Among PSUs, in

MS and HSD, BPCL had a retail market share of 29.44% and 28.62%, respectively, during FY23. The company is also a market

leader in terms of throughput per outlet.

BPCL, through its subsidiary –Bharat Petro Resources Limited (BPRL), has presence in the upstream exploration and production

business, with ownership of 17 blocks in six countries as on March 31, 2023. With 21,029 retail outlets as on March 31, 2023

(20,063 retail outlets as on March 31, 2022), BPCL has the second-largest nationwide marketing set up in the country for the

sale of petroleum products.

Strong operational profile

BPCL has three major refineries, located at Mumbai, Kochi and Bina. Its Mumbai refinery has a capacity of 12.0 million metric

tonne per annum (MMTPA), while the one at Kochi has a capacity of 15.5 MMTPA. Bharat Oman Refineries Limited, which has

been merged with BPCL, has a 7.8 MMTPA refinery at Bina in Madhya Pradesh, thereby taking the total refining capacity to 35.3

MMTPA as on March 31, 2023. The capacity utilisation for the refineries of the company has consistently remained high,

indicating strong operating efficiency. The refineries at Mumbai and Kochi are located near the coast, which provides an

advantage to the company in terms of saving transportation costs. BPCL, during FY23, reported a gross refining margin (GRM)

of US$ 20.24 per barrel (bbl) as compared to US$ 9.66 per bbl in FY22. Product cracks have shown a considerable increase in

recent times due to the dislocation in supplies, chiefly due to the Russia-Ukraine war. The rise in GRMs was partially offset by

the increase in crude oil prices, windfall tax levied by the GoI and stagnant retail prices, which has affected the overall margins

of BPCL during FY23. The company’s marketing business performance started improving from Q3FY23 onwards with a reduction

in crude prices. The profitability margins of BPCL have improved in Q1FY24 primarily due to strong marketing performance.

Going forward, the profitability is expected to moderate yet remain healthy with normalisation in marketing margins as the

prices of crude have started moving upwards.

Comfortable financial risk profile

BPCL’s financial risk profile is marked by a comfortable capital structure, marked by an overall gearing of 1.35x as on March 31,

2023 (PY: 1.30x). However, the debt coverage indicators moderated, marked by total debt (TD) to gross cash accruals (GCA) of

7.81 years during FY23 as compared to 3.62 years in FY22, owing to higher debt availed during the year coupled with lower

operating profitability due to weak marketing margins, resulting in an increase in working capital borrowings. Going forward,

CARE Ratings expects the capital structure to improve and remain below 1x owing to the expected improvement in profitability

and lower reliance on debt for funding its capex.

Liquidity: Strong

BPCL derives strong financial flexibility, given its size and strategic importance to the GoI. There is a demonstrated support

from the GoI, leading to a strong fundraising ability. Access to low-cost funds both, from domestic and overseas markets

further enhances its financial flexibility. As on March 31, 2023, BPCL had around ₹7,500 crore as cash and liquid investments

(including around ₹4,200 crore GoI oil bonds). Furthermore, the company has investments in the quoted equity shares of Oil

India Limited (rated ‘CARE AAA; Stable/ CARE A1+’), which provides additional comfort to its liquidity.

Additionally, the company has undrawn working capital limits of around ₹21,000 crore and its internal accruals are expected to

be sufficient to meet its debt repayments obligations of around ₹12,500 crore during FY24.

Key weaknesses

Sizeable capex plans

During FY24, BPCL on a consolidated basis, expects to incur a capex of around ₹13,000 crore in various segments, of which it

will spend around ₹2,500 crore on improving the efficiency of refineries, ₹5,200 crore on the expansion of marketing

2 CARE Ratings Ltd.

Press Release

infrastructure, ₹2,100 crore on investments in exploration, ₹3,000 crore on investments in the gas segment (including pipeline

network), and the remaining amount in other smaller projects. The capex is planned to be funded largely through available

cash, liquid investments and internal accruals. The timely execution of these projects within the estimated costs and the

economic ramp-up of operations post completion of the projects will remain a key monitorable. However, this risk is mitigated

to an extent due to BPCL’s vast experience in successfully undertaking such large projects in the past.

BPCL has also announced an expansion plan worth ₹49,000 crore at its Bina refinery to further increase its presence in the

petrochemical segment and renewable energy segment and augment marketing infrastructure. The project also encompasses

the establishment of an ethylene cracker (EC) complex, downstream petrochemical plants, as well as the expansion of the

existing refinery capacity from 7.8 MMTPA to 11 MMTPA and associated facilities. However, the major expenditure for this

project is expected to be incurred from FY26 onwards.

Exposure to the volatility of crude prices, crack spreads, and foreign exchange rates

The crude oil prices and crack spreads are a function of many dynamic markets and fundamental factors, such as the global

demand-supply dynamics, geopolitical stability in countries with oil reserves, policies of the Organization of the Petroleum

Exporting Countries (OPEC), foreign exchange rates, among others. These factors have translated into a high level of volatility

in oil prices and cracks. Thus, the company’s profitability is exposed to the volatility of crude prices and crack spreads, as well

as foreign exchange fluctuations. BPCL’s profitability was impacted in FY23 due to the stagnant retail prices vis-à-vis high crude

prices.

Industry prospects

The global oil and gas industry is at an inflection point, with governments placing greater priorities on climate change, emerging

alternative sources of energy, and the likely disruption in mobility with the adoption of gas, hydrogen and electric-based

transportation systems. While all these factors will impact the industry growth prospects in the long term, the immediate

outlook remains stable for the sector. The outbreak of COVID-19 had led to GRMs of global refiners plummeting to the lowest

levels in a decade, as demand for refined products crashed, thereby impacting the crack spreads, while a significant decline in

crude oil and refined products prices resulted in substantial inventory write-downs. However, with the impact of the COVID-19

pandemic receding and global economies attempting to come back on the recovery path, the Singapore benchmark GRMs

rebounded meaningfully in FY22 to US$ 4.9 per barrel. Furthermore, geopolitical tensions due to the war between Ukraine and

Russia and the resultant dislocation in global refining capacities, product cracks and GRMs shot up significantly which, however,

temporarily helped the refiners to post higher GRMs during FY23. That said, the GRMs are expected to moderate in FY24 while

remaining healthy, helping refiners.

The global slowdown with the sluggish recovery of the Chinese economy, interest rate hikes, and inflationary pressures have

resulted in a decline in crude oil prices as the global consumption of crude oil declined. However, the decline in crude oil prices

was limited with the production cut announced by OPEC. The announcement of production cuts can keep crude prices elevated,

leading to product prices remaining high.

Environment, social and governance (ESG) risk assessment

Risk factors Compliance and action by the company

Environmental Renewable energy capacity was enhanced from 46.44 MW in FY22 to 62.30 MW by FY23 end.

BPCL undertakes various steps towards energy conservation and carbon reduction.

BPCL disposes its hazardous waste as per guidelines of the Central Pollution Control Board.

Around 50% of its Mumbai refinery raw water consumption is met through the usage of sewage

treated water, recycling of effluent treatment plant (ETP) water, and rainwater harvesting.

Certification of ‘Zero Waste to Land Fil’ has been obtained by its Mumbai refinery and all retail, LPG

and lubricant marketing locations.

Around 22.65% of retail outlets were backed by solar power by FY23 end.

Social There was no lost time due to injury during FY23.

Employee satisfaction enhancement (ESE) department has been set up by BPCL to make the

company ‘A Great Place to Work’.

Around 96% of the company’s non-management employees are represented through 20 registered

trade unions in BPCL across regions and refineries.

Governance During FY23, 41% of BPCL’s board comprised independent directors.

The company has a dedicated investor grievance redressal mechanism and healthy disclosures.

Applicable criteria

Policy on default recognition

3 CARE Ratings Ltd.

Press Release

Consolidation

Factoring Linkages Government Support

Financial Ratios – Non financial Sector

Liquidity Analysis of Non-financial sector entities

Rating Outlook and Credit Watch

Short Term Instruments

Manufacturing Companies

Policy on Withdrawal of Ratings

About the company and industry

Industry classification

Macro-Economic Indicator Sector Industry Basis Industry

Energy Oil, Gas & Consumable Fuels Petroleum Products Refineries & Marketing

BPCL, a GoI undertaking (52.98% holding as on March 31, 2023) and a Fortune 500 company, was originally incorporated as

Bharat-Shell Refineries Limited (BSRL) on November 03, 1952, by Shell Petroleum Company Limited, and subsequently, in 1977,

the name was changed to BPCL. BPCL is an integrated oil refining and marketing company. It is India’s second-largest OMC,

with a domestic sales volume of over 48.92 MMT in FY23. It is India’s third-largest oil refining company, with a total refining

capacity of 35.30 MMT (including the Bina Refinery), representing around 14.13% of India's total refining capacity. With around

21,029 retail outlets as on March 31, 2023, BPCL has the second-largest marketing set up in the country for the sale of

petroleum products. BPCL, through its wholly owned subsidiary – BPRL, has participating interest (PI) in 17 blocks spread

across countries. Apart from stakes in eight blocks in India, BPRL also has PI in nine blocks in Mozambique, Brazil, Indonesia

and the UAE, along with equity stake in two Russian entities.

Brief Financials (₹ crore) FY22 (A) FY23 (Abridged) Q1FY24 (UA)

Total operating income 3,46,791 4,73,187 1,13,546

PBILDT 19,816 10,888 16,347

PAT / (Net loss) 11,682 2,131 10,644

Overall gearing (times) 1.30 1.35 NA

PBILDT Interest coverage (times) 7.61 2.91 18.81

A: Audited, UA: Unaudited; NA: Not Available. Financials are reclassified as per CARE Ratings’ standards.

Note: The above results are the latest financial results available.

Status of non-cooperation with previous CRA: Not applicable

Any other information: Not applicable

Rating history for the last three years: Please refer to Annexure-2

Covenants of the rated instruments/facilities: Please refer Annexure-3

Complexity level of the various instruments rated: Annexure-4

Lender details: Annexure-5

4 CARE Ratings Ltd.

Press Release

Annexure-1: Details of Instruments

Rating

Date of

Maturity Size of the Assigned

Name of the Issuance Coupon

ISIN Date (DD- Issue along with

Instrument (DD-MM- Rate (%)

MM-YYYY) (₹ crore) Rating

YYYY)

Outlook

Debentures-Non

CARE AAA;

Convertible INE029A08057 11-Mar-2019 8.02% 11-Mar-2024 1000.00

Stable

Debentures

Debentures-Non

CARE AAA;

Convertible INE029A08073 17-Mar-2023 7.58% 17-Mar-2026 935.61

Stable

Debentures

Debentures-Non

CARE AAA;

Convertible INE029A08065 6-Jul-2020 6.11% 6-Jul-2025 1995.20

Stable

Debentures

Debentures-Non - -

CARE AAA;

Convertible Proposed - 500.00

Stable

Debentures

Debentures-Non - -

CARE AAA;

Convertible Proposed - 69.19

Stable

Debentures

Commercial paper

Commercial paper - - - 7-364 days 2,500.00 CARE A1+

(Standalone) #

Commercial paper

Commercial paper - - - 7-364 days 4,000.00 CARE A1+

(Standalone) #

#There are no outstanding CPs as on July 31, 2023.

Annexure-2: Rating history for the last three years

Current Ratings Rating History

Date(s) Date(s) Date(s) Date(s)

Name of the

Sr. Amount and and and and

Instrument/Bank

No. Type Outstanding Rating Rating(s) Rating(s) Rating(s) Rating(s)

Facilities

(₹ crore) assigned in assigned in assigned in assigned in

2023-2024 2022-2023 2021-2022 2020-2021

1)CARE AAA 1)CARE AAA

Debentures-Non CARE 1)CARE AAA; 1)CARE AAA; (CW with (CW with

1 Convertible LT 1000.00 AAA; Stable Stable Developing Developing

Debentures Stable (23-Jun-23) (24-Jun-22) Implications) Implications)

(25-Jun-21) (26-Jun-20)

1)CARE AAA 1)CARE AAA

Debentures-Non 1)CARE AAA; (CW with (CW with

1)Withdrawn

2 Convertible LT - - Stable Developing Developing

(23-Jun-23)

Debentures (24-Jun-22) Implications) Implications)

(25-Jun-21) (26-Jun-20)

1)CARE A1+

(29-Jul-20)

2)CARE A1+

Commercial Paper-

CARE 1)CARE A1+ 1)CARE A1+ 1)CARE A1+ (26-Jun-20)

3 Commercial Paper ST 2500.00

A1+ (23-Jun-23) (24-Jun-22) (25-Jun-21)

(Standalone)

3)CARE A1+

(23-Apr-20)

4)CARE A1+

5 CARE Ratings Ltd.

Press Release

Current Ratings Rating History

Date(s) Date(s) Date(s) Date(s)

Name of the

Sr. Amount and and and and

Instrument/Bank

No. Type Outstanding Rating Rating(s) Rating(s) Rating(s) Rating(s)

Facilities

(₹ crore) assigned in assigned in assigned in assigned in

2023-2024 2022-2023 2021-2022 2020-2021

(07-Apr-20)

1)CARE AAA

(CW with

1)CARE AAA; Developing

Stable Implications) 1)CARE AAA

Debentures-Non CARE 1)CARE AAA; (03-Mar-23) (21-Feb-22) (CW with

4 Convertible LT 500.00 AAA; Stable Developing

Debentures Stable (23-Jun-23) 2)CARE AAA; 2)CARE AAA Implications)

Stable (CW with (26-Jun-20)

(24-Jun-22) Developing

Implications)

(25-Jun-21)

1)CARE AAA 1)CARE AAA

Debentures-Non (CW with (CW with

1)Withdrawn

5 Convertible LT - - - Developing Developing

(24-Jun-22)

Debentures Implications) Implications)

(25-Jun-21) (26-Jun-20)

1)CARE AAA 1)CARE AAA

Debentures-Non CARE 1)CARE AAA; 1)CARE AAA; (CW with (CW with

6 Convertible LT 1995.20 AAA; Stable Stable Developing Developing

Debentures Stable (23-Jun-23) (24-Jun-22) Implications) Implications)

(25-Jun-21) (26-Jun-20)

1)CARE A1+

Commercial Paper- (29-Jul-20)

CARE 1)CARE A1+ 1)CARE A1+ 1)CARE A1+

7 Commercial Paper ST 4000.00

A1+ (23-Jun-23) (24-Jun-22) (25-Jun-21)

(Standalone) 2)CARE A1+

(26-Jun-20)

1)CARE AAA

(CW with

1)CARE AAA; Developing

Stable Implications)

Debentures-Non CARE 1)CARE AAA; (03-Mar-23) (21-Feb-22)

8 Convertible LT 435.61 AAA; Stable -

Debentures Stable (23-Jun-23) 2)CARE AAA; 2)CARE AAA

Stable (CW with

(24-Jun-22) Developing

Implications)

(25-Jun-21)

1)CARE AAA;

Stable 1)CARE AAA

Debentures-Non CARE 1)CARE AAA; (03-Mar-23) (CW with

9 Convertible LT 500.00 AAA; Stable Developing -

Debentures Stable (23-Jun-23) 2)CARE AAA; Implications)

Stable (21-Feb-22)

(24-Jun-22)

1)CARE AAA; 1)CARE AAA

Debentures-Non CARE 1)CARE AAA; Stable (CW with

10 Convertible LT 69.19 AAA; Stable (03-Mar-23) Developing -

Debentures Stable (23-Jun-23) Implications)

2)CARE AAA; (21-Feb-22)

6 CARE Ratings Ltd.

Press Release

Current Ratings Rating History

Date(s) Date(s) Date(s) Date(s)

Name of the

Sr. Amount and and and and

Instrument/Bank

No. Type Outstanding Rating Rating(s) Rating(s) Rating(s) Rating(s)

Facilities

(₹ crore) assigned in assigned in assigned in assigned in

2023-2024 2022-2023 2021-2022 2020-2021

Stable

(24-Jun-22) 2)CARE AAA

(CW with

Developing

Implications)

(25-Jun-21)

*Long term/Short term.

Annexure-3: Detailed explanation of covenants of the rated instruments / facilities: Not applicable

Annexure-4: Complexity level of the various instruments rated

Sr. No. Name of the Instrument Complexity Level

1 Commercial Paper-Commercial Paper (Standalone) Simple

2 Debentures-Non-Convertible Debentures Simple

Note on the complexity levels of the rated instruments: CARE Ratings has classified instruments rated by it on the basis

of complexity. This classification is available at www.careedge.in. Investors/market intermediaries/regulators or others are

welcome to write to care@careedge.in for any clarifications.

Annexure-5: Lender details

To view the lender wise details of bank facilities please click here

Annexure 6: List of entities whose financials have been consolidated (As on March 31, 2023)

Percentage of

Sr. no. Subsidiaries, Joint Ventures and Associates

ownership interest

Subsidiaries (including stepdown subsidiaries)

1 Bharat PetroResources Ltd. 100.00%

2 Bharat Petro Resources JPDA Ltd. 100.00%

3 BPRL International BV 100.00%

4 BPRL International Singapore Pte Ltd. 100.00%

5 BPRL Ventures BV 100.00%

6 BPRL Ventures Mozambique BV 100.00%

7 BPRL Ventures Indonesia BV 100.00%

8 BPRL International BV 100.00%

Joint Venture

1 Central UP Gas Ltd. 25.00%

2 Sabarmati Gas Ltd. 49.94%

3 Matrix Bharat Pte. Ltd. 50.00%

4 Delhi Aviation Fuel Facility Private Ltd. 37.00%

5 Mumbai Aviation Fuel Farm Facility Private Ltd 25.00%

6 Kochi Salem Pipeline Private Ltd. 50.00%

7 Haridwar Natural Gas Pvt Ltd. 50.00%

8 Goa Natural Gas Pvt Ltd. 50.00%

9 Ratnagiri Refinery & Petrochemicals Ltd. 25.00%

10 Bharat Stars Services Private Ltd. (including Bharat Stars Services (Delhi) Private Ltd.) 50.00%

11 Maharashtra Natural Gas Ltd. 22.50%

12 BPCL-KIAL Fuel Farm Pvt. Ltd. 74.00%

13 IHB Ltd 25.00%

14 IBV (Brasil) Petroleo Ltda 61.36%

15 Taas India Pte Ltd. 33.00%

16 LLC TYNGD 9.87%

7 CARE Ratings Ltd.

Press Release

Percentage of

Sr. no. Subsidiaries, Joint Ventures and Associates

ownership interest

17 Vankor India Pte Ltd. 33.00%

18 Falcon Oil & Gas BV 30.00%

19 Urja Bharat Pte Ltd 50.00%

20 Bharat Renewable Energy Limited 33.33%

Associates

1 Petronet LNG Ltd. (including Petronet Energy Ltd.) 12.50%

2 Petrnonet India Limited 16.00%

3 Petronet CI Limited 11.00%

4 FINO Paytech Limited (including FINO Payments Bank) 21.10%

5 GSPL India Gasnet Ltd. 11.00%

6 GSPL India Transco Ltd. 11.00%

7 Indraprastha Gas Ltd. 22.50%

8 Mozambique LNG 1 Holding Co. Ltd. 10.00%

9 Mozambique LNG 1 Company Pte Ltd. 10.00%

10 Mozambique LNG 1 Financing Company Ltd. 10.00%

11 Mozambique LNG 1 Co. Financing, LDA 10.00%

12 JSC Vankorneft (Associate of Vankor India Pte Ltd.) 7.89%

13 Kannur International Airport Limited 16.20%

8 CARE Ratings Ltd.

Press Release

Contact us

Media Contact Analytical Contacts

Name: Mradul Mishra Name: Ranjan Sharma

Director Senior Director

CARE Ratings Limited CARE Ratings Limited

Phone: +91-22-6754 3596 Phone: +91-22-6754 3453

E-mail: mradul.mishra@careedge.in E-mail: ranjan.sharma@careedge.in

Relationship Contact Name: Hardik Shah

Director

Name: Saikat Roy CARE Ratings Limited

Senior Director Phone: +91-22-6754 3591

CARE Ratings Limited E-mail: hardik.shah@careedge.in

Phone: +91-22-6754 3404

E-mail: saikat.roy@careedge.in Name: Surabhi Nahar

Assistant Director

CARE Ratings Limited

Phone: +91-22-6754 3437

E-mail: surabhi.nahar@careedge.in

About us:

Established in 1993, CARE Ratings is one of the leading credit rating agencies in India. Registered under the Securities and

Exchange Board of India, it has been acknowledged as an External Credit Assessment Institution by the RBI. With an equitable

position in the Indian capital market, CARE Ratings provides a wide array of credit rating services that help corporates raise

capital and enable investors to make informed decisions. With an established track record of rating companies over almost

three decades, CARE Ratings follows a robust and transparent rating process that leverages its domain and analytical expertise,

backed by the methodologies congruent with the international best practices. CARE Ratings has played a pivotal role in

developing bank debt and capital market instruments, including commercial papers, corporate bonds and debentures, and

structured credit.

Disclaimer:

The ratings issued by CARE Ratings are opinions on the likelihood of timely payment of the obligations under the rated instrument and are not recommendations to

sanction, renew, disburse, or recall the concerned bank facilities or to buy, sell, or hold any security. These ratings do not convey suitability or price for the investor.

The agency does not constitute an audit on the rated entity. CARE Ratings has based its ratings/outlook based on information obtained from reliable and credible

sources. CARE Ratings does not, however, guarantee the accuracy, adequacy, or completeness of any information and is not responsible for any errors or omissions

and the results obtained from the use of such information. Most entities whose bank facilities/instruments are rated by CARE Ratings have paid a credit rating fee,

based on the amount and type of bank facilities/instruments. CARE Ratings or its subsidiaries/associates may also be involved with other commercial transactions

with the entity. In case of partnership/proprietary concerns, the rating/outlook assigned by CARE Ratings is, inter-alia, based on the capital deployed by the

partners/proprietors and the current financial strength of the firm. The ratings/outlook may change in case of withdrawal of capital, or the unsecured loans brought

in by the partners/proprietors in addition to the financial performance and other relevant factors. CARE Ratings is not responsible for any errors and states that it

has no financial liability whatsoever to the users of the ratings of CARE Ratings. The ratings of CARE Ratings do not factor in any rating-related trigger clauses as

per the terms of the facilities/instruments, which may involve acceleration of payments in case of rating downgrades. However, if any such clauses are introduced

and triggered, the ratings may see volatility and sharp downgrades.

For the detailed Rationale Report and subscription information,

please visit www.careedge.in

9 CARE Ratings Ltd.

You might also like

- RFI For Procurement of 03 X 200T NP Water Barge For INDocument38 pagesRFI For Procurement of 03 X 200T NP Water Barge For INjami sharat chand100% (1)

- Creating The LACE (V5.1)Document29 pagesCreating The LACE (V5.1)JorgeMadrizNo ratings yet

- Cole Harris IndictmentDocument14 pagesCole Harris IndictmentJennifer Van LaarNo ratings yet

- Zbynek Boldis RT6a PDFDocument10 pagesZbynek Boldis RT6a PDFkotiniNo ratings yet

- Inbound Cross DockDocument135 pagesInbound Cross DockSonaliNo ratings yet

- The Impact of Traffic Congestion To The Academic Performance of The New Era University StudentsDocument12 pagesThe Impact of Traffic Congestion To The Academic Performance of The New Era University Studentsdarlene belleNo ratings yet

- A Project Report On HRDDocument84 pagesA Project Report On HRDSaurav Gautam70% (10)

- K.P.R. Sugar Mill LimitedDocument7 pagesK.P.R. Sugar Mill LimitedKarthikeyan RK SwamyNo ratings yet

- Champion Commercial Company LimitedDocument7 pagesChampion Commercial Company LimitedCedric KerkettaNo ratings yet

- Kalpataru Projects International LimitedDocument9 pagesKalpataru Projects International LimitedvenkyniyerNo ratings yet

- Godrej Industries LimitedDocument8 pagesGodrej Industries LimitedJigarNo ratings yet

- Bharat Gears LimitedDocument7 pagesBharat Gears LimitedjagadeeshNo ratings yet

- Myra Hygiene Products Private LimitedDocument7 pagesMyra Hygiene Products Private Limitedanuj7729No ratings yet

- Ajanta Soya 13may2021Document7 pagesAjanta Soya 13may2021praveen kumarNo ratings yet

- Radico Khaitan LimitedDocument6 pagesRadico Khaitan LimitedHarminder Singh BajwaNo ratings yet

- Indian Oil Corporation Limited: Rating RationaleDocument5 pagesIndian Oil Corporation Limited: Rating RationaleAanubhav KackerNo ratings yet

- L.G. Balakrishnan & Bros Limited: Summary of Rating ActionDocument7 pagesL.G. Balakrishnan & Bros Limited: Summary of Rating ActionChromoNo ratings yet

- BIBA Apparels Private - R - 22022019Document7 pagesBIBA Apparels Private - R - 22022019swapnil solankiNo ratings yet

- Press Release Airo Lam Limited: Details of Instruments/facilities in Annexure-1Document4 pagesPress Release Airo Lam Limited: Details of Instruments/facilities in Annexure-1flying400No ratings yet

- Vivriti Capital Private Limited PDFDocument9 pagesVivriti Capital Private Limited PDFIb SulochanaNo ratings yet

- Bikanervala Foods Private Limited: Summary of Rated InstrumentsDocument7 pagesBikanervala Foods Private Limited: Summary of Rated InstrumentsDarshan ShahNo ratings yet

- Gujarat Themis Biosyn LimitedDocument5 pagesGujarat Themis Biosyn LimitedAshwani KesharwaniNo ratings yet

- Credit Rating Post March 2023Document26 pagesCredit Rating Post March 2023Sumiran BansalNo ratings yet

- Bharat Forge LimitedDocument7 pagesBharat Forge LimitedjagadeeshNo ratings yet

- Amarth Ifestyle RetailingDocument5 pagesAmarth Ifestyle Retailingheera lal thakurNo ratings yet

- Pondy Oxides and Chemicals 22apr2019Document6 pagesPondy Oxides and Chemicals 22apr2019DarshanNo ratings yet

- Anthem Biosciences-R-21052018Document7 pagesAnthem Biosciences-R-21052018swarnaNo ratings yet

- Ganga Rasayanie Private Limited-R-10102019Document7 pagesGanga Rasayanie Private Limited-R-10102019DarshanNo ratings yet

- Press Release Adani Agri Logistics (Harda) LimitedDocument5 pagesPress Release Adani Agri Logistics (Harda) Limitedsurprise MFNo ratings yet

- Rating Rationale - Hero Steel Oct 2019Document4 pagesRating Rationale - Hero Steel Oct 2019Puneet367No ratings yet

- Globus Spirits LimitedDocument5 pagesGlobus Spirits LimitedHarminder Singh BajwaNo ratings yet

- Prayag Polymers Private LimitedDocument4 pagesPrayag Polymers Private Limitednandinimishra6168No ratings yet

- AETHER Industries LTD - 2020 Credit RatingDocument5 pagesAETHER Industries LTD - 2020 Credit RatingEast West Strategic ConsultingNo ratings yet

- Press Release Panoli Intermediates (India) Private Limited: Details of Instruments/ Facilities in Annexure-1Document6 pagesPress Release Panoli Intermediates (India) Private Limited: Details of Instruments/ Facilities in Annexure-1Patel ZeelNo ratings yet

- Aachi Masala Foods-R-28092018 PDFDocument7 pagesAachi Masala Foods-R-28092018 PDFபாரத் அச்சுNo ratings yet

- 3F Industries LimitedDocument5 pages3F Industries LimitedData CentrumNo ratings yet

- Bharti AXA Life Insurance Company LimitedDocument8 pagesBharti AXA Life Insurance Company LimitedJinal SanghviNo ratings yet

- PSK Engineering Construction & Co-08-06-2020Document5 pagesPSK Engineering Construction & Co-08-06-2020The JdNo ratings yet

- Keventer Agro LimitedDocument4 pagesKeventer Agro LimitedYasser SayedNo ratings yet

- KPR Care Rating Jan 21Document4 pagesKPR Care Rating Jan 21V KeshavdevNo ratings yet

- ICRA Report - United Breweries - R - 23082019Document7 pagesICRA Report - United Breweries - R - 23082019dnwekfnkfnknf skkjdbNo ratings yet

- Press Release 3B Fibreglass SPRL: Facilities Amount (Rs. Crore) Rating Rating ActionDocument4 pagesPress Release 3B Fibreglass SPRL: Facilities Amount (Rs. Crore) Rating Rating ActionData CentrumNo ratings yet

- AKR Industries 19mar2020Document8 pagesAKR Industries 19mar2020Karthikeyan RK Swamy100% (1)

- Akar Auto Industries LimitedDocument5 pagesAkar Auto Industries Limitedkrushna.maneNo ratings yet

- Technico Industries LimitedDocument4 pagesTechnico Industries Limitedshankarravi8975No ratings yet

- Barbeque Nation Hospitality LimitedDocument7 pagesBarbeque Nation Hospitality Limitednayabrasul208No ratings yet

- Waaree Energies LimitedDocument6 pagesWaaree Energies LimitedHasik JainNo ratings yet

- Wockhardt LimitedDocument8 pagesWockhardt LimitedKumar SatyakamNo ratings yet

- United Breweries Limited: Summary of Rated InstrumentsDocument8 pagesUnited Breweries Limited: Summary of Rated InstrumentsKaushikDasguptaNo ratings yet

- Luxor Writing Instruments Pvt. LTDDocument7 pagesLuxor Writing Instruments Pvt. LTDbookdekho.ytNo ratings yet

- La Opala RG LimitedDocument5 pagesLa Opala RG LimitedAshwani KesharwaniNo ratings yet

- Incred Financial Services Limited Press+ReleaseDocument7 pagesIncred Financial Services Limited Press+ReleaseGautam MehtaNo ratings yet

- The Bombay Dyeing & Manufacturing Company LimitedDocument5 pagesThe Bombay Dyeing & Manufacturing Company LimitedvaishnaviNo ratings yet

- Ginni Filaments Limited-09!07!2020Document4 pagesGinni Filaments Limited-09!07!2020Saurabh AgarwalNo ratings yet

- Tube Investments of India LimitedDocument8 pagesTube Investments of India Limitedpraveen kumarNo ratings yet

- Northern Arc Capital - R-01072019Document10 pagesNorthern Arc Capital - R-01072019vaibhav khandelwalNo ratings yet

- Credit Assignment - State - Bank - of - IndiaDocument11 pagesCredit Assignment - State - Bank - of - IndiashivamNo ratings yet

- Naresh Kumar and Company Private LimitedDocument5 pagesNaresh Kumar and Company Private LimitedKunalNo ratings yet

- Bajaj Hindusthan Sugar LimitedDocument6 pagesBajaj Hindusthan Sugar LimitednileshNo ratings yet

- Roots Industries India Limited: Facilities/Instruments Amount (Rs. Crore) Rating Rating ActionDocument4 pagesRoots Industries India Limited: Facilities/Instruments Amount (Rs. Crore) Rating Rating ActionKarthikeyan RK SwamyNo ratings yet

- Home First Finance Company India LimitedDocument8 pagesHome First Finance Company India LimitedRAROLINKSNo ratings yet

- Press Release RACL Geartech LTDDocument4 pagesPress Release RACL Geartech LTDSourav DuttaNo ratings yet

- Ganesha Ecosphere Limited-01-29-2019Document6 pagesGanesha Ecosphere Limited-01-29-2019gangashaharNo ratings yet

- Future Retail Limited: Carved Out of Working Capital Limits Details of Instruments/facilities in Annexure-1Document9 pagesFuture Retail Limited: Carved Out of Working Capital Limits Details of Instruments/facilities in Annexure-1Nostalgic MediatorNo ratings yet

- Shapoorji Pallonji and Company Private LimitedDocument5 pagesShapoorji Pallonji and Company Private LimitedPrabhakar DubeyNo ratings yet

- Filatex India Limited PDFDocument6 pagesFilatex India Limited PDFfatNo ratings yet

- Braced for Impact: Reforming Kazakhstan's National Financial Holding for Development Effectiveness and Market CreationFrom EverandBraced for Impact: Reforming Kazakhstan's National Financial Holding for Development Effectiveness and Market CreationNo ratings yet

- Bharat Rasayan LimitedDocument7 pagesBharat Rasayan LimitedjagadeeshNo ratings yet

- Tata Motors LimitedDocument11 pagesTata Motors LimitedjagadeeshNo ratings yet

- Vol12 No01 A2Document7 pagesVol12 No01 A2jagadeeshNo ratings yet

- ACA Hosting BCCI Matches 2022-23 1 PDFDocument1 pageACA Hosting BCCI Matches 2022-23 1 PDFjagadeeshNo ratings yet

- Latest Pre Ipo English VersionDocument14 pagesLatest Pre Ipo English VersionjagadeeshNo ratings yet

- Reserve Bank of India Draft Guidelines For Licensing of "Small Banks" in The Private Sector July 17, 2014 I. PreambleDocument6 pagesReserve Bank of India Draft Guidelines For Licensing of "Small Banks" in The Private Sector July 17, 2014 I. PreamblejagadeeshNo ratings yet

- Fin Regulation83Document14 pagesFin Regulation83jagadeeshNo ratings yet

- Logical DDocument1 pageLogical DjagadeeshNo ratings yet

- Finitiatives Learning India Pvt. Ltd. (FLIP) : Head: Learning Delivery Management (LDM)Document2 pagesFinitiatives Learning India Pvt. Ltd. (FLIP) : Head: Learning Delivery Management (LDM)jagadeeshNo ratings yet

- BTP100 EN Col07-41Document1 pageBTP100 EN Col07-41Slata sahuNo ratings yet

- Overview of Apparel Manufacturing Industry in IndiaDocument28 pagesOverview of Apparel Manufacturing Industry in Indiashreay12345No ratings yet

- CSC 2 0 Digital Seva Connect v1.1Document41 pagesCSC 2 0 Digital Seva Connect v1.1AzImm100% (1)

- GoodsandServicesTaxGSTinMalaysiaBehindSuccessfulExperiences2 Edit PDFDocument23 pagesGoodsandServicesTaxGSTinMalaysiaBehindSuccessfulExperiences2 Edit PDFAmirahNo ratings yet

- M Phil Thesis Topics in Human Resource ManagementDocument8 pagesM Phil Thesis Topics in Human Resource Managementtracydolittlesalem100% (1)

- L4 - V2 - Capital Expenditure - SlidesDocument12 pagesL4 - V2 - Capital Expenditure - SlidesGary Gary xuNo ratings yet

- WEEK 1 MEE 527 Engineering ManagementDocument20 pagesWEEK 1 MEE 527 Engineering ManagementTamara-emomoemi BrownNo ratings yet

- Group - 6 Ohhh KakaninDocument27 pagesGroup - 6 Ohhh KakaninJAY LORD CAMARILLONo ratings yet

- Proposal For CCTV Annual Maintenance - PMC Y2024 - Y2025Document7 pagesProposal For CCTV Annual Maintenance - PMC Y2024 - Y2025crosleydollisNo ratings yet

- 2020 MDCN Remita LicenseDocument1 page2020 MDCN Remita LicenseFavour MichaelNo ratings yet

- 4a. Question - Chapter 4Document4 pages4a. Question - Chapter 4plinhcoco02No ratings yet

- Gross Profit From SaleDocument5 pagesGross Profit From SaleRosemarie CruzNo ratings yet

- Case StudyDocument4 pagesCase StudyNguyễn Văn DũngNo ratings yet

- Quickbooks - Chapter 3 PowerpointDocument23 pagesQuickbooks - Chapter 3 PowerpointAdrian ColemanNo ratings yet

- Solution ProMana - MID - 2021Document6 pagesSolution ProMana - MID - 2021Quỳnh HoaNo ratings yet

- Ncnda Imfpa Liberty Shanay 100kg-AuDocument12 pagesNcnda Imfpa Liberty Shanay 100kg-AuJuan BriceñoNo ratings yet

- By The Numbers:: The Home Appliance Industry in Europe, 2018-2019Document48 pagesBy The Numbers:: The Home Appliance Industry in Europe, 2018-2019류강민No ratings yet

- High Protein Castor Deoiled Cake & Organic Fertilizer Exporters in IndiaDocument8 pagesHigh Protein Castor Deoiled Cake & Organic Fertilizer Exporters in IndiaSun Agri ExportNo ratings yet

- 4 Billboard PDFDocument1 page4 Billboard PDFIvan BaracNo ratings yet

- SR-1 Leave Application FormDocument1 pageSR-1 Leave Application FormUma Maheswararao0% (1)

- Camlin Fine SciencesDocument21 pagesCamlin Fine SciencesSreenadhVNo ratings yet

- Unit 203 Principles of Manufacturing Technology: Level: 2 Credit Value: 7 Uan: K/503/0175 Unit AimDocument4 pagesUnit 203 Principles of Manufacturing Technology: Level: 2 Credit Value: 7 Uan: K/503/0175 Unit AimEóin O CeranaighNo ratings yet

- 2015 BG Catalogue PDFDocument210 pages2015 BG Catalogue PDFCharles RiceNo ratings yet