Professional Documents

Culture Documents

La Opala RG Limited

Uploaded by

Ashwani KesharwaniOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

La Opala RG Limited

Uploaded by

Ashwani KesharwaniCopyright:

Available Formats

Press Release

La Opala RG Limited

January 04, 2023

Ratings

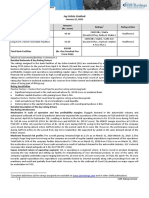

Facilities/Instruments Amount (₹ crore) Ratings1 Rating Action

CARE AA; Stable

Long-term bank facilities 5.00 Reaffirmed

(Double A; Outlook: Stable)

Long-term/Short-term CARE AA; Stable / CARE A1+

5.00 Reaffirmed

bank facilities (Double A; Outlook: Stable/ A One Plus)

CARE A1+

Short-term bank facilities 3.00 Reaffirmed

(A One Plus)

13.00

Total bank facilities

(₹ Thirteen crore only)

Details of facilities in Annexure-1.

Detailed rationale and key rating drivers

The ratings assigned to the bank facilities of La Opala RG Limited (LORGL) continue to derive strength from the leadership

position of the company in the domestic opal-ware segment with a strong brand image. The company has a wide product range

catering to both economy and premium segments, supported by its established distribution network along with presence in the

export market.

The ratings also derive comfort from its superior profitability margin, comfortable capital structure with low debt level and

strong liquidity maintained by the company in the form of mutual fund investments.

The ratings also take note of the improvement in the total operating income (TOI) and profitability of the company in FY22

(refers to the period April 1 to March 31) after witnessing a decline in FY21 on account of the impact of the COVID-19

pandemic. In H1FY23, the TOI and profitability have witnessed further improvement with higher sales volume due to the

commissioning of the greenfield opal-ware capacity at Sitarganj in Q1FY23.

With continuing increase in demand and healthy market share of LORGL in the opal-ware segment supported by the recent

increase in capacity, the profitability and debt coverage indicators are expected to remain healthy going forward.

The long-term ratings, however, continue to remain constrained by the susceptibility of its profitability to volatility in raw

material prices, foreign exchange fluctuation risk, working capital-intensive nature of operations and competition from

substitute products, cheaper imports and other domestic players.

The ratings also take note of the planned capex for setting up a borosilicate unit to further diversify the revenue profile of the

company and complement its existing product portfolio. The capex is expected to be entirely funded through internal

generations/available liquidity. However, the timelines for the project are yet to be finalised.

Rating sensitivities

Positive factors – Factors that could lead to positive rating action/upgrade:

• Significant increase in the scale of operations including diversification of product portfolio while earning PBILDT margin in

excess of 40% on a sustained basis along with maintaining its healthy leverage and debt coverage indicators.

• Significant increase in market share of LORGL.

• Improvement in the operating cycle below 70 days.

Negative factors – Factors that could lead to negative rating action/downgrade:

• Reduction in the liquid investments held by the company to below ₹150 crore.

• Deterioration in debt coverage indicators with total debt to gross cash accruals (TD/GCA) going above unity on a sustained

basis.

• Inability to grow its TOI at a healthy pace along with significant moderation in its PBILDT margin and return on capital

employed (ROCE) due to sustained competitive pressure.

Detailed description of the key rating drivers

Key rating strengths

Leadership position in the domestic opal-ware segment and strong brand image: LORGL, promoted by Sushil

Jhunjhunwala in 1987, started its operations of manufacturing opal-ware products with its first opal glass plant in 1988 and

expanded its capacity over the years. In 1996, the company started its first crystal glass plant.

1

Complete definition of the ratings assigned are available at www.careedge.in and other CARE Ratings Ltd.’s publications

1 CARE Ratings Ltd.

Press Release

The company has been operating in the opal-ware segment for more than three decades and has a leadership position in the

domestic opal-ware segment. The company is also operating in the glassware segment for more than two decades. Over the

period, the company has developed a strong brand image for its opal and crystal-ware products. Furthermore, the company

launched its premium product range through the ‘Diva’ brand in 2008. To cope with the increasing lifestyle changes, the

company focuses significantly on research and development (R&D) and introduces new designs every year. With the current

increase in capacities, CARE Ratings expects LORGL to maintain its leadership position in the opal-ware industry.

Wide product range catering to both, economy and premium segments: With planned design and a price-interactive

range, the company targets different socio-economic segments. It sells its opal-ware products under two brands – ‘La Opala’

(caters to economy segment) and ‘Diva’ (caters to premium segment), and glassware products under ‘Solitaire’ brand (caters to

premium segment). Under ‘Diva’, the prominent brands are ‘Classique’, ‘Ivory’, ‘Cosmo’, ‘Quadra’ and ‘Sovrana’. Each segment

carries a price premium over the other, leading to improvement in the blended operating margin.

Established distribution network and marketing arrangements: LORGL sells its products through a network of about

20,000 retailers and 200 distributors in India, across around 600 towns (as on March 31, 2022). The domestic sales accounted

for 84% of LORGL’s sales in FY22 (86% in FY21). The company exports its products to more than 30 countries across the

world. Majority of the company’s sales are through its distribution network, followed by organised retail markets, wherein sales

are made to major retail chains. It also relies on institutional sales where the products are sold directly to large corporates and

canteen stores department. The exports are made directly to private parties, who sell the same under their brand name. The

company exports its finished products mainly to West Asia, Brazil and the UK.

Improvement witnessed in sales and profitability in FY22, which continued in H1FY23: The TOI of the company

witnessed a growth of about 52% y-o-y in FY22 on account of resumption of sales in the malls, shops, etc. and more footfalls in

stores as compared with FY21, which was impacted by the pandemic. The PBILDT and profit after tax (PAT) margins also

increased from 32.55% and 23.45%, respectively, in FY21 to 37.92% and 27.08%, respectively, in FY22, on account of

increase in sales and realisations.

With the improvement in demand, increase in realisations, and new capacity coming onstream from June 2022 at Sitarganj, the

TOI of the company witnessed a growth of 74% y-o-y in H1FY23. The PBILDT margin also witnessed an improvement, from

36.19% in H1FY22 to 39.56% in H1FY23, on account of better economies of scale. The interest coverage ratio continued to

remain healthy at around 30x in H1FY23.

Comfortable capital structure with very low debt level, expected to continue going forward: The capital structure of

the company continues to remain strong with low debt level. The company availed a term loan of ₹12.50 crore in FY22 for part

funding its capex. Low level of total debt imparts good financial flexibility to the company, which has also resulted in

comfortable capital structure. The debt coverage indicators also continued to remain strong in FY22, with TDGCA of 0.14x and

total debt to PBILDT of 0.12x, as on March 31, 2022. The overall gearing ratio remained comfortable at 0.02x, as on March 31,

2022.

Going forward, with no debt-funded capex planned and working capital being funded through the healthy cash generations, the

capital structure is expected to remain comfortable.

Growing demand: Glassware, which includes decorative glassware, tableware, lamps and lamp-wares, drinking containers,

etc., is expected to continue witnessing an increase in demand with increase in the demand for fancy tableware both in the

household and hotel, restaurants, caterers (HoReCa) segment. There is significant demand potential from the semi-urban sector

as well, with rising disposable income.

Liquidity: Strong

The liquidity of LORGL is marked by strong accruals against low debt repayment obligations and significant liquid investments

available to the tune of ₹377.61 crore, as on September 30, 2022. With 0.02x gearing as on March 31, 2022, the company has

sufficient gearing headroom to raise additional debt for its capex, if required. The company proposes to fund the upcoming

capex through surplus cash accruals and available liquidity, which is expected to be sufficient to meet the requirement. The

average fund-based working capital limit utilisation for the trailing 12-month period ended October 2022 stood very low at

around 4%.

Key rating weaknesses

Profitability susceptible to volatility in raw material prices: LORGL’s raw materials (soda ash, borax, sodium silico

fluoride, quartz powder, etc.) accounted for 33% of its cost of sales in FY22 vis-à-vis 34% in FY21. One of the major raw

2 CARE Ratings Ltd.

Press Release

materials – quartz powder – is domestically sourced from Rajasthan and others – soda ash, boric acid, etc. – are also majorly

procured locally. The price of soda ash increased during the first quarter of FY23 before decreasing in second quarter and then

stabilizing in Q3FY23, at a similar level to Q3FY22.

Chemicals like borax and fluorspar are mainly imported from Turkey, US, China and other countries. Given that the prices of

raw materials are volatile in nature and LORGL does not have any long-term agreements for their procurement, LORGL’s

profitability is susceptible to fluctuation in the raw material prices. Furthermore, power and fuel cost comprised 24% of the cost

of sales of LORGL in FY22 (16% in FY21). Power is sourced from Uttarakhand Power Corporation Limited and Jharkhand Bijli

Vidyut Nigam Limited. In FY21, the company had received rebate from the power providers due to the pandemic, which had led

to lower costs.

Foreign exchange fluctuation risk: LORGL’s profitability is exposed to the fluctuation in foreign exchange rates. Until FY20,

the company was a net exporter enjoying a natural hedge for its import obligations on account of matching export receivables.

During FY21, exports witnessed a decline while imports increased, mainly on account of the import of capital goods to be used

for the new plant coming up in Sitargunj. However, in FY22, exports increased yet again with easing out of the COVID-19

related restrictions and the company continues to be a net exporter for its finished goods vis-à-vis its import of raw materials

and components and spare parts. Any timing mismatch in the receipt of export proceeds vis-à-vis repayment of imports

payables can make LORGL susceptible to forex fluctuation risks. Depending upon the market scenario, the company hedges its

foreign currency exposure.

Working capital-intensive operations albeit improved operating cycle: LORGL’s business is inherently working capital-

intensive, marked by high average inventory period. As the company sells a large variety of products, which come in different

shapes, sizes, colors and designs, it has to maintain sufficient amount of inventory for each of its product types. The inventory

holding period stood at around 64 days in FY22 (refers to period April 1 to March 31), decreased from 113 days in FY21 due to

increase in sales, though inventories at the end of FY22 increased compared to the previous year. In the case of exports, the

company either collects in advance or the orders are LC-backed. Furthermore, LORGL also has to offer a credit period of around

45-60 days to its domestic customers while payment to its suppliers is met in a months’ period. The average collection period

decreased from 70 days in FY21 to 34 days in FY22, in view of its improved distributor network. The operating cycle of the

company stood at around 74 days in FY22, decreased from 151 days in FY21.

Risk associated with implementation and stabilisation of projects: The company has commissioned the plant for

manufacturing opal ware at Sitarganj in June 2022, within the estimated project cost. It is in the planning process of setting up

a borosilicate plant at an estimated cost of ₹70 crore, which is to be funded through internal accruals and existing liquidity. The

project timelines and schedule are yet to be finalised. The company remains exposed to the pre-implementation and post-

implementation risks associated with the projects.

Competition from substitutes, cheaper imports and other domestic players: The industry faces competition from easy

substitutability with various other segments of tableware (such as steel ware, melamine, bone china, ceramic, etc.).

Furthermore, durability is the key issue in Indian households and lack of awareness regarding opal-ware qualities, such as chip

and scratch resistance, affordable pricing, etc., has resulted in lower penetration even after 30 years of its launch. Intense

competition requires considerable effort on building the distribution network and expenditure on advertising and sales

promotion to sustain and build the market share.

The company also faces competition from cheap imports from China and UAE. The Government of India has re-imposed anti-

dumping duty (ADD) on import of opal-ware from China and UAE for a period of five years starting from August 2022 to curb

the rising imports. CARE Ratings expects the measures taken by the Government of India to safeguard domestic players like

LORGL from cheap imports to an extent.

Analytical approach: Standalone

Applicable criteria

Rating Outlook and Rating Watch

Policy on default recognition

Financial Ratios – Non-financial Sector

Liquidity Analysis of Non-financial sector entities

Short Term Instruments

Manufacturing Companies

3 CARE Ratings Ltd.

Press Release

About the company

LORGL, incorporated in 1987, is promoted by the Kolkata-based Jhunjhunwala family. LORGL is one of the leading players in

the tableware products (opal and glass) in India. The company’s production facilities are located at Madhupur, Jharkhand, and

Sitarganj, Uttarakhand, having a total installed capacity of 36,000 MTPA for the opal-ware and glassware segments. The

company has the largest opal-glassware-tableware capacity in India.

The company sells its opal ware products under two brands, i.e., La Opala (economy segment) and Diva (Premium segment)

and glassware products under Solitaire brand (premium segment). LORGL exports its products to over 30 countries.

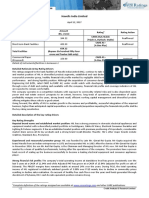

Brief Financials (₹ crore) FY21 (A) FY22 (A) H1FY23 (UA)

TOI 211.40 322.70 217.07

PBILDT 68.81 122.37 85.88

PAT 49.57 87.37 59.14

Overall gearing (times) 0.00 0.02 0.02

Interest coverage (times) 271.23 30.06 30.24

A: Audited; UA: Unaudited

Status of non-cooperation with previous CRA: Not applicable

Any other information: Not applicable

Rating history for last three years: Please refer Annexure-2

Covenants of rated instruments/facilities: Detailed explanation of covenants of the rated instruments/facilities is given in

Annexure-3

Complexity level of various instruments rated for this company: Annexure-4

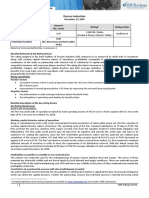

Annexure-1: Details of instruments / facilities

Size of the

Name of the Date of Coupon Maturity Rating assigned along

ISIN Issue

Instrument Issuance Rate Date with Rating Outlook

(₹ crore)

Fund-based - LT-Cash Credit - - - 5.00 CARE AA; Stable

Fund-based - LT/ ST-

- - - 5.00 CARE AA; Stable / CARE A1+

CC/PC/Bill Discounting

Non-fund-based - ST-BG/LC - - - 3.00 CARE A1+

Annexure-2: Rating history of last three years

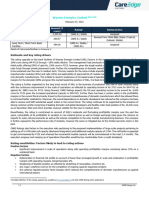

Current Ratings Rating history

Date(s) & Date(s) & Date(s) & Date(s) &

Name of the

Sr. Amount Rating(s) Rating(s) Rating(s) Rating(s)

Instrument/Bank

No. Type Outstanding Rating assigned assigned assigned assigned

Facilities

(₹ crore) in 2021- in 2020- in 2019- in 2018-

2022 2021 2020 2019

Non-fund-based - CARE 1)CARE A1+ 1)CARE A1+ 1)CARE A1+

1 ST 3.00 -

ST-BG/LC A1+ (07-Mar-22) (30-Dec-20) (04-Oct-19)

CARE 1)CARE AA; 1)CARE AA; 1)CARE AA;

Fund-based - LT-

2 LT 5.00 AA; - Stable Stable Stable

Cash Credit

Stable (07-Mar-22) (30-Dec-20) (04-Oct-19)

CARE

1)CARE AA; 1)CARE AA; 1)CARE AA;

Fund-based - LT/ AA;

Stable / Stable / Stable /

3 ST-CC/PC/Bill LT/ST* 5.00 Stable / -

CARE A1+ CARE A1+ CARE A1+

Discounting CARE

(07-Mar-22) (30-Dec-20) (04-Oct-19)

A1+

*Long term/ Short term

Annexure-3: Detailed explanation of covenants of the rated instruments/facilities: Not applicable

4 CARE Ratings Ltd.

Press Release

Annexure-4: Complexity level of various instruments rated for this company

Sr. No Name of instrument Complexity level

1 Fund-based - LT-Cash Credit Simple

2 Fund-based - LT/ ST-CC/PC/Bill Discounting Simple

3 Non-fund-based - ST-BG/LC Simple

Annexure-5: Bank lender details for this company

To view the lender wise details of bank facilities please click here

Note on complexity levels of the rated instruments: CARE Ratings Ltd. has classified instruments rated by it on the basis

of complexity. Investors/market intermediaries/regulators or others are welcome to write to care@careedge.in for any

clarifications.

Contact us

Media Contact

Name: Mradul Mishra

Phone: +91-22-6754 3573

E-mail: mradul.mishra@careedge.in

Analyst Contact

Name: Mamta Muklania

Phone: +91-33-4018 1651

E-mail: mamta.khemka@careedge.in

Relationship Contact

Name: Lalit Sikaria

Phone: + 91-33- 4018 1607

E-mail: lalit.sikaria@careedge.in

About CARE Ratings Limited:

Established in 1993, CARE Ratings Ltd. is one of the leading credit rating agencies in India. Registered under the Securities and

Exchange Board of India (SEBI), it has also been acknowledged as an External Credit Assessment Institution (ECAI) by the

Reserve Bank of India (RBI). With an equitable position in the Indian capital market, CARE Ratings Limited provides a wide

array of credit rating services that help corporates to raise capital and enable investors to make informed decisions backed by

knowledge and assessment provided by the company.

With an established track record of rating companies over almost three decades, we follow a robust and transparent rating

process that leverages our domain and analytical expertise backed by the methodologies congruent with the international best

practices. CARE Ratings Limited has had a pivotal role to play in developing bank debt and capital market instruments including

CPs, corporate bonds and debentures, and structured credit.

Disclaimer

The ratings issued by CARE Ratings Limited are opinions on the likelihood of timely payment of the obligations under the rated instrument and are not

recommendations to sanction, renew, disburse or recall the concerned bank facilities or to buy, sell or hold any security. These ratings do not convey suitability or

price for the investor. The agency does not constitute an audit on the rated entity. CARE Ratings Limited has based its ratings/outlooks based on information

obtained from reliable and credible sources. CARE Ratings Limited does not, however, guarantee the accuracy, adequacy or completeness of any information and is

not responsible for any errors or omissions and the results obtained from the use of such information. Most entities whose bank facilities/instruments are rated by

CARE Ratings Limited have paid a credit rating fee, based on the amount and type of bank facilities/instruments. CARE Ratings Limited or its subsidiaries/associates

may also be involved with other commercial transactions with the entity. In case of partnership/proprietary concerns, the rating /outlook assigned by CARE Ratings

Limited is, inter-alia, based on the capital deployed by the partners/proprietor and the current financial strength of the firm. The rating/outlook may undergo a

change in case of withdrawal of capital or the unsecured loans brought in by the partners/proprietor in addition to the financial performance and other relevant

factors. CARE Ratings Limited is not responsible for any errors and states that it has no financial liability whatsoever to the users of CARE Ratings Limited’s rating.

Our ratings do not factor in any rating related trigger clauses as per the terms of the facility/instrument, which may involve acceleration of payments in case of

rating downgrades. However, if any such clauses are introduced and if triggered, the ratings may see volatility and sharp downgrades.

**For detailed Rationale Report and subscription information, please contact us at www.careedge.in

5 CARE Ratings Ltd.

You might also like

- Tarsons Products LimitedDocument5 pagesTarsons Products LimitedujjwalgoldNo ratings yet

- 10102022062806_Myra_Hygiene_Products_Private_LimitedDocument7 pages10102022062806_Myra_Hygiene_Products_Private_Limitedanuj7729No ratings yet

- Filatex India Limited press release ratings reaffirmedDocument6 pagesFilatex India Limited press release ratings reaffirmedfatNo ratings yet

- IOL Chemicals and Pharmaceuticals Limited-07-07-2020Document4 pagesIOL Chemicals and Pharmaceuticals Limited-07-07-2020Jeet SinghNo ratings yet

- 04102022073602_Divis_Laboratories_LimitedDocument7 pages04102022073602_Divis_Laboratories_Limiteddivygupta198No ratings yet

- Maithan Alloys LimitedDocument6 pagesMaithan Alloys Limiteddrkashish1989No ratings yet

- Vinati Organics LimitedDocument6 pagesVinati Organics LimitedAshwani KesharwaniNo ratings yet

- S. Jogani Exports Private LimitedDocument6 pagesS. Jogani Exports Private Limitedarc14consultantNo ratings yet

- Piramal Pharma LimitedDocument6 pagesPiramal Pharma Limitedsoumyadwip samantaNo ratings yet

- Keventer Agro LimitedDocument4 pagesKeventer Agro LimitedYasser SayedNo ratings yet

- Tarsons Products LimitedDocument6 pagesTarsons Products LimitedRAROLINKSNo ratings yet

- Shilchar_Technologies_LimitedDocument5 pagesShilchar_Technologies_Limitedjaikumar608jainNo ratings yet

- Abdos Lamitubes Private Limited press release reaffirms ratingsDocument5 pagesAbdos Lamitubes Private Limited press release reaffirms ratingsPuneet367No ratings yet

- Press Release Om Logistics Limited: Details of Instruments/facilities in Annexure-1Document6 pagesPress Release Om Logistics Limited: Details of Instruments/facilities in Annexure-1Sinius InfracomNo ratings yet

- 3F Industries LimitedDocument5 pages3F Industries LimitedData CentrumNo ratings yet

- Press Release Panoli Intermediates (India) Private Limited: Details of Instruments/ Facilities in Annexure-1Document6 pagesPress Release Panoli Intermediates (India) Private Limited: Details of Instruments/ Facilities in Annexure-1Patel ZeelNo ratings yet

- Radico Khaitan LimitedDocument6 pagesRadico Khaitan LimitedHarminder Singh BajwaNo ratings yet

- Piramal Pharma Credit Rating - 13 March 2023Document8 pagesPiramal Pharma Credit Rating - 13 March 2023Ikp IkpNo ratings yet

- Press Release Tab India Granites Private LimitedDocument6 pagesPress Release Tab India Granites Private LimitedRavi BabuNo ratings yet

- Jay Ushin Limited: Rationale-Press ReleaseDocument4 pagesJay Ushin Limited: Rationale-Press Releaseravi.youNo ratings yet

- Rating Definitions - 19 July 2018Document4 pagesRating Definitions - 19 July 2018SushantNo ratings yet

- Vinati Organics Ratings Reaffirmed by CARE Despite Planned CapexDocument5 pagesVinati Organics Ratings Reaffirmed by CARE Despite Planned CapexmgrreddyNo ratings yet

- Amarth Ifestyle RetailingDocument5 pagesAmarth Ifestyle Retailingheera lal thakurNo ratings yet

- Care Rating Sterling - Addlife - India - Private - LimitedDocument6 pagesCare Rating Sterling - Addlife - India - Private - Limitedrahul.tibrewalNo ratings yet

- Globus Spirits LimitedDocument5 pagesGlobus Spirits LimitedHarminder Singh BajwaNo ratings yet

- Ajanta Soya 13may2021Document7 pagesAjanta Soya 13may2021praveen kumarNo ratings yet

- PR ARCL Organics 31jan22Document7 pagesPR ARCL Organics 31jan22anady135344No ratings yet

- Anuh Pharma LimitedDocument7 pagesAnuh Pharma Limitedadhyan kashyapNo ratings yet

- Technico Industries LimitedDocument4 pagesTechnico Industries Limitedshankarravi8975No ratings yet

- Gujarat Themis Biosyn LimitedDocument5 pagesGujarat Themis Biosyn LimitedAshwani KesharwaniNo ratings yet

- Press Release Tarsons Products Private Limited: Details of Instruments/facilities in Annexure-1Document4 pagesPress Release Tarsons Products Private Limited: Details of Instruments/facilities in Annexure-1hussainNo ratings yet

- Anthem Biosciences-R-21052018Document7 pagesAnthem Biosciences-R-21052018swarnaNo ratings yet

- Shapoorji Pallonji and Company Private LimitedDocument5 pagesShapoorji Pallonji and Company Private LimitedPrabhakar DubeyNo ratings yet

- Wockhardt LimitedDocument8 pagesWockhardt LimitedKumar SatyakamNo ratings yet

- Press Release Vijay Sales (India) Private Limited: Experienced PromotersDocument4 pagesPress Release Vijay Sales (India) Private Limited: Experienced PromoterssriharikosaNo ratings yet

- Press Release Nahar Poly Films LimitedDocument5 pagesPress Release Nahar Poly Films LimitedHarshit SinghNo ratings yet

- Unit OperatorDocument7 pagesUnit OperatorJimmyNo ratings yet

- Signode India Financial ReportDocument5 pagesSignode India Financial Reportsaikiran reddyNo ratings yet

- Akar Auto Industries LimitedDocument5 pagesAkar Auto Industries Limitedkrushna.maneNo ratings yet

- Press Release Jash Engineering LTD.: Details of Instruments/ Facilities in Annexure-1Document6 pagesPress Release Jash Engineering LTD.: Details of Instruments/ Facilities in Annexure-1ArunVenkatachalamNo ratings yet

- Sunlex Fabrics Private Limited - Care RatingsDocument6 pagesSunlex Fabrics Private Limited - Care RatingsManeet GoyalNo ratings yet

- 07022023063446_Waaree_Energies_LimitedDocument6 pages07022023063446_Waaree_Energies_LimitedHasik JainNo ratings yet

- Press Release Adani Agri Logistics (Harda) LimitedDocument5 pagesPress Release Adani Agri Logistics (Harda) Limitedsurprise MFNo ratings yet

- Credit Rating Post March 2023Document26 pagesCredit Rating Post March 2023Sumiran BansalNo ratings yet

- Prayag Polymers Private LimitedDocument4 pagesPrayag Polymers Private Limitednandinimishra6168No ratings yet

- TGV SRAAC LimitedDocument6 pagesTGV SRAAC Limitedjayadeep akasamNo ratings yet

- Bharat Petroleum Corporation LimitedDocument9 pagesBharat Petroleum Corporation LimitedjagadeeshNo ratings yet

- Titan Company LimitedDocument7 pagesTitan Company Limiteddanish.40581No ratings yet

- Thriveni Earthmovers Private LimitedDocument9 pagesThriveni Earthmovers Private Limitedarc14consultantNo ratings yet

- Deepak Nitrite R 22082019Document7 pagesDeepak Nitrite R 22082019SalmanNo ratings yet

- Haldiram Products Private LimitedDocument7 pagesHaldiram Products Private LimitedAman GuptaNo ratings yet

- Roots Industries India Limited: Facilities/Instruments Amount (Rs. Crore) Rating Rating ActionDocument4 pagesRoots Industries India Limited: Facilities/Instruments Amount (Rs. Crore) Rating Rating ActionKarthikeyan RK SwamyNo ratings yet

- Press Release Deccan Industries: Positive FactorsDocument4 pagesPress Release Deccan Industries: Positive FactorsHARI HARANNo ratings yet

- SJS Enterprises LimitedDocument7 pagesSJS Enterprises LimitedCA Ankur BariaNo ratings yet

- Bikanervala Foods Private Limited: Summary of Rated InstrumentsDocument7 pagesBikanervala Foods Private Limited: Summary of Rated InstrumentsDarshan ShahNo ratings yet

- Rating Rationale - Adani Wilmar LimitedDocument13 pagesRating Rationale - Adani Wilmar LimitedAnjum SamiraNo ratings yet

- R. K. Marble Private Limited-12!30!2020Document6 pagesR. K. Marble Private Limited-12!30!2020Brajpal JhalaNo ratings yet

- VE Commercial Vehicles LimitedDocument8 pagesVE Commercial Vehicles LimitedRajNo ratings yet

- Jodhani Papers Private LimitedDocument5 pagesJodhani Papers Private LimitedPunit PansariNo ratings yet

- TIT//N: 500114 TitanDocument2 pagesTIT//N: 500114 TitanAshwani KesharwaniNo ratings yet

- Gujarat Themis Biosyn LimitedDocument5 pagesGujarat Themis Biosyn LimitedAshwani KesharwaniNo ratings yet

- Bandra (E), Mumbai - 400 051 NSE Symbol: SULA BSE Scrip Code: 543711 ISIN: INE142Q01026 ISIN: INE142Q01026Document22 pagesBandra (E), Mumbai - 400 051 NSE Symbol: SULA BSE Scrip Code: 543711 ISIN: INE142Q01026 ISIN: INE142Q01026Ashwani KesharwaniNo ratings yet

- Mix Design Practice For Bituminous MixDocument49 pagesMix Design Practice For Bituminous MixAshwani KesharwaniNo ratings yet

- Investor@radico Co inDocument19 pagesInvestor@radico Co inAshwani KesharwaniNo ratings yet

- Irc 6 2014 PDFDocument94 pagesIrc 6 2014 PDFMuthusamy Arumugam100% (1)

- ALL INDIA CONSUMER PRICE INDEX FROM 1995 To 2012Document1 pageALL INDIA CONSUMER PRICE INDEX FROM 1995 To 2012Ashwani KesharwaniNo ratings yet

- WWW - Gfl.co - In: Bhavin Vipin DesaiDocument34 pagesWWW - Gfl.co - In: Bhavin Vipin DesaiAshwani KesharwaniNo ratings yet

- StiffnessDocument18 pagesStiffnessAshwani KesharwaniNo ratings yet

- IrcDocument9 pagesIrcAshwani KesharwaniNo ratings yet

- PCI ch3 Precast Concrete PDFDocument86 pagesPCI ch3 Precast Concrete PDFBhuidhar Verma100% (1)

- M 3 L 04Document27 pagesM 3 L 04Ashwani KesharwaniNo ratings yet

- TB1103 To 1107Document10 pagesTB1103 To 1107Ashwani KesharwaniNo ratings yet

- Mmrda LetterDocument1 pageMmrda LetterAshwani KesharwaniNo ratings yet

- MSEDCL recruitment for over 70 positionsDocument12 pagesMSEDCL recruitment for over 70 positionsVijay BiloriyaNo ratings yet

- National Institute of Technology Calicut, KeralaDocument4 pagesNational Institute of Technology Calicut, KeralaAshwin SheriefNo ratings yet

- CSM Graduate Student HandbookDocument51 pagesCSM Graduate Student HandbookAshwani KesharwaniNo ratings yet

- NetApp Basic Concepts Quick Start GuideDocument132 pagesNetApp Basic Concepts Quick Start Guidemichelgene75% (4)

- The Weird Trading Trick That Wins Big and Wipes Out Losses: Hughes Optioneering Team RevealsDocument27 pagesThe Weird Trading Trick That Wins Big and Wipes Out Losses: Hughes Optioneering Team RevealsE TrialNo ratings yet

- Midas Method - Has One of The Simplest Goal Setting Processes I'Ve Ever Seen. It Just Works. I'Ve Achieved Things I Never Thought Were PossibleDocument0 pagesMidas Method - Has One of The Simplest Goal Setting Processes I'Ve Ever Seen. It Just Works. I'Ve Achieved Things I Never Thought Were PossiblePavel TisunovNo ratings yet

- A European Call Option Gives A Person The Right ToDocument1 pageA European Call Option Gives A Person The Right ToAmit PandeyNo ratings yet

- Prooblem 4-5 No. 2 Journal EntriesDocument12 pagesProoblem 4-5 No. 2 Journal EntriesJoseph LimbongNo ratings yet

- Analog To Digital Converters (ADC) : A Literature Review: and Sanjeet K. SinhaDocument9 pagesAnalog To Digital Converters (ADC) : A Literature Review: and Sanjeet K. SinhaRyu- MikaNo ratings yet

- Improve Your Well-Being With The Wheel Of Life ExerciseDocument2 pagesImprove Your Well-Being With The Wheel Of Life ExerciseLINA PASSIONNo ratings yet

- TARPfinal PDFDocument28 pagesTARPfinal PDFRakesh ReddyNo ratings yet

- Outzone InjectionDocument11 pagesOutzone InjectionFaby Borja ArévaloNo ratings yet

- Abraca Cortina Ovelha-1 PDFDocument13 pagesAbraca Cortina Ovelha-1 PDFMarina Renata Mosella Tenorio100% (7)

- Max14920 Max14921Document30 pagesMax14920 Max14921Enrique Sanchez (KicKeWoW)No ratings yet

- Advanced Storage - Window Area Dialux - ReportDocument17 pagesAdvanced Storage - Window Area Dialux - ReportAnupamaaNo ratings yet

- Iphone 14 Plus InvoiceDocument2 pagesIphone 14 Plus Invoicesubhashgidwani0099100% (1)

- Tut 1Document5 pagesTut 1foranangelqwertyNo ratings yet

- How To Add Message Queuing Feature - Dell IndiaDocument2 pagesHow To Add Message Queuing Feature - Dell Indiayuva razNo ratings yet

- Court of Appeals decision on Batara family land disputeDocument19 pagesCourt of Appeals decision on Batara family land disputeKhanini GandamraNo ratings yet

- Yard FacilitiesDocument30 pagesYard FacilitiesYgandranNo ratings yet

- 'Elements of Research Design McqsDocument5 pages'Elements of Research Design McqsZara KhanNo ratings yet

- Transfer Price MechanismDocument5 pagesTransfer Price MechanismnikhilkumarraoNo ratings yet

- Mining Gate2021Document7 pagesMining Gate2021level threeNo ratings yet

- Electrovalvula Norgren V51Document4 pagesElectrovalvula Norgren V51Base SistemasNo ratings yet

- Chapter 4 Review QuestionsDocument5 pagesChapter 4 Review Questionschiji chzzzmeowNo ratings yet

- Paf-Karachi Institute of Economics & Technology Spring - 2021Document3 pagesPaf-Karachi Institute of Economics & Technology Spring - 2021Basic Knowledge Basic KnowledgeNo ratings yet

- Bank TellerDocument3 pagesBank Tellerapi-3701112No ratings yet

- Export Promotion Capital Goods Scheme PresentationDocument32 pagesExport Promotion Capital Goods Scheme PresentationDakshata SawantNo ratings yet

- NPTELOnline CertificationDocument66 pagesNPTELOnline CertificationAkash GuruNo ratings yet

- A Review of Solar Photovoltaic System Maintenance StrategiesDocument8 pagesA Review of Solar Photovoltaic System Maintenance StrategiessamNo ratings yet

- Communication Skills: Condition of Slums in IndiaDocument17 pagesCommunication Skills: Condition of Slums in Indiahappyskd1993No ratings yet

- Falk Series C, E, F, G, J, P, Q, S, Y Gear Drives - Service ManualDocument4 pagesFalk Series C, E, F, G, J, P, Q, S, Y Gear Drives - Service ManualJorge Iván Carbajal100% (1)

- SGLGB ImplementationDocument47 pagesSGLGB ImplementationDILG Maragondon CaviteNo ratings yet