Professional Documents

Culture Documents

Shilchar Technologies Limited

Uploaded by

jaikumar608jainOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Shilchar Technologies Limited

Uploaded by

jaikumar608jainCopyright:

Available Formats

Press Release

Shilchar Technologies Limited

June 22, 2023

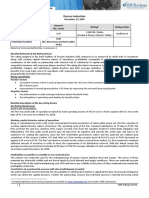

Facilities/Instruments Amount (₹ crore) Rating1 Rating Action

Long Term / Short Term Bank CARE BBB+; Stable / Revised from CARE BBB; Stable /

60.00

Facilities CARE A2 CARE A3+

Long Term Bank Facilities - - Withdrawn^

Details of facilities in Annexure -1; ^ Withdrawn based on no due certificate from the lender

Rationale and key rating drivers

The revision in the ratings assigned to bank facilities of Shilchar Technologies Limited (STL) takes into account improvement in

financial profile with growth in scale of operations and significant improvement in profitability supported by increase in exports

by the company during FY23 (FY refers to the period from April 1 to March 31). Furthermore, ratings factors in increase in its

order book position.

The ratings continue to derive strength from vast experience of promoters with established track record of its operations

coupled with reputed clientele base. The rating also continues to factor in its comfortable capital structure, debt coverage

indicators and adequate liquidity.

The ratings, however, continue to remain constrained on account of its presence in competitive and niche industry restricting its

growth prospects, moderately concentrated customer base and susceptibility of its profit margins to volatile raw material prices

and foreign exchange fluctuations.

Key Rating Sensitivities: Factors likely to lead to rating actions

Positive Factors

• Sustained increase in scale of operation with total operating income (TOI) of over Rs.400 crore while maintaining healthy

profitability above 15%

• Improvement in operating cycle to around 60 days on sustained basis.

Negative Factors

• Decline in scale of operation with TOI falling below Rs.250 crore and PBILDT margin below 13% on sustained basis.

• Deterioration in overall gearing to more than 0.40 times

• Elongation of operating cycle beyond 120 days

Analytical Approach: Standalone

Outlook: Stable

The outlook on the long-term rating of STL is “Stable” considering the benefits derived from established track record of the

company coupled with improvement in order book position that would enable the company to sustain its operational

performance over the medium term.

Key Rating Strengths

Significant growth in its scale of operations along with improvement in profitability

In FY23, STL’s TOI grew significantly by ~57% on y-o-y basis to Rs.286.49 crore owing to increased order inflow from export

customers. STL’s exports grew from Rs.45.70 crore during FY22 to Rs.144.83 crore during FY23 while domestic sales remained

relatively stable over the previous year.

PBILDT margin of the company has increased significantly by 890 bps Y-o-Y to 20.76% in FY23 with better absorption of fixed

cost, better management of raw material costs and significantly increased export sales having better margins, consequently,

PAT margin has also increased significant by 735 bps Y-o-Y to 15.05% in FY23 with improved PBILDT margin. As a result,

return ratios of the company also improved over the previous year and remained healthy with ROCE and RONW of over 52%

and 42% respectively in FY23.

Improvement in order book position

As on May 23, 2023, STL’s order book position (with order execution cycle ranging from 3-12 months) had increased including

export orders as compared to corresponding previous year. The growth was driven by penetration into export market.

1

Complete definition of the ratings assigned are available at www.careedge.in and other CARE Ratings Ltd.’s publications

1 CARE Ratings Ltd.

Press Release

Comfortable capital structure and debt coverage indicators

The capital structure of STL continued to remain comfortable owing to lower reliance on debt marked by overall gearing ratio of

0.04 times as on March 31, 2023 [0.27 times as on March 31, 2022; 0.15 times as on March 31, 2021]. The debt coverage

indicators of STL improved significantly over the previous year on the back of improved profitability and decreased interest cost

[with reduction in total debt] and continued to remain comfortable with interest coverage ratio of 99.21 times [PY: 20.14 times]

and total debt / GCA of 0.10 times [PY: 1.26 times] for the year ended as on March 31, 2023.

Established track record of operations

STL has an operational track record of over two decades with an established position in the domestic market for renewable

energy segment. It also exports its products to various countries like USA, Canada Middle East and African nations such as

Kenya and Nigeria. Over the years it has established its product and customer base. STL manufactures distribution transformers

ranging from 5 KVA to 3,000 KVA and power transformers ranging from 3,000 KVA to 50,000 KVA. Domestically, STL generates

a major portion of its revenue by manufacturing transformers mainly for power and energy sector (with major portion from

domestic renewable sector i.e. solar and wind forming around 50%-60% of net sales). STL is gradually increasing its presence

in other industries like steel and cement. STL is accredited with ISO 9001-2015 certificate from Bureau Veritas for its Design,

Manufacturing and dispatch of transformers and special transformer up to size 650KV peak basic impulse level and is BIS

certified. Furthermore, it has received certificate of accreditation from National Accreditation Board for Testing and Calibration

Laboratories (NABL) for transformer testing laboratory located at their facility at Gavasad, Vadodara.

Experienced promoters

Son of founder Mr. Jitendra Shah, Mr. Alay Shah, Chairman and Managing Director of the company, holds experience of around

three decades in transformer industry and looks after the overall operations of the company. He is assisted by his sons, Mr.

Aashay Shah (Director) and Mr Aatman Shah. They are supported by a team of experienced and well qualified professionals

who are associated with the company for over a decade which includes Mr. Prajesh Purohit, Chief Financial Officer (CFO), who

is holding this responsibility since 2016.

Key Rating Weaknesses

Presence in niche and competitive industry restricting its growth prospects

The transformer manufacturing industry is highly fragmented marked by presence of large number of medium sized players

coupled with presence of large established players with reputed brand names, hence, profitability margins of the industry

players come under pressure because of competitive nature of the industry. STL’s caters to niche industry segments viz

renewable energy, cement, steel and other sectors where it has established presence and has better profitability, but it faces

competition from large players domestically and globally. Overall industry size of transformer requirement in niche segments is

limited restricting its growth prospects.

Reputed customer base albeit customer concentration

Over the years, STL has established its position in the market having served reputed private clients. STL mainly focuses on

private sector clients due to lower collection period. STL has moderate customer concentration as marked by its top five

domestic customers forms ~54% of its domestic sales in FY23 [FY22: ~44%; FY21: ~72%]. However, credit risk remains low

due to its reputed clientele base.

Raw material and forex fluctuation risk

STL’s major raw material includes copper, transformer oil, cold rolled grain-oriented (CRGO) steel and aluminium forming

around 80- 85% of the total raw material cost whose prices have historically remained volatile. The prices of raw material are

driven by international demand-supply dynamics and have exhibited a volatile trend in the past. CRGO steel is imported in India

due to lack of any domestic manufacturing facility, which results in added volatility in its prices due to movement in foreign

exchange (forex) rates. Also, as articulated by management company is also focusing of order back booking of major raw

material like CRGO and copper to hedge against price volatility to an extent.

Also, STL’s 52% of TOI in FY23 [PY: 25%] was from export sales and in absence of active hedging policy, its profitability is

exposed to foreign currency fluctuation risk to a certain extent. The company booked foreign exchange gain of Rs.2.81 crore in

FY23 as against gain of Rs.0.44 crore in FY22.

Liquidity: Adequate

STL’s liquidity position remaine adequate marked by healthy cash flow from operations (CFO), nil debt repayment obligations,

moderate liquidity ratios and low utilization of its fund based working capital limits. It mainly uses performance bank guarantee

resulting in moderate utilization of non fund based limits.

2 CARE Ratings Ltd.

Press Release

CARE ratings expects company to generate healthy cash accruals in near term as against nil long-term debt repayment

obligations. The current ratio remained at moderate level of 2.60 times as on March 31, 2023. CFO of the company improved

over the previous year on the back of increased operating profit as well as decreased inventory level for the year ended on

March 31, 2023 which led to CFO of Rs.38.04 crore in FY23 which subsequently resulted in to increase in unencumbered cash

and bank balance to Rs.9.25 crore as on March 31, 2023. Average utilization of its fund-based working capital facilities

remained negligible in last 12 months ended in March, 2023, while non-fund-based limits remained ~86% p.a. [PY: ~85% p.a.]

utilized during the same period. STL’s operating cycle remained at 90 days in FY23 which is in line with FY22 levels.

Applicable Criteria:

Policy on default recognition

Financial Ratios – Non financial Sector

Liquidity Analysis of Non-financial sector entities

Rating Outlook and Credit Watch

Short Term Instruments

Manufacturing Companies

Policy on Withdrawal of Ratings

About the company and industry

Industry Classification

Macro Economic Indicator Sector Industry Basic Industry

Industrials Capital Goods Electrical Equipment Other Electrical Equipment

About the company

Vadodara (Gujarat) based STL was established in 1986 and is engaged in manufacturing of various categories of transformers

including power, distribution and electronics & telecommunication. The company caters to the demand of domestic market as

well as export market mainly including Africa, USA, Canada and Middle-East countries.

The company manufactures and supplies customized transformers of various ratings and power specifications tailor-made

according to the needs and specifications of the customers, having application in niche industry segments. The company has

capacity of 4000 MVA as on March 31, 2023 to manufacture distribution transformers ranging from 5 KVA to 3,000 KVA and

power transformers ranging from 3 MVA to 15 MVA.

Brief Financials (Rs. crore) FY21 (A) FY22 (A) FY23 (A)

Total operating income 119.14 182.40 286.49

PBILDT 10.84 21.64 59.49

PAT 5.52 14.04 43.12

Overall gearing (times) 0.15 0.27 0.04

Interest coverage (times) 5.01 20.14 99.21

A: Audited; Note: ‘the above results are latest financial results available’

Status of non-cooperation with previous CRA: Not Applicable

Any other information: Not Applicable

Rating History (Last three years): Please refer Annexure-2

Covenants of rated facility: Detailed explanation of covenants of the rated facilities is given in Annexure-3

Complexity level of various instruments rated for this company: Annexure-4

Lender details: Annexure-5

Annexure-1: Details of instruments/facilities

Date of Maturity Size of the Rating Assigned

Name of the Coupon

ISIN Issuance (DD- Date (DD- Issue along with

Instrument Rate (%)

MM-YYYY) MM-YYYY) (₹ crore) Rating Outlook

Fund-based - LT-

- - - 31/03/2024 0.00 Withdrawn

Term Loan

Fund-based - LT/ ST- CARE BBB+; Stable

- - - - 10.00

CC/Packing Credit / CARE A2

Fund-based/Non- CARE BBB+; Stable

- - - - 10.00

fund-based-LT/ST / CARE A2

Non-fund-based - LT/ CARE BBB+; Stable

- - - - 40.00

ST-Bank Guarantee / CARE A2

3 CARE Ratings Ltd.

Press Release

Annexure-2: Rating history for the last three years

Current Ratings Rating History

Date(s) Date(s)

Date(s)

Name of the and and Date(s) and

Sr. Amount and

Instrument/Bank Rating(s) Rating(s) Rating(s)

No. Type Outstanding Rating Rating(s)

Facilities assigned assigned assigned in

(₹ crore) assigned in

in 2023- in 2022- 2020-2021

2021-2022

2024 2023

1)CARE BBB-;

1)CARE BBB- Stable / CARE

1)CARE ; Stable / A3

CARE

BBB; CARE A3 (24-Dec-20)

Fund-based - LT/ BBB+;

Stable / (17-Feb-22) 2)CARE BB+;

1 ST-CC/Packing LT/ST* 10.00 Stable -

CARE A3+ 2)CARE BBB- Stable / CARE

Credit / CARE

(06-Jun- ; Stable / A4+; ISSUER

A2

22) CARE A3 NOT

(28-Jan-22) COOPERATING*

(18-Aug-20)

1)CARE BBB- 1)CARE BBB-;

1)CARE ; Stable / Stable / CARE

CARE

BBB; CARE A3 A3

BBB+;

Fund-based/Non- Stable / (17-Feb-22) (24-Dec-20)

2 LT/ST* 10.00 Stable -

fund-based-LT/ST CARE A3+ 2)CARE BBB- 2)CARE A4+;

/ CARE

(06-Jun- ; Stable / ISSUER NOT

A2

22) CARE A3 COOPERATING*

(28-Jan-22) (18-Aug-20)

1)CARE BBB- 1)CARE BBB-;

1)CARE ; Stable / Stable / CARE

CARE

BBB; CARE A3 A3

Non-fund-based - BBB+;

Stable / (17-Feb-22) (24-Dec-20)

3 LT/ ST-Bank LT/ST* 40.00 Stable -

CARE A3+ 2)CARE BBB- 2)CARE A4+;

Guarantee / CARE

(06-Jun- ; Stable / ISSUER NOT

A2

22) CARE A3 COOPERATING*

(28-Jan-22) (18-Aug-20)

1)CARE BBB-

1)CARE

; Stable

BBB; 1)CARE BBB-;

Fund-based - LT- (17-Feb-22)

4 LT - - - Stable Stable

Term Loan 2)CARE BBB-

(06-Jun- (24-Dec-20)

; Stable

22)

(28-Jan-22)

*Long term/Short term.

Annexure-3: Detailed explanation of covenants of the rated instruments/facilities: Not applicable

Annexure-4: Complexity level of the various instruments rated

Sr.

Name of the Instrument Complexity Level

No.

1 Fund-based - LT-Term Loan Simple

2 Fund-based - LT/ ST-CC/Packing Credit Simple

3 Fund-based/Non-fund-based-LT/ST Simple

4 Non-fund-based - LT/ ST-Bank Guarantee Simple

Annexure-5: Lender details

To view the lender wise details of bank facilities please click here

4 CARE Ratings Ltd.

Press Release

Note on complexity levels of the rated instruments: CARE Ratings Limited has classified instruments rated by it on the

basis of complexity. This classification is available at www.careedge.in. Investors/market intermediaries/regulators or others are

welcome to write to care@careedge.in for any clarifications.

Contact us

Media Contact Analytical Contacts

Name: Mradul Mishra Name: Kalpesh Patel

Director Director

CARE Ratings Limited CARE Ratings Limited

Phone: +91-22-6754 3596 Phone: +91-79-4026 5611

E-mail: mradul.mishra@careedge.in E-mail: kalpesh.patel@careedge.in

Relationship Contact Name: Akhil Goyal

Associate Director

Name: Deepak Purshottambhai Prajapati CARE Ratings Limited

Senior Director Phone: +91-79-4026 5621

CARE Ratings Limited E-mail: akhil.goyal@careedge.in

Phone: +91-79-4026 5656

E-mail: deepak.prajapati@careedge.in Name: Harsh Desai

Lead Analyst

CARE Ratings Limited

E-mail: harsh.desai@careedge.in

About us:

Established in 1993, CARE Ratings is one of the leading credit rating agencies in India. Registered under the Securities and

Exchange Board of India, it has been acknowledged as an External Credit Assessment Institution by the RBI. With an equitable

position in the Indian capital market, CARE Ratings provides a wide array of credit rating services that help corporates raise

capital and enable investors to make informed decisions. With an established track record of rating companies over almost

three decades, CARE Ratings follows a robust and transparent rating process that leverages its domain and analytical expertise,

backed by the methodologies congruent with the international best practices. CARE Ratings has played a pivotal role in

developing bank debt and capital market instruments, including commercial papers, corporate bonds and debentures, and

structured credit.

Disclaimer:

The ratings issued by CARE Ratings are opinions on the likelihood of timely payment of the obligations under the rated instrument and are not recommendations to

sanction, renew, disburse, or recall the concerned bank facilities or to buy, sell, or hold any security. These ratings do not convey suitability or price for the investor.

The agency does not constitute an audit on the rated entity. CARE Ratings has based its ratings/outlook based on information obtained from reliable and credible

sources. CARE Ratings does not, however, guarantee the accuracy, adequacy, or completeness of any information and is not responsible for any errors or omissions

and the results obtained from the use of such information. Most entities whose bank facilities/instruments are rated by CARE Ratings have paid a credit rating fee,

based on the amount and type of bank facilities/instruments. CARE Ratings or its subsidiaries/associates may also be involved with other commercial transactions

with the entity. In case of partnership/proprietary concerns, the rating/outlook assigned by CARE Ratings is, inter-alia, based on the capital deployed by the

partners/proprietors and the current financial strength of the firm. The ratings/outlook may change in case of withdrawal of capital, or the unsecured loans brought

in by the partners/proprietors in addition to the financial performance and other relevant factors. CARE Ratings is not responsible for any errors and states that it

has no financial liability whatsoever to the users of the ratings of CARE Ratings. The ratings of CARE Ratings do not factor in any rating-related trigger clauses as

per the terms of the facilities/instruments, which may involve acceleration of payments in case of rating downgrades. However, if any such clauses are introduced

and triggered, the ratings may see volatility and sharp downgrades.

For the detailed Rationale Report and subscription information, please visit www.careedge.in

5 CARE Ratings Ltd.

You might also like

- A Study of the Supply Chain and Financial Parameters of a Small BusinessFrom EverandA Study of the Supply Chain and Financial Parameters of a Small BusinessNo ratings yet

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryFrom EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- STEER Engineering Private Limited: Summary of Rated InstrumentsDocument7 pagesSTEER Engineering Private Limited: Summary of Rated InstrumentsNarendranNo ratings yet

- Bharat Gears LimitedDocument7 pagesBharat Gears LimitedjagadeeshNo ratings yet

- SGS Tekniks Manufacturing PVT LTDDocument7 pagesSGS Tekniks Manufacturing PVT LTDgcgary87No ratings yet

- Myra Hygiene Products Private LimitedDocument7 pagesMyra Hygiene Products Private Limitedanuj7729No ratings yet

- CTR Manufacturing Industries Private LimitedDocument7 pagesCTR Manufacturing Industries Private Limitedkrushna.maneNo ratings yet

- Ajanta Soya 13may2021Document7 pagesAjanta Soya 13may2021praveen kumarNo ratings yet

- Press Release Deccan Industries: Positive FactorsDocument4 pagesPress Release Deccan Industries: Positive FactorsHARI HARANNo ratings yet

- SJS Enterprises LimitedDocument7 pagesSJS Enterprises LimitedCA Ankur BariaNo ratings yet

- CARE Sunflag 4.01.2024Document9 pagesCARE Sunflag 4.01.2024Swapnil SomkuwarNo ratings yet

- Waaree Energies LimitedDocument6 pagesWaaree Energies LimitedHasik JainNo ratings yet

- Champion Commercial Company LimitedDocument7 pagesChampion Commercial Company LimitedCedric KerkettaNo ratings yet

- Filatex India Limited PDFDocument6 pagesFilatex India Limited PDFfatNo ratings yet

- Onshore Construction Company Private LimitedDocument7 pagesOnshore Construction Company Private Limitedhesham zakiNo ratings yet

- Technico Industries LimitedDocument4 pagesTechnico Industries Limitedshankarravi8975No ratings yet

- Electromech Material R 08022018Document8 pagesElectromech Material R 08022018amol_patil51429514No ratings yet

- Shapoorji Pallonji and Company Private LimitedDocument5 pagesShapoorji Pallonji and Company Private LimitedPrabhakar DubeyNo ratings yet

- L & W Building Solutions PVT LTDDocument7 pagesL & W Building Solutions PVT LTDhesham zakiNo ratings yet

- A One Steel Alloys 10may2021Document7 pagesA One Steel Alloys 10may2021L KNo ratings yet

- Press Release Tarsons Products Private Limited: Details of Instruments/facilities in Annexure-1Document4 pagesPress Release Tarsons Products Private Limited: Details of Instruments/facilities in Annexure-1hussainNo ratings yet

- Sunlex Fabrics Private Limited - Care RatingsDocument6 pagesSunlex Fabrics Private Limited - Care RatingsManeet GoyalNo ratings yet

- Oriental Rubber Industries Pvt. LTDDocument7 pagesOriental Rubber Industries Pvt. LTDPriya VijiNo ratings yet

- United Breweries Limited: Summary of Rated InstrumentsDocument8 pagesUnited Breweries Limited: Summary of Rated InstrumentsKaushikDasguptaNo ratings yet

- Vijaya Diagnostic Centre LimitedDocument7 pagesVijaya Diagnostic Centre LimitedRavi KNo ratings yet

- Bhuwalka and Sons Private LimitedDocument4 pagesBhuwalka and Sons Private LimiteddoctorsabeehNo ratings yet

- Patels Airtemp (India) LimitedDocument5 pagesPatels Airtemp (India) LimitedAnkit LohiyaNo ratings yet

- Big Bags International PVT LTDDocument7 pagesBig Bags International PVT LTDnayabrasul208No ratings yet

- Prayag Polymers Private LimitedDocument4 pagesPrayag Polymers Private Limitednandinimishra6168No ratings yet

- Chromachemie Laboratory Private LimitedDocument7 pagesChromachemie Laboratory Private Limitedkrushna.maneNo ratings yet

- Press Release Om Logistics Limited: Details of Instruments/facilities in Annexure-1Document6 pagesPress Release Om Logistics Limited: Details of Instruments/facilities in Annexure-1Sinius InfracomNo ratings yet

- L.G. Balakrishnan & Bros Limited: Summary of Rating ActionDocument7 pagesL.G. Balakrishnan & Bros Limited: Summary of Rating ActionChromoNo ratings yet

- Gujarat Themis Biosyn LimitedDocument5 pagesGujarat Themis Biosyn LimitedAshwani KesharwaniNo ratings yet

- Tube Investments of India LimitedDocument8 pagesTube Investments of India Limitedpraveen kumarNo ratings yet

- Padget Electronics Pvt. LTDDocument9 pagesPadget Electronics Pvt. LTDvenkyniyerNo ratings yet

- S. Jogani Exports Private LimitedDocument6 pagesS. Jogani Exports Private Limitedarc14consultantNo ratings yet

- Zetwerk Manufacturing Businesses PVT LTDDocument8 pagesZetwerk Manufacturing Businesses PVT LTDrahulappikatlaNo ratings yet

- Naresh Kumar and Company Private LimitedDocument5 pagesNaresh Kumar and Company Private LimitedKunalNo ratings yet

- Track Components - ICRADocument8 pagesTrack Components - ICRAPuneet367No ratings yet

- Happy ForgingsDocument7 pagesHappy ForgingsArshChandraNo ratings yet

- Press Release Gravita India Limited: Ratings Facilities Amount (Rs. Crore) Ratings Rating ActionDocument7 pagesPress Release Gravita India Limited: Ratings Facilities Amount (Rs. Crore) Ratings Rating ActionhamsNo ratings yet

- La Opala RG LimitedDocument5 pagesLa Opala RG LimitedAshwani KesharwaniNo ratings yet

- Stove Kraft LimitedDocument7 pagesStove Kraft LimitedSiddharth Rai SuranaNo ratings yet

- Anthem Biosciences-R-21052018Document7 pagesAnthem Biosciences-R-21052018swarnaNo ratings yet

- AKR Industries 19mar2020Document8 pagesAKR Industries 19mar2020Karthikeyan RK SwamyNo ratings yet

- Press Release RACL Geartech LTDDocument4 pagesPress Release RACL Geartech LTDSourav DuttaNo ratings yet

- SRC Chemicals Private LimitedDocument8 pagesSRC Chemicals Private Limitedgcgary87No ratings yet

- C&S Electric Limited: Rating History Instrument Rating Outstanding Previous Ratings March, 2010 September, 2008Document4 pagesC&S Electric Limited: Rating History Instrument Rating Outstanding Previous Ratings March, 2010 September, 2008sgoswami_1No ratings yet

- Northern Arc Capital - R-01072019Document10 pagesNorthern Arc Capital - R-01072019vaibhav khandelwalNo ratings yet

- Epicenter Technologies Private - R - 11082020Document7 pagesEpicenter Technologies Private - R - 11082020Shawn BlazeNo ratings yet

- Press Release RACL Geartech LTDDocument4 pagesPress Release RACL Geartech LTDSourav DuttaNo ratings yet

- Wockhardt LimitedDocument8 pagesWockhardt LimitedKumar SatyakamNo ratings yet

- Divis Laboratories LimitedDocument7 pagesDivis Laboratories Limiteddivygupta198No ratings yet

- Rane Engine Valve Limited: Summary of Rated Instruments Instrument Rated Amount (Rs. Crore) Rating ActionDocument7 pagesRane Engine Valve Limited: Summary of Rated Instruments Instrument Rated Amount (Rs. Crore) Rating ActiontomNo ratings yet

- Rajendra Singh Bhamboo Infra Private LimitedDocument5 pagesRajendra Singh Bhamboo Infra Private LimitedBABU LAL CHOUDHARYNo ratings yet

- Incred Financial Services Limited Press+ReleaseDocument7 pagesIncred Financial Services Limited Press+ReleaseGautam MehtaNo ratings yet

- Ganga Rasayanie Private Limited-R-10102019Document7 pagesGanga Rasayanie Private Limited-R-10102019DarshanNo ratings yet

- Kitex Garments LimitedDocument8 pagesKitex Garments LimitedSamsuzzoha ZohaNo ratings yet

- Subros LimitedDocument8 pagesSubros LimitedrajpersonalNo ratings yet

- Press Release: Refer Annexure For DetailsDocument4 pagesPress Release: Refer Annexure For DetailsAmit BelladNo ratings yet

- Chapter 13 - Loan ReceivableDocument15 pagesChapter 13 - Loan ReceivableDidik DidiksterNo ratings yet

- Test Bank For Essentials of Investments 11th Edition Zvi Bodie Alex Kane Alan Marcus Isbn10 1260013928 Isbn13 9781260013924Document30 pagesTest Bank For Essentials of Investments 11th Edition Zvi Bodie Alex Kane Alan Marcus Isbn10 1260013928 Isbn13 9781260013924Peggy Robinson100% (37)

- Sales and DistributionDocument7 pagesSales and DistributionRanjith SNo ratings yet

- Case Studies of BST Class 11 CHDocument6 pagesCase Studies of BST Class 11 CHBhavik gamerNo ratings yet

- Volkswagen 11Document49 pagesVolkswagen 11Frank BessiNo ratings yet

- NIGERIA STARTUP ACT 2022 Final PublicationDocument28 pagesNIGERIA STARTUP ACT 2022 Final PublicationDare LawansonNo ratings yet

- Jul22 Osa Supp Accounting and Financial Management Question PaperDocument9 pagesJul22 Osa Supp Accounting and Financial Management Question PaperMelokuhle MhlongoNo ratings yet

- Capital Market and FinanceDocument12 pagesCapital Market and FinanceUTKARSH ZAMBARENo ratings yet

- Operating and Financial Budgeting FinalDocument10 pagesOperating and Financial Budgeting FinalKharen SantosNo ratings yet

- The Modern Microsoft Partner Series Part 5-Deliver Customer Lifetime Value 2016Document31 pagesThe Modern Microsoft Partner Series Part 5-Deliver Customer Lifetime Value 2016Sp PouloNo ratings yet

- ENTREPRENEURSHIPDocument15 pagesENTREPRENEURSHIPAlly OcbianNo ratings yet

- Internship Report On RBB Srijana NeupaneDocument39 pagesInternship Report On RBB Srijana NeupaneconXn Communication & CyberNo ratings yet

- Insplore TLS FinalDocument68 pagesInsplore TLS FinalManisha DashNo ratings yet

- Cash 1099Document6 pagesCash 1099Shub OutNo ratings yet

- T2sch100-Fill-20e - Balance Sheet InformationDocument2 pagesT2sch100-Fill-20e - Balance Sheet Informationnh nNo ratings yet

- E2 CH2 Alternative Approaches To Business ModelsDocument9 pagesE2 CH2 Alternative Approaches To Business ModelstutorbritzNo ratings yet

- Penney Merger Case Solution 3Document15 pagesPenney Merger Case Solution 3Carlos VeraNo ratings yet

- NORE INTERNATIONAL Business PlanDocument12 pagesNORE INTERNATIONAL Business Planfranklyn007No ratings yet

- Chapter-5 - Money and BankingDocument3 pagesChapter-5 - Money and BankingramanNo ratings yet

- UEH AdvancedFM Chapter9Document45 pagesUEH AdvancedFM Chapter9Quỳnh Nguyễn ThúyNo ratings yet

- 2014 07 17 Base ProspectusDocument126 pages2014 07 17 Base ProspectusVipin VipinNo ratings yet

- ENT PS Unit2 Lesson3 FinalDocument35 pagesENT PS Unit2 Lesson3 FinalRJ GasconNo ratings yet

- PetMeds Analysis 2Document10 pagesPetMeds Analysis 2Марго КоваленкоNo ratings yet

- 2021 Annual ReportDocument372 pages2021 Annual ReportfinanceconnoisseurngNo ratings yet

- Key From Unit 6 To Unit 10 Esp PDF FreeDocument20 pagesKey From Unit 6 To Unit 10 Esp PDF FreeTrần Đức TàiNo ratings yet

- Priciples of Commerce Short Long Questions I YearDocument4 pagesPriciples of Commerce Short Long Questions I YearMuhammad MuneebNo ratings yet

- HK V2 Exam 2 PMDocument31 pagesHK V2 Exam 2 PMHarsh KabraNo ratings yet

- SWOT Analysis and TOWS Matrix AssignmentDocument2 pagesSWOT Analysis and TOWS Matrix AssignmentFadiah AliNo ratings yet

- FMAI - Ch04 - Stock MarketDocument105 pagesFMAI - Ch04 - Stock Marketngoc duongNo ratings yet

- Financial Analysis of Jamuna Oil Company LimitedDocument48 pagesFinancial Analysis of Jamuna Oil Company LimitedMohammad Mamun100% (1)