Professional Documents

Culture Documents

Vinati Organics Limited

Uploaded by

Ashwani KesharwaniOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Vinati Organics Limited

Uploaded by

Ashwani KesharwaniCopyright:

Available Formats

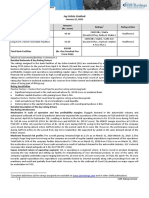

Press Release

Vinati Organics Limited

October 06, 2022

Ratings

Facilities/Instruments Amount (₹ crore) Rating1 Rating Action

CARE AA; Positive Reaffirmed; Outlook

Long-term bank facilities 5.00

(Double A; Outlook: Positive) revised from Stable

Long-term / Short-term 110.00 CARE AA; Positive / CARE A1+ Reaffirmed; Outlook

bank facilities (Enhanced from 75.00) (Double A; Outlook: Positive/ A One Plus) revised from Stable

CARE A1+

Short-term bank facilities 10.00 Reaffirmed

(A One Plus)

125.00

Total bank facilities (₹ One hundred twenty-

five crore only)

Details of instruments/facilities in Annexure-1.

Detailed rationale and key rating drivers

The ratings assigned to the bank facilities of Vinati Organics Limited (VOL) factor in its market leadership in its two key

products, viz, in 2- Acrylamido 2 Methylpropane Sulfonic Acid (ATBS) and Isobutyl Benzene (IBB) in the global market. CARE

Ratings Limited (CARE Ratings) believes that the competitive advantage of VOL in both its product segments is expected to

sustain in the medium term as the manufacturing processes are not easy to replicate and the same acts as entry barrier for new

entrants.

The ratings also factor in the improvement in sales reported by VOL in FY22 (refers to the period April 1 to March 31) on the

back of strong demand for ATBS (contributing to around 50% of the total sales for VOL). Revenue from ATBS grew by 123% in

FY22 on a YoY basis, while revenue from IBB declined by 34% over the same period. Furthermore, during the year FY21, VOL

commenced commercial production of a new product, viz., butyl phenol, which contributed to around 12% to the total revenue

of the company in FY22. VOL is currently undertaking capex of around ₹580 crore (around ₹300 crore in VOL for ATBS capacity

expansion and around ₹280 crore in Veeral Organics Private Limited (VOPL; 100% subsidiary of VOL) which will enable it to

manufacture additional derivatives of Isobutylene (IB)). As such, future revenue growth will be supported by increasing demand

for ATBS and butyl phenols and incremental revenue from new IB derivatives.

The operating margins for VOL have declined to around 30% in FY22 (PY: 38%) owing to rising raw-material prices, higher

freight cost due to shortage of containers and higher power and fuel costs due to significant jump in coal and gas prices. While

rising input costs are passed on to the customers with a lag, the overall operating margins are expected to be lower than

historical levels, albeit at healthy levels owing to changing product mix.

The ratings continue to derive strength from the long-track record and experience of the promoters in the speciality organic

chemical industry. VOL continues to benefit from the long-term relationship with established and reputed clientele across

various geographies. Backward integrated manufacturing process with zero discharge along with VOL’s cost-efficient operations

acts as an entry barrier for new entrants. Furthermore, the rating derives strength from healthy cash flows from operations,

favourable capital structure along with strong liquidity and debt coverage indicators.

The ratings continue to be tempered by the concentration of its total operating income from limited key products and

susceptibility of VOL’s operating margin to raw material price/foreign exchange fluctuations.

Rating sensitivities

Positive factors – Factors that could lead to positive rating action/upgrade:

• Growth in the total operating income on the back of increased demand from the existing products as well as effective

diversification in product profile.

• Return on capital employed above 25% on a sustained basis.

1

Complete definition of the ratings assigned are available at www.careedge.in and other CARE Ratings Ltd.’s publications

1 CARE Ratings Ltd.

Press Release

Negative factors – Factors that could lead to negative rating action/downgrade:

• Any significant debt-funded organic or inorganic expansion undertaken by the company which adversely impacts the

debt protection metrics going forward.

• Weakening of its PBILDT margins below 25% and RoCE below 22% on sustained basis.

Outlook: Positive

The positive outlook primarily reflects CARE’s belief that VOL’s business and financial risk profile will continue to remain strong

and will further improve over the medium term. The revision in outlook also reflects expectations of VOL’s healthy revenue

growth on back of increase in demand from existing products as well as effective diversification in product profile while

sustaining PBILDT margins in range of 25-27% and with debt free profile and strong liquidity. The Outlook may be revised to

‘Stable’ on significant decline in PBILDT margins, and deterioration in capital structure due to increased debt levels or lower

cash accruals.

Detailed description of the key rating drivers

Key rating strengths

Vast experience of the promoters in the specialty chemical business: VOL is promoted by Vinod Saraf, first-generation

entrepreneur who has over two decades of experience in the chemical industry. The day-to-day operations of the company are

managed by a team of qualified and experienced personnel headed by Vinod Saraf. Besides, his daughter, Vinati Saraf has also

been actively involved in managing the business.

Prior to incorporation of VOL, Saraf was associated with companies such as the Bhilwara group, Modern Syntex (I) Ltd., Grasim

Industries Ltd. and Mangalore Refinery and Petrochemicals Ltd. Under his leadership, VOL has grown both in terms of capacities

and in terms of basket of products manufactured by it and has become world’s largest manufacturers and sellers of Isobutyl

Benzene (IBB) and ATBS with a significant market share in both the product categories.

Backward integrated manufacturing of ATBS and Butyl Phenols; highly cost efficient and zero discharge

manufacturing facilities: VOL is the only backward integrated manufacturer of ATBS and butyl phenols with its own

Isobutylene (IB) manufacturing unit which makes its operations more cost efficient. Well-integrated product portfolio has

helped VOL to achieve high operational efficiencies and produce high-quality products

Long-established relationship with reputed clients with diversified presence in domestic and export markets:

VOL has been able to maintain long-term relationship with its clients over the years with its client list including reputed

companies such as Chemtall Inc., BASF Corporation, Mitsubishi Corporation, SNF, Dow Europe GMBH among others. VOL enters

into long-term supply contracts with its customers, for its two primary products IBB and ATBS. It is an export-oriented company

with around 70% of its revenues from exports. It supplies to around 40 countries across the world with majority exports to

USA, Europe, Japan and China.

Improving total operating income on the back of strong contribution from ATBS and stable demand from other

segments: VOL witnessed TOI growth of around 72% in FY22 on a y-o-y basis and 57% growth when compared with pre-

COVID-19 which was primarily driven by growth in ATBS sales due to revival in demand from USA and Europe for ATBS. ATBS

is witnessing healthy demand from various end-user industries including oil and gas, water treatment, cosmetic and detergent

industries. The company expects the demand to be robust in the coming years, owing to which, it has announced the expansion

of its capacity from 40,000TPA to 60,000TPA. IBB sales were impacted in FY22 owing to overstocking by the customers in FY21.

Sales growth in FY22 is also supported by revenue from BP. In FY23, IBB sales are expected to improve as its demand is

returning to normalcy. Strong demand from ATBS and butyl phenols is likely to drive revenue growth going forward.

Robust financial risk profile: In order to increase its scale of operations and diversify its revenue base the company has

been consistently adding capacities of its existing product lines as well as introducing new products. Healthy cash flows from

operations have helped VOL fund its capex entirely from internal accruals thus, resulting in a healthy capital structure. During

FY22, VOL reported cash flow from operations of ₹126.77 crore and it had cash and cash equivalents (including investments) of

around ₹1.07 crore as on March 31, 2022. Moreover, VOL’s fund-based utilisation also remains low thus, providing additional

liquidity.

Diversification into antioxidants through proposed amalgamation of Veeral Additives Private Limited (VAPL):

VAPL is engaged in the manufacture of Antioxidants (AO) used in plastics, LDPE, LLDPE, and polypropylene. This company was

acquired by Vinod Saraf (Chairman of VOL) four years back and is fully owned by the promoters of VOL. As per Board resolution

dated February 2, 2021, the board of VOL had approved the scheme of merger of VAPL with VOL. Recently, vide board

2 CARE Ratings Ltd.

Press Release

resolution dated September 8, 2021, the board of VOL amended the scheme of merger wherein the shareholders of VAPL shall

get 14 shares of VOL of ₹1 each in exchange for 713 fully paid up shares of ₹10 each held in VAPL. This scheme of merger is

yet to be approved by SEBI, the stock exchanges and NCLT. The value of this transaction is close to ₹330 crore which includes

the value of share transfer and the loan of around ₹130 crore extended by VOL to VAPL to repay its existing bank debt. The

following are the synergies which are anticipated from this amalgamation:

• Manufacturing of three types of anti-oxidants

• Anti-oxidants use Butyl Phenols as a raw material

• VOL manufactures its own Isobutylene which is used in manufacturing butyl phenols

• VOL would become the largest and only doubly integrated manufacturer of these AO's in India

• The amalgamation would allow VOL to acquire technology, knowledge and resources in the niche AO space

which has potential for import substitution as well as exports.

AOs has higher global demand than domestic demand. As such, apart from catering to domestic demand VOL will be able to

cater to export requirements as well. Approximately 50% of the products will be sold in domestic market and 50% exported.

Revenue expectation post-merger is to the tune of ₹300 crore per annum.

During FY22, to facilitate forward integration to the existing product lines of VAPL, to expedite the completion of the project in

time and to avoid delays in the execution due to ongoing pandemic, VOL has advanced loans of ₹120.48 crore (PY: ₹131.86

crore) to VAPL. Outstanding balance of loans given to VAPL is ₹252.34 crore as on March 31, 2022 (vs. ₹131.86 crore as on

March 31, 2021). VAPL’s facility came on stream in March 2022, which will start its supplies from H2FY23.

Key rating weaknesses

Product concentrations risk owing to higher dependence on two of its key products although the same is

expected to reduce with ramping up of operations in the butyl phenol segment: Despite having a well-integrated

product portfolio, VOL continues to derive majority of its revenues from its key products i.e. IBB and ATBS. During FY22, VOL

derived around 63% (PY: 63%) of its total revenues from these two products put together. Nonetheless, diverse application of

ATBS reduces the product concentration risk up-to a certain extent. Moreover, the company has added four varieties of Butyl

Phenol (BP) to its product portfolio and successful ramping of product will reduce its reliance on the two major products up-to

some extent. Butyl Phenol contributed around 12% to total revenues in FY22 and is expected to further increase as BP sales

gain momentum which is expected to contribute to around 15-20% of the total revenue going forward. During Q1FY23, BP

contributed around 19% to total revenues.

Decline in operating margins in FY22: VOL has been consistently reporting high operating margins in the past ranging

between 35% and 42% on the back of its strong position in both its key product segments, i.e., IBB and ATBS. However, steep

increase in the price of its key raw materials, increased freight costs and change in sales mix in FY22 led to a decline in

operating margins. While raw material prices and freight costs have softened compared to its peak levels. Going forward, with

increasing share of butyl phenols in the sales mix, operating margins are expected to be lower than historical levels but will

remain at healthy levels.

Exposure to raw material volatility and foreign currency fluctuations mitigated to an extent by cost plus mark-

up formulae of pricing followed by VOL: Crude derivatives such as toluene, propylene, acrylonitrile and methyl tert butyl

ether are the key raw materials required in the manufacturing process of IBB and ATBS. The company procures toluene from

Reliance Industries Limited (RIL) and local traders whereas propylene is sourced from local refineries like Bharat Petroleum

Corporation Limited (BPCL). The pricing terms are based on the base prices of toluene and propylene, which are published by

Platts (leading global provider of energy and metals information). VOL follows a cost-plus mark-up formula for pricing of its

products and as such is able to pass on raw material price increase to its customers. Being a net exporter, VOL is exposed to

foreign exchange fluctuation risk. The company has natural hedge up-to the extent of imports. However, as the company does

not hedge fully its foreign currency exposure, it remains exposed to any adverse movement in the foreign exchange. As on

March 31, 2022, the company had net USD exposure of ₹234.05 crore (PY: ₹157.59 crore) and net Euro exposure of ₹11.92

crore (P.Y: ₹6.32 crore).

Liquidity: Strong

Liquidity of VOL is marked by healthy cash accruals from operations against no long-term debt repayment. VOL has

unencumbered cash and investments balance of ₹1.07 crore as on March 31, 2022. Furthermore, VOL has been regularly

reporting healthy cash flow from operations and the same stood at ₹126.77 crore during FY22. With a negligible overall

3 CARE Ratings Ltd.

Press Release

gearing, VOL has sufficient headroom to raise additional debt for its capex. Working capital limits are mostly used to meet non-

fund-based requirements with very little fund-based utilization.

Analytical approach

CARE Ratings has considered consolidated financials for arriving at the rating owing to operations in similar line of business and

business linkages that exists with its subsidiaries. VOL incorporated a wholly owned subsidiary named Veeral Organics Private

Limited on October 05, 2020.

Applicable criteria

Policy on default recognition

Consolidation

Financial Ratios – Non financial Sector

Liquidity Analysis of Non-financial sector entities

Rating Outlook and Credit Watch

Short Term Instruments

Manufacturing Companies

About the company

Incorporated in 1989, VOL is one of India’s leading manufacturers and exporters of specialty organic intermediaries, monomers,

and polymers. VOL is the world’s largest manufacturer of isobutyl benzene (IBB) and 2-Acrylamido 2- Methylpropane Sulfonic

Acid (ATBS). In an effort towards backward integration, VOL manufactures Isobutylene (IB), one of the key components used

in manufacturing ATBS. Besides, VOL also manufactures butyl phenols, Normal Butylbenzene (NBB), Hexenes, N-Tertiary Butyl

Acrylamide (TBA), high purity methyl tertiary butyl amine (HP-MTBE) and other industrial monomers on a small scale.

Moreover, the company also manufacturers Tertiary Butyl Amine (TB-Amine), Tertiary Butyl Benzoic Acid (PTBBA) and a couple

of customized products. Also, VOL plans to expand its product portfolio through Veeral Organics Ltd (fully owned subsidiary) by

introducing products like MEHQ and Guaiacol (2000 MT) and Iso Amylene (30000 MT)

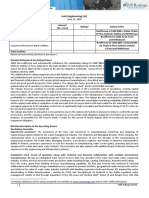

Brief Financials (₹ crore) March 31, 2021 (A) March 31, 2022 (A) June 30, 2022 (UA)

Total operating income 971.31 1,674.61 525.01

PBILDT 370.31 494.46 149.57

PAT 269.32 346.51 101.19

Overall gearing (times) 0.00 0.01 NA

Interest coverage (times) 390.54 299.27 318.23

A: Audited; UA: Unaudited; NA: Not available

Status of non-cooperation with previous CRA:

Not applicable

Any other information:

Not applicable

Disclosure of Interest of Independent/Non-Executive Directors of CARE Ratings Ltd.:

Name of Director Designation of Director

Adesh Kumar Gupta Non-Executive - Independent Director

Adesh Kumar Gupta who is a Non-Executive / Independent Director on the Board of Vinati Organics Ltd. is a Non-Executive /

Independent Director of CARE Ratings. Independent/Non-executive Directors of CARE Ratings. are not a part of CARE Ratings’s

Rating Committee and do not participate in the rating process.

Disclosure of Interest of Managing Director & CEO: Not applicable

Rating history for the last three years: Please refer Annexure-2

Covenants of the rated instruments/facilities: Detailed explanation of covenants of the rated instruments/facilities is

given in Annexure-3

Complexity level of various instruments rated for this company: Annexure-4

4 CARE Ratings Ltd.

Press Release

Annexure-1: Details of instruments/facilities

Coupon Maturity Size of Rating Assigned

Name of the Date of Issuance

ISIN Rate Date (DD- the Issue along with Rating

Instrument (DD-MM-YYYY)

(%) MM-YYYY) (₹ crore) Outlook

Non-fund-based - ST-

- - - - 10.00 CARE A1+

BG/LC

Fund-based - LT/ ST- CARE AA; Positive /

- - - - 110.00

CC/PC/Bill Discounting CARE A1+

Fund-based - LT-Cash

- - - - 5.00 CARE AA; Positive

Credit

Annexure-2: Rating history for the last three years

Current Ratings Rating History

Date(s) Date(s) Date(s) Date(s)

Name of the

Sr. and and and and

Instrument/Bank Amount

No. Rating(s) Rating(s) Rating(s) Rating(s)

Facilities Type Outstanding Rating

assigned assigned assigned assigned

(₹ crore)

in 2022- in 2021- in 2020- in 2019-

2023 2022 2021 2020

Non-fund-based - CARE 1)CARE A1+ 1)CARE A1+ 1)CARE A1+

1 ST 10.00 -

ST-BG/LC A1+ (01-Oct-21) (31-Aug-20) (09-Aug-19)

CARE

1)CARE AA; 1)CARE AA; 1)CARE AA;

Fund-based - LT/ AA;

Stable / Stable / Stable /

2 ST-CC/PC/Bill LT/ST* 110.00 Positive -

CARE A1+ CARE A1+ CARE A1+

Discounting / CARE

(01-Oct-21) (31-Aug-20) (09-Aug-19)

A1+

1)CARE AA;

Fund-based/Non- Stable /

3 - - - - - -

fund-based-LT/ST CARE A1+

(09-Aug-19)

CARE

Fund-based - LT-

4 LT 5.00 AA; - - - -

Cash Credit

Positive

*Long term/Short term.

Annexure-3: Detailed explanation of the covenants of the rated instruments/facilities: Not available

Annexure-4: Complexity level of various instruments rated for this company

Sr. No. Name of Instrument Complexity Level

1 Fund-based - LT-Cash Credit Simple

2 Fund-based - LT/ ST-CC/PC/Bill Discounting Simple

3 Non-fund-based - ST-BG/LC Simple

Annexure-5: Bank lender details for this company

To view the lender wise details of bank facilities please click here

Note on complexity levels of the rated instruments: CARE Ratings has classified instruments rated by it on the basis of

complexity. Investors/market intermediaries/regulators or others are welcome to write to care@careedge.in for any

clarifications.

5 CARE Ratings Ltd.

Press Release

Contact us

Media contact

Name: Mradul Mishra

Phone: +91-22-6754 3596

E-mail: mradul.mishra@careedge.in

Analyst contact

Name: Arti Roy

Phone: 9819261115

E-mail: arti.roy@careedge.in

Relationship contact

Name: Saikat Roy

Phone: +91-98209 98779

E-mail: saikat.roy@careedge.in

About us:

Established in 1993, CARE Ratings is one of the leading credit rating agencies in India. Registered under the Securities and

Exchange Board of India, it has been acknowledged as an External Credit Assessment Institution by the RBI. With an equitable

position in the Indian capital market, CARE Ratings provides a wide array of credit rating services that help corporates raise

capital and enable investors to make informed decisions. With an established track record of rating companies over almost

three decades, CARE Ratings follows a robust and transparent rating process that leverages its domain and analytical expertise,

backed by the methodologies congruent with the international best practices. CARE Ratings has played a pivotal role in

developing bank debt and capital market instruments, including commercial papers, corporate bonds and debentures, and

structured credit.

Disclaimer:

The ratings issued by CARE Ratings are opinions on the likelihood of timely payment of the obligations under the rated instrument and are not recommendations to

sanction, renew, disburse, or recall the concerned bank facilities or to buy, sell, or hold any security. These ratings do not convey suitability or price for the investor.

The agency does not constitute an audit on the rated entity. CARE Ratings has based its ratings/outlook based on information obtained from reliable and credible

sources. CARE Ratings does not, however, guarantee the accuracy, adequacy, or completeness of any information and is not responsible for any errors or omissions

and the results obtained from the use of such information. Most entities whose bank facilities/instruments are rated by CARE Ratings have paid a credit rating fee,

based on the amount and type of bank facilities/instruments. CARE Ratings or its subsidiaries/associates may also be involved with other commercial transactions

with the entity. In case of partnership/proprietary concerns, the rating/outlook assigned by CARE Ratings is, inter-alia, based on the capital deployed by the

partners/proprietors and the current financial strength of the firm. The ratings/outlook may change in case of withdrawal of capital, or the unsecured loans brought

in by the partners/proprietors in addition to the financial performance and other relevant factors. CARE Ratings is not responsible for any errors and states that it

has no financial liability whatsoever to the users of the ratings of CARE Ratings. The ratings of CARE Ratings do not factor in any rating-related trigger clauses as

per the terms of the facilities/instruments, which may involve acceleration of payments in case of rating downgrades. However, if any such clauses are introduced

and triggered, the ratings may see volatility and sharp downgrades.

For the detailed Rationale Report and subscription information,

please visit www.careedge.in

6 CARE Ratings Ltd.

You might also like

- IOL Chemicals and Pharmaceuticals Limited-07-07-2020Document4 pagesIOL Chemicals and Pharmaceuticals Limited-07-07-2020Jeet SinghNo ratings yet

- Vinati Organics Ratings Reaffirmed by CARE Despite Planned CapexDocument5 pagesVinati Organics Ratings Reaffirmed by CARE Despite Planned CapexmgrreddyNo ratings yet

- Filatex India Limited press release ratings reaffirmedDocument6 pagesFilatex India Limited press release ratings reaffirmedfatNo ratings yet

- Press Release Panoli Intermediates (India) Private Limited: Details of Instruments/ Facilities in Annexure-1Document6 pagesPress Release Panoli Intermediates (India) Private Limited: Details of Instruments/ Facilities in Annexure-1Patel ZeelNo ratings yet

- La Opala RG LimitedDocument5 pagesLa Opala RG LimitedAshwani KesharwaniNo ratings yet

- 10102022062806_Myra_Hygiene_Products_Private_LimitedDocument7 pages10102022062806_Myra_Hygiene_Products_Private_Limitedanuj7729No ratings yet

- 04102022073602_Divis_Laboratories_LimitedDocument7 pages04102022073602_Divis_Laboratories_Limiteddivygupta198No ratings yet

- Wockhardt LimitedDocument8 pagesWockhardt LimitedKumar SatyakamNo ratings yet

- Abdos Lamitubes Private Limited press release reaffirms ratingsDocument5 pagesAbdos Lamitubes Private Limited press release reaffirms ratingsPuneet367No ratings yet

- Care Rating Sterling - Addlife - India - Private - LimitedDocument6 pagesCare Rating Sterling - Addlife - India - Private - Limitedrahul.tibrewalNo ratings yet

- Anuh Pharma LimitedDocument7 pagesAnuh Pharma Limitedadhyan kashyapNo ratings yet

- Press Release Om Logistics Limited: Details of Instruments/facilities in Annexure-1Document6 pagesPress Release Om Logistics Limited: Details of Instruments/facilities in Annexure-1Sinius InfracomNo ratings yet

- Best Finance Corporation Limited: Facilities/Instruments Amount (Rs. Crore) Rating Rating ActionDocument5 pagesBest Finance Corporation Limited: Facilities/Instruments Amount (Rs. Crore) Rating Rating ActionKarthikeyan RK SwamyNo ratings yet

- Tarsons Products LimitedDocument5 pagesTarsons Products LimitedujjwalgoldNo ratings yet

- Ajanta Soya 13may2021Document7 pagesAjanta Soya 13may2021praveen kumarNo ratings yet

- Radico Khaitan LimitedDocument6 pagesRadico Khaitan LimitedHarminder Singh BajwaNo ratings yet

- Anthem Biosciences-R-21052018Document7 pagesAnthem Biosciences-R-21052018swarnaNo ratings yet

- AVT Natural Products - R - 07012020Document7 pagesAVT Natural Products - R - 07012020Hitesh ModiNo ratings yet

- Fine Organic Industries - R - 17012020Document8 pagesFine Organic Industries - R - 17012020Sameer NaikNo ratings yet

- VE Commercial Vehicles LimitedDocument8 pagesVE Commercial Vehicles LimitedRajNo ratings yet

- Sunlex Fabrics Private Limited - Care RatingsDocument6 pagesSunlex Fabrics Private Limited - Care RatingsManeet GoyalNo ratings yet

- Jay Ushin Limited: Rationale-Press ReleaseDocument4 pagesJay Ushin Limited: Rationale-Press Releaseravi.youNo ratings yet

- PR Nestor Pharma 7oct22Document8 pagesPR Nestor Pharma 7oct22jatindersinghNo ratings yet

- United Breweries Limited: Summary of Rated InstrumentsDocument8 pagesUnited Breweries Limited: Summary of Rated InstrumentsKaushikDasguptaNo ratings yet

- Hikal Limited - R - 21122020Document8 pagesHikal Limited - R - 21122020CA.Chandra SekharNo ratings yet

- Bikanervala Foods Private Limited: Summary of Rated InstrumentsDocument7 pagesBikanervala Foods Private Limited: Summary of Rated InstrumentsDarshan ShahNo ratings yet

- TGV SRAAC LimitedDocument6 pagesTGV SRAAC Limitedjayadeep akasamNo ratings yet

- Press Release Jash Engineering LTD.: Details of Instruments/ Facilities in Annexure-1Document6 pagesPress Release Jash Engineering LTD.: Details of Instruments/ Facilities in Annexure-1ArunVenkatachalamNo ratings yet

- Maithan Alloys LimitedDocument6 pagesMaithan Alloys Limiteddrkashish1989No ratings yet

- Press Release Tarsons Products Private Limited: Details of Instruments/facilities in Annexure-1Document4 pagesPress Release Tarsons Products Private Limited: Details of Instruments/facilities in Annexure-1hussainNo ratings yet

- Shilchar_Technologies_LimitedDocument5 pagesShilchar_Technologies_Limitedjaikumar608jainNo ratings yet

- Vardhman Pharma Distributors Private Limited-10-01-2020Document6 pagesVardhman Pharma Distributors Private Limited-10-01-2020Saifuddin LalaNo ratings yet

- Keventer Agro LimitedDocument4 pagesKeventer Agro LimitedYasser SayedNo ratings yet

- 07022023063446_Waaree_Energies_LimitedDocument6 pages07022023063446_Waaree_Energies_LimitedHasik JainNo ratings yet

- Venkateshwara Hatcheries Private Limited-01-08-2020Document5 pagesVenkateshwara Hatcheries Private Limited-01-08-2020Deepti JajooNo ratings yet

- Bikanervala Foods - R - 22022019Document7 pagesBikanervala Foods - R - 22022019aman.raj2022No ratings yet

- Akar Auto Industries LimitedDocument5 pagesAkar Auto Industries Limitedkrushna.maneNo ratings yet

- Barbeque Nation Hospitality LimitedDocument7 pagesBarbeque Nation Hospitality Limitednayabrasul208No ratings yet

- Tarsons Products LimitedDocument6 pagesTarsons Products LimitedRAROLINKSNo ratings yet

- Globus Spirits LimitedDocument5 pagesGlobus Spirits LimitedHarminder Singh BajwaNo ratings yet

- Piramal Pharma Credit Rating - 13 March 2023Document8 pagesPiramal Pharma Credit Rating - 13 March 2023Ikp IkpNo ratings yet

- Press Release Vijay Sales (India) Private Limited: Experienced PromotersDocument4 pagesPress Release Vijay Sales (India) Private Limited: Experienced PromoterssriharikosaNo ratings yet

- Gujarat Themis Biosyn LimitedDocument5 pagesGujarat Themis Biosyn LimitedAshwani KesharwaniNo ratings yet

- INEOS Styrolution India LimitedDocument5 pagesINEOS Styrolution India LimitedLAVKUSH YADAVNo ratings yet

- PR ARCL Organics 31jan22Document7 pagesPR ARCL Organics 31jan22anady135344No ratings yet

- Piramal Enterprises LimitedDocument10 pagesPiramal Enterprises LimitedDeepak VermaNo ratings yet

- Shapoorji Pallonji and Company Private LimitedDocument5 pagesShapoorji Pallonji and Company Private LimitedPrabhakar DubeyNo ratings yet

- Credit Rating Post March 2023Document26 pagesCredit Rating Post March 2023Sumiran BansalNo ratings yet

- Technico Industries LimitedDocument4 pagesTechnico Industries Limitedshankarravi8975No ratings yet

- Piramal Pharma LimitedDocument6 pagesPiramal Pharma Limitedsoumyadwip samantaNo ratings yet

- Prayag Polymers Private LimitedDocument4 pagesPrayag Polymers Private Limitednandinimishra6168No ratings yet

- Happy ForgingsDocument7 pagesHappy ForgingsArshChandraNo ratings yet

- HealthCaps India Limited - R - 02122020Document8 pagesHealthCaps India Limited - R - 02122020DarshanNo ratings yet

- Thriveni Earthmovers Private LimitedDocument9 pagesThriveni Earthmovers Private Limitedarc14consultantNo ratings yet

- Bikaji Foods International LimitedDocument7 pagesBikaji Foods International Limitedadhyan kashyapNo ratings yet

- Bharat Petroleum Corporation LimitedDocument9 pagesBharat Petroleum Corporation LimitedjagadeeshNo ratings yet

- Sandfits Foundries Private LimitedDocument7 pagesSandfits Foundries Private Limitedvignesh seenirajNo ratings yet

- AETHER Industries LTD - 2020 Credit RatingDocument5 pagesAETHER Industries LTD - 2020 Credit RatingEast West Strategic ConsultingNo ratings yet

- Bharat Forge LimitedDocument7 pagesBharat Forge LimitedjagadeeshNo ratings yet

- TIT//N: 500114 TitanDocument2 pagesTIT//N: 500114 TitanAshwani KesharwaniNo ratings yet

- Gujarat Themis Biosyn LimitedDocument5 pagesGujarat Themis Biosyn LimitedAshwani KesharwaniNo ratings yet

- Bandra (E), Mumbai - 400 051 NSE Symbol: SULA BSE Scrip Code: 543711 ISIN: INE142Q01026 ISIN: INE142Q01026Document22 pagesBandra (E), Mumbai - 400 051 NSE Symbol: SULA BSE Scrip Code: 543711 ISIN: INE142Q01026 ISIN: INE142Q01026Ashwani KesharwaniNo ratings yet

- Mix Design Practice For Bituminous MixDocument49 pagesMix Design Practice For Bituminous MixAshwani KesharwaniNo ratings yet

- Investor@radico Co inDocument19 pagesInvestor@radico Co inAshwani KesharwaniNo ratings yet

- Irc 6 2014 PDFDocument94 pagesIrc 6 2014 PDFMuthusamy Arumugam100% (1)

- ALL INDIA CONSUMER PRICE INDEX FROM 1995 To 2012Document1 pageALL INDIA CONSUMER PRICE INDEX FROM 1995 To 2012Ashwani KesharwaniNo ratings yet

- WWW - Gfl.co - In: Bhavin Vipin DesaiDocument34 pagesWWW - Gfl.co - In: Bhavin Vipin DesaiAshwani KesharwaniNo ratings yet

- StiffnessDocument18 pagesStiffnessAshwani KesharwaniNo ratings yet

- IrcDocument9 pagesIrcAshwani KesharwaniNo ratings yet

- PCI ch3 Precast Concrete PDFDocument86 pagesPCI ch3 Precast Concrete PDFBhuidhar Verma100% (1)

- M 3 L 04Document27 pagesM 3 L 04Ashwani KesharwaniNo ratings yet

- TB1103 To 1107Document10 pagesTB1103 To 1107Ashwani KesharwaniNo ratings yet

- Mmrda LetterDocument1 pageMmrda LetterAshwani KesharwaniNo ratings yet

- MSEDCL recruitment for over 70 positionsDocument12 pagesMSEDCL recruitment for over 70 positionsVijay BiloriyaNo ratings yet

- National Institute of Technology Calicut, KeralaDocument4 pagesNational Institute of Technology Calicut, KeralaAshwin SheriefNo ratings yet

- CSM Graduate Student HandbookDocument51 pagesCSM Graduate Student HandbookAshwani KesharwaniNo ratings yet

- Truck Europe Q1 2023 JPMorgan 280423Document10 pagesTruck Europe Q1 2023 JPMorgan 280423keshav.mundhraNo ratings yet

- Apexum - Forex Broker Business Plan 2Document43 pagesApexum - Forex Broker Business Plan 2Khaleel Musleh67% (3)

- Coporate Governance & Ethics at HDFC BankDocument10 pagesCoporate Governance & Ethics at HDFC BankShobhit BhatnagarNo ratings yet

- Disposal of Immovable PropertyDocument3 pagesDisposal of Immovable PropertyKumarVijayNo ratings yet

- Chinese Currency JigarDocument19 pagesChinese Currency JigarjigzzinNo ratings yet

- 03 Bidding Procedure For GoodsDocument84 pages03 Bidding Procedure For GoodsChiaraJayneBaluyutNo ratings yet

- Top 10 Investment ScamsDocument30 pagesTop 10 Investment ScamsnitinchunaraNo ratings yet

- Jose Velasco v. Tan Liuan CoDocument2 pagesJose Velasco v. Tan Liuan Codyosa100% (2)

- Relic Spotter Inc. CaseDocument9 pagesRelic Spotter Inc. CaseC DonisNo ratings yet

- FRMUnit IDocument17 pagesFRMUnit IAnonNo ratings yet

- Credit InstrumentsDocument18 pagesCredit InstrumentsRichard100% (2)

- PWC - IAS 16 - Accounting For Property Under Cost Model - Sep10 PDFDocument16 pagesPWC - IAS 16 - Accounting For Property Under Cost Model - Sep10 PDFSanath Fernando100% (1)

- SS 01 Quiz 2 PDFDocument60 pagesSS 01 Quiz 2 PDFYellow CarterNo ratings yet

- NISM V A - Mock Test 2 With AnswersDocument7 pagesNISM V A - Mock Test 2 With AnswersManikandan100% (3)

- Annual Report Analysis Compendium-FY10-EDELDocument201 pagesAnnual Report Analysis Compendium-FY10-EDELAnupam DeyNo ratings yet

- VisitDocument7 pagesVisitFernando BelfortNo ratings yet

- Mercantile Law) Practical Exercises by Balbastro) Made 2003) by SU Law (Daki) ) 18 PagesDocument18 pagesMercantile Law) Practical Exercises by Balbastro) Made 2003) by SU Law (Daki) ) 18 PagesbubblingbrookNo ratings yet

- Financial Accounting 3: Journal Entries for Share TransactionsDocument10 pagesFinancial Accounting 3: Journal Entries for Share TransactionsParamesvaraja MahanNo ratings yet

- Chapter - 1 Accounting in ActionDocument19 pagesChapter - 1 Accounting in ActionfuriousTaherNo ratings yet

- William CV - BlackRockDocument2 pagesWilliam CV - BlackRockWilliam GameNo ratings yet

- ANNEX “A” Notification of SuspensionDocument3 pagesANNEX “A” Notification of SuspensionAjean Tuazon-CruzNo ratings yet

- HBS Jobs - 20090916Document192 pagesHBS Jobs - 20090916boxesarefunNo ratings yet

- Accounting For Managers - FinalDocument21 pagesAccounting For Managers - FinalAnuj SharmaNo ratings yet

- Exercise InvestmentsDocument14 pagesExercise InvestmentsAlizah Lariosa Bucot43% (7)

- Workshop Debt Securities STAFFDocument42 pagesWorkshop Debt Securities STAFFIshan MalakarNo ratings yet

- Funds Flow Statement LancoDocument86 pagesFunds Flow Statement Lancothella deva prasadNo ratings yet

- Whitehall: Monitoring The Markets Vol. 5 Iss. 2 (January 21, 2015)Document2 pagesWhitehall: Monitoring The Markets Vol. 5 Iss. 2 (January 21, 2015)Whitehall & CompanyNo ratings yet

- Written Interview Questions_Wadia GhandyDocument7 pagesWritten Interview Questions_Wadia Ghandyshantanu.shimpi220No ratings yet

- Chapter 03Document13 pagesChapter 03ClaraNo ratings yet

- DHFL Annual Report 2019-20Document292 pagesDHFL Annual Report 2019-20hyenadogNo ratings yet