Professional Documents

Culture Documents

Thriveni Earthmovers Private Limited

Uploaded by

arc14consultantOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Thriveni Earthmovers Private Limited

Uploaded by

arc14consultantCopyright:

Available Formats

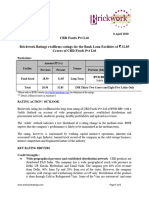

Press Release

Thriveni Earthmovers Private Limited

January 09, 2023

Ratings

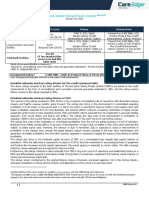

Facilities/Instruments Amount (₹ crore) Rating1 Rating Action

CARE A-; Stable Revised from CARE BBB+;

649.11

Long-term bank facilities (Single A Minus; Positive (Triple B Plus;

(Enhanced from 602.56)

Outlook: Stable) Outlook: Positive)

504.50 CARE A2+ Revised from CARE A2

Short-term bank facilities

(Reduced from 630.00) (A Two Plus) (A Two)

1,153.61

(₹One thousand one hundred

Total bank facilities

fifty-three crore and sixty-

one lakhs only)

CARE A-; Stable

Non-convertible debentures 230.00 (Single A Minus; Assigned

Outlook: Stable)

CARE A-; Stable Revised from CARE BBB+;

240.00

Non-convertible debentures (Single A Minus; Positive (Triple B Plus;

(Reduced from 300.00)

Outlook: Stable) Outlook: Positive)

470.00

Total long-term

(₹Four hundred seventy crore

instruments

only)

Details of instruments/facilities in Annexure-1.

Detailed rationale and key rating drivers

The revision in the ratings assigned to the bank facilities/instruments of Thriveni Earthmovers Private Limited (TEPL)

factors in the increasing consolidated scale of operations with diversified revenue streams and healthy revenue visibility

going forward. The ratings also factor in the improvement in consolidated operating profitability in FY22 (refers to the

period April 1 to March 31) which is expected to improve further in the medium term with higher profitability expected

from its mine developer and operator (MDO) contracts, increasing contribution of higher margin equipment rental

income in total operating income (TOI) and healthy returns expected from its investments in associate entities,

especially from Lloyds Metals and Energy Ltd (LMEL). The ratings also take note of the improvement in profitability of

subsidiary Thriveni Sainik Mining Private Limited (TSMPL) in the current financial year after incurring losses in FY21 and

FY22 in its coal mining contract.

The ratings take note of the moderation in consolidated profitability from the iron-ore pellets business in FY23 of

subsidiary Brahmani River Pellets Limited (BRPL) on account of the imposition of export duty on pellets in May 2022

which impacted the viability of pellet export sales. However, the removal of duty in November 2022 is expected to result

in improvement in profitability in the medium term, though the global demand outlook remains subdued in the near

term. Nevertheless, the generation of healthy profitability from the other business segments is expected to negate the

impact of the decline in pellets profitability.

The ratings also factor in the moderate capital structure of TEPL on a consolidated basis despite high capital intensity

of operations. While the debt level is expected to increase in FY23 to fund the investment in associates/purchase of

equipment and funding the increased working capital requirement, the overall gearing is expected to remain stable.

The debt coverage indicators remain adequate and are expected to improve further.

Furthermore, the ratings continue to derive strength from TEPL’s long track record of operations and established position

as a MDO and differentiated acquisition and rebuild model of large fleet of owned heavy equipment that reduces capital

intensity of mining services business significantly.

The ratings remain constrained by the capital-intensive nature of business, perceived regulatory risk in the mining

industry, emerging competition in mining services industry and dependence on the cyclical iron and steel sector.

1

Complete definition of the ratings assigned are available at www.careedge.in and other CARE Ratings Ltd.’s publications

1 CARE Ratings Ltd.

Press Release

Rating sensitivities

Positive Factors - Factors that could lead to positive rating action/upgrade:

• Healthy growth in consolidated TOI and profitability as envisaged from the various revenue streams with ROCE

improving to above 18% on a sustained basis

• Improvement in consolidated overall gearing at less than 0.50x and improvement in debt coverage indicators (Total

Debt/PBILDT < 1.5x and interest coverage > 5x) on a sustained basis

Negative Factors- Factors that could lead to negative rating action/downgrade:

• Significant decline in consolidated TOI or profitability (PBILDT margin < 8%) on a sustained basis

• Deterioration in consolidated capital structure (overall gearing > unity) and debt coverage indicators (Total

Debt/PBILDT > 3x and interest coverage < 2.5x) on a sustained basis

• Any significant debt laden capex/acquisition which is likely to result in significant deterioration of debt protection

metrics.

Detailed description of the key rating drivers

Key rating strengths

Long and established track record of operations as MDO: The promoters of TEPL, Mr. P. Balasubramaniam (Ex-

chairman), Mr. B. Prabhakaran (MD) and Mr. B. Karthikeyan (ED), started as MDO for limestone in 1991 and over the

years TEPL has grown to be one of the dominant players in iron ore mining in the country. It has also built presence in

open cast coal mining through its subsidiary viz. TSMPL.

Diversified revenue streams: Apart from the MDO business under TEPL and TSMPL, TEPL derives rental income from

leasing out of mining and construction equipment in Indonesia. It also holds 49% stake in BRPL through its subsidiary

Thriveni Pellets Private Limited (TPPL) and has management control of the entity. BRPL operates a 4.7 Million ton per

annum (TPA) iron-ore beneficiation plant in Barbil, Odisha, 4 Million TPA pellet plant in Jajpur, Kalinganagar and has a

230 km underground slurry pipeline connecting the beneficiation plant to the pellet plant resulting in substantial savings

in transportation cost. It has significant share in the export of pellets from India. Since February 2020, BRPL books a

fixed margin of ₹350 per MT over cost of production for sale to pellets to its shareholders. TPPL which holds 49% in

BRPL books a fixed margin of ₹100 per MT before selling it to TEPL which ultimately sells it in the market.

TEPL also holds 22.49% stake in LMEL directly and 14.83% stake through Sky United LLP in which it has 76% stake.

TEPL has made a total investment of about ₹420 crore for acquisition of the above stake in LMEL. LMEL produces sponge

iron and has captive iron ore mines with environmental clearance (EC) for production of 3 million MTPA with total

deposits of more than 91 million ton in the Maharashtra belt for which TEPL has the MDO contract. The EC for the mine

is in advanced stages of being increased to 10 million MTPA and TEPL expects to achieve healthy PBILDT from LMEL

MDO operations and its investment in LMEL.

TEPL also owns commercial lease of aggregate quarry situated at Hosur, Tamil Nadu which is used for manufacturing

sand (as opposed to river sand) which is environment friendly. This apart, TEPL has controlling interest in a coal mine

in Indonesia through its step-down subsidiary, PT Minemax Indonesia (PTM). TEPL has also entered into strategic

partnership in 2019 with some of the largest coal mine owners in Indonesia to grow its business significantly in the

future.

Healthy order-book position and strong revenue visibility through cash flows from key subsidiaries and

associates: As on September 30, 2022, TEPL has several operational MDO contracts with environmental clearance of

around 36.57 million MTPA which provides revenue visibility for the medium-term. Apart from this, the company has

bid for a new contract with EC of 24.4 million MTPA which is in advanced stage of allocation while the LMEL mine EC is

expected to increase to 10 million MTPA from the current 3 million MTPA. TEPL also has revenue visibility through rental

income from its Indonesian operations, cash flows expected from pellet sales pertaining to BRPL and other MDO

contracts (barytes, coal etc). Furthermore, the company has an order in Laserda Pacheri which is located in Bonai-

Kendujhar Belt of Kendujhar district in Odisha. The company found manganese ore having 2.3 million tonnes of reserve,

iron ore having 1.2 million tonnes of reserve and dolomite having 14.58 million tonnes of reserve during its prospecting

activities in the mine. The mining activities are expected to provide healthy revenues from FY24 onwards.

2 CARE Ratings Ltd.

Press Release

Thriveni Group has also formed a strategic alliance with Darm Henwa (DH) Group of Indonesia, one of the largest

mining contractors in Indonesia, in December 2019 wherein TEPL will manage the operations for DH and will also deploy

its mining equipment through a step-down subsidiary in Indonesia, PT Mandiangin Batubara (PT MBB) and in return

will earn lease rentals. TEPL has dispatched the mining equipment at the respective sites. The rental flow has already

started, and the company expects to book long-term high margin income from the same.

Improvement in operating performance in FY22 with further improvement expected going forward: The

consolidated TOI of TEPL improved by 13% y-o-y in FY22 to ₹7,571 crore vis-à-vis ₹6,715 crore in FY21. The

improvement in the revenue was on back of increase in revenue from mining activities along with rental income from

Indonesia and TSMPL. The increase in revenue was also contributed by increase in pellet sales during FY22.

The profitability also improved in FY22 on the back of increase in income from mining activities and rental business

which are high margin businesses. The pellet sales continued to contribute significantly to consolidated sales. However,

the gross margin from pellet sales was lower in FY22 due to the market volatility.

In H1FY23, TEPL’s standalone sales stood at around ₹1420 crore with marginal moderation witnessed due to lower

volume of pellet sales. Going forward in FY23, the TOI and the profitability are expected to improve further backed

strong revenue visibility over next couple of years from mining activities, rental income, pellet sales, etc.

Stable capital structure despite increase in debt, expected to improve in the medium term: Although the

total debt of TEPL continued to increase y-o-y in FY22 and 8MFY23, the capital structure of the company remains

moderate and stable with overall gearing at 0.60x as on March 31, 2022 (0.63x as on March 31, 2021). The company

during March 2022, converted unsecured loans of ₹331 crore to equity which strengthened its networth hereby keeping

the overall gearing stable despite the increase in the total debt.

The coverage ratios also remained stable with total debt/PBILDT of 2.78x (FY21: 3.16x) and interest coverage of 2.91x

in FY22 (2.82x in FY21).,

Debt level including unsecured loans, has increased significantly in the current year for purchasing equipment,

investment in LMEL and for meeting working capital requirement. However, debt coverage indicators are expected to

remain adequate with healthy generation of cash accruals from the various investments and no major debt planned to

be availed in the near term.

Differentiated heavy mining equipment acquisition and rebuild model: The company possesses more than

1600 heavy equipment, including some of the largest class of equipment available globally such as 240-280 Ton dumpers,

35-42 CuM Excavators/Loaders, and other supporting equipment etc. TEPL purchases many of these second-hand

equipment at the end of their life in their respective markets at a fraction of the original cost and rebuilds/refurbishes

them in its state of the art rebuild centre at Jamshedpur for which it has developed an extensive local and international

supply chain. This approach to equipment acquisition and rebuild/life extension has enabled the company to reduce

capital intensity in the MDO business. Through this approach the company is able to meet majority of its heavy equipment

requirement in-house with significant spare capacity and the remaining (mostly smaller sized equipment) is hired on

contractual basis.

Reputed Clientele: TEPL has bagged iron ore MDO contracts from the new lessees in the mining auctions concluded

in Odisha, from some of the most established names in the iron and steel sector. It also has established public sector

undertakings in its client base. In its iron ore pellet business, the company has presence both in the export and domestic

market.

Key rating weaknesses

Capital intensive nature of business: TEPL’s MDO operation is capital intensive in nature as it has to continuously

incur capex for procuring heavy earthmoving and other mining equipment. Further, the company’s MDO operation is

working capital intensive in nature due to requirement of maintenance of adequate stock of critical stores & spares for

its heavy equipment, many of which have a long lead procurement cycle and provide credit period of around two months

to its customers.

3 CARE Ratings Ltd.

Press Release

However, TEPL reduces its capex requirement, to large extent, through its strategy of procuring large mining equipment

from around the world at the end of their life in their respective markets and rebuilding them at its facility at Jamshedpur.

TEPL has also built an extensive local and international supply chain away from OEMs which has enabled to reduce cost

of maintenance and inventory holding.

Regulatory risk in the mining industry: TEPL generates significant revenue from its mining service operations. The

Indian mining industry is highly regulated by the Government of India; therefore, TEPL’s MDO business is indirectly

exposed to the risk attached to changes in government policy affecting the rights of lessees. However, this risk

associated with the mining industry has been mitigated to a large extent after amendment in the Mines and Minerals

(Development and Regulation) Act, 1957 in 2015 which has mandated that all the mining leases shall be granted

through auction by competitive bidding, including e-auction as opposed to first come first serve principles which existed

prior to the said amendment.

Emerging competition in mining services industry: The profitability margins from the new MDO contracts, bagged

by TEPL from the new lessees post conclusion of mining auction in Odisha, is reduced on account of lower mining rates

in comparison to the earlier contracts. Decline in mining rates is largely on account of competitive bidding invited by

the new lessees for award of contracts owing to the amended revenue sharing arrangement with the government.

Nevertheless, lower profitability margin is expected to be compensated, to some extent, through higher mining volumes

and optimal utilization of overhead resulting in stable profitability in the long run.

Dependence on iron and steel sector: Majority of the company’s revenue currently is derived from iron ore mining

and pellet business and the prospects of the company are dependent upon the iron and steel industry which is cyclical

in nature. However, this risk is somewhat mitigated as it has diversified into other minerals such as coal, barytes etc.

Further, as the company’s iron ore mining is largely concentrated in Odisha (and nearby Jharkhand) which are home

to majority of high-grade iron ore deposit in the country, any down-turn in steel industry leading to low demand is less

likely to impact iron ore producers in Odisha/Jharkhand. The company remains exposed to cyclicality of the steel industry

in its pellet business as well.

Liquidity: Adequate

TEPL’s cash accruals are expected to be adequate to meet its term debt and unsecured debt repayment obligations in

FY23. Average utilisation of its fund-based limits over the past 12 months ended November 2022 stood at around 90%.

The company does not have any major capex plans over the medium term. Its current ratio stood moderate at 1.10

times as on March 31, 2022, which is expected to improve going forward.

Analytical approach: Consolidated approach considering the significant exposure of TEPL in its group entities

along with presence of synergies in the operations between the group entities. Further, TEPL has provided corporate

guarantee for debt availed by TSMPL. The list of entities consolidated with TEPL are placed at Annexure-6.

Applicable criteria

Policy on default recognition

Consolidation

Financial Ratios – Non financial Sector

Liquidity Analysis of Non-financial sector entities

Rating Outlook and Credit Watch

Short Term Instruments

Manufacturing Companies

Service Sector Companies

Wholesale Trading

About the company

TEPL was initially promoted by Sri P. Balasubramaniam as a partnership firm in 1991 which was later converted into

private limited company in 1999. It is engaged in MDO contract services of various minerals (i.e. iron ore, copper, coal,

4 CARE Ratings Ltd.

Press Release

bauxite, barite ore, etc) for private mine lease owners. TEPL is one of the largest MDO of iron-ore in India and has

diversified business interests.

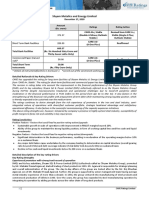

Consolidated Brief Financials (₹ crore) FY21 (A) FY22 (A) Q1FY23 (UA)*

Total operating income 6,715 7,571 890

PBILDT 553 721 114

PAT -16 200 8

Overall gearing (times) 0.63 0.60 0.87

Interest coverage (times) 2.82 2.91 2.71

A: Audited; UA: Unaudited; Financials are reclassified as per CARE Ratings’ standards

*standalone of TEPL

Status of non-cooperation with previous CRA: Not Applicable

Any other information: Not Applicable

Rating history for the last three years: Please refer Annexure-2

Covenants of the rated instruments/facilities: Detailed explanation of covenants of the rated instruments/facilities

is given in Annexure-3

Complexity level of various instruments rated for this company: Annexure-4

Bank lender details of the company: Annexure-5

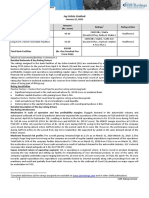

Annexure-1: Details of instruments/facilities

Date of

Maturity Size of Rating Assigned

Name of the Issuance Coupon

ISIN Date (DD- the Issue along with

Instrument (DD-MM- Rate (%)

MM-YYYY) (₹ crore) Rating Outlook

YYYY)

Fund-based - LT-

- - - 395.50 CARE A-; Stable

Cash Credit

Non-fund-based -

- - - 504.50 CARE A2+

ST-BG/LC

Term Loan-Long

- - 31/10/2027 253.61 CARE A-; Stable

Term

Debentures-Non

Convertible INE380L07020 07/10/2021 07/10/2023 60.00 CARE A-; Stable

Debentures

Debentures-Non

Convertible INE380L07038 07/10/2021 Zero coupon 07/10/2024 75.00 CARE A-; Stable

Debentures with

Debentures-Non redemption

Convertible INE380L07046 07/10/2021 premium 07/01/2026 52.50 CARE A-; Stable

Debentures

Debentures-Non

Convertible INE380L07053 07/10/2021 07/04/2027 52.50 CARE A-; Stable

Debentures

Debentures-Non

Convertible INE380L07061 19/05/2022 21/05/2023 57.50 CARE A-; Stable

Debentures

Debentures-Non

Convertible INE380L07079 19/05/2022 16% 19/05/2024 57.50 CARE A-; Stable

Debentures

Debentures-Non

Convertible INE380L07087 19/05/2022 19/05/2025 57.50 CARE A-; Stable

Debentures

5 CARE Ratings Ltd.

Press Release

Date of

Maturity Size of Rating Assigned

Name of the Issuance Coupon

ISIN Date (DD- the Issue along with

Instrument (DD-MM- Rate (%)

MM-YYYY) (₹ crore) Rating Outlook

YYYY)

Debentures-Non

Convertible INE380L07095 19/05/2022 19/05/2026 57.50 CARE A-; Stable

Debentures

Annexure-2: Rating history for the last three years

Current Ratings Rating History

Date(s)

Name of the Date(s) and Date(s) and Date(s) and

Sr. Amount and

Instrument/Bank Rating(s) Rating(s) Rating(s)

No. Type Outstanding Rating Rating(s)

Facilities assigned in assigned in assigned in

(₹ crore) assigned in

2022-2023 2020-2021 2019-2020

2021-2022

1)CARE

BBB+;

Positive 1)CARE BBB+

CARE 1)CARE BBB+; (06-Dec-21) (CW with

Fund-based - LT-

1 LT 395.50 A-; Positive - Developing

Cash Credit

Stable (06-Apr-22) 2)CARE Implications)

BBB+; (11-Feb-20)

Positive

(07-Apr-21)

1)CARE A2 1)CARE A2

(06-Dec-21) (CW with

Non-fund-based - CARE 1)CARE A2

2 ST 504.50 - Developing

ST-BG/LC A2+ (06-Apr-22)

2)CARE A2 Implications)

(07-Apr-21) (11-Feb-20)

1)CARE

BBB+;

Positive 1)CARE BBB+

CARE 1)CARE BBB+; (06-Dec-21) (CW with

Term Loan-Long

3 LT 253.61 A-; Positive - Developing

Term

Stable (06-Apr-22) 2)CARE Implications)

BBB+; (11-Feb-20)

Positive

(07-Apr-21)

Debentures-Non CARE 1)CARE BBB+;

4 Convertible LT 240.00 A-; Positive - - -

Debentures Stable (06-Apr-22)

Debentures-Non CARE

5 Convertible LT 230.00 A-;

Debentures Stable

*Long term/Short term.

6 CARE Ratings Ltd.

Press Release

Annexure-3: Detailed explanation of the covenants of the rated instruments

Name of the Instrument Detailed explanation

NCD-1 issue of ₹ 240.00 crore (zero coupon)

A. Key financial covenants

I. Debt service coverage ratio DSCR >= 1.30x

II. Long term debt/ PBILDT (standalone & Long term debt/PBILDT <= 3.50x

consolidated)

B. Key non-financial covenants

I. Standard reporting and negative Customary information and reporting covenants

covenants Restrictions on dividend payment beyond 25% of its net profit for the

year without prior consent. The right to pay dividend shall be

automatically suspended in case of EOD (Event of Default).

II. Credit Rating of Issuer Should not be below investment grade

III. Subordination of unsecured loans from All unsecured loans/promoter group loans in TEPL should be

promoters subordinated to the investor facility

IV. Agreements with BRPL Prior consent of investor required for amendment/ termination of

pellet sale agreement, pellet offtake agreement or shareholder’s

agreement

NCD-2 issue of ₹ 230.00 crore (16% coupon)

A. Key financial covenants

I. Debt service coverage ratio DSCR >= 1.30x

II. Long term debt/ PBILDT (standalone & Long term debt/PBILDT (Standalone and consolidated) <= 3.50x

consolidated)

B. Key non-financial covenants

I. Standard reporting and negative Customary information and reporting covenants

covenants Restrictions on dividend payment beyond 25% of its net profit for the

year without prior consent. The right to pay dividend shall be

automatically suspended in case of EOD (Event of Default).

II. Credit Rating of Issuer Should not be below investment grade

III. Subordination of unsecured loans from All unsecured loans/promoter group loans in TEPL should be

promoters subordinated to the investor facility

IV. Agreements with BRPL Prior consent of investor required for amendment/ termination of

pellet sale agreement, pellet offtake agreement or shareholder’s

agreement

V. Agreement with Sky United LLP Prior consent of investor required for amendment/modification in

shareholding agreement with Sky United LLP

Annexure-4: Complexity level of various instruments rated for this company

Sr. No. Name of Instrument Complexity Level

1 Debentures-Non Convertible Debentures Simple

2 Fund-based - LT-Cash Credit Simple

3 Non-fund-based - ST-BG/LC Simple

4 Term Loan-Long Term Simple

Annexure-5: Bank lender details for this company

To view the lender wise details of bank facilities please click here

7 CARE Ratings Ltd.

Press Release

Annexure 6: List of entities consolidated as on March 31, 2022

Name of Entity Relationship % Holding

Sumrit Metaliks Private Limited Subsidiary 99.81%

Geovale Services Private Limited Subsidiary 60.00%

Thriveni Sands & Aggregates LLP Subsidiary 90.00%

Thriveni Logistics Services LLP Subsidiary 60.00%

Maa Tarani Logistics Limited Subsidiary 58.31%

Thriveni Apparels & Textiles Private Limited Subsidiary 100.00%

TSMPL Subsidiary 51.00%

Stem Minerals & Resources LLP Subsidiary 70.00%

Thriveni Resomin Pte Ltd (Consolidated) Subsidiary 100.00%

Thriveni International Limited (Consolidated) Subsidiary 100.00%

Thriveni Ramka Mining Private Limited Subsidiary 51.00%

TPPL (Consolidated) Subsidiary 51.00%

KJS Pellets & Power Private Limited Subsidiary 51.00%

STK Energies Private Limited Subsidiary 51.00%

Thriveni Sainik PBNW Private Limited Subsidiary 60.00%

Thriveni Llyods Mining Private Limited Subsidiary 60.00%

Thriveni Minerals Mozambique Limited* Subsidiary 100.00%

Mangampet Barytes Project Subsidiary 65.00%

Geomysore Services India Private Limited Associate 45.84%

LMEL Associate 24.41%

* Thriveni Minerals Mozambique Ltd is under voluntary liquidation

Note on complexity levels of the rated instruments: CARE Ratings has classified instruments rated by it on the

basis of complexity. Investors/market intermediaries/regulators or others are welcome to write to care@careedge.in for

any clarifications.

8 CARE Ratings Ltd.

Press Release

Contact us

Media contact

Name: Mradul Mishra

Phone: +91-22-6754 3596

E-mail: mradul.mishra@careedge.in

Analyst contact

Name: Mamta Muklania

Phone: + 91-33-4018 1651

E-mail: mamta.khemka@careedge.in

Relationship contact

Name: Lalit Sikaria

Phone: + 91-033- 40181600

E-mail: lalit.sikaria@careedge.in

About us:

Established in 1993, CARE Ratings is one of the leading credit rating agencies in India. Registered under the Securities

and Exchange Board of India, it has been acknowledged as an External Credit Assessment Institution by the RBI. With

an equitable position in the Indian capital market, CARE Ratings provides a wide array of credit rating services that help

corporates raise capital and enable investors to make informed decisions. With an established track record of rating

companies over almost three decades, CARE Ratings follows a robust and transparent rating process that leverages its

domain and analytical expertise, backed by the methodologies congruent with the international best practices. CARE

Ratings has played a pivotal role in developing bank debt and capital market instruments, including commercial papers,

corporate bonds and debentures, and structured credit.

Disclaimer:

The ratings issued by CARE Ratings are opinions on the likelihood of timely payment of the obligations under the rated instrument and are not

recommendations to sanction, renew, disburse, or recall the concerned bank facilities or to buy, sell, or hold any security. These ratings do not convey

suitability or price for the investor. The agency does not constitute an audit on the rated entity. CARE Ratings has based its ratings/outlook based on

information obtained from reliable and credible sources. CARE Ratings does not, however, guarantee the accuracy, adequacy, or completeness of any

information and is not responsible for any errors or omissions and the results obtained from the use of such information. Most entities whose bank

facilities/instruments are rated by CARE Ratings have paid a credit rating fee, based on the amount and type of bank facilities/instruments. CARE Ratings

or its subsidiaries/associates may also be involved with other commercial transactions with the entity. In case of partnership/proprietary concerns, the

rating/outlook assigned by CARE Ratings is, inter-alia, based on the capital deployed by the partners/proprietors and the current financial strength of the

firm. The ratings/outlook may change in case of withdrawal of capital, or the unsecured loans brought in by the partners/proprietors in addition to the

financial performance and other relevant factors. CARE Ratings is not responsible for any errors and states that it has no financial liability whatsoever to

the users of the ratings of CARE Ratings. The ratings of CARE Ratings do not factor in any rating-related trigger clauses as per the terms of the

facilities/instruments, which may involve acceleration of payments in case of rating downgrades. However, if any such clauses are introduced and

triggered, the ratings may see volatility and sharp downgrades.

For the detailed Rationale Report and subscription information, please visit www.careedge.in

9 CARE Ratings Ltd.

You might also like

- Thriveni Sainik Mining Private Limited 2023Document8 pagesThriveni Sainik Mining Private Limited 2023Karthikeyan RK SwamyNo ratings yet

- 10102022062806_Myra_Hygiene_Products_Private_LimitedDocument7 pages10102022062806_Myra_Hygiene_Products_Private_Limitedanuj7729No ratings yet

- Unit OperatorDocument7 pagesUnit OperatorJimmyNo ratings yet

- TGV SRAAC LimitedDocument6 pagesTGV SRAAC Limitedjayadeep akasamNo ratings yet

- 06012022070753_IMC_LimitedDocument5 pages06012022070753_IMC_LimitedMayank AgarwalNo ratings yet

- Press Release Panoli Intermediates (India) Private Limited: Details of Instruments/ Facilities in Annexure-1Document6 pagesPress Release Panoli Intermediates (India) Private Limited: Details of Instruments/ Facilities in Annexure-1Patel ZeelNo ratings yet

- Coral AssociatesDocument5 pagesCoral AssociatesFunny CloudsNo ratings yet

- PR ARCL Organics 31jan22Document7 pagesPR ARCL Organics 31jan22anady135344No ratings yet

- Maithan Alloys LimitedDocument6 pagesMaithan Alloys Limiteddrkashish1989No ratings yet

- Technico Industries LimitedDocument4 pagesTechnico Industries Limitedshankarravi8975No ratings yet

- Radico Khaitan LimitedDocument6 pagesRadico Khaitan LimitedHarminder Singh BajwaNo ratings yet

- Mega Steel IndustriesDocument4 pagesMega Steel IndustrieshseckalpeshNo ratings yet

- CARE_Sunflag_4.01.2024Document9 pagesCARE_Sunflag_4.01.2024Swapnil SomkuwarNo ratings yet

- Gujarat Themis Biosyn LimitedDocument5 pagesGujarat Themis Biosyn LimitedAshwani KesharwaniNo ratings yet

- Antony Waste Handling Cell LimitedDocument5 pagesAntony Waste Handling Cell Limitedsoumyadwip samantaNo ratings yet

- Best Finance Corporation Limited: Facilities/Instruments Amount (Rs. Crore) Rating Rating ActionDocument5 pagesBest Finance Corporation Limited: Facilities/Instruments Amount (Rs. Crore) Rating Rating ActionKarthikeyan RK SwamyNo ratings yet

- Press Release Adani Agri Logistics (Harda) LimitedDocument5 pagesPress Release Adani Agri Logistics (Harda) Limitedsurprise MFNo ratings yet

- Press Release Tab India Granites Private LimitedDocument6 pagesPress Release Tab India Granites Private LimitedRavi BabuNo ratings yet

- Udaipur Cement Works receives rating reaffirmationDocument6 pagesUdaipur Cement Works receives rating reaffirmationflying400No ratings yet

- Jupiter International LimitedDocument6 pagesJupiter International LimitedRahul syalNo ratings yet

- Subros LimitedDocument8 pagesSubros LimitedrajpersonalNo ratings yet

- Filatex India Limited press release ratings reaffirmedDocument6 pagesFilatex India Limited press release ratings reaffirmedfatNo ratings yet

- Kalpataru Power Transmission LimitedDocument8 pagesKalpataru Power Transmission LimitedjayNo ratings yet

- Continental Carbon India LimitedDocument4 pagesContinental Carbon India LimitedKamaldeep MaanNo ratings yet

- Tarsons Products LimitedDocument5 pagesTarsons Products LimitedujjwalgoldNo ratings yet

- Future Retail Limited: Carved Out of Working Capital Limits Details of Instruments/facilities in Annexure-1Document9 pagesFuture Retail Limited: Carved Out of Working Capital Limits Details of Instruments/facilities in Annexure-1Nostalgic MediatorNo ratings yet

- Naresh Kumar and Company Private LimitedDocument5 pagesNaresh Kumar and Company Private LimitedKunalNo ratings yet

- AETHER Industries LTD - 2020 Credit RatingDocument5 pagesAETHER Industries LTD - 2020 Credit RatingEast West Strategic ConsultingNo ratings yet

- Press Release Gravita India Limited: Ratings Facilities Amount (Rs. Crore) Ratings Rating ActionDocument7 pagesPress Release Gravita India Limited: Ratings Facilities Amount (Rs. Crore) Ratings Rating ActionhamsNo ratings yet

- Shri Balaji Rollings Private Limited Receives Ratings From CAREDocument4 pagesShri Balaji Rollings Private Limited Receives Ratings From CAREData CentrumNo ratings yet

- Shyam Metalics and Energy Limited-12-17-2020Document7 pagesShyam Metalics and Energy Limited-12-17-2020Parth PatelNo ratings yet

- Jay Ushin Limited: Rationale-Press ReleaseDocument4 pagesJay Ushin Limited: Rationale-Press Releaseravi.youNo ratings yet

- A One Steel Alloys 10may2021Document7 pagesA One Steel Alloys 10may2021L KNo ratings yet

- Emcer Tiles Private LimitedDocument4 pagesEmcer Tiles Private LimitedRudra RoyNo ratings yet

- IRB Hapur Moradabad Tollway Limited-03-30-2020Document7 pagesIRB Hapur Moradabad Tollway Limited-03-30-2020ANUBHAVCFANo ratings yet

- Mahindra & Mahindra LimitedDocument6 pagesMahindra & Mahindra Limitedjerin jNo ratings yet

- Ganga Rasayanie Private Limited-R-10102019Document7 pagesGanga Rasayanie Private Limited-R-10102019DarshanNo ratings yet

- IOL Chemicals and Pharmaceuticals Limited-07-07-2020Document4 pagesIOL Chemicals and Pharmaceuticals Limited-07-07-2020Jeet SinghNo ratings yet

- Care Rating Sterling - Addlife - India - Private - LimitedDocument6 pagesCare Rating Sterling - Addlife - India - Private - Limitedrahul.tibrewalNo ratings yet

- 04102022073602_Divis_Laboratories_LimitedDocument7 pages04102022073602_Divis_Laboratories_Limiteddivygupta198No ratings yet

- R. K. Marble Private Limited-12!30!2020Document6 pagesR. K. Marble Private Limited-12!30!2020Brajpal JhalaNo ratings yet

- La Opala RG LimitedDocument5 pagesLa Opala RG LimitedAshwani KesharwaniNo ratings yet

- Press Release Mehul Construction Company Private Limited: Details of Instruments/facilities in Annexure-1Document5 pagesPress Release Mehul Construction Company Private Limited: Details of Instruments/facilities in Annexure-1tejasNo ratings yet

- PR - Sri Anagha - Refineries - 23 - 09 - 2020Document6 pagesPR - Sri Anagha - Refineries - 23 - 09 - 2020Jayshreeben DobariyaNo ratings yet

- Sunlex Fabrics Private Limited - Care RatingsDocument6 pagesSunlex Fabrics Private Limited - Care RatingsManeet GoyalNo ratings yet

- Press Release Om Logistics Limited: Details of Instruments/facilities in Annexure-1Document6 pagesPress Release Om Logistics Limited: Details of Instruments/facilities in Annexure-1Sinius InfracomNo ratings yet

- S. Jogani Exports Private LimitedDocument6 pagesS. Jogani Exports Private Limitedarc14consultantNo ratings yet

- CRD Foods 8apr2020Document6 pagesCRD Foods 8apr2020samudragupta05No ratings yet

- PR Mahamaya Sponge Iron 8jan24Document9 pagesPR Mahamaya Sponge Iron 8jan24Rohit MotapartiNo ratings yet

- Nezone Pipes & Structures-R-05042018Document7 pagesNezone Pipes & Structures-R-05042018rahul badgujarNo ratings yet

- Credit Rating Post March 2023Document26 pagesCredit Rating Post March 2023Sumiran BansalNo ratings yet

- Pump DesignDocument4 pagesPump Designmarathasanatani6No ratings yet

- Incred Financial Services Limited Press+ReleaseDocument7 pagesIncred Financial Services Limited Press+ReleaseGautam MehtaNo ratings yet

- Ajanta Soya 13may2021Document7 pagesAjanta Soya 13may2021praveen kumarNo ratings yet

- Pennar Industries Ratings ReaffirmedDocument4 pagesPennar Industries Ratings ReaffirmedRadha MohanNo ratings yet

- Pondy Oxides and Chemicals 22apr2019Document6 pagesPondy Oxides and Chemicals 22apr2019DarshanNo ratings yet

- Tarsons Products LimitedDocument6 pagesTarsons Products LimitedRAROLINKSNo ratings yet

- Home First Finance Company India LimitedDocument8 pagesHome First Finance Company India LimitedRAROLINKSNo ratings yet

- Bharat Petroleum Corporation LimitedDocument9 pagesBharat Petroleum Corporation LimitedjagadeeshNo ratings yet

- CH 03Document34 pagesCH 03rajat318No ratings yet

- Accenture Ready Set Scale PDFDocument48 pagesAccenture Ready Set Scale PDFKristo SootaluNo ratings yet

- 149 Newbury Boulevard Craigieburn 3064 CONTRACT of SALEDocument198 pages149 Newbury Boulevard Craigieburn 3064 CONTRACT of SALERAINBOW FUN FACTORNo ratings yet

- Final Examination TT For Cert & Dip - Feb 2023Document3 pagesFinal Examination TT For Cert & Dip - Feb 2023wilfredNo ratings yet

- Business Finance Lesson 2Document20 pagesBusiness Finance Lesson 2Iekzkad RealvillaNo ratings yet

- Discussion 2 Second SemDocument8 pagesDiscussion 2 Second SemEmey Calbay100% (1)

- The Following Instances Do Not Necessarily Establish A PartnershipDocument4 pagesThe Following Instances Do Not Necessarily Establish A PartnershipGIRLNo ratings yet

- Marketing Research Project On Nike ShoesDocument8 pagesMarketing Research Project On Nike ShoesRi TalzNo ratings yet

- Deloitte NL Risk Sdgs From A Business PerspectiveDocument51 pagesDeloitte NL Risk Sdgs From A Business PerspectiveAshraf ChowdhuryNo ratings yet

- BF2 - AnswerDocument34 pagesBF2 - AnswerCherielee FabroNo ratings yet

- Specialized Expertise: Established Knowledge, Guiding You ThroughDocument6 pagesSpecialized Expertise: Established Knowledge, Guiding You ThroughOmar GuillenNo ratings yet

- Script JFC Coop Pmes 2022 091822Document7 pagesScript JFC Coop Pmes 2022 091822Glen ArayonNo ratings yet

- COMPARISON OF PHILIPPINE TAX RATESDocument3 pagesCOMPARISON OF PHILIPPINE TAX RATESKevin JugaoNo ratings yet

- Astm E1187Document4 pagesAstm E1187AlbertoNo ratings yet

- Loading AU Calculation Cards Using HCM Data LoaderDocument45 pagesLoading AU Calculation Cards Using HCM Data Loadersachanpreeti100% (1)

- GENERALLY ACCEPTED ACCOUNTING PRINCIPLES Chapter - 3Document3 pagesGENERALLY ACCEPTED ACCOUNTING PRINCIPLES Chapter - 3RitaNo ratings yet

- Ind Nifty PharmaDocument2 pagesInd Nifty PharmaPrashant DalviNo ratings yet

- Reaction Paper Fostering Competition in The Philippines The Challenge of Restrictive RegulationsDocument3 pagesReaction Paper Fostering Competition in The Philippines The Challenge of Restrictive RegulationsJoey Albert SabuyaNo ratings yet

- SME Sustainability HandbookDocument8 pagesSME Sustainability HandbookWan Zulkifli Wan IdrisNo ratings yet

- A brief history of how brands and place branding evolvedDocument7 pagesA brief history of how brands and place branding evolvedSalma wahbiNo ratings yet

- Perdana Annual Report 2010Document276 pagesPerdana Annual Report 2010Yusop MDNo ratings yet

- Csec Poa June 2010 p2Document12 pagesCsec Poa June 2010 p2Renelle RampersadNo ratings yet

- A2 8.4.19Document15 pagesA2 8.4.19ikhwan azmanNo ratings yet

- EB-5 Guide FinalDocument12 pagesEB-5 Guide FinalPrince Charles MoyoNo ratings yet

- Chap 007 Business PlanDocument31 pagesChap 007 Business PlanAliAdnan AliAdnanNo ratings yet

- True/False Questions: labor-intensive (cần nhiều nhân công)Document31 pagesTrue/False Questions: labor-intensive (cần nhiều nhân công)Ngọc MinhNo ratings yet

- Citizens Budget 2022Document17 pagesCitizens Budget 2022Kristi DuranNo ratings yet

- Arcelor Mittal Operations: Operational Area Is Sub-Divided Into 4 PartsDocument5 pagesArcelor Mittal Operations: Operational Area Is Sub-Divided Into 4 Partsarpit agrawalNo ratings yet

- Statement of Financial Position: Fundamentals of Accountancy, Business and Management 2Document55 pagesStatement of Financial Position: Fundamentals of Accountancy, Business and Management 2Arminda Villamin75% (4)

- Exploring Strateg1Document7 pagesExploring Strateg1soomsoomislamNo ratings yet