Professional Documents

Culture Documents

Maithan Alloys Limited

Uploaded by

drkashish1989Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Maithan Alloys Limited

Uploaded by

drkashish1989Copyright:

Available Formats

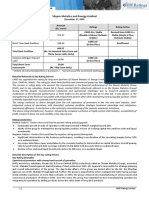

Press Release

Maithan Alloys Limited

December 05, 2022

Ratings

Rating

Facilities Amount (₹ crore) Ratings1

Action

CARE AA; Stable

Long-term bank facilities 90.00 Reaffirmed

(Double A; Outlook: Stable)

Long-term/Short-term CARE AA; Stable / CARE A1+

15.00 Reaffirmed

(LT/ST) bank facilities (Double A; Outlook: Stable/ A One Plus)

CARE A1+

Short-term bank facilities 435.00 Reaffirmed

(A One Plus)

540.00

Total bank facilities

(₹ Five hundred forty crore only)

Details of facilities in Annexure-1

Detailed Rationale & Key Rating Drivers

The ratings assigned to the bank facilities of Maithan Alloys Limited (MAL) continue to derive strength from its strong business

and financial risk profile marked by large scale of operations and established presence in the ferro-alloys industry, sizeable

presence in the export market providing diversification to revenue, healthy capacity utilisation, strong liquidity and debt

coverage indicators with low reliance on debt.

The ratings also take note of the substantial improvement in operating profitability in FY22 (refers to the period April 1 to March

31) largely driven by the significant increase in realisation of finished goods backed by a strong demand scenario for the end-

use products. While the profitability continued to remain strong in Q1FY23, the margins have witnessed moderation in Q2FY23

on account of the decline in average sales realisation in line with the industry following correction in steel prices. Going forward,

the demand is expected to remain stable, though the margin is expected to normalize; to pre-COVID levels.

Furthermore, the capital structure is expected to remain healthy going forward with negligible utilisation of the fund-based

working capital limits given the healthy liquidity available with the company and no debt proposed to be taken for the capex

plans. The company has plans for greenfield expansion of its ferro alloy capacity. The entire capex is expected to be funded out

of the internal generations and the available liquidity.

The ratings continue to remain constrained by the dependence of the ferro alloy industry on the cyclical steel sector,

susceptibility of profitability margins to volatility in raw material and finished goods prices, working capital intensive nature of

operations and foreign exchange fluctuation risks. Furthermore, the company remains exposed to the risks associated with the

planned capex.

Rating Sensitivities

Positive Factors - Factors that could lead to positive rating action/upgrade:

• Substantial increase in the consolidated operating income and improvement in return on capital employed (ROCE) above

25% on sustained basis.

• Improvement in the operating cycle to below 70 days on sustained basis.

Negative Factors- Factors that could lead to negative rating action/downgrade:

• Decline in the consolidated operating income below ₹1,500 crore and PBILDT margin below 12%.

• Deterioration in overall gearing beyond 0.5x and total debt/PBILDT above 2x.

• Reduction in cash and cash equivalents below ₹500 crore.

Detailed description of the key rating drivers

Key Rating Strengths

Established presence in the ferro alloys industry: MAL’s promoter, Mr Subhas Chandra Agarwalla has an experience of

around three decades in the ferro alloy industry. He is supported by his sons, Mr Subodh Agarwalla (Whole-time Director and

CEO) and Mr Sudhanshu Agarwalla (CFO) who have sound technical and managerial qualifications and experience. The

experience and technical expertise of the promoters have contributed to MAL establishing its strong foothold in an otherwise

highly volatile ferro alloy industry. The company has large manufacturing capacity of 2,35,600 metric tonne per annum (MTPA)

of ferro alloys which is further augmented by acquisition of Impex Metals and Ferro Alloys Limited (Impex) in FY22 having

1

Complete definition of the ratings assigned are available at www.careedge.in and other CARE Ratings Ltd.’s publications

1 CARE Ratings Ltd.

Press Release

production capacity of 46,900 MTPA.

Diversified operations with strategic location of the manufacturing facilities: MAL’s manufacturing facilities are

present in Kalyaneshwari (West Bengal), Visakhapatnam (Andhra Pradesh) and Ri-Bhoi (Meghalaya). The manganese ore

requirements are met through imports from South Africa, Gabon and Australia. Coke is imported from South Africa and

Columbia for Visakhapatnam unit and purchased from Jharkhand and Assam for Kalyaneshwari unit and from Guwahati for the

Meghalaya unit. While the company mostly caters to the domestic market through its plant in West Bengal & Meghalaya, it

caters to international market through its plant in Visakhapatnam (being near to the port). Proximity to end-users due to

presence of large number of steel players in East India for the domestic sales and presence near the port for export sales and

imported raw materials results in optimal freight and inventory holding costs, leading to competitive pricing and better margins.

Established and reputed clientele along with strong presence in the export market: Around 65% of MAL’s domestic

revenue in FY22 (90% in FY21) was from Steel Authority of India Ltd (SAIL; rated CARE AA; Stable/CARE A1+). Although

concentrated in the domestic market, counter party risk is mitigated to a large extent due to SAIL being a large steel producer

with high credit standing. The company also has sizeable presence in export markets with 74% of its consolidated total

operating income (TOI) in FY22 (58% in FY21) being derived from exports. In FY22, MAL’s share in the bulk ferro alloys exports

from India (excluding export of ferro chrome and other ferro alloys) was around 8% (12% in FY21). In export market, MAL

caters to reputed global players, some of which are also state-controlled entities. MAL gets repeat orders from its clients due to

its established relationship with them.

High capacity utilization (CU) levels: The CU witnessed an increase in FY22 to 96% (including Impex) compared with 89%

in FY21 and reached its pre-COVID level. In FY21, CU had witnessed decline on account of the first wave of COVID-19

pandemic which had led to nation-wide lockdown impacting the production. The second wave in Q1FY22 did not have any

major impact on the CU as export demands were rising.

In H1FY23, its CU stood at about 86%. The CU has remained high over the years reflecting the company’s strong track record

to operate optimally.

Robust financial risk profile with significant improvement in FY22 and H1FY23: The TOI of the company witnessed a

significant y-o-y growth of 85.3% in FY22 compared with FY21 to ₹3,001.65 crore. The increase in revenue was mainly on

account of significant increase in realisation per ton along with increase in total sales quantity of the ferro alloy products. The

significant increase in realisation with no major increase in costs led to almost doubling of its PBILDT margin from 18.17% in

FY21 to 36.13% in FY22. The average sales realisation of manganese alloys (which constitutes around 93% of manufacturing

sales) witnessed significant increase in FY22. The improved operating margins coupled with low capital costs led to

improvement in PAT margin as well in FY22 compared with FY21. ROCE also improved significantly from 20.60% in FY21 to

54.92% in FY22.

In H1FY23, TOI witnessed a growth of 35% y-o-y with overall growth in both volume and per ton realisation. PBILDT margin

remained healthy at 27.04% with higher margin earned in Q1FY23 which offset the impact of the decline in margin in Q2FY23.

In Q2FY23, TOI witnessed de-growth of 29% q-o-q on account of reduction in sales realisation which also impacted the PBILDT

margin apart from increase in power cost. Going forward, with decline in realisation of finished goods, the revenue and

profitability are expected to moderate to near the pre-pandemic levels.

Robust capital structure and debt coverage indicators

The company has a robust capital structure with an overall gearing of 0.05x as on March 31, 2022 vis-à-vis 0.12x as on March

31, 2021. The improvement in the overall gearing was on account of lower working capital utilisation by the company. The debt

coverage indicators also remained robust with Total debt/GCA of 0.14x as on March 31, 2022 (0.74x as on March 31, 2021).

With nil term debt and low utilisation of fund-based limits, the interest cost continued to remain low and accordingly interest

coverage continued to be very comfortable. The company has an estimated capex plan of around ₹250 crore during the period

FY24-FY25, which is planned to be expended out of the available liquidity and internal generations and no debt is planned to be

availed.

As stated, and demonstrated by the company’s management, its overall gearing is not expected to exceed 0.50 times, at any

point of time in the future. Going forward, maintenance of low gearing risk and high operational efficiencies shall remain crucial

from credit perspective as the company operates in highly volatile ferro alloys industry which is susceptible to the vagaries of

steel cycles.

2 CARE Ratings Ltd.

Press Release

Key rating weaknesses

Dependence of the ferro alloy industry on the cyclical steel sector: The bulk ferro alloy market segment is categorised

into alloy steel, carbon steel, stainless steel and others. Around 17%-23% chromium is required for every ton of stainless steel

manufactured and around 0.7% manganese is required for every ton of steel. The above is met through alloys of chromium and

manganese. Thus, there exists a strong co-relation between the growth of the ferro alloy industry and the steel industry.

Susceptibility of profitability to volatile raw material and finished goods price: Manganese ore, coal and coke are the

major raw materials required which constituted about 45% of total cost of sales in FY22 (46% in FY21). It purchases power

from state power utilities. Going forward, the power cost shall witness an increase on account of the hike in tariff from FY23

onwards. MAL has recognized ₹101.92 crore of exceptional expenses w.r.to electricity charges for earlier years in H1FY23

however the same is being contested by the company.

The price of manganese ore and coke is highly volatile and the realisation of the ferro alloys is also governed by the

performance of the end-user steel industry. Thus, MAL’s profitability is highly susceptible to fluctuation in prices of the raw

materials and the finished goods. However, due to its strong management and cost-effective operations, the company has been

able to manage these fluctuations somewhat better as reflected in relative steadiness in its operating margins vis-à-vis the

peers.

Working capital intensive nature of operation: MAL’s operations are working capital intensive in nature as it has to offer

credit period of around two months to its customers due to intense competition in the industry. Other than inventory in transit,

MAL usually maintains around one month of inventory at its Visakhapatnam unit and two months of inventory at its

Kalyaneshwari unit for smooth running of operations. The working capital cycle of the company stood at 143 days in FY22,

increased from 136 days in FY21. Though total receivables have increased as on March 31, 2022 compared with March 31,

2021, receivables period witnessed a decline from 82 days in FY21 to 69 days in FY22 on account of significant increase in

revenue. With increase in inventory period from 89 days in FY21 to 110 days in FY22, the operating cycle increased slightly.

Increase in inventory was mainly on account of significant increase in both quantity as well as value of raw materials during the

year.

Nevertheless, with healthy cash generation from the business and availability of liquidity, the company is not required to avail

debt to fund the increase in working capital requirement.

Foreign exchange fluctuation risk: MAL imports manganese ore from South Africa and Gabon (around 80%) and Australia

(around 20%). The company imports around 90% of its raw-material requirement (mainly manganese ore). Also, the company

has a strong presence in export market with exports contributing to around 74% of its TOI in FY22. Hence, the company enjoys

natural hedge to an extent and for the remaining portion, if any, it hedges its net foreign currency exposure through forward

contracts thereby mitigating foreign currency fluctuation risk to a large extent. The company earned foreign exchange gain of

₹33.30 crore in FY22 vis-à-vis foreign exchange gain of ₹9.30 crore in FY21.

Project implementation risk: The company has planned a greenfield project of around ₹250 crore towards the ferro

manganese/ silico manganese unit of 1 lakh MT p.a. in Bankura, West Bengal for which it has set up a subsidiary, Maithan

Ferrous Private Limited. The company has also purchased land for the same. The company has received environmental

clearance and expects the project work to start in FY24. Major expenditure on the project is expected to be incurred in FY24

and FY25 and funded out of its internal accruals. Timely completion and stabilization of the capex would be critical for its RoCE.

Stable industry prospects

The fortune of the ferro alloys industry is directly correlated to the steel industry. The domestic steel demand growth is

expected to remain strong at 9-10% in FY23, due to the government’s infrastructure push and increased investments in real

estate and construction sectors amid an overall economic rebound. In addition to this, lower raw material prices are expected to

support steel production in India, though steel prices are expected to continue to remain moderate. The removal of export duty

on various steel products w.e.f November 19, 2022 also augurs well for the steel industry.

Liquidity: Strong

Liquidity is marked by strong accruals in FY22 and H1FY23 against nil term debt repayment obligations and free cash and liquid

investments to the tune of ₹1,380 crore as on November 08, 2022. The working capital limit also remained unutilised during the

last 12 months period ended August 2022. The company’s unutilised bank lines are adequate to meet its incremental working

capital needs over the next one year. With an overall gearing of 0.05 times as on March 31, 2022, the issuer has sufficient

gearing headroom to meet its capex requirement.

3 CARE Ratings Ltd.

Press Release

Analytical approach: Consolidated

Care Ratings Limited (Care Ratings) had earlier taken a standalone view while analysing MAL as all the subsidiaries were in the

initial stage of operation and more than 99% of turnover and profits at a consolidated level, were attributable to the standalone

operations of MAL. However, the analytical view is now changed to consolidated taking into account the acquisition of Impex as

a subsidiary in FY22 and strong operational linkages associated with it.

List of entities being consolidated with MAL is as under:

Name of subsidiary % of holding as on March 31, 2022

Anjaney Minerals Ltd 100%

Salanpur Sinters Pvt Ltd 100%

AXL Explorations Pvt Ltd 75%

Maithan Ferrous Pvt Ltd 80%

Impex Metal and Ferro Alloys Ltd 100%

Applicable Criteria

Rating Outlook and Credit Watch

Criteria for short term instruments

Policy on default recognition

Financial Ratios – Non-Financial Sector

Rating Methodology – Manufacturing Companies

Liquidity Analysis of Non-Financial Sector Entities

Rating Methodology – Steel Industry

Consolidation

About the Company

MAL, incorporated in 1985, is engaged in the manufacturing of ferro alloys, having an installed capacity of 136 MVA (i.e.

235,600 MT of ferro Alloys) at three locations i.e. 49 MVA (94,600 MTPA) at Kalyaneshwari, West Bengal, 15 MVA (21,000

MTPA) at Ri-Bhoi, Meghalaya and 72 MVA (1,20,000 MTPA) at Visakhapatnam, Andhra Pradesh. The Meghalaya unit has a

captive power plant of 15 MW, which is not operational since January 2019. MAL is also engaged in the trading of metal &

mineral products and wind power operation. The day-to-day operations of the company are looked after by Mr S. C. Agarwalla

with support from his two sons, Mr Subodh Agarwalla & Mr Sudhanshu Agarwalla.

In FY22, MAL acquired Impex through a liquidation process. Post-acquisition, Impex successfully commenced its production in

December 2021. Impex has a capacity to produce 46,900 MT of ferro silicon.

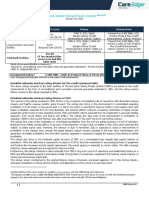

Brief Consolidated Financials (₹crore) FY21 (A) FY22 (A) H1FY23 (UA)

TOI 1619.78 3001.65 1664.99

PBILDT 294.29 1084.38 450.22

PAT 230.03 818.04 328.14

Overall gearing (times) 0.12 0.05 NA

Interest coverage (times) 93.13 315.23 865.81

A: Audited; UA: Unaudited; NA: Not Available; Financials are reclassified as per CARE Ratings standards

Status of non-cooperation with previous CRA: Not Applicable

Any other information: Not Applicable

Rating History for last three years: Please refer Annexure-2

Covenants of rated instrument / facility: Detailed explanation of covenants of the rated instruments/facilities is given in

Annexure-3

Complexity level of various instruments rated for this company: Annexure 4

4 CARE Ratings Ltd.

Press Release

Annexure-1: Details of Facilities

Coupon Size of the

Name of the Date of Maturity Rating Assigned along

ISIN Rate Issue

Instrument Issuance Date with Rating Outlook

(%) (₹ crore)

Fund-based - LT-Cash

- - - 90.00 CARE AA; Stable

Credit

Non-fund-based - LT/ ST-

- - - 15.00 CARE AA; Stable / CARE A1+

Bank guarantee

Non-fund-based - ST-Bank

- - - 35.00 CARE A1+

guarantee

Non-fund-based - ST-Letter

- - - 400.00 CARE A1+

of credit

Annexure-2: Rating History of last three years

Current Ratings Rating History

Date(s) Date(s) Date(s)

Name of the and and and Date(s) and

Sr. Amount

Instrument/Bank Rating(s) Rating(s) Rating(s) Rating(s)

No. Facilities

Type Outstanding Rating

assigned assigned assigned assigned in

(₹ crore)

in 2022- in 2021- in 2020- 2019-2020

2023 2022 2021

1)CARE 1)CARE

Non-fund-based - CARE 1)CARE A1+

1 ST 400.00 - A1+ A1+

ST-Letter of credit A1+ (16-Aug-19)

(06-Sep-21) (08-Oct-20)

1)CARE 1)CARE

Non-fund-based - CARE 1)CARE A1+

2 ST 35.00 - A1+ A1+

ST-Bank guarantee A1+ (16-Aug-19)

(06-Sep-21) (08-Oct-20)

CARE 1)CARE AA; 1)CARE AA; 1)CARE AA;

Fund-based - LT-

3 LT 90.00 AA; - Stable Stable Stable

Cash Credit

Stable (06-Sep-21) (08-Oct-20) (16-Aug-19)

Fund-based - LT-

1)Withdrawn

4 External commercial LT - - - - -

(16-Aug-19)

borrowings

CARE

1)CARE AA; 1)CARE AA;

Non-fund-based - AA;

Stable / Stable /

5 LT/ ST-Bank LT/ST* 15.00 Stable / - -

CARE A1+ CARE A1+

guarantee CARE

(06-Sep-21) (08-Oct-20)

A1+

*Long term/Short term

Annexure-3: Detailed explanation of covenants of the rated instrument / facilities

Not Applicable

Annexure 4: Complexity level of various instruments rated for this company

Sr. No. Name of Instrument Complexity Level

1 Fund-based - LT-Cash credit Simple

2 Non-fund-based - LT/ ST-Bank guarantee Simple

3 Non-fund-based - ST-Bank guarantee Simple

4 Non-fund-based - ST-Letter of credit Simple

Annexure-5: Bank Lender Details

To view the lender-wise details of bank facilities please click here

Note on complexity levels of the rated instrument: CARE Ratings has classified instruments rated by it on the basis of

complexity. Investors/market intermediaries/regulators or others are welcome to write to care@careedge.in for any

clarifications.

5 CARE Ratings Ltd.

Press Release

Contact us

Media contact

Name: Mradul Mishra

Phone: +91-22-6754 3596

E-mail: mradul.mishra@careedge.in

Analyst contact

Name: Mamta Muklania

Phone: +91-33-4018 1651

E-mail: mamta.khemka@careedge.in

Relationship contact

Name: Lalit Sikaria

Phone: +91-33-4018 1607

E-mail: lalit.sikaria@careedge.in

About us:

Established in 1993, CARE Ratings is one of the leading credit rating agencies in India. Registered under the Securities

and Exchange Board of India, it has been acknowledged as an External Credit Assessment Institution by the RBI. With

an equitable position in the Indian capital market, CARE Ratings provides a wide array of credit rating services that help

corporates raise capital and enable investors to make informed decisions. With an established track record of rating

companies over almost three decades, CARE Ratings follows a robust and transparent rating process that leverages its

domain and analytical expertise, backed by the methodologies congruent with the international best practices. CARE

Ratings has played a pivotal role in developing bank debt and capital market instruments, including commercial papers,

corporate bonds and debentures, and structured credit.

Disclaimer

The ratings issued by CARE Ratings are opinions on the likelihood of timely payment of the obligations under the rated instrument and are not

recommendations to sanction, renew, disburse, or recall the concerned bank facilities or to buy, sell, or hold any security. These ratings do not convey

suitability or price for the investor. The agency does not constitute an audit on the rated entity. CARE Ratings has based its ratings/outlook based on

information obtained from reliable and credible sources. CARE Ratings does not, however, guarantee the accuracy, adequacy, or completeness of any

information and is not responsible for any errors or omissions and the results obtained from the use of such information. Most entities whose bank

facilities/instruments are rated by CARE Ratings have paid a credit rating fee, based on the amount and type of bank facilities/instruments. CARE Ratings

or its subsidiaries/associates may also be involved with other commercial transactions with the entity. In case of partnership/proprietary concerns, the

rating/outlook assigned by CARE Ratings is, inter-alia, based on the capital deployed by the partners/proprietors and the current financial strength of the

firm. The ratings/outlook may change in case of withdrawal of capital, or the unsecured loans brought in by the partners/proprietors in addition to the

financial performance and other relevant factors. CARE Ratings is not responsible for any errors and states that it has no financial liability whatsoever to

the users of the ratings of CARE Ratings. The ratings of CARE Ratings do not factor in any rating-related trigger clauses as per the terms of the

facilities/instruments, which may involve acceleration of payments in case of rating downgrades. However, if any such clauses are introduced and

triggered, the ratings may see volatility and sharp downgrades.

For detailed Rationale Report and subscription information,

please contact us at www.careedge.in

6 CARE Ratings Ltd.

You might also like

- Reforms, Opportunities, and Challenges for State-Owned EnterprisesFrom EverandReforms, Opportunities, and Challenges for State-Owned EnterprisesNo ratings yet

- Shyam Metalics and Energy Limited-12-17-2020Document7 pagesShyam Metalics and Energy Limited-12-17-2020Parth PatelNo ratings yet

- Akar Auto Industries LimitedDocument5 pagesAkar Auto Industries Limitedkrushna.maneNo ratings yet

- Udaipur Cement Works receives rating reaffirmationDocument6 pagesUdaipur Cement Works receives rating reaffirmationflying400No ratings yet

- TGV SRAAC LimitedDocument6 pagesTGV SRAAC Limitedjayadeep akasamNo ratings yet

- CARE_Sunflag_4.01.2024Document9 pagesCARE_Sunflag_4.01.2024Swapnil SomkuwarNo ratings yet

- La Opala RG LimitedDocument5 pagesLa Opala RG LimitedAshwani KesharwaniNo ratings yet

- Mahindra & Mahindra LimitedDocument6 pagesMahindra & Mahindra Limitedjerin jNo ratings yet

- Unit OperatorDocument7 pagesUnit OperatorJimmyNo ratings yet

- Radico Khaitan LimitedDocument6 pagesRadico Khaitan LimitedHarminder Singh BajwaNo ratings yet

- 06012022070753_IMC_LimitedDocument5 pages06012022070753_IMC_LimitedMayank AgarwalNo ratings yet

- Press Release Panoli Intermediates (India) Private Limited: Details of Instruments/ Facilities in Annexure-1Document6 pagesPress Release Panoli Intermediates (India) Private Limited: Details of Instruments/ Facilities in Annexure-1Patel ZeelNo ratings yet

- Thriveni Earthmovers Private LimitedDocument9 pagesThriveni Earthmovers Private Limitedarc14consultantNo ratings yet

- Technico Industries LimitedDocument4 pagesTechnico Industries Limitedshankarravi8975No ratings yet

- Roots Industries India Limited: Facilities/Instruments Amount (Rs. Crore) Rating Rating ActionDocument4 pagesRoots Industries India Limited: Facilities/Instruments Amount (Rs. Crore) Rating Rating ActionKarthikeyan RK SwamyNo ratings yet

- Tarsons Products LimitedDocument5 pagesTarsons Products LimitedujjwalgoldNo ratings yet

- 10102022062806_Myra_Hygiene_Products_Private_LimitedDocument7 pages10102022062806_Myra_Hygiene_Products_Private_Limitedanuj7729No ratings yet

- R. K. Marble Private Limited-12!30!2020Document6 pagesR. K. Marble Private Limited-12!30!2020Brajpal JhalaNo ratings yet

- A One Steel Alloys 10may2021Document7 pagesA One Steel Alloys 10may2021L KNo ratings yet

- Bharat Forge LimitedDocument7 pagesBharat Forge LimitedjagadeeshNo ratings yet

- Amman TRY Sponge and Power Private LimitedDocument4 pagesAmman TRY Sponge and Power Private LimitedKathiresan Mathavi's SonNo ratings yet

- IOL Chemicals and Pharmaceuticals Limited-07-07-2020Document4 pagesIOL Chemicals and Pharmaceuticals Limited-07-07-2020Jeet SinghNo ratings yet

- July 8, 2021Document12 pagesJuly 8, 2021786rohitsandujaNo ratings yet

- Press Release Gravita India Limited: Ratings Facilities Amount (Rs. Crore) Ratings Rating ActionDocument7 pagesPress Release Gravita India Limited: Ratings Facilities Amount (Rs. Crore) Ratings Rating ActionhamsNo ratings yet

- Bhuwalka and Sons Private LimitedDocument4 pagesBhuwalka and Sons Private LimiteddoctorsabeehNo ratings yet

- Peekay Steel Castings Private Limited-01!09!2019Document5 pagesPeekay Steel Castings Private Limited-01!09!2019GAYATHRI S.RNo ratings yet

- Subros LimitedDocument8 pagesSubros LimitedrajpersonalNo ratings yet

- Shaily Engineering Plastics Limited-09-25-2019Document4 pagesShaily Engineering Plastics Limited-09-25-2019Ashutosh Gupta100% (1)

- Mega Steel IndustriesDocument4 pagesMega Steel IndustrieshseckalpeshNo ratings yet

- Shilchar_Technologies_LimitedDocument5 pagesShilchar_Technologies_Limitedjaikumar608jainNo ratings yet

- PR Mahamaya Sponge Iron 8jan24Document9 pagesPR Mahamaya Sponge Iron 8jan24Rohit MotapartiNo ratings yet

- Jay Ushin Limited: Rationale-Press ReleaseDocument4 pagesJay Ushin Limited: Rationale-Press Releaseravi.youNo ratings yet

- VE Commercial Vehicles LimitedDocument8 pagesVE Commercial Vehicles LimitedRajNo ratings yet

- Care Rating Sterling - Addlife - India - Private - LimitedDocument6 pagesCare Rating Sterling - Addlife - India - Private - Limitedrahul.tibrewalNo ratings yet

- KEI Industries LimitedDocument8 pagesKEI Industries Limitedpraveen kumarNo ratings yet

- Press Release Jash Engineering LTD.: Details of Instruments/ Facilities in Annexure-1Document6 pagesPress Release Jash Engineering LTD.: Details of Instruments/ Facilities in Annexure-1ArunVenkatachalamNo ratings yet

- Rockman Industries Jan 2020 ICRADocument9 pagesRockman Industries Jan 2020 ICRAPuneet367No ratings yet

- AVT McCormick-R-26032018Document7 pagesAVT McCormick-R-26032018Siddharth DamaniNo ratings yet

- Tarsons Products LimitedDocument6 pagesTarsons Products LimitedRAROLINKSNo ratings yet

- Ajanta Soya 13may2021Document7 pagesAjanta Soya 13may2021praveen kumarNo ratings yet

- Rating Rationale - Adani Wilmar LimitedDocument13 pagesRating Rationale - Adani Wilmar LimitedAnjum SamiraNo ratings yet

- Raymond Limited - (CARE) 18th November 2019Document7 pagesRaymond Limited - (CARE) 18th November 2019Moin KhanNo ratings yet

- Filatex India Limited press release ratings reaffirmedDocument6 pagesFilatex India Limited press release ratings reaffirmedfatNo ratings yet

- Thriveni Sainik Mining Private Limited 2023Document8 pagesThriveni Sainik Mining Private Limited 2023Karthikeyan RK SwamyNo ratings yet

- Saakha Steel Industries Private Limited Bank Facilities Rating ReaffirmedDocument4 pagesSaakha Steel Industries Private Limited Bank Facilities Rating ReaffirmedRanib SainjuNo ratings yet

- Vinati Organics LimitedDocument6 pagesVinati Organics LimitedAshwani KesharwaniNo ratings yet

- Pennar Industries Ratings ReaffirmedDocument4 pagesPennar Industries Ratings ReaffirmedRadha MohanNo ratings yet

- MSL Driveline Systems - R - 16102020Document8 pagesMSL Driveline Systems - R - 16102020DarshanNo ratings yet

- Prateek Wires (P) LTD - R - 08102020Document6 pagesPrateek Wires (P) LTD - R - 08102020DarshanNo ratings yet

- L.G. Balakrishnan & Bros Limited: Summary of Rating ActionDocument7 pagesL.G. Balakrishnan & Bros Limited: Summary of Rating ActionChromoNo ratings yet

- Press Release Adani Agri Logistics (Harda) LimitedDocument5 pagesPress Release Adani Agri Logistics (Harda) Limitedsurprise MFNo ratings yet

- Press Release Om Logistics Limited: Details of Instruments/facilities in Annexure-1Document6 pagesPress Release Om Logistics Limited: Details of Instruments/facilities in Annexure-1Sinius InfracomNo ratings yet

- Rockman Industries Limited: Summary of Rated Instruments Instrument Rated Amount (Rs. Crore) Rating ActionDocument7 pagesRockman Industries Limited: Summary of Rated Instruments Instrument Rated Amount (Rs. Crore) Rating ActionVirender RawatNo ratings yet

- Ganga Rasayanie Private Limited-R-10102019Document7 pagesGanga Rasayanie Private Limited-R-10102019DarshanNo ratings yet

- Press Release Deccan Industries: Positive FactorsDocument4 pagesPress Release Deccan Industries: Positive FactorsHARI HARANNo ratings yet

- Nelcast Limited: Long-Term Rating Re-Affirmed and Outlook Revised To Negative Short-Term Rating Downgraded To (ICRA) A1 Summary of Rating ActionDocument7 pagesNelcast Limited: Long-Term Rating Re-Affirmed and Outlook Revised To Negative Short-Term Rating Downgraded To (ICRA) A1 Summary of Rating ActionPuneet367No ratings yet

- Gujarat Themis Biosyn LimitedDocument5 pagesGujarat Themis Biosyn LimitedAshwani KesharwaniNo ratings yet

- Shri Balaji Rollings Private Limited Receives Ratings From CAREDocument4 pagesShri Balaji Rollings Private Limited Receives Ratings From CAREData CentrumNo ratings yet

- T V Sundram Iyengar-R-16022018Document7 pagesT V Sundram Iyengar-R-16022018AGN YaNo ratings yet

- Signode India Financial ReportDocument5 pagesSignode India Financial Reportsaikiran reddyNo ratings yet

- BST Memebook 2.ODocument194 pagesBST Memebook 2.OArshdeep SinghNo ratings yet

- Capital Structure, Capitalisation and LeverageDocument53 pagesCapital Structure, Capitalisation and LeverageCollins NyendwaNo ratings yet

- Strategic Financial ManagementDocument96 pagesStrategic Financial Managementansary75No ratings yet

- Samo 2019Document15 pagesSamo 2019vera maulithaNo ratings yet

- Bharti Airtel Capital Structure and Financing AnalysisDocument11 pagesBharti Airtel Capital Structure and Financing AnalysisDavid WilliamNo ratings yet

- Ananta-12-Cost of CapitalDocument35 pagesAnanta-12-Cost of CapitalDaffa Khairon khanNo ratings yet

- Private Equity Investment Banking Hedge Funds Venture CapitalDocument26 pagesPrivate Equity Investment Banking Hedge Funds Venture Capitalpankaj_xaviersNo ratings yet

- Advanced Corporate Finance (Moon) SP2016Document7 pagesAdvanced Corporate Finance (Moon) SP2016darwin12100% (1)

- MBA Final Year ReportDocument9 pagesMBA Final Year ReportmmddugkyfinanceNo ratings yet

- Ch16 Practice Quiz ProblemsDocument14 pagesCh16 Practice Quiz ProblemswarrenmertzNo ratings yet

- B. Com. (Hons.) FMM Semester SyllabusDocument21 pagesB. Com. (Hons.) FMM Semester SyllabusPiyush OmarNo ratings yet

- AR Bio Farma 2022 - Low Res AgustusDocument958 pagesAR Bio Farma 2022 - Low Res AgustusK4yraa .Azka.No ratings yet

- Finance Reading List PHDDocument8 pagesFinance Reading List PHDAnonymous P1xUTHstHTNo ratings yet

- Leverage (Financial Management)Document2 pagesLeverage (Financial Management)Rika Miyazaki100% (1)

- Determinants of Capital Structure - PresentationDocument17 pagesDeterminants of Capital Structure - PresentationKashif GhaniNo ratings yet

- Ch09 P18 Build A ModelDocument2 pagesCh09 P18 Build A ModelsadolehNo ratings yet

- Manisha Project ReportDocument44 pagesManisha Project Reportmayra kshyapNo ratings yet

- FIN 5001 - Course OutlineDocument9 pagesFIN 5001 - Course OutlineJoel DsouzaNo ratings yet

- Capital Structure Analysis - Bangladesh (Rezwana Nasreen & M. Shahryar Faiz)Document85 pagesCapital Structure Analysis - Bangladesh (Rezwana Nasreen & M. Shahryar Faiz)Shibli Md. FaizNo ratings yet

- Summer Report.Document90 pagesSummer Report.Maitri Sukhadia100% (1)

- Cost of CapitalDocument33 pagesCost of CapitalMichaela San DiegoNo ratings yet

- Financial Management.Document114 pagesFinancial Management.CHARAK RAYNo ratings yet

- Acca PDFDocument14 pagesAcca PDFtepconNo ratings yet

- Financial ManagementDocument85 pagesFinancial ManagementRajesh MgNo ratings yet

- An Analysis of Annual Ratio of TCS FinalDocument106 pagesAn Analysis of Annual Ratio of TCS FinalChandan Srivastava100% (1)

- Cost of CapitalDocument8 pagesCost of CapitalAreeb BaqaiNo ratings yet

- Test Paper: Chapter-1: Cost of CapitalDocument13 pagesTest Paper: Chapter-1: Cost of Capitalcofinab795No ratings yet

- Capital Structure Definition and FactorsDocument15 pagesCapital Structure Definition and FactorsPriyanka SharmaNo ratings yet

- Costs of CapitalDocument80 pagesCosts of Capitalmanojben100% (1)

- Quiz FinalDocument22 pagesQuiz FinalAnand JohnNo ratings yet

- You Need a Budget: The Proven System for Breaking the Paycheck-to-Paycheck Cycle, Getting Out of Debt, and Living the Life You WantFrom EverandYou Need a Budget: The Proven System for Breaking the Paycheck-to-Paycheck Cycle, Getting Out of Debt, and Living the Life You WantRating: 4 out of 5 stars4/5 (104)

- Financial Literacy for All: Disrupting Struggle, Advancing Financial Freedom, and Building a New American Middle ClassFrom EverandFinancial Literacy for All: Disrupting Struggle, Advancing Financial Freedom, and Building a New American Middle ClassNo ratings yet

- Sacred Success: A Course in Financial MiraclesFrom EverandSacred Success: A Course in Financial MiraclesRating: 5 out of 5 stars5/5 (15)

- Bookkeeping: An Essential Guide to Bookkeeping for Beginners along with Basic Accounting PrinciplesFrom EverandBookkeeping: An Essential Guide to Bookkeeping for Beginners along with Basic Accounting PrinciplesRating: 4.5 out of 5 stars4.5/5 (30)

- How To Budget And Manage Your Money In 7 Simple StepsFrom EverandHow To Budget And Manage Your Money In 7 Simple StepsRating: 5 out of 5 stars5/5 (4)

- The Black Girl's Guide to Financial Freedom: Build Wealth, Retire Early, and Live the Life of Your DreamsFrom EverandThe Black Girl's Guide to Financial Freedom: Build Wealth, Retire Early, and Live the Life of Your DreamsNo ratings yet

- How to Pay Zero Taxes, 2020-2021: Your Guide to Every Tax Break the IRS AllowsFrom EverandHow to Pay Zero Taxes, 2020-2021: Your Guide to Every Tax Break the IRS AllowsNo ratings yet

- Budget Management for Beginners: Proven Strategies to Revamp Business & Personal Finance Habits. Stop Living Paycheck to Paycheck, Get Out of Debt, and Save Money for Financial Freedom.From EverandBudget Management for Beginners: Proven Strategies to Revamp Business & Personal Finance Habits. Stop Living Paycheck to Paycheck, Get Out of Debt, and Save Money for Financial Freedom.Rating: 5 out of 5 stars5/5 (82)

- Extreme Couponing for Busy Women: A Busy Woman's Guide to Extreme CouponingFrom EverandExtreme Couponing for Busy Women: A Busy Woman's Guide to Extreme CouponingRating: 5 out of 5 stars5/5 (1)

- Money Made Easy: How to Budget, Pay Off Debt, and Save MoneyFrom EverandMoney Made Easy: How to Budget, Pay Off Debt, and Save MoneyRating: 5 out of 5 stars5/5 (1)

- Improve Money Management by Learning the Steps to a Minimalist Budget: Learn How To Save Money, Control Your Personal Finances, Avoid Consumerism, Invest Wisely And Spend On What Matters To YouFrom EverandImprove Money Management by Learning the Steps to a Minimalist Budget: Learn How To Save Money, Control Your Personal Finances, Avoid Consumerism, Invest Wisely And Spend On What Matters To YouRating: 5 out of 5 stars5/5 (5)

- The New York Times Pocket MBA Series: Forecasting Budgets: 25 Keys to Successful PlanningFrom EverandThe New York Times Pocket MBA Series: Forecasting Budgets: 25 Keys to Successful PlanningRating: 4.5 out of 5 stars4.5/5 (8)

- Minding Your Own Business: A Common Sense Guide to Home Management and IndustryFrom EverandMinding Your Own Business: A Common Sense Guide to Home Management and IndustryRating: 5 out of 5 stars5/5 (1)

- Personal Finance for Beginners - A Simple Guide to Take Control of Your Financial SituationFrom EverandPersonal Finance for Beginners - A Simple Guide to Take Control of Your Financial SituationRating: 4.5 out of 5 stars4.5/5 (18)

- The Complete Strategy Guide to Day Trading for a Living in 2019: Revealing the Best Up-to-Date Forex, Options, Stock and Swing Trading Strategies of 2019 (Beginners Guide)From EverandThe Complete Strategy Guide to Day Trading for a Living in 2019: Revealing the Best Up-to-Date Forex, Options, Stock and Swing Trading Strategies of 2019 (Beginners Guide)Rating: 4 out of 5 stars4/5 (34)

- Swot analysis in 4 steps: How to use the SWOT matrix to make a difference in career and businessFrom EverandSwot analysis in 4 steps: How to use the SWOT matrix to make a difference in career and businessRating: 4.5 out of 5 stars4.5/5 (4)

- CDL Study Guide 2022-2023: Everything You Need to Pass Your Exam with Flying Colors on the First Try. Theory, Q&A, Explanations + 13 Interactive TestsFrom EverandCDL Study Guide 2022-2023: Everything You Need to Pass Your Exam with Flying Colors on the First Try. Theory, Q&A, Explanations + 13 Interactive TestsRating: 4 out of 5 stars4/5 (4)

- Summary of You Need a Budget: The Proven System for Breaking the Paycheck-to-Paycheck Cycle, Getting Out of Debt, and Living the Life You Want by Jesse MechamFrom EverandSummary of You Need a Budget: The Proven System for Breaking the Paycheck-to-Paycheck Cycle, Getting Out of Debt, and Living the Life You Want by Jesse MechamRating: 5 out of 5 stars5/5 (1)

- Happy Go Money: Spend Smart, Save Right and Enjoy LifeFrom EverandHappy Go Money: Spend Smart, Save Right and Enjoy LifeRating: 5 out of 5 stars5/5 (4)

- Altcoins Coins The Future is Now Enjin Dogecoin Polygon Matic Ada: blockchain technology seriesFrom EverandAltcoins Coins The Future is Now Enjin Dogecoin Polygon Matic Ada: blockchain technology seriesRating: 5 out of 5 stars5/5 (1)

- The Best Team Wins: The New Science of High PerformanceFrom EverandThe Best Team Wins: The New Science of High PerformanceRating: 4.5 out of 5 stars4.5/5 (31)