Professional Documents

Culture Documents

CRD Foods 8apr2020

Uploaded by

samudragupta05Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CRD Foods 8apr2020

Uploaded by

samudragupta05Copyright:

Available Formats

RATING RATIONALE

8 April 2020

CRD Foods Pvt Ltd

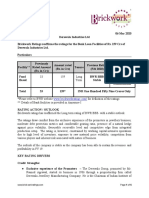

Brickwork Ratings reaffirms ratings for the Bank Loan Facilities of ₹ 32.85

Crores of CRD Foods Pvt Ltd

Particulars

Amount (₹ Crs) Rating*

Facility Previous Present Tenure Previous (July, 2018) Present

BWR BB+

BWR BB+

Fund based 28.50 32.85 Long Term (Stable)

Stable

(Reaffirmed)

Total 28.50 32.85 INR Thirty Two Crores and Eight Five Lakhs Only

*Please refer to BWR website www.brickworkratings.com/ for definition of the ratings

** Details of Bank facilities in Annexure-I

RATING ACTION / OUTLOOK

Brickwork rating has reaffirmed the long-term rating of CRD Foods Pvt Ltd at BWR BB+ with a

Stable Outlook on account of wide geographical presence, established distribution and

procurement network, moderate gearing, healthy profitability and uptrend in revenue.

The ‘stable’ outlook indicates a low likelihood of a rating change in the medium term. BWR

expects that the company’s performance is likely to be maintained in the medium term..

The rating, however, is constrained by working capital intensive operations, inherent risk

associated with Agri Industry, limited track record of the company in the cold storage business,

intense competition and fragmented nature of the industry.

KEY RATING DRIVERS

Credit Strengths :

● Wide geographical presence and established distribution network : CRD products are

distributed PAN India. The company has a wide geographical reach with presence in

Delhi, UP, Kerala, Hyderabad, and Tamil Nadu. The company gets 40% of its revenue

from Delhi, 40% from Up and 20% from rest of the states. However, the company

operates cold storage and warehousing facilities in UP only. Distribution of the produce

is done through Cold or Refrigerated Vans. Some of the Vans are outsourced and some

www.brickworkratings.com Page 1 of 6

are under tie up with the temperature controlled logistic service provider like Mr Kool

Logistics, Gati Kausar etc.

● Established Procurement Network : CRD has been procuring fruits and vegetables

from Kashmir, Himachal Pradesh, UP and Maharashtra. Company procures directly from

farmers and farmers’ co -operatives. The procurement depends upon the market rates,

quantity and quality of the product. The company procures apples from Kashmir and

Himachal Pradesh, oranges from Nagpur, Maharashtra, carrots from Karnataka. CRD

procures cauliflower, cabbage , lemons, garlic, onion, peas and eggs from UP itself.

● Moderate Financial Risk Profile : CSPL has reported moderate capital structure with

Tangible Net Worth (Analysed) of Rs.19.58 Cr and outstanding interest bearing debt

(CC, TL) at Rs.36.66 Cr. in FY19, owing to which gearing is moderate at 1.87X in FY19.

Debt Protection Metrics are above the benchmark i.e. ISCR and DSCR are at 2.44X and

1.67X in FY19. ISCR has declined marginally from 2.50X in FY18. Profitability Margins

are healthy i.e. Operating Profit Margin and Net Profit Margin are at 15.34% and 2.64%

in FY19.

● Uptrend in Revenue : The company reported Total Operating Income amounting

Rs.30.24 Cr. and Rs.49.74 Cr. in FY18 and FY19 respectively, registering a growth of

almost 66% in FY19. According to the information provided by the management the

company has achieved a Revenue of Rs.67.95 till 24/03/20 (certified by CA). And the

company projects to achieve Rs.70.00 Cr. in the current financial year. There is further

scope of an increase in revenue as the unutilized capacity of 25% is still available.

Credit Risks :

● Working Capital Intensive operations : The company’s operations are highly working

capital intensive in nature as marked by 100% of the utilization of the bank facilities

(CC) in the peak season and 90-95% of the utilization in Non-peak season. Conversion

cycle had also been elongated in FY19 i.e. 227 Days. due to higher inventory days of the

company. Higher inventory days owes to seasonality of business operations.

● Inherent risk associated with Agri industry : The company is engaged in processing

and storage of agri based products thus exposed to risk associated with the fluctuation in

production levels, uncertain weather conditions and limited shelf life of the products.

● Limited track record of the company in the cold storage business : The company got

established in 2010 but became operational in 2016. Prior experience of the Directors is

in the business of trading of metals like gold and silver. The Directors have a limited

track record of the company in the cold storage business.

● Intense Competition and fragmented nature of the industry - The cold storage

industry is dominated by numerous independent, small-scale enterprises. High degree of

fragmentation due to the presence of large numbers of unorganized players has led to

high competitive intensity in the processing segment.

ANALYTICAL APPROACH AND APPLICABLE RATING CRITERIA

www.brickworkratings.com Page 2 of 6

BWR has factored in the standalone business parameters and financial risk profile of the

company to arrive at the rating. Reference may be made to the Rating Criteria hyperlinked

detailed below (hyperlinks provided at the end of this rationale).

RATING SENSITIVITIES

Going forward, the company's ability to increase the scale of the business would be key

sensitivity over short to medium term.

Positive : The rating outlook may be revised to positive if the company improves the topline.

Negative : The rating may be downgraded if there is deterioration of profitability and gearing

levels.

LIQUIDITY POSITION (Adequate)

The liquidity position of the company is adequate, marked by healthy Cash and Cash

equivalents, which have increased significantly to Rs.3.60 Cr. in FY19 from Rs.0.43 Cr. in

FY18. Net Cash Accruals have also increased from Rs.4.31 Cr. to Rs.4.40 Cr. The same are

against CPLTD of Rs.2.06 Cr. in FY19. Other Liquidity indicators are stretched marked by

100% of the utilization of the bank facilities (CC) in the peak season and 90-95% of the

utilization in Non-peak seasons. Current Ratio in FY19 is at 1.33X which is considered

moderate.

COMPANY PROFILE

CRD FOODS Pvt. Ltd. was established in 2010 by Mr. Ashok Kumar Agarwal, who is currently

MD of the company. The company has an Integrated Controlled Atmosphere Cold Store certified

from FSSAI for long-term storage of fruits and vegetables with capacity of 5500 MT and

located in Mathura, U.P. As per company, Sale of produce is done through its brand name CRD

FRESH. Directors are Mr. Ashok Agrawal, Mr. Chaitanya Agarwal, Mr. Rajat Agarwal & Mr.

Devesh Agarwal, who are all graduates. Presently the company has an installed capacity of 5500

MT which has been utilized upto 75% in FY20.

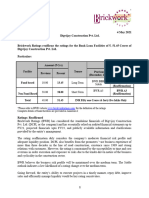

KEY FINANCIAL INDICATORS (in INR Cr)

The company reported Total Operating Income amounting Rs.30.24 Cr. and Rs.49.74 Cr. in

FY18 and FY19 respectively, registering a growth of almost 66% in FY19. According to the

information provided by the management the company has achieved a Revenue of Rs.67.95 Cr.

till 24/03/20. And the company projects to achieve Rs.70.00 Cr. in the current financial year.

www.brickworkratings.com Page 3 of 6

Key Parameters Units 2019 2018

Result Type Audited Audited

Operating Revenue ₹ Cr 49.74 30.24

EBITDA ₹ Cr 7.63 7.21

PAT ₹ Cr 1.31 0.65

Tangible Net worth (Analysed) ₹ Cr 19.58 12.63

Total Debt/Tangible Net worth (Analysed) Times 1.87 2.47

Current Ratio Times 1.33 1.32

KEY COVENANTS OF THE INSTRUMENT/FACILITY RATED : NIL

NON-COOPERATION WITH PREVIOUS RATING AGENCY : NA

RATING HISTORY

Instrument

Current Rating (March, 2020)

/Facility Rating History

Type

Amount

(Long Term/ Rating 2019 July, 2018 2017

(₹ Crs)

Short Term)

BWR BB+

BWR BB+

Fund Based Long Term 32.85 Stable - -

Stable

(Reaffirm)

Total 32.85 ₹ Thirty Two Crores and Eighty Five Lakhs Only

COMPLEXITY LEVELS OF THE INSTRUMENTS

For more information, visit www.brickworkratings.com/download/ComplexityLevels.pdf

Hyperlink/Reference to applicable Criteria

www.brickworkratings.com Page 4 of 6

Analytical Contacts Investor Contacts

Satvinder Kumar Gakhar

Associate Director - Ratings

B :+91 11 2341 2232 Liena Thakur

satvinder.g@brickworkratings.com Assistant Vice President - Corporate Communications

+91 84339 94686

Aayush Verma liena.t@brickworkratings.com

Ratings Analyst

B :+91 11 2341 2232

aayush.v@brickworkratings.com

1-860-425-2742

CRD Foods Pvt Ltd

ANNEXURE I

Details of Bank Facilities rated by BWR

Sl. No. Name of the Type of Long Term ShortTerm Total

Bank Facilities (₹ Cr) (₹ Cr) (₹ Cr)

1 Punjab Cash Credit 20.00 - 20.00

National Bank

2 Term Loan 12.85 - 12.85

TOTAL 32.85

Total Rupees Thirty Two Crores and Eighty Five Lakhs only.

For print and digital media The Rating Rationale is sent to you for the sole purpose of dissemination through your

print, digital or electronic media. While it may be used by you acknowledging credit to BWR, please do not change

the wordings in the rationale to avoid conveying a meaning different from what was intended by BWR. BWR alone

has the sole right of sharing (both direct and indirect) its rationales for consideration or otherwise through any print

or electronic or digital media.

About Brickwork Ratings :Brickwork Ratings (BWR), a SEBI registered Credit Rating Agency, accredited by RBI

and empaneled by NSIC, offers Bank Loan, NCD, Commercial Paper, MSME ratings and grading services.

NABARD has empaneled Brickwork for MFI and NGO grading. BWR is accredited by IREDA & the Ministry of

New and Renewable Energy (MNRE), Government of India. Brickwork Ratings has Canara Bank, a leading public

sector bank, as its promoter and strategic partner. BWR has its corporate office in Bengaluru and a country-wide

presence with its offices in Ahmedabad, Chandigarh, Chennai, Hyderabad, Kolkata, Mumbai and New Delhi along

with representatives in 150+ locations.

DISCLAIMER Brickwork Ratings (BWR) has assigned the rating based on the information obtained from the

issuer and other reliable sources, which are deemed to be accurate. BWR has taken considerable steps to avoid any

www.brickworkratings.com Page 5 of 6

data distortion; however, it does not examine the precision or completeness of the information obtained. And hence,

the information in this report is presented “as is” without any express or implied warranty of any kind. BWR does

not make any representation in respect to the truth or accuracy of any such information. The rating assigned by

BWR should be treated as an opinion rather than a recommendation to buy, sell or hold the rated instrument and

BWR shall not be liable for any losses incurred by users from any use of this report or its contents. BWR has the

right to change, suspend or withdraw the ratings at any time for any reasons.

www.brickworkratings.com Page 6 of 6

You might also like

- Finding Balance 2016: Benchmarking the Performance of State-Owned Enterprise in Island CountriesFrom EverandFinding Balance 2016: Benchmarking the Performance of State-Owned Enterprise in Island CountriesNo ratings yet

- Faridabad Steel Mongers Rating RationaleDocument4 pagesFaridabad Steel Mongers Rating RationaleShamNo ratings yet

- RATING RATIONALE FOR DEREWALA INDUSTRIES LTDDocument6 pagesRATING RATIONALE FOR DEREWALA INDUSTRIES LTDMukul SoniNo ratings yet

- Mahima Real Estate 10apr2019Document5 pagesMahima Real Estate 10apr2019Reena GahlotNo ratings yet

- BWR A4 Rating for Malar International's Rs.6 Cr Bank Loan FacilitiesDocument4 pagesBWR A4 Rating for Malar International's Rs.6 Cr Bank Loan FacilitiesNalla ThambiNo ratings yet

- PR - Sri Anagha - Refineries - 23 - 09 - 2020Document6 pagesPR - Sri Anagha - Refineries - 23 - 09 - 2020Jayshreeben DobariyaNo ratings yet

- Entertainment City Ratings ReaffirmedDocument6 pagesEntertainment City Ratings ReaffirmedPuneet367No ratings yet

- Globe Capacitors 14nov2019Document6 pagesGlobe Capacitors 14nov2019Puneet367No ratings yet

- Tehri Pulp and Paper 5feb2021Document6 pagesTehri Pulp and Paper 5feb2021Ck WilliumNo ratings yet

- Ankit Pulps and Boards - R-25102018Document6 pagesAnkit Pulps and Boards - R-25102018HEMANT GURJARNo ratings yet

- Brickwork assigns BWR BB- rating to Asquare Food & BeveragesDocument6 pagesBrickwork assigns BWR BB- rating to Asquare Food & BeveragesTanmay GuptaNo ratings yet

- Sun Home Appliances Private - R - 25082020Document7 pagesSun Home Appliances Private - R - 25082020DarshanNo ratings yet

- PR Chennai Rice 24june22Document8 pagesPR Chennai Rice 24june22RaviNo ratings yet

- SPG Infraprojects BL 23sep2019 PDFDocument6 pagesSPG Infraprojects BL 23sep2019 PDFChander ShekharNo ratings yet

- JP Infra Mumbai 23dec2021Document6 pagesJP Infra Mumbai 23dec2021Rishabh MehtaNo ratings yet

- Pondy Oxides and Chemicals 22apr2019Document6 pagesPondy Oxides and Chemicals 22apr2019DarshanNo ratings yet

- Press Release: R B Construction CompanyDocument4 pagesPress Release: R B Construction CompanyRavi BabuNo ratings yet

- Aria CR Dec 19Document4 pagesAria CR Dec 19swamih.knightfrankNo ratings yet

- Ajanta Soya 13may2021Document7 pagesAjanta Soya 13may2021praveen kumarNo ratings yet

- Press Release MaharajaDocument5 pagesPress Release MaharajaMS SAMIRANNo ratings yet

- Sanghi Jewellers PVT - R - 20102020Document7 pagesSanghi Jewellers PVT - R - 20102020DarshanNo ratings yet

- Rajesh Exports 20may2021Document6 pagesRajesh Exports 20may2021adhyan kashyapNo ratings yet

- KIL Ratings RationaleDocument7 pagesKIL Ratings RationaleaaravNo ratings yet

- ReNew Power BL 17jan2019Document5 pagesReNew Power BL 17jan2019HEM BANSALNo ratings yet

- HRMM Agro Overseas BL 18apr2018Document5 pagesHRMM Agro Overseas BL 18apr2018Shiv KumarNo ratings yet

- Sitaram Maharaj Sakhar - R - 22042019 PDFDocument6 pagesSitaram Maharaj Sakhar - R - 22042019 PDFJagadamba RealtorNo ratings yet

- Ganga Rasayanie Private Limited-R-10102019Document7 pagesGanga Rasayanie Private Limited-R-10102019DarshanNo ratings yet

- Vinayak Steels Limited Financial ReportDocument7 pagesVinayak Steels Limited Financial Reportsaikiran reddyNo ratings yet

- RR 20190917Document4 pagesRR 20190917omkarambale1No ratings yet

- Prime Urban ICRA April 17Document7 pagesPrime Urban ICRA April 17BALMERNo ratings yet

- Gujarat Themis Biosyn LimitedDocument5 pagesGujarat Themis Biosyn LimitedAshwani KesharwaniNo ratings yet

- PR ARCL Organics 31jan22Document7 pagesPR ARCL Organics 31jan22anady135344No ratings yet

- Anand Jewels (Indore) - R-30072019Document6 pagesAnand Jewels (Indore) - R-30072019Rishabh KhandelwalNo ratings yet

- Super Screws Private Limited: Summary of Rated InstrumentsDocument7 pagesSuper Screws Private Limited: Summary of Rated InstrumentsAnonymous bdUhUNm7JNo ratings yet

- SVR Drugs Rating AssignedDocument4 pagesSVR Drugs Rating Assignedlalit rawatNo ratings yet

- Gujarat Guardian Limited-R-30032018Document6 pagesGujarat Guardian Limited-R-30032018SuhasNo ratings yet

- Mega Steel IndustriesDocument4 pagesMega Steel IndustrieshseckalpeshNo ratings yet

- Tripurashwari Agro Product Pvt. Ltd.-07-21-2020Document4 pagesTripurashwari Agro Product Pvt. Ltd.-07-21-2020Manish DadlaniNo ratings yet

- India Ratings Affirms Parasakti Cement at 'BBB+'; Outlook StableDocument5 pagesIndia Ratings Affirms Parasakti Cement at 'BBB+'; Outlook StableSaranNo ratings yet

- Gokak Textiles Limited: Ratings Reaffirmed Long-Term Rating Withdrawn Summary of Rating ActionDocument6 pagesGokak Textiles Limited: Ratings Reaffirmed Long-Term Rating Withdrawn Summary of Rating Actionabhi MestriNo ratings yet

- Hinduja Healthcare 29dec2020Document8 pagesHinduja Healthcare 29dec2020Bijay MehtaNo ratings yet

- St. Johns Rajakumar Education & Research TrustDocument3 pagesSt. Johns Rajakumar Education & Research TrustSrikar tejNo ratings yet

- Rating Rationale: TNPFIDC or "Corporation")Document5 pagesRating Rationale: TNPFIDC or "Corporation")venugopallNo ratings yet

- PSK Engineering Construction & Co-08-06-2020Document5 pagesPSK Engineering Construction & Co-08-06-2020The JdNo ratings yet

- A One Steel Alloys 10may2021Document7 pagesA One Steel Alloys 10may2021L KNo ratings yet

- Jyoti CNC Automation 24dec2019Document7 pagesJyoti CNC Automation 24dec2019Puneet367No ratings yet

- R.S. Brothers Retail - R-06122017Document7 pagesR.S. Brothers Retail - R-06122017srv 99No ratings yet

- Digvijay Construction 4may2021Document7 pagesDigvijay Construction 4may2021hesham zakiNo ratings yet

- Microfinance Private LimitedDocument5 pagesMicrofinance Private LimitedsantoshbsantuNo ratings yet

- D&H Secheron Electrodes Private Limited: Summary of Rated InstrumentsDocument6 pagesD&H Secheron Electrodes Private Limited: Summary of Rated InstrumentsMahee MahemaaNo ratings yet

- Ganesh Benzoplast LTD (GBL)Document7 pagesGanesh Benzoplast LTD (GBL)Positive ThinkerNo ratings yet

- Sree Akkamamba Textiles - R - 13032020Document7 pagesSree Akkamamba Textiles - R - 13032020saikiran reddyNo ratings yet

- Satya Deeptha Pharmaceuticals LimitedDocument6 pagesSatya Deeptha Pharmaceuticals LimitedsriramraneNo ratings yet

- Stove Kraft Limited-3Document5 pagesStove Kraft Limited-3venkyniyerNo ratings yet

- Mehala Machines India LimitedDocument4 pagesMehala Machines India LimitedKarthikeyan RK SwamyNo ratings yet

- Happy ForgingsDocument7 pagesHappy ForgingsArshChandraNo ratings yet

- Della Adventure R 17112017Document7 pagesDella Adventure R 17112017Anil KanojiaNo ratings yet

- VNS Finance & Capital Services Limited: Summary of Rated InstrumentsDocument6 pagesVNS Finance & Capital Services Limited: Summary of Rated InstrumentsRakesh JainNo ratings yet

- Save Microfinance Private Limited: RatingsDocument4 pagesSave Microfinance Private Limited: RatingsSubhamNo ratings yet

- Press Release: Details of Instruments/facilities in Annexure-1Document4 pagesPress Release: Details of Instruments/facilities in Annexure-1Aman DubeyNo ratings yet