Professional Documents

Culture Documents

St. Johns Rajakumar Education & Research Trust

Uploaded by

Srikar tejOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

St. Johns Rajakumar Education & Research Trust

Uploaded by

Srikar tejCopyright:

Available Formats

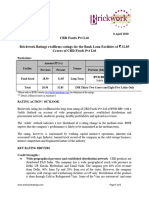

Press Release

St. John`s Rajakumar Education & Research Trust

September 19, 2022

Ratings

Amount

Facilities / Instruments Rating1 Rating Action

(Rs. crore)

Rating continues to remain

CARE B+; Stable; under ISSUER NOT

ISSUER NOT COOPERATING* COOPERATING category and

Long Term Bank Facilities 73.00

(Single B Plus; Outlook: Stable Revised from CARE BB-;

ISSUER NOT COOPERATING*) Stable; (Double B Minus;

Outlook: Stable)

73.00

Total Facilities (Rs. Seventy-Three

Crore Only)

Details of facilities in Annexure-1

Detailed Rationale & Key Rating Drivers

CARE Ratings Ltd. had, vide its press release dated September 15, 2021, placed the rating(s) of St. John`s Rajakumar

Education & Research Trust (SJRERT) under the ‘issuer non-cooperating’ category as SJRERT had failed to provide information

for monitoring of the rating and had not paid the surveillance fees for the rating exercise as agreed to in its Rating Agreement.

SJRERT continues to be non-cooperative despite repeated requests for submission of information through e-mails, phone calls

and a letter/email dated August 01, 2022, August 11, 2022, August 21, 2022.

In line with the extant SEBI guidelines, CARE Ratings Ltd. has reviewed the rating on the basis of the best available information

which however, in CARE Ratings Ltd.’s opinion is not sufficient to arrive at a fair rating.

Users of this rating (including investors, lenders and the public at large) are hence requested to exercise caution

while using the above rating(s).

The ratings have been revised on account of non-availability of requisite information

Detailed description of the key rating drivers

Please refer to PR dated September 15, 2021

Analytical approach: Combined.

To arrive at the rating of SJRERT, business and financial risk profiles of St. John's Educational Trust (SJET) and St. John`s

Rajakumar Education & Research Trust (SJRERT) have been combined since both the trusts are owned and managed by same

promoter family, are in same line of business and are co-borrowers for each other’s bank loans.

Applicable Criteria

Policy in respect of Non-cooperation by issuer

Policy on default recognition

Criteria on assigning outlook and credit watch

About the Company

SJET was established by Late Mr. G. Rajakumar in 1968 and currently operates 9 schools in Chennai (of which 5 schools are

affiliated to CBSE and 4 schools to Tamil Nadu State Board). The trust is managed by Dr. Kishore Kumar Rajakumar (son of

Late Mr. G. Rajakumar) along with his two brothers Mr. Suresh Kumar R and Mr. Ramesh Kumar R. SJRERT was set up by Dr.

Kishore Kumar Rajakumar in 2010 to set up new high-quality schools. It has Dr. Kishore Kumar Rajakumar and his wife - Mrs

Caroline Kishore as trustees. SJRERT currently operates 2 schools in Chennai (1 fully operational and one partially operational

and under construction), both of them affiliated to CBSE.

Brief Financials (Rs. crore) FY20(A) FY21(A) FY22(Prov.) Q1FY23(Prov.)

Total operating income NA NA NA NA

PBILDT NA NA NA NA

PAT NA NA NA NA

Overall gearing (times) NA NA NA NA

Interest coverage (times) NA NA NA NA

A - Audited, Prov. Provisional, NA – Not Available

1Complete definitions of the ratings assigned are available at www.careedge.in and in other CARE Ratings Ltd.’s publications

*Issuer did not cooperate; Based on best available information

1 CARE Ratings Ltd.

Press Release

Status of non-cooperation with previous CRA: Not Applicable

Any other information: Not Applicable

Rating History for last three years: Please refer Annexure-2

Covenants of rated instrument/facility: Annexure 3

Complexity level of various instruments rated for this company: Annexure 4

Annexure-1: Details of Instruments/ Facilities

Size of the

Name of the Date of Coupon Maturity Rating Assigned along

ISIN Issue

Instrument Issuance Rate (%) Date with Rating Outlook

(₹ crore)

Fund-based - LT- CARE B+; Stable; ISSUER

- - - Proposed 73.00

Term Loan NOT COOPERATING*

*Issuer did not cooperate; based on best available information

Annexure-2: Rating History of last three years

Current Ratings Rating History

Name of the

Sr. Date(s) & Date(s) & Date(s) & Date(s) &

Instrument/ Amount

No Rating(s) Rating(s) Rating(s) Rating(s)

Bank Type Outstanding Rating

. assigned in assigned in assigned in assigned in

Facilities (₹ crore)

2022-2023 2021-2022 2020-2021 2019-2020

CARE B+; 1)CARE BB-; 1)CARE BB; 1)CARE BB;

Stable; Stable; Stable; Stable; ISSUER

Fund-based - ISSUER ISSUER NOT ISSUER NOT NOT

1 LT 73.00 -

LT-Term Loan NOT COOPERATI COOPERATIN COOPERATING

COOPERA NG* G* *

TING* (15-Sep-21) (25-Aug-20) (28-May-19)

*Issuer did not cooperate; based on best available information

Annexure-3: Detailed explanation of covenants of the rated instrument / facilities - Not Applicable

Annexure 4: Complexity level of various instruments rated for this Company

Sr. No. Name of Instrument Complexity Level

1 Fund-based - LT-Term Loan Simple

Annexure 5: Bank Lender Details for this Company

To view the lender wise details of bank facilities please click here

Note on complexity levels of the rated instrument: CARE Ratings Ltd. has classified instruments rated by it on the basis

of complexity. Investors/market intermediaries/regulators or others are welcome to write to care@careedge.in for any

clarifications.

2 CARE Ratings Ltd.

Press Release

Contact us

Media Contact

Mr. Mradul Mishra

Contact No.: +91-22-6754 3573

Email ID – mradul.mishra@careedge.in

Analyst Contact

Ms. Shachee Vyas

Contact No.: +91-79-4026 5665

Email ID – shachee.tripathi@careedge.in

Relationship Contact

Ms. Swati Agrawal

Contact No.: +91-11-45333237

Email ID – swati.agrawal@careedge.in

About CARE Ratings Limited:

Established in 1993, CARE Ratings Ltd. is one of the leading credit rating agencies in India. Registered under the Securities and

Exchange Board of India (SEBI), it has also been acknowledged as an External Credit Assessment Institution (ECAI) by the

Reserve Bank of India (RBI). With an equitable position in the Indian capital market, CARE Ratings Limited provides a wide

array of credit rating services that help corporates to raise capital and enable investors to make informed decisions backed by

knowledge and assessment provided by the company.

With an established track record of rating companies over almost three decades, we follow a robust and transparent rating

process that leverages our domain and analytical expertise backed by the methodologies congruent with the international best

practices. CARE Ratings Limited has had a pivotal role to play in developing bank debt and capital market instruments including

CPs, corporate bonds and debentures, and structured credit.

Disclaimer

The ratings issued by CARE Ratings Limited are opinions on the likelihood of timely payment of the obligations under the rated

instrument and are not recommendations to sanction, renew, disburse or recall the concerned bank facilities or to buy, sell or

hold any security. These ratings do not convey suitability or price for the investor. The agency does not constitute an audit on

the rated entity. CARE Ratings Limited has based its ratings/outlooks based on information obtained from reliable and credible

sources. CARE Ratings Limited does not, however, guarantee the accuracy, adequacy or completeness of any information and is

not responsible for any errors or omissions and the results obtained from the use of such information. Most entities whose bank

facilities/instruments are rated by CARE Ratings Limited have paid a credit rating fee, based on the amount and type of bank

facilities/instruments. CARE Ratings Limited or its subsidiaries/associates may also be involved with other commercial

transactions with the entity. In case of partnership/proprietary concerns, the rating /outlook assigned by CARE Ratings Limited

is, inter-alia, based on the capital deployed by the partners/proprietor and the current financial strength of the firm. The

rating/outlook may undergo a change in case of withdrawal of capital or the unsecured loans brought in by the

partners/proprietor in addition to the financial performance and other relevant factors. CARE Ratings Limited is not responsible

for any errors and states that it has no financial liability whatsoever to the users of CARE Ratings Limited’s rating.

Our ratings do not factor in any rating related trigger clauses as per the terms of the facility/instrument, which may involve

acceleration of payments in case of rating downgrades. However, if any such clauses are introduced and if triggered, the

ratings may see volatility and sharp downgrades.

**For detailed Rationale Report and subscription information, please contact us at www.careedge.in

3 CARE Ratings Ltd.

You might also like

- Hitkari Gram Udyog SanghDocument3 pagesHitkari Gram Udyog SanghAryan LakraNo ratings yet

- CityLife Retail Private LimitedDocument3 pagesCityLife Retail Private LimitedArnab MitraNo ratings yet

- Shri Ram Autotech Rating Continues Under Non-CooperationDocument3 pagesShri Ram Autotech Rating Continues Under Non-CooperationAmanNo ratings yet

- Tripurashwari Agro Product Pvt. Ltd.-07-21-2020Document4 pagesTripurashwari Agro Product Pvt. Ltd.-07-21-2020Manish DadlaniNo ratings yet

- Venkateshwara Power Project LimitedDocument3 pagesVenkateshwara Power Project Limited04 Sourabh BaraleNo ratings yet

- Press Release: Details of Instruments/facilities in Annexure-1Document4 pagesPress Release: Details of Instruments/facilities in Annexure-1Aman DubeyNo ratings yet

- Dhatarwal Construction Company Private LimitedDocument3 pagesDhatarwal Construction Company Private LimitedVipasha SanghaviNo ratings yet

- Shree Kongu Velalar Educational TrustDocument3 pagesShree Kongu Velalar Educational TrustKarthikeyan RK SwamyNo ratings yet

- CRISIL Rating Metro July19Document3 pagesCRISIL Rating Metro July19pankaj_xaviersNo ratings yet

- Primatel Fibcom LimitedDocument3 pagesPrimatel Fibcom LimitedHargovind SachdevNo ratings yet

- Prithvi PumpsDocument3 pagesPrithvi PumpsdishandshahNo ratings yet

- Santkrupa Milk and Milk Products-05!27!2020Document4 pagesSantkrupa Milk and Milk Products-05!27!2020Sanket PawarNo ratings yet

- Mehala Machines India LimitedDocument4 pagesMehala Machines India LimitedKarthikeyan RK SwamyNo ratings yet

- Details of Facilities in Annexure - 1: Rationale-Press ReleaseDocument3 pagesDetails of Facilities in Annexure - 1: Rationale-Press ReleaseTathagata DasNo ratings yet

- 24/7 Customer Private Limited withdraws ratingsDocument4 pages24/7 Customer Private Limited withdraws ratingsData CentrumNo ratings yet

- 3B Binani GlassfibreDocument2 pages3B Binani GlassfibreData CentrumNo ratings yet

- Press Release Adani Agri Logistics (Harda) Limited: Details of Facilities in Annexure-1Document3 pagesPress Release Adani Agri Logistics (Harda) Limited: Details of Facilities in Annexure-1surprise MFNo ratings yet

- Press Release India Belt Company: Details of Instruments/facilities in Annexure-1Document4 pagesPress Release India Belt Company: Details of Instruments/facilities in Annexure-1ANUBHAVCFANo ratings yet

- Rating Rationale Withdrawn for C&J Corporate Park NCDDocument3 pagesRating Rationale Withdrawn for C&J Corporate Park NCDKomal ParmarNo ratings yet

- Press Release 3B Fibreglass Norway AS: Policy On Withdrawal of Ratings Policy On Default RecognitionDocument3 pagesPress Release 3B Fibreglass Norway AS: Policy On Withdrawal of Ratings Policy On Default RecognitionData CentrumNo ratings yet

- Pump DesignDocument4 pagesPump Designmarathasanatani6No ratings yet

- Credit Rating - Jun 2021 - Atmastco - LimitedDocument4 pagesCredit Rating - Jun 2021 - Atmastco - LimitedSaurav GanguliNo ratings yet

- Kapsons Industries Private Limited-05-27-2019Document3 pagesKapsons Industries Private Limited-05-27-2019Puneet367No ratings yet

- BWR A4 Rating for Malar International's Rs.6 Cr Bank Loan FacilitiesDocument4 pagesBWR A4 Rating for Malar International's Rs.6 Cr Bank Loan FacilitiesNalla ThambiNo ratings yet

- Mahima Real Estate 10apr2019Document5 pagesMahima Real Estate 10apr2019Reena GahlotNo ratings yet

- CRD Foods 8apr2020Document6 pagesCRD Foods 8apr2020samudragupta05No ratings yet

- Faridabad Steel Mongers Rating RationaleDocument4 pagesFaridabad Steel Mongers Rating RationaleShamNo ratings yet

- DR Datson Labs 22mar2021Document5 pagesDR Datson Labs 22mar2021office88kolNo ratings yet

- Entertainment City Ratings ReaffirmedDocument6 pagesEntertainment City Ratings ReaffirmedPuneet367No ratings yet

- Shri Senthur Velan InfrasDocument5 pagesShri Senthur Velan InfrasraghavendraNo ratings yet

- Globe Capacitors 14nov2019Document6 pagesGlobe Capacitors 14nov2019Puneet367No ratings yet

- Shree Radhekrushna Ginning - R-11092017Document6 pagesShree Radhekrushna Ginning - R-11092017SuMit PaTilNo ratings yet

- PJS Credit Rating by Brickwork On On 26th Aug 2019Document4 pagesPJS Credit Rating by Brickwork On On 26th Aug 2019PJS OverseasNo ratings yet

- IRB InviT Rating WithdrawnDocument2 pagesIRB InviT Rating WithdrawnANUBHAVCFANo ratings yet

- JP Infra Mumbai 23dec2021Document6 pagesJP Infra Mumbai 23dec2021Rishabh MehtaNo ratings yet

- Ramnord Research Laboratories Pvt. LtdDocument6 pagesRamnord Research Laboratories Pvt. LtdraghavNo ratings yet

- Rama Udyog Private Limited November 03, 2020: Rating Instrument / Facility Amount (Rs. Crore) Rating Rating ActionDocument4 pagesRama Udyog Private Limited November 03, 2020: Rating Instrument / Facility Amount (Rs. Crore) Rating Rating ActionRAMODSNo ratings yet

- PR - Sri Anagha - Refineries - 23 - 09 - 2020Document6 pagesPR - Sri Anagha - Refineries - 23 - 09 - 2020Jayshreeben DobariyaNo ratings yet

- SPG Infraprojects BL 23sep2019 PDFDocument6 pagesSPG Infraprojects BL 23sep2019 PDFChander ShekharNo ratings yet

- Shree Lakshmi Narayan Sugar Industries Private Limited-12-01-2020Document3 pagesShree Lakshmi Narayan Sugar Industries Private Limited-12-01-2020YUVRAJ YADAVNo ratings yet

- Noble Tech Industries Private LimitedDocument3 pagesNoble Tech Industries Private Limitedkarthikeyan A INo ratings yet

- Press Release Gem Granites: Facilities/Instruments Amount (Rs. Crore) Ratings Rating ActionDocument4 pagesPress Release Gem Granites: Facilities/Instruments Amount (Rs. Crore) Ratings Rating ActionRavi BabuNo ratings yet

- Brickwork assigns BWR BB- rating to Asquare Food & BeveragesDocument6 pagesBrickwork assigns BWR BB- rating to Asquare Food & BeveragesTanmay GuptaNo ratings yet

- A-1 Facility and Property Managers Private Limited: Rating RationaleDocument5 pagesA-1 Facility and Property Managers Private Limited: Rating RationaleDeepti JajooNo ratings yet

- Continental Carbon India LimitedDocument4 pagesContinental Carbon India LimitedKamaldeep MaanNo ratings yet

- Brajesh Packaging Private - R - 25082020Document4 pagesBrajesh Packaging Private - R - 25082020DarshanNo ratings yet

- ACCUFOX-ENTERPRISES - PC Jewellers Franchise - 1 StoreDocument5 pagesACCUFOX-ENTERPRISES - PC Jewellers Franchise - 1 StoreJai PhookanNo ratings yet

- Bhadreshwar Vidyut Private LimitedDocument5 pagesBhadreshwar Vidyut Private LimitedJaganNo ratings yet

- Della Adventure R 17112017Document7 pagesDella Adventure R 17112017Anil KanojiaNo ratings yet

- Press Release New Sapna Granite Industries: Details of Instruments/facilities in Annexure-1Document3 pagesPress Release New Sapna Granite Industries: Details of Instruments/facilities in Annexure-1Ravi BabuNo ratings yet

- West Coast Paper Mills LTDDocument6 pagesWest Coast Paper Mills LTDRavi KNo ratings yet

- Pan Healthcare Private Limited (PHCPL) October 12, 2020Document5 pagesPan Healthcare Private Limited (PHCPL) October 12, 2020Sachin DhorajiyaNo ratings yet

- CRISIL Rating Metro April18Document3 pagesCRISIL Rating Metro April18pankaj_xaviersNo ratings yet

- The Government Tele Communication R 03102017Document7 pagesThe Government Tele Communication R 03102017SandeeploguNo ratings yet

- Indotech Transformers LimitedDocument6 pagesIndotech Transformers LimitedMonika GNo ratings yet

- Hinduja Healthcare 29dec2020Document8 pagesHinduja Healthcare 29dec2020Bijay MehtaNo ratings yet

- Kogta Financial India LimitedDocument5 pagesKogta Financial India LimitedofficeloginpurposeNo ratings yet

- Servotech Power Systems Limited-12-21-2018Document5 pagesServotech Power Systems Limited-12-21-2018Sarthak SharmaNo ratings yet

- Rajratan Global Wire LimitedDocument6 pagesRajratan Global Wire Limitedpraveen kumarNo ratings yet

- What Is Seed BankingDocument5 pagesWhat Is Seed BankingSrikar tejNo ratings yet

- St. Johns Rajakumar Education & Research TrustDocument3 pagesSt. Johns Rajakumar Education & Research TrustSrikar tejNo ratings yet

- GraphiteDocument8 pagesGraphiteSrikar tejNo ratings yet

- JMO 2024 (7,8) Question PaperDocument2 pagesJMO 2024 (7,8) Question PaperSrikar tejNo ratings yet

- Class 9 - PA 2 DatesheetDocument1 pageClass 9 - PA 2 DatesheetSrikar tejNo ratings yet

- Worksheet - 1 - ModalsDocument1 pageWorksheet - 1 - ModalsSrikar tejNo ratings yet

- Dates - SocialDocument5 pagesDates - SocialSrikar tejNo ratings yet

- JMO 2024 (5,6) Question PaperDocument2 pagesJMO 2024 (5,6) Question PaperSrikar tejNo ratings yet

- 2nov HW Class9Document1 page2nov HW Class9Srikar tejNo ratings yet

- 2004 Indian Tsunami ReportDocument19 pages2004 Indian Tsunami ReportSrikar tejNo ratings yet

- A Neural Network Is A Series of Algorithms That Endeavors To Recognize UnderlyingDocument4 pagesA Neural Network Is A Series of Algorithms That Endeavors To Recognize UnderlyingSrikar tejNo ratings yet

- Act of ValourDocument5 pagesAct of ValourSrikar tejNo ratings yet

- Eng InsuranceDocument1 pageEng InsuranceSrikar tejNo ratings yet

- Strings: - A String Is A Sequence of Characters Treated As A Group - We Have Already Used Some String LiteralsDocument48 pagesStrings: - A String Is A Sequence of Characters Treated As A Group - We Have Already Used Some String LiteralsJNUNo ratings yet

- KUBOTA MU5501 4WD Tractor - T-1037-1562-2016Document9 pagesKUBOTA MU5501 4WD Tractor - T-1037-1562-2016Prashant PatilNo ratings yet

- 2012 PTQ q1Document132 pages2012 PTQ q1jainrakeshj4987No ratings yet

- Tacana Project (15687597)Document1 pageTacana Project (15687597)jesusNo ratings yet

- Business and Tech Mock Exam (8Document11 pagesBusiness and Tech Mock Exam (8Jack PayneNo ratings yet

- Certif Icate of Motor Insurance: MmencementDocument2 pagesCertif Icate of Motor Insurance: MmencementSarfraz ZahoorNo ratings yet

- Law On Other Business Transactions 20181Document365 pagesLaw On Other Business Transactions 20181Leonel King0% (1)

- Linear Algebra and Analytical Geometry: A B C Ab CDDocument3 pagesLinear Algebra and Analytical Geometry: A B C Ab CDTooba AkhtarNo ratings yet

- Being A Teacher: DR Dennis FrancisDocument14 pagesBeing A Teacher: DR Dennis FranciselsayidNo ratings yet

- ANU Issue 2Document64 pagesANU Issue 2Gideon GreigNo ratings yet

- DepEd Tayo Training Series Accomplishment Report Sapang Maragul Integrated School JHS DepartmentDocument6 pagesDepEd Tayo Training Series Accomplishment Report Sapang Maragul Integrated School JHS DepartmentTeng SevillaNo ratings yet

- How Do I Create An Import DC ApplicationDocument10 pagesHow Do I Create An Import DC ApplicationPeter CheungNo ratings yet

- Industrial Attachment ReportDocument82 pagesIndustrial Attachment ReportNiyibizi Promesse100% (8)

- The Champion Legal Ads: 03-30-23Document49 pagesThe Champion Legal Ads: 03-30-23Donna S. SeayNo ratings yet

- Intention To SubmitDocument12 pagesIntention To SubmitJoseph SalazarNo ratings yet

- Assessment of Radical Innovation and Significant Relationship of Metromile Car Insurance CompanyDocument10 pagesAssessment of Radical Innovation and Significant Relationship of Metromile Car Insurance CompanyBidisha BhoumickNo ratings yet

- Firelights PDFDocument2 pagesFirelights PDFEFG EFGNo ratings yet

- DDCS Expert User's Manual V1-已压缩Document137 pagesDDCS Expert User's Manual V1-已压缩andréNo ratings yet

- Sonic sdw45Document2 pagesSonic sdw45Alonso InostrozaNo ratings yet

- Chapter 2 1 Determination of Interest RatesDocument63 pagesChapter 2 1 Determination of Interest RatesLâm Bulls100% (1)

- Audprob 9Document2 pagesAudprob 9lovely abinalNo ratings yet

- Student Report Card ManagementDocument38 pagesStudent Report Card ManagementKannan Thangaraju41% (17)

- What is Strategic Human Resource ManagementDocument8 pagesWhat is Strategic Human Resource ManagementYashasvi ParsaiNo ratings yet

- Codex AlexandrinusDocument294 pagesCodex AlexandrinusHevel Cava100% (2)

- PK 7Document45 pagesPK 7Hernan MansillaNo ratings yet

- Emmanuel Oneka - CV-3Document3 pagesEmmanuel Oneka - CV-3Emmanuel OnekaNo ratings yet

- Polycab PVCDocument32 pagesPolycab PVCshilpidangiNo ratings yet

- Chapter OneDocument18 pagesChapter Oneحيدر محمدNo ratings yet

- HW3 Solutions 2017 SpringDocument4 pagesHW3 Solutions 2017 SpringAtaush Sabuj100% (1)

- Registered Unregistered Land EssayDocument3 pagesRegistered Unregistered Land Essayzamrank91No ratings yet