Professional Documents

Culture Documents

Mehala Machines India Limited

Uploaded by

Karthikeyan RK SwamyOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Mehala Machines India Limited

Uploaded by

Karthikeyan RK SwamyCopyright:

Available Formats

Press Release

Mehala Machines India Limited

February 10, 2023

Amount (₹

Facilities/Instruments Rating1 Rating Action

crore)

Long Term Bank CARE BB; Stable; ISSUER NOT Rating moved to ISSUER NOT

9.50

Facilities COOPERATING* COOPERATING category

Details of instruments/facilities in Annexure-1.

*Issuer did not cooperate; based on best available information.

Rationale and key rating drivers

Mehala Machines India Limited (MMIL) has not paid the surveillance fees for the rating exercise agreed to in its Rating Agreement.

In line with the extant SEBI guidelines, CARE Ratings Ltd.’s rating on Mehala Machines India Limited’s bank facilities will now be

denoted as CARE BB; Stable; ISSUER NOT COOPERATING*.

Users of this rating (including investors, lenders and the public at large) are hence requested to exercise caution

while using the above ratings

The rating assigned to the bank facilities of Mehala Machines India Limited (MMIL) continues to be constrained by moderate scale

of operations, moderate debt coverage indicators and presence in highly fragmented and competitive industry. However, rating

derives strengths from experienced promoters with established track record, comfortable capital structure and reputed clientele

base.

Analytical approach: Standalone

The following were the rating strengths and weaknesses of MMIL:

Key weaknesses

Moderate scale of operations

The scale of operations remained small albeit increased by 42% in FY22 to Rs. 121.04 crore from Rs.85.51 crore in FY21 due to

higher demand of used textile machineries. The company booked income of Rs. 70.80 crore and net profit of Rs. 3.95 crore in

8mFY23 (Prov.).

Moderate debt coverage indicators

The debt coverage indicators stood moderate with Total debt/GCA which improved to 7.69x as of March 31, 2022 from 9.53x as

of March 31, 2021 due to increase in accruals.

Highly fragmented and competitive industry

The trading industry is highly fragmented with large number of organized and unorganized players in India. There is high

competition within the industry due to low entry barriers on account of low capital investment required. On account of the same

competition within the players is very high which in turn leads to a fragmented market and moderate profitability margins.

Key strengths

Experienced promoters with established track record

MMIL was incorporated in 1996 by Mr. C. Subramaniam along with other directors. Mr. C. Subramaniam is a qualified graduate

and he is the Managing Director of the company who takes care of day to day operations. The company has experienced executive

team who has more than a decade of experience in the industry. The vast experience of the promoters in the industry the

company has enabled the company to have established relationship with suppliers and customers.

Comfortable capital structure

The capital structure continued to remain comfortable with overall gearing (Including LC acceptances) of 1.01x as on March 31,

2022 (PY: 0.88x).

Reputed clientele base

MMIL’s has established strong business relationship with various reputed clients namely Raymond Apparel Limited, Godrej

Industries Limited, Arvind Limited (CARE AA-; Stable / CARE A1+), Shahi Exports Limited, Best Corporation Private Limited (CARE

A; Stable / CARE A1) and others.

Liquidity: Stretched

Liquidity is stretched marked by moderate accruals to repay its term debt obligations of Rs. 1.35 crore and with moderate cash

balance of Rs. 1.55 crore as of March 31, 2022. The operating cycle of the company remained stretched albeit improved to 106

days in FY22 from 113 days in FY21. Being a trader, the company imports and stocks sufficient machineries in its stockyard to

meet demand from customers and holds spare parts for manufacturing of woollen ring frames. On account of this, the inventory

period stood at 85 days in FY21 (PY:106 days). MMIL imports machinery through letter of credit facility with sanctioned limit of

1

Complete definition of the ratings assigned are available at www.careedge.in and other CARE Ratings Ltd.’s publications

1 CARE Ratings Ltd.

Press Release

Rs. 25 crore. The entity had been sanctioned with cash credit limit of 9.50 crore. The average utilization of LC and CC stood 90%

and 99% respectively for last twelve months ended January 2023.

Applicable criteria

Policy in respect of Non-cooperation by issuer

Policy on default recognition

Financial Ratios – Non financial Sector

Liquidity Analysis of Non-financial sector entities

Rating Outlook and Credit Watch

Wholesale Trading

About the company

Mehala Machines India Limited (MMIL) was incorporated in 1996 by Mr. C. Subramaniam and other directors at Tamil Nadu. The

company is engaged in trading of “Industrial Garment Machinery”. MMIL purchases Industrial Garments Machinery from China,

Taiwan and Germany and sells the products to the customers located in India. The registered office of the company is located at

Tirupur, Tamil Nadu.

Brief Financials (₹ crore) March 31, 2021 (A) March 31, 2022 (A) 9MFY23 (P)

Total operating income 85.51 121.04 70.80

PBILDT 6.88 8.85 5.52

PAT 2.83 4.41 NA

Overall gearing (times) 0.51 0.57 NA

Interest coverage (times) 2.68 4.19 6.00

A: Audited; P: Provisional; NA: Not Available

Status of non-cooperation with previous CRA: Not Applicable

Any other information: Not Applicable

Rating history for the last three years: Please refer Annexure-2

Covenants of the rated instruments/facilities: Detailed explanation of the covenants of the rated instruments/facilities is

given in Annexure-3

Complexity level of the various instruments rated: Annexure-4

Lender details: Annexure-5

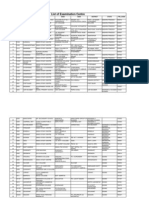

Annexure-1: Details of instruments/facilities

Date of

Maturity Size of Rating Assigned

Name of the Issuance Coupon

ISIN Date (DD- the Issue along with Rating

Instrument (DD-MM- Rate (%)

MM-YYYY) (₹ crore) Outlook

YYYY)

CARE BB; Stable;

Fund-based -

- - - 9.50 ISSUER NOT

LT-Cash Credit

COOPERATING*

*Issuer did not cooperate; based on best available information.

Annexure-2: Rating history for the last three years

Current Ratings Rating History

Date(s) Date(s) Date(s) Date(s)

Name of the

Sr. and and and and

Instrument/Bank Amount

No. Rating(s) Rating(s) Rating(s) Rating(s)

Facilities Type Outstanding Rating

assigned assigned assigned assigned

(₹ crore)

in 2022- in 2021- in 2020- in 2019-

2023 2022 2021 2020

CARE BB; 1)CARE 1)CARE 1)CARE

Fund-based - LT- Stable; ISSUER BB; Stable BB; Stable BB; Stable

1 LT 9.50 -

Cash Credit NOT (23-Dec- (26-Mar- (03-Mar-

COOPERATING* 21) 21) 20)

2 CARE Ratings Ltd.

Press Release

*Issuer did not cooperate; based on best available information.

*Long term/Short term.

Annexure-3: Detailed explanation of the covenants of the rated instruments/facilities: Not Applicable

Annexure-4: Complexity level of the various instruments rated

Sr. No. Name of the Instrument Complexity Level

1 Fund-based - LT-Cash Credit Simple

Annexure-5: Lender details

To view the lender wise details of bank facilities please click here

Note on the complexity levels of the rated instruments: CARE Ratings has classified instruments rated by it on the basis

of complexity. Investors/market intermediaries/regulators or others are welcome to write to care@careedge.in for any

clarifications.

3 CARE Ratings Ltd.

Press Release

Contact us

Media contact

Name: Mradul Mishra

Phone: +91-22-6754 3596

E-mail: mradul.mishra@careedge.in

Analyst contact

Name: Naveen S

Phone: 0422- 4332399

E-mail: naveen.kumar@careedge.in

Relationship contact

Name: Pradeep Kumar V

Phone: +91-98407 54521

E-mail: pradeep.kumar@careedge.in

About us:

Established in 1993, CARE Ratings is one of the leading credit rating agencies in India. Registered under the Securities and

Exchange Board of India, it has been acknowledged as an External Credit Assessment Institution by the RBI. With an equitable

position in the Indian capital market, CARE Ratings provides a wide array of credit rating services that help corporates raise capital

and enable investors to make informed decisions. With an established track record of rating companies over almost three decades,

CARE Ratings follows a robust and transparent rating process that leverages its domain and analytical expertise, backed by the

methodologies congruent with the international best practices. CARE Ratings has played a pivotal role in developing bank debt

and capital market instruments, including commercial papers, corporate bonds and debentures, and structured credit.

Disclaimer:

The ratings issued by CARE Ratings are opinions on the likelihood of timely payment of the obligations under the rated instrument and are not recommendations to

sanction, renew, disburse, or recall the concerned bank facilities or to buy, sell, or hold any security. These ratings do not convey suitability or price for the investor.

The agency does not constitute an audit on the rated entity. CARE Ratings has based its ratings/outlook based on information obtained from reliable and credible

sources. CARE Ratings does not, however, guarantee the accuracy, adequacy, or completeness of any information and is not responsible for any errors or omissions

and the results obtained from the use of such information. Most entities whose bank facilities/instruments are rated by CARE Ratings have paid a credit rating fee,

based on the amount and type of bank facilities/instruments. CARE Ratings or its subsidiaries/associates may also be involved with other commercial transactions with

the entity. In case of partnership/proprietary concerns, the rating/outlook assigned by CARE Ratings is, inter-alia, based on the capital deployed by the

partners/proprietors and the current financial strength of the firm. The ratings/outlook may change in case of withdrawal of capital, or the unsecured loans brought

in by the partners/proprietors in addition to the financial performance and other relevant factors. CARE Ratings is not responsible for any errors and states that it has

no financial liability whatsoever to the users of the ratings of CARE Ratings. The ratings of CARE Ratings do not factor in any rating-related trigger clauses as per the

terms of the facilities/instruments, which may involve acceleration of payments in case of rating downgrades. However, if any such clauses are introduced and

triggered, the ratings may see volatility and sharp downgrades.

For the detailed Rationale Report and subscription information,

please visit www.careedge.in

4 CARE Ratings Ltd.

You might also like

- Securitization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsFrom EverandSecuritization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsNo ratings yet

- Press Release: Details of Instruments/facilities in Annexure-1Document4 pagesPress Release: Details of Instruments/facilities in Annexure-1Aman DubeyNo ratings yet

- Pump DesignDocument4 pagesPump Designmarathasanatani6No ratings yet

- Coptech Wire IndustryDocument4 pagesCoptech Wire IndustryKarthi KarthiNo ratings yet

- Shree Kongu Velalar Educational TrustDocument3 pagesShree Kongu Velalar Educational TrustKarthikeyan RK SwamyNo ratings yet

- Shri Ram Autotech Private LimitedDocument3 pagesShri Ram Autotech Private LimitedAmanNo ratings yet

- Indotech Transformers LimitedDocument6 pagesIndotech Transformers LimitedMonika GNo ratings yet

- PR JyotiCNC 26apr23Document7 pagesPR JyotiCNC 26apr23Virag ShahNo ratings yet

- Shree Lakshmi Narayan Sugar Industries Private Limited-12-01-2020Document3 pagesShree Lakshmi Narayan Sugar Industries Private Limited-12-01-2020YUVRAJ YADAVNo ratings yet

- Venkateshwara Power Project LimitedDocument3 pagesVenkateshwara Power Project Limited04 Sourabh BaraleNo ratings yet

- 3B Binani GlassfibreDocument2 pages3B Binani GlassfibreData CentrumNo ratings yet

- Press Release 3B Fibreglass Norway AS: Policy On Withdrawal of Ratings Policy On Default RecognitionDocument3 pagesPress Release 3B Fibreglass Norway AS: Policy On Withdrawal of Ratings Policy On Default RecognitionData CentrumNo ratings yet

- Kogta Financial India LimitedDocument5 pagesKogta Financial India LimitedofficeloginpurposeNo ratings yet

- Micromax Biofuels PVT Ltd.Document6 pagesMicromax Biofuels PVT Ltd.Kamlakar AvhadNo ratings yet

- Details of Facilities in Annexure - 1: Rationale-Press ReleaseDocument3 pagesDetails of Facilities in Annexure - 1: Rationale-Press ReleaseTathagata DasNo ratings yet

- St. Johns Rajakumar Education & Research TrustDocument3 pagesSt. Johns Rajakumar Education & Research TrustSrikar tejNo ratings yet

- Continental Carbon India LimitedDocument4 pagesContinental Carbon India LimitedKamaldeep MaanNo ratings yet

- Press Release RACL Geartech LTDDocument4 pagesPress Release RACL Geartech LTDSourav DuttaNo ratings yet

- Press Release India Belt Company: Details of Instruments/facilities in Annexure-1Document4 pagesPress Release India Belt Company: Details of Instruments/facilities in Annexure-1ANUBHAVCFANo ratings yet

- Press Release Adani Agri Logistics (Harda) Limited: Details of Facilities in Annexure-1Document3 pagesPress Release Adani Agri Logistics (Harda) Limited: Details of Facilities in Annexure-1surprise MFNo ratings yet

- West Coast Paper Mills LTDDocument6 pagesWest Coast Paper Mills LTDRavi KNo ratings yet

- Credit Perspective GetRationaleFile 103495Document6 pagesCredit Perspective GetRationaleFile 103495anil1820No ratings yet

- Bharti Enterprises LimitedDocument4 pagesBharti Enterprises LimitedjagadeeshNo ratings yet

- Customer Private LimitedDocument4 pagesCustomer Private LimitedData CentrumNo ratings yet

- Terrier Security Services (India) Private LimitedDocument7 pagesTerrier Security Services (India) Private Limitedgcgary87No ratings yet

- Super Spinning Mills Limited-09-08-2020Document4 pagesSuper Spinning Mills Limited-09-08-2020Positive ThinkerNo ratings yet

- Credit Rating - Jun 2021 - Atmastco - LimitedDocument4 pagesCredit Rating - Jun 2021 - Atmastco - LimitedSaurav GanguliNo ratings yet

- ACCUFOX-ENTERPRISES - PC Jewellers Franchise - 1 StoreDocument5 pagesACCUFOX-ENTERPRISES - PC Jewellers Franchise - 1 StoreJai PhookanNo ratings yet

- JP Infra Mumbai 23dec2021Document6 pagesJP Infra Mumbai 23dec2021Rishabh MehtaNo ratings yet

- Hitkari Gram Udyog SanghDocument3 pagesHitkari Gram Udyog SanghAryan LakraNo ratings yet

- CityLife Retail Private LimitedDocument3 pagesCityLife Retail Private LimitedArnab MitraNo ratings yet

- Tehri Pulp and Paper 5feb2021Document6 pagesTehri Pulp and Paper 5feb2021Ck WilliumNo ratings yet

- Mega Steel IndustriesDocument4 pagesMega Steel IndustrieshseckalpeshNo ratings yet

- Derewala Industries 6mar2020Document6 pagesDerewala Industries 6mar2020Mukul SoniNo ratings yet

- Stove Kraft Limited-3Document5 pagesStove Kraft Limited-3venkyniyerNo ratings yet

- Document Service V2Document6 pagesDocument Service V2UTSAV DUBEYNo ratings yet

- Sun Home Appliances Private - R - 25082020Document7 pagesSun Home Appliances Private - R - 25082020DarshanNo ratings yet

- Kellton Tech Solutions R 28092018Document7 pagesKellton Tech Solutions R 28092018Suresh Kumar RaiNo ratings yet

- Tripurashwari Agro Product Pvt. Ltd.-07-21-2020Document4 pagesTripurashwari Agro Product Pvt. Ltd.-07-21-2020Manish DadlaniNo ratings yet

- Facility Amount (Tenure Rating BWR BB+ (Pronounced As BWR Double B Plus)Document4 pagesFacility Amount (Tenure Rating BWR BB+ (Pronounced As BWR Double B Plus)ShamNo ratings yet

- Rajratan Global Wire LimitedDocument6 pagesRajratan Global Wire Limitedpraveen kumarNo ratings yet

- Laser Fibers Private Limited: Summary of Rated Instruments Instrument Rated Amount (In Rs. Crore) Rating ActionDocument6 pagesLaser Fibers Private Limited: Summary of Rated Instruments Instrument Rated Amount (In Rs. Crore) Rating ActionBhavin SagarNo ratings yet

- Entertainment-City-Jan 2019 BRICKWORKDocument6 pagesEntertainment-City-Jan 2019 BRICKWORKPuneet367No ratings yet

- Mahima Real Estate 10apr2019Document5 pagesMahima Real Estate 10apr2019Reena GahlotNo ratings yet

- Hinduja Healthcare 29dec2020Document8 pagesHinduja Healthcare 29dec2020Bijay MehtaNo ratings yet

- Press Release Deccan Industries: Positive FactorsDocument4 pagesPress Release Deccan Industries: Positive FactorsHARI HARANNo ratings yet

- Press Release: Raichur Power Corporation LimitedDocument3 pagesPress Release: Raichur Power Corporation LimitedPrasanna Kumar KNo ratings yet

- Prithvi PumpsDocument3 pagesPrithvi PumpsdishandshahNo ratings yet

- Shri Balaji Rollings Private LimDocument4 pagesShri Balaji Rollings Private LimData CentrumNo ratings yet

- Sree Akkamamba Textiles - R - 13032020Document7 pagesSree Akkamamba Textiles - R - 13032020saikiran reddyNo ratings yet

- The Government Tele Communication R 03102017Document7 pagesThe Government Tele Communication R 03102017SandeeploguNo ratings yet

- CRD Foods 8apr2020Document6 pagesCRD Foods 8apr2020samudragupta05No ratings yet

- Rating Rationale: Facility Amount ( CR) Tenure RatingDocument4 pagesRating Rationale: Facility Amount ( CR) Tenure RatingNalla ThambiNo ratings yet

- DRL1 CRDocument3 pagesDRL1 CRpankaj_xaviersNo ratings yet

- Gujarat Guardian Limited-R-30032018Document6 pagesGujarat Guardian Limited-R-30032018SuhasNo ratings yet

- Suprajit Engineering LimitedDocument6 pagesSuprajit Engineering LimitedHarinath ReddyNo ratings yet

- Asquare Food Beverages 27dec2018Document6 pagesAsquare Food Beverages 27dec2018Tanmay GuptaNo ratings yet

- Ujaas Energy - Crisil BBB+Document4 pagesUjaas Energy - Crisil BBB+Sidhesh KanadeNo ratings yet

- PR Sheetal Coolproducts 4jul23Document5 pagesPR Sheetal Coolproducts 4jul23jay.futuretecNo ratings yet

- Pan Healthcare Private Limited (PHCPL) October 12, 2020Document5 pagesPan Healthcare Private Limited (PHCPL) October 12, 2020Sachin DhorajiyaNo ratings yet

- Former Judges Madras High CourtDocument11 pagesFormer Judges Madras High CourtKarthikeyan RK SwamyNo ratings yet

- MAK Controls & Systems Private LimitedDocument4 pagesMAK Controls & Systems Private LimitedKarthikeyan RK SwamyNo ratings yet

- Details of Sugar Industries in Tamil NaduDocument3 pagesDetails of Sugar Industries in Tamil NadugouthamNo ratings yet

- Division of Taxpayers - CentreDocument1,451 pagesDivision of Taxpayers - Centresundar111167% (3)

- Best Finance Corporation Limited: Facilities/Instruments Amount (Rs. Crore) Rating Rating ActionDocument5 pagesBest Finance Corporation Limited: Facilities/Instruments Amount (Rs. Crore) Rating Rating ActionKarthikeyan RK SwamyNo ratings yet

- Christy Apparels-RA-10-03-2023Document10 pagesChristy Apparels-RA-10-03-2023Karthikeyan RK SwamyNo ratings yet

- Roots Industries India Limited: Facilities/Instruments Amount (Rs. Crore) Rating Rating ActionDocument4 pagesRoots Industries India Limited: Facilities/Instruments Amount (Rs. Crore) Rating Rating ActionKarthikeyan RK SwamyNo ratings yet

- Electricity 02 00009 v2Document15 pagesElectricity 02 00009 v2Karthikeyan RK SwamyNo ratings yet

- Sakthi Finance: (Stock Code: 511066)Document144 pagesSakthi Finance: (Stock Code: 511066)Karthikeyan RK SwamyNo ratings yet

- Raghuram Rajan TOI ArticleDocument2 pagesRaghuram Rajan TOI ArticleKarthikeyan RK SwamyNo ratings yet

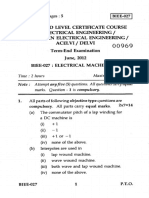

- B.Tech. Electrical Engineering (Btelvi) Term-End Examination June, 2013 Biee-018 High Voltage EngineeringDocument2 pagesB.Tech. Electrical Engineering (Btelvi) Term-End Examination June, 2013 Biee-018 High Voltage EngineeringKarthikeyan RK SwamyNo ratings yet

- MAK Controls & Systems Private LimitedDocument4 pagesMAK Controls & Systems Private LimitedKarthikeyan RK SwamyNo ratings yet

- Sakthi Finance Limited: March 30, 2016Document276 pagesSakthi Finance Limited: March 30, 2016Karthikeyan RK SwamyNo ratings yet

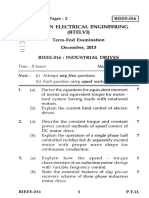

- Industrial Drives BIEEE-016Document2 pagesIndustrial Drives BIEEE-016Dawit Shimeles TesfayeNo ratings yet

- Time: 2 Hours Maximum Marks: 70 Note: Attempt Any Five (5) Questions. All Questions Carry Equal Marks. Question - 1 Is CompulsoryDocument5 pagesTime: 2 Hours Maximum Marks: 70 Note: Attempt Any Five (5) Questions. All Questions Carry Equal Marks. Question - 1 Is CompulsoryKarthikeyan RK SwamyNo ratings yet

- AC Induction Motor FundamentalsDocument24 pagesAC Induction Motor Fundamentalsrohtahir100% (3)

- Application Form For Re-Evaluation of Answer ScriptsDocument3 pagesApplication Form For Re-Evaluation of Answer ScriptsarijitnirmalNo ratings yet

- Basics of Electricity: Siemens STEP 2000 CourseDocument44 pagesBasics of Electricity: Siemens STEP 2000 CourseEveraldo SantanaNo ratings yet

- Training Hand-Out-1Document8 pagesTraining Hand-Out-1Karthikeyan RK SwamyNo ratings yet

- B.Tech. in Electrical Engineering (Btelvi) : BIEEE-016 No. of Printed Pages: 2Document2 pagesB.Tech. in Electrical Engineering (Btelvi) : BIEEE-016 No. of Printed Pages: 2Karthikeyan RK SwamyNo ratings yet

- Important: Two Demand Drafts: All The Existing Registered Students (Document3 pagesImportant: Two Demand Drafts: All The Existing Registered Students (Karthikeyan RK SwamyNo ratings yet

- Motor Load and Efficiency PDFDocument16 pagesMotor Load and Efficiency PDFwfjerrNo ratings yet

- State Income PDFDocument15 pagesState Income PDFDhivya NarayananNo ratings yet

- Xi Jinping Needs A Trade Deal Just As Much As Donald Trump DoesDocument4 pagesXi Jinping Needs A Trade Deal Just As Much As Donald Trump DoesKarthikeyan RK SwamyNo ratings yet

- DC Fundamentals Handbook Electrical Science Volume 3 of 4Document119 pagesDC Fundamentals Handbook Electrical Science Volume 3 of 4Sk RajNo ratings yet

- Examination Centre ListDocument54 pagesExamination Centre Listrkthbd58450% (3)

- Which Post-Pandemic Government?: Raghuram G. RajanDocument4 pagesWhich Post-Pandemic Government?: Raghuram G. RajanKarthikeyan RK SwamyNo ratings yet

- Karthikeyan K: Job ObjectiveDocument3 pagesKarthikeyan K: Job ObjectiveKarthikeyan RK SwamyNo ratings yet

- Wells Technical Institute (WTI), A School Owned by Tristana Wells, Provides Training To Individuals Who Pay Tuition Directly To The School. Part 3Document2 pagesWells Technical Institute (WTI), A School Owned by Tristana Wells, Provides Training To Individuals Who Pay Tuition Directly To The School. Part 3Fanny SosrosandjojoNo ratings yet

- Module 2 - Major Specialized IndustriesDocument10 pagesModule 2 - Major Specialized IndustriesKalven Perry AgustinNo ratings yet

- Topic No. 2 - Statement of Cash Flows PDFDocument3 pagesTopic No. 2 - Statement of Cash Flows PDFSARAH ANDREA TORRESNo ratings yet

- Lectures 5 & 7 - Easy Exercises - Attempt ReviewDocument17 pagesLectures 5 & 7 - Easy Exercises - Attempt ReviewHeidi DaoNo ratings yet

- A PPT On Money MarketDocument25 pagesA PPT On Money MarketBasanta100% (27)

- Bali Company Worksheet For The Year Ended December 31, 2020: InstructionsDocument4 pagesBali Company Worksheet For The Year Ended December 31, 2020: Instructionsshera haniNo ratings yet

- Tax Calculator by Tax GurujiDocument4 pagesTax Calculator by Tax Gurujicdem3782No ratings yet

- Application To Purchase FX FormDocument1 pageApplication To Purchase FX FormAnne VallaritNo ratings yet

- Cambridge International AS & A Level: ACCOUNTING 9706/22Document16 pagesCambridge International AS & A Level: ACCOUNTING 9706/22Aimen AhmedNo ratings yet

- Booking 1059985616Document2 pagesBooking 1059985616Deni SetiawanNo ratings yet

- 07 Activity 2Document3 pages07 Activity 2marcusNo ratings yet

- Controller and Treasurer DifferencesDocument1 pageController and Treasurer DifferencesRechelle PerezNo ratings yet

- Raj Packaging Industries: PrintDocument2 pagesRaj Packaging Industries: PrintRAKESH VARMANo ratings yet

- FCFWACCReviewproblemspart 1 SolutionDocument2 pagesFCFWACCReviewproblemspart 1 SolutionKevser BozoğluNo ratings yet

- Garcia, Almira C. 1. Prepare Journal Entries To Record The Foregoing Transactions For Branch Books Home OfficeDocument4 pagesGarcia, Almira C. 1. Prepare Journal Entries To Record The Foregoing Transactions For Branch Books Home Officealmira garciaNo ratings yet

- At Reviewer PT 3Document22 pagesAt Reviewer PT 3lender kent alicanteNo ratings yet

- Schedule III Financial StatementsDocument21 pagesSchedule III Financial StatementsKunal DixitNo ratings yet

- Payments, Processors, & Fintech: Payments Is Taking A BiteDocument359 pagesPayments, Processors, & Fintech: Payments Is Taking A BiteShuchita Agarwal100% (1)

- Charger Bill 20wattDocument4 pagesCharger Bill 20wattATIK ZAFARNo ratings yet

- ISJ018Document82 pagesISJ0182imediaNo ratings yet

- 02 - Abdul Qodir - 3H AKM - Current Liability and Bank Payable - Case 9Document4 pages02 - Abdul Qodir - 3H AKM - Current Liability and Bank Payable - Case 9abdul qodirNo ratings yet

- Practice Questions - Cash FlowDocument13 pagesPractice Questions - Cash FlowMariamNo ratings yet

- VP Institutional Asset Management in Washington DC Resume Lisa DrazinDocument3 pagesVP Institutional Asset Management in Washington DC Resume Lisa DrazinLisaDrazinNo ratings yet

- Startup Valuation ExplorerDocument22 pagesStartup Valuation Explorershandhin.malviya07No ratings yet

- Introduction AlifDocument19 pagesIntroduction AlifNiaz AhmedNo ratings yet

- Managing Risks in Financial Inclusion and Agency BankingDocument30 pagesManaging Risks in Financial Inclusion and Agency BankingEmmanuel Moore AboloNo ratings yet

- Prudential Bank v. Don A. Alviar, Et AlDocument14 pagesPrudential Bank v. Don A. Alviar, Et AlMarielNo ratings yet

- Chase Quickpay® With Zelle Service Agreement and Privacy NoticeDocument18 pagesChase Quickpay® With Zelle Service Agreement and Privacy NoticeRELOJERIANo ratings yet

- ICICI Bank ACQUISITION WITH BANK OF RAJASTHANDocument6 pagesICICI Bank ACQUISITION WITH BANK OF RAJASTHANPrayagraj PradhanNo ratings yet

- Analysis of Customer Satisfaction in Banking Sector of Jammu Kashmir BankDocument88 pagesAnalysis of Customer Satisfaction in Banking Sector of Jammu Kashmir BankOwais ShiekhNo ratings yet