Professional Documents

Culture Documents

Bharti Enterprises Limited

Uploaded by

jagadeeshOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Bharti Enterprises Limited

Uploaded by

jagadeeshCopyright:

Available Formats

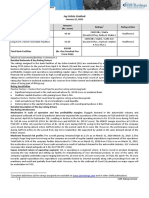

Press Release

Bharti Enterprises Limited

September 18, 2023

Facilities/Instruments Amount (₹ crore) Rating1 Rating Action

Commercial paper 3,000.00 CARE A1+ Reaffirmed

Details of instruments/facilities in Annexure-1.

Rationale and key rating drivers

The reaffirmation of the rating assigned to the commercial paper (CP) programme of Bharti Enterprises Limited (BEL) continues

to factor the robust financial flexibility driven by the strong parentage and established track record of the Bharti group2. BEL has

major investments in Airtel Payments Bank Limited (APBL), ICICI Lombard General Insurance Company Limited (ILGICL), Bharti

Realty Limited (BRL), Field Fresh Foods Private Limited (FFFPL), Bharti Overseas Private Limited and Bharti Life Ventures Private

Limited (BLVPL).

The rating favourably factors in the significant market value of the investments of the parent, viz, Bharti Enterprises (Holdings)

Pvt Ltd’s (BEHPL’s) significant holding in the listed equity shares of Bharti Airtel Limited (BAL) through Bharti Telecom Ltd (BTL)

and the integrated nature of the treasury function among the holding companies (Holdcos) of the group, viz, BEHPL, BTL, and

BEL. Furthermore, the promoter shareholding in underlying investments in the Bharti group is entirely unencumbered. The credit

profile of BEL is also strengthened by having access to equity stake in ILGICL post-merger of Bharti General Ventures Private

Limited (BGVPL) with BEL thereby rendering financial flexibility. The rating continues to draw comfort from the adequate market

value of investments to debt cover for the three Holdcos and CARE Ratings expects the cover to remain comfortable going forward

as well.

The above rating strengths, however, are tempered by the limited revenue avenues for BEL and exposure to market-related

systematic risks.

Rating Sensitivities

Positive factors – Factors that could lead to positive rating action/upgrade

Not applicable

Negative factors – Factors that could lead to negative rating action/downgrade:

• Material deterioration in the credit profile of BEHPL.

• Significant decline in the market capitalisation of BAL leading to weakened market value to debt coverage on a sustained

basis

Analytical approach

Standalone. Given the importance of BEL for the Bharti group, CARE Ratings has evaluated the credit profile of BEL factoring in

the managerial and financial support BEL receives from its parent, BEHPL. Given the common treasury function for the Bharti

group, market value to debt cover has been analysed on a combined basis for the three Holdcos viz. BEL, BTL and BEHPL.

Outlook: Not applicable

Detailed description of the key rating drivers:

Key strengths

Strong parentage: BEL is one of the holding companies of the Bharti group. The group is one of the leading conglomerates in

India, with diversified interests in telecom, insurance and payment solutions, real estate, and agri-products.

Strategic role, thus impending need-based support from the group: BEL, BEHPL, and BTL are the three major Holdcos

of the Bharti group for the group’s investments. The significance of these Holdcos for the group is reflected by the underlying

business held by them. BEL’s major investments are into payment bank solutions, real estate (primarily commercial), insurance,

and the processed food sector. CARE Ratings believes that BEHPL will continue to exercise management control over BEL and will

continue to provide operational and need-based financial support to BEL.

1

Complete definition of the ratings assigned are available at www.careedge.in and other CARE Ratings Ltd.’s publications

2

Bharti Group refers to Bharti Enterprise Limited, Bharti Enterprise Holding Private Limited and Bharti Telecom Limited

1 CARE Ratings Ltd.

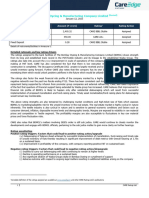

Press Release

Strong financial flexibility: The financial flexibility of BEL is derived from the strong reputation and resourcefulness of the

promoter family, the significant market value of BEHPL’s indirect stake in BAL, and the integrated finance function of the Bharti

group with demonstrated ability of fundraising in the past. The market value of BEHPL’s holding (50.56%) in BTL is significant,

derived from BTL’s stake in BAL. BTL is the single-largest shareholder in BAL and holds a 38.50% stake (as on June 30, 2023).

Strong market value of the group’s investments ensures that the credit profile of BEL remains comfortable. The group’s financial

flexibility is underpinned by the sound credit profile of the flagship business viz. BAL.

Comfortable market value of investments to debt cover: The Bharti group has historically been conservative on leverage

and has a track record of maintaining modest market value to debt cover on their investments. Though, leverage among the

Holdcos increased during FY23 due to the acquisition of 3.3% stake in BAL from Singtel Telecommunications Limited, the market

value to debt cover remains comfortable. CARE Ratings expects that the existing level of cover will continue to be maintained on

a sustained basis considering the overall debt of the Holdcos.

Key weaknesses

Exposure to inherent market risk and limited revenue sources: BEL’s management and support services income is

currently low, and hence, it depends on the monetisation of investments or dividend income from group companies. The market

value of investments of the Holdcos of the group is exposed to the volatility associated with market-linked fluctuations. Any

increase in market-related risks, leading to a sharp fall in the share prices of its investments, will be a key monitorable.

Liquidity: Strong

The liquidity profile of BEL is aided by the strong financial flexibility rendered to the company being part of the Bharti group.

Given its role as a Holdco, BEL will be dependent on the monetisation of investments, refinancing, or need-based support, which

underpins its liquidity profile. The continued financial flexibility for repayment of the debt obligation, going forward, will be a

rating monitorable.

Assumptions/Covenants: Not applicable

Environment, social, and governance (ESG) risks: Not applicable

Applicable criteria

Policy on default recognition

Factoring Linkages Parent Sub JV Group

Financial Ratios – Non financial Sector

Investment Holding Companies

Liquidity Analysis of Non-financial sector entities

Rating Outlook and Credit Watch

Short Term Instruments

Policy on Withdrawal of Ratings

About the company and industry

Industry classification

Macro-Economic Indicator Sector Industry Basic Industry

Financial Services Financial Services Finance Holding Company

BEL was incorporated on November 21, 2005, as Bharti Ventures Ltd. It is 100% held by the ultimate holding company of the

Bharti group, ie, BEHPL. BEHPL is held by the Mittal family. The company is one of the prominent holdcos of the Bharti group,

with investments across diverse businesses, viz, payment solutions, real estate, insurance, and processed food.

Brief Financials (₹ crore) March 31, 2022 (A) March 31, 2023 (A) Q1FY24 (UA)

Total operating income 12.39 19.48 3.75

PBILDT -10.06 -7.13 -3.57

PAT -138.26 -191.71 -48.46

Overall gearing (times) NM 4.76 NA

Interest coverage (times) NM NM NM

A: Audited; UA: Un-audited. Note: The above results are the latest financial results available.

2 CARE Ratings Ltd.

Press Release

NA: Not available, NM: Not meaningful

Status of non-cooperation with previous CRA: Not applicable

Any other information: Not applicable

Rating history for the last three years: Please refer Annexure-2

Covenants of the rated instruments/facilities: Detailed explanation of the covenants of the rated instruments/facilities is

given in Annexure-3

Complexity level of the various instruments rated: Annexure-4

Lender details: Annexure-5

Annexure-1: Details of instruments/facilities

Rating

Date of

Maturity Size of the Assigned

Name of the Issuance

ISIN Coupon (%) Date (DD- Issue along with

Instrument (DD-MM-

MM-YYYY) (₹ crore) Rating

YYYY)

Outlook

INE396J14307 07-09-2023 NA 06-03-2024 465

INE396J14216 06-12-2022 NA 05-12-2023 350

Commercial paper-

INE396J14240 28-02-2023 NA 27-02-2024 400

Commercial paper CARE A1+

INE396J14281 28-07-2023 NA 22-12-2023 500

(Standalone)

INE396J14299 28-07-2023 NA 27-10-2023 475

Unutilized - - 0-364 days 810

NA: Not applicable

Annexure-2: Rating history for the last three years

Current Ratings Rating History

Date(s) Date(s) Date(s) Date(s)

Name of the

and and and and

Sr. No. Instrument/Bank Amount

Rating(s) Rating(s) Rating(s) Rating(s)

Facilities Type Outstanding Rating

assigned assigned assigned assigned

(₹ crore)

in 2023- in 2022- in 2021- in 2020-

2024 2023 2022 2021

1)CARE

A1+

(21-Mar-

22)

1)CARE 2)CARE

Commercial paper-

CARE A1+ A1+

1 Commercial paper ST* 3000.00 - -

A1+ (20-Sep- (08-Dec-

(Standalone)

22) 21)

3)CARE

A1+

(09-Jul-

21)

*Short term.

3 CARE Ratings Ltd.

Press Release

Annexure-3: Detailed explanation of the covenants of the rated instruments/facilities: Not applicable

Annexure-4: Complexity level of the various instruments rated

Sr. No. Name of the Instrument Complexity Level

1 Commercial paper-Commercial paper (Standalone) Simple

Annexure-5: Lender details

Not applicable

Note on the complexity levels of the rated instruments: CARE Ratings has classified instruments rated by it on the basis

of complexity. Investors/market intermediaries/regulators or others are welcome to write to care@careedge.in for any

clarifications.

Contact us

Media Contact Analytical Contacts

Mradul Mishra Name: Rajashree Murkute

Director Senior Director

CARE Ratings Limited CARE Ratings Limited

Phone: +91-22-6754 3596 Phone: +91-22-68374474

E-mail: mradul.mishra@careedge.in E-mail: Rajashree.murkute@careedge.in

Relationship Contact Name: Maulesh Desai

Director

Pankaj Sharma CARE Ratings Limited

Director Phone: +91-79-40265605

CARE Ratings Limited E-mail: maulesh.desai@careedge.in

Phone: +91-120-445 2007

E-mail: pankaj.sharma@careedge.in Prasanna Krishnan Lakshmi Kumar

Associate Director

CARE Ratings Limited

Phone: +91-120-4452014

E-mail: prasanna.krishnan@careedge.in

About us:

Established in 1993, CARE Ratings is one of the leading credit rating agencies in India. Registered under the Securities and

Exchange Board of India, it has been acknowledged as an External Credit Assessment Institution by the RBI. With an equitable

position in the Indian capital market, CARE Ratings provides a wide array of credit rating services that help corporates raise capital

and enable investors to make informed decisions. With an established track record of rating companies over almost three decades,

CARE Ratings follows a robust and transparent rating process that leverages its domain and analytical expertise, backed by the

methodologies congruent with the international best practices. CARE Ratings has played a pivotal role in developing bank debt

and capital market instruments, including commercial papers, corporate bonds and debentures, and structured credit.

Disclaimer:

The ratings issued by CARE Ratings are opinions on the likelihood of timely payment of the obligations under the rated instrument and are not recommendations to

sanction, renew, disburse, or recall the concerned bank facilities or to buy, sell, or hold any security. These ratings do not convey suitability or price for the investor.

The agency does not constitute an audit on the rated entity. CARE Ratings has based its ratings/outlook based on information obtained from reliable and credible

sources. CARE Ratings does not, however, guarantee the accuracy, adequacy, or completeness of any information and is not responsible for any errors or omissions

and the results obtained from the use of such information. Most entities whose bank facilities/instruments are rated by CARE Ratings have paid a credit rating fee,

based on the amount and type of bank facilities/instruments. CARE Ratings or its subsidiaries/associates may also be involved with other commercial transactions with

the entity. In case of partnership/proprietary concerns, the rating/outlook assigned by CARE Ratings is, inter-alia, based on the capital deployed by the

partners/proprietors and the current financial strength of the firm. The ratings/outlook may change in case of withdrawal of capital, or the unsecured loans brought

in by the partners/proprietors in addition to the financial performance and other relevant factors. CARE Ratings is not responsible for any errors and states that it has

no financial liability whatsoever to the users of the ratings of CARE Ratings. The ratings of CARE Ratings do not factor in any rating-related trigger clauses as per the

terms of the facilities/instruments, which may involve acceleration of payments in case of rating downgrades. However, if any such clauses are introduced and

triggered, the ratings may see volatility and sharp downgrades.

For the detailed Rationale Report and subscription information, please visit www.careedge.in

4 CARE Ratings Ltd.

You might also like

- Coptech Wire IndustryDocument4 pagesCoptech Wire IndustryKarthi KarthiNo ratings yet

- Mehala Machines India LimitedDocument4 pagesMehala Machines India LimitedKarthikeyan RK SwamyNo ratings yet

- 3B Binani GlassfibreDocument2 pages3B Binani GlassfibreData CentrumNo ratings yet

- Future Corporate Resources - R - 05052020Document7 pagesFuture Corporate Resources - R - 05052020ChristianStefanNo ratings yet

- Press Release Adani Agri Logistics (Harda) Limited: Details of Facilities in Annexure-1Document3 pagesPress Release Adani Agri Logistics (Harda) Limited: Details of Facilities in Annexure-1surprise MFNo ratings yet

- Press Release RACL Geartech LTDDocument4 pagesPress Release RACL Geartech LTDSourav DuttaNo ratings yet

- Press Release: Details of Instruments/facilities in Annexure-1Document4 pagesPress Release: Details of Instruments/facilities in Annexure-1Aman DubeyNo ratings yet

- Press Release 3B Fibreglass SPRL: Facilities Amount (Rs. Crore) Rating Rating ActionDocument4 pagesPress Release 3B Fibreglass SPRL: Facilities Amount (Rs. Crore) Rating Rating ActionData CentrumNo ratings yet

- Press Release 3B Fibreglass Norway AS: Policy On Withdrawal of Ratings Policy On Default RecognitionDocument3 pagesPress Release 3B Fibreglass Norway AS: Policy On Withdrawal of Ratings Policy On Default RecognitionData CentrumNo ratings yet

- Bharat Electronics Limited: Summary of Rating ActionDocument7 pagesBharat Electronics Limited: Summary of Rating ActionrohanNo ratings yet

- Pan Healthcare Private Limited (PHCPL) October 12, 2020Document5 pagesPan Healthcare Private Limited (PHCPL) October 12, 2020Sachin DhorajiyaNo ratings yet

- Customer Private LimitedDocument4 pagesCustomer Private LimitedData CentrumNo ratings yet

- Credit Rating - Jun 2021 - Atmastco - LimitedDocument4 pagesCredit Rating - Jun 2021 - Atmastco - LimitedSaurav GanguliNo ratings yet

- Shree Kongu Velalar Educational TrustDocument3 pagesShree Kongu Velalar Educational TrustKarthikeyan RK SwamyNo ratings yet

- Servotech Power Systems Limited-12-21-2018Document5 pagesServotech Power Systems Limited-12-21-2018Sarthak SharmaNo ratings yet

- Tripurashwari Agro Product Pvt. Ltd.-07-21-2020Document4 pagesTripurashwari Agro Product Pvt. Ltd.-07-21-2020Manish DadlaniNo ratings yet

- PR JyotiCNC 26apr23Document7 pagesPR JyotiCNC 26apr23Virag ShahNo ratings yet

- Primatel Fibcom LimitedDocument3 pagesPrimatel Fibcom LimitedHargovind SachdevNo ratings yet

- Super Spinning Mills Limited-09-08-2020Document4 pagesSuper Spinning Mills Limited-09-08-2020Positive ThinkerNo ratings yet

- Shree Lakshmi Narayan Sugar Industries Private Limited-12-01-2020Document3 pagesShree Lakshmi Narayan Sugar Industries Private Limited-12-01-2020YUVRAJ YADAVNo ratings yet

- Bata India Limited: Summary of Rating ActionDocument6 pagesBata India Limited: Summary of Rating ActionDhrubajyoti DattaNo ratings yet

- Sun Home Appliances Private - R - 25082020Document7 pagesSun Home Appliances Private - R - 25082020DarshanNo ratings yet

- Details of Facilities in Annexure - 1: Rationale-Press ReleaseDocument3 pagesDetails of Facilities in Annexure - 1: Rationale-Press ReleaseTathagata DasNo ratings yet

- Hitkari Gram Udyog SanghDocument3 pagesHitkari Gram Udyog SanghAryan LakraNo ratings yet

- Santkrupa Milk and Milk Products-05!27!2020Document4 pagesSantkrupa Milk and Milk Products-05!27!2020Sanket PawarNo ratings yet

- Tata Advanced Materials-R-28062019Document7 pagesTata Advanced Materials-R-28062019shoaib merchantNo ratings yet

- Girnar Software Pvt. LTDDocument7 pagesGirnar Software Pvt. LTDnabh.21bms0336No ratings yet

- Press Release Mehul Construction Company Private Limited: Details of Instruments/facilities in Annexure-1Document5 pagesPress Release Mehul Construction Company Private Limited: Details of Instruments/facilities in Annexure-1tejasNo ratings yet

- Jay Ushin Limited: Rationale-Press ReleaseDocument4 pagesJay Ushin Limited: Rationale-Press Releaseravi.youNo ratings yet

- IREDADocument8 pagesIREDAGorilla GondaNo ratings yet

- Press Release RACL Geartech LTDDocument4 pagesPress Release RACL Geartech LTDSourav DuttaNo ratings yet

- Kogta Financial India LimitedDocument5 pagesKogta Financial India LimitedofficeloginpurposeNo ratings yet

- Press Release Amkette Analytics Limited: Details of Instruments/facilities in Annexure-1Document5 pagesPress Release Amkette Analytics Limited: Details of Instruments/facilities in Annexure-1Data CentrumNo ratings yet

- Shri Balaji Rollings Private LimDocument4 pagesShri Balaji Rollings Private LimData CentrumNo ratings yet

- Press Release India Belt Company: Details of Instruments/facilities in Annexure-1Document4 pagesPress Release India Belt Company: Details of Instruments/facilities in Annexure-1ANUBHAVCFANo ratings yet

- Bharti AXA Life Insurance Company LimitedDocument8 pagesBharti AXA Life Insurance Company LimitedJinal SanghviNo ratings yet

- Mega Steel IndustriesDocument4 pagesMega Steel IndustrieshseckalpeshNo ratings yet

- Acknit Industries Limited: Summary of Rating ActionDocument7 pagesAcknit Industries Limited: Summary of Rating ActionprasanthNo ratings yet

- Prithvi PumpsDocument3 pagesPrithvi PumpsdishandshahNo ratings yet

- Sree Akkamamba Textiles - R - 13032020Document7 pagesSree Akkamamba Textiles - R - 13032020saikiran reddyNo ratings yet

- Indotech Transformers LimitedDocument6 pagesIndotech Transformers LimitedMonika GNo ratings yet

- Continental Carbon India LimitedDocument4 pagesContinental Carbon India LimitedKamaldeep MaanNo ratings yet

- 3F Oil Palm Agrotech Private Limited-02-27-2020 PDFDocument4 pages3F Oil Palm Agrotech Private Limited-02-27-2020 PDFData CentrumNo ratings yet

- Terrier Security Services (India) Private LimitedDocument7 pagesTerrier Security Services (India) Private Limitedgcgary87No ratings yet

- Shapoorji Pallonji and Company Private LimitedDocument5 pagesShapoorji Pallonji and Company Private LimitedPrabhakar DubeyNo ratings yet

- Tata Elxsi Limited: Summary of Rating ActionDocument7 pagesTata Elxsi Limited: Summary of Rating ActionXyzNo ratings yet

- Incred Financial Services Limited Press+ReleaseDocument7 pagesIncred Financial Services Limited Press+ReleaseGautam MehtaNo ratings yet

- Document Service V2Document6 pagesDocument Service V2UTSAV DUBEYNo ratings yet

- Ian Renewable Energy Development Agency Limited - IPO NoteDocument11 pagesIan Renewable Energy Development Agency Limited - IPO NotedeepaksinghbishtNo ratings yet

- Shri Ram Autotech Private LimitedDocument3 pagesShri Ram Autotech Private LimitedAmanNo ratings yet

- The Bombay Dyeing & Manufacturing Company LimitedDocument5 pagesThe Bombay Dyeing & Manufacturing Company LimitedvaishnaviNo ratings yet

- St. Johns Rajakumar Education & Research TrustDocument3 pagesSt. Johns Rajakumar Education & Research TrustSrikar tejNo ratings yet

- Sub: Rating Downgrade by Icra of Ncds of PNB Housing Finance Limited ("The Company")Document10 pagesSub: Rating Downgrade by Icra of Ncds of PNB Housing Finance Limited ("The Company")Aniket PatelNo ratings yet

- Prime Urban ICRA April 17Document7 pagesPrime Urban ICRA April 17BALMERNo ratings yet

- Kellton Tech Solutions R 28092018Document7 pagesKellton Tech Solutions R 28092018Suresh Kumar RaiNo ratings yet

- Attra Infotech PVT LTD: Ratings Reaffirmed Summary of Rating ActionDocument7 pagesAttra Infotech PVT LTD: Ratings Reaffirmed Summary of Rating ActionCharan gowdaNo ratings yet

- Aghara Knitwear Pvt. LTD.: Summary of Rated InstrumentsDocument6 pagesAghara Knitwear Pvt. LTD.: Summary of Rated Instrumentssatvik ahujaNo ratings yet

- Airvision India Private Limited - R - 25082020Document7 pagesAirvision India Private Limited - R - 25082020DarshanNo ratings yet

- Braced for Impact: Reforming Kazakhstan's National Financial Holding for Development Effectiveness and Market CreationFrom EverandBraced for Impact: Reforming Kazakhstan's National Financial Holding for Development Effectiveness and Market CreationNo ratings yet

- SERIES 65 EXAM STUDY GUIDE 2021 + TEST BANKFrom EverandSERIES 65 EXAM STUDY GUIDE 2021 + TEST BANKNo ratings yet

- Bharat Rasayan LimitedDocument7 pagesBharat Rasayan LimitedjagadeeshNo ratings yet

- GS Final v1Document19 pagesGS Final v1jagadeeshNo ratings yet

- ACA Hosting BCCI Matches 2022-23 1 PDFDocument1 pageACA Hosting BCCI Matches 2022-23 1 PDFjagadeeshNo ratings yet

- Latest Pre Ipo English VersionDocument14 pagesLatest Pre Ipo English VersionjagadeeshNo ratings yet

- Reserve Bank of India Draft Guidelines For Licensing of "Small Banks" in The Private Sector July 17, 2014 I. PreambleDocument6 pagesReserve Bank of India Draft Guidelines For Licensing of "Small Banks" in The Private Sector July 17, 2014 I. PreamblejagadeeshNo ratings yet

- List of Holidays 2014Document18 pagesList of Holidays 2014jagadeeshNo ratings yet

- RBI Financial Stability Report Jun 2015Document92 pagesRBI Financial Stability Report Jun 2015jagadeeshNo ratings yet

- Fin Regulation83Document14 pagesFin Regulation83jagadeeshNo ratings yet

- Finitiatives Learning India Pvt. Ltd. (FLIP) : Head: Learning Delivery Management (LDM)Document2 pagesFinitiatives Learning India Pvt. Ltd. (FLIP) : Head: Learning Delivery Management (LDM)jagadeeshNo ratings yet

- Gess 2 PsDocument9 pagesGess 2 PsfriendkwtNo ratings yet

- Revised Regulatory Framework For NBFC 10112014Document36 pagesRevised Regulatory Framework For NBFC 10112014teammrauNo ratings yet

- Logical DDocument1 pageLogical DjagadeeshNo ratings yet

- Table 1 Account List and Opening Balance - WIRASTRIDocument4 pagesTable 1 Account List and Opening Balance - WIRASTRIAfrili Setio BoedionoNo ratings yet

- Chapter 13Document34 pagesChapter 13Kad SaadNo ratings yet

- F 09420010120134019 PP T 06Document21 pagesF 09420010120134019 PP T 06Morita MichieNo ratings yet

- Cafes Monte Bianco MemoDocument4 pagesCafes Monte Bianco Memocatspajamas 1167% (6)

- (The Second Schdule) : (See Section 4 (B) ) Computation of Gross ProfitsDocument11 pages(The Second Schdule) : (See Section 4 (B) ) Computation of Gross ProfitsYoga GuruNo ratings yet

- Investment TheoryDocument7 pagesInvestment TheoryJoshua KirbyNo ratings yet

- Net Present Value MethodDocument6 pagesNet Present Value MethodAkash Rs100% (1)

- RV 31032010Document218 pagesRV 31032010Shamanth1No ratings yet

- FIL 124 - Final TestDocument16 pagesFIL 124 - Final TestChavey Jean V. RenidoNo ratings yet

- Roll No Time Allowed: 3 Hours Maximum Marks: 100 Total Number of Questions: 8 Total Number of Printed Pages: 11Document11 pagesRoll No Time Allowed: 3 Hours Maximum Marks: 100 Total Number of Questions: 8 Total Number of Printed Pages: 11Jesse SandersNo ratings yet

- A1 Mini ProjectDocument7 pagesA1 Mini Projectthaheerhauf1234No ratings yet

- NeoPriceActionAnalyzer DefinitionsDocument1 pageNeoPriceActionAnalyzer DefinitionsJohn TucăNo ratings yet

- United States District Court Southern District of New YorkDocument28 pagesUnited States District Court Southern District of New YorkAnn DwyerNo ratings yet

- A Comparative Study of Financial Performance of Canara Bank and Union Bank of India PDFDocument8 pagesA Comparative Study of Financial Performance of Canara Bank and Union Bank of India PDFPravin RnsNo ratings yet

- 1211Document201 pages1211Angel CapellanNo ratings yet

- ListDocument2 pagesListresearchprofoundNo ratings yet

- Online Offline Trading in Stock MarketDocument7 pagesOnline Offline Trading in Stock Marketkumar4243No ratings yet

- Course Outline HRM 302Document2 pagesCourse Outline HRM 302nogarap767No ratings yet

- Advanced Binary Options Strategy: Autotrader Signal ToolDocument22 pagesAdvanced Binary Options Strategy: Autotrader Signal ToolDiego FernandesNo ratings yet

- 3cet FinalDocument30 pages3cet FinalhimanshusangaNo ratings yet

- Afm (Acca)Document13 pagesAfm (Acca)Anmol SahajwaniNo ratings yet

- 3f2.list Oivdoiv'wvinwovibwodvbrvbrovbobkvosdkbvosdvbsdoava'odvb'dovsd'of Sawvevnorovre'vudi Business Delegation To Sofia BGDocument9 pages3f2.list Oivdoiv'wvinwovibwodvbrvbrovbobkvosdkbvosdvbsdoava'odvb'dovsd'of Sawvevnorovre'vudi Business Delegation To Sofia BGRupesh GuravNo ratings yet

- Notes On Commercial BankDocument8 pagesNotes On Commercial BankMr. Rain ManNo ratings yet

- Lucky Cement Supply ChainDocument40 pagesLucky Cement Supply ChainMohammed UbaidNo ratings yet

- Lse Asl 2009Document60 pagesLse Asl 2009Bijoy AhmedNo ratings yet

- TAXATION BAR Q and A A. Domondon PDFDocument102 pagesTAXATION BAR Q and A A. Domondon PDFArvin Balag100% (1)

- Harry Marcopolis Red FlagsDocument16 pagesHarry Marcopolis Red Flagsapi-10114739100% (2)

- Appendix 74 - Instructions - IIRUPDocument2 pagesAppendix 74 - Instructions - IIRUPLian Blakely Cousin100% (2)

- Starbucks Memo Draft 1Document2 pagesStarbucks Memo Draft 1uygh gNo ratings yet

- MSC Thesis ProposalDocument47 pagesMSC Thesis ProposalEric Osei Owusu-kumihNo ratings yet