Professional Documents

Culture Documents

Bharat Rasayan Limited

Uploaded by

jagadeeshOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Bharat Rasayan Limited

Uploaded by

jagadeeshCopyright:

Available Formats

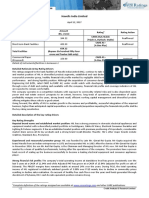

Press Release

Bharat Rasayan Limited

January 03, 2023

Ratings

Facilities/Instruments Amount (₹ crore) Rating1 Rating Action

CARE AA-; Stable

Long-term bank facilities 149.00 Reaffirmed

(Double A Minus; Outlook: Stable)

CARE A1+

Short-term bank facilities 101.00 Reaffirmed

(A One Plus)

250.00

Total bank facilities

(₹ Two hundred fifty crore only)

CARE A1+

Commercial paper 50.00 Reaffirmed

(A One Plus)

CARE A1+

Commercial paper (Carved out) * 50.00 Reaffirmed

(A One Plus)

100.00

Total short-term instruments

(₹ One hundred crore only)

Details of instruments/facilities in Annexure-1.

*Carved out of working capital limits of the company.

Detailed rationale and key rating drivers

The reaffirmation to the bank facilities of Bharat Rasayan Limited (BRL) continues to derive strength from the long track record

of the promoters in the pesticides industry and its integrated operations marked by its presence in the entire value chain of the

pesticides. The ratings further factor in its wide marketing and distribution network with large number of product registrations

and its reputed customer base across the globe. The ratings also factor in the comfortable financial risk profile of the company

characterised by its growing scale of operations, strong capital structure and healthy debt coverage indicators. These rating

strengths are, however, partially offset by its exposure to the foreign currency fluctuation risk, working capital intensive nature

of its operations, highly regulated and competitive nature of the pesticides industry, and vulnerability of the operations to agro

climatic conditions.

Rating sensitivities

Positive factors – Factors that could lead to positive rating action/upgrade:

• Ability of the company to enhance its scale of operations over ₹1,200 crore on a sustained basis without impacting its

profitability and capital structure.

• Ability to improve its PBILDT margins and sustain the same at 20% or above from the current levels.

Negative factors – Factors that could lead to negative rating action/downgrade:

• Significant increase in the working capital cycle on a sustained basis impacting the liquidity profile of BRL.

• Decline in the total operating income (TOI) by more than 20% or decline in the PBILDT margin by more than 500 bps

on a sustained basis.

• Deterioration in its capital structure with overall gearing of more than 0.60x in the projected period.

Outlook: Stable

Detailed description of the key rating drivers

Key rating strengths

Long track record of management in the pesticides industry and resourceful promoters: BRL being part of the

Bharat group, benefits from the long track record of operations and experienced management of the group. BRL is one of the

leading manufacturers of technical-grade pesticides in India and has been engaged in the operations of manufacturing and

selling of pesticides with the promoter’s experience spanning more than four decades. S.N. Gupta, Chairman and Managing

Director (MD) of BRL, is a postgraduate in economics and has vast experience in the fields of international business, overall

marketing strategy and corporate planning besides the pesticides industry. M.P. Gupta, whole-time director of BRL and BRAL, is

a graduate in commerce and has more than 38 years of experience. He looks after banking, finance, taxation, accounts and

1

Complete definition of the ratings assigned are available at www.careedge.in and other CARE Ratings Ltd.’s publications

1 CARE Ratings Ltd.

Press Release

administration. Furthermore, R.P. Gupta, whole-time director of BRL and BRAL, has over 30 years of experience in the

agrochemical industry. He looks after the research and development (R&D), production and project execution activities. The

directors of the group are supported by a team of professionals with rich experience in varied spheres of business. The

promoters of the company have a demonstrated track record in supporting the working capital requirements of the company as

and when required.

Integrated operations offering diversified product mix: BRL is majorly in the manufacturing of technical grade

pesticides, and the sales of technical grades of the company is also made to BR Agrotech Limited (BRAL), which uses it as a raw

material for the manufacturing of formulations. BRL also manufactures intermediates, which is the raw material for

manufacturing technical grades. BRL and BRAL derive cost advantage from the integrated operations through lower

dependence on the import of technical grades, which is the key input for manufacturing of formulations. BRL has established a

strong presence in domestic as well as international markets. The group has synergetic operations through integrated and

interlinked business processes of the group companies. BRL has made its presence in the value chain, right from production of

technical grade pesticides to the varied formulations through direct and reverse integration. In FY22 (refers to the period April 1

to March 31), technical pesticides accounted for 78.12% (PY: 68.29%), intermediates accounted for 18.98% (PY: 24.13%) and

formulation grades accounted for 2.09% (PY: 6.81%) of gross sales of BRL. BRL product portfolio comprises wide range of

pesticides, including insecticides, fungicides, herbicides, weedicides, intermediates and plant growth regulators to cater to all

the pest problems of major crops grown in India, including paddy, cotton, soybean, sugarcane, wheat, groundnut, maize,

cumin, all vegetables and horticulture crops, including their formulations and intermediates. BRL’s product mix comprises 378

varieties of pesticides under technical grade, formulations and intermediates. Furthermore, BRL has around 115 international

registrations, and has been exporting its products (technical grade, intermediates and formulations) to more than 60 countries

across the globe. It is a preferred supplier for several MNCs for their global demand of several molecules. BRL also has two

Government-approved R&D centres based in Bahadurgarh, Haryana, and Dahej, Gujarat. Furthermore, the group has a strong

R&D team registered with the Ministry of Science & Technology, Government of India.

Diverse geographic presence and reputed client base with long-standing relations: BRL has a market leadership in

many technical products, including Lambda Cyhalothrin Technical, Metaphenoxy Benzaldehyde, Metribuzine Technical,

Thiamethoxam (Insecticides) and Fipronil (Insecticides) among others, for which BRL is a preferred supplier in the international

markets. The contribution from Lambda Cyhalothrin Technical, Metaphenoxy, Metribuzine Technical is 35% to 40% of its TOI.

Furthermore, the company is supplying its products in both local as well as overseas market. BRL has around 115 international

registrations and has been exporting its products to more than 60 countries across the globe. The domestic sales account for

around 48.71% of the total sales of BRL in FY22 (63.23% in FY21) and 51.07% in H1FY23 (H1FY22: 60.40%). Furthermore,

BRL has a large institutional customer base in the domestic market as well as in the international market with long-standing

relationship and low client concentration risk. In the international market, the group has strong presence in East Asia, South

America, Europe and Middle East. Furthermore, few large customers like Syngenta and Sumitomo contribute to both the

domestic and export pie of BRL. There is a product concentration risk, as the top 10 products of BRL account for around

79.04% of the total sales of BRL in FY22 (PY: 54%) and around 80% of the total sales of BRL in H1FY23 (H1FY22: 62%).

However, BRL’s long-standing customer relationship with all the large institutional buyers for these products mitigates this risk

for BRL to some extent. Furthermore, the major suppliers for the imported raw materials are located in China, Hong Kong,

Singapore, and Belgium.

Comfortable financial risk profile and strong capital structure: The TOI of the company had been consistently

increasing from ₹797.92 crore in FY18 to ₹1,314.85 crore in FY22 with a compounded annual growth rate (CAGR) of 13.34%.

However, FY21 was affected due to the COVID-19 pandemic, which affected the export sales of the company in Q1FY21 that

form a large part of the company’s top line. The company recorded a TOI of ₹1,314.85 crore, which is an increase in the TOI by

19.83% as compared with FY21. During H1FY23 (refers to the period from April 01 to September 30), the company achieved a

TOI of ₹631.61 crore (₹526.77 crore in H1FY22). However, PBILDT and profit after tax (PAT) in H1FY23 has declined to

₹101.25 crore (H1FY22: ₹104 crore) and ₹61.65 crore (H1FY22: ₹67 crore), respectively. The same has been on account of

increase in the input cost and fire incident, which took place in Q1FY23. The capital structure of the company is strong marked

by zero long-term debt as on March 31, 2022. The total debt of the company stood at ₹174 crore (CC- ₹173 crore and loan

from promoter- ₹1 crore) as on March 31, 2022. The other debt coverage indicators were also healthy in FY22. The total debt

to gross cash accruals (GCA) and interest coverage ratio stood at 0.86x (PY: 0.31x) and 41.28x (PY: 63.45x), respectively, for

FY22. The company has been generating healthy cash accruals and has comfortable liquidity. The company has free cash &

bank balance amounting to ₹0.33 crore as on March 31, 2022 (PY: ₹26.63 crore) and around ₹7.13 crore (PY: 6.93) as on

September 30, 2022, against which there are no long-term debt repayments. The total debt of the company continues to

remain low at ₹114 crore as on September 30, 2022. Due to the fire breakout in Q1FY23 at one of the blocks in Dahej of BRL,

there will be some loss of production and profitability due to the same, but it will not materially impact the credit profile of BRL.

The operations in the respective block are likely to be restored in June 2023, and the company is in the process of filing the

final insurance claim for the loss so suffered.

2 CARE Ratings Ltd.

Press Release

Key rating weaknesses

Working capital intensive nature of operations: The pesticide industry requires high working capital investment due to

high inventory and long credit period on sales. The commoditised nature of the products and seasonality factor (high demand

during crop-sowing seasons) makes the operations of the company highly working capital intensive. Around 60% sales for the

whole year is done on the first half of the year for BRL, and most of the sales are done on a credit of around 90 days-120 days

to its customers, resulting in high debtors in the first half of the year. This results in high working capital requirement by BRL in

first half of the year as compared with the second half of the year. Furthermore, due to the seasonal demand for pesticides,

BRL is required to stack up variety of products as inventory in advance of the season resulting in high inventory holding period,

which is a common phenomenon across the pesticide industry. This increases the inventory holding cost. Furthermore, since

pesticides are the last link in the agricultural operation, after having invested in seeds, fertilizers, etc., the farmers have little

surplus money for purchasing pesticides. Therefore, providing credit is necessary to stimulate demand. Also, the company

makes early payments to its suppliers on account of early payment discount from domestic suppliers and purchases on cash

basis from foreign suppliers, resulting in average creditor period of around 18 days. Thus, due to such intrinsic nature of

business, the group’s working capital requirement continues to remain high. During FY22, the operating cycle of the group

stood at 161 days in FY21 (PY: 140 days).

Highly dependent upon monsoon and climatic conditions: The pesticide industry derives its sales from the agriculture

sector, which is highly dependent upon monsoons as well as incidence of fungal/pest attack on crops. The sales and profitability

of the pesticides industry depends largely on the prevalent agro-climatic conditions. However, BRL has its presence spread

across all states as well as in multiple markets (domestic and international), which reduces the group’s dependence on climatic

conditions of a particular region.

Highly regulated and competitive nature of operations: The pesticides industry is marked by heavy fragmentation with

the absence of any player having sizeable market share. The intense competition leads to competitive pricing and lower

margins. Traditionally, the Indian players have concentrated on marketing generic and off-patent products with little

expenditure on R&D, while MNCs have focused on developing patented molecules. The pesticides are regulated products and

require prior registration with the relevant governing authorities in each country before they are allowed to be sold.

Furthermore, the industry also faces regulatory risk due to the prohibited usage of certain molecules. However, BRL holds 378

registered products including both in technical grade as well as formulations. Furthermore, since BRL is into manufacturing of

technical grade, the same requires compliance with stringent pollution control norms set by the regulatory authorities and any

violation in compliance with these norms or any further strengthening of these norms would have an adverse impact on the

company’s operations. However, with a commitment to promote health, safety and protect environment, BRL has equipped its

units with in-house systems for treatment of solid, liquid and gaseous effluents. All these factors have facilitated the company

to obtain certifications of ISO 14001:2004 for Environment Management System and OHS 18001:2007 for Occupational Health

and Safety.

Exposure to foreign currency fluctuation risk: BRL is exposed to the foreign currency fluctuation risk as the total export

sales constitute 51.29% of the total sales of the company in FY22 (PY: around 36.77%). BRL is also importing raw materials for

manufacturing of technical grade pesticides. The mix of domestic and imported raw material is 45:55 and 70% of the imported

raw material is from China (the mix has reduced from 80% from China in FY18 to 70% in FY20 and FY21). However, the

company purchases raw material from foreign markets on cash basis for around 80% of its purchases from foreign market.

Furthermore, foreign exchange fluctuation risk is reduced partially on account of the natural hedge available in the form of

export sales by the company. The company has booked a forex gain of ₹12.81 crore in FY22 (PY: gain of ₹3.14 crore) on

account of favourable exchange rate fluctuation.

Liquidity: Strong

The liquidity of BRL is strong. The company is generating healthy cash accruals with no long-term debt outstanding. BRL

operates in a highly working capital-intensive industry marked by high inventory holding days and elongated collection period.

During the 12-month period ending September 2022, average working capital utilisation stood comfortable at 9.00%, while the

average of maximum utilisation stood at 27.40%. The company has been generating healthy cash accruals and has comfortable

liquidity. The company has free cash balance and liquid investments of around ₹7.13 crore as on September 30, 2022. This

apart, the company has unutilised working capital limits of ₹80-90 crore.

Analytical approach: Standalone

3 CARE Ratings Ltd.

Press Release

Applicable criteria

Policy on default recognition

Financial Ratios – Non financial Sector

Liquidity Analysis of Non-financial sector entities

Rating Outlook and Credit Watch

Short Term Instruments

Manufacturing Companies

Pesticide

Policy on Withdrawal of Ratings

About the company

Bharat Rasayan Ltd. (BRL) was incorporated in May 1989 by the current Chairman and Managing Director, S. N Gupta, for the

manufacturing of technical grade pesticides as a part of backward integration. BRL is the flagship company of the Bharat group,

which also comprises BR Agrotech Ltd (BRAL). BRL and BRAL has synergetic operations through integrated and interlinked

business processes with both the companies being managed by the same management. BRL is engaged in the core business

activities of manufacturing of technical grade pesticides (a B2B segment), which is a key ingredient for formulations and is used

for captive consumption to some extent, whereas BRAL is engaged in valued-added product of formulations and packaging (Pet

Bottles). BRL started its operations by setting up a manufacturing plant with installed capacity of 5,000 MTPA at Mokhra,

Haryana, in 1989 and later increased its production capacity in the year 2012 by setting up a plant of installed capacity of

12,000 MTPA at Dahej, Gujarat and with the current expansion installed capacity has been increased to 29,200 MTPA. BRL is

one of the leading manufacturers of technical grade pesticides in India and is a government-recognised Star Export house.

BRL has executed a joint venture (JV) Agreement on February 18, 2020, with Nissan Chemical Corporation, a company

incorporated in Japan. The JV will operate through a company named 'Nissan Bharat Rasayan Private Limited', a company

incorporated in India in which BRL has 30% share and NCC has 70% share. The total investment as per equity in this JV was

₹150 crore, which had to be done by both the sponsors in their shareholding proportion, and accordingly, BRL has provided all

the equity of ₹45 crore out of its internal accruals in NBRPL. Nissan Chemical Corporation is a research-based company and is

one of the largest manufacturers of agrochemicals in Japan having global operations. The main rationale of NCC’s investment is

that they wanted to diversify and secure sources of active ingredients and decrease material shortages risk.

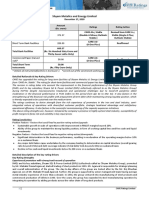

Brief Financials (₹ crore) March 31, 2021 (A) March 31, 2022 (A) H1FY23 (UA)

Total operating income 1,096.46 1,314.85 631.61

PBILDT 244.67 269.10 101.25

PAT 164.47 177.13 61.65

Overall gearing (times) 0.08 0.23 0.14

Interest coverage (times) 62.81 40.99 32.56

A: Audited; UA: Unaudited

Status of non-cooperation with previous CRA: Not applicable

Any other information: Not applicable

Rating history for the last three years: Please refer Annexure-2

Covenants of the rated instruments/facilities: Detailed explanation of covenants of the rated instruments/facilities is

given in Annexure-3

Complexity level of various instruments rated for this company: Annexure-4

4 CARE Ratings Ltd.

Press Release

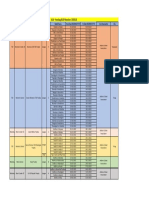

Annexure-1: Details of instruments/facilities

Coupon Maturity Size of Rating Assigned

Name of the Date of Issuance

ISIN Rate Date (DD- the Issue along with Rating

Instrument (DD-MM-YYYY)

(%) MM-YYYY) (₹ crore) Outlook

Commercial paper-

Commercial paper (Carved NA NA NA 50.00 CARE A1+

out)

Commercial paper-

Commercial paper NA NA NA 50.00 CARE A1+

(Standalone)

Fund-based - LT-Cash

- - - 149.00 CARE AA-; Stable

credit

Non-fund-based - ST-

- - - 101.00 CARE A1+

BG/LC

Annexure-2: Rating history for the last three years

Current Ratings Rating History

Date(s) Date(s) Date(s)

Name of the

Sr. and and Date(s) and and

Instrument/Bank Amount

No. Facilities

Rating(s) Rating(s) Rating(s) Rating(s)

Type Outstanding Rating

assigned assigned assigned in assigned

(₹ crore)

in 2022- in 2021- 2020-2021 in 2019-

2023 2022 2020

1)CARE AA-;

Stable

CARE 1)CARE AA-; (23-Dec-21) 1)CARE AA-; 1)CARE AA-;

Fund-based - LT-

1 LT 149.00 AA-; Stable Stable Stable

Cash credit

Stable (25-May-22) 2)CARE AA-; (30-Dec-20) (27-Dec-19)

Stable

(20-Dec-21)

1)CARE A1+

(23-Dec-21)

Non-fund-based - CARE 1)CARE A1+ 1)CARE A1+ 1)CARE A1+

2 ST 101.00

ST-BG/LC A1+ (25-May-22) (30-Dec-20) (27-Dec-19)

2)CARE A1+

(20-Dec-21)

Commercial paper-

1)Withdrawn 1)CARE A1+

3 Commercial paper ST - - - -

(22-Dec-20) (27-Dec-19)

(Standalone)

1)CARE A1+

Commercial paper- (23-Dec-21)

CARE 1)CARE A1+ 1)CARE A1+ 1)CARE A1+

4 Commercial paper ST 50.00

A1+ (25-May-22) (22-Dec-20) (27-Dec-19)

(Carved out) 2)CARE A1+

(20-Dec-21)

Commercial paper-

CARE 1)CARE A1+ 1)CARE A1+

5 Commercial paper ST 50.00 - -

A1+ (25-May-22) (23-Dec-21)

(Standalone)

*Long term/Short term.

Annexure-3: Detailed explanation of the covenants of the rated instruments/facilities: NA

5 CARE Ratings Ltd.

Press Release

Annexure-4: Complexity level of various instruments rated for this company

Sr. No. Name of Instrument Complexity Level

1 Commercial paper-Commercial paper (Carved out) Simple

2 Commercial paper-Commercial paper (Standalone) Simple

3 Fund-based - LT-Cash credit Simple

4 Non-fund-based - ST-BG/LC Simple

Annexure-5: Bank lender details for this company

To view the lender wise details of bank facilities please click here

Note on complexity levels of the rated instruments: CARE Ratings has classified instruments rated by it on the basis of

complexity. Investors/market intermediaries/regulators or others are welcome to write to care@careedge.in for any

clarifications.

6 CARE Ratings Ltd.

Press Release

Contact us

Media contact

Name: Mradul Mishra

Phone: +91-22-6754 3596

E-mail: mradul.mishra@careedge.in

Analyst contact

Name: Ravleen Sethi

Phone: 9818032229

E-mail: ravleen.sethi@careedge.in

Relationship contact

Name: Swati Agrawal

Phone: +91-11-4533 3200

E-mail: swati.agrawal@careedge.in

About us:

Established in 1993, CARE Ratings is one of the leading credit rating agencies in India. Registered under the Securities and

Exchange Board of India, it has been acknowledged as an External Credit Assessment Institution by the RBI. With an equitable

position in the Indian capital market, CARE Ratings provides a wide array of credit rating services that help corporates raise

capital and enable investors to make informed decisions. With an established track record of rating companies over almost

three decades, CARE Ratings follows a robust and transparent rating process that leverages its domain and analytical expertise,

backed by the methodologies congruent with the international best practices. CARE Ratings has played a pivotal role in

developing bank debt and capital market instruments, including commercial papers, corporate bonds and debentures, and

structured credit.

Disclaimer:

The ratings issued by CARE Ratings are opinions on the likelihood of timely payment of the obligations under the rated instrument and are not recommendations to

sanction, renew, disburse, or recall the concerned bank facilities or to buy, sell, or hold any security. These ratings do not convey suitability or price for the investor.

The agency does not constitute an audit on the rated entity. CARE Ratings has based its ratings/outlook based on information obtained from reliable and credible

sources. CARE Ratings does not, however, guarantee the accuracy, adequacy, or completeness of any information and is not responsible for any errors or omissions

and the results obtained from the use of such information. Most entities whose bank facilities/instruments are rated by CARE Ratings have paid a credit rating fee,

based on the amount and type of bank facilities/instruments. CARE Ratings or its subsidiaries/associates may also be involved with other commercial transactions

with the entity. In case of partnership/proprietary concerns, the rating/outlook assigned by CARE Ratings is, inter-alia, based on the capital deployed by the

partners/proprietors and the current financial strength of the firm. The ratings/outlook may change in case of withdrawal of capital, or the unsecured loans brought

in by the partners/proprietors in addition to the financial performance and other relevant factors. CARE Ratings is not responsible for any errors and states that it

has no financial liability whatsoever to the users of the ratings of CARE Ratings. The ratings of CARE Ratings do not factor in any rating-related trigger clauses as

per the terms of the facilities/instruments, which may involve acceleration of payments in case of rating downgrades. However, if any such clauses are introduced

and triggered, the ratings may see volatility and sharp downgrades.

For the detailed Rationale Report and subscription information,

please visit www.careedge.in

7 CARE Ratings Ltd.

You might also like

- Abraca Cortina Ovelha-1 PDFDocument13 pagesAbraca Cortina Ovelha-1 PDFMarina Renata Mosella Tenorio100% (7)

- Aditya Birla Grasim PaintsDocument19 pagesAditya Birla Grasim Paintsinternetsuks5631No ratings yet

- Tech Elevator School Catalog, 2020 PDFDocument29 pagesTech Elevator School Catalog, 2020 PDFjohanmulyadi007No ratings yet

- Tarsons Products LimitedDocument6 pagesTarsons Products LimitedRAROLINKSNo ratings yet

- Piramal Pharma LimitedDocument6 pagesPiramal Pharma Limitedsoumyadwip samantaNo ratings yet

- 04102022073602_Divis_Laboratories_LimitedDocument7 pages04102022073602_Divis_Laboratories_Limiteddivygupta198No ratings yet

- Radico Khaitan LimitedDocument6 pagesRadico Khaitan LimitedHarminder Singh BajwaNo ratings yet

- Tarsons Products LimitedDocument5 pagesTarsons Products LimitedujjwalgoldNo ratings yet

- Gujarat State Fertilizers & Chemicals LimitedDocument6 pagesGujarat State Fertilizers & Chemicals LimitedGopal PatelNo ratings yet

- Filatex India Limited press release ratings reaffirmedDocument6 pagesFilatex India Limited press release ratings reaffirmedfatNo ratings yet

- Rating Definitions - 19 July 2018Document4 pagesRating Definitions - 19 July 2018SushantNo ratings yet

- Mahindra & Mahindra LimitedDocument6 pagesMahindra & Mahindra Limitedjerin jNo ratings yet

- IOL Chemicals and Pharmaceuticals Limited-07-07-2020Document4 pagesIOL Chemicals and Pharmaceuticals Limited-07-07-2020Jeet SinghNo ratings yet

- Technico Industries LimitedDocument4 pagesTechnico Industries Limitedshankarravi8975No ratings yet

- La Opala RG LimitedDocument5 pagesLa Opala RG LimitedAshwani KesharwaniNo ratings yet

- Raymond Limited - (CARE) 18th November 2019Document7 pagesRaymond Limited - (CARE) 18th November 2019Moin KhanNo ratings yet

- Kalpataru Power Transmission LimitedDocument8 pagesKalpataru Power Transmission LimitedjayNo ratings yet

- Piramal Pharma Credit Rating - 13 March 2023Document8 pagesPiramal Pharma Credit Rating - 13 March 2023Ikp IkpNo ratings yet

- Vinati Organics LimitedDocument6 pagesVinati Organics LimitedAshwani KesharwaniNo ratings yet

- Thriveni Earthmovers Private LimitedDocument9 pagesThriveni Earthmovers Private Limitedarc14consultantNo ratings yet

- 2nd DocumentDocument14 pages2nd DocumentSanjay GulatiNo ratings yet

- Venkateshwara Hatcheries Private Limited-01-08-2020Document5 pagesVenkateshwara Hatcheries Private Limited-01-08-2020Deepti JajooNo ratings yet

- 3F Industries LimitedDocument5 pages3F Industries LimitedData CentrumNo ratings yet

- 10102022062806_Myra_Hygiene_Products_Private_LimitedDocument7 pages10102022062806_Myra_Hygiene_Products_Private_Limitedanuj7729No ratings yet

- Press Release Tab India Granites Private LimitedDocument6 pagesPress Release Tab India Granites Private LimitedRavi BabuNo ratings yet

- Jay Ushin Limited: Rationale-Press ReleaseDocument4 pagesJay Ushin Limited: Rationale-Press Releaseravi.youNo ratings yet

- Maithan Alloys LimitedDocument6 pagesMaithan Alloys Limiteddrkashish1989No ratings yet

- Press Release Nahar Poly Films LimitedDocument5 pagesPress Release Nahar Poly Films LimitedHarshit SinghNo ratings yet

- Roots Industries India Limited: Facilities/Instruments Amount (Rs. Crore) Rating Rating ActionDocument4 pagesRoots Industries India Limited: Facilities/Instruments Amount (Rs. Crore) Rating Rating ActionKarthikeyan RK SwamyNo ratings yet

- Press Release Panoli Intermediates (India) Private Limited: Details of Instruments/ Facilities in Annexure-1Document6 pagesPress Release Panoli Intermediates (India) Private Limited: Details of Instruments/ Facilities in Annexure-1Patel ZeelNo ratings yet

- Optus Laminates Private Limited-04!02!2018 2Document4 pagesOptus Laminates Private Limited-04!02!2018 2jainam.gargNo ratings yet

- IOL Chemicals and Pharmaceuticals Limited-07!02!2019Document4 pagesIOL Chemicals and Pharmaceuticals Limited-07!02!2019Technical dostNo ratings yet

- 06012022070753_IMC_LimitedDocument5 pages06012022070753_IMC_LimitedMayank AgarwalNo ratings yet

- Anthem Biosciences-R-21052018Document7 pagesAnthem Biosciences-R-21052018swarnaNo ratings yet

- Vinati Organics Ratings Reaffirmed by CARE Despite Planned CapexDocument5 pagesVinati Organics Ratings Reaffirmed by CARE Despite Planned CapexmgrreddyNo ratings yet

- Saraf Chemicals Private LimitedDocument6 pagesSaraf Chemicals Private LimitedCedric KerkettaNo ratings yet

- Amarth Ifestyle RetailingDocument5 pagesAmarth Ifestyle Retailingheera lal thakurNo ratings yet

- Arya Steels Ratings Remain StableDocument4 pagesArya Steels Ratings Remain StableData CentrumNo ratings yet

- Press Release Airo Lam Limited: Details of Instruments/facilities in Annexure-1Document4 pagesPress Release Airo Lam Limited: Details of Instruments/facilities in Annexure-1flying400No ratings yet

- Bharat Petroleum Corporation LimitedDocument9 pagesBharat Petroleum Corporation LimitedjagadeeshNo ratings yet

- TGV SRAAC LimitedDocument6 pagesTGV SRAAC Limitedjayadeep akasamNo ratings yet

- Press Release Mehul Construction Company Private Limited: Details of Instruments/facilities in Annexure-1Document5 pagesPress Release Mehul Construction Company Private Limited: Details of Instruments/facilities in Annexure-1tejasNo ratings yet

- Abdos Lamitubes Private Limited press release reaffirms ratingsDocument5 pagesAbdos Lamitubes Private Limited press release reaffirms ratingsPuneet367No ratings yet

- Tenshi Life Sciences - R - 25032020Document8 pagesTenshi Life Sciences - R - 25032020AbdulkadirrajaNo ratings yet

- Emami Paper Mills Ratings Revised on Moderate Financial FlexibilityDocument7 pagesEmami Paper Mills Ratings Revised on Moderate Financial FlexibilityAdhiraj BNo ratings yet

- AVT McCormick-R-26032018Document7 pagesAVT McCormick-R-26032018Siddharth DamaniNo ratings yet

- Care Rating Sterling - Addlife - India - Private - LimitedDocument6 pagesCare Rating Sterling - Addlife - India - Private - Limitedrahul.tibrewalNo ratings yet

- Pennar Industries Ratings ReaffirmedDocument4 pagesPennar Industries Ratings ReaffirmedRadha MohanNo ratings yet

- Press Release Om Logistics Limited: Details of Instruments/facilities in Annexure-1Document6 pagesPress Release Om Logistics Limited: Details of Instruments/facilities in Annexure-1Sinius InfracomNo ratings yet

- 3F Oil Palm Agrotech Private Limited-02-27-2020 PDFDocument4 pages3F Oil Palm Agrotech Private Limited-02-27-2020 PDFData CentrumNo ratings yet

- Shyam Metalics and Energy Limited-12-17-2020Document7 pagesShyam Metalics and Energy Limited-12-17-2020Parth PatelNo ratings yet

- Subros LimitedDocument8 pagesSubros LimitedrajpersonalNo ratings yet

- Ajanta Soya 13may2021Document7 pagesAjanta Soya 13may2021praveen kumarNo ratings yet

- Servotech Power Systems Limited-12-21-2018Document5 pagesServotech Power Systems Limited-12-21-2018Sarthak SharmaNo ratings yet

- Press Release Amkette Analytics Limited: Details of Instruments/facilities in Annexure-1Document5 pagesPress Release Amkette Analytics Limited: Details of Instruments/facilities in Annexure-1Data CentrumNo ratings yet

- Press Release Tarsons Products Private Limited: Details of Instruments/facilities in Annexure-1Document4 pagesPress Release Tarsons Products Private Limited: Details of Instruments/facilities in Annexure-1hussainNo ratings yet

- Gujarat Themis Biosyn LimitedDocument5 pagesGujarat Themis Biosyn LimitedAshwani KesharwaniNo ratings yet

- Press Release RACL Geartech LTDDocument4 pagesPress Release RACL Geartech LTDSourav DuttaNo ratings yet

- SMS Life Sciences India Limited Financial ReportDocument7 pagesSMS Life Sciences India Limited Financial Reportsaikiran reddyNo ratings yet

- Sunlex Fabrics Private Limited - Care RatingsDocument6 pagesSunlex Fabrics Private Limited - Care RatingsManeet GoyalNo ratings yet

- T V Sundram Iyengar-R-16022018Document7 pagesT V Sundram Iyengar-R-16022018AGN YaNo ratings yet

- Jodhani Papers Private LimitedDocument5 pagesJodhani Papers Private LimitedPunit PansariNo ratings yet

- Model answer: Launching a new business in Networking for entrepreneursFrom EverandModel answer: Launching a new business in Networking for entrepreneursNo ratings yet

- ACA Hosting BCCI Matches 2022-23 1 PDFDocument1 pageACA Hosting BCCI Matches 2022-23 1 PDFjagadeeshNo ratings yet

- Latest Pre Ipo English VersionDocument14 pagesLatest Pre Ipo English VersionjagadeeshNo ratings yet

- GS Final v1Document19 pagesGS Final v1jagadeeshNo ratings yet

- Reserve Bank of India Draft Guidelines For Licensing of "Small Banks" in The Private Sector July 17, 2014 I. PreambleDocument6 pagesReserve Bank of India Draft Guidelines For Licensing of "Small Banks" in The Private Sector July 17, 2014 I. PreamblejagadeeshNo ratings yet

- List of Holidays 2014Document18 pagesList of Holidays 2014jagadeeshNo ratings yet

- Gess 2 PsDocument9 pagesGess 2 PsfriendkwtNo ratings yet

- Fin Regulation83Document14 pagesFin Regulation83jagadeeshNo ratings yet

- RBI Financial Stability Report Jun 2015Document92 pagesRBI Financial Stability Report Jun 2015jagadeeshNo ratings yet

- Revised Regulatory Framework For NBFC 10112014Document36 pagesRevised Regulatory Framework For NBFC 10112014teammrauNo ratings yet

- Finitiatives Learning India Pvt. Ltd. (FLIP) : Head: Learning Delivery Management (LDM)Document2 pagesFinitiatives Learning India Pvt. Ltd. (FLIP) : Head: Learning Delivery Management (LDM)jagadeeshNo ratings yet

- Logical DDocument1 pageLogical DjagadeeshNo ratings yet

- CHAP002 (Chapter 2 Information System Building Blocks)Document14 pagesCHAP002 (Chapter 2 Information System Building Blocks)Mohammed Atef0% (1)

- Working Capital ManagmentDocument7 pagesWorking Capital ManagmentMarie ElliottNo ratings yet

- G.R. No. 201302 Hygienic Packaging Corporation, Petitioner Nutri-Asia, Inc., Doing Business Under The Name and Style of Ufc Philippines (FORMERLY NUTRI-ASIA, INC.), Respondent Decision Leonen, J.Document5 pagesG.R. No. 201302 Hygienic Packaging Corporation, Petitioner Nutri-Asia, Inc., Doing Business Under The Name and Style of Ufc Philippines (FORMERLY NUTRI-ASIA, INC.), Respondent Decision Leonen, J.SK Fairview Barangay BaguioNo ratings yet

- 3600 ATEX-lrDocument96 pages3600 ATEX-lrArnaldo BenitezNo ratings yet

- NPTELOnline CertificationDocument66 pagesNPTELOnline CertificationAkash GuruNo ratings yet

- 3dpros 1.0 Documentation & Quick TourDocument18 pages3dpros 1.0 Documentation & Quick TourBambang SuhermantoNo ratings yet

- Brekeke Tutorial DialplanDocument22 pagesBrekeke Tutorial DialplanMiruna MocanuNo ratings yet

- Slides 06 PDFDocument71 pagesSlides 06 PDFLoai MohamedNo ratings yet

- Export Promotion Capital Goods Scheme PresentationDocument32 pagesExport Promotion Capital Goods Scheme PresentationDakshata SawantNo ratings yet

- Consumer ProtectionDocument30 pagesConsumer ProtectionSunil ShawNo ratings yet

- Berges 7,5KWDocument66 pagesBerges 7,5KWGabriel CasNo ratings yet

- Mysql Insert Into StatementDocument8 pagesMysql Insert Into StatementsalimdzNo ratings yet

- Filipino Department's Culminating Activities Foster LearningDocument6 pagesFilipino Department's Culminating Activities Foster LearningJhonlee GananNo ratings yet

- Manage clinics and hospitals with SoftClinic softwareDocument31 pagesManage clinics and hospitals with SoftClinic softwareMahmoud AhmedNo ratings yet

- Nesco Utility: Expression of InterestDocument14 pagesNesco Utility: Expression of InterestSanjayaNo ratings yet

- Combined Orders (SAP Library - Production Planning and Control)Document3 pagesCombined Orders (SAP Library - Production Planning and Control)Rashid KhanNo ratings yet

- Flash 29f800Document48 pagesFlash 29f800savidhamNo ratings yet

- Authority to abate nuisancesDocument2 pagesAuthority to abate nuisancesGR100% (1)

- A Review of Solar Photovoltaic System Maintenance StrategiesDocument8 pagesA Review of Solar Photovoltaic System Maintenance StrategiessamNo ratings yet

- Flowshield ESD ConductiveDocument2 pagesFlowshield ESD ConductiveRamkumar KumaresanNo ratings yet

- Datasheet Floating Roof Tanks Spill Prevention Level Switch SXRLTX A Series1 EnglishDocument4 pagesDatasheet Floating Roof Tanks Spill Prevention Level Switch SXRLTX A Series1 EnglishDylan RamasamyNo ratings yet

- White Paper On Cyberwar and Web Based Attacks by IM v8Document8 pagesWhite Paper On Cyberwar and Web Based Attacks by IM v8IM222No ratings yet

- ART. 1326 - ART 1335 DiscussionDocument20 pagesART. 1326 - ART 1335 DiscussionJessica JamonNo ratings yet

- Entrepreneurship Starting and Operating A Small Business 4th Edition Mariotti Solutions Manual 1Document17 pagesEntrepreneurship Starting and Operating A Small Business 4th Edition Mariotti Solutions Manual 1willie100% (32)

- Business Finance Week 2 2Document14 pagesBusiness Finance Week 2 2Phoebe Rafunsel Sumbongan Juyad100% (1)

- TARPfinal PDFDocument28 pagesTARPfinal PDFRakesh ReddyNo ratings yet

- Final Project Capital BudgetingDocument52 pagesFinal Project Capital BudgetingYugendra Babu K100% (2)