Professional Documents

Culture Documents

Arya Steels Rolling (India) Limite

Uploaded by

Data CentrumCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Arya Steels Rolling (India) Limite

Uploaded by

Data CentrumCopyright:

Available Formats

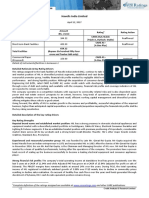

Press Release

Arya Steels Rolling (India) Limited

December 31, 2018

Ratings

Amount 1

Facilities Rating Rating Action

(Rs. crore)

CARE BB+; Stable

Long term Bank Facilities 18.00 Assigned

(Double B Plus; Outlook: Stable)

CARE A4+

Short Term Bank Facilities 6.00 Assigned

(A Four Plus)

24.00

Total (Rupees Twenty Four crore

only)

Details of facilities in Annexure-1

Detailed Rationale & Key Rating Drivers

The ratings assigned to bank facilities of Arya Steels Rolling (India) Limited (ASRIL) are constrained by the thin profitability

margin, moderate capital structure debt coverage indicators, susceptibility to cyclicality associated with steel industry

and dependence on end users of real estate and construction industry

The ratings derive strength from promoter’s experience in the field of iron and steel industry, growth in operating income

and established relationship with diversified clientele (distributors).

The ability to improve scale of operations, improve profitability and effectively manage working capital cycle in the

backdrop volatility in the steel prices

Detailed description of the key rating drivers

Key rating strengths

Experienced promoters in the field of iron and steel industry

ASRIL has a track record of more than ten years and is managed by the second generation entrepreneurs, Mr.Sumit

Singla, Mr.Ankur Singla and Mr.Alok Bansal who are actively involved in the company in the strength of directors. They

are commerce graduates and spearhead the company in various operations. The top management at ASRIL is ably

supported by a qualified and professional team who look after various activities such as production, procurement,

operations, marketing and branding.

Growing scale of operations

ASRIL registered a CAGR growth in total operating income of 10.02% to Rs.182.97 crore in FY18 as against Rs.151.17 crore

in FY16 led by increase in the sales volume and better sales realization. In H1FY19 the total operating income stood at

Rs.117.57 crore.

Established relationship with diversified clientele and suppliers

The company manufactures TMT Bars with the brand name of “Shirdi Sariya”, which is a well-known brand in various

southern states. ASRIL caters to diversified distributors who are key suppliers to the real estate and construction sector.

The clientele base includes local players like Ribco Steel (Mangalore), Shiva Steel (Hubli), Steel Trading House (Belgaum),

Nandi Steel (Hubli), RB Steel (Belgaum) etc. ASRIL has also channeled with various distributors in different states like

Karnataka, Maharashtra and Kerala to improve the reach of its products

Liquidity

Average cash credit utilization for 12 months ended September 2018 remained at ~80%. The cash balance as on March

31, 2018 stood at Rs.0.97 crore. The current ratio stood at 1.49 as on March 31, 2018.

Key Rating Weaknesses

1

Complete definitions of the ratings assigned are available at www.careratings.com and in other CARE

publications.

1 CARE Ratings Limited

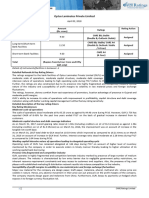

Press Release

Low profitability, moderate capital structure and debt coverage indicators

The company’s profitability has been thin and fluctuating over FY16-FY18. PBILDT margin of ASRIL declined to 3.00 % in

FY18 (as against 3.58% during the FY17 and 3.12 % during FY16) due to increase in the raw material cost over the last

three years. PAT margin in FY18 stood at 0.55% .The debt profile of ASRIL constitutes mainly working capital borrowings.

ASRIL is not having any term loan except few vehicle loans. Lower reliance on debt, led to an overall gearing of 0.96x as

on March 31, 2018 from 1.05x as on March 31, 2016. Further, the total debt to GCA stood at 10.34x as on March 31, 2018

from 14.14x as on March 31, 2016. The interest coverage ratio stood at 1.84x during FY18.

Susceptible to cyclicality associated with steel industry

The key raw material required for the manufacturing bars is MS Billets which is procured at market-linked rates. Prices of

raw material as well as finished goods have always been volatile. ASRIL operates on moderate margin and raw material is

a major cost driver’s .Hence the company’s margins are sensitive to adverse movement in prices of finished goods and/or

raw materials. The ability of the company to pass on the price increase to its customers, with the competition existing in

this segment, is a key rating monitorable

Competition from organized & unorganized sector

ASRIL operates in an industry which comprises of several small players in the unorganized sector and is also characterized

by high degree of fragmentation. There also exist big sized players with established and integrated operations along with

strong marketing & distribution network resulting in intense competition in the industry. The industry is characterized by

low entry barriers and low level of product differentiation due to minimal technological inputs and availability of

standardized machinery for production. Therefore pricing is crucial for the company to garner customer especially with no

long term contracts. It remains to be seen how ASRIL will cope with these challenges in the medium term

Analytical approach: Standalone

Applicable Criteria

Criteria on assigning Outlook to Credit Ratings

CARE’s Policy on Default Recognition

Criteria for Short Term Instruments

Rating Methodology-Manufacturing Companies

Financial ratios – Non-Financial Sector

Rating Methodology - Steel Companies

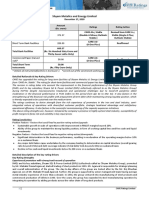

About the Company

Arya Steels Rolling India Limited (ASRIL) was incorporated in 2008 by Late.Mr.Rajender Prasad Singla, the founder of

Singla group. The company is registered at Goa and the manufacturing facilities are located in Kolhapur, Maharashtra.

ASRIL is engaged in the manufacturing of Thermo-Mechanical Treatment (TMT) bars with an installed capacity of 90000

MTPA (Metric tons per annum). ASRIL is promoted by second generation entrepreneurs Mr. Sumit Singla and Mr. Ankur

Singla and Mr. Alok Bansal. They have more than a decade of experience in the field of manufacturing TMT bars. With the

advent of technology, in 2016 the company adopted Hot Rolling Process for manufacturing of TMT Bars efficiently

thereby reducing overall cost of production. The group company “Shri Balaji Rollings Private Limited” is associated with

steel billets manufacturing since 1997.

Brief Financials (Rs. crore) FY17 (Audited) FY18 (Audited)

Total operating income 136.56 182.97

PBILDT 4.89 5.48

PAT 0.68 1.01

Overall gearing (times) 1.11 0.96

Interest coverage (times) 1.63 1.84

Status of non-cooperation with previous CRA: NA

Any other information: Not Applicable

Rating History for last three years: Please refer Annexure-2

Analyst Contact:

Name: Mr. Ashish Kashalkar

Tel: 020- 40009003

Mobile: 9890615061

Email: ashish.kashalkar@careratings.com

2 CARE Ratings Limited

Press Release

**For detailed Rationale Report and subscription information, please contact us at www.careratings.com

About CARE Ratings:

CARE Ratings commenced operations in April 1993 and over two decades, it has established itself as one of the leading

credit rating agencies in India. CARE is registered with the Securities and Exchange Board of India (SEBI) and also

recognized as an External Credit Assessment Institution (ECAI) by the Reserve Bank of India (RBI). CARE Ratings is proud of

its rightful place in the Indian capital market built around investor confidence. CARE Ratings provides the entire spectrum

of credit rating that helps the corporates to raise capital for their various requirements and assists the investors to form

an informed investment decision based on the credit risk and their own risk-return expectations. Our rating and grading

service offerings leverage our domain and analytical expertise backed by the methodologies congruent with the

international best practices.

Disclaimer

CARE’s ratings are opinions on credit quality and are not recommendations to sanction, renew, disburse or recall the

concerned bank facilities or to buy, sell or hold any security. CARE has based its ratings/outlooks on information obtained

from sources believed by it to be accurate and reliable. CARE does not, however, guarantee the accuracy, adequacy or

completeness of any information and is not responsible for any errors or omissions or for the results obtained from the

use of such information. Most entities whose bank facilities/instruments are rated by CARE have paid a credit rating fee,

based on the amount and type of bank facilities/instruments.

In case of partnership/proprietary concerns, the rating /outlook assigned by CARE is based on the capital deployed by the

partners/proprietor and the financial strength of the firm at present. The rating/outlook may undergo change in case of

withdrawal of capital or the unsecured loans brought in by the partners/proprietor in addition to the financial

performance and other relevant factors.

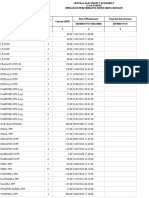

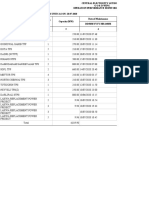

Annexure-1: Details of Instruments/Facilities

Name of the Date of Coupon Maturity Size of the Rating assigned

Instrument Issuance Rate Date Issue along with Rating

(Rs. crore) Outlook

Fund-based - LT-Cash - - - 18.00 CARE BB+; Stable

Credit

Non-fund-based - ST- - - - 5.00 CARE A4+

Letter of credit

Non-fund-based - ST- - - - 1.00 CARE A4+

Bank Guarantees

Annexure-2: Rating History of last three years

Sr. Name of the Current Ratings Rating history

No. Instrument/Bank Type Amount Rating Date(s) & Date(s) & Date(s) & Date(s) &

Facilities Outstanding Rating(s) Rating(s) Rating(s) Rating(s)

(Rs. crore) assigned in assigned in assigned in assigned in

2018-2019 2017-2018 2016-2017 2015-2016

1. Fund-based - LT-Cash LT 18.00 CARE - - - -

Credit BB+;

Stable

2. Non-fund-based - ST- ST 5.00 CARE - - - -

Letter of credit A4+

3. Non-fund-based - ST- ST 1.00 CARE - - - -

Bank Guarantees A4+

3 CARE Ratings Limited

Press Release

CONTACT

Head Office Mumbai

Ms. Meenal Sikchi Mr. Ankur Sachdeva

Cell: + 91 98190 09839 Cell: + 91 98196 98985

E-mail: meenal.sikchi@careratings.com E-mail: ankur.sachdeva@careratings.com

Ms. Rashmi Narvankar Mr. Saikat Roy

Cell: + 91 99675 70636 Cell: + 91 98209 98779

E-mail: rashmi.narvankar@careratings.com E-mail: saikat.roy@careratings.com

CARE Ratings Limited

(Formerly known as Credit Analysis & Research Ltd.)

Corporate Office: 4th Floor, Godrej Coliseum, Somaiya Hospital Road, Off Eastern Express Highway, Sion (East), Mumbai - 400 022

Tel: +91-22-6754 3456 | Fax: +91-22-6754 3457 | E-mail: care@careratings.com

AHMEDABAD E-mail: ramesh.bob@careratings.com

Mr. Deepak Prajapati

32, Titanium, Prahaladnagar Corporate Road, JAIPUR

Satellite, Ahmedabad - 380 015 Mr. Nikhil Soni

Cell: +91-9099028864 304, Pashupati Akshat Heights, Plot No. D-91,

Tel: +91-79-4026 5656 Madho Singh Road, Near Collectorate Circle,

E-mail: deepak.prajapati@careratings.com Bani Park, Jaipur - 302 016.

Cell: +91 – 95490 33222

BENGALURU Tel: +91-141-402 0213 / 14

Mr. V Pradeep Kumar E-mail: nikhil.soni@careratings.com

Unit No. 1101-1102, 11th Floor, Prestige Meridian II,

No. 30, M.G. Road, Bangalore - 560 001. KOLKATA

Cell: +91 98407 54521 Ms. Priti Agarwal

Tel: +91-80-4115 0445, 4165 4529 3rd Floor, Prasad Chambers, (Shagun Mall Bldg.)

Email: pradeep.kumar@careratings.com 10A, Shakespeare Sarani, Kolkata - 700 071.

Cell: +91-98319 67110

CHANDIGARH Tel: +91-33- 4018 1600

Mr. Anand Jha E-mail: priti.agarwal@careratings.com

SCF No. 54-55,

First Floor, Phase 11, NEW DELHI

Sector 65, Mohali - 160062 Ms. Swati Agrawal

Chandigarh 13th Floor, E-1 Block, Videocon Tower,

Cell: +91 85111-53511/99251-42264 Jhandewalan Extension, New Delhi - 110 055.

Tel: +91- 0172-490-4000/01 Cell: +91-98117 45677

Email: anand.jha@careratings.com Tel: +91-11-4533 3200

E-mail: swati.agrawal@careratings.com

CHENNAI

Mr. V Pradeep Kumar PUNE

Unit No. O-509/C, Spencer Plaza, 5th Floor, Mr.Pratim Banerjee

No. 769, Anna Salai, Chennai - 600 002. 9th Floor, Pride Kumar Senate,

Cell: +91 98407 54521 Plot No. 970, Bhamburda, Senapati Bapat Road,

Tel: +91-44-2849 7812 / 0811 Shivaji Nagar, Pune - 411 015.

Email: pradeep.kumar@careratings.com Cell: +91-98361 07331

Tel: +91-20- 4000 9000

COIMBATORE E-mail: pratim.banerjee@careratings.com

Mr. V Pradeep Kumar

T-3, 3rd Floor, Manchester Square CIN - L67190MH1993PLC071691

Puliakulam Road, Coimbatore - 641 037.

Tel: +91-422-4332399 / 4502399

Email: pradeep.kumar@careratings.com

HYDERABAD

Mr. Ramesh Bob

401, Ashoka Scintilla, 3-6-502, Himayat Nagar,

Hyderabad - 500 029.

Cell : + 91 90520 00521

Tel: +91-40-4010 2030

4 CARE Ratings Limited

You might also like

- Model answer: Launching a new business in Networking for entrepreneursFrom EverandModel answer: Launching a new business in Networking for entrepreneursNo ratings yet

- Shri Balaji Rollings Private LimDocument4 pagesShri Balaji Rollings Private LimData CentrumNo ratings yet

- Rating Definitions - 19 July 2018Document4 pagesRating Definitions - 19 July 2018SushantNo ratings yet

- Press Release RACL Geartech LTDDocument4 pagesPress Release RACL Geartech LTDSourav DuttaNo ratings yet

- Press Release Amkette Analytics Limited: Details of Instruments/facilities in Annexure-1Document5 pagesPress Release Amkette Analytics Limited: Details of Instruments/facilities in Annexure-1Data CentrumNo ratings yet

- Press Release RACL Geartech LTDDocument4 pagesPress Release RACL Geartech LTDSourav DuttaNo ratings yet

- Technico Industries LimitedDocument4 pagesTechnico Industries Limitedshankarravi8975No ratings yet

- T V Sundram Iyengar-R-16022018Document7 pagesT V Sundram Iyengar-R-16022018AGN YaNo ratings yet

- Press Release Pennar Industries Limited: Details of Instruments/facilities in Annexure-1Document4 pagesPress Release Pennar Industries Limited: Details of Instruments/facilities in Annexure-1Radha MohanNo ratings yet

- Mega Steel IndustriesDocument4 pagesMega Steel IndustrieshseckalpeshNo ratings yet

- Optus Laminates Private Limited-04!02!2018 2Document4 pagesOptus Laminates Private Limited-04!02!2018 2jainam.gargNo ratings yet

- Shyam Metalics and Energy Limited-12-17-2020Document7 pagesShyam Metalics and Energy Limited-12-17-2020Parth PatelNo ratings yet

- Press Release Mehul Construction Company Private Limited: Details of Instruments/facilities in Annexure-1Document5 pagesPress Release Mehul Construction Company Private Limited: Details of Instruments/facilities in Annexure-1tejasNo ratings yet

- Hyundai Steel India - R - 08062018Document7 pagesHyundai Steel India - R - 08062018Andrew BruceNo ratings yet

- Ayushman Merchants Private Limited: Summary of Rated InstrumentsDocument6 pagesAyushman Merchants Private Limited: Summary of Rated InstrumentsJeffNo ratings yet

- Roots Industries India Limited: Facilities/Instruments Amount (Rs. Crore) Rating Rating ActionDocument4 pagesRoots Industries India Limited: Facilities/Instruments Amount (Rs. Crore) Rating Rating ActionKarthikeyan RK SwamyNo ratings yet

- AETHER Industries LTD - 2019 Credit RatingDocument3 pagesAETHER Industries LTD - 2019 Credit RatingEast West Strategic ConsultingNo ratings yet

- Servotech Power Systems Limited-12-21-2018Document5 pagesServotech Power Systems Limited-12-21-2018Sarthak SharmaNo ratings yet

- Press Release Adani Agri Logistics (Harda) Limited: Details of Facilities in Annexure-1Document3 pagesPress Release Adani Agri Logistics (Harda) Limited: Details of Facilities in Annexure-1surprise MFNo ratings yet

- Poddar Diamonds Limited-09-29-2017Document4 pagesPoddar Diamonds Limited-09-29-2017tridev kant tripathiNo ratings yet

- Rating Rationale - Hero Steel Oct 2019Document4 pagesRating Rationale - Hero Steel Oct 2019Puneet367No ratings yet

- Bata India Limited: Summary of Rating ActionDocument6 pagesBata India Limited: Summary of Rating ActionDhrubajyoti DattaNo ratings yet

- Press Release MaharajaDocument5 pagesPress Release MaharajaMS SAMIRANNo ratings yet

- Press Release Adani Agri Logistics (Harda) LimitedDocument5 pagesPress Release Adani Agri Logistics (Harda) Limitedsurprise MFNo ratings yet

- CARE Sunflag 4.01.2024Document9 pagesCARE Sunflag 4.01.2024Swapnil SomkuwarNo ratings yet

- Signode India Financial ReportDocument5 pagesSignode India Financial Reportsaikiran reddyNo ratings yet

- Raymond Limited - (CARE) 18th November 2019Document7 pagesRaymond Limited - (CARE) 18th November 2019Moin KhanNo ratings yet

- Continental Carbon India LimitedDocument4 pagesContinental Carbon India LimitedKamaldeep MaanNo ratings yet

- Press Release Airo Lam Limited: Details of Instruments/facilities in Annexure-1Document4 pagesPress Release Airo Lam Limited: Details of Instruments/facilities in Annexure-1flying400No ratings yet

- Press Release Tab India Granites Private LimitedDocument6 pagesPress Release Tab India Granites Private LimitedRavi BabuNo ratings yet

- Sree Akkamamba Textiles - R - 13032020Document7 pagesSree Akkamamba Textiles - R - 13032020saikiran reddyNo ratings yet

- Aachi Masala Foods-R-28092018 PDFDocument7 pagesAachi Masala Foods-R-28092018 PDFபாரத் அச்சுNo ratings yet

- Ramani Cars Private Limited 2023Document6 pagesRamani Cars Private Limited 2023Karthikeyan RK SwamyNo ratings yet

- Tab India Granites Private Limited-02-07-2020Document6 pagesTab India Granites Private Limited-02-07-2020Puneet367No ratings yet

- Customer Private LimitedDocument4 pagesCustomer Private LimitedData CentrumNo ratings yet

- R.S. Brothers Retail - R-06122017Document7 pagesR.S. Brothers Retail - R-06122017srv 99No ratings yet

- Vikas Spool Private Limited: Summary of Rated Instruments Instrument Rated Amount (Rs. Crore) Rating ActionDocument6 pagesVikas Spool Private Limited: Summary of Rated Instruments Instrument Rated Amount (Rs. Crore) Rating Actionvinay durgapalNo ratings yet

- Rockman Industries Limited: Summary of Rated Instruments Instrument Rated Amount (Rs. Crore) Rating ActionDocument7 pagesRockman Industries Limited: Summary of Rated Instruments Instrument Rated Amount (Rs. Crore) Rating ActionVirender RawatNo ratings yet

- SMC Power Generation LTD.: Summary of Rated InstrumentsDocument7 pagesSMC Power Generation LTD.: Summary of Rated Instrumentspiyush upadhyayNo ratings yet

- Bharat Gears LimitedDocument7 pagesBharat Gears LimitedjagadeeshNo ratings yet

- Aghara Knitwear Pvt. LTD.: Summary of Rated InstrumentsDocument6 pagesAghara Knitwear Pvt. LTD.: Summary of Rated Instrumentssatvik ahujaNo ratings yet

- Indotech Transformers LimitedDocument6 pagesIndotech Transformers LimitedMonika GNo ratings yet

- Research Paper - Rashmi Sponge Iron & Power Industries LTDDocument6 pagesResearch Paper - Rashmi Sponge Iron & Power Industries LTDSoumyakanti S. Samanta (Pgdm 09-11, Batch II)No ratings yet

- Hinduja Healthcare 29dec2020Document8 pagesHinduja Healthcare 29dec2020Bijay MehtaNo ratings yet

- Bhuwalka and Sons Private LimitedDocument4 pagesBhuwalka and Sons Private LimiteddoctorsabeehNo ratings yet

- Thriveni Earthmovers Private LimitedDocument9 pagesThriveni Earthmovers Private Limitedarc14consultantNo ratings yet

- Bharat Petroleum Corporation LimitedDocument9 pagesBharat Petroleum Corporation LimitedjagadeeshNo ratings yet

- Jeevaka Industries PVT R 06042020Document7 pagesJeevaka Industries PVT R 06042020saikiran reddyNo ratings yet

- Titan Company LimitedDocument7 pagesTitan Company Limiteddanish.40581No ratings yet

- Shree Lakshmi Narayan Sugar Industries Private Limited-12-01-2020Document3 pagesShree Lakshmi Narayan Sugar Industries Private Limited-12-01-2020YUVRAJ YADAVNo ratings yet

- Incred Financial Services Limited Press+ReleaseDocument7 pagesIncred Financial Services Limited Press+ReleaseGautam MehtaNo ratings yet

- Zenith Engineering CorporatiDocument3 pagesZenith Engineering CorporatiData CentrumNo ratings yet

- Mahindra & Mahindra LimitedDocument6 pagesMahindra & Mahindra Limitedjerin jNo ratings yet

- IB League 2019: HSBC STG BangaloreDocument13 pagesIB League 2019: HSBC STG BangaloreMayur AgrawalNo ratings yet

- T V Sundram Iyengar - R-25022019 PDFDocument7 pagesT V Sundram Iyengar - R-25022019 PDFSankar KumarNo ratings yet

- Kellton Tech Solutions R 28092018Document7 pagesKellton Tech Solutions R 28092018Suresh Kumar RaiNo ratings yet

- Press Release 3B Fibreglass SPRL: Facilities Amount (Rs. Crore) Rating Rating ActionDocument4 pagesPress Release 3B Fibreglass SPRL: Facilities Amount (Rs. Crore) Rating Rating ActionData CentrumNo ratings yet

- Peekay Steel Castings Private Limited-01!09!2019Document5 pagesPeekay Steel Castings Private Limited-01!09!2019GAYATHRI S.RNo ratings yet

- Amarth Ifestyle RetailingDocument5 pagesAmarth Ifestyle Retailingheera lal thakurNo ratings yet

- Super Spinning Mills Limited-09-08-2020Document4 pagesSuper Spinning Mills Limited-09-08-2020Positive ThinkerNo ratings yet

- dgr13 2020 07 18Document8 pagesdgr13 2020 07 18Data CentrumNo ratings yet

- Northern: All India / Regionwise Power Generation Overview 18-Jul-2020Document2 pagesNorthern: All India / Regionwise Power Generation Overview 18-Jul-2020Data CentrumNo ratings yet

- Coal Lignite Gas Liquid Diesel: Central Electricity Authority Go&Dwing Operation Performance Monitoring DivisionDocument2 pagesCoal Lignite Gas Liquid Diesel: Central Electricity Authority Go&Dwing Operation Performance Monitoring DivisionData CentrumNo ratings yet

- dgr14 2020 07 18Document2 pagesdgr14 2020 07 18Data CentrumNo ratings yet

- Central Electricity Authority Go&Dwing Operation Performance Monitoring DivisionDocument4 pagesCentral Electricity Authority Go&Dwing Operation Performance Monitoring DivisionData CentrumNo ratings yet

- Northern: All India / Regionwise Power Generation Overview 18-Jul-2020Document2 pagesNorthern: All India / Regionwise Power Generation Overview 18-Jul-2020Data CentrumNo ratings yet

- dgr8 2020 07 18Document2 pagesdgr8 2020 07 18Data CentrumNo ratings yet

- Daily Maintenance Report (Coal, Lignite and Nuclear) 06-07-2020Document18 pagesDaily Maintenance Report (Coal, Lignite and Nuclear) 06-07-2020Data CentrumNo ratings yet

- Category Wise-Fuel Wise Generation. 01-Jul-2020Document4 pagesCategory Wise-Fuel Wise Generation. 01-Jul-2020Data CentrumNo ratings yet

- Daily Maintenance Report (Thermal and Nuclear Units) For 500 and Above 18-07-2020Document6 pagesDaily Maintenance Report (Thermal and Nuclear Units) For 500 and Above 18-07-2020Data CentrumNo ratings yet

- dgr12 2020 07 05Document12 pagesdgr12 2020 07 05Data CentrumNo ratings yet

- dgr12 2020 07 05Document12 pagesdgr12 2020 07 05Data CentrumNo ratings yet

- dgr13 2020 07 18Document8 pagesdgr13 2020 07 18Data CentrumNo ratings yet

- Unit 1 Unit 2 Unit 3 Unit 4 Unit 5 Unit 6Document10 pagesUnit 1 Unit 2 Unit 3 Unit 4 Unit 5 Unit 6Data CentrumNo ratings yet

- Category Wise-Fuel Wise Generation. 01-Jul-2020Document4 pagesCategory Wise-Fuel Wise Generation. 01-Jul-2020Data CentrumNo ratings yet

- All India / Regionwise Power Generation Overview 18-Jul-2020Document2 pagesAll India / Regionwise Power Generation Overview 18-Jul-2020Data CentrumNo ratings yet

- dgr6 2020 07 05Document2 pagesdgr6 2020 07 05Data CentrumNo ratings yet

- All India Capacity Availability For 18/07/2020 (Region Wise Utility Wise Summary Report)Document8 pagesAll India Capacity Availability For 18/07/2020 (Region Wise Utility Wise Summary Report)Data CentrumNo ratings yet

- Monitored Cap. (MW)Document35 pagesMonitored Cap. (MW)Data CentrumNo ratings yet

- dgr3 2019 12 16Document2 pagesdgr3 2019 12 16Leela KrishnaNo ratings yet

- Coal Lignite Gas Liquid Diesel: Central Electricity Authority Go&Dwing Operation Performance Monitoring DivisionDocument2 pagesCoal Lignite Gas Liquid Diesel: Central Electricity Authority Go&Dwing Operation Performance Monitoring DivisionData CentrumNo ratings yet

- dgr14 2020 07 05Document2 pagesdgr14 2020 07 05Data CentrumNo ratings yet

- Daily Maintenance Report (Thermal and Nuclear Units) For 500 and Above 02-07-2020Document6 pagesDaily Maintenance Report (Thermal and Nuclear Units) For 500 and Above 02-07-2020Data CentrumNo ratings yet

- Northern: All India / Regionwise Power Generation Overview 18-Jul-2020Document2 pagesNorthern: All India / Regionwise Power Generation Overview 18-Jul-2020Data CentrumNo ratings yet

- All India / Regionwise Power Generation Overview 18-Jul-2020Document2 pagesAll India / Regionwise Power Generation Overview 18-Jul-2020Data CentrumNo ratings yet

- Central Electricity Authority Go&Dwing Operation Performance Monitoring DivisionDocument6 pagesCentral Electricity Authority Go&Dwing Operation Performance Monitoring DivisionData CentrumNo ratings yet

- dgr13 2020 07 18Document8 pagesdgr13 2020 07 18Data CentrumNo ratings yet

- Daily Maintenance Report (Coal, Lignite and Nuclear) 05-07-2020Document18 pagesDaily Maintenance Report (Coal, Lignite and Nuclear) 05-07-2020Data CentrumNo ratings yet

- Daily Maintenance Report (Thermal and Nuclear Units) For 500 and Above 02-07-2020Document6 pagesDaily Maintenance Report (Thermal and Nuclear Units) For 500 and Above 02-07-2020Data CentrumNo ratings yet

- dgr12 2020 07 05Document12 pagesdgr12 2020 07 05Data CentrumNo ratings yet

- Loan AgreementDocument17 pagesLoan AgreementVishal BawaneNo ratings yet

- 1001 Questions For Last Moment Banking PreparationsDocument35 pages1001 Questions For Last Moment Banking PreparationsAparajito SethNo ratings yet

- BAE - Sem 4 - BCH 4.4 (B) - ERDFEM - W2 - CG - Unit 5Document45 pagesBAE - Sem 4 - BCH 4.4 (B) - ERDFEM - W2 - CG - Unit 5Mahesh Babu Mahesh BabuNo ratings yet

- Answer Key DDocument231 pagesAnswer Key DAbhisek Mukherjee0% (1)

- LendingTech Report 1708998284Document9 pagesLendingTech Report 1708998284Dushyant GargNo ratings yet

- 1) - Introduction: A) - Introduction of The Automobile IndustryDocument12 pages1) - Introduction: A) - Introduction of The Automobile IndustryRohit AswaniNo ratings yet

- Ready Forward ContractsDocument7 pagesReady Forward ContractsSatyendra Veer SinghNo ratings yet

- Rtgs - Axis BankDocument2 pagesRtgs - Axis BankAmarnath Vuyyuri0% (1)

- What India's New Rules Mean For E-Marketplaces: The Top Do-GooderDocument18 pagesWhat India's New Rules Mean For E-Marketplaces: The Top Do-Goodervipul aroraNo ratings yet

- Bob StatementDocument18 pagesBob StatementShreya AgrawalNo ratings yet

- DMS-IIT Delhi Compendium 2019-21Document55 pagesDMS-IIT Delhi Compendium 2019-21Sounak Chatterjee100% (1)

- Multiple Choice QuestionsDocument12 pagesMultiple Choice Questionssunilkumar100% (2)

- MBA-III-Investment Management Notes: Financial Accounting and Auditing VII - Financial Accounting (University of Mumbai)Document131 pagesMBA-III-Investment Management Notes: Financial Accounting and Auditing VII - Financial Accounting (University of Mumbai)asadNo ratings yet

- Gagan Puri HDFC CASA ReportDocument72 pagesGagan Puri HDFC CASA Reportgaganpuripali100% (2)

- IndusInd BankDocument67 pagesIndusInd BankCHITRANSH SINGHNo ratings yet

- August 2020Document166 pagesAugust 2020ARGHA PAULNo ratings yet

- Study of Organisational Structure Syndicate BankDocument48 pagesStudy of Organisational Structure Syndicate BankJissy Shravan50% (2)

- Journal Pre-Proof: IIMB Management ReviewDocument60 pagesJournal Pre-Proof: IIMB Management ReviewKapilSahuNo ratings yet

- Discussion On Rbi Grade B 2019 Notification + Study PlanDocument28 pagesDiscussion On Rbi Grade B 2019 Notification + Study PlanjyottsnaNo ratings yet

- Report of The Working Group On FinTech and Digital BankingDocument1 pageReport of The Working Group On FinTech and Digital BankingHEMANG PAREEKNo ratings yet

- Corporate LoansDocument19 pagesCorporate Loansmsumit555No ratings yet

- Chapter 1 EvolutionDocument20 pagesChapter 1 Evolutioneman siddiquiNo ratings yet

- Role of Banks in Economic DevelopmentDocument86 pagesRole of Banks in Economic Developmentsahilkamble459No ratings yet

- Allocations - BookletDocument18 pagesAllocations - BookletRanjeet SinghNo ratings yet

- Rtgs and NeftDocument31 pagesRtgs and NeftPravah Shukla100% (5)

- Financing Self Help Groups (SHGS) - Union Bank of IndiaDocument3 pagesFinancing Self Help Groups (SHGS) - Union Bank of IndiaSWAYAM PRAKASH PARIDANo ratings yet

- Mrunal Monthly CA Laptop Friendly 2021 11 NovDocument141 pagesMrunal Monthly CA Laptop Friendly 2021 11 Novlipsa jenaNo ratings yet

- Banking Law RDDocument3 pagesBanking Law RDAditi VatsaNo ratings yet

- BTLP Unit-1Document102 pagesBTLP Unit-1Dr.Satish RadhakrishnanNo ratings yet

- Sip Report 1st Draft PDFDocument35 pagesSip Report 1st Draft PDFSumit AnandNo ratings yet