Professional Documents

Culture Documents

FinMan Unit 2 Tutorial-Financial Statement Analysis Revised Aug2021

Uploaded by

Debbie DebzCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FinMan Unit 2 Tutorial-Financial Statement Analysis Revised Aug2021

Uploaded by

Debbie DebzCopyright:

Available Formats

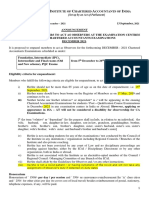

University of Technology, Jamaica

FINANCIAL MANAGEMENT: FIN3001

UNIT 2: FINANCIAL STATEMENT ANALYSIS

Revised August 2021 1|Page

Revised August 2021 2|Page

Revised August 2021 3|Page

FINANCIAL MANAGEMENT TUTORIAL

FIN 3001

UNIT 2: Financial Statement Analysis

1. Why would the inventory turnover ratio be more important when analyzing a grocery

chain than an insurance company?

2. If a firm’s ROE is low and management wants to improve it, explain how using more

debt might help

Use the supplied financial statements for Fontana Limited to answer questions 3 to 9

3. Calculate the firm’s accounts receivable ratio in 2019 and 2020 (assume all sales were on

credit). Are they different? What might have caused the difference?

4. Find the firm’s days sales outstanding (DSO) in 2019 and 2020? (1 year = 365 days)

What accounts for the difference between them?

5. Calculate and interpret Fontana’s return on assets (ROA) for 2019 and 2020. Comment

on the difference.

6. Calculate and interpret the firm’s return on equity (ROE) for 2019 & 2020. Comment on

the difference.

7. What is Fontana’s basic earning power ratio (BEP) for each year? Give an interpretation

of your answers.

8. What is Fontana’s times interest earned (TIE) ratio for 2019 & 2020? Give an

interpretation of your answers.

9. For 2019 & 2020, find Fontana’s (i) current ratio (ii) quick ratio? Interpret your results.

10. Blue Ice Limited has $10B in assets and its tax rate is 25%. The firm’s Basic Earning

Power ratio is 18% and its return on assets (ROA) 12%. What is Blue Ice Limited TIE

ratio?

11. TOS Company has an EPS of $5.00, a book value per share of $30, and a market/book

value ratio of 1.5x. What is TOS’s P/E ratio?

12. Logan Manufacturing currently has $1,000,000 in accounts receivable. Its days sales

outstanding (DSO) is 40 days. It wants to reduce its DSO to the industry average of 25

days by pressuring customers to pay on time. The Chief Financial Officer (CFO)

estimates that average sales will fall by 12% if the policy is adopted. Assuming the firms

achieves the DSO of 25 days and suffers the 12% sales decline, what will be the new

level of accounts receivable? Assume 1 year =365 days

Revised August 2021 4|Page

13. Petland Limited has $8M in sales. Its ROE is 10% and total assets turnover is 2.0 times.

Petland is 70% equity financed. What is its net income?

14. Complete the following balance sheet using the given information: Debt ratio = 40%.

Total assets turnover = 1.8, current ratio = 2.1, DSO = 20 days, gross profit margin

[(sales – cost of goods sold)/sales] = 40%, Inventory turnover ratio = 6. (Assume 360

days)

ASSETS ($) LIABILITIES & EQUITY ($)

Cash Accounts Payable

Accounts Receivable Long-Term Debt 90,000

Inventories Common Stock

Fixed Assets ________ Retained Earnings 102,500

Total Assets 400,000 Total Liabilities & Equity _______

Sales Cost of Goods Sold

Revised August 2021 5|Page

You might also like

- Understanding IFRS Fundamentals: International Financial Reporting StandardsFrom EverandUnderstanding IFRS Fundamentals: International Financial Reporting StandardsNo ratings yet

- FM Unit 2 Tutorial - Finanacial Statement Analysis Revised 2019Document4 pagesFM Unit 2 Tutorial - Finanacial Statement Analysis Revised 2019Tanice WhyteNo ratings yet

- ACCT3203 Week 3 Tutorial Questions Joint Products S2 2022: Product Separable Costs Sales ValueDocument7 pagesACCT3203 Week 3 Tutorial Questions Joint Products S2 2022: Product Separable Costs Sales ValueJingwen YangNo ratings yet

- Week #10 ACCT 3039 Decision MakingDocument3 pagesWeek #10 ACCT 3039 Decision MakingPriscella LlewellynNo ratings yet

- Alam Sbn Bhd intangible assets journal entriesDocument2 pagesAlam Sbn Bhd intangible assets journal entriesPremalatha DevindranNo ratings yet

- Time Value of MoneyDocument10 pagesTime Value of MoneyAbasi masoudNo ratings yet

- Business, Technology & Finance 1Document47 pagesBusiness, Technology & Finance 1Minh NguyenNo ratings yet

- Soal P 7.2, 7.3, 7.5Document3 pagesSoal P 7.2, 7.3, 7.5boba milkNo ratings yet

- Calculate Zurich's taxable income and income taxes payable for 2007Document31 pagesCalculate Zurich's taxable income and income taxes payable for 2007Shah KamalNo ratings yet

- Consolidated statement of financial position for Hever group incorporating associateDocument2 pagesConsolidated statement of financial position for Hever group incorporating associateGueagen1969No ratings yet

- Acca p2 Advance Financial Reporting 2016 BPP PasscardDocument178 pagesAcca p2 Advance Financial Reporting 2016 BPP PasscardCường Lê TựNo ratings yet

- Course Outline of Financial Statement AnalysisDocument4 pagesCourse Outline of Financial Statement AnalysisJesin EstianaNo ratings yet

- Stock Price Number of Shares Outstanding Stock A $ 4 0 2 0 0 Stock B $ 7 0 5 0 0 Stock C $ 1 0 6 0 0Document8 pagesStock Price Number of Shares Outstanding Stock A $ 4 0 2 0 0 Stock B $ 7 0 5 0 0 Stock C $ 1 0 6 0 0likaNo ratings yet

- Unit 2 MANAGEMENT ACCOUNTINGDocument43 pagesUnit 2 MANAGEMENT ACCOUNTINGSANDFORD MALULU100% (1)

- ACCA P2 Corporate Reporting - Mock Exam Answers 1 PDFDocument24 pagesACCA P2 Corporate Reporting - Mock Exam Answers 1 PDFමිලන්No ratings yet

- Exercises Budgeting ACCT2105 3s2010Document7 pagesExercises Budgeting ACCT2105 3s2010Hanh Bui0% (1)

- Maximizing Profits from Running FestivalDocument17 pagesMaximizing Profits from Running FestivalAdnan SiddiquiNo ratings yet

- MGMT3048 - Financial Management IIDocument4 pagesMGMT3048 - Financial Management IIJustine PowellNo ratings yet

- Trade Me analysis reveals stock valuationDocument20 pagesTrade Me analysis reveals stock valuationCindy YinNo ratings yet

- Financial Accounting 2012 Exam PaperDocument28 pagesFinancial Accounting 2012 Exam PaperJane Fondue100% (1)

- Appendix B Solutions To Concept ChecksDocument31 pagesAppendix B Solutions To Concept Checkshellochinp100% (1)

- Black Knights Factory Location Analysis: Building C NPV LowestDocument6 pagesBlack Knights Factory Location Analysis: Building C NPV LowestVịt HoàngNo ratings yet

- Individual Assignment Acct 232 Management Accounting 2Document3 pagesIndividual Assignment Acct 232 Management Accounting 2pfungwaNo ratings yet

- Measuring Financial Position (Balance SheetDocument2 pagesMeasuring Financial Position (Balance SheetjakelakerNo ratings yet

- MA ACCA Sunway Tes Chapter AssessmentDocument434 pagesMA ACCA Sunway Tes Chapter AssessmentFarahAin Fain100% (2)

- ACC 1110 Introductory Managerial Accounting Practice Final ExamDocument24 pagesACC 1110 Introductory Managerial Accounting Practice Final ExamMariela CNo ratings yet

- ACCA F8-2015-Jun-QDocument10 pagesACCA F8-2015-Jun-QSusie HopeNo ratings yet

- CH 4 - End of Chapter Exercises SolutionsDocument80 pagesCH 4 - End of Chapter Exercises SolutionsPatrick AlphonseNo ratings yet

- Managerial FinanceDocument7 pagesManagerial FinanceHafsa Siddiq0% (1)

- UWI Management Accounting Course GuideDocument16 pagesUWI Management Accounting Course Guidemolengene882No ratings yet

- F9 Progress Test 2: Key Financial Calculations for Machine ProjectsDocument3 pagesF9 Progress Test 2: Key Financial Calculations for Machine ProjectsCoc GamingNo ratings yet

- Chapter 6Document26 pagesChapter 6dshilkarNo ratings yet

- Financial Accounting Ifrs 4e Chapter 4 SolutionDocument50 pagesFinancial Accounting Ifrs 4e Chapter 4 SolutionSana SoomroNo ratings yet

- F2 Mock 5Document9 pagesF2 Mock 5deepakNo ratings yet

- Question 75: Basic Consolidation: Profit For The Year 9,000 3,000Document5 pagesQuestion 75: Basic Consolidation: Profit For The Year 9,000 3,000Lidya Abera100% (1)

- Final Examinations Advanced Accounting and Financial ReportingDocument4 pagesFinal Examinations Advanced Accounting and Financial ReportingSheharyar HasanNo ratings yet

- Practice Questions - Ratio AnalysisDocument2 pagesPractice Questions - Ratio Analysissaltee100% (5)

- Limiting Factors & Linear ProgrammingDocument8 pagesLimiting Factors & Linear ProgrammingMohammad Faizan Farooq Qadri AttariNo ratings yet

- CH 4Document6 pagesCH 4Jean ValderramaNo ratings yet

- E-14 AfrDocument5 pagesE-14 AfrInternational Iqbal ForumNo ratings yet

- The Finance Director of Stenigot Is Concerned About The LaxDocument1 pageThe Finance Director of Stenigot Is Concerned About The LaxAmit PandeyNo ratings yet

- Final Exam, s1, 2019 FINALDocument12 pagesFinal Exam, s1, 2019 FINALShivneel NaiduNo ratings yet

- Accounting For ManagersDocument286 pagesAccounting For ManagersSatyam Rastogi100% (1)

- Whether to operate a second production shiftDocument4 pagesWhether to operate a second production shiftMeghan Kaye LiwenNo ratings yet

- F3FFA Chapter 9 TANGIBLE NON CURRENT ASSET.Document31 pagesF3FFA Chapter 9 TANGIBLE NON CURRENT ASSET.Md Enayetur Rahman100% (1)

- Cashflow Statements IAS 7 - P4Document10 pagesCashflow Statements IAS 7 - P4Vardhan Chulani100% (1)

- MG 204 Mid Semester Exam Solutions Sem 1 2017Document5 pagesMG 204 Mid Semester Exam Solutions Sem 1 2017Nileshni DeviNo ratings yet

- Non Current Asset Questions For ACCADocument11 pagesNon Current Asset Questions For ACCAAiril RazaliNo ratings yet

- Consolidated financial statements of Zena GroupDocument27 pagesConsolidated financial statements of Zena Groupbcnxv100% (1)

- Revised Acct 3039 Course GuideDocument20 pagesRevised Acct 3039 Course GuideDaniel FergersonNo ratings yet

- BUSI 353 Assignment #5 General Instructions For All AssignmentsDocument3 pagesBUSI 353 Assignment #5 General Instructions For All AssignmentsTanNo ratings yet

- Tutorial On Ratio AnalysisDocument4 pagesTutorial On Ratio AnalysisRajyaLakshmiNo ratings yet

- Chapter # 8 Exercise & Problems - AnswersDocument8 pagesChapter # 8 Exercise & Problems - AnswersZia UddinNo ratings yet

- 3 - Analysis of Financial Statements 2Document2 pages3 - Analysis of Financial Statements 2Axce1996No ratings yet

- Why Are Ratios UsefulDocument11 pagesWhy Are Ratios UsefulKriza Sevilla Matro100% (3)

- Case Study - Track SoftwareDocument6 pagesCase Study - Track SoftwareRey-Anne Paynter100% (14)

- Concepts Rev Iew and Critical Thinking QuestionsDocument8 pagesConcepts Rev Iew and Critical Thinking Questionsdt0035620No ratings yet

- Chapter 12 Mini Case SolutionsDocument10 pagesChapter 12 Mini Case SolutionsFarhanie NordinNo ratings yet

- DocumentDocument7 pagesDocumentWayne GodioNo ratings yet

- BBA 2004 Business Accounting and Financial ManagementDocument17 pagesBBA 2004 Business Accounting and Financial ManagementUT Chuang ChuangNo ratings yet

- Briefly Explain Three Common Indicators of The Existence of Ergonomic ProblemsDocument1 pageBriefly Explain Three Common Indicators of The Existence of Ergonomic ProblemsDebbie DebzNo ratings yet

- How Is The Current Pandemic Impacting The Lives of Jamaicans?Document2 pagesHow Is The Current Pandemic Impacting The Lives of Jamaicans?Debbie DebzNo ratings yet

- Module Description and OutlineDocument2 pagesModule Description and OutlineDebbie DebzNo ratings yet

- Class Participation Grding RubricDocument1 pageClass Participation Grding RubricDebbie DebzNo ratings yet

- Occupational Safety and HealthDocument252 pagesOccupational Safety and HealthDebbie DebzNo ratings yet

- Article Review Guidelines and QuestionsDocument2 pagesArticle Review Guidelines and QuestionsDebbie DebzNo ratings yet

- Back Injuries Nations 1 Workplace Safety ProblemDocument5 pagesBack Injuries Nations 1 Workplace Safety ProblemDebbie DebzNo ratings yet

- Course OutlineDocument2 pagesCourse OutlineDebbie DebzNo ratings yet

- Occupational Safety and HealthDocument87 pagesOccupational Safety and HealthDebbie DebzNo ratings yet

- Appendix B: Screener For Qualitative Focus Groups: NHTSA: Monroney Label Consumer Research ICR Focus Group ScreenerDocument3 pagesAppendix B: Screener For Qualitative Focus Groups: NHTSA: Monroney Label Consumer Research ICR Focus Group ScreenerDebbie DebzNo ratings yet

- Article Review Grading RubricDocument1 pageArticle Review Grading RubricDebbie DebzNo ratings yet

- Article - The Role of HR in Handling Workplace BullyingDocument14 pagesArticle - The Role of HR in Handling Workplace BullyingDebbie DebzNo ratings yet

- Article - The Role of HR in Handling Workplace BullyingDocument3 pagesArticle - The Role of HR in Handling Workplace BullyingDebbie DebzNo ratings yet

- Add SubmissionDocument1 pageAdd SubmissionDebbie DebzNo ratings yet

- Safety Awareness - QuizDocument14 pagesSafety Awareness - QuizDebbie DebzNo ratings yet

- Article - The Role of HR in Handling Workplace Bullying To SummarizeDocument9 pagesArticle - The Role of HR in Handling Workplace Bullying To SummarizeDebbie DebzNo ratings yet

- Article - The Role of HR in Handling Workplace BullyingDocument14 pagesArticle - The Role of HR in Handling Workplace BullyingDebbie DebzNo ratings yet

- FM Unit 8 Lecture Notes - Capital BudgetingDocument4 pagesFM Unit 8 Lecture Notes - Capital BudgetingDebbie DebzNo ratings yet

- Global Marketing: Ninth EditionDocument41 pagesGlobal Marketing: Ninth EditionDebbie DebzNo ratings yet

- Assessment DatesDocument3 pagesAssessment DatesDebbie DebzNo ratings yet

- GM Tutorial Sheet - SEM 2 2021-22Document4 pagesGM Tutorial Sheet - SEM 2 2021-22Debbie DebzNo ratings yet

- RubricDocument2 pagesRubricDebbie DebzNo ratings yet

- FinMan Unit 6 Lecture-Stock Valuation 2021 S1Document24 pagesFinMan Unit 6 Lecture-Stock Valuation 2021 S1Debbie DebzNo ratings yet

- GM Article Review InstructionsDocument2 pagesGM Article Review InstructionsDebbie DebzNo ratings yet

- FinMan Unit 8 Lecture-Capital Budgeting 2021 S1Document29 pagesFinMan Unit 8 Lecture-Capital Budgeting 2021 S1Debbie DebzNo ratings yet

- FinMan Unit 5 Lecture-Bond Valuation-2021 S1Document42 pagesFinMan Unit 5 Lecture-Bond Valuation-2021 S1Debbie DebzNo ratings yet

- Africa Continental Free Trade AreaDocument4 pagesAfrica Continental Free Trade AreaDebbie DebzNo ratings yet

- FM Unit 7 Lecture Notes - Cost of CapitalDocument2 pagesFM Unit 7 Lecture Notes - Cost of CapitalDebbie DebzNo ratings yet

- FM Unit 7 Lecture Notes - Cost of CapitalDocument2 pagesFM Unit 7 Lecture Notes - Cost of CapitalDebbie DebzNo ratings yet

- FM Unit 6 Lecture Notes - Stock ValuationDocument4 pagesFM Unit 6 Lecture Notes - Stock ValuationDebbie DebzNo ratings yet

- Septi Febriyanti S.SosDocument2 pagesSepti Febriyanti S.SosAJI PANGESTUNo ratings yet

- Pranjal Jain ResumeDocument1 pagePranjal Jain ResumeSanskarNo ratings yet

- Eatigo - Group 10Document4 pagesEatigo - Group 10satyam mishraNo ratings yet

- TAX - Partnership, JV, & Co-OwnershipDocument6 pagesTAX - Partnership, JV, & Co-OwnershipVon Andrei MedinaNo ratings yet

- Chapter 1Document21 pagesChapter 1SABBIR AHMEDNo ratings yet

- AUD689 2019 June SolutionDocument9 pagesAUD689 2019 June SolutionRossa HohoNo ratings yet

- Week 2 Tasks and MilestonesDocument52 pagesWeek 2 Tasks and MilestonesManoranjan8720% (5)

- Ipa-Kim Sing-Yin Swe-Yin PDFDocument16 pagesIpa-Kim Sing-Yin Swe-Yin PDFKO KO LwinNo ratings yet

- Exam 53697Document9 pagesExam 53697Vimal Shroff55No ratings yet

- Question 1Document114 pagesQuestion 1OneNo ratings yet

- Ratio Analysis Missing FiguresDocument1 pageRatio Analysis Missing FiguresFahad Batavia0% (1)

- F6 SMART Notes FA20 Till March-2022 byDocument44 pagesF6 SMART Notes FA20 Till March-2022 byAshfaq Ul Haq OniNo ratings yet

- Tugas 6 - Vania Olivine Danarilia (486211)Document5 pagesTugas 6 - Vania Olivine Danarilia (486211)Vania OlivineNo ratings yet

- Statement Summary: Run24.mx Sapi de CV Statement Date: Statement Period: Billing MethodDocument6 pagesStatement Summary: Run24.mx Sapi de CV Statement Date: Statement Period: Billing MethodnovelNo ratings yet

- Aligarh Muslim University: Faculty of LawDocument8 pagesAligarh Muslim University: Faculty of LawHanzalaahmedNo ratings yet

- Grace Strux Beton PDFDocument33 pagesGrace Strux Beton PDFmpilgirNo ratings yet

- BAMCUP Feasibility StudyDocument48 pagesBAMCUP Feasibility StudyBlessie VillaruelNo ratings yet

- Automotive Test Probe ConstructionDocument4 pagesAutomotive Test Probe ConstructionLy Fotoestudio DigitalcaNo ratings yet

- Knowledge Management in Commercial Banks - A Study of SBIDocument31 pagesKnowledge Management in Commercial Banks - A Study of SBImbsuvarchalambanuNo ratings yet

- LXP RFP For L&D TransformationDocument24 pagesLXP RFP For L&D Transformationnana hariNo ratings yet

- Understanding HypercompetitionDocument10 pagesUnderstanding HypercompetitiongorvNo ratings yet

- Reference Letter For Government EmployeeDocument5 pagesReference Letter For Government Employeee7dh8zb1100% (1)

- Versant English Test Sample Email WritingDocument8 pagesVersant English Test Sample Email Writingrama devi88% (16)

- Industrial Machinery & Tractor TyresDocument2 pagesIndustrial Machinery & Tractor TyresFelipe HernándezNo ratings yet

- Perspectivespaper ESGinBusinessValuationDocument12 pagesPerspectivespaper ESGinBusinessValuationsreerahNo ratings yet

- Understand Your CompetitorsDocument5 pagesUnderstand Your CompetitorsTesfaye NokoNo ratings yet

- Course Code - 102 Course Title-Accounting For Business Decisions 2. Learning Objectives of The CourseDocument29 pagesCourse Code - 102 Course Title-Accounting For Business Decisions 2. Learning Objectives of The Courseavinash singhNo ratings yet

- The Informal Sector and Covid-19 Economic Impacts: The Case of Bahia, BrazilDocument14 pagesThe Informal Sector and Covid-19 Economic Impacts: The Case of Bahia, BrazilYago AlvesNo ratings yet

- Knockoff WorldDocument3 pagesKnockoff WorldPrabhakar RaiNo ratings yet

- 2023 ALS Sustainability ReportDocument104 pages2023 ALS Sustainability ReportRichard NegronNo ratings yet