Professional Documents

Culture Documents

Depository System, What Has Gone Wrong

Uploaded by

AKHIL H KRISHNANOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Depository System, What Has Gone Wrong

Uploaded by

AKHIL H KRISHNANCopyright:

Available Formats

Indian Securities Depository System: What Has Gone Wrong?

Author(s): L. C. Gupta and Naveen Jain

Source: Economic and Political Weekly , May 17-23, 2003, Vol. 38, No. 20 (May 17-23,

2003), pp. 1969-1971+1973-1974

Published by: Economic and Political Weekly

Stable URL: https://www.jstor.org/stable/4413573

JSTOR is a not-for-profit service that helps scholars, researchers, and students discover, use, and build upon a wide

range of content in a trusted digital archive. We use information technology and tools to increase productivity and

facilitate new forms of scholarship. For more information about JSTOR, please contact support@jstor.org.

Your use of the JSTOR archive indicates your acceptance of the Terms & Conditions of Use, available at

https://about.jstor.org/terms

Economic and Political Weekly is collaborating with JSTOR to digitize, preserve and extend

access to Economic and Political Weekly

This content downloaded from

3.6.73.78 on Tue, 12 Oct 2021 08:36:50 UTC

All use subject to https://about.jstor.org/terms

Indian Securities Depository System

What Has Gone Wrong?

Unknowingly and unintentionally, the share depository system is adversely affecting

millions of small investors and also hurting the equity market's growth by causing such

investors to gradually withdraw from the market. This paper attempts to explain

how this has come about and what corrective action is needed.

L C GUPTA, NAVEEN JAIN

and to continue holding paper certificates but this leaves them o

the horns of a dilemma (see below). Also, about 40 per cent

Emerging Problem Areas

listed companies, mainly the smaller ones, have not joined

W hile the depository system eliminates many irritating depository system but, as the traditional trading system has bee

problems and costs (like back-and-forth transmission

almost dismanatled in haste, the shareholders of such compan

of millions of physical share certificates, bad deli-

are also suffering. This has created serious difficulties for mid-si

veries, shares lost or stolen in transit, delay in share and

transfer

small companies in tapping the public market for capital.

registration, etc), it has created some new problems which thesehave

aspects are not being given proper consideration by poli

hurt most of the small investors. As we shall show, the small

makers and regulators concerned with the capital market.

long-term investors are finding the system so costly that they

Empirical data about ordinary investors' attitude towards depo

are tending to quit the equity market in large numbers. toryThe system and its spread among such investors has beco

depository system has belied the expectations raised by it.available

Around through a recent Household Investors Survey organi

the time when the Depositories Act was enacted in 1996 by the Society for Capital Market Research and Developme

to enable

(SCMRD),

the creation of a depository system, the official expectation from jointly with Vivek Financial Focus.4 Our main co

the new system of dematerialisation of securities was expressed

clusions are derived on the basis of this new data, as present

by SEBI in the following words: later in this paper. The sample households covered by the sur

It is expected that as the network of depository participantsrepresent

expands, a wide cross-section of the middle class investors. Det

about the composition of the sample, in terms of income-classw

and the proportion of securities dematerialised in the depository

agewise,

increases, the benefits of reduced risk and lower transaction costs occupation wise and statewise distribution of samp

household,

will extend to the vast majority of market participants and lead is shown in the Appendix Tables Al to A4.

to improved investor protection and service.1 (emphasis added.)

The truth is that the 'vast majority of market participants' have II

been cheated by the depository system. Depository System's Overall Structure in India

The securities depository system was introduced in India towards

Compulsory Demat Needs Reconsiderationthe end of 1996 with the creation of the National Securities

A point to be noted is that share depository serviceDepository

has un- (NSDL) under the sponsorship of IDBI, UTI and N

fortunately not evolved in India as a voluntary commercialSubsequently,

service, in February 1999, a second depository, ca

to be priced attractively for the users but as a compulsoryCentral Depository Services (India) (CDSL), was sponsored

bureaucratic requirement prescribed by SEBI for tradingthe Bombay Stock Exchange. The SEBI Working Group

shares.2

Making demat compulsory and allowing the depositories framework

to for a Depository System, mentioned above,

envisaged a competitive system of multiple depositories bec

exploit their near-monopolistic position by charging whatever

in the

fees they like, is nothing but robbing of the small investors. ThisGroup's opinion, it would be too risky to have a si

is pushing the small investors out of the equity market. depository

Demat in the initial stages (Para 10 of Group's Report).

has never been compulsory in the US. The Working Group, Depositories

set Act 1996, recognised the competitive principl

up by SEBI in 1994, on the legal framework of a depository keeping

system the door open for multiple depositories.

for India,3 had envisaged that "it would be optional for However,

an the bulk of the depository system in India cam

investor to hold and transfer the securities through orbe controlled by NSDL, because, during the period from

outside

vember 1996 up to February 1999 SEBI made trading thro

the depository", although, in long run, the bulk of the securities

depository compulsory and NSDL was the sole depository at

may be held in the depository form. The group also recognised

that "in many cases, investors would be residing at a placetime.

whereThis gave NSDL monopoly power by placing any l

no depository facilities are available and a small investorentrant,

might like CDSL, at enormous disadvantage. The CDSL c

find it costly to transfer the shares through depository." garner only the 'left over' depository business because switc

from one depository to another is too costly to be workabl

Empirical data on the extent of acceptance of the depository

practice.

system among ordinary investors reveals that a vast majority of In this paper, we shall mostly refer to NSDL bec

of its

middle class shareowners in India have preferred not to go for dematdominant and determining role in evolving the syste

Economic and Political Weekly May 17, 2003 1969

This content downloaded from

3.6.73.78 on Tue, 12 Oct 2021 08:36:50 UTC

All use subject to https://about.jstor.org/terms

depository charges. For example, when NSDL initiated a change they pay to NSDL. Many DPs levy several miscellaneous ty

from ad valorem principle to flat rate system in April 2002, the of charges too, such as courier charges, interest and penalt

CDSL had to willy-nilly follow. minimum cash deposit with the DP, etc.

The NSDL levies certain fees from Depository Participants The system of DPs' charges to the investors are a virtual jung

The charges differ a great deal, both with respect to the he

(DPs), who are its agencies for providing depository services to

investors. The investors have direct contact only with the DPs

under which they are made and also with respect to the l

and no contact at all with NSDL. of charges. For this reason, the investors have great difficu

in comparing

Around April 2002, the NSDL changed the basic principle for the charges of various DPs to find out the low

charges

charging fees for the various depository services. Its on overall basis. This makes the whole system v

charges

under the old as well as the new system are shown in opaque

Exhibitand

1. obstructs competition. A few actual examples of

How the new system has affected small and big investors varietywill

of DPs' charges are shown in Exhibit 2. These were pi

be explained a little later by a practical example. Theup from

NSDL hasNSDL's site.

laid down a uniform scale of charges payable by all the DPs for

certain specific depository services (like custody of shareholding, Ill

transaction settlement, pledge creation, etc). In addition, NSDL Inequity of NSDL Charges

collects a blanket or lump sum 'annual fee' from each DP.

The NSDL leaves DPs completely free to decide in what manner

A Fundamental Shift in Depository Charges

and how much they will charge to the investors for the depository

services. Most DPs charge for account opening, account Sincemain-

its inception up to around April 2002, NSDL was fol-

tenance, custody, transaction settlement, pledge creation and

lowing the ad valorem principle for all its fees for each specific

closure, etc. The DPs have to charge to investors substantially

depository service (see Exhibit 1). The new system of its charges

more than what the NSDL charges to DPs in total because

has thrown DPs

out the ad valorem principle and adopted flat rates

have to recover their own operational expenses, besides the fee in custody, per transaction settled, per pledge

per shareholding

created, etc, irrespective of the value involved. How the revision

has affected the small and big investors is brought out in the

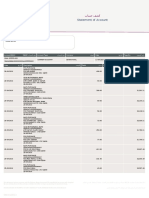

Exhibit 1 following example.

NSDL's Old and New Fee Structure

Fee Type Old Rate of Fees New Rate of Fees A Practical Example

Custody fee 0.01 per cent Rs 6 per annum per

total holding in a company Under the old system, NSDL annually charged a custody fee to

Transaction fee 0.02 per cent Rs 10 per transaction DPs at the advalorem rate of 0.01 per cent of the value of each

(Charged to seller only) (Charged to seller only)

distinct shareholding in one company. Its revised custody fee is

Pledge creation 0.01 per cent Rs 25 per instruction

Pledge closure 0.01 per cent Abolished a flat rate of Rs 6 per holding in one company, irrespective of

Pledge invocation 0.02 per cent Abolished whether the value of the holding is Rs 10,000 or Rs 10 lakh or

Securities 0.02 per cent Rs 25 per instruction

Rs 10 crore. Thus, whereas earlier, NSDL's annual custody fee

borrowing (0.04 per cent

>3 months) for a small shareholding of, say, Rs 5,000 in a company was only

Rematerialisation 0.02 per cent or Rs 10 per certificate Rs 0.50, (i e, 50 paise at 0.01 per cent of Rs 5,000), the new

Rs 10 per Certificate,

whichever higher

system has raised the same to Rs 6, i e, 12 times of the earlier

Annual fee Rs.1 lakh (min) and Rs 1.5 lakh charge. On the other hand, for a large shareholding of, say, Rs 5

Rs 5 lakh (max) lakh in a company, the custody fee has been reduced drastically

Source: NSDLwebsite. by 88 per cent, i e, from Rs 50 under the old system to just Rs

6 under the new flat rate system; for a still larger shareholding of

Rs 1 crore, the annual custody fee has been reduced from Rs 1,000

under the old system to just Rs 6 under the new system, i e, a

reduction of 99.4 per cent. The NSDL seems to have completely

Exhibit 2 lost sight of the equity principle and the needs of small investors.

Charges Made by a Sample of DPs to Investors

Losers and Gainers

(a) Advance deposit of Rs 1200 (valid for 2 years) and account

maintenance charges of Rs 600 pa but no other charges.

(b) Transaction charge 0.04 per cent (min Rs 20) + NSDL's settlement The losers from the revision of NSDL's custody fees are th

charge. small and medium-sized investors, and the gainers are the b

(c) Transaction charge 0.04 per cent (min Rs 20).

(d) Transaction charge 0.02 per cent (min Rs 10) + NSDL settlement investors and big market operators. Presumably, the NSDL saw

charge. an easy opportunity for securing a huge increase in its profit

(e) Rs 15 per transaction + NSDL settlement charge. as it was in a monopoly position. The number of small investor

(f) Transaction charges Rs 16 for value up to Rs 1 lakh and 0.02 per

cent if value exceeds Rs 1 lakh who were effectively locked in by NSDL, runs into millions a

(g) Account maintenance charge on slab basis. hence the profit realised by NSDL from the higher custody a

(h) Account maintenance charge is found to vary among DPs from zero

transaction fees charged to small investors will, on a rough

to Rs 450 per annum, the most common range being Rs 200-300.

(i) Some DPs demand security deposit. estimate, be around at least half a billion rupee. Switching

(j) Some DPs have a policy of cross-selling among their associated

CDSL, which makes no custody charge, was not practicable f

businesses by giving discounts to the favoured customers.

these investors because of high costs of switching. On the oth

hand, the number of large investors is only a few thousands a

1970 Economic and Political Weekly May 17, 2003

This content downloaded from

3.6.73.78 on Tue, 12 Oct 2021 08:36:50 UTC

All use subject to https://about.jstor.org/terms

hence the reduction in the fee realisation from these will be a all income-classes and age-classes are long-term oriented

relatively small amount. On balance, the NSDL will be making shareowners. This is indicated by two sets of data collected

through the survey. One set was based on the expression of

for itself a huge profit at the cost of lakhs of small investors.

The SEBI had appointed a committee in November 2001 on

preference for long-term strategy of investing in shares, and the

'Reduction in Cost for the Investors relating to Demat Opera- second set was based on the frequency of actual buying/ selling

tions'.5 Even before the committee had considered the matter, activity in shares by household investors, as reported by the

the NSDL changed its system of charges from advaloremrespondents

basis to the survey.

Over 60 per cent of the sample households across income-

to a flat rate basis, resulting in raising of charges for all small

investors and reduction for large investors, as already mentioned

classes and age-classes, expressed preference for holding shares

above. The NSDL has tried to justify its new structure of charges

over long periods of several years instead of short-term trading.

by arguing that its own costs were a function of the number of

As regards trading frequency, a little over one-half of the sample

households were found to have undertaken no transaction (neither

transactions and accounts processed and not related to their value.

This may be so, but it cannot be the only consideration. Wesalemust nor purchase) in shares during the whole of preceding 12

also take into account broader considerations, speciallymonths the before the survey in question, implying that they are not

economic effects and equitable sharing of the costs of infrastruc-

frequent traders in shares. In view of the high cost of depository

ture services. The depository service is part of the financial

system for custody purposes alone, an investor, who is not a

infrastructure of the economy. frequent trader, is being quite rational by not going for demat.

The Consumer Education and Research Centre (CERC) of The whole depository system in India seems to have been designed

Ahmedabad collected some feedback from investors about mainly keeping in view the needs of frequent traders and specu-

depository services in order to help the deliberations of the rather

lators SEBI than the needs of long-term investors who may trade

Committee. Apart from numerous irritants faced by investors

only once at

in a while. Perhaps, those who designed the depository

the DP level (e g, delays in demat and procedures not systembeing

were also motivated by the objective of maximising the

investor-friendly), the foremost problem which emergeddepository's

from the income rather than serving the actual needs of the

CERC's survey was the snall investors' complaint about deposi-

clients in the most economical way.

tory charges, as reproduced below:

Dematerialisation should be optional (especially for below par

Data on Spread of Demat among Ordinary Investors

value shares) as small investors find the charges very high. At

times, the cost of the shares is less than the total cost of

The survey findings provide an explanation as to why most

denmaterialisation. Compulsory demat should be abolished and

of the small

transactions should be allowed for physical sale or purchase in and middle-class investors have not gone for demat

case of small investors.6 (Emphasis added) despite demat being made a compulsory requirement for trading

The SEBI Committee brushed aside CERC findings,shares. The main reason is that they don't intend to trade but

and the

Note of Dissent submitted by Manubhai Shah of CERC simply

andhold

as the shares for long term. The survey results

also the objections raised by Kirit Somaiya, MP, whoconclusively

resigned showed that only those who need to trade regularly

or frequently find it worthwhile to join the demat system and

from the committee in protest against raising of depository

charges for the small investors. that too only for those shares in which they want to trade. The

survey

In response to press reports, criticising NSDL's revised found that two-thirds of even those who had opened a

system

of depository charges, the SEBI asked NSDL to review demat account

its did not get all their shareholdings converted to

charges. The NSDL made a very nominal reduction butdemat form but only a part of the holdings (Table 1). This is true

the basic

problem of small investors was left unresolved. across almost all income-classes, as may be observed from Table 1.

We were not able to collect data about individual companies

IV regarding the percentage of their shareholders who still hold

paper certificates. Such percentage is likely to be quite substantial

Adverse Impact of NSDL Charges on Equity

Market's Growth even for the largest companies. SEBI should collect such data

and make it available to facilitate more informed discussion of

This section is based on the data generated by the all-Ini, iathe problem.

Household Investor Survey conducted by the Society for Capital

Market Research and Development during September-OctoberReasons for Not Going for Demat

2002. The survey brought out two inter-related facts, viz, (a) a

majority of middle class households are long-term oriented To a question to the respondents as to why they had not

investors who do not indulge in frequent trading in shares; andconverted all their shareholding into demat, many of them stated

(b) a majority of the middle class shareowners have continuedthat they were long-term holders and hence why should they

to hold paper certificates simply because they find that theunnecessarily pay the high custody and account maintenance

depository system is not cost-effective from the viewpoint of charges annually.

long-term shareholders. Both these behavioral characteristics of We found that less than one-fourth of the total number of

ordinary investors are relevant to the present discussion. shareowners, covered by the SCMRD survey, had all their

shareholdings in demat form. This is true across almost all

income-classes (Table 1). This is a very significant fact because

Long-Term Investors Predominate among

Small Investors it means that even those familiar with the depository system and

processes do not regard it worthwhile to demat all their shares

The SCMRD survey shows that, contrary to the general belief, but only some shares in which they may have to trade. This

between one half to two-thirds of household shareowners across explains why as high as 76 per cent of shareowners in the sample

Economic and Political Weekly May 17, 2003 1971

This content downloaded from

3.6.73.78 on Tue, 12 Oct 2021 08:36:50 UTC

All use subject to https://about.jstor.org/terms

of households continue to hold paper certificates: 36 per cent by NSDL from every DP with the result that many small places

had paper certificates only without having any demat account have no DP and some places have only one DP. This annual flat

and 40 per cent had paper certificates as well as demat account fee discourages the emergence of a new DP as he will take several

for some speculative scrips in which they may like to trade years to develop a sufficient volume of business to be able to

frequently. recover his fixed costs.

The heavy annual custody and account maintenance charges Switching costs for a DP from one depository (say, NSDL)

penalise the small long-term holders of shares and have the effect to another (like CDSL) are heavy and so also are switching costs

of squeezing them out from the equity market. The small investors for an investor from one DP to another. A key deterrent to

are faced with a serious dilemma. On the one hand, if they demat switching depositories is that transferring one's security holdings

the holding, they find that long-term holding of shares in demat from one depository to another depository is wrongly treated as

form is too costly due to annual account maintenance and 'transaction' liable to payment of transaction fee.

custody charges. Both these charges go on cumulating over the J R Varma, a former member of SEBI, has argued that "the

years even when the dividend may be nil or negligible and the key (to competition) is to reduce switching costs for investors

holder is not a short-term trader. On the other hand, if they and depository participants and to ensure fast and easy inter-

continue to hold paper certificates, they will have difficulty in connectivity, for a potential new depository".7 However, in our

selling their holding as and when they want because trading view, what has seriously gone wrong is not just insufficient

arrangements for paper certificates are very inadequate and costly. competition (which, in any case, cannot be unrestricted) but the

Hence, such long-term small investors are gradually quitting the very philosophy guiding the structure of the depository charges,

equity market. as we have specifically pointed out.

It is the numerous small investors who had lent dynamism to

the Indian equity market over the last three decades. Their gradual Coverage Achieved by the Indian

exit has begun to affect the equity market's growth adversely. Depository System

The SCMRD investor survey (Sep-Oct 2002) also showed that

household investors as a whole are tending to reduce their The official claim that almost 99.9 per cent of stock exchange

exposure to equity investment and even the size of shareowning transactions are being settled electronically through the deposi-

population in India has begun to shrink. tory system in India creates a false impression about the reality

The large institutional holders (like FIIs), holding shares worth of coverage achieved by the Indian depository system. Presently,

crores of rupees, now pay a negligible custody charge, as we settlement through the depository system in India represents less

have shown above. Only for the small investors, the new flat than 20 per cent of total stock exchange trades, as more than

rate system of charges has become uneconomical. The NSDL 80 per cent of trading has continued to be non-delivery trading

has completely ignored the needs of these small investors. even after the adoption of rolling settlement system in India. Also,

as we have shown earlier, a majority of small long-term investors

V have remained outside the depository system.

The finding of the household survey that the Indian depository

Concluding Comments

system covers only a small fraction of shareowners is substantia-

ted by the fact that the number of shareholders who have joined the

Competition Not Effective

depository system is only around 40 lakh, whereas the total share-

The NSDL has argued that because of the existence of more owning individuals in India, as per independent estimates pro-

than 300 DPs in the country and two competing depositories, vided by the Society for Capital Market Research and Develop-

there is sufficient competition in the Indian depository system ment and by SEBI-NCAER survey, is around 2 crore.8 Even if we

to keep depository charges down. This argument is fallacious. allow for some consolidation of shareholding by various members

An examination of ground realities shows that competition is of the same family for the purpose of opening a single depository

not working for several reasons. Among these are: an opaque account, it is reasonable to infer that roughly three-fourths of

and confusing system of charges at the DP level; substantial costs ordinary investors in shares have not joined the depository

and hassles for the investor if he wants to change his DP; system. Should this fact not worry our authorities? Should they

insufficient connectivity between the two depositories (NSDL ignore the needs of such a huge number of small middle class

and CDSL); and a heavy annual flat fee of Rs 1.5 lakh charged investors?

Table 1: Per Cent of Shareowners Holding Shares in Demat Form and/or Paper Certificates Form

(Investor Survey of September-October 2002)

Household Income Class

Form of Shareholding All Income- (Household Monthly Income in Rs)

Classes Upto 10,000 10,001-15,000 15,001-20,000 20,001-25,000 Over 25,000

Classification of sample shareowners

(a) Per cent of shareowners who have all their shareholdings

in demat only 23.4 38.2 20.2 17.5 21.6 22.8

(b) Per cent of shareowners who have all their share

in paper certificates only (i e, no demat A/c opened) 36.0 29.4 43.8 43.3 27.5 30.7

(c) Per cent of shareowners having both demat and

paper certificates 40.6 32.4 36.0 39.2 51.0 46.5

Total (a+b+c) 100.0 100.0 100.0 100.0 100.0 100.0

No of shareowners covered (406) (68) (89) (97) (51) (101)

Source: Based on SCMRD survey of household investors.

Economic and Political Weekly May 17, 2003 1973

This content downloaded from

3.6.73.78 on Tue, 12 Oct 2021 08:36:50 UTC

All use subject to https://about.jstor.org/terms

continued parti

Need for Providing Safe-Keeping Depository Service

the market.

Given the Indian situation, our suggestion is that it would be

appropriate for the policy-making and market regulatory authori- Domestic Investors vs Flls

ties to consider the provision of an economical paperless system

for providing purely "safe-keeping" facility for the huge number In our opinion it is the growth of domestic shareownin

of small investors.9 This is an urgent need in the interest of the population which will give inherent strength to our equity marke

whole lot of small- and middle-class investors. Such facility is Hence the growth of domestic shareowners should be emphasis

likely to help in reviving the equity market by encouraging much more than FII portfolio investment which will alway

remain fickle.

Appendix The middle class households have been the backbone of the

Table A 1: Income-Classwise Distribution of Sample Indian equity market over the last three decades. Their withdra

Households

in recent years has weakened the market greatly. Our data sh

Income-Class Questionnaire-1 Questionnaire-2 that a majority of household investors are long-term orient

(Rs per Month) No of Per Cent No of Per Cent This is a healthy feature and ought to be encouraged. Shareown

Respondents Respondents

households in India are just about 4 per cent of the total num

1 Up to 10,000 114 21.47 56 21.54 of Indian households,l? whereas the comparative percentag

2 10,001-15,000 117 22.03 42 16.15

the US is around 50 per cent. Hence, our policies should

3 15,001-20,000 115 21.66 59 22.69

4 20,001-25,000 68 12.81 42 16.15 designed to encourage a greater number of households to inv

5 Over 25,000 117 22.03 61 23.46 in equity shares. Even prime minister Atal Behari Vajpayee h

All income-classes 531 100.00 260 100.00

been strongly urging this but the policy-makers have been una

to get down toof

Table A 2: Age-Classwise Distribution brassHousehold

tacks. New entrants into shareowning

Heads

mostly begin in a small way as small investors only. How

Age Class No of Respondents Per Cent

they begin if the depository system has shut the door for sm

1 Under 30 60 11.30 long-term investors? [i]

2 30 to under 40 144 27.12

3 40 to under 50 165 31.07

4 50 to under 60 101 19.02 Address for correspondence:

5 60 and above 61 11.48 scmrd @bol.net.in

All income-classes 531 100.00

Notes

Table A 3: Occupationwise Distribution of Sample

Occupation No of Respondents Per Cent 1 See SEBI Annual Report, 1996-97, p 20. In May1996, SEBI also notified

1 Govt service 130 24.95

SEBI(Depositories and Participants) Regulations. Following the

2 Other service 190 36.47 notification, National Securities Depository (NSDL) was sponsored by

3 Own business 92 17.66 IDBI, UTI and NSE. The NSDL began its operations in November 1996.

4 Professional practice 42 8.06 2 In January 1998, SEBI had made trading through depository compulsory

5 Retired 61 11.71 for large institutional investors in selected scrips. In January 1999, trading

6 Housewife 6 1.15

through the depository was made compulsory for all investors in selected

All classes 521 100.00

actively traded shares. Only shareholdings upto 500 shares are allowed

Note: Occupational information was available for only 521 out of to be traded in the form of physical certificates but this system is not

531 respondents. working efficiently.

3 The members of the SEBI Working Group on Framework for Depository

Table A 4: Statewise Distribution of Sample Households System were: C Achuttan, L C Gupta, S Murthy and D N Raval. See Report

SI No State/Union Territory No of Respondents Per Cent of the Working Group (August 1994, unpublished), specially para 11.4.

4 The full report of the survey will be published shortly.

1 Andhra Pradesh 33 6.21

5 report of the SEBI Committee on Reduction of Cost for the Investors

2 Assam 11 2.07

3 Bihar 12 2.26

Relating to Demat Operations (1998, unpublished; download from SEBI

web site). The committee had C B Bhave, MD of NSDL as its chairman.

4 Chandigarh 14 2.64

5 Chennai 21 3.95 Other members were: B G Daga (MD of CDSL), B V Goud (MD of

6 Chhattisgarh 1 0.19 Stockholding Corporation), Anand Natarajan (Standard Chartered Bank),

7 Delhi 54 10.17

C Parthasarthy (Karvy Consultants), Kirit Somaiya (MP and president

8 Goa 10 1.88

of Investors' Grievance Forum) and Manubhai Shah (managing trustee,

9 Gujarat 20 3.77 Consumer Education and Research Centre).

10 Haryana 18 3.39

11 Jharkhand 11 2.07 6 The feedback collected by CERC from investors was appended to the

12 Karnataka 45 8.47 Report of the SEBI Committee on Reduction of Depository Cost.

13 Kerala 31 5.84 7 J R Varma, 'Regulatory Implications of Monopolies in the Securities

14 Madhya Pradesh 18 3.39 Industry', IIMA Working Paper Series, No 2001-09-05, September 2001.

15 Maharashtra 45 8.47

8 See SEBI-NCAER Survey of Indian Investors (published by SEBI, June

16 Nagaland 1 0.19

17 Orissa 19 3.58

2000). See also L C Gupta, C P Gupta and Naveen Jain, Households'

18 Pondicherry 12 2.26

Investment Prefrences.: The 3rd All-India Investors' Survey

19 Punjab 25 4.71 SCMRD,2001), specially pp 110-21.

20 Rajasthan 14 2.64 9 It is interesting to note that the Depository Trust and Clearing Corporation

21 Tamil Nadu 30 5.65 (DTCC) of the US provides for the safe-keeping of securities forcustomers.

22 Uttar Pradesh 30 5.65

See News and Information for DTC Customers, October 2002, page 11,

23 West Bengal 56 10.54 attached to its Annual Report, 2001.

Total 531 100.00

10 See Gupta, et al, op cit, pp 120-21.

1974 Economic and Political Weekly May 17, 2003

This content downloaded from

3.6.73.78 on Tue, 12 Oct 2021 08:36:50 UTCTC

All use subject to https://about.jstor.org/terms

You might also like

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Directors Fiduciary Duty To A Company (India)Document19 pagesDirectors Fiduciary Duty To A Company (India)AKHIL H KRISHNANNo ratings yet

- Kerala's Progress in Providing Tap Water Connections Under Jal Jeevan MissionDocument4 pagesKerala's Progress in Providing Tap Water Connections Under Jal Jeevan MissionAKHIL H KRISHNANNo ratings yet

- Ministry of Housing and Urban AffiresDocument1 pageMinistry of Housing and Urban AffiresAKHIL H KRISHNANNo ratings yet

- Ministry of Agriculture and Farmer's WelfareDocument6 pagesMinistry of Agriculture and Farmer's WelfareAKHIL H KRISHNANNo ratings yet

- Probabilistic ThinkingDocument11 pagesProbabilistic ThinkingAKHIL H KRISHNANNo ratings yet

- Global Economic Crisis 2009Document53 pagesGlobal Economic Crisis 2009Mohit GargNo ratings yet

- RT I Springer ArticleDocument20 pagesRT I Springer ArticleAKHIL H KRISHNANNo ratings yet

- Ratification of The 1999 Montreal Convention On Aviation LiabilityDocument4 pagesRatification of The 1999 Montreal Convention On Aviation LiabilityAKHIL H KRISHNANNo ratings yet

- Financial Sector in IndiaDocument15 pagesFinancial Sector in IndiaAnamika Rai PandeyNo ratings yet

- Whether Companies Amendment Act, 2019 Contemplates Dematerialization of Shares For Private Companies?Document2 pagesWhether Companies Amendment Act, 2019 Contemplates Dematerialization of Shares For Private Companies?AKHIL H KRISHNANNo ratings yet

- 44925979Document40 pages44925979Sandeep ChowdhuryNo ratings yet

- The Current State of Financial and Regulatory Frameworks in Asian Economies The Case of IndiaDocument31 pagesThe Current State of Financial and Regulatory Frameworks in Asian Economies The Case of IndiaAKHIL H KRISHNANNo ratings yet

- The Financial Crisis and The Haphazard Pursuit of Financial CrimeDocument32 pagesThe Financial Crisis and The Haphazard Pursuit of Financial CrimeAKHIL H KRISHNANNo ratings yet

- Global Economic Crisis 2009Document53 pagesGlobal Economic Crisis 2009Mohit GargNo ratings yet

- Depository Ordinance, 1995 and Its Implications For Law Relating To Transfer of Securities Under Companies Act, 1956Document7 pagesDepository Ordinance, 1995 and Its Implications For Law Relating To Transfer of Securities Under Companies Act, 1956AKHIL H KRISHNANNo ratings yet

- Corporate Governance in The Wake of The Financial CrisisDocument185 pagesCorporate Governance in The Wake of The Financial CrisisTarun SinghNo ratings yet

- Physical To Demat: A Move From Opacity To Transparency: Vinita Nair Nikita SnehilDocument3 pagesPhysical To Demat: A Move From Opacity To Transparency: Vinita Nair Nikita SnehilAKHIL H KRISHNANNo ratings yet

- A. Indian Evacuation Mission Interrupted. B. Tweet by Mr. Hardeep Singh Puri. C. All Party Meeting To Be Convened TomorrowDocument3 pagesA. Indian Evacuation Mission Interrupted. B. Tweet by Mr. Hardeep Singh Puri. C. All Party Meeting To Be Convened TomorrowAKHIL H KRISHNANNo ratings yet

- Half A Decade of Dematerialisation A ReviewDocument7 pagesHalf A Decade of Dematerialisation A ReviewAKHIL H KRISHNANNo ratings yet

- Note On Malayalam Movie Industry How The Rise in Mapilla Financial Power Has Changed The Face of The Industry 1Document3 pagesNote On Malayalam Movie Industry How The Rise in Mapilla Financial Power Has Changed The Face of The Industry 1AKHIL H KRISHNANNo ratings yet

- Kerala Election Commission Report 1960Document139 pagesKerala Election Commission Report 1960AKHIL H KRISHNANNo ratings yet

- Kerala Election Report 1957Document143 pagesKerala Election Report 1957AKHIL H KRISHNANNo ratings yet

- StatisticalReport Kerala91Document178 pagesStatisticalReport Kerala91bharatNo ratings yet

- Statistical Report General Election, 1970 The Legislative Assembly KeralaDocument162 pagesStatistical Report General Election, 1970 The Legislative Assembly KeralaAKHIL H KRISHNANNo ratings yet

- A. Indian Evacuation Mission Interrupted. B. Tweet by Mr. Hardeep Singh Puri. C. All Party Meeting To Be Convened TomorrowDocument3 pagesA. Indian Evacuation Mission Interrupted. B. Tweet by Mr. Hardeep Singh Puri. C. All Party Meeting To Be Convened TomorrowAKHIL H KRISHNANNo ratings yet

- Statistical Report General Election, 1967 The Legislative Assembly KeralaDocument162 pagesStatistical Report General Election, 1967 The Legislative Assembly KeralaAKHIL H KRISHNANNo ratings yet

- A. Indian Evacuation Mission Interrupted. B. Tweet by Mr. Hardeep Singh Puri. C. All Party Meeting To Be Convened TomorrowDocument3 pagesA. Indian Evacuation Mission Interrupted. B. Tweet by Mr. Hardeep Singh Puri. C. All Party Meeting To Be Convened TomorrowAKHIL H KRISHNANNo ratings yet

- KD Kamathe CaseDocument306 pagesKD Kamathe CaseDivija PiduguNo ratings yet

- CHAPTER-8 Parliamentary PrivilegesDocument67 pagesCHAPTER-8 Parliamentary PrivilegesPRANOY GOSWAMINo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Afar 3Document2 pagesAfar 3Eric Kevin LecarosNo ratings yet

- IAS 2 Inventories Mindmap UpdateDocument1 pageIAS 2 Inventories Mindmap Updatem2mlckNo ratings yet

- Makalah Manajemen Dana (BRI)Document7 pagesMakalah Manajemen Dana (BRI)23253018No ratings yet

- 14W-Ch 16 Capital Structure Decisions - BasicsDocument31 pages14W-Ch 16 Capital Structure Decisions - BasicsMuhammadHammadNo ratings yet

- Questions On Preparation of Financial Statements 1-4Document4 pagesQuestions On Preparation of Financial Statements 1-4LaoneNo ratings yet

- Final AccountsDocument15 pagesFinal AccountsVaishnavi VyapariNo ratings yet

- Auditing and Assurance Services 7Th Edition Louwers Solutions Manual Full Chapter PDFDocument51 pagesAuditing and Assurance Services 7Th Edition Louwers Solutions Manual Full Chapter PDFrickeybrock6oihx100% (11)

- Analysis of Kohinoor Chemical Company's Financial Performance and Stock ValuationDocument13 pagesAnalysis of Kohinoor Chemical Company's Financial Performance and Stock ValuationShouvoRahamanNo ratings yet

- Financial Reporting I - Final Exam 2Document2 pagesFinancial Reporting I - Final Exam 2MohammedBahgatNo ratings yet

- Buyback of Shares As Poison PillDocument17 pagesBuyback of Shares As Poison PillupendraNo ratings yet

- Working Capital ManagementDocument84 pagesWorking Capital ManagementGuman SinghNo ratings yet

- AFAR Test BankDocument57 pagesAFAR Test BankandengNo ratings yet

- Cost Residual Value Dapriciable Amount Useful Life Building Machinery EquipmentDocument14 pagesCost Residual Value Dapriciable Amount Useful Life Building Machinery EquipmentcharlottevinsmokeNo ratings yet

- 12 - Incomplete Record - With - AnswerDocument13 pages12 - Incomplete Record - With - AnswerAbid faisal AhmedNo ratings yet

- GSX Annual Report 2019Document195 pagesGSX Annual Report 2019happy daysNo ratings yet

- DA4139 Level II CFA Mock Exam 1 AfternoonDocument34 pagesDA4139 Level II CFA Mock Exam 1 AfternoonIndrama Purba100% (1)

- Kpit TechnologiesDocument7 pagesKpit TechnologiesRanjan BeheraNo ratings yet

- Lambert Department Store Is Located in Midtown Metropolis During TheDocument1 pageLambert Department Store Is Located in Midtown Metropolis During Thetrilocksp SinghNo ratings yet

- Introduction To AccountingDocument57 pagesIntroduction To AccountingJustine MaravillaNo ratings yet

- Advantages and Disadvantages of IFRSDocument2 pagesAdvantages and Disadvantages of IFRSraylan02300No ratings yet

- Bank Management Koch 8th Edition Test BankDocument12 pagesBank Management Koch 8th Edition Test BankKenneth EbertNo ratings yet

- Phillips CarbonDocument14 pagesPhillips CarbonKrishnamoorthy SubramaniamNo ratings yet

- Ipo DocumentDocument16 pagesIpo Documentalan ruzarioNo ratings yet

- Statement of AccountDocument5 pagesStatement of AccountabdoNo ratings yet

- Responsiveamguide PDFDocument586 pagesResponsiveamguide PDFNader OkashaNo ratings yet

- 2021 UTS JawabanDocument8 pages2021 UTS JawabanAdam FitraNo ratings yet

- Solution Manual For Financial Acct2 2nd Edition by GodwinDocument36 pagesSolution Manual For Financial Acct2 2nd Edition by GodwinArielCooperbzqsp100% (83)

- Effects of Working Capital Management On SME Profitability: Evidence From An Emerging EconomyDocument11 pagesEffects of Working Capital Management On SME Profitability: Evidence From An Emerging EconomyHargobind CoachNo ratings yet

- Mutual Fund Report Feb-20Document39 pagesMutual Fund Report Feb-20muddasir1980No ratings yet

- Article IFRS 3 Business Combinations PDFDocument14 pagesArticle IFRS 3 Business Combinations PDFEhsanulNo ratings yet