Professional Documents

Culture Documents

Axis Bank - Initiating Coverage (Keynote Capitals)

Uploaded by

DenilOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Axis Bank - Initiating Coverage (Keynote Capitals)

Uploaded by

DenilCopyright:

Available Formats

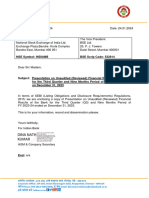

K E Y N O T E

INSTITUTIONAL RESEARCH

Initiating Coverage

January 18, 2011

Axis Bank Ltd.

Hetal Shah, Analyst

(hetal@keynoteindia.net)

(+9122-30266059)

Keynote Capitals Institutional Research is also available on

Bloomberg KNTE <GO>, Thomson One Analytics, Reuters Knowledge, Capital IQ, TheMarkets.com and securities.com

Keynote Capitals Institutional Research - winner of “India’s Best IPO Analyst Award 2009" by MCX-Zee Business

K E Y N O T E

Axis Bank

Easy Access to Customers… January 18, 2011

Key Stock Data Axis Bank Ltd. (formerly known as UTI Bank Ltd.) incorporated in 1994 is one of the

new generation private sector banks, which has established a track record of expanding

Sector Private Bank

its business at a faster pace than the industry. The bank was jointly promoted by the

CMP `1227.55

Specified Undertaking of the Unit Trust of India (SUUTI), Life Insurance Corporation

52-wk High / Low `1608/967.15 (LIC), General Insurance Corporation (GIC), and other four PSU insurance companies

Market Cap `497.36bn i.e. National Insurance Company Ltd., The New India Assurance Company Ltd., The

($10931mn) Oriental Insurance Company Ltd. and United India Insurance Company Ltd. In terms

Avg 6m daily vol. 212003 of asset size and market capitalization, Axis Bank ranks third amongst the private

BSE Sensex 18882.25 sector banks and has got a network of 1120 branches/ extension counters, 5303

ATM’s as of Dec-10 across India and international presence in Singapore, Hong

Reco ‘Buy’

Kong and Dubai. It has five wholly-owned subsidiaries namely, Axis Securities and

TP `1415

Sales Ltd., Axis Private Equity Ltd., Axis Trustee Services Ltd., Axis Asset Management

Company Ltd. and Axis Mutual Fund Trustee Ltd.

Stock Codes

¾ Diversified loan book with highly rated Corporate and mid-corporate advances

Bloomberg Code AXSB.IN

constituting more than 50% of the total advances.

Reuters Code AXBK.BO

BSE Code 532215

¾ Healthy CASA ratio of ~44% provides respite to cost of funds and likely to sustain

NSE Code AXISBANK NIM in coming years.

Face Value `10per share

¾ Growth in core business revenues, fee income and better cost efficiency measures

Shareholding Pattern (30th Sept, 2010)

will enhance bank’s earnings quality.

¾ The bank is well capitalized and in a position to meet lending targets. The core

operating performance and growth is expected to increase ROE and ROA in

Others

20.8% future.

Promoter

DIIs 5.3% 37.4%

¾ The asset quality of the bank is comfortable and has been maintained consistently,

resulting in reduction of gross and net NPA ratios.

FIIs

36.6%

¾ An all-share deal worth `2067cr with one of India’s leading financial services

firm, Enam Securities Ltd would enhance positive synergies in future.

Price (continued...)

Price Performance

Performance (%)

(%)

1 Mth 3 Mths 6 Mths 1 Yr Key Financials `Cr)

(`

-6.2% -18.5% -9.7% 13.9%

Particulars FY08 FY09 FY10 FY11E FY12E

Price

StockPerformance

Price Performance (%) Advances 59661.15 81556.76 104343.12 128488.92 149564.34

Outperformance of Axis Bank vis-a-vis Deposits 87626.22 117374.11 141300.22 163908.26 186035.87

BSESENSEX & BANKEX

175% NII 2585.35 3686.21 5004.49 6785.06 8593.25

150% Total Income 8800.80 13732.36 15583.80 19313.85 23376.91

125% Profit after Tax 1071.03 1815.36 2514.53 3283.51 3907.71

100% EPS (`) 29.94 50.57 62.06 80.11 93.37

75% Book Value (`) 245.13 284.53 396.00 453.82 517.49

50% Adjusted Book Value (`) 238.19 275.41 385.66 442.57 505.52

Jan-10

Feb-10

Jun-10

Jan-11

Aug-10

Sep-10

Apr-10

Jul-10

Oct-10

Dec-10

Mar-10

May-10

Nov-10

RONW (%) 17.6% 19.1% 19.2% 19.0% 19.4%

ROA (%) 1.2% 1.4% 1.5% 1.7% 1.7%

Axis Bank BSESENSEX BSEBANKEX

(E- Keynote Capitals Institutional Research Estimates)

2 Keynote Capitals Institutional Research

K E Y N O T E

The key concerns are:

a) Any possible rise in NPAs could see higher provisions than estimated, and may impact

profitability and ROE.

b) Competition from other private banks.

At CMP of `1227.55, the stock is trading at 3.2x FY10 price to adjusted book and is expected

to trade at 2.8xFY11E and 2.4xFY12E price to adjusted book. Considering the overall growth

prospects of the bank, we recommend a 'Buy', assigning a multiple of 2.8x FY12E price to

adjusted book to arrive at the target price of `1415 per share for a period of one year.

Investment Rationale:

1. Healthy Advances growth:

The Bank’s loan book grew at a CAGR of 46.2% stands at `104343cr during FY06-10. With

revival in the macro-economic conditions, we expect momentum in loan growth to continue in

future. The banking industry will register the loan growth largely driven by increase in

consumption demand and infrastructure activities.

The growth of bank’s loan book clearly surpasses the industry and other banks. It grew by

39.1% (yoy) in 1QFY11, 36.5% (yoy) in 2QFY11 and 45.7% (yoy) in 3QFY11 and is expected

to increase by 23.1% in FY11E.

Chart 1

Advances yoy growth more Advances yoy growth (%)

than the industry and other

banks 60% Axis Bank

50%

40%

Public Sector Banks

30%

20% Industry

10%

New Private Sector Banks

0%

Aug-09

Apr-10

Aug-08

Apr-09

Dec-09

Jun-08

Oct-08

Dec-08

Feb-09

Jun-09

Oct-09

Feb-10

Jun-10

Axis Bank Public Sector Banks

New Private Sector Banks Industry

(Source: RBI & Keynote Capitals Institutional Research)

Increase in CD ratio more than the industry average indicates strong demand in credit

disbursement compared to deposit mobilization. The same trend is expected to be continued

in FY12E at 80.4%, leading to better yield on advances and improvement in utilization of

funds.

Keynote Capitals Institutional Research 3

K E Y N O T E

Chart 2

Business Mix

200000 100%

180000

160000 78.4% 80.4%

73.8% 80%

140000 68.1% 69.5%

`Cr

120000 62.7%

100000 55.6% 60%

80000

60000

40%

40000

20000

0 20%

FY06 FY07 FY08 FY09 FY10 FY11E FY12E

Advances Deposits CD Ratio

(E: Keynote Capitals Institutional Research Estimates)

The bank has a well-diversified loan book with large & mid corporate loan book accounting for

50% of the loan portfolio. It is seen from the past trend that its overall loan mix will not witness

any significant change and will remain focused on growing its retail loan book in future. It is

expected that its retail loan portfolio to increase ~22% by FY12E, on account of the surge in

demand in retail credit within sectors like home loans, auto loans etc.

Chart 3

The bank is more focusing on Loan Book

loan book expansion in large

100%

and mid-corporate segment

90% 22.8% 19.7% 20.0% 19.8% 22.3%

80%

9.2% 10.1% 11.1% 11.3% 11.5%

70%

60% 19.3% 19.7% 18.7% 16.5% 16.3%

50%

40%

30%

48.7% 50.5% 50.3% 52.5% 50.0%

20%

10%

0%

FY08 FY09 FY10 FY11E FY12E

Corporate & Mid Corporate Advances MSME Agriculture Retail Credit

(E: Keynote Capitals Institutional Research Estimates)

As of Sept-10, the share of corporate loans to the total portfolio increased to ~57% on account

of the one?off lending to the telecom and infrastructure sector. Going forward it is expected

that the share of corporate loans to the total portfolio will decrease and stabilize around 50%.

The Corporate, SME and Agriculture loan book is well diversified with maximum exposure in

Financial companies of 12.7% followed by 11.6% in Infrastructure as of Dec-10. Out of the

total Corporate advances of the bank, the high rated loan book constitutes around 73% as of

Dec-10, having advantage of low risk through a diversified loan book.

4 Keynote Capitals Institutional Research

K E Y N O T E

Industry-wise exposure Sep-10

Financial Companies 12.7%

Infrastructure 11.6%

Power Generation & Distribution 9.7%

Well diversified and high-rated Metal & metal products 7.9%

loan book Engineering incl. electronics 6.1%

Telecommunication Services 5.0%

Trade 4.7%

Real estate 3.7%

Petrochemical & Petroleum Products 3.5%

Food processing 3.4%

Others 31.6%

(Source: Company & Keynote Capitals Institutional Research)

Amongst the leading new private players, Axis bank's Retail loans as percentage to gross

Advances stands lowest at 19% at the end of Sept-10, and has highest proportion of home

loans (secured loans), at 73%.

Retail and home loans of three largest new private banks `Cr)

(`

Axis Bank HDFC Bank ICICI Bank

Particulars

FY08 FY09 FY10 FY08 FY09 FY10 FY08 FY09 FY10

Retail Loans 13592 16052 20823 39327 61154 69994 131663 106972 77918

% to gross Advances 22.8% 19.7% 20.0% 58.1% 61.0% 55.0% 58.4% 49.0% 43.0%

Housing Loans 7747 10434 14743 - 3500 8700 68741 57765 46751

% to Retail loans 57.0% 65.0% 70.8% - 5.7% 12.4% 52.2% 54.0% 60.0%

(Source: Company & Keynote Capitals Institutional Research)

Under the Retail loan category, auto loans have been consistently maintained at 13% between

FY08-10. The bank's focus on secured loans i.e. housing and auto loans are likely to be

enhanced.

Chart 4

Retail Loans break-up (%)

FY10 FY11E FY12E

2.2% 2.5% 2.8%

9.5% 4.2% 9.3% 4.0% 9.3% 3.8%

13% 13.3% 13.5%

13.3% 70.5% 13.8% 14%

70.8% 70.3%

0.3% 0.5% 0.5%

Housing Loans Personal Loan Cards Non-schematic Passenger cars Commercial vehicle

(E: Keynote Capitals Institutional Research Estimates)

Keynote Capitals Institutional Research 5

K E Y N O T E

2. Deposit Mix:

During FY06-10, the bank's deposit grew at a CAGR of 34.8% (`141300cr), current deposit at

35.1% (`32167.7cr) and savings deposit grew at 47.3% (`33861.8cr).

Chart 5

Deposit Mix (%)

100% 48%

90% 45.7%

80% 46%

46.7%

70% 44.0%

44%

Branch expansion to 60%

strengthen the CASA ratio 50% 43.2% 43.0% 42%

40%

40%

30%

40.0% 39.9%

20% 38%

10%

0% 36%

FY06 FY07 FY08 FY09 FY10 FY11E FY12E

Current Deposits Savings Deposit

Term Deposits CASA Deposits

(E: Keynote Capitals Institutional Research Estimates)

CASA deposits grew at a CAGR of 40.5% stands at `66029.54cr over FY06-10, reporting a

CASA ratio of 46.7% in FY10. It outpaced the CAGR growth of term deposit of 30.8% which

stands at `75270.7cr for the same period. The management is continuously focusing on

improving its CASA deposits and thereby reducing its cost of funds. Due to progress in Branch

expansion activities, the remarkable achievement has been made in improving the CASA

ratio.

The bank seize the opportunity to increase the business through expansion of distribution

network to various customers whereby promote the Retail, Agriculture & SME segments

including the sale of third party products. The Bank crossed a landmark in Mar-10 by opening

its 1000th branch in Mumbai and is now present in all States and Union Territories (except

Lakshadweep) and is pioneer in ATM sharing arrangements. The distribution network covers

734 centres in India and 4 centres in overseas as on Dec-10.

Chart 6

Network

6000

5350 5500

5000

4293

4000 3595

3000 2764

2341

2000 1891

1360

835 1035 1210

1000 671

450 561

0

FY11E

FY12E

FY11E

FY12E

FY08

FY09

FY10

FY07

FY08

FY06

FY07

FY06

FY09

FY10

Branches ATMS

(E: Keynote Capitals Institutional Research Estimates)

6 Keynote Capitals Institutional Research

K E Y N O T E

Further, the process of spreading to overseas network has already been initiated by opening

foreign branches in major financial hubs in Asia i.e. Singapore, Hong Kong and Dubai, and

representative offices at Shanghai and Dubai, and strategic alliances with banks and exchange

houses in the Gulf Co-operation Council (GCC) countries. While the branches at Singapore,

Increase in branch and ATMs

networking in domestic and Hong Kong and DIFC-Dubai enable the bank to partner with Indian corporates doing business

overseas countries. globally, the Dubai Representative Office and the arrangement with GCC based banks and

exchange houses provides access to the NRI population. The Shanghai Representative Office

apart from providing presence in the key market of China fulfills the regulatory requirement of

establishing a branch in course of time to enhance the ability of the bank to tap business

opportunities emanating from that region. As on Dec-10, the total assets works out to 4.59bn

USD through overseas operations.

Chart 7

No of branches-FY10 (1035)

6%

31%

25%

38%

Metro 326 Urban 389 Semi-urban 256 Rural 64

(E: Keynote Capitals Institutional Research Estimates)

During FY10, the bank has a network of 1027 branches and 8 extension counters and targets

to add ~200 branches to its network in this fiscal, thereby supporting CASA growth in future

which will reduce the overall cost of funds in an increasing interest rate cycle and support

NIM. We expect CASA ratio to be sustained at ~44.5% and thus resulting an increase in

CASA per branch in coming years.

Chart 8

`Cr)

Casa per branch (`

70

63.80

65

59.65 60.65 60.19

60 58.25

55

Enhancement in CASA per 50

branch in future 45 41.77

40

35.63

35

30

FY06 FY07 FY08 FY09 FY10 FY11E FY12E

(E: Keynote Capitals Institutional Research Estimates)

Keynote Capitals Institutional Research 7

K E Y N O T E

Highest CASA per branch among the three largest bank:

Particulars Axis Bank HDFC Bank ICICI Bank

FY09 FY10 FY09 FY10 FY09 FY10

CASA (`Cr) 50643.7 66029.5 63359.7 87103.9 62667.8 84215.8

Branches 835 1035 1412 1725 1438 1741

Casa per branch (`Cr) 60.65 63.80 44.87 50.50 43.58 48.37

(Source: Company & Keynote Capitals Institutional Research)

3. Net Interest Income and NIM:

The bank posted strong growth in NII at a CAGR of 46.9% stands at `5004.49cr during

FY06-10, on account of robust growth in loans and advances. Enhancing NII will be continued

for another few quarters inspite of rise in the cost/ average asset. The low proportion of retail

loans has resulted better fee income to asset among its peers.

Particulars Axis Bank HDFC Bank ICICI Bank

FY09 FY10 FY09 FY10 FY09 FY10

NII to average asset 2.9% 3.0% 4.7% 4.1% 2.1% 2.2%

Fee to average asset 1.9% 1.8% 1.9% 1.7% 1.7% 1.5%

Cost to average asset 2.2% 2.3% 2.6% 2.8% 1.8% 1.6%

(Source: Company & Keynote Capitals Institutional Research)

Chart 9

Return Ratios

12%

9.4% 9.7%

10% 8.7% 9.0% 9.1%

8%

NII growth and NIM expansion 6.4%

are likely to be key earnings 5.9%

6% 5.1% 4.9%

drivers in FY12E. 4.8%

4%

3.5% 3.8% 3.5% 3.5%

2% 3.3%

0%

FY08 FY09 FY10 FY11E FY12E

Net Interest Margin (NIM) Yield on Advances Cost of Deposits

(E: Keynote Capitals Institutional Research Estimates)

Savings deposits growth has been maintained above 30% during the past five quarters,

supporting the rapid expansion in NIM. Higher CASA ratio and re-pricing of advances enabled

the bank to reduce the cost of funds and increase the yields which supported NIM in FY10.

The bank reported a NIM of 3.8% in FY10, 3.7% in 1QFY11 & 2QFY11 and 3.8% in 3QFY11.

Increase in policy rates has led to the marginal increase in deposit rates and stable yield on

advances due to adequate liquidity in the system, which will put some pressure on NIM in

the short run. However, as demand for credit picks up, yield on advances will improve, as

banks will be in a better position to be able to pass on the increase in interest rates to the

borrowers. Furthermore, introduction of base rate will result in banks withdrawing the flow of

advances to Corporates for the short term at lower interest rates, indicating an upward direction

for lending rates. Hence, yields on advances are expected to pick up from the 2HFY11,

enabling the bank to maintain its NIM guidance of 3.5% going forward.

8 Keynote Capitals Institutional Research

K E Y N O T E

4. Earnings Quality:

a. Non-Interest income:

The bank's earnings are evenly distributed between core interest income and the non-

interest income. Its non-interest income grew at a CAGR of 56.8% stands at `3945.78cr

over FY06-10. Though the bank is maintaining its non-interest income as a proportion

of total income above 40%, we may expect a marginal decrease due to more focus on

core banking in coming years.

Chart 10

Return Ratios

16000 44.0% 44.1% 45%

14000

43%

12000

40.8% 41.0%

10000 40.4% 41%

`Cr

8000 39.0%

6000 39%

37.4%

4000

37%

2000

0 35%

FY06 FY07 FY08 FY09 FY10 FY11E FY12E

Net Total Income Non Interest Income/ Net Total Income

(E: Keynote Capitals Institutional Research Estimates)

The bank earns non-interest income from fee income and trading profits. It has developed a

strong and diversified fee-income stream to complement its core lending operations and

ensure less volatility in the overall fee-income. It has healthy deposits franchise and leadership

position in debt syndication, augmenting its position to leverage the spread and fee-income

opportunity from infrastructure and capex-related credit demand. In FY11, banks are likely to

get negatively impacted due to rise in bond yields, which may lead to mark-to-market loses

in the available for sale (AFS) and held for trading (HFT) portfolio. As of Dec-10, out of the

total investment portfolio, the bank's AFS and HFT portfolio constitutes 36.6% and 3.3%

respectively, making the investment portfolio susceptible to increase in yields. However, its

less dependence on volatile treasury profits (constitutes only ~18% of the non-interest income)

reflects the quality and stability of non-interest income.

Chart 11

Non-Interest Income break-up

90% 83.2% 84.5% 82.3%

79.5%

80% 74.1%

70%

60%

50%

40%

30%

20.8%

20% 12.9% 15.2% 13.0%

11.8%

10% 5.0% 5.1% 5.3% 4.7%

2.6%

0%

FY08 FY09 FY10 FY11E FY12E

Fee Income Trading Profit Misc Income

(E: Keynote Capitals Institutional Research Estimates)

Keynote Capitals Institutional Research 9

K E Y N O T E

The bank derives majority of its fee income from Large & Mid Corporate and Retail segments.

In the corporate segment, fee income is generated from cash management services, forex

services, merchant banking services and debt syndication. In the Retail segment, the bank

earns fee income by selling third party products, processing fees, debit and credit cards.

Also earns fee income from Treasury, Agriculture & SME Banking, Business Banking and

Capital Market segments.

Chart 12

Fee Income break-up

100%

90%

31.5% 30.7% 27.6% 29.5%

80% 37.0%

70% 2.0% 1.7%

9.5% 10.2% 8.8%

60% 9.4% 15.0% 4.4%

11.5% 7.8%

50% 12.4%

14.0% 7.7% 18.1% 21.2%

40%

8.6% 8.6%

30% 15.9%

14.1% 14.2%

20%

34.3% 34.5%

10% 18.2% 24.6%

16.8%

0%

FY08 FY09 FY10 FY11E FY12E

Large & Mid Corporate Credit Treasury Agri & SME

Business Banking Capital Markets Retail Business

(E: Keynote Capitals Institutional Research Estimates)

The fee income from Corporate and Retail business is expected to grow due to the various

programmes undertaken by the bank which are as follows:

1. Restructuring of Retail Banking into two groups namely; Mass and Mass Affluent and

Affluent segments in order to become more customer-centric, rather than product-centric.

2. Addressing the needs of the Mass Affluent segment and also to take the Priority Banking

to a larger set of customers and locations. The Bank has set up 11 new Priority Lounges

during FY10 (in 3 new centres) in the country.

3. Being the fourth largest debit card issuer in the industry with a base of 147 lac debit

cards issued till 31 March 2010, it has designed 14 variants cards for different customer

segments.

4. First to launch a Platinum Chip Debit Card in the country, and is presently offered

exclusively to the Priority Banking customer segment. In the prepaid cards market, the

Bank has attained a leadership position offering a bouquet of products suited to a variety

of needs.

5. Focuses on distribution of third party products, with a special thrust on mutual funds

and Bancassurance and is a leading distributor of mutual funds in the country, adding

90,000 new customers in FY10.

6. Continuing to retain its leadership position in the infrastructure debt market and

syndication of debt issues.

b. Rise in Operating expenses:

The bank managed to reduce the cost to income ratio (41.4%) over the years through

implementation of CBS across its branches. Branch expansion plans in another couple of

10 Keynote Capitals Institutional Research

K E Y N O T E

years may stabilize the cost to income ratio at ~44%. However, it has maintained higher

operating efficiency (measured by cost to income ratio) compared to its peers, enabling to

increase its earning’s quality.

Chart 13

Better cost efficiencies Cost to Income ratio (%)

leading to increase in

productivity ratios and 75% 69.4%

68.7%

profitability

50% 44.1%

41.4%

25%

0%

Axis Bank HDFC Bank Kotak ICICI Bank

(E: Keynote Capitals Institutional Research Estimates)

Hence, the healthier core business growth, increase in fee income and higher operating

efficiency will lead to the better profitability in future.

5. Adequately capitalized to support earnings quality:

The bank is well capitalized and in a position to meet lending targets in coming years. It has

been raising sufficient capital at regular intervals to ensure growth in its balance sheet.

During FY10, the bank had undertaken a Qualified Institutional Placement (QIP), follow-on

Global Depositary Receipt (GDR) issue and preferential allotment to raise capital amounting

to `3816.14cr and consequently increased its Capital Adequacy Ratio (CAR) in FY10. The

infusion of Tier I capital would facilitate to raise Tier II capital in future, which will further

reinforce CAR and enable the bank to grow its loan book and capitalize on emerging growth

opportunities. At the end of 2QFY11, CAR stood at 13.68% and tier I ratio was 9.77%, well

above the required regulatory limit.

Capital Structure FY06 FY07 FY08 FY09 FY10

Tier I Ratio 7.3% 6.4% 10.2% 9.3% 11.2%

Tier II Ratio 3.8% 5.2% 3.6% 4.4% 4.6%

Total Capital Ratio 11.1% 11.6% 13.7% 13.7% 15.8%

(Source: Company & Keynote Capitals Institutional Research)

The bank has a higher return on average equity (ROE) and return on average assets (ROA)

of ~19.2% and 1.5% respectively, during the financial year ending 2010. In FY11, we expect

ROA to sustain at this levels and ROE to decline marginally to 19.0% on account of slippages

from restructured loan portfolio and dilution in equity following the capital raised worth

`3816.14cr in 2QFY10. Nevertheless, we expect return ratios to improve in FY12 on growth

momentum in loan book and higher margins.

Keynote Capitals Institutional Research 11

K E Y N O T E

Chart 14

Return Ratios (%)

24% 2%

1.7% 1.7%

1.5%

22% 1.4%

2%

20% 1.2%

18% 1%

16%

1%

14%

12% 0%

FY08 FY09 FY10 FY11E FY12E

ROE (%) ROA (%)

(E: Keynote Capitals Institutional Research Estimates)

The potential in corporate loan growth and momentum in capital market enhance the fee

income prospects to achieve the upturn in return ratios by the financial year ending 2012.

6. Stable Asset Quality:

The asset quality of the bank is comfortable with gross and net NPA ratios of 1.2% and 0.3%

respectively, as of Dec-2010. Provision coverage stands at 91.4% including technical write-

offs well above RBI's mandate of 70%. We expect the same to continue and the gross and

net NPA ratio may be maintained around 1.2% & 0.3% respectively, in another couple of

Restructuring exercise paved years.

the way to improve the asset Chart 15

quality

`Cr)

Asset Quality (`

2000 91.0% 92%

90.5%

1800

88.6% 90%

1600

1400 88%

1200 85.3%

86%

1000

800 82.8% 84%

600 82%

400

80%

200

0 78%

FY08 FY09 FY10 FY11E FY12E

Gross NPA Net NPA Provision Coverage

(E: Keynote Capitals Institutional Research Estimates)

Sequentially, the slippage

ratio has broadly been The bank's restructured loan portfolio aggregates to `2286.10cr as on FY 2010 or 2.0% of

declining to 1.7% in2QFY11

from 2.2% in FY2010 gross advances. Of which, Large & Mid-Corporate credit comprises of 69.3%, SME and

Agriculture loans consists of 21.1% and 6.1% respectively and Capital Markets comprises of

3.5%. The bank faces the risk of slippages from its restructured loan portfolio, particularly

from the SME and agricultural segment which can improve the NPAs. The higher provision

coverage will enable the bank to maintain the NPA levels going forward.

12 Keynote Capitals Institutional Research

K E Y N O T E

Segment-wise non-performing assets (as of FY10)

Particulars % of NPAs to total advances in that sector

Agriculture and allied activities 2.3%

MSME 1.0%

Services 0.7%

Personal Loans 1.9%

(Source: Company & Keynote Capitals Institutional Research)

7. Positive Synergies expected from tie-up with ENAM Securities Ltd in coming years:

Axis Bank has entered into an all-share deal worth `2067cr with one of India’s leading financial

services firm, Enam Securities Ltd, following which the investment banking, corporate advisory

services and equity distribution business of the latter will be merged with the bank’s wholly-

owned subsidiary. As part of the deal, Enam Securities will enter into a five-year non-compete

agreement with Axis Bank and the bank will have the right to use the Enam brand name for

two years. However, ENAM will retain its AMC, PMS and insurance broking business and

will be free to compete with Axis Bank.

The Key points of the deal are as follows:

• The Shareholders of Enam Securities will own 3.3% equity stake in Axis Bank post the

deal.

• The Co-founder and Chairman of Enam Securities will get a position on the board of the

bank as an independent director, while one the key Director of Enam Securities will

become the MD & CEO of the new subsidiary.

• However, the deal required an approval of the Shareholders, Reserve Bank of India

(RBI), the Securities and Exchange Board of India and the High Courts of Gujarat and

Mumbai and is expected to be completed in 4-6 months.

The Synergies involved therein:

The bank is a dominant player in placement and syndication of debt issues and arranged

debt aggregating `20330cr during 3QFY11. It was assessed by Prime Database as the No.1

Debt Arranger for the quarter ending June-10 and also by Bloomberg Underwriter league

table for the period Jan-10 to Sep-10. Further, it was awarded the "Best Domestic Debt

House in India" 2010 by Asiamoney and "Best Bond House in India" 2010 by Finance Asia

and Euromoney. It lacks expertise in Institutional Broking and Investment Banking and was

low on the league tables whereas Enam bagged the third place with a market share of 9.3%

in the Indian domestic equity and rights issuances as per the Bloomberg league table for

FY2010. Hence, with this deal, it will take over one of the top-three domestic firms in the

primary equity issuance space.

The bank’s wide distribution platform of almost 1088 branches and Enam’s retail network

will lead to an opportunity to build a leading retail franchise. The planned objective behind

the deal is to expand its product and service offerings for corporate, institutional and

individual clients, thereby enhancing the ability of the entity to serve client needs in a

flawless manner across product categories and geographies. Hence, the merger is

expected to bring positive synergies and will also help the bank to increase its fee income.

Financial Analysis:

Majority of the bank revenue is from the corporate segment followed by retail segment.

The acquisition of the assets of Enam Securities will allow it to offer a complete portfolio

of financial services to its clients, thus helping it to increase its revenue. For FY10, total

Keynote Capitals Institutional Research 13

K E Y N O T E

income of the businesses being acquired from Enam Securities stood at `242cr, with PBT

of `92cr. From Apr-Oct, 2010, total income stood at `182cr, with PBT of `77cr. On an

annualized basis, FY11 PAT works out to ~`90cr, implying valuations of 22.97x FY11E

earnings, which is at 39% premium to the listed brokerage companies (peers), on 1HFY11

annualized PAT basis.

Particulars Market Annualized PAT P/E (x)

cap FY10 FY11E FY10 FY11E

Edelweiss Capital 4380.33 229.20 254.92 19.11 17.18

India Infoline 3241.30 231.99 194.56 13.97 16.66

Motilal Oswal Fin. 2613.40 170.45 170.00 15.33 15.37

Total 10235.03 631.64 619.48 16.20 16.52

Enam Securities 2067.00 69.00 90.00 29.96 22.97

Premium (%) 39.0%

Source: Company & Keynote Capitals Institutional Research

(As on 18th Nov-10)

The impact of the deal is neutral for bank's capital adequacy and will have limited impact

on its EPS as the merger is just ~3.3% of the market capitalization of the bank. As a part

of the deal, 400 employees and net current assets worth `300cr of Enam will be transferred

to the bank.

Particulars Pre-Deal Post-Deal

FY11E FY12E FY11E FY12E

EPS (`) 80.11 95.33 80.11 93.37

Adj. Book Value (`) 442.57 515.97 442.57 505.52

E: Keynote Capitals Institutional Research Estimates

Other information

1. a) Axis Bank: Shareholding Pattern

Shareholding Pattern: FY08 FY09 FY10 Dec-10

SUUTI 27.2% 27.1% 24.0% 23.7%

LIC 10.4% 10.4% 10.3% 9.6%

FIIs 33.9% 23.4% 33.1% 36.6%

Others 28.5% 39.1% 32.6% 30.1%

(Source: Company & Keynote Capitals Institutional Research)

b) More than 1% holdings (Dec-2010)

Name of the Shareholder No of shares % of Holding

Deutsche Securities Mauritius Ltd 9555860 2.3%

Genesis Indian Investment Company Ltd - General Sub Fund 9786478 2.4%

HSBC Bank Mauritius Ltd A/c Cinnamon Capital Ltd 19812210 4.8%

HSBC Bank Mauritius Ltd A/c HSBC IRIS Investments

Mauritius Ltd 19609210 4.8%

ICICI Prudential Life Insurance Company Ltd 11073569 2.7%

Swiss Finance Corporation (Mauritius) Ltd - HSBC Securities

Services 4325034 1.1%

2. Dividend History

Year End FY05 FY06 FY07 FY08 FY09 FY10

Dividend-Amount 76.66 97.54 126.73 214.63 359.01 486.22

Dividend-% 28.0% 35.0% 45.0% 60.0% 100.0% 120.0%

(Source: Company & Keynote Capitals Institutional Research)

14 Keynote Capitals Institutional Research

K E Y N O T E

Risks and Concerns:

¾ Restructuring exercise in lending to different verticals under RBI’s guidelines may lead

to increase in NPAs and thus affecting the bank’s asset quality. And increase in number

of accounts turning into NPA’s from the restructured portfolio would lead to increase in

provisioning amount, having a negative impact on the profits.

¾ The bank can face stiff competition from other private banks and might reduce its market

share in future.

Sector Outlook:

During 1HFY11, the Industry has achieved ~35% of the total expected credit off-take for this

fiscal (assuming 20% credit growth for FY11) and is expected to improve in H2FY11 on

account of sharp increase in short term rates, increase in commodity prices as well as Crude

touching 90 US $ per barrel coupled with rural demand. On the other hand, hike in deposits

rate by most of the banks may lead to enhancement in deposit mobilization going forward.

The current incremental CD ratio of the banking system is hovering around 75%, which

indicates relatively strong demand in credit disbursement compared to deposit mobilization

and we expect the increase for coming years as well due to strong economic activities.

Total Business Growth outlook: `Cr)

(`

Particulars Deposit Credit CDRatio

Total Business as on Mar-10 4486574 3193906 71.2%

% Growth as per RBI Target 18.0% 20.0%

Expected business as on Mar-11 5294157 3832687 72.4%

Less: Achieved in 1HFY11 (as on Sep-10) 4775300 3414487 71.5%

% Growth (YTD) 6.4% 6.9%

Incremental Business for 2HFY11 518857 418200 80.6%

Source: RBI & Keynote Capitals Institutional Research

Investment book comparison of banks states that the current rise in yields beyond 8% will

result in MTM losses for banks and PSU banks will have to provide for the same. Treasury

gains are not seen in the next couple of quarters leading to non interest income of banks

growing in line with business only. Most banks witnessed margin expansion during Q2FY11

on the back of increased PLRs along with increase in CASA ratio. However, margins are

likely to witness some pressures on account of recent increase in the cost of deposit along

with higher term deposit rates. On account of availability of the cheaper sources of funds

and the new base rate system, there has been an increased activity in the commercial paper

and external borrowings market. However, the scenario is now changing, as with the rising

interest rates, CP rates are now closer to the base rate as against the case earlier, thereby

leaving no scope of arbitrage for companies to raise funds through these alternative channels.

Branch expansion by most of the banks, pension liabilities and restructuring of loan book

resulting in higher provisioning is expected to impact more on public sector banks compared

to private sector bank’s earnings growth in H2FY11.

Monetary/Liquidity Scenario:

Faster credit growth has put pressure on the liquidity of Banks. In FY11, this scenario is

likely to be seen as the high inflation rate has dissuaded investors to park their funds with

banks, resulting in low deposit growth. The RBI recent Mid-Quarter Monetary Policy Review

(Dec-10) has supported for additional liquidity measures to sustain growth in credit off take

and maintain the growth momentum.

1. Repo rate, reverse repo rate were retained at 6.25% and 5.25% respectively.

Keynote Capitals Institutional Research 15

K E Y N O T E

2. The cash reserve ratio (CRR) maintained at 6.0% of net demand and time liabilities

(NDTL) of scheduled banks.

3. Statutory liquidity ratio (SLR) of scheduled commercial banks (SCBs) reduced to 24%

from 25% of their NDTL with effect from December 18, 2010.

4. Open market operation (OMO) auctions will be conducted for purchase of government

securities for an aggregate amount of `48,000cr in the next one month.

5. Reduction in government borrowings to `6000cr as against `11000cr per week.

Future Outlook:

In FY11, the economy is expected to face stiff interest rates as inflation still hovers much

over the estimated levels and liquidity getting weaker due to larger than expected credit

growth, lower deposit growth and increased government borrowing. Going ahead, deposit

rate increase, asset quality deterioration, inflation etc might impact banks negatively. Hence,

we continue to remain cautious and any decline will be an opportunity for investment at one

year horizon.

Valuations:

The bank's total business, multiple sources of sustainable fee-income, distribution network

and vast customer base in CASA-franchise enable it to leverage significant business

opportunities in the current rising interest rate scenario. This along with a balanced loan

portfolio and high proportion of low-cost funds will help the bank to earn better margins

compared to its peers. Considering the above factors, we initiate coverage on the stock

arriving at a target price of `1415 per share by assigning a multiple of 2.8x FY12E price to

adjusted book for the period of one year, with a 'Buy' recommendation. At CMP of `1227.55,

the stock is trading at 3.2x FY10 price to adjusted book and is expected to trade at 2.8xFY11E

and 2.4xFY12E price to adjusted book.

Chart 16

P/ABV Bands

1800

1600

1400 3.25x

1200 2.75x

1000 2.25x

800

1.75x

600

400

200

0

Apr-08

Apr-06

Apr-07

Apr-09

Apr-10

Oct-08

Oct-09

Jul-06

Oct-06

Jan-07

Jul-07

Oct-07

Jan-08

Jul-08

Jan-09

Jul-09

Oct-10

Jan-10

Jul-10

Jan-11

(Source: Keynote Capitals Institutional Research)

16 Keynote Capitals Institutional Research

K E Y N O T E

Chart 18

PE Bands

2000

25.0x

1800

1600 20.0x

1400

1200 15.0x

1000

800 10.0x

600

400

200

0

Apr-06

Apr-10

Apr-07

Apr-08

Apr-09

Jul-06

Jan-07

Jul-07

Oct-07

Jul-08

Jan-10

Jan-11

Oct-06

Jan-08

Oct-08

Jan-09

Jul-09

Oct-09

Jul-10

Oct-10

(Source: Keynote Capitals Institutional Research)

Peer Comparisons:

Key Operating parameters of Peer Group (FY10) `Cr)

(`

Particulars Axis Bank HDFC Bank ICICI Bank Kotak

Net worth 16044.61 21519.58 51296.50 7910.94

Deposits 141300.22 167297.78 241572.30 21819.18

Advances 104343.12 126162.73 225778.13 29724.29

Total Income 15583.80 20270.00 59599.77 10108.93

Net Profit 2514.53 3003.65 4670.29 1307.00

NPM 16.1% 14.8% 7.8% 12.9%

EPS 62.06 63.62 39.84 18.77

Book Value 396.00 472.23 460.10 227.23

NIM (%) 3.8% 4.3% 2.5% 6.3%

Cost to income ratio 41.4% 44.1% 69.4% 68.7%

ROAA (%) 1.5% 1.5% 1.1% 1.7%

ROANW (%) 19.2% 16.5% 9.7% 13.3%

Gross NPAs (%) 1.3% 1.4% 4.2% 2.6%

Net NPAs (%) 0.4% 0.3% 1.7% 1.2%

Provision Coverage Ratio 88.6% 74.8% 59.5% 58.0%

Capital Adequacy Ratio 15.8% 17.4% 19.4% 18.4%

Business per employee (`) 11.36 5.90 10.29 4.87

Market Price (`) 1227.55 2075.30 1000.70 403.15

Market Capitalization 49736.64 94994.78 111567.04 14035.26

Paid up equity capital 405.17 457.74 1114.89 348.14

Source: Company & Keynote Capitals Institutional Research

Forward Valuations:

Peers P/E (x) P/ABV (x) ROE (%)

FY11E FY12E FY11E FY12E FY11E FY12E

Axis Bank 15.32 13.15 2.77 2.43 19.0% 19.4%

HDFC Bank 25.23 22.45 3.88 3.34 15.5% 14.9%

ICICI Bank 21.18 19.08 1.99 1.83 9.4% 9.6%

Kotak Bank 18.20 16.12 3.01 2.75 15.0% 14.5%

E: Keynote Capitals Institutional Research Estimates

Keynote Capitals Institutional Research 17

K E Y N O T E

Chart 18

Heading

30

25 ICICI Bank HDFC Bank

(9.6%, 19.08) (14.9%, 22.45)

FY12E P/E (x)

20

15

Kotak Bank

10 (14.5%, 16.12) Axis Bank

(19.4%, 13.15)

5

0.05 0.1 0.15 0.2 0.25

FY12E ROE (%)

(Source: Keynote Capitals Institutional Research)

Quarterly Performance Trends: `Cr)

(`Cr)

Particulars Q1-FY10 Q2-FY10 Q3-FY10 Q4-FY10 Q1-FY11 Q2-FY11 Q3-FY11

Interest Earned 2905.56 2860.36 2883.65 2988.45 3325.59 3624.25 3838.31

Interest on advances 1973.56 1950.19 1987.88 2074.97 2310.89 2429.03 2600.55

Income from Investment 867.31 859.56 845.43 856.01 935.26 1123.54 1166.83

Interest on RBI balances & others 35.43 30.02 27.35 27.20 32.48 38.37 48.18

Others 29.26 20.59 22.99 30.27 46.96 33.31 22.75

Interest expended 1859.93 1710.68 1534.54 1528.38 1811.82 2009.15 2105.19

Net Interest Income 1045.63 1149.68 1349.11 1460.07 1513.77 1615.10 1733.12

Non-Interest Income 958.57 1065.58 988.09 933.54 1000.78 1033.24 1147.71

Net Total Income 2004.20 2215.26 2337.20 2393.61 2514.55 2648.34 2880.83

Operating Expenses 827.84 909.51 962.57 1009.80 1064.50 1161.99 1222.35

Staff costs 309.33 304.20 308.54 333.75 416.42 405.30 396.16

Other expenses 518.51 605.31 654.03 676.05 648.08 756.69 826.19

Pre-provisioning profit (PPP) 1176.36 1305.75 1374.63 1383.81 1450.05 1486.35 1658.48

Provisions and Contingencies 315.29 498.89 373.14 201.87 333.00 378.76 313.88

PBT 861.07 806.86 1001.49 1181.94 1117.05 1107.59 1344.60

Tax 299.03 275.22 345.51 417.07 375.17 372.45 453.24

PAT 562.04 531.64 655.98 764.87 741.88 735.14 891.36

`)

EPS (` 13.87 13.12 16.19 18.88 18.31 18.14 21.75

Paid-up Equity Share Capital 278.69 281.63 357.71 359.01 405.17 409.90 409.90

% Gross NPAs to Gross Advances 1.2% 1.4% 1.4% 1.3% 1.2% 1.2% 1.2%

% Net NPAs to Net Advances 0.5% 0.5% 0.5% 0.4% 0.4% 0.4% 0.3%

Source: Company & Keynote Capitals Institutional Research

18 Keynote Capitals Institutional Research

K E Y N O T E

Financials

Profit & Loss Statements (`Cr)

Particulars FY08 FY09 FY10 FY11E FY12E

Interest Earned 7005.31 10835.48 11638.02 14981.56 18233.00

Interest on advances 4745.65 7465.86 7986.60 10234.09 12234.69

Income from Investment 2102.31 3051.50 3428.31 4456.64 5745.14

Interest on RBI balances & others 107.64 210.19 120.00 169.62 166.22

Others 49.71 107.93 103.11 121.22 86.95

Interest expended 4419.96 7149.27 6633.53 8196.51 9639.75

Net Interest Income 2585.35 3686.21 5004.49 6785.06 8593.25

Non-Interest Income 1795.49 2896.88 3945.78 4332.28 5143.91

Net Total Income 4380.84 6583.09 8950.27 11117.34 13737.16

Operating Expenses 2154.92 2858.21 3709.72 4762.81 5978.88

Staff costs 670.25 997.66 1255.82 1658.06 2150.24

Other expenses 1484.67 1860.55 2453.90 3104.75 3828.64

Pre-provisioning profit (PPP) 2225.92 3724.88 5240.55 6354.53 7758.28

Provisions and Contingencies 579.64 939.68 1389.19 1403.96 1835.46

PBT 1646.28 2785.20 3851.36 4950.56 5922.83

Tax 575.25 969.84 1336.83 1667.06 2015.12

PAT 1071.03 1815.36 2514.53 3283.51 3907.71

`)

EPS (` 29.94 50.57 62.06 80.11 93.37

`)

Book Value (` 245.13 284.53 396.00 453.82 517.49

`)

Adjusted Book Value (` 238.19 275.41 385.66 442.57 505.52

(E - Keynote Capitals Institutional Research Estimates)

Balance Sheets (`Cr)

Particulars FY08 FY09 FY0 FY11E FY12E

Sources of Funds

Paid-up Equity Share Capital 357.71 359.01 405.17 409.90 418.54

Reserves 8410.79 9855.79 15639.44 18192.37 21240.38

Net Worth 8768.50 10214.80 16044.61 18602.27 21658.92

Deposits 87626.22 117374.11 141300.22 163908.26 186035.87

Borrowings 5624.04 15519.87 17169.55 24035.17 29657.76

Other Liabilities & Provisions 7606.91 4650.07 6166.15 5028.38 6075.89

Total Liabilities 109625.67 147758.85 180680.53 211574.07 243428.44

Applications of Funds

Cash & Balances with RBI 7305.66 9419.21 9473.88 11063.81 12248.04

Bal with Banks & money at call 5198.58 5597.69 5732.56 6867.19 6998.88

Investments 33705.10 46330.35 55974.81 62285.14 71623.81

Advances 59661.15 81556.76 104343.12 128488.92 149564.34

Fixed Assets 922.85 1072.89 1222.42 1318.78 1368.08

Other Assets 2832.33 3781.95 3933.74 1550.23 1625.28

Total Assets 109625.67 147758.85 180680.53 211574.07 243428.44

(E - Keynote Capitals Institutional Research Estimates)

Keynote Capitals Institutional Research 19

K E Y N O T E

Return Ratios (%)

FY08 FY09 FY10 FY11(E) FY12(E)

Net Interest Margin (NIM) 3.5% 3.3% 3.8% 3.5% 3.5%

Yield on Advances 9.4% 9.7% 8.7% 9.0% 9.1%

Yield on Investments 6.9% 7.6% 6.7% 7.5% 8.6%

Cost of Deposits 5.9% 6.4% 5.1% 4.8% 4.9%

Return on Average Assets 1.2% 1.4% 1.5% 1.7% 1.7%

Return on Average Net worth/ROAE 17.6% 19.1% 19.2% 19.0% 19.4%

Dividend Yield (%) 0.5% 0.8% 1.0% 1.2% 1.4%

Effective tax rate 34.9% 34.8% 34.7% 33.7% 34.0%

(E: Keynote Capitals Institutional Research Estimates)

Efficiency Ratios (%)

FY08 FY09 FY10 FY11(E) FY12(E)

Net Interest Income/ Net total Income 59.0% 56.0% 55.9% 61.0% 62.6%

Non Interest Income/ Net total Income 41.0% 44.0% 44.1% 39.0% 37.4%

Interest expended/ Interest earned 63.1% 66.0% 57.0% 54.7% 52.9%

Cost to income 49.2% 43.4% 41.4% 42.8% 43.5%

Opex/ Avg. assets 2.4% 2.2% 2.3% 2.4% 2.6%

Credit Deposit ratio (C-D ratio) 68.1% 69.5% 73.8% 78.4% 80.4%

Incremental C-D ratio 79.0% 73.6% 95.2% 106.8% 95.2%

Investment Deposit ratio (I-D ratio) 38.5% 39.5% 39.6% 38.0% 38.5%

Incremental I-D ratio 23.6% 42.4% 40.3% 27.9% 42.2%

Credit/ Assets 54.4% 55.2% 57.8% 60.7% 61.4%

Loan growth 61.8% 36.7% 27.9% 23.1% 16.4%

Deposits/Assets 79.9% 79.4% 78.2% 77.5% 76.4%

Deposit growth 49.1% 33.9% 20.4% 16.0% 13.5%

(E: Keynote Capitals Institutional Research Estimates)

Per share Data

FY08 FY09 FY10 FY11(E) FY12(E)

EPS (`) 29.94 50.57 62.06 80.11 93.37

Book Value (`) 245.13 284.53 396.00 453.82 517.49

Adjusted Book value (`) 238.19 275.41 385.66 442.57 505.52

(E: Keynote Capitals Institutional Research Estimates)

Valuation ratios (%)

FY08 FY09 FY10 FY11(E) FY12(E)

P/e (x) 41.00 24.28 19.78 15.32 13.15

P/BV (x) 5.01 4.31 3.10 2.70 2.37

P/ABV (x) 5.15 4.46 3.18 2.77 2.43

(E: Keynote Capitals Institutional Research Estimates)

20 Keynote Capitals Institutional Research

K E Y N O T E

Growth ratios (%)

FY08 FY09 FY10 FY11(E) FY12(E)

Adjusted Book value 114.5% 15.6% 40.0% 14.8% 14.2%

Advances 61.8% 36.7% 27.9% 23.1% 16.4%

Deposits 49.1% 33.9% 20.4% 16.0% 13.5%

Investments 25.3% 37.5% 20.8% 11.3% 15.0%

Net interest income 73.2% 42.6% 35.8% 35.6% 26.6%

Non-interest Income 82.1% 61.3% 36.2% 9.8% 18.7%

Net total Income 76.8% 50.3% 36.0% 24.2% 23.6%

Pre-provisioning profit 76.1% 67.3% 40.7% 21.3% 22.1%

Net profit 62.5% 69.5% 38.5% 30.6% 19.0%

EPS 28.0% 68.9% 22.7% 29.1% 16.6%

(E: Keynote Capitals Institutional Research Estimates)

Productivity ratios (%)

FY08 FY09 FY10 FY11(E) FY12(E)

No. of employees (Avg) 12765 18117 21621 24864 27848

% growth 47.0% 41.9% 19.3% 15.0% 12.0%

No. of branches 671 835 1035 1210 1360

% growth 19.6% 24.4% 24.0% 16.9% 12.4%

No. of ATMs 2764 3595 4293 5350 5500

% growth 18.1% 30.1% 19.4% 24.6% 2.8%

Total Business (`Cr) 147287 198931 245643 292397 335600

% growth 54.0% 35.1% 23.5% 19.0% 14.8%

Business per employee (`Cr) 11.54 10.98 11.36 11.76 12.05

Business per branch (`Cr) 219.50 238.24 237.34 241.65 246.76

Cost per employee (`Cr) 0.17 0.16 0.17 0.19 0.21

Cost per branch (`Cr) 3.21 3.42 3.58 3.94 4.40

Net Profit per employee (`Cr) 0.08 0.10 0.12 0.13 0.14

Net Profit per branch (`Cr) 1.60 2.17 2.43 2.71 2.87

(E: Keynote Capitals Institutional Research Estimates)

Asset quality

FY08 FY09 FY10 FY11(E) FY12(E)

Gross NPA (`Cr) 494.61 897.77 1318.00 1564.45 1726.45

Net NPA (`Cr) 248.29 327.13 419.00 461.51 500.67

Gross NPA ratio 0.8% 1.1% 1.3% 1.2% 1.2%

Net NPA ratio 0.4% 0.4% 0.4% 0.4% 0.3%

Provision Coverage 82.8% 85.3% 88.6% 90.5% 91.0%

(E: Keynote Capitals Institutional Research Estimates)

Asset Liability

FY08 FY09 FY10 FY11(E) FY12(E)

Credit-Deposit ratio 68.1% 69.5% 73.8% 78.4% 80.4%

Investment/Deposit 38.5% 39.5% 39.6% 38.0% 38.5%

Proportion of CASA deposits 45.7% 43.1% 46.7% 43.0% 44.0%

(E: Keynote Capitals Institutional Research Estimates)

Keynote Capitals Institutional Research 21

K E Y N O T E

Institutional Equity Team

Subramanyam Ravisankar

Director - Equities sravisankar@keynotecapitals.net +91 22 3026 6018

Analysts / Associates

Krishna Mahale krishna@keynoteindia.net +91 22 3026 6059

Denil Savla denil@keynoteindia.net +91 22 3026 6043

Hetal Shah hetal@keynoteindia.net +91 22 2269 4325

Ashwin Kumar ashwin@keynoteindia.net +91 22 3026 6059

Rohan Admane rohan@keynoteindia.net +91 22 2269 4322

Rajesh Sinha rajesh@keynotecapitals.net +91 22 2269 4322

Mamta Singh mamta.singh@keynotecapitals.net +91 22 3026 6057

Technical Analyst

Sanjay Bhatia sanjay@keynotecapitals.net +91 22 3026 6065

Dealing / Sales

Nilesh Dhruv nilesh@keynoteindia.net +91 22 3026 6040

Puja Shah puja.shah@keynoteindia.net +91 22 3026 6057

Farha Shaikh farha@keynoteindia.net +91 22 3026 6057

KEYNOTE CAPITALS LTD.

Member

Stock Exchange, Mumbai (INB 010930556)

National Stock Exchange of India Ltd. (INB 230930539)

Over the Counter Exchange of India Ltd. (INB 200930535)

Central Depository Services Ltd. (IN-DP-CDSL-152-2001)

4th Floor, Balmer Lawrie Building, 5, J. N. Heredia Marg, Ballard Estate, Mumbai 400 001. INDIA

Tel. : 9122-2269 4322 / 24 / 25 • www.keynoteindia.net

DISCLAIMER

• This report has been prepared and issued by Keynote Capitals Limited, based solely on public information and sources believed to be reliable.

• Neither the information nor any opinion expressed herein, constitutes an offer, or an invitation to make an offer, to buy or sell any securities or any

options, futures or other derivatives related to such securities and also for the purpose of trading activities.

• Keynote Capitals Limited makes no guarantee, representation or warranty, express or implied and accepts no responsibility or liability as to the

accuracy or completeness or correctness of the information in this report.

• Keynote Capitals and its affiliates and their respective officers, directors and employees may hold positions in any securities mentioned in this

Report (or in any related investment) and may from time to time add to or dispose of any securities or investments.

• Keynote Capitals may also have proprietary trading positions in securities covered in this report or in related instruments.

• An affiliate of Keynote Capitals Limited may also perform or seek to perform broking, investment banking and other banking services for the

company under coverage.

• If ‘Buy’, ‘Sell’, or ‘Hold’ recommendation is made in this Report, such recommendation or view or opinion expressed on investments in this Report

is not intended to constitute investment advice and should not be intended or treated as a substitute for necessary review or validation or any

professional advice. The views expressed in this Report are those of the analyst which are subject to change and do not represent to be an authority

on the subject. Keynote Capitals may or may not subscribe to any and/ or all the views expressed herein.

• The opinions presented herein are liable to change without any notice.

• Though due care has been taken in the preparation of this report, Keynote Capitals limited or any of its directors, officers or employees shall be in

any way be responsible for any loss arising from the use thereof.

• Investors are advised to apply their judgment before acting on the contents of this report.

• This report or any portion hereof may not be reprinted, sold or redistributed without the written consent of Keynote Capitals Limited.

22 Keynote Capitals Institutional Research

You might also like

- Investor Diary Expert Stock Analysis Excel (V-3) : How To Use This Spreadsheet?Document75 pagesInvestor Diary Expert Stock Analysis Excel (V-3) : How To Use This Spreadsheet?raghawindor0% (4)

- Chapter 19 Test BankDocument100 pagesChapter 19 Test BankBrandon LeeNo ratings yet

- Chapter 15 Transfer Pricing QDocument9 pagesChapter 15 Transfer Pricing QMaryane AngelaNo ratings yet

- Uber Porter's Five Forces Analysis PresentationDocument12 pagesUber Porter's Five Forces Analysis PresentationAshish Singh100% (1)

- Investor Diary Expert Stock Analysis Excel (V-3) : How To Use This Spreadsheet?Document206 pagesInvestor Diary Expert Stock Analysis Excel (V-3) : How To Use This Spreadsheet?karife3137100% (1)

- Syndicated Leveraged Loans During and After The CrisisDocument25 pagesSyndicated Leveraged Loans During and After The Crisisresat gürNo ratings yet

- PWC Payments Handbook 2023Document34 pagesPWC Payments Handbook 2023Koshur KottNo ratings yet

- ICICI Bank ReportDocument6 pagesICICI Bank Reportsuhail_thakurNo ratings yet

- Axis Enam MergerDocument9 pagesAxis Enam MergernnsriniNo ratings yet

- Invesco India Caterpillar PortfolioDocument1 pageInvesco India Caterpillar PortfolioAnkurNo ratings yet

- AU Small Bank Motilal OswalDocument10 pagesAU Small Bank Motilal Oswalsaurabhjain05No ratings yet

- Growth Story & Successful Market EntryDocument14 pagesGrowth Story & Successful Market Entryrajshekhar87No ratings yet

- Diwali Picks October - Fundamental DeskDocument16 pagesDiwali Picks October - Fundamental DeskSenthil KumarNo ratings yet

- 01 NIC Annual Report 64-65Document84 pages01 NIC Annual Report 64-65Ronit KcNo ratings yet

- Quess CorpDocument22 pagesQuess CorpdcoolsamNo ratings yet

- Dina Nath Kumar: Nse Symbol: Indianb BSE Scrip Code-532814Document48 pagesDina Nath Kumar: Nse Symbol: Indianb BSE Scrip Code-532814dipesh.shopNo ratings yet

- KUBCQ4Newsletter FinalDocument11 pagesKUBCQ4Newsletter FinalVenkata SubramanianNo ratings yet

- ICICI BANK - ResearchDocument1 pageICICI BANK - ResearchankitNo ratings yet

- 19th ANNUAL CEO TRACK RECORDDocument91 pages19th ANNUAL CEO TRACK RECORDChetan ChouguleNo ratings yet

- Andhra Bank: Quality Franchise at Attractive ValuationDocument3 pagesAndhra Bank: Quality Franchise at Attractive ValuationBharatNo ratings yet

- SKS Microfinance: Prosperity To MassesDocument16 pagesSKS Microfinance: Prosperity To Massesnscibi86No ratings yet

- Report On Financial Analysis of ICI Pakistan Limited 2008Document9 pagesReport On Financial Analysis of ICI Pakistan Limited 2008helperforeuNo ratings yet

- State Bank of India (Staban) : Striking The Right Cord: Unlocking ValueDocument20 pagesState Bank of India (Staban) : Striking The Right Cord: Unlocking ValuePraharsh SinghNo ratings yet

- Welspun Enterprises LTD - Investor Presentation - 2Document36 pagesWelspun Enterprises LTD - Investor Presentation - 2Dwijendra ChanumoluNo ratings yet

- HDFC Mutual FUNDDocument22 pagesHDFC Mutual FUNDSushma VegesnaNo ratings yet

- Icici Bank: CMP: INR502 Operating Performance Resilient Technology Remains Key Growth DriverDocument14 pagesIcici Bank: CMP: INR502 Operating Performance Resilient Technology Remains Key Growth DriverRajat GroverNo ratings yet

- Retail Equity Highlight FundsDocument4 pagesRetail Equity Highlight FundsRavi KumarNo ratings yet

- The Best Stock To Add To Your Portfolio This Month Is Here!: OCTOBER 2020Document9 pagesThe Best Stock To Add To Your Portfolio This Month Is Here!: OCTOBER 2020Vighnesh KurupNo ratings yet

- BFM Assignment 2: Submitted By: Adhiraj Rathore E-02 20020441015Document14 pagesBFM Assignment 2: Submitted By: Adhiraj Rathore E-02 20020441015Tabrej AlamNo ratings yet

- Latent View Analytics Limited Ipo: All You Need To Know AboutDocument7 pagesLatent View Analytics Limited Ipo: All You Need To Know AboutPeterNo ratings yet

- 19 Ijmres 10012020Document12 pages19 Ijmres 10012020International Journal of Management Research and Emerging SciencesNo ratings yet

- Feel Left Out of Midcap Party - Here Are 10 Stocks To Help You Join in - The Economic TimesDocument5 pagesFeel Left Out of Midcap Party - Here Are 10 Stocks To Help You Join in - The Economic Timesnarendran ramanNo ratings yet

- Investor Diary Expert Stock Analysis Excel (V-3) : How To Use This Spreadsheet?Document76 pagesInvestor Diary Expert Stock Analysis Excel (V-3) : How To Use This Spreadsheet?AkhileshChauhanNo ratings yet

- Indiabulls ThesisDocument5 pagesIndiabulls Thesisdivyanshu kumarNo ratings yet

- Analysis of Financial StatementsDocument12 pagesAnalysis of Financial StatementsAgha Nawazish Ali KhanNo ratings yet

- Banking 1Document20 pagesBanking 1Akash BdNo ratings yet

- Tata Communications (VIDSAN) : Data Segment Highly Margin AccretiveDocument3 pagesTata Communications (VIDSAN) : Data Segment Highly Margin AccretivevikkediaNo ratings yet

- ICICI Securities Ltd. - PCG HNI Note - SMIFS ResearchDocument11 pagesICICI Securities Ltd. - PCG HNI Note - SMIFS ResearchShweta ChaudharyNo ratings yet

- 2020 Annual ENGDocument145 pages2020 Annual ENGwmdn88mrdkNo ratings yet

- Initiating Coverage Report - YES BankDocument35 pagesInitiating Coverage Report - YES Bankarnabmoitra11No ratings yet

- Repco Home Finance Ltd. (Repco) : Background Stock Performance DetailsDocument7 pagesRepco Home Finance Ltd. (Repco) : Background Stock Performance DetailstsrupenNo ratings yet

- Stock Pointer: Alok Industries LTDDocument20 pagesStock Pointer: Alok Industries LTDGirish RaskarNo ratings yet

- IDFC First Initial (Key Note)Document26 pagesIDFC First Initial (Key Note)beza manojNo ratings yet

- 5 Stocks For Accelerated Profit Apr2021Document28 pages5 Stocks For Accelerated Profit Apr2021Amrit KocharNo ratings yet

- Leaflet Flexi Cap FundDocument4 pagesLeaflet Flexi Cap FundBhaskar Reddy NvsNo ratings yet

- Kotak BankDocument44 pagesKotak BankPrince YadavNo ratings yet

- FY22 Q4 - Update Note - Citi AcquisitionDocument8 pagesFY22 Q4 - Update Note - Citi Acquisitioncerohad333No ratings yet

- Report 2022Document338 pagesReport 2022Yerrolla MadhuravaniNo ratings yet

- Corporate Mechanism in Axiata Group BHD: Universiti Utara MalaysiaDocument15 pagesCorporate Mechanism in Axiata Group BHD: Universiti Utara MalaysiaAmin AkasyafNo ratings yet

- MMP Corfin Study Case - GalihAbimataDocument2 pagesMMP Corfin Study Case - GalihAbimataDImas AntonioNo ratings yet

- 20190204018-MULTICAP FUND (Sep 2020) DP-LeafletDocument3 pages20190204018-MULTICAP FUND (Sep 2020) DP-Leafletkovi mNo ratings yet

- Financial ManagementDocument13 pagesFinancial Managementruchi sharmaNo ratings yet

- Angel One Initial (Key Note)Document32 pagesAngel One Initial (Key Note)beza manojNo ratings yet

- Annual Report 2007Document52 pagesAnnual Report 2007rafayahmad02No ratings yet

- Axis Bank - HSL - 06122021Document14 pagesAxis Bank - HSL - 06122021GaganNo ratings yet

- Top 8 Microcaps To BuyDocument42 pagesTop 8 Microcaps To Buyrusheekesh3497No ratings yet

- 2009 September IHCLDocument12 pages2009 September IHCLreba_sNo ratings yet

- New Banking License Catalyst For Consolidation 081010Document3 pagesNew Banking License Catalyst For Consolidation 081010kotler_2006No ratings yet

- Aptus Value Housing Finance LTD - Pick of The Week - Axis Direct - 100623 (1) - 12-06-2023 - 09Document4 pagesAptus Value Housing Finance LTD - Pick of The Week - Axis Direct - 100623 (1) - 12-06-2023 - 09Porus Saranjit SinghNo ratings yet

- Title of Project-Credit Risk Management in Banks Name of CompanyDocument12 pagesTitle of Project-Credit Risk Management in Banks Name of CompanyAarti GuptaNo ratings yet

- Axis BAnk Case AnalysisDocument53 pagesAxis BAnk Case AnalysisAbhishekohliNo ratings yet

- Reforms, Opportunities, and Challenges for State-Owned EnterprisesFrom EverandReforms, Opportunities, and Challenges for State-Owned EnterprisesNo ratings yet

- Braced for Impact: Reforming Kazakhstan's National Financial Holding for Development Effectiveness and Market CreationFrom EverandBraced for Impact: Reforming Kazakhstan's National Financial Holding for Development Effectiveness and Market CreationNo ratings yet

- Empirical Note on Debt Structure and Financial Performance in Ghana: Financial Institutions' PerspectiveFrom EverandEmpirical Note on Debt Structure and Financial Performance in Ghana: Financial Institutions' PerspectiveNo ratings yet

- Karakteristik Perjanjian Jual Beli Medium Term Notes: Universitas AirlanggaDocument20 pagesKarakteristik Perjanjian Jual Beli Medium Term Notes: Universitas AirlanggaMuhammad Rexel Abdi ZulfikarNo ratings yet

- Chapter 14 - AnswerDocument24 pagesChapter 14 - AnswerAgentSkySky100% (1)

- 1846635969Document85 pages1846635969Riadh RidhaNo ratings yet

- Nature and Scope of Managerial EconomicsDocument25 pagesNature and Scope of Managerial EconomicsHibaNo ratings yet

- Goto Uob 02 Jan 2024 240116 124127Document5 pagesGoto Uob 02 Jan 2024 240116 124127marcellusdarrenNo ratings yet

- Debt Service, Financing Constraints, and Fixed Investment: Evidence From Panel DataDocument25 pagesDebt Service, Financing Constraints, and Fixed Investment: Evidence From Panel DataGustavo GarcíaNo ratings yet

- Distribution NetworkDocument3 pagesDistribution NetworkMaryam KhalidNo ratings yet

- 25 Question PaperDocument4 pages25 Question PaperPacific TigerNo ratings yet

- Cost Concepts and ClassificationsDocument6 pagesCost Concepts and ClassificationsNailiah MacakilingNo ratings yet

- 03 - Literature ReviewDocument7 pages03 - Literature ReviewSonali mishraNo ratings yet

- AppliedEcon Economics and The Real World Q1 Mod1 V3Document83 pagesAppliedEcon Economics and The Real World Q1 Mod1 V3Iris Rivera-Perez83% (6)

- The Role of The Agency For Export Promotion and Investment AttractionDocument14 pagesThe Role of The Agency For Export Promotion and Investment AttractionNatalita Rucavita0% (1)

- Objectives of The StudyDocument25 pagesObjectives of The StudyMeena Sivasubramanian100% (1)

- Enabling Assessment: 4200 Case 2: With Defective UnitsDocument2 pagesEnabling Assessment: 4200 Case 2: With Defective UnitsVon Andrei MedinaNo ratings yet

- Economic Thought of Ibn Al-Qayyim 1292 - 1350 AdDocument29 pagesEconomic Thought of Ibn Al-Qayyim 1292 - 1350 Adজুম্মা খানNo ratings yet

- Internship ReportDocument40 pagesInternship ReportSujith SukumaranNo ratings yet

- An Introduction To Mutual FundsDocument36 pagesAn Introduction To Mutual FundsKaran MandalNo ratings yet

- ABDM3574 L3-Identify OpportunityDocument8 pagesABDM3574 L3-Identify OpportunitySeng WeyyNo ratings yet

- The Transactions Listed Below Are Typical of Those Involving SouthernDocument1 pageThe Transactions Listed Below Are Typical of Those Involving SouthernTaimour HassanNo ratings yet

- Liggett Group, Incorporated, Now Named Brooke Group, Limited v. Brown & Williamson Tobacco Corporation, and Generic Products Corporation, (Three Cases), 964 F.2d 335, 4th Cir. (1992)Document11 pagesLiggett Group, Incorporated, Now Named Brooke Group, Limited v. Brown & Williamson Tobacco Corporation, and Generic Products Corporation, (Three Cases), 964 F.2d 335, 4th Cir. (1992)Scribd Government DocsNo ratings yet

- P Company Acquires 80Document5 pagesP Company Acquires 80hus wodgyNo ratings yet

- Investor Digest 23 Oktober 2019Document10 pagesInvestor Digest 23 Oktober 2019Rising PKN STANNo ratings yet

- 1.4 Basic Research QuestionsDocument3 pages1.4 Basic Research QuestionsYidnekachewNo ratings yet

- Clean Edge RazorDocument5 pagesClean Edge RazorSahil Anand100% (1)

- Marketing Strategies For Profitabilty of Handicraft Industry....Document9 pagesMarketing Strategies For Profitabilty of Handicraft Industry....Leslie Ann Elazegui UntalanNo ratings yet