Professional Documents

Culture Documents

Application of Ratio Analysis in Enterprise Financial Management

Uploaded by

FengboOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Application of Ratio Analysis in Enterprise Financial Management

Uploaded by

FengboCopyright:

Available Formats

Application of ratio analysis in enterprise financial

management

Abstract : In the process of operation and development, in order to obtain more

economic profits, the enterprise needs the financial management and analysis, and

then realizes the shareholder wealth maximization. Ratio analysis is more practical in

financial management. Therefore, this paper analyzes the application of ratio analysis

in enterprise financial management, and points out some noteworthy places in the face

of the limitations of ratio analysis.

Key words:ratio analysis,financial management,enterprise decision

1. The connotation of ratio analysis

Generally, in financial analysis,we should analyze solvency, operation ability and

profitability ( There are other categories certainly, but they don't go beyond these

three dimensions). The method we usually use is ratio analysis. Ratio analysis is to

process and analyze financial information on the basis of deep understanding of

enterprise operation and management, so as to help enterprises make judgments,

decisions and forecasts. As an effective method and technique, ratio analysis can

reflect the cash flow, financial status and operating results of an enterprise. Through

the implementation of the relevant financial ratio index analysis can provide a

favorable basis for enterprise managers to make decisions.

2. The ratio analysis of three kinds of indicators

2.1 Solvency analysis

Solvency refers to the degree to which an enterprise can guarantee its debts in a

corresponding period, which is deeply affected by the enterprise's liquidity of asset.

Solvency mainly consists of short-term solvency and long-term solvency. The ratio

that reflects short-term solvency mainly involves current ratio, cash ratio and quick

ratio; The ratio that reflects long-term solvency mainly involves debt-to-assets,

interest coverage and equity ratio.

The liquidity of enterprise assets have a subtle influence on the short-term

solvency. The liquidity refers to the transformation of assets without price reduction

and the shrinkage of current assets caused by the transformation. To some extent,

enterprise management efficiency and operation level have a decisive impact on cash

inflow. Current ratio refers to the ratio of current assets and current liabilities.

Generally, financial risks will decrease with the enhancement of short-term solvency

and the increase of current ratio. Otherwise, risks will increase, so the reasonable limit

is particularly important. From a theoretical point of view, “2” of liquidity ratio is

usually understood to be normal, meaning that the financial situation is good; Less

than “1” means that the enterprise has a large financial risk, the repayment of short-

term debt has a certain difficulty; A current ratio higher than “2” means that

enterprises have wasted assets and unreasonable allocation. Long-term solvency needs

to take a long-term view as the starting point and dynamically observe whether an

enterprise can repay the principal and interest on time. For the generation of debt

repayment funds, capital guarantee is the appreciation of the asset, which needs the

support of the normal profitability of the enterprise. The enterprise cannot rely on

selling assets to repay long-term liabilities for a long time. The profitability of the

enterprise is closely related to long-term solvency.

Debt-to-assets refers to the proportion between total liabilities and total assets,

which is an indispensable debt repayment indicator. Taking the conservatism principle

as the starting point, asset-liability ratio of about 50% is understood as a high asset-

liability ratio, which means that the enterprise has a strong ability to raise funds. But

low asset-liability ratio means that the financial risk of the enterprise is smaller. The

enterprise should be clever to clarify the degree of liabilities in combination with the

actual situation and improve profits. Equity ratio refers to the ratio between total debt

and owners' equity. A higher ratio means that the capital structure has higher risks and

higher benefits. The interest coverage is refers to the ratio of EBIT to interest

expense.Interest expense involves financial expenses and capitalized interest. This

ratio exerts a subtle influence on the enterprise debt paying ability, in general

enterprise’s solvency will enhance with the increase of the ratio. To some extent, only

when the ratio is higher than 1 can the enterprise be able to repay the interest expense.

2.2 Operation ability analysis

Activity ratios refers to how efficiently an enterprise can use all its assets based

on the turnover speed of each asset. The strength of operation capacity is not only

reflected in the application ratio of a single asset, but also longitudinal analysis based

on the trend of index change, and horizontal analysis compared with the same

industry. Activity ratios analysis involves accounts receivable turnover, fixed assets

turnover, operating cycle and total assets turnover, etc. Accounts receivable turnover

ratio refers to the proportion between sales and accounts receivable, and days of sales

outstanding is the proportion of the number of days in the whole year and the ratio of

accounts receivable turnover. It means the speed of receivables collection and

management efficiency of an enterprise, so as to infer the profitability and asset

liquidity of an enterprise. First of all, a larger receivables turnover ratio means that the

enterprise can quickly withdraw the sales revenue, which has a higher management

efficiency .Secondly, less receivables means rapid capital turnover. It is likely that the

enterprise has put forward harsh conditions for supply requirements and credit

standards, resulting in a small market share.

Inventory turnover refers to the proportion of COGS and inventory. In general,

high inventory turnover means that companies have large COGS and sell more

products,In other words,the enterprise has a strong sales ability.Inventory turnover

ratio plays a role in measuring whether inventory capacity is reasonable, and it is the

main sign to ensure the supply, production and sales cycle of enterprises. Therefore,

enterprises need to make reasonable adjustments according to the actual situation. In

addition, the speed of capital turnover increases with the decrease of receivables, and

the enterprise credit requirements and supply conditions are too strict, which reduces

the market share to a certain extent. In general, the operation will be accelerated with

the speed of turnover of all assets, and the operation efficiency will be improved with

the shortening of the operating cycle. Asset turnover ratio refers to the proportional

relationship between the revenue and the average total asset value. It is a

comprehensive evaluation of the operating efficiency of an enterprise, and fully shows

the input and output velocity of all assets of an enterprise, as well as a comprehensive

evaluation of the utilization efficiency and management quality of all assets of an

enterprise. Generally speaking, asset turnover has a subtle impact on the operating

capacity of an enterprise, and sales capacity will be strengthened with the increase of

asset turnover. In order to accelerate the speed of asset turnover, some enterprises

choose bulk-cheap to improve their profits.

2.3 Profitability analysis

Profitability refers to the potential or possibility of an enterprise to obtain profits

within a certain period of time. Profit is not only the starting point and destination of

enterprises, but also the source of investors' income. It’s also an important basis for

judging managers' performance and the main guarantee for employees' treatment

improvement. Profitability analysis involves the ratios of gross profit margin, return

on total assets and net profit margin,etc.

Gross profit margin refers to the proportion between gross profit and net

revenue. The use of this ratio needs to fully consider the characteristics of the

industry,the operating cycle, and a reasonable comparison with the same industry, to

find the distance and improve profits. Return on total assets refers to the proportion

between net income and average total assets, which fully demonstrates net profit per

unit of assets. Generally, the management efficiency based on the operation of all

assets will be improved with the improvement of the profitability of the total assets.

The net profit margin is the ratio of net income to revenue,and indicates how much of

per unit of sales left after all expenses. Profitability will increase as the ratio increases.

3.Matters needing attention in the application of ratio analysis

3.1 Make full use of all indicators

In ratio analysis, we should not unilaterally pay attention to the change of a

certain financial index, but consider from various aspects. For example, on the

analysis of short-term solvency, it is necessary to analyze the current ratio, quick ratio

and cash ratio simultaneously, Moreover, It can also be analyzed by the guarantee

degree of monetary funds and cash flow of operating activities on short-term debt. If

monetary funds and cash flow from operating activities cannot guarantee short-term

debt, cash inflow from financing activities can be further analyzed.

3.2 Pay attention to the limitations of ratio analysis

With the development of economy and society, many new economic business

forms and models have emerged, such as group companies, multinational companies,

Internet companies and sharing economy. The group company may have subsidiaries

in different industries and businesses. First of all, from the perspective of data

acquisition, if some data from the consolidated report are selected for ratio analysis,

the reflected situation will be inconsistent with the actual situation. Because such data

is the average, is mixed data.So it’s necessary to increase the granularity of financial

ratio analysis.Secondly, there is a lack of financial analysis tools to analyze the effect

of foreign exchange transactions and foreign exchange risk avoidance in multinational

companies. Finally, some key financial ratio analysis indicators are often focused on

by corporate management and used to sugarcoat and manipulate financial data. It is

very important to identify this kind of financial data fraud behavior through

systematic financial ratio analysis.

3.3 Note the comprehensive understanding of the industrial environment

The current financial ratio analysis can not make a comprehensive reflection to the

operation activities of enterprises. The ratio analysis method is simple and widely

used in practice, but it can only help stakeholders to make a rough judgment. This

rough analysis separates the overall view of enterprise management. The conclusion

obtained through basic ratio analysis has little contribution to the stakeholders and

limited contribution to the improvement of the enterprise operation. In principle, the

business situation of the enterprise will be reflected in the data, but it is still difficult

to reverse the business activities of the enterprise through the financial data in

practice. One of the advantages of the ratio analysis method is to dilute the influence

of different enterprises, which makes it possible to compare enterprises of different

sizes and even in different industries with the same benchmark. However,in the

evaluation of the financial ratio, the data should not be evaluated by data,or simple

comparison of the absolute value of the numbers should not be made. Instead, the

analysis should be carried out in combination with the external and internal

environment of the enterprise to make the ratio analysis more in-depth and the

conclusion more objective.

3.4 Note the important influence of non-monetary measurement on the

development of enterprises

In the process of long-term development of enterprises, the financial situation

can not be completely analyzed and controlled by monetary measurement. Non-

con

monetary factors such as leaders' ideas, corporate culture, managerial competence and

experience, product category and marketing status are equally important. Enterprises

will formulate different development strategies and adjust the strategies of research

and development, production and sales according to the development status.During

the adjustment period, it will affect the costs, expenses, profits and other aspects.

These non-monetary measures have little impact on the financial data in the short

term, but for the long-term development, there will be a large gap. Therefore, not all

financial information needs to rely on monetary measurement to reflect. It is

necessary to analyze all the links and factors that affect the development of

enterprises, and then make effective decisions. Although it costs a lot of time, it can

improve the accuracy of financial ratio analysis and increase the authenticity of

financial statement information.

Conclusion: In summary, financial management plays an extremely important role

in the development of enterprises, and ratio analysis is an indispensable tool for

corporate financial management, so the application of ratio analysis is very important.

It is vital to note that although the ratio analysis has played a relatively active role,

there is also a corresponding disadvantages and limitations. It cannot show

enterprise's actual conditions completely, which requires that enterprises need to make

reasonable analysis on the basis of fully understanding and mastering other indicators,

so as to draw more scientific and objective conclusions and promote the realization of

the maximum benefits of enterprises.

You might also like

- ACFrOgBfkBoiRJszOmdFhuS8P6k4A cO98JX2vRe4126n8qkQ 55MrwphGFcPDfwkNMXQoQ - 79H 3AybOD0Zw6MH17zIh h9b3u2CWDF4691W6dWpUdLUkpW5jZq60rrVjTzln29bnexP0mQThOP PDFDocument14 pagesACFrOgBfkBoiRJszOmdFhuS8P6k4A cO98JX2vRe4126n8qkQ 55MrwphGFcPDfwkNMXQoQ - 79H 3AybOD0Zw6MH17zIh h9b3u2CWDF4691W6dWpUdLUkpW5jZq60rrVjTzln29bnexP0mQThOP PDFCAIRA GAIL MALABANANNo ratings yet

- BHEL FinanceDocument44 pagesBHEL FinanceJayanth C VNo ratings yet

- 4 Reasons Why Ratios and Proportions Are So ImportantDocument8 pages4 Reasons Why Ratios and Proportions Are So ImportantShaheer MehkariNo ratings yet

- Analysis and Interpretation of Financial StatementDocument7 pagesAnalysis and Interpretation of Financial StatementshubhcplNo ratings yet

- Classification of Ratio: Current LiabilitiesDocument2 pagesClassification of Ratio: Current LiabilitiesVijay Kumar T GoudarNo ratings yet

- Financial analysis ratiosDocument30 pagesFinancial analysis ratiosRutuja KhotNo ratings yet

- Fin Financial Statement AnalysisDocument8 pagesFin Financial Statement AnalysisshajiNo ratings yet

- Lectures Analysis of Financial StatementsDocument2 pagesLectures Analysis of Financial Statementsmarilyn c. papinaNo ratings yet

- Liquidity and ProfitabilityDocument63 pagesLiquidity and ProfitabilityMamilla Babu100% (1)

- Financial Ratio MBA Complete ChapterDocument19 pagesFinancial Ratio MBA Complete ChapterDhruv100% (1)

- Theoretical PerspectiveDocument12 pagesTheoretical PerspectivepopliyogeshanilNo ratings yet

- Samle 8Document2 pagesSamle 8Mane DaralNo ratings yet

- Ratio Analysis: A Tool for Financial Statement EvaluationDocument8 pagesRatio Analysis: A Tool for Financial Statement EvaluationRG RAJNo ratings yet

- Ratio Analysis TheoryDocument22 pagesRatio Analysis TheoryTarun Sukhija100% (1)

- Pegasus Hotel Financial Ratio AnalysisDocument38 pagesPegasus Hotel Financial Ratio AnalysisBella BellNo ratings yet

- Financial Management Chapter 03 IM 10th EdDocument38 pagesFinancial Management Chapter 03 IM 10th EdDr Rushen SinghNo ratings yet

- FSA Notes IDocument10 pagesFSA Notes Iparinita raviNo ratings yet

- Liquidity Ratios:: Current Ratio: It Is Used To Test A Company's LiquidityDocument12 pagesLiquidity Ratios:: Current Ratio: It Is Used To Test A Company's LiquidityDinesh RathinamNo ratings yet

- Theory of Ratio AnalysisDocument14 pagesTheory of Ratio AnalysisReddy BunnyNo ratings yet

- FMA Assignment - 2022mb22012 - Amandeep SinghDocument14 pagesFMA Assignment - 2022mb22012 - Amandeep Singh200100175No ratings yet

- Meaning and Definition: ProfitcapitalDocument8 pagesMeaning and Definition: ProfitcapitalSuit ChetriNo ratings yet

- FM - Lesson 4 - Fin. Analysis - RatiosDocument8 pagesFM - Lesson 4 - Fin. Analysis - RatiosRena MabinseNo ratings yet

- Proj 3.0 2Document26 pagesProj 3.0 2Shivam KharuleNo ratings yet

- Analyzing PNB's Financial RatiosDocument73 pagesAnalyzing PNB's Financial RatiosPrithviNo ratings yet

- Ratio Analysis Brief Notes: Prof. Mayur Malviya Ratio AnalysisDocument11 pagesRatio Analysis Brief Notes: Prof. Mayur Malviya Ratio AnalysisravikumardavidNo ratings yet

- Financial ManagementDocument120 pagesFinancial Managementdaniellema5752No ratings yet

- 41-Liquidity and ProfitabilityDocument65 pages41-Liquidity and Profitabilityshameem afroseNo ratings yet

- Financial Ratio AnalysisDocument11 pagesFinancial Ratio Analysispradeep100% (5)

- Analyze Financial Ratios to Evaluate Business PerformanceDocument5 pagesAnalyze Financial Ratios to Evaluate Business Performancealfred benedict bayanNo ratings yet

- Answer On Question#38790 - Math - OtherDocument4 pagesAnswer On Question#38790 - Math - OtherAbiguel LabanaNo ratings yet

- Financial Ratios End TermDocument11 pagesFinancial Ratios End TermPriyanka Roy100% (1)

- Management Accounting Assignment Topic:Ratio Analysis: Room 34Document18 pagesManagement Accounting Assignment Topic:Ratio Analysis: Room 34nuttynehal17100% (1)

- Types Financial RatiosDocument8 pagesTypes Financial RatiosRohit Chaudhari100% (1)

- Class 12 AccountDocument9 pagesClass 12 AccountChandan ChaudharyNo ratings yet

- Ratio AnalysisDocument57 pagesRatio AnalysisShaik Sajid AhmedNo ratings yet

- Brand Awairness Cocacola ProjectDocument70 pagesBrand Awairness Cocacola Projectthella deva prasadNo ratings yet

- Financial Statements and Ratio Analysis: ChapterDocument25 pagesFinancial Statements and Ratio Analysis: Chapterkarim67% (3)

- Chapter 03 IM 10th EdDocument32 pagesChapter 03 IM 10th EdahelmyNo ratings yet

- Ratio Analysis Notes and Practice Questions With SolutionsDocument23 pagesRatio Analysis Notes and Practice Questions With SolutionsAnkith Poojary60% (5)

- What Is The Current RatioDocument5 pagesWhat Is The Current RatioRijo RejiNo ratings yet

- T2 - Analysis of Financial StatementsDocument2 pagesT2 - Analysis of Financial StatementsJERRIE MAY JAMBANGANNo ratings yet

- Classification of RatiosDocument10 pagesClassification of Ratiosaym_6005100% (2)

- MPADocument24 pagesMPAanushkaanandaniiiNo ratings yet

- Chapter 8 - CompleteDocument12 pagesChapter 8 - Completemohsin razaNo ratings yet

- Financial Statements Analysis - ReportDocument18 pagesFinancial Statements Analysis - ReportKrissa SustalNo ratings yet

- Evaluating A Firms Financial Performance by Keown3Document36 pagesEvaluating A Firms Financial Performance by Keown3talupurum100% (1)

- Ratio Analysis.Document3 pagesRatio Analysis.রুবাইয়াত নিবিড়No ratings yet

- 19wj1e0022 Financial Statment Analysis RelianceDocument67 pages19wj1e0022 Financial Statment Analysis RelianceWebsoft Tech-HydNo ratings yet

- Ratio Analysis GuideDocument7 pagesRatio Analysis GuideVinesh Kumar100% (1)

- CH 2Document53 pagesCH 2malo baNo ratings yet

- Financial Ratio Analysis GuideDocument64 pagesFinancial Ratio Analysis Guidedk6666No ratings yet

- Ratio Analysis of Reliance IndustriesDocument27 pagesRatio Analysis of Reliance IndustriesSanjana Kurhade100% (5)

- Accounting Ratios: MeaningDocument10 pagesAccounting Ratios: MeaningAlokSinghNo ratings yet

- 11 Ratio AnalysisDocument22 pages11 Ratio Analysisjessamaejardio16No ratings yet

- Financial AnalysisDocument14 pagesFinancial AnalysisTusharNo ratings yet

- Banking ReviewerDocument4 pagesBanking ReviewerRaymark MejiaNo ratings yet

- Finance for Nonfinancial Managers: A Guide to Finance and Accounting Principles for Nonfinancial ManagersFrom EverandFinance for Nonfinancial Managers: A Guide to Finance and Accounting Principles for Nonfinancial ManagersNo ratings yet

- Corporate Finance Weight: 10 %Document182 pagesCorporate Finance Weight: 10 %FengboNo ratings yet

- Equity Investments - 2020Document210 pagesEquity Investments - 2020FengboNo ratings yet

- Internship Report of Efu Insurance Company PDF FreeDocument33 pagesInternship Report of Efu Insurance Company PDF FreeFengboNo ratings yet

- Insurance Awareness ReportDocument57 pagesInsurance Awareness ReportBinita rani mohapatraNo ratings yet

- Insurance MH 02Document75 pagesInsurance MH 02mehedi hasanNo ratings yet

- Work in Pairs and Discuss The Following QuestionsDocument1 pageWork in Pairs and Discuss The Following QuestionsFengboNo ratings yet

- Fundamentals of Corporate Finance Canadian 5th Edition Brealey Test BankDocument68 pagesFundamentals of Corporate Finance Canadian 5th Edition Brealey Test BankEricBergermfcrd100% (13)

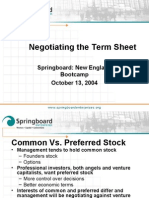

- Negotiating The Term SheetDocument21 pagesNegotiating The Term SheetDaniel100% (6)

- Managerial Accounting Quiz 2Document1 pageManagerial Accounting Quiz 2Raju SainiNo ratings yet

- ACCT 575quiz 1 PDFDocument16 pagesACCT 575quiz 1 PDFMelNo ratings yet

- Financial Reporting and Analysis 21BAT-602: Master of Business AdministrationDocument39 pagesFinancial Reporting and Analysis 21BAT-602: Master of Business AdministrationAshutosh prakashNo ratings yet

- Instructor Manual For Financial Managerial Accounting 16th Sixteenth Edition by Jan R Williams Sue F Haka Mark S Bettner Joseph V CarcelloDocument14 pagesInstructor Manual For Financial Managerial Accounting 16th Sixteenth Edition by Jan R Williams Sue F Haka Mark S Bettner Joseph V CarcelloMarkCallahanxgyfq100% (37)

- DEBT-EQUITY RATIO ANALYSISDocument9 pagesDEBT-EQUITY RATIO ANALYSISSHRI0588No ratings yet

- UNION CHRISTIAN COLLEGE MOCK BOARD EXAM REVIEWDocument13 pagesUNION CHRISTIAN COLLEGE MOCK BOARD EXAM REVIEWAllen Fey De Jesus50% (4)

- Module 3 - Topic 3 - Topic NotesDocument38 pagesModule 3 - Topic 3 - Topic NotesHa Vi TrinhNo ratings yet

- Assignment 01 QuestionsDocument3 pagesAssignment 01 QuestionsHanlin ShaoNo ratings yet

- Docs in A Box, Inc.Document6 pagesDocs in A Box, Inc.Leonardo D NinoNo ratings yet

- Boundless Lecture Slides: Available On The Boundless Teaching PlatformDocument55 pagesBoundless Lecture Slides: Available On The Boundless Teaching PlatformAugustNo ratings yet

- ACF 103 Revision Qns Solns 20141Document11 pagesACF 103 Revision Qns Solns 20141danikadolorNo ratings yet

- Assignment 3 SolutionDocument7 pagesAssignment 3 SolutionAaryaAustNo ratings yet

- Cash FlowsDocument3 pagesCash FlowsAngelyn SamandeNo ratings yet

- CPA Review Income Recognition GuideDocument44 pagesCPA Review Income Recognition GuideMarjorie PalmaNo ratings yet

- Fidelity Bank - Statement Template 15Document30 pagesFidelity Bank - Statement Template 15colton gallaharNo ratings yet

- Cost of Capital BVU2011 - 12 - CzaplinskiDocument4 pagesCost of Capital BVU2011 - 12 - CzaplinskikapurrrnNo ratings yet

- GTBO LKKInterim 30sept2019Document73 pagesGTBO LKKInterim 30sept2019Arief Noven IdNo ratings yet

- 74757bos60489 cp14Document77 pages74757bos60489 cp14Vansh AmeraNo ratings yet

- BCP Shares FinancingDocument1 pageBCP Shares FinancingRahmat HidayatNo ratings yet

- Corporate TaxationDocument7 pagesCorporate TaxationExequiel CrusperoNo ratings yet

- GTU MBA 2018 3rd Semester Winter 2830201 Strategic Financial ManagementDocument4 pagesGTU MBA 2018 3rd Semester Winter 2830201 Strategic Financial ManagementAbhishek ChaturvediNo ratings yet

- Portions of Accounting BookDocument23 pagesPortions of Accounting Bookjamcarzadon.scNo ratings yet

- Accounting Class No. 2-3 (Case 4-7)Document2 pagesAccounting Class No. 2-3 (Case 4-7)Мария НиколенкоNo ratings yet

- Week 2 Learning Material - ACCT 1073 Financial MarketsDocument6 pagesWeek 2 Learning Material - ACCT 1073 Financial MarketsMark Angelo BustosNo ratings yet

- Lecture - 5 - CFI-3-statement-model-completeDocument37 pagesLecture - 5 - CFI-3-statement-model-completeshreyasNo ratings yet

- Unclaimed and Unpaid Dividend Pending With The Company As On 31.03.2019Document9 pagesUnclaimed and Unpaid Dividend Pending With The Company As On 31.03.2019harsh bangurNo ratings yet

- Advanced Public Finance and Taxation Strathmore University Notes and Revision KitDocument286 pagesAdvanced Public Finance and Taxation Strathmore University Notes and Revision Kitmillicent odhiamboNo ratings yet

- 49aijc7 PDFDocument3 pages49aijc7 PDFParth MahisuryNo ratings yet