Professional Documents

Culture Documents

Jawaban Quiz 3 AKM Kelas C - Amanda G Erari - F0320007

Jawaban Quiz 3 AKM Kelas C - Amanda G Erari - F0320007

Uploaded by

Amanda Givelline Erari0 ratings0% found this document useful (0 votes)

5 views2 pagesOriginal Title

Jawaban Quiz 3 AKM kelas C_Amanda G Erari_F0320007

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

5 views2 pagesJawaban Quiz 3 AKM Kelas C - Amanda G Erari - F0320007

Jawaban Quiz 3 AKM Kelas C - Amanda G Erari - F0320007

Uploaded by

Amanda Givelline ErariCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

Nama : Amanda Givelline Erari

NIM : F0320007

Mata Kuliah : Akuntansi Menengah 1 (C)

Quiz 3

Statement of cash flows preparation.

Selected financial statement information and additional data for Stanislaus Co. is

presented below. Prepare a statement of cash flows for the year ending December 31,

2019

December 31

2018 2019

Land ....................................................... € 63,800 € 21,000

Equipment .............................................. 504,000 789,600

Inventory ................................................ 173,000 201,600

Accounts receivable (net) ...................... 84,000 151,200

Cash........................................................ 32,000 63,000

TOTAL ...................................... €856,800 €1,226,400

Share capital–ordinary ........................... €420,000 € 487,200

Retained earnings ................................... 67,200 205,800

Notes payable - Long-term .................... 168,000 302,400

Notes payable - Short-term (trade) ........ 67,200 29,400

Accounts payable ................................... 50,400 86,000

Accumulated depreciation ..................... 84,000 115,600

TOTAL ...................................... €856,800 €1,226,400

Additional data for 2019:

1. Net income was €215,200.

2. Depreciation was €31,600.

3. Land was sold at its original cost.

4. Dividends of €76,600 were paid.

5. Equipment was purchased for €84,000 cash.

6. A long-term note for €201,600 was used to pay for an equipment purchase.

7. Ordinary shares were issued to pay a €67,200 long-term note payable.

Jawaban :

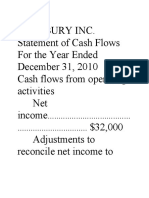

Stanislaus Co.

Statement of Cash Flows

For the year ended December 31, 2019

Net Income $215,200

Cash flow from operating activities

Depreciation expense 31,600

Increase in accounts receivable (67,200)

Increase in inventory (28,600)

Increase in accounts payable 35,600

Decrease in short-term notes payable (67,200) (29,400)

Net cash provided by operating activities 185,800

Cash flow from investing activities

Purchase equipment (84,000)

Sale of land 42,800

Net cash used by investing activities (41,200)

Cash flow from financing activities

Payment of cash dividend (76,600)

Net cash used by financing activities (76,600)

Net increase in cash 31,000

Cash at beginning of year 32,000

Cash at end of the year 63,000

Noncash investing and financing activities

Payment for equipment with issuance of $201,600 long-term note

Payment of long-term note payable with issuance of $67,200 of common stock

You might also like

- P11Document7 pagesP11Arif RahmanNo ratings yet

- E21 16Document2 pagesE21 16Warmthx0% (1)

- P2 41 2 42 SolutionsDocument3 pagesP2 41 2 42 SolutionsMarjorie PalmaNo ratings yet

- 3 Cash - Assignment PDFDocument6 pages3 Cash - Assignment PDFCatherine RiveraNo ratings yet

- ACCT550 Homework Week 2Document5 pagesACCT550 Homework Week 2Natasha Declan100% (2)

- AccountingDocument8 pagesAccountingDarshan SomashankaraNo ratings yet

- Kisi2 UAS AKM TerjawabDocument8 pagesKisi2 UAS AKM TerjawabBakhtiar AlakadarnyaNo ratings yet

- TR 2 IndahDocument3 pagesTR 2 IndahIndahyuliaputriNo ratings yet

- Tugas Latihan Soal EPSDocument4 pagesTugas Latihan Soal EPSNaoya FaldinyNo ratings yet

- Chap 2 ProblemDocument5 pagesChap 2 Problem烈仙雪No ratings yet

- Regression Line of Overhead Costs On LaborDocument3 pagesRegression Line of Overhead Costs On LaborElliot Richard100% (1)

- Chapter 17 HWDocument40 pagesChapter 17 HWEejay MagatNo ratings yet

- Intermediate Accounting: Assignment 2Document2 pagesIntermediate Accounting: Assignment 2Putri SerlyNo ratings yet

- Problem 21.3Document3 pagesProblem 21.3Fayed Rahman MahendraNo ratings yet

- ACCT550 Exercises Week 1Document6 pagesACCT550 Exercises Week 1Natasha DeclanNo ratings yet

- Contoh Dan Soal Cash FlowDocument9 pagesContoh Dan Soal Cash FlowAltaf HauzanNo ratings yet

- Tutorial Laporan Arus KasDocument17 pagesTutorial Laporan Arus KasRatna DwiNo ratings yet

- Tugas CH 8 Dan 9Document13 pagesTugas CH 8 Dan 9muhammad alfariziNo ratings yet

- Latihan 3Document3 pagesLatihan 3Radit Ramdan NopriantoNo ratings yet

- Jawaban Soal Latihan Ch.11Document2 pagesJawaban Soal Latihan Ch.11Wira DinataNo ratings yet

- Chapter 6 and 7 NR and BPDocument2 pagesChapter 6 and 7 NR and BPCa Ada100% (1)

- Acct 301 Ex Textbook SP 2022Document15 pagesAcct 301 Ex Textbook SP 2022semsem ahmedNo ratings yet

- Presented Below Is The Trial Balance of Vivaldi Spa at December 31, 2019Document2 pagesPresented Below Is The Trial Balance of Vivaldi Spa at December 31, 2019SalsabiilaNo ratings yet

- Working 4Document8 pagesWorking 4Hà Lê DuyNo ratings yet

- Tugas 6 AKM1 Muhammad Alfarizi 142200278 EA-IDocument9 pagesTugas 6 AKM1 Muhammad Alfarizi 142200278 EA-Imuhammad alfariziNo ratings yet

- Erika Christina - LD53 - Latihan KPDocument14 pagesErika Christina - LD53 - Latihan KPNatasha HerlianaNo ratings yet

- E14-3 (Entries For Bond Transactions) Presented Below Are Two Independent SituationsDocument3 pagesE14-3 (Entries For Bond Transactions) Presented Below Are Two Independent SituationsAsuna SanNo ratings yet

- Latihan Soal Akuntansi Untuk PensionDocument4 pagesLatihan Soal Akuntansi Untuk PensionRini SusantyNo ratings yet

- Exercise - Dilutive Securities - AdillaikhsaniDocument4 pagesExercise - Dilutive Securities - Adillaikhsaniaidil fikri ikhsanNo ratings yet

- Akuntansi Keuangan 1 TUGAS E5.11, E5.12, E5.15 DAN E5.16 Kelas ADocument8 pagesAkuntansi Keuangan 1 TUGAS E5.11, E5.12, E5.15 DAN E5.16 Kelas ADedep0% (1)

- Chapter 7 Supplemental QuestionsDocument7 pagesChapter 7 Supplemental QuestionsDita Ens100% (1)

- Pr. 4-146-Income StatementDocument13 pagesPr. 4-146-Income StatementElene SamnidzeNo ratings yet

- Pertemuan 12 Chapter 19 KiesoDocument90 pagesPertemuan 12 Chapter 19 KiesoJordan SiahaanNo ratings yet

- Final Review Jawaban IntermediateDocument33 pagesFinal Review Jawaban Intermediatelukes12No ratings yet

- CH 14Document71 pagesCH 14Febriana Nurul HidayahNo ratings yet

- Soal Ch. 15Document6 pagesSoal Ch. 15Kyle KuroNo ratings yet

- Presentasi Ak. Keu. KLMPK 3Document14 pagesPresentasi Ak. Keu. KLMPK 3Menaz Sadaka100% (1)

- RWD 05 CVP AnalysisDocument58 pagesRWD 05 CVP Analysishamba allahNo ratings yet

- 17-38 Transferred-In Costs, Weighted-Average Method. Bookworm, Inc., Has TwoDocument6 pages17-38 Transferred-In Costs, Weighted-Average Method. Bookworm, Inc., Has TwoMajd MustafaNo ratings yet

- Zulfitri Handayani - A031191125 (Akkeu P15-3)Document6 pagesZulfitri Handayani - A031191125 (Akkeu P15-3)RismayantiNo ratings yet

- E22-6 (LO 2) Accounting Changes-DepreciationDocument6 pagesE22-6 (LO 2) Accounting Changes-DepreciationRiana DeztianiNo ratings yet

- The Statement of Financial Position of Stancia Sa at DecemberDocument1 pageThe Statement of Financial Position of Stancia Sa at DecemberCharlotte100% (1)

- AKUNTANSI BIAYA Week 4 - Cornelius CakraDocument3 pagesAKUNTANSI BIAYA Week 4 - Cornelius CakraCornelius cakraNo ratings yet

- Condensed Income Statement, Periodic Inventory MethodDocument2 pagesCondensed Income Statement, Periodic Inventory MethodAsma HatamNo ratings yet

- Akuntansi KeuanganDocument11 pagesAkuntansi KeuanganDyan NoviaNo ratings yet

- Chapter 13Document8 pagesChapter 13kimberlyann ongNo ratings yet

- Tugas AKM II Minggu 9Document2 pagesTugas AKM II Minggu 9Clarissa NastaniaNo ratings yet

- LATIH SOAL M3 3 Laporan Laba Rugi Dan Hal Lain Yg BerkaitanDocument2 pagesLATIH SOAL M3 3 Laporan Laba Rugi Dan Hal Lain Yg BerkaitanBlue FinderNo ratings yet

- Latih Soal Kieso E5-6 E5-12Document4 pagesLatih Soal Kieso E5-6 E5-12Agung Setya NugrahaNo ratings yet

- Belinda 125150469 OY E7-14. On April 1, 2015, Prince Company Assigns $500,000 of Its Accounts Receivable To TheDocument1 pageBelinda 125150469 OY E7-14. On April 1, 2015, Prince Company Assigns $500,000 of Its Accounts Receivable To ThebelindaNo ratings yet

- Homework Chapter 6Document10 pagesHomework Chapter 6Le Nguyen Thu UyenNo ratings yet

- Wahyudi Syaputra - Assignment Week 13Document11 pagesWahyudi Syaputra - Assignment Week 13Wahyudi SyaputraNo ratings yet

- p5 6Document10 pagesp5 6/// MASTER DOGENo ratings yet

- Ananda Febrian P.S - 041911333118 - Tugas Akm 8Document5 pagesAnanda Febrian P.S - 041911333118 - Tugas Akm 8sari ayuNo ratings yet

- Week13 SolutionsDocument14 pagesWeek13 SolutionsRian RorresNo ratings yet

- Fa2 TutorialDocument59 pagesFa2 TutorialNam PhươngNo ratings yet

- Chap 13 Statement of Cash FlowsPractice QuestionsDocument7 pagesChap 13 Statement of Cash FlowsPractice QuestionshatanoloveNo ratings yet

- 3512 Chapter 23 Cash Flows HW Exercises ProblemsDocument12 pages3512 Chapter 23 Cash Flows HW Exercises ProblemsM MustafaNo ratings yet

- PR Week 10Document8 pagesPR Week 10Rifda AmaliaNo ratings yet

- SFP and SCF - Practice QuestionsDocument3 pagesSFP and SCF - Practice QuestionsFazelah YakubNo ratings yet

- Financial Statement Analysis 11th Edition Test Bank K R SubramanyamDocument46 pagesFinancial Statement Analysis 11th Edition Test Bank K R SubramanyamMarlys Campbell100% (30)

- Krsnaa Diagnostics - Full Form of ResidentDocument12 pagesKrsnaa Diagnostics - Full Form of ResidentAbisekNo ratings yet

- Working Capital Two Mark QuestionsDocument4 pagesWorking Capital Two Mark QuestionsHimaja SridharNo ratings yet

- Larry Williams: 50 Years of Trading ExperienceDocument7 pagesLarry Williams: 50 Years of Trading ExperienceMaria José Botet CaridadNo ratings yet

- Peregrine Presentation FinalDocument15 pagesPeregrine Presentation FinalTanya SokolovaNo ratings yet

- Affise ReachDocument12 pagesAffise ReachMario IbarraNo ratings yet

- Financial Management COM 4203Document411 pagesFinancial Management COM 4203Enock Mochama MainaNo ratings yet

- Capital Expenditure DecisionsDocument5 pagesCapital Expenditure Decisionskeerthana chandrasekarNo ratings yet

- Ratio Analysis Al Anwar Ceramic Tiles SAOG CoDocument16 pagesRatio Analysis Al Anwar Ceramic Tiles SAOG CoDevender SharmaNo ratings yet

- Case StudyDocument7 pagesCase StudyAli RazaNo ratings yet

- Inventories Ch9IDocument2 pagesInventories Ch9Isamia.aliNo ratings yet

- Icse 2024 Specimen 631 CSTDocument7 pagesIcse 2024 Specimen 631 CSTShweta SamantNo ratings yet

- Chapter 5Document5 pagesChapter 5Kaleab TessemaNo ratings yet

- Chapter 4 Securities MarketsDocument24 pagesChapter 4 Securities MarketsHaider Salahaldin ArefNo ratings yet

- Trust Fund DoctrineDocument10 pagesTrust Fund DoctrineKhimie PadillaNo ratings yet

- PDF Financial Accounting For Management An Analytical Perspective 5Th Edition Ambrish Gupta Ebook Full ChapterDocument53 pagesPDF Financial Accounting For Management An Analytical Perspective 5Th Edition Ambrish Gupta Ebook Full Chapterjessie.ham964100% (1)

- Marathon Session (Part 08) - Class NotesDocument68 pagesMarathon Session (Part 08) - Class NotesSiya GoyalNo ratings yet

- Project Report 1: SharesDocument9 pagesProject Report 1: SharesvarungolechhaNo ratings yet

- Polaroid Case AnalysisDocument2 pagesPolaroid Case AnalysisDavid WebbNo ratings yet

- What Is The Breakeven Point (BEP) ?Document4 pagesWhat Is The Breakeven Point (BEP) ?Muhammad NazmuddinNo ratings yet

- Assumptions: Comparable Companies:Market ValueDocument18 pagesAssumptions: Comparable Companies:Market ValueTanya YadavNo ratings yet

- Greek LettersDocument10 pagesGreek LettersDhaval ShahNo ratings yet

- Alternative Investments - Structures and Outlook 2021: By: F.A. Emlyn NgwiriDocument13 pagesAlternative Investments - Structures and Outlook 2021: By: F.A. Emlyn NgwirijayRNo ratings yet

- What Gann's Square-Of-9 Means For The Nasdaq 100Document12 pagesWhat Gann's Square-Of-9 Means For The Nasdaq 100fsolomon100% (2)

- Final Report Aman DwivediDocument48 pagesFinal Report Aman Dwivediaman DwivediNo ratings yet

- English Email Templates For Project Follow Up With Your CustomerDocument3 pagesEnglish Email Templates For Project Follow Up With Your CustomerSunnie YangNo ratings yet

- Ratio Analysis - Most Comprehensive Guide (Excel Based)Document246 pagesRatio Analysis - Most Comprehensive Guide (Excel Based)Abhiron BhattacharyaNo ratings yet

- BKM CH 07 Answers W CFADocument14 pagesBKM CH 07 Answers W CFAGhulam Hassan100% (5)

- Pyt Mat 112Document6 pagesPyt Mat 112Hazeeq SamsulNo ratings yet

- Introduction To Derivatives and Risk Management 10th Edition Chance Test BankDocument9 pagesIntroduction To Derivatives and Risk Management 10th Edition Chance Test Banktaylorhughesrfnaebgxyk100% (16)