Professional Documents

Culture Documents

BR Table For BNM Website

BR Table For BNM Website

Uploaded by

Rubaa AjeOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

BR Table For BNM Website

BR Table For BNM Website

Uploaded by

Rubaa AjeCopyright:

Available Formats

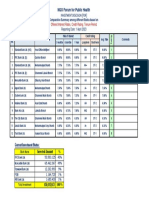

Base Rates, Base Lending/Financing Rates and Indicative Effective Lending Rates

No. Financial Institution Base Rate (%) Base Lending Indicative Effective

Rate (%) Lending Rate* (%)

1 Affin Bank Berhad 2.70 5.56 3.30

2 Alliance Bank Malaysia Berhad 2.57 5.42 3.11

3 AmBank (M) Berhad 2.60 5.45 3.25

4 Bangkok Bank Berhad 3.22 5.87 4.42

5 Bank of China (Malaysia) Berhad 2.55 5.35 3.55

6 CIMB Bank Berhad 2.75 5.60 3.50

7 Citibank Berhad 2.40 5.55 3.20

8 Hong Leong Bank Malaysia Berhad 2.63 5.64 3.50

9 HSBC Bank Malaysia Berhad 2.39 5.49 3.50

10 Industrial and Commercial Bank of China

2.52 5.45 3.47

(Malaysia) Berhad

11 Malayan Banking Berhad 1.75 5.40 3.25

12 OCBC Bank (Malaysia) Berhad 2.58 5.51 3.45

13 Public Bank Berhad 2.27 5.47 3.10

14 RHB Bank Berhad 2.50 5.45 3.50

No. Financial Institution Base Rate (%) Base Lending Indicative Effective

Rate (%) Lending Rate* (%)

15 Standard Chartered Bank Malaysia Berhad 2.27 5.45 3.50

16 United Overseas Bank (Malaysia) Bhd. 2.61 5.57 3.36

No. Islamic Financial Institution Base Rate (%) Base Financing Indicative Effective

Rate (%) Lending Rate (%)

1 Affin Islamic Bank Berhad 2.70 5.56 3.30

2 Al Rajhi Banking & Investment Corporation

2.85 5.75 4.20

(Malaysia) Berhad

3 Alliance Islamic Bank Berhad 2.57 5.42 3.11

4 AmBank Islamic Berhad 2.60 5.45 3.25

5 Bank Islam Malaysia Berhad 2.52 5.47 3.25

6 Bank Muamalat Malaysia Berhad 2.56 5.56 3.56

7 CIMB Islamic Bank Berhad 2.75 5.60 3.50

8 Hong Leong Islamic Bank Berhad 2.63 5.64 3.35

9 HSBC Amanah Malaysia Berhad 2.39 5.49 3.50

10 Kuwait Finance House (Malaysia) Berhad 2.25 6.14 3.30

11 Maybank Islamic Berhad 1.75 5.40 3.25

No. Islamic Financial Institution Base Rate (%) Base Financing Indicative Effective

Rate (%) Lending Rate (%)

12 MBSB Bank Berhad 2.65 5.50 3.20

13 OCBC Al-Amin Bank Berhad 2.58 5.52 3.45

14 Public Islamic Bank Berhad 2.27 5.47 3.10

15 RHB Islamic Bank Berhad 2.50 5.45 3.50

16 Standard Chartered Saadiq Berhad 2.27 5.45 3.50

No. Development Financial Institution Base Rate (%) Base Financing Indicative Effective

Rate (%) Lending Rate (%)

1 Bank Kerjasama Rakyat Malaysia Berhad 2.60 5.58 3.40

2 Bank Pertanian Malaysia Berhad

2.35 5.50 -

(Agrobank)

3 Bank Simpanan Nasional 2.60 5.35 3.10

Note:

* Indicative effective lending rate refers to the indicative annual effective lending rate for a standard 30-year housing loan/home

financing product with financing amount of RM350k and has no lock-in period.

As at 6 August 2020

Bank Negara Malaysia

You might also like

- Bank Swift CodeDocument6 pagesBank Swift CodeYew HongNo ratings yet

- Internship Report MCB Bank LTDDocument100 pagesInternship Report MCB Bank LTDSajidp78663% (16)

- MBBsavings - 110041 019774 - 2022 03 31Document23 pagesMBBsavings - 110041 019774 - 2022 03 31Mohd HasrieNo ratings yet

- ICAEW ATE List-2Document9 pagesICAEW ATE List-2maisonnbc100% (1)

- The Basel Ii "Use Test" - a Retail Credit Approach: Developing and Implementing Effective Retail Credit Risk Strategies Using Basel IiFrom EverandThe Basel Ii "Use Test" - a Retail Credit Approach: Developing and Implementing Effective Retail Credit Risk Strategies Using Basel IiNo ratings yet

- Listed CompaniesDocument17 pagesListed CompaniesRevive RevivalNo ratings yet

- CREDIT RISK MANAGEMENT IN BANK OF INDIA Final WorkingDocument154 pagesCREDIT RISK MANAGEMENT IN BANK OF INDIA Final Workingsanitjaitpal27_28710No ratings yet

- Security Bank P2Document9 pagesSecurity Bank P2jancat_06100% (2)

- Base Rates, Base Lending/Financing Rates and Indicative Effective Lending RatesDocument3 pagesBase Rates, Base Lending/Financing Rates and Indicative Effective Lending Ratespiscesguy78No ratings yet

- BR Table For BNM Website (18.01.19) PDFDocument3 pagesBR Table For BNM Website (18.01.19) PDFJarul ZahariNo ratings yet

- Interest Rate SpreadDocument6 pagesInterest Rate SpreadJannat TaqwaNo ratings yet

- Bank Interest Rate CalcultationDocument2 pagesBank Interest Rate CalcultationNprantoNo ratings yet

- HDFC StrongestBankDocument2 pagesHDFC StrongestBankjalalisumanNo ratings yet

- Assured ReturnsDocument11 pagesAssured ReturnsTheMoneyMitraNo ratings yet

- Bank Analysis WorkingDocument21 pagesBank Analysis WorkingNajmus SakibNo ratings yet

- CS FDRDocument1 pageCS FDRRONINo ratings yet

- FD Vs Debt Mutal Fund ModelDocument5 pagesFD Vs Debt Mutal Fund ModeltestNo ratings yet

- SL. NO. Name of The Bank Type of Bank Input Variables Public / Privat Fixed Assets Labour Borrowing FundsDocument10 pagesSL. NO. Name of The Bank Type of Bank Input Variables Public / Privat Fixed Assets Labour Borrowing Fundsdip16aniNo ratings yet

- Padma Bank: Doomed From Day One: Course InformationDocument8 pagesPadma Bank: Doomed From Day One: Course InformationIrfan Qadir 2035029660No ratings yet

- Current Scenario of Loans and Advances of Bank Asia Ltd. Moghbazar BranchDocument74 pagesCurrent Scenario of Loans and Advances of Bank Asia Ltd. Moghbazar BranchSumaiya AmrinNo ratings yet

- Chapter 3 NabinDocument15 pagesChapter 3 NabinNabin AdNo ratings yet

- Credit Risk Management 2017Document31 pagesCredit Risk Management 2017nazmulhossain01011997No ratings yet

- Determinants of Interest Rate Spread in The Banking Sector of Bangladesh: An Econometric AnalysisDocument17 pagesDeterminants of Interest Rate Spread in The Banking Sector of Bangladesh: An Econometric AnalysisAJHSSR JournalNo ratings yet

- A Research On: Analysis of Customer Satisfaction & Identification of Future Progress: A Case StudyDocument34 pagesA Research On: Analysis of Customer Satisfaction & Identification of Future Progress: A Case StudyShadman KibriaNo ratings yet

- Boi ProjectDocument133 pagesBoi ProjectrupalijaiswalNo ratings yet

- All ThesisDocument111 pagesAll ThesisArjun kumar ShresthaNo ratings yet

- Numan Intership Final Report MCB2022Document23 pagesNuman Intership Final Report MCB2022Muhammad ImranNo ratings yet

- Banking Theory and Practice: Digital Assignment 1Document5 pagesBanking Theory and Practice: Digital Assignment 1muthu kumaranNo ratings yet

- Economics AssignmentDocument11 pagesEconomics AssignmentRAJVINo ratings yet

- A Summer Internship ReportDocument85 pagesA Summer Internship ReportAbhi PatelNo ratings yet

- Non-Performing AssetsDocument20 pagesNon-Performing AssetsSagar PawarNo ratings yet

- Camel 01Document8 pagesCamel 01Pooja PawarNo ratings yet

- Gohil Jaydeep 2024 Sip PDFDocument84 pagesGohil Jaydeep 2024 Sip PDFJaydeep GohilNo ratings yet

- Assignment For Strategic Management ExplDocument25 pagesAssignment For Strategic Management ExplDesmond WilliamsNo ratings yet

- Bank LendingingDocument268 pagesBank LendingingAbhay Mathur100% (1)

- Table B6: Bank-Wise Non-Performing Assets (Npas) of Scheduled Commercial Banks: 2004 (Amount in Rs - Crore) As On March 31 Bank Name Gross Npas Gross Advances Gross Npa Ratio %Document2 pagesTable B6: Bank-Wise Non-Performing Assets (Npas) of Scheduled Commercial Banks: 2004 (Amount in Rs - Crore) As On March 31 Bank Name Gross Npas Gross Advances Gross Npa Ratio %abcNo ratings yet

- Comparative Study of BanksDocument8 pagesComparative Study of BanksSaurabh RajNo ratings yet

- Repot On SBIDocument76 pagesRepot On SBIPrasad SawantNo ratings yet

- Symbiosis LawsReleatedtoBankingDocument372 pagesSymbiosis LawsReleatedtoBankingPravindra Singh100% (1)

- MeghaDocument72 pagesMeghasumitNo ratings yet

- Internship ReportDocument82 pagesInternship ReportTasnuva TishaNo ratings yet

- Project On VaishyabankDocument49 pagesProject On Vaishyabankaniket7gNo ratings yet

- Comparing Finacial Performances of DCB Bank & Lakshmi Vilas BankDocument25 pagesComparing Finacial Performances of DCB Bank & Lakshmi Vilas BankDaniel Mathew VibyNo ratings yet

- Credit Management Policy and PerformanceDocument82 pagesCredit Management Policy and PerformanceAlinur IslamNo ratings yet

- Business Template 0001Document12 pagesBusiness Template 0001Ashif AliNo ratings yet

- 4.1.1 Ratio of Interest Income To Total Assets: 4.1 AnalysisDocument8 pages4.1.1 Ratio of Interest Income To Total Assets: 4.1 AnalysisGolam Samdanee TaneemNo ratings yet

- Customers' Satisfaction in Commercial Banks of Nepal: Dr. Jitendra Prasad UpadhyayDocument7 pagesCustomers' Satisfaction in Commercial Banks of Nepal: Dr. Jitendra Prasad Upadhyayrezina pokhrelNo ratings yet

- HDFC Bank Summer Internship Lokit Agarwal Report 3 PDFDocument29 pagesHDFC Bank Summer Internship Lokit Agarwal Report 3 PDFMona AgarwalNo ratings yet

- FIN 101 AssignmentDocument12 pagesFIN 101 AssignmentNasrullah Khan AbidNo ratings yet

- BRAC Internship ReportDocument82 pagesBRAC Internship ReportSayeedMdAzaharulIslamNo ratings yet

- 2.Maf603-Question Individual Project June 2020Document8 pages2.Maf603-Question Individual Project June 2020Nur ImanNo ratings yet

- Bank Fund Maanagement TermpaperDocument15 pagesBank Fund Maanagement Termpaper49 Modasser Islam EmonNo ratings yet

- Bank RD Interest Rates (General Public) Senior Citizen RD RatesDocument3 pagesBank RD Interest Rates (General Public) Senior Citizen RD RatesKushal MpvsNo ratings yet

- Training Report On Loan and Credit Facility at Cooperative BankDocument86 pagesTraining Report On Loan and Credit Facility at Cooperative BanksumanNo ratings yet

- Rawat Bhaskar SinghDocument13 pagesRawat Bhaskar SinghBhaskar RawatNo ratings yet

- AFS PJCTDocument47 pagesAFS PJCTAbdul BasitNo ratings yet

- Internship ReportDocument58 pagesInternship ReportMehedi BappiNo ratings yet

- Maths ProjectDocument15 pagesMaths Projecttmbcreditdummy50% (2)

- PNB Project Sahil Khurana-1Document67 pagesPNB Project Sahil Khurana-1PraveenNo ratings yet

- Developments of Islamic Banking in BangladeshDocument12 pagesDevelopments of Islamic Banking in Bangladesherrorrr007No ratings yet

- Risk Management BlackbookDocument80 pagesRisk Management Blackbookjaueshmahale1234No ratings yet

- 2.financial Institutions and Markets PresentationDocument23 pages2.financial Institutions and Markets PresentationSabiha ShantaNo ratings yet

- Digital Banking W.R.T. Janakalyan Sahakari Bank Ltd.Document43 pagesDigital Banking W.R.T. Janakalyan Sahakari Bank Ltd.Kareena WasanNo ratings yet

- Meth ProjectDocument3 pagesMeth Projectjha.smritiNo ratings yet

- Product Code and Descriptions For Pos Malaysia Track Trace SystemDocument3 pagesProduct Code and Descriptions For Pos Malaysia Track Trace Systemanisah zahrullail100% (2)

- Senarai Organisasi Aktif-Converted ReduceDocument99 pagesSenarai Organisasi Aktif-Converted ReduceAzlan AzizanNo ratings yet

- Latihan 1 Rusamezananiff Bin RuselanDocument46 pagesLatihan 1 Rusamezananiff Bin RuselanAnifNo ratings yet

- Nov 2014Document9 pagesNov 2014SANTHANo ratings yet

- Kuala Lumpur Stock Exchange KLSE MESDAQ - 11-Sep-08Document1 pageKuala Lumpur Stock Exchange KLSE MESDAQ - 11-Sep-08STTINo ratings yet

- Laki - LakiDocument80 pagesLaki - LakiRachman MercyNo ratings yet

- Nestle List Mills February 2018Document114 pagesNestle List Mills February 2018AkmalNo ratings yet

- IOI Full Mill ListDocument12 pagesIOI Full Mill ListOperation LNVNo ratings yet

- Payment 01Document16 pagesPayment 01SaodahSheikhHassanNo ratings yet

- Cover File BesiDocument7 pagesCover File BesiSanorajaya RTNo ratings yet

- Lampiran A - Emk Fasa 1 2015 (Agihan Kedua)Document759 pagesLampiran A - Emk Fasa 1 2015 (Agihan Kedua)you chinhuaNo ratings yet

- Update Notice Banking Operations Mco 120121Document2 pagesUpdate Notice Banking Operations Mco 120121Mohd Farouk Abd RahmanNo ratings yet

- MMHE Application FormDocument2 pagesMMHE Application FormVesva Chander100% (1)

- LISTING Projek Petroleum and OilDocument33 pagesLISTING Projek Petroleum and Oilsyaz inaNo ratings yet

- EflyerDocument2 pagesEflyeradie adNo ratings yet

- Affin BankDocument3 pagesAffin BankGhanthymathy PalaniandyNo ratings yet

- RB Overall Master Mill List 2020 External FinalDocument128 pagesRB Overall Master Mill List 2020 External FinalOperation LNVNo ratings yet

- July23Document2 pagesJuly23Izzah IzzatiNo ratings yet

- List - of - Companies Bursa MalaysiaDocument23 pagesList - of - Companies Bursa MalaysiaSITI NUR NATASYA MUHAMED HALEMINo ratings yet

- Ibs Simpang Kuala 1 30/09/21Document16 pagesIbs Simpang Kuala 1 30/09/21Kamarudin SalehNo ratings yet

- Senarai Peserta Larian Virtual 3.0Document13 pagesSenarai Peserta Larian Virtual 3.0MAZUAN BIN MUJAIL MoeNo ratings yet

- CASA Statement Aug2023 01092023003052 PDFDocument7 pagesCASA Statement Aug2023 01092023003052 PDFTony TrisnoNo ratings yet

- Bank Code DUITNOW PAY TO ACCOUNT 2Document1 pageBank Code DUITNOW PAY TO ACCOUNT 2Mishhak MunanginNo ratings yet

- Alamat CompanyDocument5 pagesAlamat CompanyAtikah JembariNo ratings yet

- h1 2021 Mill ListDocument18 pagesh1 2021 Mill ListenquirysakuragawaNo ratings yet

- Important Notice 16 November 2020: Revised Tim IngsDocument2 pagesImportant Notice 16 November 2020: Revised Tim IngsWinston CkyNo ratings yet