Professional Documents

Culture Documents

SAP Assignment Dec. 4

Uploaded by

PAU VLOGSOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

SAP Assignment Dec. 4

Uploaded by

PAU VLOGSCopyright:

Available Formats

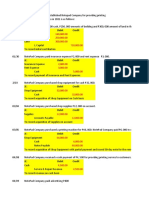

Exercise 5.

2

Record the following transactions using the Manual Journal Entry:

On January 20, 2020, the company received billings for the following utilities:

Dr. Light Expense P 6,750

Dr. Water Expense P 4,400

Cr. Accrued Expense Payable P 11,150

On January 25, 2020, billings received were paid for cash.

Dr. Accrued Expense Payable P 11,150

Cr. Cash on Hand P 11,150

Insert the screenshot of your output here:

Manual Journal Entry and Journal Vouchers

Exercise 5.3

Record the following transactions using the Manual Journal Entry:

On February 10, 20XX, the owner of the company had an additional cash investment of P 500,000,

deposited on the company’s BDO Bank Account.

Dr. Cash in Bank – BDO P 500,000

Cr. Aquino, Capital P 500,000

Insert the screenshot of your output here:

Exercise 5.4

Record the following transactions using the Manual Journal Entry:

On March 15, 20XX, the owner withdrawn some of his cash investment to pay for his personal expenses

amounting to P 25,000. The Disbursement Officer withdrew the amount from the company’s BDO

account.

Dr. Aquino, Drawing P 25,000

Cr. Cash in Bank - BDO P 25,000

Insert the screenshot of your output here:

Exercise 5.5

Record the following transactions using the Manual Journal Entry:

On March 30, 20XX, the company recorded a Salary Expense worth of P 100,000, paid for through the

company’s BDO Bank Account:

Dr. Salaries and Wages P 100,000

Cr. Cash in Bank, BDO P 100,000

Insert the screenshot of your output here:

Exercise 5.6

Create the following entries in journal entry through the journal vouchers.

Date Transaction Amount

April 01, 20XX Sansa Aquino invested office equipment Php 850,000

for the business

April 02, 20XX The owner invested additional cash Php 72,000

through a bank deposit in Metrobank

April 03, 20XX Paid transportation for business related Php 1,750

travels

Submit the screenshot of the journal voucher created and the transaction journal report from April 01,

20XX – April 03, 20XX.

Insert the screenshot of your output here:

Special Journals (Purchase)

Exercise 5.7

On April 10, 20XX, the company received the billing from PLDT worth Php 11,200 (tax inclusive). It is to

be recorded as Communication Expense on the A/P invoice.

Screenshot the journal entry created from the A/P invoice.

Insert the screenshot of your output here:

Exercise 5.8

On April 11, 20XX, the company received the billing from Philhealth, worth P 3000, for the employees’

recent salary.

Screenshot the journal entry created from the A/P invoice.

Insert the screenshot of your output here:

Exercise 5.9

On April 13, 20XX, the company received the billing from SSS, worth P 5000, for the employees’ recent

salary.

Screenshot the journal entry created from the A/P invoice.

Insert the screenshot of your output here:

You might also like

- 6870 - FAR First PreboardDocument14 pages6870 - FAR First PreboardZiee00No ratings yet

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- MIDTERM LESSON 1 Accounting EquationDocument2 pagesMIDTERM LESSON 1 Accounting EquationJomar Villena100% (3)

- Practice Set #1 (3-56) Recording Transactions in A Financial Transaction WorksheetDocument11 pagesPractice Set #1 (3-56) Recording Transactions in A Financial Transaction WorksheetBenedict FajardoNo ratings yet

- Stradcom v. OrpillaDocument2 pagesStradcom v. OrpillaHomer SimpsonNo ratings yet

- Assets Liabilities + Equity + Income - Expenses: Oct. TransactionsDocument4 pagesAssets Liabilities + Equity + Income - Expenses: Oct. Transactionsalford sery Cammayo0% (1)

- Slavery in The Chocolate IndustryDocument1 pageSlavery in The Chocolate Industryannett_6164No ratings yet

- Journal Entries - 1666100137Document12 pagesJournal Entries - 1666100137Van OneNo ratings yet

- ACT #4 - Jewel Ann C. Penaranda - ACT213Document20 pagesACT #4 - Jewel Ann C. Penaranda - ACT213JEWELL ANN PENARANDA100% (1)

- ACTIVITY 04 - Analyzing TransactionsDocument6 pagesACTIVITY 04 - Analyzing TransactionsJohn Luis Cordova CacayurinNo ratings yet

- Prac 1Document11 pagesPrac 1AJ0% (2)

- Statement of Cash FlowsDocument6 pagesStatement of Cash FlowsLuiNo ratings yet

- Computerised Accounting Practice Set Using MYOB AccountRight - Entry Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Entry Level: Australian EditionNo ratings yet

- Week 5Document18 pagesWeek 5Agnes Patricia MendozaNo ratings yet

- Chapter 2 - The Accounting CycleDocument36 pagesChapter 2 - The Accounting CycleAlan Lui50% (2)

- Problem 1: PostingDocument7 pagesProblem 1: Postingbunny bunnyNo ratings yet

- Adjusting EntriesDocument5 pagesAdjusting Entriesdatu puti33% (3)

- Exercises in Adjusting EntriesDocument5 pagesExercises in Adjusting EntriesJhon Robert BelandoNo ratings yet

- PROBLEM 1 RESA Anna Corp. Uses The Direct Method To Prepare Its Statement of Cash Flows. Anna Corp.'s TrialDocument16 pagesPROBLEM 1 RESA Anna Corp. Uses The Direct Method To Prepare Its Statement of Cash Flows. Anna Corp.'s TrialJomar Villena100% (2)

- FundamentalsofABM2 Q1 M5Revised.-1Document12 pagesFundamentalsofABM2 Q1 M5Revised.-1Jomein Aubrey Belmonte60% (5)

- Alyssa C. Del Pilar Bsa-1 Brfabm1 225Document28 pagesAlyssa C. Del Pilar Bsa-1 Brfabm1 225Ken Sann89% (9)

- PTB Bonfiacio CruzDocument12 pagesPTB Bonfiacio CruzHarry PotterNo ratings yet

- Problems in AccountingDocument4 pagesProblems in AccountingRaul Soriano CabantingNo ratings yet

- Magada, Ma. Louella ODocument17 pagesMagada, Ma. Louella OMaria Louella MagadaNo ratings yet

- CH6-7 Home QuizDocument5 pagesCH6-7 Home QuizAngel MenodiadoNo ratings yet

- Fundamentals of Accounting Exercise WorkbookDocument26 pagesFundamentals of Accounting Exercise WorkbookVILLAVERT DAINIEL MATTHEU B.No ratings yet

- 24-Month Note Due To BDODocument3 pages24-Month Note Due To BDOEliza CruzNo ratings yet

- POFA (ACCT 100) Tutorial: Week 2 Chapter 2 - The Recording Process Topics CoveredDocument3 pagesPOFA (ACCT 100) Tutorial: Week 2 Chapter 2 - The Recording Process Topics CoveredAli Zain ParharNo ratings yet

- Activity PostingDocument3 pagesActivity PostingApril BalsitaNo ratings yet

- Additional Exercises Transaction Analaysis Journalizing Posting and Unadjusted TDocument4 pagesAdditional Exercises Transaction Analaysis Journalizing Posting and Unadjusted TRenalyn Ps MewagNo ratings yet

- Comprehensive Problem-Analysis of TransactionDocument43 pagesComprehensive Problem-Analysis of TransactionJoanna DandasanNo ratings yet

- Chapter 1 Acctg Equation JournalizingDocument4 pagesChapter 1 Acctg Equation JournalizingNicole Marie Pontay BajadeNo ratings yet

- FDNACCT - Quiz #1 - Answer Key - Set CDocument4 pagesFDNACCT - Quiz #1 - Answer Key - Set CleshamunsayNo ratings yet

- Total Cash P 4,950,000Document44 pagesTotal Cash P 4,950,000Angel Nicole OriasNo ratings yet

- Lab FinalsDocument9 pagesLab FinalsErika Jeanne CatulayNo ratings yet

- Exercises For Midterm PDFDocument10 pagesExercises For Midterm PDFThanh HằngNo ratings yet

- Rich Angelie Muñez - Adjusting Entries and Promissory NotesDocument9 pagesRich Angelie Muñez - Adjusting Entries and Promissory NotesRich Angelie MuñezNo ratings yet

- Special Journals (Purchase) : Exercise 5.7Document12 pagesSpecial Journals (Purchase) : Exercise 5.7Claudette ClementeNo ratings yet

- Ch-1 (All Math)Document5 pagesCh-1 (All Math)Mohammad Jakirul IslamNo ratings yet

- FAR 01C Review of Accounting Cycle IllustrationsDocument2 pagesFAR 01C Review of Accounting Cycle Illustrationsbyunb3617No ratings yet

- Presentation1 AutosavedDocument19 pagesPresentation1 AutosavedJoefet PatalotNo ratings yet

- Group Assignment OneDocument2 pagesGroup Assignment Oneehitemariam berhanu100% (2)

- Course Name 9Document6 pagesCourse Name 9Revise PastralisNo ratings yet

- Adjusting Entries and Promissory NotesDocument6 pagesAdjusting Entries and Promissory Noteselma wagwagNo ratings yet

- Bram Wear CaseDocument2 pagesBram Wear CaseHabtamu Ye Asnaku Lij89% (9)

- Accounting EquationDocument8 pagesAccounting EquationIanah AlvaradoNo ratings yet

- Journal Entry DiscussionDocument18 pagesJournal Entry DiscussionPhoebe Balino100% (2)

- Exercise For Chapter 2Document6 pagesExercise For Chapter 2Dĩm MiNo ratings yet

- Merchandising 2 Set ADocument2 pagesMerchandising 2 Set AGabrielle VizcarraNo ratings yet

- Chapter 2 QuestionsDocument23 pagesChapter 2 QuestionsSaleh AlzahraniNo ratings yet

- Tax Accounting Set ADocument4 pagesTax Accounting Set AGopti EmmanuelNo ratings yet

- Exercises of Session 3Document3 pagesExercises of Session 3tranhlthNo ratings yet

- FABM1 Template - TQ Q3 24 REMEDIALDocument4 pagesFABM1 Template - TQ Q3 24 REMEDIALcinderelladiaz16No ratings yet

- Practice Set 2Document4 pagesPractice Set 2Mylene CandidoNo ratings yet

- Activity in IT202Document3 pagesActivity in IT202Tine Robiso100% (1)

- Lecture 3 Accounting CycleDocument8 pagesLecture 3 Accounting Cycleedith carbonelNo ratings yet

- Midterm 2nd 3rd Meeting RevisedDocument6 pagesMidterm 2nd 3rd Meeting RevisedChristopher CristobalNo ratings yet

- Spjimr - PGDM - 2021 - Financial Accounting and AnalysisDocument2 pagesSpjimr - PGDM - 2021 - Financial Accounting and AnalysisRishabh ChawlaNo ratings yet

- Fabm1 Q2 PPT W2Document24 pagesFabm1 Q2 PPT W2esmeraylunaaaNo ratings yet

- Cash Flow Online April 6 2024 For StudentsDocument5 pagesCash Flow Online April 6 2024 For Studentsraven.jumaoas.eNo ratings yet

- 7077 - Cash and Accruals BasisDocument2 pages7077 - Cash and Accruals BasisKlare JimenoNo ratings yet

- Business Cup Level 1 Quiz BeeDocument28 pagesBusiness Cup Level 1 Quiz BeeRowellPaneloSalapareNo ratings yet

- FDNACCT - Quiz #1 - Answer Key - Set ADocument5 pagesFDNACCT - Quiz #1 - Answer Key - Set AleshamunsayNo ratings yet

- Our Products: Powercore Grain Oriented Electrical SteelDocument20 pagesOur Products: Powercore Grain Oriented Electrical SteelkoalaboiNo ratings yet

- Wsat-Ee: Installation and Use ManualDocument44 pagesWsat-Ee: Installation and Use ManualNicolÁs Marcelo Fuenzalida MasottiNo ratings yet

- Software TestDocument378 pagesSoftware TestUriel TijerinoNo ratings yet

- Finance e PN 2016 17Document69 pagesFinance e PN 2016 17Ancy RajNo ratings yet

- A Project Report On "Whatsapp-An Innovative Service" Submitted in The Partial Fulfilment For The Requirement of The Degree ofDocument21 pagesA Project Report On "Whatsapp-An Innovative Service" Submitted in The Partial Fulfilment For The Requirement of The Degree ofGunveen AbrolNo ratings yet

- Production Music Rate Card 2021Document12 pagesProduction Music Rate Card 2021Benny IrawanNo ratings yet

- Online Summer ReportDocument23 pagesOnline Summer ReportajendraNo ratings yet

- Deceptive Advertising AssignmentDocument2 pagesDeceptive Advertising Assignmentapi-277766829No ratings yet

- 6-SOM-service InventoryDocument10 pages6-SOM-service InventoryUrmilaAnantNo ratings yet

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument3 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing Balancep4ukumarNo ratings yet

- A Case Study of CITIC Investment CorporationDocument5 pagesA Case Study of CITIC Investment Corporationmoni123456No ratings yet

- Gmail - DOCUMENT VERIFICATION OF PROBATIONARY OFFICERS ON 27.10.2020Document8 pagesGmail - DOCUMENT VERIFICATION OF PROBATIONARY OFFICERS ON 27.10.2020shelharNo ratings yet

- Ay 22-23 Dattatri Kadam With Sign & StampDocument13 pagesAy 22-23 Dattatri Kadam With Sign & StampRAJESH DNo ratings yet

- ST - Joseph's Degree & PG College Business Law Unit1Document14 pagesST - Joseph's Degree & PG College Business Law Unit1Saud Waheed KhanNo ratings yet

- Final Assignment MGT351Document5 pagesFinal Assignment MGT351Sk. Shahriar Rahman 1712886630No ratings yet

- Client Request FormDocument1 pageClient Request FormDenald Paz100% (1)

- AMAZONDocument22 pagesAMAZONASHWINI PATILNo ratings yet

- Onyxworks® Gateways: NFN Fire MonitoringDocument2 pagesOnyxworks® Gateways: NFN Fire MonitoringMinhthien NguyenNo ratings yet

- Option Pricing Using Artificial Neural NetworksDocument201 pagesOption Pricing Using Artificial Neural NetworksemmunarNo ratings yet

- Meisyi Nabila - 2222010228 - Essay General EnglishDocument2 pagesMeisyi Nabila - 2222010228 - Essay General Englishleo afrizalNo ratings yet

- Electronic Reservation Slip (ERS) : 2100858446 12056/Ndls Janshtabdi Second Sitting (RESERVED) (2S)Document3 pagesElectronic Reservation Slip (ERS) : 2100858446 12056/Ndls Janshtabdi Second Sitting (RESERVED) (2S)vineetkr.2349No ratings yet

- 4 Cost EffectivenessDocument7 pages4 Cost Effectivenessshivani dasNo ratings yet

- Britannia IndustriesDocument40 pagesBritannia IndustriesabhilashjadhavNo ratings yet

- Marketing Management Project On Coca Cola-LibreDocument38 pagesMarketing Management Project On Coca Cola-Librehamza.ashfaq2280% (1)

- Full Download First Course in Statistics 12th Edition Mcclave Solutions ManualDocument36 pagesFull Download First Course in Statistics 12th Edition Mcclave Solutions Manualhierslelanduk100% (30)

- Broadcast Engineering Consultants India Limited: Vacancy Advertisement No. 127Document2 pagesBroadcast Engineering Consultants India Limited: Vacancy Advertisement No. 127Bipin KashyapNo ratings yet