Professional Documents

Culture Documents

Acid Test Ratio

Uploaded by

Sofia ArissaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Acid Test Ratio

Uploaded by

Sofia ArissaCopyright:

Available Formats

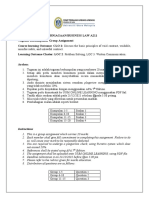

FORMULA 2019 2018

Acid Test Ratio 8,062.6−123.3 9,338.9−108.5

= =

4,727.4 3,383.4

Current Assets−Inventory

Current liabilities 7,939.3 9,230.4

= 4,727.4 = 3,383.4

= 1.68 : 1 = 2.73 : 1

1) LIQUIDITY

A liquidity ratio is a financial ratio that indicates whether a company's current assets will be

sufficient to meet the company's obligations when they become due.

Acid Test Ratio

The quick ratio or acid test ratio is a liquidity ratio that measures the ability of a

company to pay its current liabilities when they come due with only quick assets. Quick

assets are current assets that can be converted to cash within 90 days or in the short-term. An

acid test ratio that is greater than 1 means that the company has enough quick assets to pay

for its current liabilities. If a firm has enough quick assets to cover its total current liabilities,

the firm will be able to pay off its obligations without having to sell off any long-term or

capital assets.

In the year 2019, it shows that every RM1 of current liability, the Genting Malaysia

Bhd has RM 1.68 of quick assets to pay for it. In the year 2018, it shows that every RM 1 of

current liability, the Genting Malaysia Bhd has RM2.73 of quick assets to pay for it. Hence,

this means that Genting Malaysia Bhd can pay off all of its current liabilities with quick

assets and still have some quick assets left over.

You might also like

- Aside From ThatDocument1 pageAside From ThatSofia ArissaNo ratings yet

- Company-Tax-Wordsearch 221205 111229Document1 pageCompany-Tax-Wordsearch 221205 111229Sofia ArissaNo ratings yet

- A211 Tugasan 1Document12 pagesA211 Tugasan 1Sofia ArissaNo ratings yet

- Topic 11-Loan DebentureDocument57 pagesTopic 11-Loan DebentureSofia ArissaNo ratings yet

- A202 Job Interview Stage TwoDocument4 pagesA202 Job Interview Stage TwoSofia ArissaNo ratings yet

- Chapter 6 - FAR 5 - Note Earnings ManagementDocument5 pagesChapter 6 - FAR 5 - Note Earnings ManagementSofia ArissaNo ratings yet

- Resume: The Do'S AND The Dont'SDocument20 pagesResume: The Do'S AND The Dont'SSofia ArissaNo ratings yet

- A201 Take Home Exam Answer BookletDocument5 pagesA201 Take Home Exam Answer BookletSofia ArissaNo ratings yet

- Draft Assignment 1 MaDocument2 pagesDraft Assignment 1 MaSofia ArissaNo ratings yet

- School of Economics, Finance and Banking Uum College of BusinessDocument9 pagesSchool of Economics, Finance and Banking Uum College of BusinessSofia ArissaNo ratings yet

- 3 Minute SpeechDocument2 pages3 Minute SpeechSofia ArissaNo ratings yet

- Executive SummaryDocument3 pagesExecutive SummarySofia ArissaNo ratings yet

- Draft For Ma Slide Market SegmentationDocument3 pagesDraft For Ma Slide Market SegmentationSofia ArissaNo ratings yet

- Table 3.1.1: Frequency Distribution of Age Table 3.1.2: Descriptive Statistics of AgeDocument4 pagesTable 3.1.1: Frequency Distribution of Age Table 3.1.2: Descriptive Statistics of AgeSofia ArissaNo ratings yet

- RM RM Sales (14,000 X RM120) (-) Cost of Goods Sold:: (-) Overapplied Fixed Overhead (2,500)Document2 pagesRM RM Sales (14,000 X RM120) (-) Cost of Goods Sold:: (-) Overapplied Fixed Overhead (2,500)Sofia ArissaNo ratings yet

- Respondent Profile Analysis Respondent Profile Analysis by VariableDocument3 pagesRespondent Profile Analysis Respondent Profile Analysis by VariableSofia ArissaNo ratings yet

- Session 2Document1 pageSession 2Sofia ArissaNo ratings yet

- Revision Muet Writing Q2 UrbanisationDocument2 pagesRevision Muet Writing Q2 UrbanisationSofia Arissa100% (2)

- Session 2 Muet 2019Document2 pagesSession 2 Muet 2019Sofia ArissaNo ratings yet

- Muet Q2 Past Year QuestionsDocument3 pagesMuet Q2 Past Year QuestionsSofia ArissaNo ratings yet

- Math Group AssignmentDocument4 pagesMath Group AssignmentSofia ArissaNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5796)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (589)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)