Professional Documents

Culture Documents

Income Tax Pan Services Unit: ACKNOWLEDGEMENT NO.881035292293111

Uploaded by

MSEB WalujOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Income Tax Pan Services Unit: ACKNOWLEDGEMENT NO.881035292293111

Uploaded by

MSEB WalujCopyright:

Available Formats

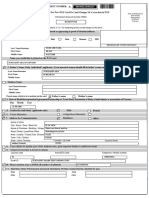

INCOME TAX PAN SERVICES UNIT

(Managed By NSDL e-Governance Infrastructure Limited)

5th Floor, Mantri Sterling, Plot No. 341, Survey No. 997/8,

Model Colony, Near Deep Bungalow Chowk, Pune - 411 016.

Ref.No.TIN/PAN/CR-/88103529229311102 Date: 23-NOV-2021

Shri SURESH KADUBA SONAWNE

DHANGAR GALLI

WALUJ GANGAPUR

AURANGABAD Maharashtra 431133

Dear Sir/Madam,

Subject : Discrepancy in the documents received for PAN application

1. This has reference to documents received in connection with your request for New PAN card and/or changes/correction in PAN data for PAN BCDPS1962F made vide

acknowledgement no. 881035292293111. Following discrepancies are observed between details provided in application and details available with Income Tax Department

(ITD).

Particular As per Application As per ITD's Database Discrepancy in documents submitted

Father's Name KADUBA SONAWNE KADU THAKAJI SONAWANE AADHAR Card issued by the Unique Identification Authority of India

of SURESH KADUBA SONAWNE does not contain Father's full name

KADUBA SONAWNE (Please refer list 1)

2. Please submit the below specified documents (with details as per application) to clear the above mentioned discrepancy (ies).

Father's Name

( any one of the following - List 1 )

Passport

Elector's photo identity card

Driving License

Certificate of identity signed by a Member of

Parliament or a Member of Legislative Assembly or a

Muncipal councilor or a Gazetted Officer along with

copy of office identity proof of issuing officer.

Any of the below mentioned document in the name of

Karta of HUF

Aadhaar Card issued by the Unique Identification

Authority of India

Arm's license

Pensioner card having photograph of the applicant

Central Government Health Service Scheme Card

Bank certificate in Original on letter head from the

branch (alongwith name and stamp of the issuing

officer) containing duly attested photograph and bank

account number of the applicant

Ex-Servicemen Contributory Health Scheme photo

card

Photo identity card issued by the Central Government

or State Government or Public Sector Undertaking

3. Please note your PAN application will be processed only on receipt of documents as explained above.

4. If we do not receive documents as mentioned above within 30 days, then your application will be filed and no further action will be taken.

5. Information relating to all PAN Services of ITD can be obtained by making a phone call to Aaykar Sampark Kendra (1800-180-1961) or TIN-Call Centre (020-27218080)

or from the website: www.incometaxindia.gov.in or www.tin-nsdl.com

(This being a computer-generated letter,no signature is required) Income Tax Department

Caution : Income Tax Department does not send e-mails regarding refunds and does not seek any taxpayer information like user name, password, details of ATM, bank accounts,

credit cards, etc. Taxpayers are advised not to part with such information on the basis of emails.

To be sent to NSDL along with documents RETURN-SLIP

ACKNOWLEDGEMENT NO.881035292293111

Please indicate how you want your application to be processed by putting tick in appropriate boxes.

A. Reprint PAN card with ITD data, no change required: [ ]

B. For following fields, details available with Income Tax Department is / are correct and should not be changed (ignore application data):

[ ] Name [ ] Father's Name [ ] DOB

C. For following fields, details available with Income Tax Department is / are incorrect and should be changed:

[ ] Name [ ] Father's Name [ ] DOB (provide documents to support changes as described overleaf)

List of Documents attached: (1)_____________(2)___________(3)___________(4)____________

Name of Applicant: Shri SURESH KADUBA SONAWNE

Signature of Applicant: _______________

You might also like

- Income Tax Pan Services Unit: ACKNOWLEDGEMENT NO.881036279775761Document1 pageIncome Tax Pan Services Unit: ACKNOWLEDGEMENT NO.881036279775761surinderNo ratings yet

- Annex 582729700036153Document1 pageAnnex 582729700036153venkatNo ratings yet

- Annex 830355500000272Document1 pageAnnex 830355500000272raj sanganiNo ratings yet

- Rajesh Annex-259579700022090Document1 pageRajesh Annex-259579700022090sona singhNo ratings yet

- Annex 603869700012681Document1 pageAnnex 603869700012681ULTIMA SERVICESNo ratings yet

- Income Tax Pan Services Unit: ACKNOWLEDGEMENT NO.845739700001221Document1 pageIncome Tax Pan Services Unit: ACKNOWLEDGEMENT NO.845739700001221SameerNo ratings yet

- Annex - 071469700651425Document1 pageAnnex - 071469700651425KALYAN KUMARNo ratings yet

- Annex 030409710286616Document1 pageAnnex 030409710286616sameer pashaNo ratings yet

- Annex 205919700005773Document1 pageAnnex 205919700005773Brisk VpnNo ratings yet

- Annex 881038200955301Document1 pageAnnex 881038200955301cads vjaNo ratings yet

- PAN DISCREPANCY RESOLVEDDocument1 pagePAN DISCREPANCY RESOLVEDSayed ShoiabNo ratings yet

- Income Tax Pan Services Unit: ACKNOWLEDGEMENT NO.091019703743452Document1 pageIncome Tax Pan Services Unit: ACKNOWLEDGEMENT NO.091019703743452Sumanth RNo ratings yet

- Income Tax Pan Services Unit: Reference: Our Letter Ref - No. TIN/PAN/CR-II/N-8810552613810721171 Dated 11-SEP-2021Document3 pagesIncome Tax Pan Services Unit: Reference: Our Letter Ref - No. TIN/PAN/CR-II/N-8810552613810721171 Dated 11-SEP-2021Rashid KhanNo ratings yet

- Income Tax PAN discrepancyDocument1 pageIncome Tax PAN discrepancyRaja RajNo ratings yet

- ANNEX-882039274666970Document1 pageANNEX-882039274666970sandeep.soniNo ratings yet

- Annex 010109703338232Document1 pageAnnex 010109703338232Sahil RajputNo ratings yet

- Annex 882038275424342Document1 pageAnnex 882038275424342Shree Nath Transport Co.No ratings yet

- Income Tax Pan Services Unit: (Managed by National Securities Depository Limited)Document2 pagesIncome Tax Pan Services Unit: (Managed by National Securities Depository Limited)MalliMurthyNo ratings yet

- Annex 717329700375352Document1 pageAnnex 717329700375352niharxerox180No ratings yet

- Income Tax PAN ServicesDocument1 pageIncome Tax PAN ServicesShamim AkhtarNo ratings yet

- Income Tax Pan Services Unit: (Managed by NSDL E-Governance Infrastructure Limited)Document2 pagesIncome Tax Pan Services Unit: (Managed by NSDL E-Governance Infrastructure Limited)Moinuddin AnsariNo ratings yet

- Annex 055840100375124Document2 pagesAnnex 055840100375124Siddhi PatilNo ratings yet

- Form 1 EnglishDocument2 pagesForm 1 Englishashish yadavNo ratings yet

- 881053278006296Document2 pages881053278006296Sameer MittalNo ratings yet

- Acknowledgment For Request For New PAN Card or - and Changes or Correction in PAN Data (881030205408706)Document1 pageAcknowledgment For Request For New PAN Card or - and Changes or Correction in PAN Data (881030205408706)kapilchandanNo ratings yet

- BBL PanDocument1 pageBBL Pankhan100% (2)

- Aadhaar Update Form: 2021 Express (Mobile,) Only Fields Mentioned Here Will Be Updated at ASK CenterDocument1 pageAadhaar Update Form: 2021 Express (Mobile,) Only Fields Mentioned Here Will Be Updated at ASK CenterSharma AmitRajNo ratings yet

- RtiDocument14 pagesRtiPRAMOD PANDITNo ratings yet

- Portal1.Passportindia - Gov.in AppOnlineProject Secure ViewDraftAction Arn 13-0007206836Document2 pagesPortal1.Passportindia - Gov.in AppOnlineProject Secure ViewDraftAction Arn 13-0007206836patelaxayNo ratings yet

- Ein Verification Letter 05Document2 pagesEin Verification Letter 05tontiw63No ratings yet

- NSDLDocument13 pagesNSDLSrini VasanNo ratings yet

- MOSHARAF HOSSEN SKDocument1 pageMOSHARAF HOSSEN SKSarfarz KhanNo ratings yet

- Team Ralys TANDocument1 pageTeam Ralys TANrameshNo ratings yet

- Acknowledgment For Request For New PAN Card PDFDocument1 pageAcknowledgment For Request For New PAN Card PDFrednipuhbNo ratings yet

- Safari 3Document5 pagesSafari 3Dhruvang SahaNo ratings yet

- IOCL Application FormDocument1 pageIOCL Application FormSairam SaiNo ratings yet

- 06112015032845agreement VSNDocument10 pages06112015032845agreement VSNVISHESHNo ratings yet

- (Registration Wing) Form For Capturing Details of Parent's Name & Communication DetailsDocument1 page(Registration Wing) Form For Capturing Details of Parent's Name & Communication DetailsVinesh NairNo ratings yet

- Acknowledgement of PAN Application (Change Request) : Copy To Be Kept With ApplicationDocument1 pageAcknowledgement of PAN Application (Change Request) : Copy To Be Kept With ApplicationHari Shanker JadoliaNo ratings yet

- Receipt 881031205406052Document1 pageReceipt 881031205406052murali1622No ratings yet

- 881060224386252-Sai NadhDocument3 pages881060224386252-Sai NadhVlcomputers TenaliNo ratings yet

- Itr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)Document1 pageItr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)Manogya SharmaNo ratings yet

- Apply Digital Signature CertificateDocument4 pagesApply Digital Signature CertificateSiddharth ChNo ratings yet

- Appointment RecieptDocument2 pagesAppointment Recieptimtiyaz zumraanNo ratings yet

- N PanDocument2 pagesN PanMonika BansalNo ratings yet

- PAN Application Acknowledgement ReceiptDocument1 pagePAN Application Acknowledgement Receiptps3225No ratings yet

- PAN Application (881020124470496)Document2 pagesPAN Application (881020124470496)Sandeep SheoranNo ratings yet

- Classification Election. See Form 8832 and Its Instructions For Additional InformationDocument3 pagesClassification Election. See Form 8832 and Its Instructions For Additional InformationSamuel RodriguezNo ratings yet

- िवदेश मं ालय भारत सरकार Ministry of External Affairs Government of India Online Appointment ReceiptDocument2 pagesिवदेश मं ालय भारत सरकार Ministry of External Affairs Government of India Online Appointment ReceiptBinanjay GurungNo ratings yet

- UFlex Mandotry KYC LetterDocument7 pagesUFlex Mandotry KYC Letterabhikumarchoudhary85No ratings yet

- Application For License - Employment Exchange Card - NSC Card - Employment Exchange Card RegistrationDocument1 pageApplication For License - Employment Exchange Card - NSC Card - Employment Exchange Card RegistrationAbhiNo ratings yet

- XXXPH2966X ITRV - UnlockedDocument1 pageXXXPH2966X ITRV - UnlockedVivek HaldarNo ratings yet

- Xxxpi5752x ItrvDocument1 pageXxxpi5752x ItrvIngole DeepakNo ratings yet

- View/Print Submitted Form: Service RequiredDocument3 pagesView/Print Submitted Form: Service RequiredSanjay HandaNo ratings yet

- Appointment Reciept DILIP KUMARDocument4 pagesAppointment Reciept DILIP KUMARSatish MandapetaNo ratings yet

- Acknowledgment For Request For New PAN Card (Form 49A)Document2 pagesAcknowledgment For Request For New PAN Card (Form 49A)Rajneesh PerhateNo ratings yet

- CONSUMER INFORMATION SHEET (Wait List ID: 3171315)Document3 pagesCONSUMER INFORMATION SHEET (Wait List ID: 3171315)Vinod Singh BishtNo ratings yet

- National Pension System (NPS) : SR - No ParticularDocument8 pagesNational Pension System (NPS) : SR - No ParticularLalita PhegadeNo ratings yet

- Computerised Payroll Practice Set Using MYOB AccountRight: Australian EditionFrom EverandComputerised Payroll Practice Set Using MYOB AccountRight: Australian EditionNo ratings yet

- Goods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesFrom EverandGoods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesNo ratings yet

- Employees' State Insurance Corporation E-Pehchan Card: Personal DetailsDocument2 pagesEmployees' State Insurance Corporation E-Pehchan Card: Personal Detailskunal monadlNo ratings yet

- e-Nomination - Balu ChavhanDocument2 pagese-Nomination - Balu ChavhanMSEB WalujNo ratings yet

- e-Nomination - Dipak SonwaneDocument2 pagese-Nomination - Dipak SonwaneMSEB WalujNo ratings yet

- ESIC-tulashiram Link With AdharDocument1 pageESIC-tulashiram Link With AdharMSEB WalujNo ratings yet

- Tax Invoice: A-3/7, Mayapuri Industrial Area, Phase-Iimayapuriwest Delhi110064Delhi07 Cin: U74899Dl1988Ptc031785Document1 pageTax Invoice: A-3/7, Mayapuri Industrial Area, Phase-Iimayapuriwest Delhi110064Delhi07 Cin: U74899Dl1988Ptc031785MSEB WalujNo ratings yet

- Ngaur10593490000010676 2023Document2 pagesNgaur10593490000010676 2023MSEB WalujNo ratings yet

- FM220 CMOS USB Fingerprint Scanner: STARTEK Engineering Inc. TEL E-Mail Web: Address Taiwan, R.O.CDocument4 pagesFM220 CMOS USB Fingerprint Scanner: STARTEK Engineering Inc. TEL E-Mail Web: Address Taiwan, R.O.CMSEB WalujNo ratings yet

- Directorate of Vocational Education and Training, Maharashtra StateDocument1 pageDirectorate of Vocational Education and Training, Maharashtra StateMSEB WalujNo ratings yet

- Pupun17470080000014421 2023Document2 pagesPupun17470080000014421 2023MSEB WalujNo ratings yet

- Vaccine Certificate (Mummy)Document1 pageVaccine Certificate (Mummy)Aàdesh SámudreNo ratings yet

- Vaccine Certificate (Mummy)Document1 pageVaccine Certificate (Mummy)Aàdesh SámudreNo ratings yet

- NIV Appointment System 2Document2 pagesNIV Appointment System 2Xstian BastianNo ratings yet

- Dipswitch Clear - Clear Cmos - CLR - CLRPWD - Passwd - Password - PWDDocument4 pagesDipswitch Clear - Clear Cmos - CLR - CLRPWD - Passwd - Password - PWDalireza naseriNo ratings yet

- Embassy of Pakistan, Kabul: Visa Application FormDocument2 pagesEmbassy of Pakistan, Kabul: Visa Application FormNoorzad KhalqiNo ratings yet

- Worker Temp Worker Priority Request Form 12 20 v2.0Document3 pagesWorker Temp Worker Priority Request Form 12 20 v2.0Tania PredaNo ratings yet

- E-Pass No.:DGS/0420129: Government of India Ministry of Shipping Directorate General of ShippingDocument1 pageE-Pass No.:DGS/0420129: Government of India Ministry of Shipping Directorate General of ShippingReuben VijaysekarNo ratings yet

- X-10 - Registration Identity CardDocument2 pagesX-10 - Registration Identity CardcryNo ratings yet

- Declaration Form RBADocument1 pageDeclaration Form RBARoy MarteenNo ratings yet

- Common Information Sheet For Schengen Visa Applicants in IndiaDocument8 pagesCommon Information Sheet For Schengen Visa Applicants in Indiaabhishekanand20073509No ratings yet

- 495174521-5000-Fresh-Hits-AccountDocument1,362 pages495174521-5000-Fresh-Hits-AccountreezereturnsNo ratings yet

- Poland Business Visa ChecklistDocument3 pagesPoland Business Visa ChecklistSelvaRajNo ratings yet

- Joint Affidavit of Two Disinterested Persons One and The Same PersonDocument1 pageJoint Affidavit of Two Disinterested Persons One and The Same PersonAJ Akilith0% (1)

- Invitation LetterDocument3 pagesInvitation LetterNur KurtuluşNo ratings yet

- Instructions - Please Follow Carefully! Affidavit & Release Form and Certification of Identification Form 1. Affidavit and ReleaseDocument4 pagesInstructions - Please Follow Carefully! Affidavit & Release Form and Certification of Identification Form 1. Affidavit and ReleaseJohnnyLarsonNo ratings yet

- 2019 GKS-G Entry Information For FlightDocument1 page2019 GKS-G Entry Information For FlightRamdani MuhNo ratings yet

- Application For Visa: Royal Thai Embassy, IslamabadDocument1 pageApplication For Visa: Royal Thai Embassy, IslamabadSaad FarazNo ratings yet

- Spotify Premium AccountDocument12 pagesSpotify Premium AccountMG 11No ratings yet

- Krish KumarDocument1 pageKrish Kumarchanda kumariNo ratings yet

- Final EvaluationsDocument46 pagesFinal Evaluationsmscm-dpsNo ratings yet

- Jabalpur NizamuddinDocument1 pageJabalpur Nizamuddinpraveen_356No ratings yet

- Afghanistan Passport Form 1Document2 pagesAfghanistan Passport Form 1teknoloji dünyası100% (1)

- Andhra Pradesh State Road Transport CorporationDocument2 pagesAndhra Pradesh State Road Transport CorporationSeshagiri RaoNo ratings yet

- Inspire Science Temporary PasswordsDocument8 pagesInspire Science Temporary Passwordsart tubeNo ratings yet

- Form SevenDocument1 pageForm SevenSuman KunduNo ratings yet

- Special Power of Attorney: Printed Name/SignatureDocument2 pagesSpecial Power of Attorney: Printed Name/SignatureJoemil Marcellana MujarNo ratings yet

- Ffi J Alihat I::!Ierlhe Leilhl - Ltilieiielieiie UDocument9 pagesFfi J Alihat I::!Ierlhe Leilhl - Ltilieiielieiie UNikhil BissaNo ratings yet

- DPP and Visa FormDocument4 pagesDPP and Visa FormganeshNo ratings yet

- United India Insurance Company Limited: Insured Name Valid UptoDocument1 pageUnited India Insurance Company Limited: Insured Name Valid UptoRanu SharmaNo ratings yet

- Indian Passport RenewalDocument2 pagesIndian Passport Renewalrvinopsg8111100% (1)

- Learner Licence DetailsDocument3 pagesLearner Licence DetailsNil OnlyNo ratings yet

- Check List For U K Visa AppointmentsDocument3 pagesCheck List For U K Visa AppointmentsdivyapachaiyappanNo ratings yet