Professional Documents

Culture Documents

Team Ralys TAN

Uploaded by

rameshCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Team Ralys TAN

Uploaded by

rameshCopyright:

Available Formats

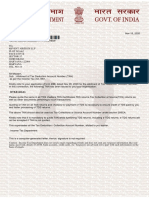

Dec 16, 2020

Ref.No.:50054701419761171/TAN/NEW

TO,

RALYS CONSULTANTS AND DESIGNERS

NO-203

SRINIDHI RESIDENCY

7TH MAIN 5TH CROSS

BSK 3RD STG

PADMANABHANAGAR BENGALURU-560085

KARNATAKA

TEL. NO.:91-9845949103

Sir/Madam,

Sub : Allotment of Tax Deduction Account Number (TAN)

as per the Income Tax Act,1961.

Kindly refer to your application (Form 49B) dated Dec 12, 2020 for the allotment of Tax Deduction Account Number.

In this connection, the following TAN has been issued to you/your organisation:

BLRR21812A

Please quote the same in all TDS challans,TDS Certificates,TDS returns,Tax Collection at Source(TCS) returns as

well as other documents pertaining to such transactions.

Quoting of TAN on all TDS returns and challans for payment of TDS is necessary to ensure credit of TDS paid by you

and faster processing of TDS returns.

The above TAN should also be used as Tax Collections at Source Account Number under section 206CA.

Kindly note that it is mandatory to quote TAN while furnishing TDS returns, including e-TDS returns. e-TDS returns will

not be accepted if TAN is not quoted.

This supersedes all the Tax Deduction / Collection Account Number, alloted to you earlier.

Income Tax Department

This is a computer-generated letter. Hence, signature is not required.

Caution : Income Tax Department does not send e-mails regarding refunds and does not seek any taxpayer information like user

name, password, details of ATM, bank accounts, credit cards, etc. Taxpayers are advised not to part with such information on the

basis of emails.

You might also like

- Natebu2019sepm15 4583314268 4466459800Document14 pagesNatebu2019sepm15 4583314268 4466459800NarasimmaNo ratings yet

- TAN - Sanjayrekha Aggregator - PNES82580BDocument1 pageTAN - Sanjayrekha Aggregator - PNES82580BHarshad JathotNo ratings yet

- Allotment of Tax Deduction Account Number (TANDocument1 pageAllotment of Tax Deduction Account Number (TANsabir hussainNo ratings yet

- TAN Allotment Letter for GNANA DEEPTHI FARMER PRODUCER COMPANY LIMITEDDocument1 pageTAN Allotment Letter for GNANA DEEPTHI FARMER PRODUCER COMPANY LIMITEDthimothiNo ratings yet

- RTKR20027ADocument1 pageRTKR20027Ajijaboy366No ratings yet

- New TAN issued for Easyfin InnovationsDocument1 pageNew TAN issued for Easyfin InnovationssantoshrdmcsNo ratings yet

- TAN - Khidmat Tours & Travels PVT LTDDocument1 pageTAN - Khidmat Tours & Travels PVT LTDSahab Uddin Ahmed ChoudhuryNo ratings yet

- Sub: Allotment of Tax Deduction Account Number (TAN) As Per Income Tax Act, 1961Document1 pageSub: Allotment of Tax Deduction Account Number (TAN) As Per Income Tax Act, 1961Abu TaherNo ratings yet

- Sub: Allotment of Tax Deduction Account Number (TAN) As Per Income Tax Act, 1961Document1 pageSub: Allotment of Tax Deduction Account Number (TAN) As Per Income Tax Act, 1961tewod31076No ratings yet

- Sub: Allotment of Tax Deduction Account Number (TAN) As Per Income Tax Act, 1961Document1 pageSub: Allotment of Tax Deduction Account Number (TAN) As Per Income Tax Act, 1961NitinNo ratings yet

- ITR1 - Part 2 (Documents Required To File ITR1)Document3 pagesITR1 - Part 2 (Documents Required To File ITR1)gaurav gargNo ratings yet

- Panchayat Secretary and SopDocument4 pagesPanchayat Secretary and SopYogendra Mishra100% (1)

- Tata Photon bill detailsDocument2 pagesTata Photon bill detailsMukesh BohraNo ratings yet

- ANNEX-882039274666970Document1 pageANNEX-882039274666970sandeep.soniNo ratings yet

- LTC Cash Vouchers Scheme - Entitilement & Reimbursement CalculationDocument2 pagesLTC Cash Vouchers Scheme - Entitilement & Reimbursement CalculationBharat KumarNo ratings yet

- Aatma Bodha667 Knowledge of SelfDocument6 pagesAatma Bodha667 Knowledge of SelfAnvith KingNo ratings yet

- Tax Certificate 03326459660 2016Document1 pageTax Certificate 03326459660 2016ChoudheryShahzadNo ratings yet

- Summary of Accounts Held Under Customer Id: 501622621 As On 28-02-2013Document2 pagesSummary of Accounts Held Under Customer Id: 501622621 As On 28-02-2013S Deva PrasadNo ratings yet

- DUPLICATE BILL DETAILS FOR RAVINDER VERMADocument2 pagesDUPLICATE BILL DETAILS FOR RAVINDER VERMAverma_ravinderNo ratings yet

- Tax Collector Correspondence3362544Document5 pagesTax Collector Correspondence3362544hamza awanNo ratings yet

- 03 Internet-July To Sep-18Document5 pages03 Internet-July To Sep-18aakashNo ratings yet

- Form 16 and Salary DetailsDocument22 pagesForm 16 and Salary DetailsAjay Chowdary Ajay ChowdaryNo ratings yet

- Associated Sites Bill Payment (Single Account) Bill Payment (Multiple Account) View Bill Lodge A Complaint Payment HistoryDocument1 pageAssociated Sites Bill Payment (Single Account) Bill Payment (Multiple Account) View Bill Lodge A Complaint Payment HistoryPulastaMahapatraNo ratings yet

- Summary of Accounts Held Under Customer Id: 523327962 As On 31-10-2012Document3 pagesSummary of Accounts Held Under Customer Id: 523327962 As On 31-10-2012skbansal1976No ratings yet

- Form 16: Wipro LimitedDocument5 pagesForm 16: Wipro Limiteddeepak9976No ratings yet

- Modified Vendor Registration Form PDFDocument3 pagesModified Vendor Registration Form PDFAnonymous cKGCdi100% (1)

- Rajesh Annex-259579700022090Document1 pageRajesh Annex-259579700022090sona singhNo ratings yet

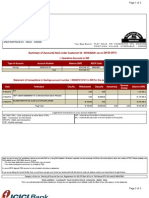

- Regd. Off.: ICICI Bank Tower, Near Chakli Circle, Old Padra Road, Vadodara, Gujarat. - 390 007. IndiaDocument1 pageRegd. Off.: ICICI Bank Tower, Near Chakli Circle, Old Padra Road, Vadodara, Gujarat. - 390 007. IndiaSrinivas GirnalaNo ratings yet

- Guidelines For Filing PF Withdrawal Form - 2012Document3 pagesGuidelines For Filing PF Withdrawal Form - 2012princeforjesusNo ratings yet

- Search FileDocument3 pagesSearch FileArunava BanerjeeNo ratings yet

- Ahrpv0731f 2013-14Document2 pagesAhrpv0731f 2013-14Shiva KumarNo ratings yet

- Tax Applicable (Tick One) 2 8 1Document7 pagesTax Applicable (Tick One) 2 8 1Gaurav BajajNo ratings yet

- Annex 055840100375124Document2 pagesAnnex 055840100375124Siddhi PatilNo ratings yet

- Form-16 Part-A From TDSCPC Website PDFDocument3 pagesForm-16 Part-A From TDSCPC Website PDFgaurav singhNo ratings yet

- P.P.T On Duties - Responsibilities of DDO For GSTDocument30 pagesP.P.T On Duties - Responsibilities of DDO For GSTBilal A BarbhuiyaNo ratings yet

- Income Tax Payment Challan: PSID #: 171610056Document1 pageIncome Tax Payment Challan: PSID #: 171610056nadeemuzairNo ratings yet

- Income Tax Pan Services Unit: ACKNOWLEDGEMENT NO.845739700001221Document1 pageIncome Tax Pan Services Unit: ACKNOWLEDGEMENT NO.845739700001221SameerNo ratings yet

- 6tv 1 PDFDocument10 pages6tv 1 PDFSarwar MiyaNo ratings yet

- BSNL bill detailsDocument3 pagesBSNL bill detailsTaniya SarkerNo ratings yet

- Calcutta TelephonesDocument3 pagesCalcutta TelephonesJorge RasmussenNo ratings yet

- Shashank Kantheti Hyd 12 13Document5 pagesShashank Kantheti Hyd 12 13kshashankNo ratings yet

- IN30267933627262Document2 pagesIN30267933627262CLANCY GAMING COMUNITYNo ratings yet

- Payment ReceiptDocument1 pagePayment ReceiptRaghavendra KumarNo ratings yet

- V. N. Hari,: Sudhakar & Kumar AssociatesDocument28 pagesV. N. Hari,: Sudhakar & Kumar AssociatesvnharicaNo ratings yet

- Annex 882038275424342Document1 pageAnnex 882038275424342Shree Nath Transport Co.No ratings yet

- Dl2011novm05 1134415034 906495033Document2 pagesDl2011novm05 1134415034 906495033sumeshkumarsharmaNo ratings yet

- Your Postpay BillDocument4 pagesYour Postpay BillAvneet MaanNo ratings yet

- Form16Document5 pagesForm16er_ved06No ratings yet

- Income Tax Pan Services Unit: ACKNOWLEDGEMENT NO.881035292293111Document1 pageIncome Tax Pan Services Unit: ACKNOWLEDGEMENT NO.881035292293111MSEB WalujNo ratings yet

- Annex 030409710286616Document1 pageAnnex 030409710286616sameer pashaNo ratings yet

- Letter To BirDocument2 pagesLetter To BirRheg Teodoro50% (2)

- Form 16A: Summary of Tax Deducted at Source in Respect of DeducteeDocument1 pageForm 16A: Summary of Tax Deducted at Source in Respect of DeducteeVinayak BadagiNo ratings yet

- Bureau of Internal Revenue: Christian Ronell SchmidtDocument2 pagesBureau of Internal Revenue: Christian Ronell SchmidtRheg TeodoroNo ratings yet

- ICICI Bank Savings Account Statement SummaryDocument3 pagesICICI Bank Savings Account Statement SummaryJayaDeyBodhakNo ratings yet

- Document Checklist - Sole-ProprietorDocument4 pagesDocument Checklist - Sole-ProprietorKarthik DeshapremiNo ratings yet

- (103850091) 522888932 - Sep2013Document3 pages(103850091) 522888932 - Sep2013Ankit AroraNo ratings yet

- Annex 205919700005773Document1 pageAnnex 205919700005773Brisk VpnNo ratings yet

- PaymentAdvice PDFDocument1 pagePaymentAdvice PDFvijay rajNo ratings yet

- Directorate of Income Tax 20 SepDocument4 pagesDirectorate of Income Tax 20 SepOmkar KhanapureNo ratings yet

- Goods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesFrom EverandGoods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesNo ratings yet