Professional Documents

Culture Documents

Sub: Allotment of Tax Deduction Account Number (TAN) As Per Income Tax Act, 1961

Uploaded by

NitinOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Sub: Allotment of Tax Deduction Account Number (TAN) As Per Income Tax Act, 1961

Uploaded by

NitinCopyright:

Available Formats

Feb 13, 2023

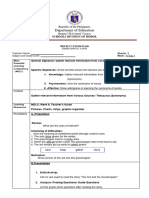

Ref.No.: 88305920720216/TAN/NEW

TO,

SWARNIM PARTNERS & ASSOCIATES LLP

A-346, UG FLOOR, DEFENCE

,

COLONY,NEW DELHI

DEFENCE COLONY (SOUTH DEL

SOUTH DELHI-110024

DELHI

TEL. NO.:9717329850

Sir/Madam,

Sub : Allotment of Tax Deduction Account Number

(TAN) as per Income Tax Act,1961

Kindly refer to your application (Form 49B) dated Feb 13, 2023 for the allotment of Tax Deduction Account Number.

In this connection, the following TAN has been issued to you/your organisation:

DELS99010C

Please quote the same in all TDS challans,TDS Certificates,TDS returns,Tax Collection at Source(TCS) returns as

well as other documents pertaining to such transactions.

Quoting of TAN on all TDS returns and challans for payment of TDS is necessary to ensure credit of TDS paid by you

and faster processing of TDS returns.

The above TAN should also be used as Tax Collections at Source Account Number under section 206CA.

Kindly note that it is mandatory to quote TAN while furnishing TDS returns, including e-TDS returns. e-TDS returns will

not be accepted if TAN is not quoted.

This supersedes all the Tax Deduction / Collection Account Number, alloted to you earlier.

Income Tax Department

Signature Not

Verified

Digitally signed by NSDL e-

Goverance Infrastructure Ltd

Date: 2023.02.13 02:44:43

GMT+05:30

Reason: NSDL eTAN Sign

Location: Mumbai

Caution : Income Tax Department does not send e-mails regarding refunds and does not seek any taxpayer information like username,

password, details of ATM, bank accounts, credit cards, etc. Taxpayers are advised not to part with such information on the basis of emails.

You might also like

- Sub: Allotment of Tax Deduction Account Number (TAN) As Per Income Tax Act, 1961Document1 pageSub: Allotment of Tax Deduction Account Number (TAN) As Per Income Tax Act, 1961tewod31076No ratings yet

- Team Ralys TANDocument1 pageTeam Ralys TANrameshNo ratings yet

- DHBVNDocument1 pageDHBVNAnil KumarNo ratings yet

- RTKR20027ADocument1 pageRTKR20027Ajijaboy366No ratings yet

- ACFrOgBAKu4HsxfYrXM18UmVwGqojgQP5r-yasAmKR80zOA3Lpk1v0Pk7l30jmekps-xoa WDA9 R0HNvBH31RV5QFPqBtYX2e3HZdmfRtzFqatXd6edMdwPEXXtYToSQwv9dZ6n-IKo 0iA0NmmDocument1 pageACFrOgBAKu4HsxfYrXM18UmVwGqojgQP5r-yasAmKR80zOA3Lpk1v0Pk7l30jmekps-xoa WDA9 R0HNvBH31RV5QFPqBtYX2e3HZdmfRtzFqatXd6edMdwPEXXtYToSQwv9dZ6n-IKo 0iA0NmmNitinNo ratings yet

- Ajrxxxxx5r Q2 2021-22Document3 pagesAjrxxxxx5r Q2 2021-22Tenzin ChoezomNo ratings yet

- Tax Invoice: Customer DetailsDocument4 pagesTax Invoice: Customer DetailsAnirban GhoshNo ratings yet

- Government of Odisha: Office of The Tahasildar Keonjhar Miscellaneous Certificate Case No: E-SEB/2023/396835 Annexure-'C'Document1 pageGovernment of Odisha: Office of The Tahasildar Keonjhar Miscellaneous Certificate Case No: E-SEB/2023/396835 Annexure-'C'Sipunkumar MahantaNo ratings yet

- Inv 12484-MarchDocument1 pageInv 12484-Marchintegral.shanNo ratings yet

- Allotment of Tax Deduction Account Number (TANDocument1 pageAllotment of Tax Deduction Account Number (TANsabir hussainNo ratings yet

- Nitin BhaiDocument1 pageNitin BhaiROHIT RAJESH (RA2111042010039)No ratings yet

- Mr. Boda Daveeduraju account statement summaryDocument1 pageMr. Boda Daveeduraju account statement summaryVara Prasad AvulaNo ratings yet

- E-SEB_2023_519173 (2)Document1 pageE-SEB_2023_519173 (2)rudra.sankhoNo ratings yet

- Alliance Broadband Services PVT LTD: Tax InvoiceDocument1 pageAlliance Broadband Services PVT LTD: Tax InvoiceacctsagarwalNo ratings yet

- Rajesh TambeDocument1 pageRajesh TambemodakmmNo ratings yet

- SEO-Optimized Title for Purchase Order Document for MicroPorous Vent PlugsDocument3 pagesSEO-Optimized Title for Purchase Order Document for MicroPorous Vent Plugsssee5b2 elsedNo ratings yet

- New TAN issued for Easyfin InnovationsDocument1 pageNew TAN issued for Easyfin InnovationssantoshrdmcsNo ratings yet

- D D MM Y Y Yy: (Separate Forms Need To Be Filled For Each Tax Type)Document3 pagesD D MM Y Y Yy: (Separate Forms Need To Be Filled For Each Tax Type)nikhil kumarNo ratings yet

- ChallanDocument2 pagesChallanSib MktgNo ratings yet

- Tax Invoice: Customer DetailsDocument4 pagesTax Invoice: Customer DetailsAnirban GhoshNo ratings yet

- Pinacle InvoiceDocument1 pagePinacle InvoicenoyonmelaNo ratings yet

- Report Name:: Internet Expense India HR PolicyDocument4 pagesReport Name:: Internet Expense India HR PolicySachin PatilNo ratings yet

- Jagath Eb 04.05.20 PDFDocument1 pageJagath Eb 04.05.20 PDFsarveshvar sNo ratings yet

- Ankit ObcDocument1 pageAnkit Obc26 Hemanta Kumar PradhanNo ratings yet

- RT 2021-22 01078Document1 pageRT 2021-22 01078M A InteriorsNo ratings yet

- App 7000034 TXN 172882049 TMPLT 995Document2 pagesApp 7000034 TXN 172882049 TMPLT 995tamil maran.uNo ratings yet

- TAN Allotment Letter for GNANA DEEPTHI FARMER PRODUCER COMPANY LIMITEDDocument1 pageTAN Allotment Letter for GNANA DEEPTHI FARMER PRODUCER COMPANY LIMITEDthimothiNo ratings yet

- Tax Collector Correspondence3362544Document5 pagesTax Collector Correspondence3362544hamza awanNo ratings yet

- ChallanDocument2 pagesChallana 2 z channelNo ratings yet

- Kanha Obc CertificateDocument1 pageKanha Obc CertificateGyanendra BarikNo ratings yet

- TAN - Sanjayrekha Aggregator - PNES82580BDocument1 pageTAN - Sanjayrekha Aggregator - PNES82580BHarshad JathotNo ratings yet

- E-Obc 2023 461730Document1 pageE-Obc 2023 461730sarojkumar333bpdNo ratings yet

- View Tax Payment Details: Reference Number: 29973456Document2 pagesView Tax Payment Details: Reference Number: 29973456arjuntyagi22No ratings yet

- In 7102388055Document2 pagesIn 7102388055Andresinho PolancoNo ratings yet

- Invoice: Invoice From Invoice To Customer InformationDocument1 pageInvoice: Invoice From Invoice To Customer InformationAmitNo ratings yet

- ChallanDocument2 pagesChallankunal monadlNo ratings yet

- Invoice 202401Document4 pagesInvoice 202401Vignesh WerNo ratings yet

- Correspondence With DepositorsDocument5 pagesCorrespondence With Depositorsatul AgalaweNo ratings yet

- ChallanDocument2 pagesChallanSanidev MishraNo ratings yet

- March InvDocument1 pageMarch Invkranthimahesh999No ratings yet

- TAN - Khidmat Tours & Travels PVT LTDDocument1 pageTAN - Khidmat Tours & Travels PVT LTDSahab Uddin Ahmed ChoudhuryNo ratings yet

- Form GST REG-03: (See Rule 9 (2) )Document1 pageForm GST REG-03: (See Rule 9 (2) )PONTAGE STAFFING INDIANo ratings yet

- ChallanDocument2 pagesChallanTejaswi SubbaNo ratings yet

- Etax Cyber Receipt Challan No./Itns 281: Details of Payment Amount in Rs. 0 0 0 0 0Document1 pageEtax Cyber Receipt Challan No./Itns 281: Details of Payment Amount in Rs. 0 0 0 0 0Aryana BalanNo ratings yet

- E0300MK9PLDocument2 pagesE0300MK9PLRISHAD P.PNo ratings yet

- BillDesk Payment GatewayDocument1 pageBillDesk Payment GatewayRashi VachhaniNo ratings yet

- E-Obc 2023 149771Document1 pageE-Obc 2023 149771Guruprasad RanaNo ratings yet

- E-Seb 2023 372345Document1 pageE-Seb 2023 372345sarojkumar333bpdNo ratings yet

- Inv Ka B1 29436538 102363408901 April 2020Document2 pagesInv Ka B1 29436538 102363408901 April 2020anandNo ratings yet

- Atria Convergence Technologies Limited, Due Date: 15/04/2021Document2 pagesAtria Convergence Technologies Limited, Due Date: 15/04/2021Saima ArshadNo ratings yet

- Online Bill Payment ReceiptDocument2 pagesOnline Bill Payment ReceiptHajeera BicsNo ratings yet

- HDFC Bank Limited - Payment-OperationsDocument1 pageHDFC Bank Limited - Payment-OperationsJESSIE JAMENo ratings yet

- Broad BandDocument4 pagesBroad BandSachin PatilNo ratings yet

- OBC Certificate for Banti PadhanDocument1 pageOBC Certificate for Banti PadhanBanti Padhan FNo ratings yet

- E0300MMPFDDocument2 pagesE0300MMPFDRISHAD P.PNo ratings yet

- Ht2333i007021258Document2 pagesHt2333i007021258Umamaheswaran SGNo ratings yet

- Signature Not Verified Digitally Signed Tax InvoiceDocument1 pageSignature Not Verified Digitally Signed Tax InvoiceNarendra v reddyNo ratings yet

- hog testDocument3 pageshog testsujaraghupsNo ratings yet

- Goods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesFrom EverandGoods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesNo ratings yet

- 21St Century Computer Solutions: A Manual Accounting SimulationFrom Everand21St Century Computer Solutions: A Manual Accounting SimulationNo ratings yet

- Kashish CVDocument2 pagesKashish CVNitinNo ratings yet

- PushkarJain InternshalaResumeDocument2 pagesPushkarJain InternshalaResumeNitinNo ratings yet

- Samyak JainDocument1 pageSamyak JainNitinNo ratings yet

- Soumita ResumeDocument2 pagesSoumita ResumeNitinNo ratings yet

- Pethia Shergill Law Firm Litigation ExpertiseDocument7 pagesPethia Shergill Law Firm Litigation ExpertiseNitinNo ratings yet

- Form 16 Certificate of Incorporation LLPDocument1 pageForm 16 Certificate of Incorporation LLPNitinNo ratings yet

- Kotak Corporate Application Form V8 Revised PageDocument7 pagesKotak Corporate Application Form V8 Revised PageNitinNo ratings yet

- SCBA Circular Dated 15.02.2023 Re Cubicles in D Block Addl. Building ComplexDocument4 pagesSCBA Circular Dated 15.02.2023 Re Cubicles in D Block Addl. Building ComplexNitinNo ratings yet

- Sinhgad Management InstitutesDocument3 pagesSinhgad Management InstitutesNitinNo ratings yet

- Sadiya Rahman (RESUME)Document2 pagesSadiya Rahman (RESUME)NitinNo ratings yet

- Fatima Zakir Thakur: Career ObjectiveDocument2 pagesFatima Zakir Thakur: Career ObjectiveNitinNo ratings yet

- Computer Engineer: Personal Particulars: SkillsDocument1 pageComputer Engineer: Personal Particulars: SkillsNitinNo ratings yet

- Resume: Bhumika Sharma Mobile No. 8287735500Document3 pagesResume: Bhumika Sharma Mobile No. 8287735500NitinNo ratings yet

- Mow CVDocument1 pageMow CVNitinNo ratings yet

- Tripti ResumeDocument2 pagesTripti ResumeNitinNo ratings yet

- Pratibha Khullar: Career ObjectiveDocument2 pagesPratibha Khullar: Career ObjectiveNitinNo ratings yet

- Anwesha Bhattacharjee: Personal StatementDocument2 pagesAnwesha Bhattacharjee: Personal StatementNitinNo ratings yet

- Carrier ObjectivesDocument2 pagesCarrier ObjectivesNitinNo ratings yet

- Playfair Cipher: Cipher Is A Manual Symmetric Encryption Technique and Was The First LiteralDocument9 pagesPlayfair Cipher: Cipher Is A Manual Symmetric Encryption Technique and Was The First LiteralJOHN CHARLASNo ratings yet

- Chapter 2 - DynamicsDocument8 pagesChapter 2 - DynamicsTHIÊN LÊ TRẦN THUẬNNo ratings yet

- Importance of Education: March 2015Document4 pagesImportance of Education: March 2015AswiniieNo ratings yet

- JAWABAN UTS Bahasa Inggris II Keperawatan Dewi YuniarDocument3 pagesJAWABAN UTS Bahasa Inggris II Keperawatan Dewi Yuniarovan maysandyNo ratings yet

- Self Unbound Ego Dissolution in PsychedelicDocument11 pagesSelf Unbound Ego Dissolution in Psychedelicszucsanna123456789No ratings yet

- Aqa Textiles Gcse Coursework Grade BoundariesDocument4 pagesAqa Textiles Gcse Coursework Grade Boundariesrqaeibifg100% (2)

- Different Type of Dealers Detail: Mfms Id Agency Name District Mobile Dealer Type State Dealership NatureDocument1 pageDifferent Type of Dealers Detail: Mfms Id Agency Name District Mobile Dealer Type State Dealership NatureAvijitSinharoyNo ratings yet

- Exam On Multiculturalism: - Acculturation Process of Immigrants From Central and Eastern Europe in SwedenDocument60 pagesExam On Multiculturalism: - Acculturation Process of Immigrants From Central and Eastern Europe in SwedenMarta santosNo ratings yet

- Bacterial Recombination MCQsDocument3 pagesBacterial Recombination MCQsJon HosmerNo ratings yet

- United States Court of Appeals, Third Circuit, 952 F.2d 742, 3rd Cir. (1991)Document22 pagesUnited States Court of Appeals, Third Circuit, 952 F.2d 742, 3rd Cir. (1991)Scribd Government DocsNo ratings yet

- Is College For Everyone - RevisedDocument5 pagesIs College For Everyone - Revisedapi-295480043No ratings yet

- Part of Speech QuestionsDocument4 pagesPart of Speech QuestionsNi Luh Ari Kusumawati0% (1)

- Firebird Developer Guide Beta Delphi FiredacDocument162 pagesFirebird Developer Guide Beta Delphi FiredacDanilo CristianoNo ratings yet

- Survey of Accounting 6th Edition Warren Solutions ManualDocument17 pagesSurvey of Accounting 6th Edition Warren Solutions Manualdevinsmithddsfzmioybeqr100% (19)

- Welcome To HDFC Bank NetBankingDocument1 pageWelcome To HDFC Bank NetBankingrajeshNo ratings yet

- 201335688Document60 pages201335688The Myanmar TimesNo ratings yet

- American SpartansDocument4 pagesAmerican SpartansArya V. VajraNo ratings yet

- Work, Energy and Power ExplainedDocument34 pagesWork, Energy and Power ExplainedncmzcnmzzNo ratings yet

- Milking MachineDocument10 pagesMilking Machineuniversaldairy100% (2)

- Manage Vitamin B12 DeficiencyDocument5 pagesManage Vitamin B12 DeficiencyAnca CucuNo ratings yet

- MHC-GPX33 55 77 88Document1 pageMHC-GPX33 55 77 88Juliana Ribeiro100% (6)

- A. Music G8 Fourth QuarterDocument7 pagesA. Music G8 Fourth Quarterjason bernalNo ratings yet

- Explosive Ordnance Disposal & Canine Group Regional Explosive Ordnance Disposal and Canine Unit 3Document1 pageExplosive Ordnance Disposal & Canine Group Regional Explosive Ordnance Disposal and Canine Unit 3regional eodk9 unit3No ratings yet

- Question 1 - Adjusting EntriesDocument10 pagesQuestion 1 - Adjusting EntriesVyish VyishuNo ratings yet

- CS 401 Artificial Intelligence: Zain - Iqbal@nu - Edu.pkDocument40 pagesCS 401 Artificial Intelligence: Zain - Iqbal@nu - Edu.pkHassan RazaNo ratings yet

- Wayside Amenities GuidelinesDocument8 pagesWayside Amenities GuidelinesUbaid UllahNo ratings yet

- Bohol - Eng5 Q2 WK8Document17 pagesBohol - Eng5 Q2 WK8Leceil Oril PelpinosasNo ratings yet

- Food Safety Culture Webinar SLIDESDocument46 pagesFood Safety Culture Webinar SLIDESAto Kwamena PaintsilNo ratings yet

- Likes and Dislikes 1Document2 pagesLikes and Dislikes 1LAURA MELISSA SANCHEZ SUAREZ50% (2)

- Operational Effectiveness and Strategy - FinalDocument11 pagesOperational Effectiveness and Strategy - FinalChanchal SharmaNo ratings yet