Professional Documents

Culture Documents

Chapter 1 "Quality Control and Engagement Standards"

Uploaded by

herrajohnOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter 1 "Quality Control and Engagement Standards"

Uploaded by

herrajohnCopyright:

Available Formats

Chapter 1 “Quality Control and Engagement Standards”

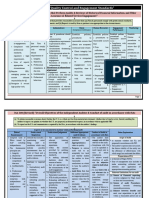

SQC – 1 “Quality Control for Firms that Perform Audits & Reviews of Historical Financial Information, and Other

Assurance & Related Services Engagements”

All firms to have system of quality control that provides reasonable assurance that: (a) Firm & personnel comply with professional standards,

regulatory & legal requirements, and (b) Reports issued by firm or partners are appropriate in the circumstances.

Leadership Ethical Independence Client Human Resources Engagement Monitoring

Acceptance/Continuance Performance

Responsibilities for Q. C. requirements

(a) Promote internal Establish policies Policies & procedures should Establish policies/ Establish policies Establish policies / Establish

enable: procedures to

culture w.r.t.: & procedures to to / procedures to Policies &

• Communication of procedures reasonable assure

• essential of quality reasonable assure independence requirements reasonable assure that reasonable assure w.r.t.: procedures to

to personnel & others. • Compliance with

in engagements. that Firm & reasonable

• Identification of clients are accepted/ that:

professional

• Compliance with personnel comply circumstances threatening assure that QC

independence. continued only where: • Firm has standards.

professional with relevant sufficient • Compliance with policies/

• Take appropriate action for • Client integrity has

standards, ethical elimination of threats / laws/ regulations. procedures are:

personnel with

requirements of withdrawal from been considered. • Engagement

regulatory / legal capabilities, • Relevant.

engagement. partner issues

requirements. 1. Integrity. • Resolution of breaches of

• Firm is competent • Adequate.

competence & reports that are

2. Objectivity. independence. to perform appropriate in the

• Issue of reports commitment to • Operating

Maintenance of independence circumstances.

appropriate in 3. Professional of personnel engagement w.r.t. effectively.

ethical Important aspects

competence & • Engagement partners to

circumstances. capability, time & principles of engagement • Complied

provide firm with relevant

(b) Require CEO/ due care. performance

information about client. resources. & with in

• Prompt notification of • Supervision.

managing partner to 4. Confidentiality. practice.

threats to independence. • Firm can comply • Responsibility • Review.

assume ultimate 5. Professional • Accumulation & • Consultation.

with ethical of engagement

responsibility for QC. behaviour. communication of relevant • Differences of Compiled by:

information to appropriate requirements. partner clearly opinion. Pankaj Garg

(c) Recognise & reward personnel. • Engagement Q. C.

defined & for students of

high quality work. These Charts are protected under Copyright and for students use only. Any Commercial review. CA - Final

communicated

use of these charts by anyone may attract Consequences under Copyright Act. • Engagement Audit

to him/ her. documentation.

Compiled by: Pankaj Garg ©www.altclasses.in Page 1

SA 200 (Revised) “Overall Objectives of the Independent Auditor & Conduct of audit in accordance with SAs

(a) To obtain reasonable assurance about whether the F. S. as a whole are free from material misstatement, whether due to fraud or error, thereby enabling the

auditor to express an opinion on whether the F.S. are prepared, in all material respects, in accordance with an applicable FRF.

(b) To report on the F.S. and communicate as required by the SAs, in accordance with the auditor’s findings.

Aspects to be considered by Auditor while performing Audit

Ethical Professional Professional Judgment Sufficient Appropriate Conduct of Audit in Other Explanation

Requirements Skepticism audit Evidence accordance with SAs

• Comprise Code of Attitude that includes a The application of relevant • Sufficiency refers to • The auditor shall Scope of Audit

Ethics issued by questioning mind, training, knowledge and quantum and comply with All SAs • To examine whether the F.S. are

ICAI including being alert to experience, Appropriateness relevant to the audit. prepared in accordance with FRF.

independence. conditions which may • within the context

refers to quality. • Compliance with SA • The auditor’s opinion does not assure,

indicate possible provided by auditing,

• The fundamental • Purpose: To reduce is to be specified in the future viability of the entity nor

misstatement due to accounting and ethical

principles are: audit risk to an Audit report only in the efficiency or effectiveness with

error or fraud, and a standards,

1. Integrity acceptably low level case of actual which mngt. has conducted the affairs.

critical assessment of • in making informed

2. Objectivity and thereby enable compliance. Preparation of F.S.

audit evidence. decisions about the

3. Professional the auditor to draw • To achieve overall • is the duty of Mngt. /TCWG.

courses of action

competence & reasonable objectives of audit, • Duty of management also includes to

due care Alertness is required • that are appropriate in conclusions on which use the objective make accounting estimates and

4. Confidentiality, w.r.t. the circumstances of the to base the auditor’s stated in Individual selection and application of

& 1. Contradictory audit audit engagement. opinion. SAs. appropriate accounting policies.

5. Professional evidence. • Audit Risk: Risk that • In case Entire SA is

behaviour 2. Reliability of It is required w.r.t.: the auditor expresses

Inherent Limitations for an audit

• Materiality & audit risk. not relevant due to

documents. (a) Nature of Financial reporting:

• Independence an inappropriate audit non-existence of

• NTE of audit procedures. involves judgment by Mngt. based

comprises both 3. Conditions opinion when the F.S. prescribed

indicating possible • Evaluating sufficiency & on facts and circumstances.

independence of are materially conditions, comply

frauds. appropriateness of audit (b) Nature of audit Procedures:

mind and misstated. with relevant

procedures. directed towards obtaining

independence of 4. Circumstances • Audit Risk is a requirements.

requiring audit • Evaluating management reasonable assurance.

appearance. function of the RMM • In case of failure to

procedures in judgment in applying (c) Balance between benefit and

and detection risk. achieve an objective

Compiled by: Pankaj addition to those applicable FRF. cost: user expectation to get AR

determine the need within a reasonable period and at

Garg for students of CA suggested in SAs. • Drawing conclusions

of modified opinion reasonable cost.

- Final Audit based on audit evidence.

or withdrawal.

Compiled by: Pankaj Garg ©www.altclasses.in Page 2

SA – 210 (Revised) – “Agreeing the Terms of Engagement”

Objective of Auditor: To accept or continue an audit engagement only when the basis upon which it is to be performed has been agreed with the client.

Agreeing the terms of audit Engagement

At the Beginning of Audit During the Course of Audit

Initial audit Engagement Recurring Audit Mngt. request for changes in terms

Limitations Imposed by mngt. No Limitations Imposed by Mngt. Determine its effect on Level of

Determine requirements w.r.t.:

Assurance & reasonable

(a) Revision of terms of Engagement; &

Do not accept unless required Ascertain existence of Preconditions Justification

by law (b) Remind the entity of existing terms

Preconditions for an audit Exist Not Exist Required Not Required Auditor Satisfied Not Satisfied

1. Determine whether the FRF is

acceptable.

2. Obtain agreement of mngt that it Accept Audit Discuss matter Send New No Further Duty Record New Do not

with Mngt. Engagement Letter Terms in accept the

understands its responsibilities for:

Engagement changes

(a) Preparation of F.S. Letter

(b) Exercising necessary Internal

Controls to enable the Do not accept audit in case of: CIRCUMSTANCES REQUIRING REVISION IN TERMS Mngt. not

preparation of F.S. that are free • Indications that the entity misunderstands the objective and permit the

(a) Unacceptable FRF

from material misstatements. scope of the audit. auditor to

or • Revised or special terms of engagement.

(c) To provide the auditor: continue

• Access to all relevant info. (b) Mngt. does not agree with • Recent change of senior management.

• Significant change in ownership. Withdraw &

• Additional info that auditor responsibilities

• Significant change in nature or size of the entity’s business. Report to

requests from mngt.

• Change in legal or regulatory requirements. appropriate

• Unrestricted access to persons

Compiled by: Pankaj Garg for • Change in FRF adopted in the preparation of the F.S. authority

within the entity.

students of CA - Final Audit • A change in other reporting requirements.

Compiled by: Pankaj Garg ©www.altclasses.in Page 3

SA – 220 (revised) “Quality Control for an audit of F.S.”

Objective: Implement QC Policies that provide Reasonable Assurance that audit complies with professional standards and audit report issued is appropriate

Leadership Ethical Independence Acceptance / Continuance Assignment of Engagement Performance Monitoring

Responsibilities

Requirements of Client relationship Engagement

Team

EP should EP to remain alert • Be satisfied that EP to be satisfied 1. Direction, Supervision and Obtain

performance: reasonable

emphasize the for evidence of Form a conclusion on appropriate procedures that ET &

• EP shall take the responsibility for

compliance with Auditor’s Expert assurance that

ET the following: non-compliance regarding client acceptance directions, supervision & performance

applicable independence not part of ET has firm’s policies /

/ continuance have been of audit engagement in compliance

• Compliance with relevant ethical requirements procedures

appropriate with standards & regulatory

with requirements by ET followed. requirements, &. relating to QC are

Obtain relevant competence &

through: • Determine whether capabilities to: • to make an appropriate AR. relevant,

professional

information from Firm 2. Reviews: adequate, and

Standards and • Inquiry. conclusions reached are ➢ Perform audit EP shall take the following

operating

appropriate. engagement in responsibilities:

legal • Observation. effectively.

Identify & Evaluate a. Reviews are being performed in

requirements. circumstances & accordance accordance with policies / procedures.

If there is an with b. Be Satisfied that SAAE has been Consider:

• Compliance

Relationship that threatens If EP obtains information

indication of non- independence that would have caused firm professional obtained to support the conclusions • Results of

with firm’s reached and AR to be issued through

compliance with to withdraw the engagement, standards and firm’s

• Review of Audit Documentation.

Q.C. Policies. Evaluate information on communicate information regulatory or

relevant ethical • Discussion with ET monitoring

• Issuance of identified breaches. promptly to firm legal 3. Consultation:

requirements, EP process.

requirements, EP shall undertake consultation

appropriate

should: • wherever required. • Whether

audit report. Determine if these Examples of Information and

• Ensure its implementation

• Consult others in threaten independence ➢ Enable an AR deficiencies

• Ability to raise

1. Integrity of Principal 4. Engagement Quality Control Review:

the firm. Owners, Mngt & TCWG that is required in case of listed entities. noted may

concerns Take appropriate action

• Determine 2. Competency of ET to appropriate in Matters to be evaluated by EQCR affect the

without fear. to eliminate such threats • Discussion of significant matters with

appropriate perform engagement. the audit

ET.

• Quality is or

3. Availability of necessary circumstances.

action. • Review of FS & proposed audit report. engagement.

essential & capabilities, including time • Review of selected audit

Promptly report & resources. documentation

indispensable Compiled by: inability to take 4. Compliance with relevant • Evaluation of conclusions reached.

in engagement Pankaj Garg appropriate action to • Considering whether proposed audit

ethical requirements.

report is appropriate.

performance. for students of firm. 5. Significant matters that

CA - Final 5. Differences of Opinion: follow the

arises during the current or

firm’s policies & procedures for dealing

Audit previous audit engagement. with and resolving differences of

opinion.

Compiled by: Pankaj Garg ©www.altclasses.in Page 4

SA – 230 (Revised) – Audit Documentation

General concepts Form, Content & Extent of Specific Documentation Retention Ownership

Documentation Period

• Documentation is the

Meaning: Record of: Auditor shall prepare audit documentation property of the

• Audit procedures performed that is sufficient to enable an experienced Compiled by:

7 Years from Auditor.

• Relevant audit evidence auditor to understand:

Pankaj Garg

• May at his discretion

date of Audit

obtained, & for students of

(a) NTE of the audit procedures; Report make portions of or

• Conclusions reached CA - Final

extracts from

(b) Results of audit procedures performed, Audit

Purpose: includes the following: documentation

& audit evidence obtained;

• Assist in Planning and available to client.

(c) Significant matters arising during the

performance of Audit. Documentation of Documentation of Documentation of

audit and the conclusions reached

• Direction, supervision & Discussion Departure from a matters arising after the

Review of work. thereon, significant professional

relevant requirement Date of Auditor’s Report

• To fix accountability. judgments made in the reaching those

• Record for future reference. conclusions.

• Significant • Reasons for the • Circumstance

• Quality control review and Factors affecting form, content & extent

Matters departure. encountered.

inspections 1. The size and complexity of the entity. Discussed with • Alternative • New or additional

• Conduct of external

2. The nature of the audit procedures to be Mngt. And procedures procedures

inspections.

performed. TCWG. performed. performed, audit

Nature documentation must 3. Identified RMM. • When and with evidence obtained,

provide for: 4. Significance of audit evidence obtained. whom the conclusions reached,

These Charts are

• Sufficient and appropriate 5. Nature & extent of exceptions identified. discussion took protected under and their effect on the

record of the basis for 6. Need to document a conclusion or the place. Copyright and for auditor’s report.

auditor’s report. basis for a conclusion not readily • How the auditor students use only. Any • When and by whom

determinable from the documentation of addresses the Commercial use of these the changes to audit

• Evidence that the audit was

inconsistency (if charts by anyone may documentation were

planned and performed in the work performed or audit evidence

any detected attract Consequences made and reviewed.

accordance with SAs & other obtained.

during under Copyright Act.

regulatory requirements. 7. The audit methodology and tools used.

discussion)

Compiled by: Pankaj Garg ©www.altclasses.in Page 5

SA 240 (Revised) – The Auditor’s Responsibilities Relating to Fraud in an Audit of Financial Statements

Fraud Risk Factors / Management Duties Auditor’s Responsibilities

Meaning and Nature of Fraud

Characteristics of Fraud

Meaning: Intentional Act involving use of deception to • Incentive or pressure to Commit Fraud: Primary responsibility To obtain reasonable assurance

for prevention & that F.S. as a whole are free from

obtain an unjust or illegal advantage. Arises when mngt is under pressure to material Misstatements.

achieve an unrealistic target. detection of fraud rests

Auditor is concerned with Fraud that causes • Perceived opportunity to do so: with Mngt and TCWG

Arises when an individual believes that Maintain an attitude of

Material Misstatement.

internal control can be overridden. To ensure prevention of Professional Skepticism

Misstatement may result from: • Rationalization to do so: fraud Mngt. must have a

A Fraudulent Financial Reporting Arises when an individual possesses an commitment to create a Circumstances indicate existence

1. Recording fictitious journal entries to attitude or character that allows them culture of honesty and of material Misstatement

manipulate operating results.

knowingly and intentionally to commit a

2. Inappropriate assumptions. Ethical behaviour.

3. Changing judgments to estimate account dishonest act.

balances. Consider whether such a

4. Omitting, advancing or delaying recognition of Risk associated for non-detection of material misstatements misstatement is an indication

events and transactions occurred during the of Fraud. If Fraud identified:

• Due to Inherent limitations there is always an unavoidable risk of material

year.

5. Concealing facts that affect the amount misstatement in F.S. due to Fraud.

recorded in F.S. • Risk of non-detecting a material misstatement resulting from fraud is Communicate to Mngt. &

6. Engaging in Complex Transactions that are higher than the risk of non-detecting one resulting from error. TCWG (also to Regulatory &

structured to misrepresent the financial • Risk of Material Misstatements due to Management Fraud is higher than Enforcement authorities, if

position or financial performance.

7. Altering records relating to significant due to Employee Fraud. required by Law)

transactions.

B Misappropriation of Assets Conditions or events which increases risk of fraud or error Auditor unable to complete

1. Embezzling receipts. 1. Discrepancies in Accounting Records: arises due to improper recording, the engagement.

2. Stealing physical assets. unauthorised transactions, last minute adjustments.

3. Causing an entity to pay for goods and services

2. Conflicting or missing evidences: missing documents, altered Consider the Possibility of

not received.

documents, non-availability of original documents, unexplained items etc. withdrawing.

4. Using entity assets for personal use.

3. Unusual relationship between auditor & mngt: undue time pressure,

Compiled by: Pankaj Garg for students of unusual delay in providing info, unwillingness to address weaknesses in IC. If withdraw:

4. Others: Mngt not allowing auditor to meet with TCWG, varied accounting • Discuss with Mngt & TCWG, &

. CA - Final Audit

• Report to appropriate persons

policies, frequent changes in accounting estimates.

Compiled by: Pankaj Garg ©www.altclasses.in Page 6

SA 250 (Revised) “Consideration of Laws and Regulations in an Audit of F.S.”

Management Responsibilities Auditor’s Responsibilities

Basic Responsibilities Specific Auditor Indicators considered by

Reporting responsibilities

Responsibilities w.r.t. Auditor

Procedure in

Obtain general

case any Non-

understanding of L&R having Other L&R that do not To TCWG Auditor Report Regularity &

Compliance is

• Legal & Regulatory direct effect on affect amount and Enforcement Authorities

Framework applicable determination disclosures in F.S. but identified /

• Compliance by Entity of material compliance with which Suspected Material Unable to If required by Law

with that Framework. amount and may be fundamental to Effect on Conclude

due to • Investigations by regulatory

disclosures in operating aspects. F.S.

Compliance of L&R is duty of

Limitation bodies.

F.S.

Mngt & TCWG and may be imposed by • Payment of fines or penalties.

performed through: • Payments for unspecified

Q/A services to consultants,

1. Monitoring legal requirements • Obtain

& ensuring that operating related parties etc.

procedures are designed to

obtain SAAE Perform limited understanding of • Excessive Sales commissions

procedures: Mngt. Circumstances

meet these requirements. the Act. or agent’s fees.

2. Instituting & operating • Inquiring of Mngt; & • Purchasing at prices

• Circumstances in

appropriate systems of IC. • Inspecting Q/D Consider the significantly above or below

which it is

3. Developing, publicising and Correspondence with Effect market price.

following a code of conduct. to ensure relevant Licensing / occurred. • Unusual payments in cash.

4. Ensuring employees are compliance • Evaluate possible • Unusual payments towards

Regulatory authority

properly trained & understand legal and retainership fees.

effects on F.S.

the code of conduct. • Matters involving non- • Payments without proper

5. Monitoring compliance with • Discuss with exchange control

to identify instances of compliance.

code of conduct & take actions Mngt. & TCWG documentation.

to discipline employees who noncompliance. • If TCWG is involved,

• Obtain legal • Existence of an information

fail to comply with it. communicate to Higher Level,

system which fails, to provide

6. Engaging legal advisors to advice wherever if any an adequate audit trail or

assist in monitoring legal required • Otherwise, obtain Legal Advice sufficient evidence.

Obtain Written Representation that all

requirements.

• Unauthorised transactions or

7. Maintaining a register of instances of non-compliance or These Charts are protected under Copyright and for students use improperly recorded

significant L & R with which the suspected non-compliance have been only. Any Commercial use of these charts by anyone may attract transactions.

entity has to comply. disclosed to auditor. Consequences under Copyright Act. • Adverse media comment.

Compiled by: Pankaj Garg ©www.altclasses.in Page 7

SA 260 (Revised) – “Communication with TCWG”

Meaning of Auditor’s Responsibilities Communication Process Factors affecting Mode of

Management & Communication

TCWG

TCWG: Persons with Determine the Matters to be communicated • Communication may be • Size, operating structure,

responsibility for appropriate Oral /written control environment, & legal

overseeing the (a) Auditor’s responsibilities in relation to F.S. Detail/Summarised structure of entity.

person to whom

Audit. Structured /Unstructured • In the case of an audit of

strategic directions & communication

(b) Planned scope & timing of audit • Should be in writing special purpose F.S., whether

obligations related to is to be made.

(c) Significant findings from audit w.r.t. the auditor also audits the

Accountability. when oral

• Accounting Policies entity’s general-purpose F. S.

Management: Person communication is not

• Accounting Estimates • Requirements of respective

with executive • F. S. Disclosures adequate. law specifying written

responsibility for • Significant difficulties encountered • Communication should communication with TCWG in

Compiled by:

during the audit. be on timely basis a prescribed form.

conduct of entity’s Pankaj Garg Examples of Significant difficulties

for students of 1. Significant delay in providing info • Expectations of TCWG,

operation

CA - Final 2. Unnecessarily brief time to complete including arrangements made

Audit the audit. Evaluate adequacy of for periodic meetings or

3. Extensive unexpected effort to obtain communication for the communications with the

SAAE. purpose of the audit. auditor.

• Determine the need to communicate with

4. Unavailability of Expected • The amount of ongoing

Governing body, if communicates with information. contact and dialogue the

subgroup. 5. Restriction imposed by management. If not adequate, evaluate

auditor has with TCWG.

• If all of TCWG are involved in managing the 6. Scope limitation imposed by its effect, on the auditor’s

• Significant changes in the

management assessment of the risks of

entity, and the matter has been membership of a governing

communicated with persons having material misstatement. body.

• Material weakness in I.C.

managerial responsibility, the matters need • Matters discuss with Mngt.

• Other significant Matters. These Charts are protected under Copyright and for students

not be communicated again to the same

use only. Any Commercial use of these charts by anyone may

persons in their governing role. (d) Statement w.r.t. compliance of ethical

attract Consequences under Copyright Act.

requirements regarding independence.

Compiled by: Pankaj Garg ©www.altclasses.in Page 8

SA-265 “Communicating Deficiencies in Internal Control to TCWG & Management

Meaning of deficiency Auditor’s Responsibilities

in internal control

(a) Inability of I.C to prevent Identification of deficiencies in Communication of deficiencies in Internal Control

detect & correct misstatement; Internal Control

or

Mode of communication Content of communication

(b) Absence of control necessary

Determine whether on the basis of

to prevent, detect & correct

work done any deficiency in In writing

misstatements internal control is identified

Determine whether individually or To TCWG To Mngt. (a) Description of deficiencies

Compiled by: Pankaj Garg for

in combination they constitute (b) Explanation of their potential

students of CA - Final Audit

significant deficiencies effect

(c) Sufficient information to explain

Indicators of Significant Deficiencies Significant Significant • that purpose of the audit is to

deficiencies deficiencies express an opinion

1. Evidence of ineffective aspects of control environment.

and other • I. C. is evaluated to design

2. Entity’s Risk assessment process – Absent/ineffective. deficiencies further audit procedures

3. Ineffective response to identified significant Risks.

4. Correction of prior period misstatements arising due to fraud/error.

These Charts are protected under Copyright and for students use only. Any

5. Management inability to oversee F.S. Preparation.

Commercial use of these charts by anyone may attract Consequences under

6. Misstatements detected by the auditor’s procedures were not Copyright Act.

prevented, or detected and corrected by the entity I.C.

Compiled by: Pankaj Garg ©www.altclasses.in Page 9

SA 299 (Revised) “Joint Audit of Financial Statements”

A joint audit is an audit of F.S. of an entity by two or more auditors appointed with the objective of issuing the audit report. Such auditors

are described as joint auditors.

Audit Planning and Allocation of Work Responsibility of Joint Auditors Audit Conclusion and Reporting

1 Development of Audit Plan • In respect of audit work divided among the joint 1 Reporting Requirements

In developing the joint audit plan, joint auditors shall: auditors, each joint auditor shall be responsible • Joint auditors are required to issue

a. Identify division of audit areas and common audit areas only for the work allocated to such joint auditor common audit report.

amongst the joint auditors that define the scope of the work of including proper execution of the audit procedures. • However, in case of any disagreement with

each joint auditor; regard to the opinion or any matters to be

• All joint auditors shall be jointly & severally

b. Ascertain the reporting objectives of the engagement to plan covered by the audit report, they shall

responsible for:

the timing of the audit and the nature of the communications express their opinion in a separate audit

required; a. audit work which is not divided among the joint

report.

c. Consider & communicate among all joint auditors the factors auditors and is carried out by all joint auditors; • A joint auditor is not bound by the views

that, in their professional judgment, are significant in directing b. decisions taken by all the joint auditors under of the majority of the joint auditors

engagement team’s efforts; audit planning in respect of common audit regarding the opinion or matters to be

d. Consider the results of preliminary engagement activities. areas concerning the NTE of the audit covered in the audit report.

e. Ascertain the NTE of resources necessary to perform the procedures to be performed by each of the joint • In case of separate reports, the audit

engagement. auditors. report(s) issued by the joint auditor(s)

2 Allocation of Work c. matters which are brought to the notice of the shall make a reference to the separate

• Joint auditors should, by mutual discussion, divide the audit joint auditors by any one of them and on which audit report(s) issued by the other joint

work among themselves. there is an agreement among the joint auditors; auditor(s). Such reference shall be made

• The division of work would usually be in terms of audit of under the heading “Other Matter

d. examining that the F.S. of the entity comply

identifiable units or specified areas. Paragraph” as per SA 706.

with the requirements of the relevant statutes;

• In some cases, due to the nature of the business of the entity 2 Review of work by other joint auditor

e. presentation and disclosure of the F.S. as

under audit, such a division of work may not be possible. In • Each joint auditor is entitled to assume

such situations, the division of work may be with reference to required by the applicable FRF;

that the other joint auditors have carried

items of assets or liabilities or income or expenditure. f. ensuring that the audit report complies with out their part of the audit work and the

• Certain areas of work, owing to their importance or owing to the requirements of the relevant statutes, the work has actually been performed in

the nature of the work involved, would often not be divided applicable Standards on Auditing and the other accordance with the SAs.

and would be covered by all the joint auditors. relevant pronouncements issued by ICAI. • It is not necessary for a joint auditor to

Documentation of Work Allocated • It shall be the responsibility of each joint auditor to review the work performed by other joint

• The work allocation document shall be signed by all the joint determine the NTE of audit procedures to be auditors.

auditors & same shall be communicated to TCWG. applied in relation to the areas of work allocated to • Each joint auditor is entitled to assume

• Documentation of allocation of work helps in avoiding any said joint auditor. that the other joint auditors have brought

dispute or confusion which may arise among the joint auditors to said joint auditor’s notice any departure

• It is the individual responsibility of each joint

regarding the scope of work to be carried out by them. from applicable FRF or significant

auditor to study and evaluate the prevailing system

• Communication of allocation of work to the entity helps in observations that are relevant to their

avoiding any dispute or confusion which may arise between of internal control and assessment of risk relating responsibilities noticed in the course of

the entity and the joint auditors. to the areas of work allocated to said joint auditor. the audit.

Compiled by: Pankaj Garg ©www.altclasses.in Page 10

SA 300 (Revised) – Planning in an audit of Financial Statements

Importance of Planning Preliminary Engagement Activities Planning Activities

1. To devote appropriate attention to (a) Procedures required by SA -220 w.r.t. Establishment of Audit Strategy Development of

important areas. continuous of Client relationship. Audit Plan.

2. Identify and Resolve potential (b) Evaluate compliance with Ethical so as to set the scope, timing &

problems on timely basis. direction of the audit

Requirements (SA-220) • NTE of RAP (SA-

3. Properly organized & managed Audit. Factors to be considered

(c) Understanding of terms of 315)

4. Assists selection of ET members with • Characteristics of Engagement.

Engagement (SA-210) • Reporting Objectives. • NTE of furthers

requisite capabilities and competence.

5. Co-ordination of work done by • Significant factors to direct ET Audit Procedures

efforts.

auditors of components and experts. Planning – A Continuous Process (SA-330)

• Result of Preliminary

6. Facilitating direction and supervision • Other Planned

Engagement Activities.

of Engagement team. Audit Procedure.

• NTE of Procedures to be

performed.

Planning is not a discrete phase of an audit but rather a continuous process. It begins shortly

CHANGES TO PLANNING DECISIONS

after completion of previous audit & continues until completion of current audit engagement.

• Auditor shall update & change overall audit strategy and audit

It includes consideration of timing of certain activities & audit procedures that need to be

plan as necessary during the course of the audit.

completed prior to performance of further audit procedures. E.g., planning includes the need to • Audit Strategy and Audit Plan may need to be modified as a result

consider, prior to the auditor’s identification and assessment of the RMM, such matters as: of unexpected events, changes in conditions, or the audit evidence

1. The analytical procedures to be applied as risk assessment procedures. Compiled by: obtained from the results of audit procedures.

• Based on the revised consideration of assessed risks, auditor

2. Obtaining a general understanding of the legal and regulatory framework. Pankaj Garg

for students of need to modify the NTE of further audit procedures. This may be

3. The determination of materiality.

CA - Final the case when information comes to the auditor’s attention that

4. The involvement of experts. Audit differs significantly from the information available when the

5. The performance of other risk assessment procedures. auditor planned the audit procedures.

Compiled by: Pankaj Garg ©www.altclasses.in Page 11

SA 315 (Revised) – Identifying and Assessing the Risk of Material Misstatements through understanding the Entity and Its Environment .

Risk Assessment Understanding of Entity & its Environment Risk in CIS Environment

Procedures

Risk imposed by IT/CIS Areas to be examined

Auditor shall obtain understanding of:

• Procedures to obtain an • Reliance on programs that process • Program Development &

1. Relevant Industry, Regulatory & other External

Maintenance.

understanding of entity Factors including FRF. inaccurate data or do inaccurate

• System Software Support.

& its environment 2. Nature of Entity including. processing.

• Operations Including processing

including I.C. • Its Operations • Unauthorized access to data that of data.

• Ownership & Governance structure

• To Identify and assess may result in destruction of data. • Physical CIS security.

• Types of investments

the RMM at F.S. and • Unauthorized changes to data in • Control over access to

• The way Entity is structured & how it is financed

Assertion Level. Master files. specialized CIS utility programs.

3. Selection & Application of Accounting Policies &

reasons for changes thereto. • Unauthorized changes to systems.

1. Components

Control Environment

of Internal Control

It Includes 4. Entity objectives & Strategies & those business • Failure to make necessary changes. • Communication of Ethical values.

a. Inquiry of mngt. & others risks that may result in increase RMM. 2. Risk Assessment Process

• Potential loss of data

b. Analytical Procedures 5. Measurement & review of Financial Performance. • Identify Business Risk

• Inability to access data as required. • Estimating significant Risks

c. Observation & Inspection 6. Internal control relevant to audit.

• Assessing Likelihood of occurrence.

• Deciding response

Identification and Assessment of RMM 3. Information System relevant to FR:

• Classes of transactions

a) F.S. Level: RMM that Assertions evaluated • Accounting procedures

Steps in Risk Risk require special

relate pervasively to Transaction • Occurrence • Accounting records

Assessment consideration

the F.S. as a whole and occurred • Completeness • Financial Reporting Process.

Process: 1. Risk of fraud • Controls over journal entries

potentially affect many during the • Accuracy

assertions. year • Cut-Off • Identify risks 2. Risk related to recent 4. Control Activities relevant to Audit

b) Assertion level for • Classification • Assess & Evaluate significant Economic, • Information processes

classes of Account • Existence Accounting & other • Segregation of duties.

• Rights & Obligations

the identified risks.

Transaction, Account balances at Developments. • Physical controls

Balances & period end • Completeness • Relate identified • Performance Reviews

disclosures: It helps • Valuation & risk to what go 3. Complexity of Transactions.

5. Monitoring of Controls

in determining the NTE Disclosure 4. Transactions with Related • Assess effectiveness of I.C. Performance.

wrong at assertion

of further audit Presentation • Occurrence Parties

& • Completeness level.

procedures necessary 5. Significant Unusual

to obtain SAAE. Disclosures • Classification • Likelihood of

• Accuracy & Valuation Transaction

misstatement.

Compiled by: Pankaj Garg ©www.altclasses.in Page 12

SA 320 (Revised) “Materiality in Planning and Performing an Audit”

Concept of Materiality Performance Materiality Auditor’s Duties

Materiality is a subject of • The amount set by auditor at (a) Upon establishing the overall audit strategy, the auditor shall

professional judgment and • less than materiality for F.S as a whole determine the materiality for the F. S. as a whole.

discussion presented in FRF (b) Determine the materiality level for specific transactions for

• to reduce to an appropriately low level

which misstatements of lower amount be expected to influence

provides a reference to the auditor in • the probability that the aggregate of the

the economic decisions of users.

determining materiality. uncorrected & undetected misstatement (c) Determine performance materiality for purpose of assessing

If FRF does not include a discussion, • exceeds materiality for F. S. as a whole the RMM and determining the NTE of further audit procedures.

following can be referred:

(a) Misstatements including

omissions expected to influence Revision of Materiality Use of benchmark in determining Materiality

the economic decision of users.

• In event of becoming aware of information A %age is often applied to a chosen benchmark as a starting

(b) Size or nature of misstatement &

that would have caused auditor to have point in determining materiality for the F.S. as a whole.

the surrounding circumstances.

determined a different amount initially,

(c) Common financial information Factors affecting identification of appropriate benchmark

auditor shall revise materiality for the F.S. as a

needs of the users as a group. 1. The elements of the financial statements;

whole & if required, for particular classes of

2. Items on which the attention of the users of the particular

transactions, account balances or disclosures.

entity’s financial statements tends to be focused;

• If the auditor concludes that a lower

3. The nature of the entity, where the entity is at in its life

materiality than that initially determined is

Judgment of materiality provides a cycle, and the industry and economic environment in

appropriate, the auditor shall determine

basis for: which the entity operates;

whether it is necessary to revise performance

(a) Determination of NTE of RAP materiality, and whether the NTE of the 4. The entity’s ownership structure and the way it is

(b) Identifying and assessing RMM. further audit procedures remain appropriate. financed; and

(c) NTE of further audit procedures. 5. The relative volatility of the benchmark.

Compiled by: Pankaj Garg ©www.altclasses.in Page 13

SA – 330 “Responses to Assessed Risks”

Objective: To obtain Sufficient and Appropriate Audit Evidence about Assessed Risk of Material Misstatement through design and implementing Appropriate Responses

Tests of Controls Substantive Procedures

Procedures designed to evaluate the operating effectiveness of controls in preventing, Procedures designed to detect material misstatements at assertion level.

detecting or correcting material misstatements at assertion level. It comprises of:

a) Test of details (of classes of transactions, Account Balances and

Obtain audit evidences w.r.t. (a) Application of controls (b) Consistency of application Disclosures); &

(c) By whom & by what means they applied Compiled by: Pankaj Garg

b) Substantive Analytical Procedures for students of CA - Final

Evaluate the audit evidences Audit

External Auditor shall consider whether EC procedures are to be

Material weaknesses identified Confirmation performed as substantive audit procedures.

(EC) Factors that may assist the auditor are:

Communicate to Mngt. & TCWG – on timely basis

procedures 1. Confirming party knowledge of Subject Matter.

Special Considerations as 2. Ability or Willingness of intended confirming part to

Factors warranting re-test of

Using Audit Evidence obtained in Interim Period: controls substantive respond.

• Obtain audit Evidence for significant changes 1. Deficient control environment. procedures 3. Objectivity of Intending Party.

subsequent to Interim Period. 2. Deficient monitoring of

controls. Closing • Reconciling F.S. with underlying accounting records.

• Determine the additional Evidence to be obtain for

3. Significant manual element to Process • Examine Material Journal Entries & other adjustments

remaining period.

relevant controls.

Using Audit Evidence obtained during previous made during the course of preparing the F.S.

4. Personnel changes that

audits: Establish Continuing relevance of that evidence significantly affect the Significant Procedures that are specifically responsive to that risk

by determining significant changes subsequent to application of control. Risks needs to be applied

previous audit 5. Changing circumstances that

• Changes occurs: Test the controls in current audit indicate the need for changes

• No Change Occurs: Test the controls once in three in the control.

Timing: When Substantive procedures are applied for interim period, the

audits 6. Deficient general IT-controls.

auditor shall cover remaining period by appropriate procedures

Compiled by: Pankaj Garg ©www.altclasses.in Page 14

SA 402 (Revised) – Audit Considerations relating to an Entity Using a Service Organisation

Auditor’s Objective Obtaining understanding of services Auditor’s considerations

provided by service Organisation (S.O.)

• Obtain an The user auditor shall obtain an • User auditor shall evaluate the design and implementation of relevant controls of

understanding of understanding of how user entity uses the user entity that relate to the services provided by service organization.

nature & significance • User auditor shall determine whether a sufficient understanding of nature and

services of a service organization in the user

of service provided by significance of services provided by service organization and their effect on the

entity operation, including:

the S.O. and their user entity internal control relevant to the audit has been obtained.

(a) Nature of service provided by the S.O. and • If user auditor is unable to obtain a sufficient understanding from the user entity,

effect on the user’s

entity internal control significance of services to user entity. user auditor shall obtain that understanding from the following procedures:

(b) Nature and materiality of the transactions (a) Obtaining a Type 1 or Type 2 Report, if available.

relevant to the audit,

(b) Contacting the service organization, through the user entity.

sufficient to identify processed or financial reporting processes

(c) Visiting the service organization.

and assess the RMM. affected by service organizations.

(d) Using another auditor to perform procedures that will provide the

• To design and (c) Degree of interaction between activities of necessary information about the relevant controls at the S.O.

perform audit

S.O. and those of the user entity. • If a S.O. uses subservice organisation, the service auditor’s report may either

procedures

(d) The nature of relationship between user include or exclude the subservice organisation’s relevant control objectives

responsive to those

& related controls in the service organisation’s description of its system & in

risks. entity and the service organization.

the scope of service auditor’s engagement. These two methods of reporting

are known as the inclusive method and the carve-out method, respectively.

User Auditor: An auditor who audits and Reports on the financial • If Type 1 or Type 2 report excludes the controls at a subservice

statements of a user entity. organisation, and the services provided by the subservice organisation are

User Entity: An Entity that uses a service organization and whose financial relevant to the audit of the user entity’s financial statements, the user

statements are being audited. auditor is required to apply the requirements of this SA in respect of the

subservice organisation.

Type 1 Report: Report on the description and design of internal controls at

• Nature and extent of work to be performed by the user auditor regarding

a service organization for a specified date.

the services provided by a subservice organisation depend on the nature

Type 2 Report: Report on the description, design and operating and significance of those services to the user entity and the relevance of

effectiveness of controls at a service organisation for a specified period. those services to the audit.

Compiled by: Pankaj Garg ©www.altclasses.in Page 15

SA 450 “Evaluation of Misstatements Identified during the Audit

Meaning and Causes of Auditor’s Procedures if Misstatements identified

Misstatements

Difference between Accumulate the misstatements other than those that clearly trivial

amounts, classification, presentation

or disclosure of a reported financial Communicate to management & request them to correct. Determine whether any

statement item, revision required in Audit

and Strategy/Plan.

amount, classification, presentation or Management corrects Management refuses

disclosure that is required for the item

Perform Additional Understand the reason for not making

to be in accordance of FRF. Audit Strategy and Audit

Procedures to corrections

Causes of Misstatement Plan require revision if

(a) Inaccuracy in gathering or determine whether

Re-assess the materiality

processing data from which the misstatements Nature of identified

F.S. are prepared; remain. misstatements and the

(b) Omission of an amount or circumstances of their

If material, communicate uncorrected

disclosure; occurrence indicate that

misstatement and their effect on his opinion to

(c) Incorrect accounting estimate

other misstatements may

TCWG with a request that uncorrected

arising from overlooking, or clear

These Charts are exist that, could be material;

misstatements be corrected.

misinterpretation of, facts; and

protected under or

(d) Unreasonable judgments of Copyright and for

Not corrected Aggregate of misstatements

management concerning students use only. Any

accumulated during the

accounting estimates. Commercial use of these

charts by anyone may Obtain a written representation from audit approaches materiality

(e) Inappropriate selection &

attract Consequences management/TCWG w.r.t their believing that determined in accordance

application of accounting policies under Copyright Act. effect of uncorrected misstatements is with SA 320 (Revised).

immaterial.

Compiled by: Pankaj Garg ©www.altclasses.in Page 16

SA 500 “Audit Evidence”

Meaning and Nature of Auditor’s duties when an information to be used as audit evidence Audit Procedures & Methods

Audit Evidence (A.E.) for obtaining audit evidence

Meaning of A.E. Information prepared using Information Procedures to obtain A.E. Methods to obtain A.E.

Information used by auditor (a) RAP 1. Inspection

work of Management Expert Produced by entity

(b) FAP (Responses): 2. Observation.

In arriving at the conclusion 3. External Confirmations

1 Evaluate Competence, Capability and Obtain A.E. about the • Tests of Control (ToC),

4. Recalculation

Objectivity of the Expert • Substantive

Source of Information for evaluation: 5. Re-performance

On which auditor’s opinion is 1. Tests of Details (ToD)

Accuracy and 6. Analytical procedures

• Personal Experience with previous work.

based. 2. Substantive Analytical

• Discussion with that expert. Completeness of info. 7. Inquiry (Oral/Written)

Nature of A.E. Procedures (SAP)

• Discussion with others. Evaluate whether info

A.E. needs to be • Knowledge of expert’s qualification,

is

memberships, other forms of recognitions.

• Published books or papers.

Reliability of Audit Evidence

Sufficient Appropriate • Auditor’s expert. sufficiently precise

Measure of Measure of 2 Obtain an understating of expert work

and detailed for Compiled by: Pankaj Garg

• Area of Specialty

quantity quality auditor’s purposes.

for students of CA - Final

• Applicable professional standards.

Affected by Relevance & Audit

• Legal & Regulatory Requirements.

• RMM & reliability in • Assumptions and Methods used. (a) External Evidences are considered more reliable than internal evidences.

providing • Nature of Source Data used. (b) The reliability of internal evidence is increased when the related controls,

• Quality of

3 Evaluate the appropriateness of Expert work imposed by entity are effective.

Audit support for

• Finding & Conclusion – Relevance,

(c) Audit evidence obtained directly by the auditor is more reliable than audit

evidences conclusion. Reasonableness & Consistency with other

A.E. evidence obtained indirectly.

• Assumptions and Methods – Relevance (d) Audit evidence in documentary form, is more reliable than evidence obtained

and Reasonableness. orally.

• Source Data – Relevance, Completeness

(e) Audit evidence provided by original documents is more reliable than audit

and accuracy.

evidence provided by photocopies.

Compiled by: Pankaj Garg ©www.altclasses.in Page 17

SA 501 “Audit Evidence – Specific Considerations for Selected Items”

Inventory – Litigation & Claims – Completeness

Existence & Condition

Auditor is required to identify litigation and claims

by following procedures:

• Inquiry: of Mngt. & others within entity,

General Procedures Special Procedures including in house legal counsel.

• Review – minutes of meetings of TCWG,

When inventory is material to the F.S. 1 Inventory counting conducted at date other than communication between entity & external legal

B/S date counsel.

the auditor shall obtain SAAE Perform audit procedures to obtain audit evidence • Review – legal expenses account.

about whether changes in inventory between the count If management refuses to permit auditor to

regarding existence & condition by communicate with legal counsel / external legal

date and the date of the F.S. are properly recorded.

counsel refuses / auditor unable to collect SAAE

2 Auditor unable to attend Inventory Count by performing alternate procedures

(a) Attendance at physical inventory Make or observe some physical counts on an alternative

counting, unless impracticable, to: date, Modify Opinion in accordance with SA 705

• Evaluate mngt. instructions &

and perform audit procedures on intervening

procedures for recording & Segment Reporting –

transactions

controlling the results of the entity’s

3 Attendance at inventory count is impracticable

Presentation & Disclosures

physical inventory counting; Perform alternative audit procedures to obtain S.A.A.E.

• Observe the performance of regarding existence and condition of inventory. Obtain SAAE regarding presentation & disclosure of segment

management’s count procedures; information in accordance with the applicable FRF by:

(a) Obtaining an understanding of the methods used by

• Inspect the inventory; If it is not possible to do so, modify the opinion in the

management in determining segment information, and

auditor’s report in accordance with SA 705.

• Perform test counts; • Evaluate whether such methods are likely to result in

4 Inventory under custody and control of Third Party disclosure in accordance with the applicable FRF; and

(b) Performing audit procedures over the

Obtain S.A.A.E by performing the following: • Where appropriate, testing the application of such

entity’s final inventory records to (a) Request confirmation from third party. methods; and

determine whether they accurately (b) Perform Inspection/other audit procedure. (b) Performing analytical procedures or other audit

reflect actual inventory count results. procedures appropriate in the circumstances.

Compiled by: Pankaj Garg ©www.altclasses.in Page 18

SA – 505 “External Confirmation”

The objective of the auditor, when using external confirmation procedures, is to design and perform such procedures to obtain relevant and reliable audit

evidence.

Meaning & Type of E.C. External Confirmation Audit Procedures in Special Circumstances Limited use of –ve

Procedures Request

Mngt. refuses to allow the auditor to send request

Audit Evidence obtained as a direct written As it provides less

Determining the information to

response to auditor from 3rd Party in • Inquire the reasons persuasive evidence

be confirmed.

Paper/Electronic/Other form. • Evaluate the implications on RMM than the positive

Selecting the Appropriate Third • Perform Alternative Audit procedure. Confirmation request.

2 Types Party. • Refusal appears to • Communicate to

be unreasonable TCWG.

+ ve Request - ve request Designing the confirmation Circumstances in

request. • Unable to collect • Determine its effect

Request that 3rd Party Request that 3rd Party

which negative

respond directly to respond directly to audit evidence on Opinion

Sending the request including request may be used

auditor auditor

follow up. Responses to E.C. request as sole substantive

indicating whether it only if it disagrees

agrees or disagrees • Creates Doubt Obtain Further procedure:

With the info in request with the information in Factors to be considered while Evidences

• Low RMM.

or the request designing E.C. request: • Not Reliable Consider its effect on

providing requested • Population consists

• Assertions being addressed. NTE of other procedures

info. of large number of

• Specific identified RMM. • No Response Perform Alternative small, homogeneous

Areas where External Confirmation may be obtained: • Layout and presentation of procedure

(a) Bank balance & Other confirmation from account balances.

request.

bankers • Unable to collect Determine its effect on

• Expectation of low

• Prior Experience of audit.

(b) Account Receivable/Account Payable Balances evidence Opinion

• Method of Communication. exception rate.

(c) Stock Lying with Third Parties

• Exception occurs Investigate to determine • Auditor not aware

(d) Property Title Deed held by third parties • Management Authorization.

(e) Investments Purchased but delivery not taken. misstatement of circumstances

• Ability of confirming party to

(f) Loan from Lenders that 3rd party

provide the requested

(g) Terms of agreement or Transaction with Third Compiled by: Pankaj Garg for students of

information disregard request.

Parties CA - Final Audit

Compiled by: Pankaj Garg ©www.altclasses.in Page 19

SA – 510 “Initial Audit Engagements – Opening Balances”

Meaning of Initial Audit Engagement: An Engagement in which financial statements for prior period are not audited or were audited by predecessor auditor.

Meaning of Opening balance – A/c balance that exist at beginning of period & also includes disclosures exists at beginning of period.

Audit Procedures Audit Conclusion & Reporting

Opening Balance Consistency of Modification in Opening Balance Consistency of Modification in

Accounting Predecessor Accounting Predecessor Auditor’s

Auditor’s Report

Policies Policies

Report

Balance

• Read most recent F.S. and auditor Obtain SAAE Evaluate the Unable to Contain material Inconsistency Modification remains

report thereon. effect of obtain SAAE misstatements not exists relevant & material for

• Obtain S.A. audit evidence w.r.t. modification properly or Current Period F.S.

existence of any material accounted / Changes not

misstatement by disclosed in properly

Compiled by:

➢ Determining correct b/f of prior current year F. S. accounted or

Pankaj Garg

period closing balance. for students of disclosed

➢ Determining application of CA - Final

appropriate accounting policies. w.r.t. Audit

• If any misstatement detected consistent Modify Current Year

Qualified / Audit Report

perform additional procedures to application

Disclaimer Qualified / Adverse Report accordingly

determine their effect on current or

Period financial statements. Proper

• If misstatement exists in Current accounting & in assessing

These Charts are protected under Copyright and for students use only. Any Commercial

Period F.S. communicate to Mngt & disclosure for RMM in Current use of these charts by anyone may attract Consequences under Copyright Act.

TCWG. changes. period F.S.

Compiled by: Pankaj Garg ©www.altclasses.in Page 20

SA 520 “Analytical Procedures”

Meaning and Nature of Analytical Procedures Auditor’s Procedures

Evaluation of financial information 1 Determine the suitability of particular substantive analytical procedures (SAPs)

Following factors requires consideration:

through analysis of relationships 1. SAPs more suitable to large volumes of transactions tending to be predictable over time.

2. But suitability of AP influenced by:

among both financial and non-financial data.

• Nature of assertion.

AND

• Auditor’s assessment of APs effectiveness to identify material misstatement.

also encompass such investigation as is necessary of

3. In some cases, unsophisticated predictive models may be useful.

identified fluctuations or relationships that are

inconsistent with other relevant information or that 4. Different types of APs provide different levels of assurance.

differ from expected values by a significant amount. 5. Particular SAP may be considered suitable when Tests of Details are performed on same assertion.

Analytical Procedures 2 Evaluate the reliability of data

Compiled by:

Following factors affects the reliability:

Pankaj Garg

Consideration of Consideration of • Source of the information available. for students of

Comparisons of relationships among

• Comparability of the information available. CA - Final

Financial Information

• Nature and relevance of the information available, and Audit

with comparable Elements of financial

information for prior information • Controls over the preparation of the information

periods. or 3 Develop an expectation of recorded amounts or ratios and evaluate whether the expectation is

or Financial information sufficiently precise to identify material misstatement.

with anticipated results and relevant non- 4 Determine the amount of any difference of recorded amounts from expected values that is

of the entity financial information.

acceptable without further investigation.

or

Auditor’s expectations 5 Investigating Results of Analytical Procedures

or If auditor identified fluctuations or relationships that are inconsistent with other relevant information

Similar industry or differ from expected values by a significant amount, the auditor shall investigate such differences by:

information. (a) Inquiring of management; and

(b) Performing other audit procedures as necessary in the circumstances.

Compiled by: Pankaj Garg ©www.altclasses.in Page 21

SA – 530 (Revised) “AUDIT SAMPLING”

Meaning & Types of Audit Sampling Sampling Risk Auditor’s Duties

Application of audit procedures to < Risk that auditor’s conclusion based on a sample may be different from 1 Sample design, size and selection of items

100 % of items within a population. the conclusion if the entire population were subjected to same audit (i) While designing, consider the purpose of

Types of Sampling procedure. the audit procedure and the

characteristics of the population.

(a) Statistical Sampling: An

(ii) Sample size should be sufficient to

approach to sampling that has the Compiled by:

Pankaj Garg reduce sampling risk to an acceptably

following characteristics: Test of Tests of details

for students of low level.

• Random selection of the controls (iii) Selection should be in such a way that

CA - Final

sample items; and Audit each sampling unit in the population has

a chance of selection.

• The use of probability

Controls are Material Affects audit 2 Perform audit procedures

theory to evaluate sample

misstatements does effectiveness and is (i) Perform audit procedures, appropriate

results, including more effective

to the purpose, on each item selected.

than they not exist when in more likely to lead to

measurement of sampling (ii) If the audit procedure is not applicable

actually are fact it does. an inappropriate to selected item, perform the procedure

risk.

audit opinion. on a replacement item.

(b) Non-Statistical Sampling: A

(iii) If the auditor is unable to apply designed

sampling approach that does not

audit procedures/alternative procedure

have characteristics of random Controls are Material Affects audit to a selected item, consider that item as

selection and use of probability efficiency as it would a deviation.

less effective misstatement exists

theory is considered non- than they when in fact it does lead to additional 3 Evaluation of results of audit sampling

statistical sampling. work to establish To determine whether the use of audit

actually are not

that initial sampling has provided a reasonable basis

conclusions were for conclusions about the population that

incorrect. has been tested.

Compiled by: Pankaj Garg ©www.altclasses.in Page 22

SA – 540 (Revised) “Auditing Accounting Estimates (AE), including Fair Value Accounting Estimates and Related Disclosures”

Objective of Auditor: To obtain SAAE whether (a) AE including Fair Value AE are reasonable; and (b) related disclosures in the F.S. are adequate.

Compiled by:

Meaning & Nature of Auditor’s Duties

Pankaj Garg

Accounting Estimates for students of

CA - Final

Audit

• Accounting estimate: Risk Assessment Procedures & Responses to Assessed Risks

“An approximation of a monetary

Related Activities

amount in the absence of a Based on assessed RMM, auditor shall determine:

precise means of measurement”. • Whether management has appropriately applied the applicable FRF.

This term is used for an amount • Whether the methods are appropriate and have been applied consistently.

1. Obtain an understating of:

measured at fair value where

there is estimation uncertainty. → Requirements of applicable FRF

• Estimation Uncertainty: → How management identifies

transactions, events and General Responses to Specific Responses to Significant Estimation

The susceptibility of an

conditions that give rise to need Assessed RMM Uncertainties

accounting estimate & related

for accounting estimates. 1. Determine whether events 1. Evaluate the following:

disclosures to an inherent risk of

→ Estimation making process occurring up to date of • How management has considered

precision in its measurement.

adopted by mngt. and data on auditor’s report provide alternative assumptions or outcomes,

• Examples of Accounting Estimates

which they are based. audit evidence regarding • How management has addressed

→ Provision for Bad Debt,

Estimation making process AE. estimation uncertainty in making the

→ Inventory loss,

• Methods/Model used in making 2. Test how management accounting estimate.

→ Warranty Obligations,

Accounting estimates. made the accounting • Whether the significant assumptions

→ Depreciation,

→ Provision against carrying • Relevant Controls estimate and the data on used by management are reasonable.

amount of investments, etc. • Use of Management Expert. which it is based. • Management’s intent to carry out

• Examples of Fair Value A.E. • Changes in the methods from 3. Test the operating specific courses of action and its ability

→ Share Based Payments, the prior period along with effectiveness of the to do so.

→ Assets held for disposal, reasons. controls. 2. If in auditor’s judgment, management has

• Assessment of effect of 4. Develop a point estimate not adequately addressed the effects of

→ Financial Instruments,

estimation uncertainties. or a range to evaluate estimation uncertainty, the auditor shall

→ Assets acquired in business

2. Review of outcome of accounting management’s point develop a range with which to evaluate the

combinations

estimates of prior period. estimate. reasonableness of the accounting estimates.

Compiled by: Pankaj Garg ©www.altclasses.in Page 23

SA 550 “Related Parties”

Meaning of Related Party Auditor’s Duties

EITHER Risk Assessment procedures Responses to Assessed Risks

Related party as defined in applicable FRF (AS

18).

OR 1 Understanding the Entity’s RP relationship and Transactions

a. Auditor to inquire management regarding: 1 Identification of unidentified /

Where applicable FRF establishes minimal or undisclosed RP or RP transaction.

no RP requirements: • Identity of entity’s RP, changes from prior period.

• Nature of relationships between entity and RP. • Communicate to other members of ET.

a. A person/entity having control/ significant

• Type & purpose of transactions with RP. • Request management to identify the

influence, over reporting entity;

b. Obtain understanding whether management has established controls to: transactions with the newly identified

b. Entity over which reporting entity has

• Identify, account for & disclose RP relationships & transactions. RP.

control / significant influence, and

• Authorise & approve significant transactions with RP. • Inquire reasons for management failure

c. Entity under common control with

• Authorise & approve significant transactions outside normal course of to identify RP or disclose RP

reporting entity, through:

business. relationship and transactions.

• Common controlling ownership

• Owners who are close family members 2 Maintaining Alertness for RP Information when Reviewing • Reconsider the risk that other

• Common key management Records/Documents unidentified RP or undisclosed RP

• Auditor to remain alert when inspecting records w.r.t. info indicating transactions may exist.

existence of RP relationships or transactions not previously identified or • If non-disclosure appears intentional,

Auditor’s responsibilities in relation to RP evaluate implications for audit.

disclosed.

• If auditor identifies significant transactions outside entity’s normal course of 2 Identified significant RP Transactions

Obtain an understanding of RP

business, inquire of management about (a) Nature of these transactions, and outside Entity’s Normal course of

Relation and Transactions:

(b) Whether RP could be involved. Business.

a. To recognize Fraud Risk factors

• Inspect underlying contracts to evaluate

General

b. To conclude whether F.S. in so far Possible Sources for identification of RP Information:

1 Income Tax Returns 7 Shareholder’s Register business rationale.

as they are affected by those

2 Internal Audit Report 8 Life insurance Policies • Examine the terms on which

relations and transactions achieve

3 Contracts with Management 9 Statement of conflict of interest transactions takes place.

• true and fair presentation and

4 Contracts outside normal 10 Information supplied to • Collect evidences w.r.t. approval and

• not misleading.

course of business regulatory authorities authorisation of transaction.

• Perform audit procedures to • Collect evidences for appropriate

5 Contracts re-negotiated 11 Specific Invoices from advisors

Identify, Assess & Respond to RMM. accounting & disclosure in compliance of

6 Register of Investments

• Evaluate whether Identified RP FRF.

Specific (FRF established

accounting & Disclosure

relationships & Transactions have 3 Identifying Fraud risk factors

3 Assertions that RP Transactions were

been appropriately accounted for & Domination of management by a single person or small group without

conducted on arm Length price.

requirements)

disclosed as per FRF. compensating controls is a fraud risk factor.

Indicators of dominant influence: • Collect SAAE w.r.t. management

• Obtain WR from management/ assertion of Arm’s length transaction.

TCWG w.r.t. • RP has vetoed significant business decisions taken by management or

TCWG. • Compare transaction prices with the

→ Disclosure to auditor the prices for identical transactions

• Significant transactions are referred to RP for final approval.

identity of RP of which they are prevailing in ordinary course of

• No/ little debate among mgmt. or TCWG regarding business proposal

aware; and business.

initiated by RP.

→ Appropriate accounting & • Engage expert to determine market

• Transactions involving RP are rarely independently reviewed / approved.

disclosure as per FRF. value.

Compiled by: Pankaj Garg ©www.altclasses.in Page 24

SA 560 “Subsequent Events”

Meaning – Events occurring between the date of F.S. and the date of Auditor’s Report AND Facts that become known to auditor after the date of Auditor’s report.

Auditor’s Duties

Events occurring between the date of F.S. and the date of Auditor’s report Facts that become known to Auditor after date of Auditor’s report

(i) Perform procedures to obtain SAAE that all events which require adjustment / Before issue of F.S. After issue of F.S.

disclosure have been identified. 1. In general Auditor has no obligation. 1. In general Auditor has no

2. However, in case of significant obligation.

(ii) For the purpose of determining nature and timing of procedures, auditor may:

matter 2. However, in case of significant

(a) Obtain the understanding of procedures applied by management for matter

• Discuss with Management

identification of significant events. • Discuss with Management

• Determine need to amend F.S.

(b) Inquire the Management as to Occurrence of subsequent events which may • Determine need to amend F.S.

• Inquire how mngt intends to • Inquire how mngt intends to

affect the F.S. address the matter in F.S. address the matter in F.S.

(c) Read the Minutes of Meetings that held after the B/S date. 3. If Mngt. amend the F.S. auditor shall 3. If Mngt. amend F.S. auditor shall

(d) Study the Interim Financial Statements, if any. • extend procedures to date of new • Carry out procedures on

(iii) If auditor identifies any event which require any adjustment/disclosure, he should report, and amended F.S.

ensure its appropriate treatment in F.S. • provide a new auditor report on • Review the steps taken by mngt

amended F.S. to ensure that recipient of F.S.

(iv) Obtain a WR from the Management that all known events have been appropriately are informed of the situation.

adjusted/disclosed, as the case may be. or

• provide a new auditor report on

• amend the audit report to amended F.S.

Specific Inquiries to be made from management include an additional date or

1. Whether new commitments, borrowings or guarantees have been entered into. restricted to that amendment • Amend the audit report to

2. Whether sales or acquisitions of assets have occurred or are planned. and include an EOM/OMP. include an additional date

3. Whether there have been increases in capital or issuance of debt instruments. 4. If mngt refuses to amend the F.S. restricted to that amendment

• Modify the report if not yet and include an EOM/OMP.

4. Whether any assets have been appropriated by government or destroyed.

provided to entity. 4. If mngt refuses to amend the F.S.

5. Whether there have been any developments regarding contingencies.

• Notify to mngt and TCWG, that

6. Whether any unusual accounting adjustments have been made. • If report already issued, notify to

the auditor will seek to prevent

7. Whether any events have occurred that will bring into question the appropriateness mngt and TCWG not to issue F.S.

reliance on Auditor’s Report.

of accounting policies used in the F.S. to third parties. • If mngt/TCWG does not take

8. Whether any events have occurred that are relevant to the measurement of • If mngt still issues F.S., take necessary steps, take

estimates or provisions made in the F.S. appropriate action to prevent appropriate action to prevent

9. Whether any events have occurred that are relevant to the recoverability of assets. reliance on auditor’s report. reliance on auditor’s report.

Compiled by: Pankaj Garg ©www.altclasses.in Page 25

SA – 570 (Revised) “Going Concern”

Mngt. Responsibilities Auditor’s Duties Conditions that may cast doubt

about G.C. Assumption

Responsibilities

• Assess the entity’s To obtain SAAE about the For this purpose, auditor is required to A Financial Conditions

ability to continue as a appropriateness of mngt use of a) Cover the same period as that used by mngt. 1. Net Liability position.

going concern. going concern basis of accounting. 2. Non-renewal of borrowings.

b) Consider whether mngt has considered all 3. Withdrawal of Financial

• General purpose F.S. are

relevant information of which auditor is aware. Support.

prepared on a going Determine whether mngt has 4. Adverse Financial Ratios.