Professional Documents

Culture Documents

Accounting For Limited Liability Partnership: (As Per Syllabus Prescribed by University of Mumbai)

Uploaded by

DhanashriOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Accounting For Limited Liability Partnership: (As Per Syllabus Prescribed by University of Mumbai)

Uploaded by

DhanashriCopyright:

Available Formats

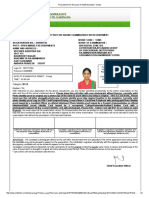

Accounting for Limited Liability Partnership

T. Y. B.Com. Semester VI

(As per Syllabus prescribed by University of Mumbai)

Nikhil Dilip Karkhanis

Assistant Professor

Mulund College of Commerce

Features of LLP

Body Perpetual Separate Artificial

Corporate Succession Legal Legal

Entity Person

Business

Common Limited for

Seal Liability Profit

Only

Nikhil Dilip Karkhanis, Mulund College of Commerce

Advantages - LLP

Perpetual Easy

Easy to Succession Audit

Transfer

form

Liability

02 03 04

01 05

Nikhil Dilip Karkhanis, Mulund College of Commerce

Disadvantages - LLP

LACK OF UNIFORMITY

NO RAISING OF

MONEY / IPO

LESS POPULAR

LESS CREDIBLE

TRANSFER OF

INTEREST

Nikhil Dilip Karkhanis, Mulund College of Commerce

LLP Vs Partnership Firm

Vs Company

Nikhil Dilip Karkhanis, Mulund College of Commerce

Basis LLP Partnership

Regulating Act The Limited Liability Partnership Act, The Indian Partnership Act, 1932.

2008

Body corporate It is a body corporate. It is not a body corporate

Separate legal entity It is a legal entity separate from its It has no separate legal identity

members.

Creation It is created by a legal process of It is created by an agreement

registration under the LLP Act, 2008. registration between the partners.

Registration Registration is mandatory. LLP can sue Registration is voluntary. Only the

and be sued in its own name. registered partnership firm can sue

the third parties.

Perpetual succession The death, insanity, retirement or the The death, insanity, Retirement or

death, insolvency of the partner(s) does insolvency of the partner(s) may

not affect its existence of LLP. Members affect its existence. It has no

may join or leave but its existence perpetual succession.

continues forever.

Nikhil Dilip Karkhanis, Mulund College of Commerce

Basis LLP Partnership

Liability Liability of each partner limited to the Liability of each partner is

extent to agreed contribution except unlimited. It can be extended up to

in case of wilful fraud. the personal assets of the partners.

Designated partners At least two designated partners. At There is no provision for such under

least one of them shall be resident in the Indian partnership Act, 1932.

India.

Responsibility of Legal Only designated partners are All partners are responsible for all

Compliance responsible for all the compliances the compliances and penalties

and penalties under this Act. under the Act.

Minor as partner Minor cannot be admitted to the Minor can be admitted to the

benefits of LLP. benefits of the partnership with

the prior consent of the existing

partners.

Nikhil Dilip Karkhanis, Mulund College of Commerce

Basis LLP Company

Regulating Act The Limited Liability Partnership The Companies Act, 2013.

Act, 2008

Members/Partners The persons who contribute to The persons who invest the money

LLP are known as partners of the in the shares are known as

LLP. members of the company.

Name Name of the LLP to contain the Name of the public company to

word “Limited Liability

contain the word “limited” and

partnership” or “LLP” as suffix. Private company to contain the

word “Private limited” as suffix.

Number of Minimum – 2 members Private company:

members/ Maximum – No such limit on the Minimum – 2 members

partners members in the Act. Maximum – 200 members

Public company:

Minimum – 7 members

Maximum – No such limit on the

members.

Nikhil Dilip Karkhanis, Mulund College of Commerce

Basis LLP Company

Conditions of The members of the LLP can be Members can be organizations,

Membership individuals/or body corporate trusts, another business form or

through the nominees. individuals.

Liability of Liability of a partners is limited to

Liability of a member is limited to

members/ the extent of agreed contributionthe amount unpaid on the shares

partners except in case of wilful fraud. held by them.

Profit Sharing As per Profit Sharing Ratio The profits (dividends) will be

decided as per LLP agreement distributed according to the shares

held.

Appointment of Only if threshold limits of Mandatory after 30 days of

Auditor contribution/turnover exceed the incorporation

prescribed limits

Nikhil Dilip Karkhanis, Mulund College of Commerce

LLP Agreement

Nikhil Dilip Karkhanis, Mulund College of Commerce

LLP Agreement

• The mutual rights and duties of partners inter se and those of the LLP

and its partners shall be governed by the agreement between

partners or between the LLP and the partners.

• This Agreement would be known as “LLP Agreement”.

• As per provisions of the LLP Act, in the absence of agreement as to

any matter, the mutual rights and liabilities shall be as provided for

under Schedule I to the Act.

Nikhil Dilip Karkhanis, Mulund College of Commerce

Contents of LLP Agreement

Interpretation clause Admission of a new Acts requiring the Assignment of

Names of designated partner consent of a requisite monetary interest of

partners Retirement of a number of percentage partners

Lawful business clause partner of the partners Rights of the legal

Registered Office Cessation of partner Indemnity representative

clause Resignation of Interest & Duration of the LLP

Capital & contribution partner remuneration Voluntary winding up

clause Expulsion of partner Appointment of Meeting, recording in

In case of conversion of Sharing of profit auditors the meeting, etc.

partnership/Company Sharing of loss Removal of auditors Changes/amendment

into LLP appropriate Meetings of partners Signatory to bank in agreement

clauses for such Voting rights and its accounts Arbitration clause

takeover determination Signatory to Legal Clause for

General terms Restriction on Agreements settlement

amongst the partners partners’ authority Share in goodwill Changes in future and

the procedure for it.

Nikhil Dilip Karkhanis, Mulund College of Commerce

Provisions Related

to Partners

Nikhil Dilip Karkhanis, Mulund College of Commerce

Partners in LLP

A minimum of two partners will be required for formation of an LLP.

Nikhil Dilip Karkhanis, Mulund College of Commerce

There will not be any limit to the maximum number of partners.

Partners are agents of LLP but not the agents of other partners.

Liability of partners is limited to the contribution made by them

except where an Act is carried out for any fraudulent purpose.

When does the partner cease to be a partner?

A person may cease to be a partner in accordance with the agreement or in the

absence of agreement, by giving 30 days’ notice to the other partners.

A person shall also cease to be a partner of a limited liability partnership-

(a) on his death or dissolution of the limited liability partnership; or

(b) if he is declared to be of unsound mind by a competent court; or

(c) if he has applied to be adjudged as an insolvent or declared as an insolvent.

Eligibility for Partners

Who can become a partner in a Who cannot become a partner in Following persons are not

LLP? LLP? allowed to become a Partner:

An individual unless otherwise An individual, if: A minor

disqualified - he has been found to be of A HUF

A company incorporated unsound mind by a Court of A Partnership Firm

under the Companies Act 1956 competent jurisdiction and the An Association of Persons

or Companies Act 2013 finding is in force; (AOP) or Body of Individuals

A LLP incorporated under LLP - he is an undischarged insolvent; (BOI)

Act 2008 or An Artificial Juridical Person

A LLP incorporated outside - he has applied to be adjudicated A Co-operative Society

India as an insolvent and his application registered under any law for

A company incorporated is pending. the time being in force

outside India A body corporate which the

Central Government may, by

notification in the Official

Gazette, specify in this behalf.

Nikhil Dilip Karkhanis, Mulund College of Commerce

Designated Partner

Every LLP must have at least two individuals as the

designated partners.

At least one of the designated partners must be resident in

India

A body corporate may appoint an individual to act as

a designated partner.

The incorporation document may specify who will be the

designated partners.

Any partner may become a designated partner or cease to

be a designated partner as per the LLP Agreement.

If there is no designated partner, or if at any time there is

only one designated partner, each partner is deemed to be

a designated partner.

Designated partners are responsible for doing all acts,

Designated Partner Identification Number

matters and things that are required to be done for

(DPIN) is a registration required for any

complying with the provisions of the LLP Act.

person who wishes to be appointed as a

A designated partner that ceases to be a partner is

Designated Partners of a Limited Liability

automatically no longer a designated partner.

Partnership (LLP)

Nikhil Dilip Karkhanis, Mulund College of Commerce

Contribution

Contribution and nature of contribution as per

the LLP Agreement.

Contribution may consist of tangible or intangible,

promissory notes, contracts for services

performed

The monetary value of the non-monetary

contribution is to be valued by a Chartered

Accountant or a Cost Accountant or an Approved

Valuer.

A creditor of an LLP may enforce such obligation

against the partner.

Share Capital Contribution

Nikhil Dilip Karkhanis, Mulund College of Commerce

Procedure of

Formation

Nikhil Dilip Karkhanis, Mulund College of Commerce

Procedure of Formation

Nikhil Dilip Karkhanis, Mulund College of Commerce

Procedure of Formation

Nikhil Dilip Karkhanis, Mulund College of Commerce

Audit

Legal Provision

Accounts of LLP are required to be audited. An LLP liable for audit if

Nikhil Dilip Karkhanis, Mulund College of Commerce

turnover in any FY exceeds ₹40 lakhs or the contribution (capital)

exceeds ₹25 lakhs.

Appointment of Auditors

First Auditors

For the first year, the auditor may be appointed any time before

the end of the F.Y.

Subsequent Years

Thereafter, the auditor is to be appointed at least 30 days prior to

the end of the F.Y.

Who will appoint

The designated partners shall appoint the auditors. If they fail to do so,

the partners may appoint the auditors.

Resignation/Non-continuation

An auditor may resign or may express his unwillingness to be

reappointed by a notice in writing along with statement of explanation

for the same.

Accounts

Nikhil Dilip Karkhanis, Mulund College of Commerce

Basis of Accounting

Double Entry System Cash or Credit

• Necessary disclosures in Books of Accounts

• all sums of money received/expended

• record of the assets and liabilities

• Statement of COGS/Inventory Records

Place of Maintenance Period of Preservation Certification of Annual Return

Registered Office 8 Years

By Designated Partners

Annual Return

Turnover up to ₹ 5 Crores

Form 11 60 Days from End of F.Y. Contribution up to ₹ 50 Lakhs

By Company Secretary

Turnover more than ₹ 5 Crores

Contribution more than ₹ 50 Lakhs

Income Tax Provisions of LLP

Applicability

Nikhil Dilip Karkhanis, Mulund College of Commerce

Partnership Firm = LLP

Foreign LLP

Foreign LLP = Company

Income Tax Rate

30% plus 4% cess.

Taxability of Remuneration and Interest

Allowable Interest and Remuneration as per Income Tax Act, 1961

Interest Up to 12% P.A.

Remuneration

On first Rs. 3 Lakhs of book profit or in case Rs. 1,50,000 or 90% of book

of loss profit, whichever is more

On the balance of the book profit On the balance of the book

profit

Capital Gain on Conversion

No CG on conversion of partnership firms into LLP u/s 47 (xiii)

MAT and Deemed Dividend

MAT provisions as applicable and Deemed Dividend provisions not Signing of Income Tax Return

applicable to LLP The Designated Partners

If not available, then other Partners

Forms and Format

• LLP Form No. 8 : Statement of Account and Solvency

https://bit.ly/3tQrwmd

• Format of Balance Sheet

https://bit.ly/3tRyl7e

• Format of Income & Expenditure

https://bit.ly/3xlTzfF

• First Schedule of LLP

https://bit.ly/32JWyjZ

READY FOR

QUIZ

Click on the following links to test your knowledge on this Module:

https://forms.gle/AGDcE1zBsKNSc78B7

https://forms.gle/dirPsMqNtoQbkUo1A

Nikhil Dilip Karkhanis, Mulund College of Commerce

Thank You!

Nikhil Dilip Karkhanis

nikhil.karkhanis@mccmulund.ac.in

Acknowledgements

Dr. Sonali Pednekar, Principal, Mulund College of Commerce

Dr. Arvind Luhar, Chairman, BOS (Accountancy), University of Mumbai

Dr. Sanjay V. Rane, M.Com Coordinator, Mulund College of Commerce

Note: Images/templates are subject to respective copyrights

© Nikhil Dilip Karkhanis

You might also like

- Trust Deed FormatDocument9 pagesTrust Deed FormatNarayana Hegde100% (1)

- LLC Beginner's Guide & S-Corp 2024: The Ultimate Handbook for Establishing, Operating, and Maximizing Tax Savings for Your LLC and S-Corp as an Entrepreneur Launching a BusinessFrom EverandLLC Beginner's Guide & S-Corp 2024: The Ultimate Handbook for Establishing, Operating, and Maximizing Tax Savings for Your LLC and S-Corp as an Entrepreneur Launching a BusinessNo ratings yet

- LLP Registration Ministry of Corporate Affairs Partnership RegistrationDocument19 pagesLLP Registration Ministry of Corporate Affairs Partnership Registrationaman dwivediNo ratings yet

- Dokumen - Tips - Labor Law Review Atty V Duano PDFDocument75 pagesDokumen - Tips - Labor Law Review Atty V Duano PDFGlenz LagunaNo ratings yet

- Ac 9401 de Leon Vs Atty. PederenaDocument1 pageAc 9401 de Leon Vs Atty. PederenaEscanor GrandineNo ratings yet

- Petition For Settlement of EstateDocument6 pagesPetition For Settlement of EstateKim InocNo ratings yet

- Downgrading of Visa PDFDocument3 pagesDowngrading of Visa PDFRomy Julie33% (3)

- ASME 889.4.1 b-2001Document101 pagesASME 889.4.1 b-2001Alaeddine Abid100% (1)

- Limited Liability PartnershipDocument7 pagesLimited Liability PartnershipDineshraj A100% (1)

- A. Sale Distinguished From Other Contracts: Contract of Sale or Contract For A Piece of WorkDocument8 pagesA. Sale Distinguished From Other Contracts: Contract of Sale or Contract For A Piece of WorkSALMAN JOHAYRNo ratings yet

- 2011 NLRC Rules of Procedure With 2019 AmendmentsDocument18 pages2011 NLRC Rules of Procedure With 2019 Amendmentsalex trincheraNo ratings yet

- Introduction To Law346 (Chapter One)Document7 pagesIntroduction To Law346 (Chapter One)RAUDAHNo ratings yet

- Legal Environment For Business Presentation: Presented byDocument16 pagesLegal Environment For Business Presentation: Presented bynikhilNo ratings yet

- Lec 3 AFM Types of CorporationsDocument47 pagesLec 3 AFM Types of CorporationsJunaidNo ratings yet

- Business Law - Module - IVDocument21 pagesBusiness Law - Module - IVdrashti vaishnavNo ratings yet

- Business Law PresentaionDocument8 pagesBusiness Law PresentaionSejal NakraNo ratings yet

- "L L P I I ": Imited Iability Artnership N NdiaDocument18 pages"L L P I I ": Imited Iability Artnership N NdiaKritika SinghNo ratings yet

- Limited Liability PartnershipDocument5 pagesLimited Liability PartnershipABHIJIT MAZUMDERNo ratings yet

- CH 6 LLPDocument24 pagesCH 6 LLPKrishna SurekaNo ratings yet

- Module Iv (Special Contracts)Document23 pagesModule Iv (Special Contracts)iamwasim43No ratings yet

- Limited Liability PartnershipDocument3 pagesLimited Liability PartnershipShruti BhatiaNo ratings yet

- Corporate LawDocument11 pagesCorporate LawAnkur YadavNo ratings yet

- Your Initial Guide Towards Your Business DreamDocument30 pagesYour Initial Guide Towards Your Business DreamShefali TripathiNo ratings yet

- PURC 7 SemDocument19 pagesPURC 7 SemGursimranNo ratings yet

- Conversion Partnership PVT LTD LLPDocument60 pagesConversion Partnership PVT LTD LLPAdarsh VermaNo ratings yet

- BL-UNIT2.2-LLP - OtherEntities-FOR CLASSDocument30 pagesBL-UNIT2.2-LLP - OtherEntities-FOR CLASSMohd Yousuf MasoodNo ratings yet

- LLP ProjectDocument15 pagesLLP Projectkhalsa computersNo ratings yet

- 8850950388/Notes/The Limited Liability Partnership Act and Partnership Act NotesDocument11 pages8850950388/Notes/The Limited Liability Partnership Act and Partnership Act Notesvani14iipsNo ratings yet

- Partnership Act, 2008Document10 pagesPartnership Act, 2008Venugopal Pandey100% (1)

- Busl Assignment2 M.P.K SrihariDocument14 pagesBusl Assignment2 M.P.K Sriharimpk srihariNo ratings yet

- Sem I - Basics of Financial AccountingDocument28 pagesSem I - Basics of Financial AccountingSonu YadavNo ratings yet

- Definition of A Limited Liability PartnershipDocument3 pagesDefinition of A Limited Liability PartnershipHashi MohamedNo ratings yet

- Limited Liability Partnerships in KenyaDocument5 pagesLimited Liability Partnerships in KenyaStephen Mallowah100% (1)

- Company Registraion For ExportDocument23 pagesCompany Registraion For ExportNikunj SatraNo ratings yet

- Unit 3 - 1Document36 pagesUnit 3 - 1Sandeep YadavNo ratings yet

- 1.difference Between Company and Limited Liability PartnershipDocument4 pages1.difference Between Company and Limited Liability PartnershipShashank JDNo ratings yet

- Partnership & Limited Liability Partnership (LLP) : (Statutory Body Under An Act of Parliament)Document7 pagesPartnership & Limited Liability Partnership (LLP) : (Statutory Body Under An Act of Parliament)Vinu DNo ratings yet

- Limited Liability Partnership - RidhiDocument5 pagesLimited Liability Partnership - Ridhivarunendra pandeyNo ratings yet

- Module 2Document12 pagesModule 2Shayek tysonNo ratings yet

- Corporatization of MSMEDocument11 pagesCorporatization of MSMEfordNo ratings yet

- Chapter-15 Partnership Accounts PDFDocument20 pagesChapter-15 Partnership Accounts PDFTarushi Yadav , 51BNo ratings yet

- Limited Liability PartnershipDocument11 pagesLimited Liability PartnershipDivyaNo ratings yet

- LLP Act.2008Document30 pagesLLP Act.2008Aman KumarNo ratings yet

- SSRN Id1545766 PDFDocument19 pagesSSRN Id1545766 PDFAtul LalNo ratings yet

- Corp Acc-2 - Chap1-5-Material Updated-Sep2013Document64 pagesCorp Acc-2 - Chap1-5-Material Updated-Sep2013Pavan Kumar MylavaramNo ratings yet

- LLP Act 2008Document25 pagesLLP Act 2008Shashwat JainNo ratings yet

- Corporations and Legal PersonalityDocument15 pagesCorporations and Legal PersonalityaliyahnicoleeeeNo ratings yet

- The Nature of PartnershipDocument75 pagesThe Nature of PartnershipLahari GadhamsettyNo ratings yet

- Limited Liability Partnership, 2008Document7 pagesLimited Liability Partnership, 2008Gouri TrivediNo ratings yet

- Limited Liability Partnership - RidhiDocument5 pagesLimited Liability Partnership - Ridhiyogita SaxenaNo ratings yet

- Limited Liability Partnership - RidhiDocument4 pagesLimited Liability Partnership - Ridhivarunendra pandeyNo ratings yet

- Limited Liability PartnershipDocument19 pagesLimited Liability PartnershipKanan JainNo ratings yet

- Comparison Partnership and LLPDocument9 pagesComparison Partnership and LLPSiti Nazatul MurnirahNo ratings yet

- LLPDocument18 pagesLLPManikandan ManoharNo ratings yet

- COMPANY LAW 1 Final EdDocument48 pagesCOMPANY LAW 1 Final EdNuwamanya DerrickNo ratings yet

- Business Organizations: Harshita Tak Yash Agarwal Sebin S. John Garima Kumawat Mehak ChopraDocument34 pagesBusiness Organizations: Harshita Tak Yash Agarwal Sebin S. John Garima Kumawat Mehak ChopraHARSHITA TAKNo ratings yet

- Limited Liability Partnership - 2008Document15 pagesLimited Liability Partnership - 2008Bharath.S 16-17-G8No ratings yet

- CH 12Document28 pagesCH 12Imtiaz PiasNo ratings yet

- Accounting For Partnerships: Learning ObjectivesDocument50 pagesAccounting For Partnerships: Learning ObjectivesBayaderNo ratings yet

- Difference Between LLP & Partnership and Between Private and Public Company - ERO0240651 - ITT Batch 606Document13 pagesDifference Between LLP & Partnership and Between Private and Public Company - ERO0240651 - ITT Batch 606Siddharth Shankar PaikrayNo ratings yet

- Law346 Chapter 1 & 2Document25 pagesLaw346 Chapter 1 & 2rumaisyaNo ratings yet

- Law of Business OrganizationsDocument3 pagesLaw of Business OrganizationsAwais AliNo ratings yet

- 1 LLP Darshan Khare QADocument7 pages1 LLP Darshan Khare QANiharika PayasiNo ratings yet

- Topic 1 Introduction To Business Organizations in MalaysiaDocument7 pagesTopic 1 Introduction To Business Organizations in MalaysiaintanNo ratings yet

- Non-Corporate Business Entities: Puttu Guru Prasad Inc GunturDocument27 pagesNon-Corporate Business Entities: Puttu Guru Prasad Inc GunturPUTTU GURU PRASAD SENGUNTHA MUDALIARNo ratings yet

- LLP 45Document45 pagesLLP 45Jumani AcademyNo ratings yet

- Limited Liability Partnership & Its Recommendations Regarding TheDocument12 pagesLimited Liability Partnership & Its Recommendations Regarding TheVíshál RánáNo ratings yet

- 41 Limited Liability Partnership Bill 2008Document24 pages41 Limited Liability Partnership Bill 2008caatulhurkatNo ratings yet

- Affidavit of Denial: Manuel C. MoralesDocument1 pageAffidavit of Denial: Manuel C. MoralesMJ CarreonNo ratings yet

- 1-2. EVA Air Pilot Application Form - SampleDocument6 pages1-2. EVA Air Pilot Application Form - SamplealNo ratings yet

- A Day in A Lawyer's LifeDocument3 pagesA Day in A Lawyer's LifeRamil De VeraNo ratings yet

- Union Bank v. Maunlad HomesDocument2 pagesUnion Bank v. Maunlad HomesKara SolidumNo ratings yet

- Justice Department Motion To Stay Ruling On Release of Barr MemoDocument21 pagesJustice Department Motion To Stay Ruling On Release of Barr MemoStefan BecketNo ratings yet

- Online Exam For ING05. - Nota 9.75Document4 pagesOnline Exam For ING05. - Nota 9.75mai.heart45279No ratings yet

- in Re - Rodriguez vs. Arroyo, G.R. No. 191805, November 15, 2011Document24 pagesin Re - Rodriguez vs. Arroyo, G.R. No. 191805, November 15, 2011Harold Q. GardonNo ratings yet

- Invitation - 1Document8 pagesInvitation - 1amaNo ratings yet

- DCCB Staff Assistant - ClerksDocument2 pagesDCCB Staff Assistant - ClerksAasish VuyyapuNo ratings yet

- Application For Authority To Print Receipts and Invoices: Kawanihan NG Rentas InternasDocument1 pageApplication For Authority To Print Receipts and Invoices: Kawanihan NG Rentas InternasYsmael Kyler Pastolero AdoracionNo ratings yet

- Ice BlockDocument26 pagesIce BlockAuduNo ratings yet

- Case StudyDocument2 pagesCase StudyThanh ThảoNo ratings yet

- Code of Criminal Procedure (CRPC) - Upsc NotesDocument4 pagesCode of Criminal Procedure (CRPC) - Upsc NotesAnshul GuptaNo ratings yet

- Debt SchemeDocument52 pagesDebt SchemeLCNo ratings yet

- Discrete MidtermDocument5 pagesDiscrete MidtermJames EsclamadoNo ratings yet

- Prohibition Against Torture 2Document15 pagesProhibition Against Torture 2elementrixbotswanaNo ratings yet

- Ramos vs. Court of AppealsDocument8 pagesRamos vs. Court of AppealsAL Babaran CanceranNo ratings yet

- 2023 Cinemalaya Mechanics 04212021Document3 pages2023 Cinemalaya Mechanics 04212021Wanda TotzNo ratings yet

- TXN Date Value Date Description Ref No./Cheque No. Branch Code Debit Credit BalanceDocument3 pagesTXN Date Value Date Description Ref No./Cheque No. Branch Code Debit Credit BalanceUtkarsh GurjarNo ratings yet

- Aide Memoire 9 (Second Report On The General Principles of Law)Document3 pagesAide Memoire 9 (Second Report On The General Principles of Law)Pearl GoNo ratings yet

- DAASNY Press Release 2.1.2021Document4 pagesDAASNY Press Release 2.1.2021MorganNo ratings yet

- Perwira Affin Bank BHD (Formerly Known As Perwira Habib Bank Malaysia BHD) V Selangor Properties SDN BHD & OrsDocument11 pagesPerwira Affin Bank BHD (Formerly Known As Perwira Habib Bank Malaysia BHD) V Selangor Properties SDN BHD & OrsCold DurianNo ratings yet