Professional Documents

Culture Documents

Effect of GCG on Islamic Bank Performance

Uploaded by

Wayan TresnaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Effect of GCG on Islamic Bank Performance

Uploaded by

Wayan TresnaCopyright:

Available Formats

Name : I Wayan Tresna Suwardiana

NIM : 2107531194

Abstract

The purpose of this study to determine the effect of the application of Good

Corporate Governance (GCG) on financial performance as measured by the ratio

of Capital Adequacy Ratio (CAR), Non Performing Financing (NPF), Return on

Assets (ROA), Return on Equity (ROE), Net Income Margin (NIM), Financing

Deposits ratio (FDR), and the ratio of Operating Expenses and Operating Income

(ROA) at the Islamic Banks. The study population was the whole Islamic Banks

that have implemented GCG according to the rules of Bank Indonesia. This

research is associative to see the relationship between the variables of one

another. The data used are secondary data from the annual report and corporate

governance report published by respectively Islamic Banks 2010-2016 period.

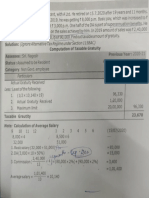

Samples collected are 10 Islamic banks by the number N = 60. The results showed

that the application of GCG is based on data collected had an average of 1:55 to

2:20 that enter into the category of "Good". This means that the quality of GCG

implementation in accordance with the BUS 11 indicators that have been set by

Bank Indonesia. The results of the t test (partial test) showed that the quality of

GCG implementation significant positive effect on the CAR, NPF and ROA. The

quality of GCG implementation negatively affects the ROA and ROE

significantly. While the statistical test results apparently GCG implementation

does not affect the performance ratio of NIM and FDR.

Keyword : Good corporate governance, capital adequacy ratio, non performing

financing, return on assets, return on equity

The Name Of The Journal : Al-Tijary. Jurnal Ekonomi dan Bisnis Islam

Volume : Vol. 2

Page : Pages 55 – 76

Tittle : Pengaruh Kualitas Penerapan Good Corporate Governance

(GCG) terhadap Kinerja Keuangan pada Bank Umum Syariah di

Indonesia (Periode 2010-2015)

Author/s : Angrum Pratiwi

The purpose of research : The purpose of this study to determine the effect of the

application of Good Corporate Governance (GCG) on financial

performance as measured by the ratio of Capital Adequacy Ratio

(CAR), Non Performing Financing (NPF), Return on Assets

(ROA), Return on Equity (ROE), Net Income Margin (NIM),

Financing Deposits ratio (FDR), and the ratio of Operating

Expenses and Operating Income (ROA) at the Islamic Banks.

The method of research : The study population was the whole Islamic Banks that have

implemented GCG according to the rules of Bank Indonesia.

This research is associative to see the relationship between the

variables of one another. The data used are secondary data from

the annual report and corporate governance report published by

respectively Islamic Banks 2010-2016 period. Samples collected

are 10 Islamic banks by the number N = 60.

The finding of the research : The results showed that the application of GCG is based on data

collected had an average of 1:55 to 2:20 that enter into the

category of "Good". This means that the quality of GCG

implementation in accordance with the BUS 11 indicators that

have been set by Bank Indonesia. The results of the t test (partial

test) showed that the quality of GCG implementation significant

positive effect on the CAR, NPF and ROA. The quality of GCG

implementation negatively affects the ROA and ROE

significantly. While the statistical test results apparently GCG

implementation does not affect the performance ratio of NIM

and FDR

The keywords : Good corporate governance, capital adequacy ratio, non

performing financing, return on assets, return on equity

You might also like

- Marketing Plan Chocolate ProductDocument30 pagesMarketing Plan Chocolate Productjointariqaslam100% (5)

- Ateneo Law JournalDocument58 pagesAteneo Law JournalCiara De LeonNo ratings yet

- Sex Toys Market - NewDocument9 pagesSex Toys Market - NewPrasun RaiNo ratings yet

- Influence of Inflation On The Financial Challenges Faced by StudentsDocument4 pagesInfluence of Inflation On The Financial Challenges Faced by StudentsNobara AkatsukiNo ratings yet

- BATA Blackbook AkshitDocument76 pagesBATA Blackbook AkshitKhan YasinNo ratings yet

- AralPan8 - Q4 - Wk8 - ANG UNITED NATIONS AT IBA PANG PANDAIGDIGANG ORGANISASYON, PANGKAT AT ALYANSA - WINNIE S. BALUDEN - CONNIE TULAN-1Document14 pagesAralPan8 - Q4 - Wk8 - ANG UNITED NATIONS AT IBA PANG PANDAIGDIGANG ORGANISASYON, PANGKAT AT ALYANSA - WINNIE S. BALUDEN - CONNIE TULAN-1Jaiz Cadang100% (1)

- Handbook - Intellectual Capital ManagementDocument62 pagesHandbook - Intellectual Capital ManagementKarmen JelcicNo ratings yet

- Liquidity Management and Its Impact On Banks Profitability: A Perspective 0f PakistanDocument6 pagesLiquidity Management and Its Impact On Banks Profitability: A Perspective 0f PakistaninventionjournalsNo ratings yet

- Impact of Liquidity On Profitability of Nepalese Commercial BanksDocument8 pagesImpact of Liquidity On Profitability of Nepalese Commercial BanksWelcome BgNo ratings yet

- Assessment of The Effect of Corporate GoDocument11 pagesAssessment of The Effect of Corporate GoTeshaleNo ratings yet

- Intro and LitDocument3 pagesIntro and LitAmanj AhmedNo ratings yet

- Intern AsionalDocument13 pagesIntern AsionalHildaNo ratings yet

- Eka Falah RamadhanDocument2 pagesEka Falah RamadhanEka FalahNo ratings yet

- Hasbi Ash Shidieq: ISSN: 2355-9357 E-Proceeding of Management: Vol.2, No.1 April 2015 - Page 462Document10 pagesHasbi Ash Shidieq: ISSN: 2355-9357 E-Proceeding of Management: Vol.2, No.1 April 2015 - Page 462AngeliaNo ratings yet

- 69-Article Text-431-1-10-20221208Document12 pages69-Article Text-431-1-10-20221208prettymaskerrNo ratings yet

- Effect of Liquidity and Bank Size On The Profitability of Commercial Banks in BangladeshDocument4 pagesEffect of Liquidity and Bank Size On The Profitability of Commercial Banks in BangladeshdelowerNo ratings yet

- Internal Determinants of Islamic Bank Profitability: Evidence From BangladeshDocument6 pagesInternal Determinants of Islamic Bank Profitability: Evidence From BangladeshMd Milon HossainNo ratings yet

- Purwohandoko, Iriani 2021Document8 pagesPurwohandoko, Iriani 2021welwencoolNo ratings yet

- Jurnal KeuanganDocument22 pagesJurnal KeuanganAyiraNo ratings yet

- Bank Internal Factors Impact on ProfitabilityDocument14 pagesBank Internal Factors Impact on Profitabilitynuwany2kNo ratings yet

- Determinants of Bank Profitability: A Study On The Banking Sector of BangladeshDocument15 pagesDeterminants of Bank Profitability: A Study On The Banking Sector of BangladeshJunaeadHossainOlyNo ratings yet

- Volatilitas Laba, Perataan Laba, dan CG terhadap Kualitas Laba Bank Syariah dan KonvensionalDocument21 pagesVolatilitas Laba, Perataan Laba, dan CG terhadap Kualitas Laba Bank Syariah dan Konvensionalanon_780898691No ratings yet

- The Impact of Asset Quality On Financial Performance of Commercial Banks in IndiaDocument12 pagesThe Impact of Asset Quality On Financial Performance of Commercial Banks in Indiaindex PubNo ratings yet

- Financial Performance Evaluation of Some Selected Jordanian Commercial BanksDocument14 pagesFinancial Performance Evaluation of Some Selected Jordanian Commercial BanksAtiaTahiraNo ratings yet

- Research articleCRMDocument5 pagesResearch articleCRMSuzal Pratap SinghNo ratings yet

- Abs TrakDocument2 pagesAbs TrakAndreas Tri PanudjuNo ratings yet

- Determinants of Financial Performance of Commercial Banks in EthiopiaDocument8 pagesDeterminants of Financial Performance of Commercial Banks in Ethiopiamesfin DemiseNo ratings yet

- 2 Ijecrapr20182Document8 pages2 Ijecrapr20182TJPRC PublicationsNo ratings yet

- 524 1409 3 PB PDFDocument9 pages524 1409 3 PB PDFDimas SetiawanNo ratings yet

- Jurnal Roa LDR Cir Nim Car NPLDocument7 pagesJurnal Roa LDR Cir Nim Car NPLwahyu setyoNo ratings yet

- Liquidity, Asset Quality, and EfficiencyDocument13 pagesLiquidity, Asset Quality, and EfficiencyM.TalhaNo ratings yet

- Analysis of The Effect of Car, NPL, Nim, Roa and LDR To Profitability (Roa & Roe) BanksDocument1 pageAnalysis of The Effect of Car, NPL, Nim, Roa and LDR To Profitability (Roa & Roe) Banksibnu wahyudiNo ratings yet

- Effect of Risk, Capital, Good Corporate Governance, Efficiency On Financial Performance at Islamic Banks in IndonesiaDocument8 pagesEffect of Risk, Capital, Good Corporate Governance, Efficiency On Financial Performance at Islamic Banks in IndonesiaInternational Journal of Business Marketing and ManagementNo ratings yet

- SynopsisDocument2 pagesSynopsisAakanshya SharmaNo ratings yet

- Determinnt of Banking Profitability - 2Document5 pagesDeterminnt of Banking Profitability - 2thaonguyenpeoctieuNo ratings yet

- Effect of Good Corporate Governance on Financial Performance of Sharia Banks in IndonesiaDocument15 pagesEffect of Good Corporate Governance on Financial Performance of Sharia Banks in IndonesiaAnnisa SophiaNo ratings yet

- Empirical Review - EditedDocument4 pagesEmpirical Review - EditedSonam ShahNo ratings yet

- 2021 IJBE - Determinants-Of-Banking-Efficiency-For-C-F445e2a6Document8 pages2021 IJBE - Determinants-Of-Banking-Efficiency-For-C-F445e2a6Wahyutri IndonesiaNo ratings yet

- Empirical ReviewDocument4 pagesEmpirical ReviewSonam ShahNo ratings yet

- Mabello - Bus@buk - Edu.ng: Bayero Journal of Management Sciences, Vol. 2, July 2019Document12 pagesMabello - Bus@buk - Edu.ng: Bayero Journal of Management Sciences, Vol. 2, July 2019Fatima Mukhtar AbubakarNo ratings yet

- 1 The - Study - of - Effect - of - Good - Corporate - Governance - oDocument5 pages1 The - Study - of - Effect - of - Good - Corporate - Governance - oWendy Sri MurtinaNo ratings yet

- Basman PaperDocument11 pagesBasman PaperAnasKhanNo ratings yet

- A Study On Liquidity Management of Commercial Banks in Nepal (With Refrence To Samina Bank LTD, Nabil Bank LTD and Kumari Bank LTD)Document5 pagesA Study On Liquidity Management of Commercial Banks in Nepal (With Refrence To Samina Bank LTD, Nabil Bank LTD and Kumari Bank LTD)Gangapurna Multipurpose Cooperative Ltd.No ratings yet

- Artikel InterDocument7 pagesArtikel InterBunga Ayu CahyaniNo ratings yet

- Operational RiskDocument6 pagesOperational Risksobi malikNo ratings yet

- Determinants of Financial Performance of Nepalese Commercial Banks: Evidence From Panel Data ApproachDocument15 pagesDeterminants of Financial Performance of Nepalese Commercial Banks: Evidence From Panel Data ApproachLaxmi DulalNo ratings yet

- Determinants of Profitability of Non Bank Financial Institutions' in A Developing Country: Evidence From BangladeshDocument12 pagesDeterminants of Profitability of Non Bank Financial Institutions' in A Developing Country: Evidence From BangladeshNahid Md. AlamNo ratings yet

- Effect of Internal Control Systems On Financial Performance of Distribution Companies in KenyaDocument23 pagesEffect of Internal Control Systems On Financial Performance of Distribution Companies in KenyaFarhan Osman ahmedNo ratings yet

- 1 PBDocument9 pages1 PBlumumba kuyelaNo ratings yet

- Impact of Liquidity Management On Bank Pradhan Nepal 2019Document11 pagesImpact of Liquidity Management On Bank Pradhan Nepal 2019carltondurrantNo ratings yet

- 1416-4241-1-PB-Ibrahim, Mukdad 2015 PDFDocument7 pages1416-4241-1-PB-Ibrahim, Mukdad 2015 PDFpink_stobelly8No ratings yet

- Abstrak: Pooled Data Antar Bank Umum Yang Terdaftar Di BEI Pada Periode 2010-2014Document2 pagesAbstrak: Pooled Data Antar Bank Umum Yang Terdaftar Di BEI Pada Periode 2010-2014NerissaArvianaShintaraNo ratings yet

- The Impact of Non-Performing Loans and Bank Performance in NigeriaDocument5 pagesThe Impact of Non-Performing Loans and Bank Performance in NigeriainventionjournalsNo ratings yet

- aaNDIC QUARTERLY VOL 33 NO 3 4 Article CAPITAL STRUCTURE AND PERFORMANCE OF DEPOSIT MONEY BANKS IN NIGERIA 2 PDFDocument31 pagesaaNDIC QUARTERLY VOL 33 NO 3 4 Article CAPITAL STRUCTURE AND PERFORMANCE OF DEPOSIT MONEY BANKS IN NIGERIA 2 PDFYemi AdetayoNo ratings yet

- 84-90+arnetaDocument7 pages84-90+arnetalananhgau1603No ratings yet

- Jurnal WahyuDocument18 pagesJurnal WahyuyukiosharisaNo ratings yet

- Theories of ProfitDocument9 pagesTheories of ProfitDeus SindaNo ratings yet

- Use of CAMEL Rating Framework: A Comparative Performance Evaluation of Selected Bangladeshi Private Commercial BanksDocument9 pagesUse of CAMEL Rating Framework: A Comparative Performance Evaluation of Selected Bangladeshi Private Commercial BanksShadabNo ratings yet

- December 2013 5Document13 pagesDecember 2013 5bedilu77No ratings yet

- Effect of Audit Quality On The Financial Performance of Selected Banks in NigeriaDocument14 pagesEffect of Audit Quality On The Financial Performance of Selected Banks in NigeriaEditor IJTSRDNo ratings yet

- Effect of Financial Ratios On Firm Performance Study of Selected Brewery Firms in NigeriaDocument8 pagesEffect of Financial Ratios On Firm Performance Study of Selected Brewery Firms in NigeriaEditor IJTSRDNo ratings yet

- Tommy RRLDocument16 pagesTommy RRLJam DomingoNo ratings yet

- Noninterest Income and Financial Performance at Jordanian BanksDocument6 pagesNoninterest Income and Financial Performance at Jordanian BanksisyanadeviNo ratings yet

- Fin Ins AssignmentDocument12 pagesFin Ins AssignmentDina AlfawalNo ratings yet

- Analisis Faktor-Faktor Yang BERPENGARUH TERHADAP Capital Adequacy RatioDocument77 pagesAnalisis Faktor-Faktor Yang BERPENGARUH TERHADAP Capital Adequacy RatioYantie Arieza UmasugiNo ratings yet

- Estimating the Job Creation Impact of Development AssistanceFrom EverandEstimating the Job Creation Impact of Development AssistanceNo ratings yet

- Empirical Note on Debt Structure and Financial Performance in Ghana: Financial Institutions' PerspectiveFrom EverandEmpirical Note on Debt Structure and Financial Performance in Ghana: Financial Institutions' PerspectiveNo ratings yet

- RBI Circular RBI2015 PDFDocument4 pagesRBI Circular RBI2015 PDFMurali RangarajanNo ratings yet

- Zenith Steel BrochureDocument4 pagesZenith Steel BrochurefebousNo ratings yet

- 2023-03-20 Godin, Karen 310072 - Installment Schedule PDFDocument3 pages2023-03-20 Godin, Karen 310072 - Installment Schedule PDFKarenNo ratings yet

- Basic AccountingDocument17 pagesBasic AccountinglizNo ratings yet

- IBT-MODULE 10... Ba - MKTGDocument8 pagesIBT-MODULE 10... Ba - MKTGRamil VillacarlosNo ratings yet

- Loan AgreementDocument2 pagesLoan Agreementgidraphgathuku2022No ratings yet

- Essence of Corporate GovernanceDocument5 pagesEssence of Corporate GovernanceNajmah Siddiqua NaazNo ratings yet

- The Statement of Financial PositionDocument17 pagesThe Statement of Financial Positionlouielyn candidoNo ratings yet

- Perspectivespaper ESGinBusinessValuationDocument12 pagesPerspectivespaper ESGinBusinessValuationsreerahNo ratings yet

- 10 Point Socioeconomic Agenda of Duterte AdministrationDocument5 pages10 Point Socioeconomic Agenda of Duterte AdministrationGlaiza Cabahug ImbuidoNo ratings yet

- Charlie Seeks Help With Debt (B0014Document3 pagesCharlie Seeks Help With Debt (B001431025100% (1)

- Section 3 (Other Definition)Document26 pagesSection 3 (Other Definition)jinNo ratings yet

- Chapter 22 Homework R. CochranDocument3 pagesChapter 22 Homework R. Cochrancochran123No ratings yet

- Group Assignment MGCR 382 Fall 2023, Oct. 4Document9 pagesGroup Assignment MGCR 382 Fall 2023, Oct. 4darkninjaNo ratings yet

- SKF Intelligent Clean Strategy MR 0Document29 pagesSKF Intelligent Clean Strategy MR 0Andres Elias Fernandez PastorNo ratings yet

- Benefits. by of Sales: 2020. SuperannuationDocument1 pageBenefits. by of Sales: 2020. SuperannuationArya RoshanNo ratings yet

- Principles of Costs and CostingDocument50 pagesPrinciples of Costs and CostingSOOMA OSMANNo ratings yet

- Water Bottling AgreementDocument8 pagesWater Bottling AgreementAshish RaiNo ratings yet

- 04 Securities Act, 2015Document17 pages04 Securities Act, 2015Nasir HussainNo ratings yet

- Tata Motors OperationsDocument5 pagesTata Motors OperationsbubaimaaNo ratings yet

- Module 1Document12 pagesModule 1Sajid IqbalNo ratings yet

- Company Law Assignment of Formation of CompanyDocument43 pagesCompany Law Assignment of Formation of CompanyTayyaba TariqNo ratings yet

- Bill To / Ship To:: Qty Gross Amount Discount Other Charges Taxable Amount CGST SGST/ Ugst Igst Cess Total AmountDocument1 pageBill To / Ship To:: Qty Gross Amount Discount Other Charges Taxable Amount CGST SGST/ Ugst Igst Cess Total AmountAmanNo ratings yet