Professional Documents

Culture Documents

Multi Tech Case Analysis

Uploaded by

Mayank PatelOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Multi Tech Case Analysis

Uploaded by

Mayank PatelCopyright:

Available Formats

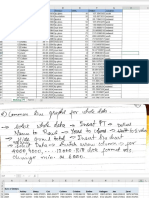

Case Analysis: MultiTech Ltd (in Rs Millions)

a b c

Sr. Particilaurs Base Case Credit Std Credit Prd Cash Dsct

Unltd to Ctgry 3&4 From 30 to 60 days 2/10 net 30

1 Sales 800 850 840 820

2 Incremental Sales nil 50 40 20

3 Average Collection Period 20 20 50 16

4 Proportion of Credit Sales 70% 70% 70% 70%

5 % CreditSales on Cash Disc. 50% 50% 20% 70%

6 Cash Discount Term 1% 1% 1% 2%

7 Bad Debt Cost 12% 12% NA NA

8 Contribution Margin 20% 20% 20% 20%

9 Tax Rate (1-t) 60% 60% 60% 60%

10 Post Tax Cost of Capital 12% 12% 12% 12%

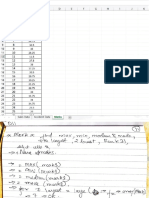

STEP ONE: Contribution

Incremental Sales nil 50 40 20

Total Contribution 160 170 168 164

Incremental Contribution 10 8 4

STEP TWO: Cost

Cash Discount Sales 280 298 118 402

Cash Discount Cost 2.80 2.98 1.18 8.04

Incremental Cash Disc. Cost 0.18 -1.62 5.24

Bad Debt Cost 6.00 0.00 0.00

Incrmntl Oprtng Cost 6.18 -1.62 5.24

STEP THREE: Operating Income

Operating Income 3.83 9.62 -1.24

After Tax Oprtng Income (1-Tax Rate 2.30 5.77 -0.74

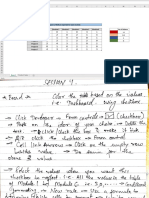

STEP FOUR: Investments

Total Invstement in Rcvbls 44.44 47.22 116.67 36.44

Incremental Investment 2.78 72.22 -8.00

Cost of Incrmntl Invstmnt 5.33 0.33 8.67 -0.96

STEP FIVE: Residual Income

Residual Income 1.96 -2.89 0.22

Incremental ROI OpInc/ Incrtl 82.6% 8.0% 9.3%

Decision Yes No Yes

You might also like

- Credit Standards Multitech Classifies Customers Into 4 Categories, 1 Through 4. Credit RatingDocument1 pageCredit Standards Multitech Classifies Customers Into 4 Categories, 1 Through 4. Credit RatingRTR TECHNOLOGYNo ratings yet

- Capital Structure and Leverage HandoutDocument24 pagesCapital Structure and Leverage HandoutMayank PatelNo ratings yet

- Session 4 - WCMDocument68 pagesSession 4 - WCMMayank PatelNo ratings yet

- Particulars: KEY FINANCIAL RATIOS of Tata Consultancy Services LTDDocument4 pagesParticulars: KEY FINANCIAL RATIOS of Tata Consultancy Services LTDMayank PatelNo ratings yet

- Why Working Capital MattersDocument4 pagesWhy Working Capital MattersMayank PatelNo ratings yet

- Retrive Data - Combocheckbox - GraphDocument6 pagesRetrive Data - Combocheckbox - GraphMayank PatelNo ratings yet

- Session 1 Goal and Function of FinanceDocument59 pagesSession 1 Goal and Function of FinanceMayank PatelNo ratings yet

- 2 Amount Spent On Travel: Age GenderDocument6 pages2 Amount Spent On Travel: Age GenderMayank PatelNo ratings yet

- 22-05-2006lip Gloss: 928.71948312 MidwestDocument3 pages22-05-2006lip Gloss: 928.71948312 MidwestMayank PatelNo ratings yet

- E F G H J K Income Statement Balance SheetDocument4 pagesE F G H J K Income Statement Balance SheetMayank PatelNo ratings yet

- Maths FormulaesDocument4 pagesMaths FormulaesMayank PatelNo ratings yet

- Combo Bar GraphDocument3 pagesCombo Bar GraphMayank PatelNo ratings yet

- Heat MapDocument4 pagesHeat MapMayank PatelNo ratings yet

- Report of Defects Reported For Each Module Module 1 - Module 2 - Module 3 Module 4 Module 5 Module 6 - Project 1 Project 2 0Document4 pagesReport of Defects Reported For Each Module Module 1 - Module 2 - Module 3 Module 4 Module 5 Module 6 - Project 1 Project 2 0Mayank PatelNo ratings yet

- Ob - 12Document3 pagesOb - 12Mayank PatelNo ratings yet

- Why Do You Want To Work For Vanity Wagon ?Document2 pagesWhy Do You Want To Work For Vanity Wagon ?Mayank PatelNo ratings yet

- What Do You Know About Vanity Wagon?Document2 pagesWhat Do You Know About Vanity Wagon?Mayank PatelNo ratings yet

- 5 Product D 6 Product E: May Jan Productb 295Document3 pages5 Product D 6 Product E: May Jan Productb 295Mayank PatelNo ratings yet

- Why Do You Want To Work For Vanity Wagon ?Document3 pagesWhy Do You Want To Work For Vanity Wagon ?Mayank PatelNo ratings yet

- What Do You Know About Vanity Wagon?Document2 pagesWhat Do You Know About Vanity Wagon?Mayank PatelNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5806)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (589)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (842)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- BRM Lecture 2 - 053 Bridge Resource ManagementDocument23 pagesBRM Lecture 2 - 053 Bridge Resource ManagementMichael Miller100% (5)

- Designing For Self-Tracking of Emotion and ExperienceDocument11 pagesDesigning For Self-Tracking of Emotion and ExperienceDAVID GOMEZNo ratings yet

- Wcdma Kpi Optimization: Presented by Ahmed AzizDocument64 pagesWcdma Kpi Optimization: Presented by Ahmed AzizCesar Ivan Alvear Vega100% (5)

- Digitalization in The Financial StatementsDocument12 pagesDigitalization in The Financial Statementsrockylie717No ratings yet

- Panasonic IP CameraDocument77 pagesPanasonic IP CameraEtc EtcNo ratings yet

- Berang BerangDocument1 pageBerang BerangFikria Nur RNo ratings yet

- Reference Only: I Pus Pond StreetDocument132 pagesReference Only: I Pus Pond StreetJagdish ShindeNo ratings yet

- Academic CV Working DraftDocument3 pagesAcademic CV Working Draftapi-548597996No ratings yet

- HSE Safety AlertsDocument7 pagesHSE Safety Alertsrasnowmah2012No ratings yet

- Dim 1001Document7 pagesDim 1001Kokxing KkxNo ratings yet

- PDF Free Download Here Pdfsdocuments2com PDFDocument2 pagesPDF Free Download Here Pdfsdocuments2com PDFAngelo TabbayNo ratings yet

- Absorption Spectrum of A Conjugated DyeDocument6 pagesAbsorption Spectrum of A Conjugated DyeKing Everest100% (1)

- Glencoe Life Science2Document93 pagesGlencoe Life Science2Cosmina MariaNo ratings yet

- I N T e L L I G e N C e B U R e A U MS Word FileDocument175 pagesI N T e L L I G e N C e B U R e A U MS Word FileHashmat Ali AbbasiNo ratings yet

- Review Article SugarDocument8 pagesReview Article SugarMadelaine RamosNo ratings yet

- IC Construction RiskDocument7 pagesIC Construction RiskmiptahulNo ratings yet

- CWSB The ConfederacyDocument45 pagesCWSB The ConfederacyEd Franks Jr.100% (2)

- A Proposed Medium-Term Development Plan For Data Center College of The Philippines Laoag City CampusDocument3 pagesA Proposed Medium-Term Development Plan For Data Center College of The Philippines Laoag City Campussheng cruzNo ratings yet

- Catalogo Marmol Artificial - Kingkonree International China Surface Industrial Co., LTDDocument67 pagesCatalogo Marmol Artificial - Kingkonree International China Surface Industrial Co., LTDTDNRamonNo ratings yet

- Rebuilding The Base: How Al-Qaida Could ResurgeDocument13 pagesRebuilding The Base: How Al-Qaida Could ResurgeguiludwigNo ratings yet

- Excel Property Management Invoice TemplateDocument10 pagesExcel Property Management Invoice Templatenull22838No ratings yet

- Nursing Council CXC Past Paper MCQ (1) (319) IMPORTANTDocument25 pagesNursing Council CXC Past Paper MCQ (1) (319) IMPORTANTAaron Wallace88% (32)

- Linear Search in JavaDocument2 pagesLinear Search in JavaWipuli Lochana DisanayakeNo ratings yet

- 03 01 Straight LineDocument31 pages03 01 Straight LineSai Ganesh0% (1)

- A Collection of Quotes From: Patrick LencioniDocument38 pagesA Collection of Quotes From: Patrick LencioniIchsan RizallusaniNo ratings yet

- CATALOGO Scorziello SASADocument52 pagesCATALOGO Scorziello SASAantonio_militeNo ratings yet

- Scheme - I Sample Question Paper: Program Name: Diploma in Plastic EngineeringDocument4 pagesScheme - I Sample Question Paper: Program Name: Diploma in Plastic EngineeringAmit GhadeNo ratings yet

- Basic English Language SkillsDocument59 pagesBasic English Language SkillsShane HtetNo ratings yet

- CEC OrganisationDocument3 pagesCEC OrganisationAndreas ErnstNo ratings yet

- Anti TBDocument44 pagesAnti TBLoreine Jane ClaritoNo ratings yet