Professional Documents

Culture Documents

IFMSem1 Regulators and Regulations

Uploaded by

Shubham Saxena0 ratings0% found this document useful (0 votes)

12 views42 pagesCopyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

12 views42 pagesIFMSem1 Regulators and Regulations

Uploaded by

Shubham SaxenaCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 42

Semester 1 Introduction to Financial

Markets – Session 4 – Regulators and

Regulations

©2015 BSE Institute Limited

Recap of Session 3

• List alternative investment schemes

• List Other Investment Products

©2015 BSE Institute Limited

Session Objectives

• Describe Regulators and their role

• List Various Regulations of Securities Markets

©2015 BSE Institute Limited

Discussion

• What would happen if there was no regulation

on securities markets, if there were no

regulators like SEBI, RBI, etc.? How would

securities transactions take place? Have a

lively discussion on this.

©2015 BSE Institute Limited

Regulators of Securities Markets

• The DEA and DCA are regulators from the

Govt. under the Finance Ministry

• Securities and Exchange Board of India

(SEBI)

• Reserve Bank of India (RBI)

• Stock Exchanges

©2015 BSE Institute Limited

Other Regulatory Bodies

• Indian Financial system governed by various

regulatory bodies which come under the

purview of the DEA and DCA which are given

empowerment under SCRA

• RBI

• IRDA

• PFRDA

• FMC

• FSDC

• Stock Exchanges

• AMFI

©2015 BSE Institute Limited

Regulatory Structure

Govt of India

Ministry of Finance

Dept of Company Affairs Dept of economic Affairs

RBI SEBI IRDA PFRDA FERA/ FEMA FMC

©2015 BSE Institute Limited

SEBI

• SEBI is the chief regulator of securities

markets in India

• Apex controller and regulator

• To protect the interests of investors, to

develop securities markets and to regulate

securities markets

• SEBI Act, 1992 gives full power to SEBI.

• SEBI is also the regulator under SCRA,

Depositories Act and Companies Act, where

relevant

©2015 BSE Institute Limited

SEBI

• SEBI act passed on April 4,1992.

Functions of SEBI as stated in the preamble

to SEBI Act

• To protect the interest of investors

• To promote the development of & regulate

the securities market.

©2015 BSE Institute Limited

Role of SEBI

• Regulate the Business in SE’s

• Register & Regulate intermediaries, collective

investment schemes (incl. MF’s)

• Promote & regulate SRO’s

• Prohibit unfair & fraudulent trade practices

• Promote investor education & Training

• Prohibit Insider trading

©2015 BSE Institute Limited

Role of SEBI……. Contd.

• Regulate substantial acquisition of shares &

take over of companies

• Inspection/Audit of intermediaries & SRO’s

• Any other function as provided under the

SCRA 1956, as delegated by the govt.

©2015 BSE Institute Limited

Powers of SEBI

• Discovery and production of books of accounts

and other documents as may be specified by

sebi

• Summoning and enforcing the attendance of

persons and examining them on oath

• Inspection of any books, registers, and other

documents

©2015 BSE Institute Limited

RBI

• Reserve Bank of India

• Apex body for regulation of Banking Sector

• Controls money supply in India

• Banker to Government and banker to banks

• Responsible for monetary and fiscal policy

• Regulates the debt securities of Government

and forex markets

©2015 BSE Institute Limited

IRDA

• IRDA – Insurance Regulatory Development

Authority

• Controls the Insurance sector

• Investor benefited as fair practices came into

being

©2015 BSE Institute Limited

PFRDA

• The Pension Fund Regulatory & Development

Authority Act was passed on 19th September,

2013 and the same was notified on 1st

February, 2014.

• PFRDA is regulating NPS, subscribed by

employees of Govt. of India, State

Governments and by employees of private

institutions/organizations & unorganized

sectors.

©2015 BSE Institute Limited

FMC

• Forward Market Commission

• Regulates Commodities exchanges in India

• Investigates events like price rigging etc.

• Proposed to be merged with SEBI in the

budget on 28th February 2015

©2015 BSE Institute Limited

FDSC

• FSDC – Financial Stability Development

Council

• Chairman is Finance Minister Himself

• It solves the Inter-Regulatory Tussle between

the various bodies

©2015 BSE Institute Limited

Stock Exchanges as first level regulators

• To promote develop & maintain a well regulated

market for dealing in securities

• To safe guard interest of members & investing public

having dealings on SE

• Promote industrial development through efficient

resource mobilization by way of investment in

corporate securities

• Establish & promote honourable & just practices in

securities transactions.

©2015 BSE Institute Limited

AMFI

• AMFI – Association of Mutual Funds of India

• Advisory body for mutual funds

• Represents MF industry before the

Government

• All AMCs are members of AMFI

• Gives information about all schemes on its

website

• Like an SRO

• Has framed code of conduct and ethics for

AMCs

©2015 BSE Institute Limited

Regulatory Framework

• Broad and Comprehensive

• Various Acts Enacted

• Govt. and SEBI issue notifications, guidelines,

etc.

• SROs

©2015 BSE Institute Limited

Key Regulations

• SCRA

• Depositories Act

• Companies Act limited to certain parts like

issue of securities, mergers and

amalgamations, etc.

• Prevention of Money Laundering Act

• SEBI Act

©2015 BSE Institute Limited

SCRA, 1956

• Provides for direct and indirect control of

virtually all aspects of securities trading and

running of stock exchanges

• Aims to prevent undesirable transactions in

securities

• Gives SEBI regulatory jurisdiction over:

Stock exchanges

Contracts in securities

Listing of securities

©2015 BSE Institute Limited

SCRA, 1956, contd.

• Stock exchanges have to make application to

SEBI for recognition

• If SEBI and Central Govt. are satisfied,

recognition is granted

• Can also revoke recognition if it is interest of

trade or public interest

• Stock exchanges to provide periodical returns

to SEBI

• Stock exchanges can make bye-laws

• Bye-laws to be within scope of law

©2015 BSE Institute Limited

SCRA, 1956, Contd.

• SEBI can suspend governing body of stock

exchange with written notice

• SEBI can also suspend business on a stock

exchange for a period of upto 7 days.

• This has to be notified in the Official Gazette

• Only brokers can transact on the stock

exchanges

• SEBI can prohibit contracts in certain cases

like speculation, etc.

©2015 BSE Institute Limited

Companies Act, 1956

• Deals with issue, allotment and transfer of

securities and various aspects relating to

company management

• Recent Companies Act, 2013, has

substantially revamped the original Act and

made it more comprehensive

• Act gives details about types of companies –

public and private

• Types of share capital like equity and

preference

©2015 BSE Institute Limited

Companies Act, 1956 contd.

• Contains provisions for voting rights and

dividends and IEPF

• Gives the particulars with respect to AGMs

• All details of directors like remunerations,

minimum number, meetings of the board, etc.

• Prescribes rules for shareholder meetings,

postal ballot, etc.

• Governs what should go into annual reports,

directors, report, books of account, final

accounts, etc.

©2015 BSE Institute Limited

Companies Act, 1956

• Governs details regarding public deposits

• Declaration of dividend

• Public issue

• Auditors

• Merger and Demerger

• Reduction of capital

• Buy back of shares

©2015 BSE Institute Limited

Depositories Act, 1996

• Provided for establishment of Depositories

• For dematerialisation of securities

• Can be done by surrender of physical

certificate to depository

• CDSL and NSDL are the two depositories

• Act through their agents called DPs

• Function of Depository

• Surrender of physical certificate to depository

• Registration of transfer of securities with

depository

©2015 BSE Institute Limited

Depositories Act, 1996

• Option to receive certificates or hold security

with depository

• Holding of securities by depository

• Rights of depository and beneficial owner

• Pledging of Securities held with depository

• Furnishing of information by depository

• Option to opt out in respect of any security

• Indemnification of loss by depository in certain

cases

©2015 BSE Institute Limited

PMLA Act, 2002

• Prevent money laundering and confiscation of

property derived from or involved in money

laundering

• Money laundering

• Punishment for offence

• Obligation on intermediaries

©2015 BSE Institute Limited

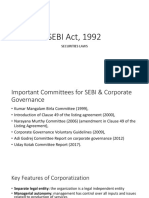

SEBI Act, 1992

• Most important legislation

• Land mark Act enacted after liberalisation in

1990s

• Gave SEBI statutory powers

• Regulatory jurisdiction extends over

corporates in issue of capital and transfer of

securities and all persons associated with

securities markets

• Gives details to become member on stock

exchanges

©2015 BSE Institute Limited

SEBI Act, 1992, contd.

• Conditions for corporate membership of stock

exchange

• Constitution of SEBI

• Function of SEBI

• Powers of SEBI

• Penalties are provided for violation of Act

• SEBI can frame rules for efficient function of

securities markets

©2015 BSE Institute Limited

Penalties provided under SEBI act

• Suspension or cancellation of certificate of

registration

• Monetary penalty to be imposed

• Any person aggrieved by the order of SAT

(securities appellate tribunal) may file and

appeal in the high court

©2015 BSE Institute Limited

Regulations under SEBI Act

• SEBI Stock Brokers and Sub-Brokers

Regulations, 1992

• SEBI Insider Trading Regulations, 1992

• SEBI Prohibition of Fraudulent and Unfair

Trade Practices Relating to Securities Markets

Regulations, 1995

©2015 BSE Institute Limited

SEBI (Stock Brokers & Sub Brokers)

Regulations, 1992

• Capital Adequacy Norms

• Conditions for Grant of Certificate

• Definition of small investor

• Registration of Stock and Sub-Broker

• Eligibility Criteria

• Code of Conduct

• Fees Payable

• Suspension of Registration

• Maintenance of proper books of accounts

©2015 BSE Institute Limited

SEBI (Stock Brokers & Sub Brokers)

Regulations, 1992

• Procedure for inspection to be followed by

SEBI

• Imposition of penalty

• Fees to be paid

©2015 BSE Institute Limited

SEBI Insider Trading Regulations, 1992

• Insider Trading

• Code of Conduct

• Dealing in Securities

• Definition of Insider

• Connected Person

• Unpublished Price Sensitive Information

• Investigative Powers vested in SEBI

©2015 BSE Institute Limited

FUTP Regulations, 2003

• Frauds

• SEBI Investigations

• Duties of persons being investigated

• Working of the Investigating officer

• Actions that SEBI can take

©2015 BSE Institute Limited

Recap

• Describe Regulators and their role

• List Various Regulations of Securities Markets

©2015 BSE Institute Limited

Exercise

1) Go to the websites of RBI, PFRDA and IRDA. List their functions

and aims and objectives. Submit it as a report.

©2015 BSE Institute Limited

Quiz

• Question 1: What are the objectives of SEBI?

• Question 2: Name 3 rules framed under SEBI Act.

• Question 3: Over whom does regulatory jurisdiction of SEBI extend

under SEBI Act?

• Question 4: Which Act gives power to DEA and DCA?

• Question 5: What is the main aim of stock exchanges?

©2015 BSE Institute Limited

Thank you

©2015 BSE Institute Limited

You might also like

- Objection Handling ManualDocument29 pagesObjection Handling ManualNagendran Balasubramanian80% (5)

- Trucking in India - WB StudyDocument84 pagesTrucking in India - WB Studymowr2001No ratings yet

- Project On SebiDocument15 pagesProject On SebiVrushti Parmar86% (14)

- Securities and Exchange Board of IndiaDocument23 pagesSecurities and Exchange Board of IndiaAppan Kandala VasudevacharyNo ratings yet

- Non Banking Financial Company: (NBFC)Document29 pagesNon Banking Financial Company: (NBFC)ArtiTomar100% (1)

- BOMBAY STOCK EXCHANGE (BSE) KEY FACTSDocument25 pagesBOMBAY STOCK EXCHANGE (BSE) KEY FACTSanon_35679790650% (2)

- IC 85 ReinsuranceDocument84 pagesIC 85 ReinsuranceAnand sharma0% (1)

- A Project Study Report On Training Undertaken At: Deepshikha College of Technical Education, JaipurDocument78 pagesA Project Study Report On Training Undertaken At: Deepshikha College of Technical Education, JaipurLaxmikant Sharma100% (2)

- Bajaj Allianz Life Insurance ReportDocument67 pagesBajaj Allianz Life Insurance Reportvipul tandonNo ratings yet

- Module 1.2 Regulatory FrameworkDocument28 pagesModule 1.2 Regulatory FrameworksateeshjorliNo ratings yet

- SEBI Meaning: Securities Mutual FundsDocument13 pagesSEBI Meaning: Securities Mutual FundsVipra VashishthaNo ratings yet

- Regulation of Capital Market in IndiaDocument15 pagesRegulation of Capital Market in Indiapooja100% (1)

- The Securities and Exchange Board of India (Sebi)Document33 pagesThe Securities and Exchange Board of India (Sebi)Sakshi DamwaniNo ratings yet

- Made By: Akshay VirkarDocument19 pagesMade By: Akshay Virkarakshay virkarNo ratings yet

- CH 7 Securities Law and RegulationsDocument46 pagesCH 7 Securities Law and RegulationsPUTTU GURU PRASAD SENGUNTHA MUDALIAR100% (2)

- Devina Varma Advitiya Pandit Gajanan Prithviraj PDocument39 pagesDevina Varma Advitiya Pandit Gajanan Prithviraj PGajanan0% (1)

- SEBI Act, 1992Document26 pagesSEBI Act, 1992saif aliNo ratings yet

- Mission of SEBIDocument7 pagesMission of SEBIananth100% (1)

- Regulation of Stock Exchanges and Role of SEBIDocument25 pagesRegulation of Stock Exchanges and Role of SEBIRaj PatelNo ratings yet

- SEBI Regulations Explained in 40 CharactersDocument19 pagesSEBI Regulations Explained in 40 CharactersMurugesh KumarNo ratings yet

- Corporate Law-Ii Important QuestionsDocument26 pagesCorporate Law-Ii Important QuestionsNishaath ShareefNo ratings yet

- Market Regulator - SEBIDocument29 pagesMarket Regulator - SEBISachin GaudNo ratings yet

- Business Environment PPT Group-4 NewDocument15 pagesBusiness Environment PPT Group-4 Newmms2022033iomNo ratings yet

- Sebi Securities Contract Regulation Act 1956Document10 pagesSebi Securities Contract Regulation Act 1956yogeshaier53No ratings yet

- NISM CH 13Document11 pagesNISM CH 13Darshan JainNo ratings yet

- SEBI N FEMADocument28 pagesSEBI N FEMAD Attitude KidNo ratings yet

- All About Mutual Funds: by - Dr. Y. P. Singh Lucknow (India)Document183 pagesAll About Mutual Funds: by - Dr. Y. P. Singh Lucknow (India)Deepti SinghNo ratings yet

- Securities Exchange Board of IndiaDocument16 pagesSecurities Exchange Board of Indiavksr_dsatmNo ratings yet

- Regulatory Framework of Corporate GovernanceDocument21 pagesRegulatory Framework of Corporate GovernanceKEVAL SHAHNo ratings yet

- SEBI Act, 1992: Securities LawsDocument25 pagesSEBI Act, 1992: Securities LawsAlok KumarNo ratings yet

- SebiDocument23 pagesSebiShivani MahajanNo ratings yet

- Fa 2Document28 pagesFa 2rizzzNo ratings yet

- SEBI protects investors' interestsDocument12 pagesSEBI protects investors' interestsMonique RamirezNo ratings yet

- SEBIDocument7 pagesSEBIGujar DwarkadasNo ratings yet

- Stock Market - SEBI Regulations: From Navdeep Singh 10808865 RS1806b38Document22 pagesStock Market - SEBI Regulations: From Navdeep Singh 10808865 RS1806b38kaler21No ratings yet

- SEBI PPT III BADocument15 pagesSEBI PPT III BAKeerthi RajeshNo ratings yet

- ACCT 860: Financial Accounting Week 1: NZ External Reporting EnvironmentDocument36 pagesACCT 860: Financial Accounting Week 1: NZ External Reporting EnvironmentNam PhamNo ratings yet

- Stock Exchange & Its RegulationsDocument35 pagesStock Exchange & Its RegulationsSmita Jhankar100% (1)

- SEBI's regulatory environment for hedge funds in India and Participatory NotesDocument4 pagesSEBI's regulatory environment for hedge funds in India and Participatory NotesAdarsh BhandariNo ratings yet

- Regulatory Framework of Mutual FundsDocument24 pagesRegulatory Framework of Mutual FundsLovepreet NegiNo ratings yet

- Financial Regulators ExplainedDocument70 pagesFinancial Regulators Explainedanmaya agarwalNo ratings yet

- MSF Unit 4 Sebi: by Mayur GujarDocument7 pagesMSF Unit 4 Sebi: by Mayur GujarGujar DwarkadasNo ratings yet

- Sa - Securities MarketsDocument39 pagesSa - Securities Marketsapi-3757629No ratings yet

- Sebi & RbiDocument35 pagesSebi & Rbibhaviniparmar100% (7)

- SEBIDocument12 pagesSEBIdeeptiNo ratings yet

- Investment Banking Marshal Chapter 2Document52 pagesInvestment Banking Marshal Chapter 2ObydulRanaNo ratings yet

- MSF Unit 4 Sebi: by Mayur GujarDocument7 pagesMSF Unit 4 Sebi: by Mayur GujarGujar DwarkadasNo ratings yet

- Securities Exchange Board of IndiaDocument24 pagesSecurities Exchange Board of IndiaasdNo ratings yet

- GFMP Presentation CustomisedDocument46 pagesGFMP Presentation Customisedsowmya_bNo ratings yet

- Stockbroking 101108232905 Phpapp02Document30 pagesStockbroking 101108232905 Phpapp02Kalpesh GundechaNo ratings yet

- Unit 3Document16 pagesUnit 3rishavNo ratings yet

- Financial RegulationDocument21 pagesFinancial RegulationMitesh PatilNo ratings yet

- SEBI - Regulator of Indian securities marketsDocument37 pagesSEBI - Regulator of Indian securities marketsBhushan KharatNo ratings yet

- 1.7 Business Legal Systems: Mfa 1 SemesterDocument53 pages1.7 Business Legal Systems: Mfa 1 SemesterSoumyaparna SinghaNo ratings yet

- Securities and Exchange Board of IndiaDocument57 pagesSecurities and Exchange Board of IndiaTanay Kumar SinghNo ratings yet

- Stock Market and Trading Mechanism: Chapter - 2Document77 pagesStock Market and Trading Mechanism: Chapter - 2Nidhi JajodiaNo ratings yet

- Lec-5-Regulatory FrameworkDocument31 pagesLec-5-Regulatory FrameworkRahul BambhaNo ratings yet

- SEBI Role & FunctionsDocument27 pagesSEBI Role & FunctionsGayatri MhalsekarNo ratings yet

- Securities and Exchange Board of India (SEBI)Document10 pagesSecurities and Exchange Board of India (SEBI)Utkarsh SethiNo ratings yet

- Nbfis and NbfcsDocument11 pagesNbfis and Nbfcs679shrishti SinghNo ratings yet

- What Is Stock ExchangeDocument16 pagesWhat Is Stock ExchangeNeha_18No ratings yet

- Mastering REIT Investments - A Comprehensive Guide to Wealth Building: Real Estate Investing, #3From EverandMastering REIT Investments - A Comprehensive Guide to Wealth Building: Real Estate Investing, #3No ratings yet

- Analysis of JSW Steel and Tata Steel Through Option ChainDocument12 pagesAnalysis of JSW Steel and Tata Steel Through Option ChainShubham SaxenaNo ratings yet

- Social Internship ReportDocument9 pagesSocial Internship ReportShubham SaxenaNo ratings yet

- Comparison of Traditional vs Digital Marketing in 40 CharactersDocument8 pagesComparison of Traditional vs Digital Marketing in 40 CharactersShubham SaxenaNo ratings yet

- Customer Relationshi ManagementDocument52 pagesCustomer Relationshi ManagementSaurabhTamrakarNo ratings yet

- DerivativesDocument10 pagesDerivativesShubham SaxenaNo ratings yet

- Types of Investment-1Document7 pagesTypes of Investment-1Shubham SaxenaNo ratings yet

- Of Studies by Francis Bacon - Line by Line ExplanationDocument2 pagesOf Studies by Francis Bacon - Line by Line ExplanationShubham SaxenaNo ratings yet

- Rules of ConjunctionsDocument5 pagesRules of ConjunctionsShubham SaxenaNo ratings yet

- A Comparative Analysis of Role of InsuranceDocument12 pagesA Comparative Analysis of Role of InsuranceShubham SaxenaNo ratings yet

- IU2015ERP1080Document1 pageIU2015ERP1080Shubham SaxenaNo ratings yet

- Financial Markets: ©2017 BSE Institute LimitedDocument39 pagesFinancial Markets: ©2017 BSE Institute LimitedShubham SaxenaNo ratings yet

- Nouns: Rules and ExceptionsDocument33 pagesNouns: Rules and ExceptionsShubham SaxenaNo ratings yet

- BSE(H) Student PresentationsDocument4 pagesBSE(H) Student PresentationsShubham SaxenaNo ratings yet

- IFMSem1 Public Issues and ProcessDocument54 pagesIFMSem1 Public Issues and ProcessShubham SaxenaNo ratings yet

- 10 Biggest IPO's in Indian MarketsDocument7 pages10 Biggest IPO's in Indian MarketsShubham SaxenaNo ratings yet

- Ministry of Labour and EmploymentDocument5 pagesMinistry of Labour and EmploymentShubham SaxenaNo ratings yet

- Tata Consultancy Services Shubham SaxenaDocument10 pagesTata Consultancy Services Shubham SaxenaShubham SaxenaNo ratings yet

- User Details SpreadsheetDocument115 pagesUser Details SpreadsheetShubham SaxenaNo ratings yet

- RbiDocument25 pagesRbiShubham SaxenaNo ratings yet

- ShresthaDocument4 pagesShresthaShubham SaxenaNo ratings yet

- Tata Consultancy Services Shubham SaxenaDocument10 pagesTata Consultancy Services Shubham SaxenaShubham SaxenaNo ratings yet

- TermsDocument16 pagesTermsShubham SaxenaNo ratings yet

- SamplingDocument53 pagesSamplingShubham SaxenaNo ratings yet

- TermsDocument16 pagesTermsShubham SaxenaNo ratings yet

- Ministry of Labour and EmploymentDocument5 pagesMinistry of Labour and EmploymentShubham SaxenaNo ratings yet

- RbiDocument25 pagesRbiShubham SaxenaNo ratings yet

- ShresthaDocument4 pagesShresthaShubham SaxenaNo ratings yet

- SamplingDocument53 pagesSamplingShubham SaxenaNo ratings yet

- ShresthaDocument4 pagesShresthaShubham SaxenaNo ratings yet

- Insurance - Unit 3&4Document20 pagesInsurance - Unit 3&4Dhruv GandhiNo ratings yet

- TPA-1-2 and 5-12Document13 pagesTPA-1-2 and 5-12katts4uNo ratings yet

- FAQs on Life Insurance Policies and IRDAI RegulationsDocument12 pagesFAQs on Life Insurance Policies and IRDAI RegulationsPiyushNo ratings yet

- InsuranceDocument144 pagesInsuranceShubhampratapsNo ratings yet

- Sict College Sagar: in Partial Fulfillment of MBA Fourth Semester Project Session 2008-2010Document47 pagesSict College Sagar: in Partial Fulfillment of MBA Fourth Semester Project Session 2008-2010Ranjeet RajputNo ratings yet

- IRDA Guidelines On OutsourcingDocument30 pagesIRDA Guidelines On OutsourcingDr Sarbesh MishraNo ratings yet

- NEW A Project Report On TATA AIGDocument70 pagesNEW A Project Report On TATA AIGprincyarora1989No ratings yet

- Case SummaryDocument2 pagesCase SummaryDhananjaya BkNo ratings yet

- Research Paper On Life Insurance in IndiaDocument5 pagesResearch Paper On Life Insurance in Indiagw1sj1yb100% (1)

- IRDA (Insurance Advertisements and Disclosure) Regulations, 2000-Updated-20.05.2020Document6 pagesIRDA (Insurance Advertisements and Disclosure) Regulations, 2000-Updated-20.05.2020Akanksha BohraNo ratings yet

- General Insurance Market in IndiaDocument56 pagesGeneral Insurance Market in IndiaCHAITRA NAIK100% (5)

- (Type The Document Title) : Grizli777Document22 pages(Type The Document Title) : Grizli777Shiva KumarNo ratings yet

- All Risk Policy ScheduleDocument8 pagesAll Risk Policy Schedulejawwad joeNo ratings yet

- Presentation On IRDADocument29 pagesPresentation On IRDAAnjaliinani100% (2)

- Fundamental Analysis of Life Insurance Industry & Valuation of Metlife Insurance LimitedDocument13 pagesFundamental Analysis of Life Insurance Industry & Valuation of Metlife Insurance LimitedKajol JajuNo ratings yet

- Services, Banks, and Types Explained with RBI and ICICI Bank ExamplesDocument8 pagesServices, Banks, and Types Explained with RBI and ICICI Bank ExamplesRajeshsharmapurangNo ratings yet

- A Project Report On Child Health Plans NEW EDITEDDocument50 pagesA Project Report On Child Health Plans NEW EDITEDShubham MatkarNo ratings yet

- To Study The Level of Customer Satisfaction Towards Bajaj AllianzDocument49 pagesTo Study The Level of Customer Satisfaction Towards Bajaj AllianzSunny RekhiNo ratings yet

- Insurance Act, 1938Document4 pagesInsurance Act, 1938AmanDeep SinghNo ratings yet

- IRDADocument11 pagesIRDAkhrn_himanshuNo ratings yet

- MetLife Srinagar SayeemDocument99 pagesMetLife Srinagar Sayeemsayeemlsm100% (1)

- Business Strategy of Anthem IncDocument4 pagesBusiness Strategy of Anthem IncAmar narayanNo ratings yet

- Everything you need to know about corporate insurance agentsDocument9 pagesEverything you need to know about corporate insurance agentsKhandelwal CyclesNo ratings yet

- ICICI Ppt'sDocument48 pagesICICI Ppt'svisheshkotha3009No ratings yet

- FINANCIAL REGULATORS INDIADocument1 pageFINANCIAL REGULATORS INDIABhavneet SachdevaNo ratings yet