Professional Documents

Culture Documents

Press Release: Heidelbergcement With Strong Result in 2020

Uploaded by

Niyati TiwariOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Press Release: Heidelbergcement With Strong Result in 2020

Uploaded by

Niyati TiwariCopyright:

Available Formats

Press release

18 March 2021

HeidelbergCement with strong result in 2020

− Record result despite corona-related decline in demand: result from current operations

before depreciation and amortisation increases like-for-like by around 6% to €3.7 billion

compared with the previous year

− ROIC at 7.9% – well on track to reach strategic medium-term target of “clearly above 8%”

− Adjusted earnings per share increase by €0.48 to €6.88

− Faster than expected return to progressive dividend policy: dividend proposal of €2.20

per share

− Significant drop in net debt by €1.5 billion reduces leverage ratio to 1.86x – already

clearly within the target range of 1.5x-2.0x

− Further reduction of CO2 emissions; good progress in implementing CCU/S technologies

on an industrial scale; pioneer in linking remuneration to CO2 reduction target

− Good start to the year confirms optimistic outlook for 2021

HeidelbergCement closed the 2020 financial year with top results in key figures. Result from

current operations before and after depreciation and amortisation as well as earnings per share

adjusted for non-recurring effects rose to new record levels. Thanks to the very good free cash

flow, net debt was significantly reduced. In 2020, a clear premium on the cost of capital was

earned. The dividend is to increase by 5% to €2.20 per share compared with the pre-corona year

2018.

“The entire HeidelbergCement team has demonstrated exceptional flexibility and resilience over

the past year,” said Dr. Dominik von Achten, Chairman of the Managing Board of

HeidelbergCement. “As a result, we were able to achieve top results in key figures despite an

unprecedentedly difficult year. This also applies to the important topic of sustainability, where

we have once again made significant progress. I would like to thank all our employees for their

extraordinary commitment. We have thus laid the foundation for a successful future.”

1/6

Contact: Director Group Communications & Investor Relations

Christoph Beumelburg, Tel.: +49 (0) 6221 481 13249

info@heidelbergcement.com

HeidelbergCement AG · www.heidelbergcement.com

Press release

18 March 2021

Considerable increase in results despite corona-related decline in demand – ROIC rises

significantly to 7.9%

Group revenue decreased by 6.6% to €17,606 million (previous year: 18,851) in comparison with

the previous year. On a like-for-like basis, the decline amounted to 4.6%. The €601 million

decrease in HC Trading's revenue due to the decision to significantly reduce fuel trading with

third-party customers contributed significantly to this decline.

Result from current operations before depreciation and amortisation increased by 3.5% to

€3,707 million (previous year: 3,580). On a like-for-like basis, the increase amounted to 6.1%

compared to the previous year. In addition to successful price increases and lower energy costs,

significant savings from the COPE (COVID Contingency Plan Execution) action plan, launched in

February 2020, had a particularly positive impact on the result. Result from current operations

rose by 8.1% to €2,363 million (previous year: 2,186). On a like-for-like basis, the increase

amounts to 11.0%.

The additional ordinary result of €-3,678 million (previous year: €-178 million) was adversely

affected by impairment of goodwill and other non-current assets totaling €3,497. This resulted

essentially from the COVID-19-related revaluation of the HeidelbergCement Group's asset

portfolio.

Excluding the additional ordinary result and a non-recurring deferred tax income in connection

with the impairment of goodwill in 2020, the Group share of profit rose by 7.6% to €1,365 million

(previous year: 1,269). Adjusted earnings per share increased accordingly by €0.48 to €6.88

(previous year: 6.40).

In the financial year, the return on invested capital (ROIC) reached already 7.9% (previous year:

6.5%). This means, HeidelbergCement has again earned a clear premium on its cost of capital in

2020. “We have made considerable progress in 2020 in terms of return on invested capital. This

puts us on track to achieve our strategic medium-term target earlier than expected,” said Dr.

Dominik von Achten. The Group aims to achieve a ROIC of clearly above 8% by 2025.

2/6

Contact: Director Group Comminication & Investor Relations

Christoph Beumelburg, Tel.: +49 (0) 6221 481 13249

info@heidelbergcement.com

HeidelbergCement AG · www.heidelbergcement.com

Press release

18 March 2021

Strong cash flow – leverage ratio already within the target range

Despite the difficult market environment, the cash inflow from operating activities of the

continuing operations increased significantly by €370 million to €3,046 million (previous year:

2,676) in the 2020 financial year. The cash inflow was used in particular for the reduction of net

debt. The considerable increase in cash inflow from operating activities was based on the good

operating business and the consistent spending discipline within the framework of the COPE

action plan.

Net debt decreased by around €1.5 billion compared to 2019 to €6.9 billion (incl. accounting for

lease liabilities). The leverage ratio decreased accordingly to 1.86x.

“As part of our COPE action plan, we were able to realise cash savings of around €1.3 billion,”

said Dr. Lorenz Näger, Chief Financial Officer of HeidelbergCement. “As a result of the strong cash

flow, we were able to reduce net debt in 2020 even more significantly than in previous years. In

this way we have already reached the target corridor for our leverage ratio of 1.5x to 2.0x and

are thus in an excellent financial position.”

Dividend leap to €2.20 per share proposed

Following the positive business trend in 2020, HeidelbergCement is resuming its progressive

dividend policy faster than expected. For the past financial year, the Managing Board and

Supervisory Board propose to the Annual General Meeting the distribution of a dividend of €2.20

(previous year: 0.60) per share. This corresponds to a payout ratio of 32.0% in relation to the

Group share of adjusted profit for the financial year. Compared to the pre-corona year 2018, the

dividend is to increase by 5%.

Leading the way in climate protection and sustainability

HeidelbergCement considers climate change as a central challenge for the future, both for the

company and for society. As one of the world's leading building materials manufacturers,

HeidelbergCement has the ambition and the innovative strength to actively shape this change in

a pioneering role.

For this reason, the company is giving high priority to the topic of sustainability. By 2025,

HeidelbergCement aims to reduce specific net CO2 emissions to below 525 kg per tonne of

cementitious material. This corresponds to a reduction of 30% compared with 1990. In 2020,

specific net CO2 emissions decreased by 2.3% to 576 kg per tonne of cementitious material

compared with the previous year (minus 23% compared with 1990).

3/6

Contact: Director Group Comminication & Investor Relations

Christoph Beumelburg, Tel.: +49 (0) 6221 481 13249

info@heidelbergcement.com

HeidelbergCement AG · www.heidelbergcement.com

Press release

18 March 2021

The company is also making great strides in the industrial scaling of CO2 reduction and capture

technologies. Three CO2 capture and utilisation/storage (CCU/S) projects are entering the next

phase. The CCS project in Brevik, Norway, is scheduled to start regular operations by 2024. In the

pilot project “catch4climate” at the cement plant in Mergelstetten, Germany, a demonstration

plant for CO2 capture will be built on a semi-industrial scale. With the “LEILAC 2” project, the

LEILAC technology is to be implemented on an industrial scale at HeidelbergCement’s Hanover

cement plant by 2025. HeidelbergCement is also active in other partnerships, including the HyNet

North West consortium in the United Kingdom and the collaboration with the materials

technology company Fortera at the Redding cement plant, California, United States.

To put even more emphasis on the sustainability goals, the company is consistently linking its

CO2 reduction targets to the worldwide remuneration systems. In future, full variable

remuneration can only be achieved if both the financial targets and the sustainability target are

met. The regulation will apply to all members of the Managing Board and to every bonus-eligible

employee worldwide from the 2021 financial year.

Outlook 2021

HeidelbergCement expects demand to develop positively in many markets in the 2021 financial

year. “The good start to the year confirms our optimistic outlook for 2021,” says Dr. Dominik von

Achten. “There should be tailwind from the partly massive infrastructure programmes in many

countries. The private residential construction sector should also continue to grow.”

Based on the overall economic and industry-specific outlook for the building materials industry

and the specific growth prospects for the markets in which HeidelbergCement operates, the

company expects a slight increase in revenue before exchange rate and consolidation effects in

2021. HeidelbergCement anticipates further increases in the costs of raw materials as well as

secondary cementitious materials and expects moderately rising energy costs, particularly for

electricity, diesel, and petroleum coke, on a like-for-like basis. Against this background,

HeidelbergCement anticipates a slight increase in the result from current operations before

exchange rate and consolidation effects for 2021, as well as a significant increase in ROIC to

above 8%.

Decisive for the actual extent of growth are, in particular, the further development of the corona

pandemic and progress with vaccinations, as well as local economic development and the level

of public and private investments.

4/6

Contact: Director Group Comminication & Investor Relations

Christoph Beumelburg, Tel.: +49 (0) 6221 481 13249

info@heidelbergcement.com

HeidelbergCement AG · www.heidelbergcement.com

Press release

18 March 2021

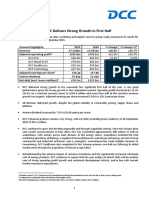

Group financial figures

Key financial figures January-December Q4

Like-for- Like-for-

€m 2019 2020 Variance like1) 2019 2020 Variance like1)

Sales volumes

Cement (Mt) 125.9 122.0 -3% -3% 31.4 31.9 2% 2%

Aggregates (Mt) 308.3 296.3 -4% -3% 75.0 75.5 1% 1%

Ready-mixed concrete (Mm3) 50.7 46.9 -7% -7% 12.7 12.5 -2% -2%

Asphalt (Mt) 11.3 11.0 -3% -3% 2.9 2.9 0% 2%

Income statement

Revenue 18,851 17,606 -7% -5% 4,578 4,466 -3% -1%

Result from current operations before

3,580 3,707 4% 6% 968 976 1% 16%

depreciation and amortisation2)

in % of revenue 19.0% 21.1% 21.2% 21.8%

Result from current operations 2,186 2,363 8% 11% 603 648 7% 25%

Profit/loss for the period 1,242 -2,009 376 388 3%

Group share of profit/loss 1,091 -2,139 339 349 3%

Adjusted Group share of profit2) 1,269 1,365 8%

Earnings per share in € (IAS 33) 3) 5.50 -10.78

Adjusted earnings per share in € (IAS 33) 2) 6.40 6.88 8%

4)

Dividend in € 0.60 2.20

Statement of cash flows and balance sheet

Cash flow from operating activities 2,664 3,027 363

Cash flow from investing activities -906 -949 -44

Net debt 8,410 6,893 -1,518

Leverage ratio 2.35% 1.86%

1) Adjusted for currency and consolidation effects

2) Adjusted for the additional ordinary result and a non-recurring deferred tax income in connection with the revaluation of the

asset portfolio in 2020

3) Attributable to the shareholders of HeidelbergCement AG

4) Recommendation to the Annual General Meeting

Heidelberg, 18 March 2021

5/6

Contact: Director Group Comminication & Investor Relations

Christoph Beumelburg, Tel.: +49 (0) 6221 481 13249

info@heidelbergcement.com

HeidelbergCement AG · www.heidelbergcement.com

Press release

18 March 2021

Financial calendar

Group annual accounts 2020 18 March 2021

Press conference 18 March 2021

First quarter 2021 results 6 May 2021

Annual General Meeting 6 May 2021

Second quarter 2021 results 29 July 2021

Third quarter 2021 results 4 November 2021

7,700 characters

About HeidelbergCement

HeidelbergCement is one of the world’s largest integrated manufacturers of building materials

and solutions, with leading market positions in aggregates, cement, and ready-mixed concrete.

Around 53,000 employees at more than 3,000 locations in over 50 countries deliver long-term

financial performance through operational excellence and openness for change. At the center of

actions lies the responsibility for the environment. As forerunner on the path to carbon

neutrality, HeidelbergCement crafts material solutions for the future.

Disclaimer – forward-looking statements

This document contains forward-looking statements. Such forward-looking statements do not constitute forecasts

regarding results or any other performance indicator, but rather trends or targets, as the case may be, including with

respect to plans, initiatives, events, products, solutions and services, their development and potential. Although

HeidelbergCement believes that the expectations reflected in such forward-looking statements are based on

reasonable assumptions as at the time of publishing this document, investors are cautioned that these statements are

not guarantees of future performance. Actual results may differ materially from the forward-looking statements as a

result of a number of risks and uncertainties, many of which are difficult to predict and generally beyond the control

of HeidelbergCement, including but not limited to the risks described in the HeidelbergCement annual report available

on its website (www.heidelbergcement.com) and uncertainties related to the market conditions and the

implementation of our plans. Accordingly, we caution you against relying on forward-looking statements.

HeidelbergCement does not undertake to provide updates of these forward-looking statements.

6/6

Contact: Director Group Comminication & Investor Relations

Christoph Beumelburg, Tel.: +49 (0) 6221 481 13249

info@heidelbergcement.com

HeidelbergCement AG · www.heidelbergcement.com

You might also like

- Book TurmericDocument14 pagesBook Turmericarvind3041990100% (2)

- Filehost - CIA - Mind Control Techniques - (Ebook 197602 .TXT) (TEC@NZ)Document52 pagesFilehost - CIA - Mind Control Techniques - (Ebook 197602 .TXT) (TEC@NZ)razvan_9100% (1)

- Pilapil v. CADocument2 pagesPilapil v. CAIris Gallardo100% (2)

- Hankinson - Location Branding - A Study of The Branding Practices of 12 English CitiesDocument16 pagesHankinson - Location Branding - A Study of The Branding Practices of 12 English CitiesNatalia Ney100% (1)

- Lesson 17 Be MoneySmart Module 1 Student WorkbookDocument14 pagesLesson 17 Be MoneySmart Module 1 Student WorkbookAry “Icky”100% (1)

- Manhole DetailDocument1 pageManhole DetailchrisNo ratings yet

- Answer Key For 1st QaurterDocument5 pagesAnswer Key For 1st QaurterSteffi89% (9)

- Assignment 8 - W8 Hand in (Final Project)Document3 pagesAssignment 8 - W8 Hand in (Final Project)Rodrigo Montechiari33% (6)

- (Adolescence and Education) Tim Urdan, Frank Pajares - Academic Motivation of Adolescents-IAP - Information Age Publishing (2004) PDFDocument384 pages(Adolescence and Education) Tim Urdan, Frank Pajares - Academic Motivation of Adolescents-IAP - Information Age Publishing (2004) PDFAllenNo ratings yet

- Rajasekhara Dasa - Guide To VrindavanaDocument35 pagesRajasekhara Dasa - Guide To VrindavanaDharani DharendraNo ratings yet

- Strategic PlanDocument32 pagesStrategic PlanCommodityNo ratings yet

- The Music Tree Activities Book Part 1 Music Tree Summy PDF Book by Frances ClarkDocument3 pagesThe Music Tree Activities Book Part 1 Music Tree Summy PDF Book by Frances ClarkRenata Lemes0% (2)

- European Investment Bank Group Sustainability Report 2021From EverandEuropean Investment Bank Group Sustainability Report 2021No ratings yet

- Letter To ShareholdersDocument3 pagesLetter To ShareholdersMku MkuNo ratings yet

- Generali Launches Lifetime Partner 24: Driving: GrowthDocument4 pagesGenerali Launches Lifetime Partner 24: Driving: GrowthMislav GudeljNo ratings yet

- 2022 H1 Interim ResultsDocument10 pages2022 H1 Interim ResultsRichardNo ratings yet

- Deutsche Bank Q4 2022 Media ReleaseDocument13 pagesDeutsche Bank Q4 2022 Media Release0840328818zNo ratings yet

- Generali 2021 Results Slide CommentaryDocument18 pagesGenerali 2021 Results Slide CommentaryAmal SebastianNo ratings yet

- Annual Report ReleaseDocument2 pagesAnnual Report ReleaseZyyFakeeNo ratings yet

- Generali Group Consolidated Results As at 31 December 2018: Press ReleaseDocument19 pagesGenerali Group Consolidated Results As at 31 December 2018: Press ReleaseBenjamin ChabrierNo ratings yet

- Raport Anual SWECODocument27 pagesRaport Anual SWECOGabriel AvacariteiNo ratings yet

- Ey Aarsrapport 2021 22 5Document1 pageEy Aarsrapport 2021 22 5Ronald RunruilNo ratings yet

- BMW GroupDocument9 pagesBMW GroupVish RughooburNo ratings yet

- Aviva Hy2021 Analyst PackDocument119 pagesAviva Hy2021 Analyst PackIan McConnochieNo ratings yet

- Pre-Q1 2022 Sales Communication: Significant Perimeter ImpactDocument2 pagesPre-Q1 2022 Sales Communication: Significant Perimeter ImpactBilahari PrasadNo ratings yet

- Ey Aarsrapport 2021 22 6Document1 pageEy Aarsrapport 2021 22 6Ronald RunruilNo ratings yet

- INTERNAL REPORT 1 - British PetroleumDocument41 pagesINTERNAL REPORT 1 - British PetroleumMohammad Farhan AdbiNo ratings yet

- Booths 2023 Companies - House - DocumentDocument46 pagesBooths 2023 Companies - House - DocumenttuyreNo ratings yet

- Beiersdorf Completes Successful Fiscal Year 2021Document5 pagesBeiersdorf Completes Successful Fiscal Year 2021Pancho Ahumada RojasNo ratings yet

- Adidas Q4Document12 pagesAdidas Q4Bhavya BankaNo ratings yet

- CIECH S.A. For 2022Document131 pagesCIECH S.A. For 2022Huifeng LeeNo ratings yet

- Annual Report 2019-ComDocument64 pagesAnnual Report 2019-ComFilipe BenjamimNo ratings yet

- Enel Strategic Plan 2023 2025Document8 pagesEnel Strategic Plan 2023 2025William WNo ratings yet

- Our Goal Is To Materially Improve Returns To Our Shareholders Over Time While Maintaining A Strong Capital RatioDocument6 pagesOur Goal Is To Materially Improve Returns To Our Shareholders Over Time While Maintaining A Strong Capital RatioPaa JoeNo ratings yet

- Interim Report 2021Document39 pagesInterim Report 2021Priya ShindeNo ratings yet

- Science in Sport PLC Results 2022 RNS 29.06.23Document21 pagesScience in Sport PLC Results 2022 RNS 29.06.23a.andrade.egiNo ratings yet

- ONE - 20230425184825 - EN ONE 2022 Annual Report VFDocument227 pagesONE - 20230425184825 - EN ONE 2022 Annual Report VFmariusbuharu18No ratings yet

- Company AnnouncementDocument28 pagesCompany AnnouncementdawnNo ratings yet

- Capgemini - 2022-10-27 - Q3 2022 RevenuesDocument6 pagesCapgemini - 2022-10-27 - Q3 2022 RevenuesYOUSSEF OUAAQILNo ratings yet

- Adidas Fast Out of The Gate in 2021 Full-Year Outlook UpgradedDocument8 pagesAdidas Fast Out of The Gate in 2021 Full-Year Outlook UpgradedCêcilia ĐặngNo ratings yet

- 2006 LTSB Bank Ra PDFDocument76 pages2006 LTSB Bank Ra PDFsaxobobNo ratings yet

- Greenyard Returns To Financial Health Through Successful TransformationDocument13 pagesGreenyard Returns To Financial Health Through Successful TransformationJili DiengNo ratings yet

- Pacifico Renewables Yield AG 2021H1 enDocument50 pagesPacifico Renewables Yield AG 2021H1 enLegonNo ratings yet

- Informe Sostenibilidad EngDocument390 pagesInforme Sostenibilidad EngMuhammad Saeful HakimNo ratings yet

- Saipem 28.10.2021 - StrategyDocument3 pagesSaipem 28.10.2021 - StrategyM SidinaNo ratings yet

- Itx Interim22Document16 pagesItx Interim22javedpatelabiNo ratings yet

- Ienergizer Limited 31 March 2021 - Annual ReportDocument86 pagesIenergizer Limited 31 March 2021 - Annual ReportKartikaeNo ratings yet

- 9M22 Press Release FinalDocument16 pages9M22 Press Release FinalkhalidNo ratings yet

- Dobank Business PlanDocument7 pagesDobank Business PlanSankary CarollNo ratings yet

- PR Mcphy Results 2018 12032019 Eng VFDocument7 pagesPR Mcphy Results 2018 12032019 Eng VFusb tsoiNo ratings yet

- OMV Factbook 2018Document80 pagesOMV Factbook 2018Victor Alfonso Peña CruzNo ratings yet

- Capital Budgeting Case - UKDocument2 pagesCapital Budgeting Case - UK23321gauravNo ratings yet

- Covestro Overview Key DataDocument9 pagesCovestro Overview Key DataTobias JankeNo ratings yet

- Capgemini - 2023-02-21 - 2022 Annual ResultsDocument9 pagesCapgemini - 2023-02-21 - 2022 Annual ResultsVasavi MNo ratings yet

- AGM Presentation 28 April 2022Document22 pagesAGM Presentation 28 April 2022YukiNo ratings yet

- 2021 Informe Gestion Individual ENGDocument317 pages2021 Informe Gestion Individual ENGPEDRO MIGUEL SOLORZANO PICONNo ratings yet

- Press Release Tereos 2022 23 Annual ResultsDocument12 pagesPress Release Tereos 2022 23 Annual ResultsPerico EldelospalotesNo ratings yet

- Engie 9M 2023 PR - VdefDocument11 pagesEngie 9M 2023 PR - VdefAshutos MohantyNo ratings yet

- ING Press Release 2Q2022Document17 pagesING Press Release 2Q2022Daniel SbizzaroNo ratings yet

- Rfa 2021 - 2022 - UkDocument210 pagesRfa 2021 - 2022 - Uksanthoshkapalavai2No ratings yet

- 2022 Fy Results Press Release VfinalDocument58 pages2022 Fy Results Press Release Vfinalsalsabila fitristantiNo ratings yet

- Genel Trading and Operations Update Jan 23 FINALDocument3 pagesGenel Trading and Operations Update Jan 23 FINALAhmed MusadaqNo ratings yet

- 2020 - 21 Full Year Results - RNS - PART 1.docx - DownloadassetDocument43 pages2020 - 21 Full Year Results - RNS - PART 1.docx - DownloadassetErika SNo ratings yet

- Pendragon PLC - FY21 HY ResultsDocument46 pagesPendragon PLC - FY21 HY ResultsMessina04No ratings yet

- DemeDocument12 pagesDemeKevin ParkerNo ratings yet

- Agility Annual Report 2020 Web English HighDocument156 pagesAgility Annual Report 2020 Web English HighPakistani ArmyNo ratings yet

- RG 2021 Fy Results GB-PRDocument8 pagesRG 2021 Fy Results GB-PRpaulouisvergnesNo ratings yet

- Volvo Report q1 2020 Eng 2020 04 23 05 20 31 2020 04 23 05 20 31Document34 pagesVolvo Report q1 2020 Eng 2020 04 23 05 20 31 2020 04 23 05 20 31Mustafa YilmazNo ratings yet

- Policies and Investments to Address Climate Change and Air Quality in the Beijing–Tianjin–Hebei RegionFrom EverandPolicies and Investments to Address Climate Change and Air Quality in the Beijing–Tianjin–Hebei RegionNo ratings yet

- FT Article - The Quality of Quantity at NetflixDocument10 pagesFT Article - The Quality of Quantity at NetflixNiyati TiwariNo ratings yet

- Mirae Asset Securities Co., Ltd. NCEM@EY 211108 - Mirae Asset Sekuritas Indonesia - Cement Outlook 1HDocument20 pagesMirae Asset Securities Co., Ltd. NCEM@EY 211108 - Mirae Asset Sekuritas Indonesia - Cement Outlook 1HNiyati TiwariNo ratings yet

- Annual Financial Statements 2020 WebDocument42 pagesAnnual Financial Statements 2020 WebNiyati TiwariNo ratings yet

- Slides Session6 ProfBrahmDocument82 pagesSlides Session6 ProfBrahmNiyati TiwariNo ratings yet

- Slides Session7 ProfBrahmDocument86 pagesSlides Session7 ProfBrahmNiyati Tiwari100% (1)

- Corporate Parent Advantage Exercise - With AnswersDocument2 pagesCorporate Parent Advantage Exercise - With AnswersNiyati TiwariNo ratings yet

- CebuanoDocument1 pageCebuanoanon_58478535150% (2)

- Sheet PilesDocument5 pagesSheet PilesolcayuzNo ratings yet

- Zoonotic Diseases From HorsesDocument12 pagesZoonotic Diseases From HorsesSandra Ximena Herreño MikánNo ratings yet

- Notice: Grant and Cooperative Agreement Awards: Public Housing Neighborhood Networks ProgramDocument3 pagesNotice: Grant and Cooperative Agreement Awards: Public Housing Neighborhood Networks ProgramJustia.comNo ratings yet

- Fix Problems in Windows SearchDocument2 pagesFix Problems in Windows SearchSabah SalihNo ratings yet

- Executive SummaryDocument3 pagesExecutive SummarySofia ArissaNo ratings yet

- Kozier Erbs Fundamentals of Nursing 8E Berman TBDocument4 pagesKozier Erbs Fundamentals of Nursing 8E Berman TBdanie_pojNo ratings yet

- Green and White Zero Waste Living Education Video PresentationDocument12 pagesGreen and White Zero Waste Living Education Video PresentationNicole SarileNo ratings yet

- Digestive System LabsheetDocument4 pagesDigestive System LabsheetKATHLEEN MAE HERMONo ratings yet

- Group 2 Lesson 2 DramaDocument38 pagesGroup 2 Lesson 2 DramaMar ClarkNo ratings yet

- Spice Processing UnitDocument3 pagesSpice Processing UnitKSHETRIMAYUM MONIKA DEVINo ratings yet

- 1 Piling LaranganDocument3 pages1 Piling LaranganHannie Jane Salazar HerreraNo ratings yet

- Wastewater Treatment: Sudha Goel, Ph.D. Department of Civil Engineering, IIT KharagpurDocument33 pagesWastewater Treatment: Sudha Goel, Ph.D. Department of Civil Engineering, IIT KharagpurSubhajit BagNo ratings yet

- CPGDocument9 pagesCPGEra ParkNo ratings yet

- Catalogue 2021Document12 pagesCatalogue 2021vatsala36743No ratings yet

- Cover Letter For Lettings Negotiator JobDocument9 pagesCover Letter For Lettings Negotiator Jobsun1g0gujyp2100% (1)

- Novedades Jaltest CV en 887Document14 pagesNovedades Jaltest CV en 887Bruce LyndeNo ratings yet

- Placement TestDocument6 pagesPlacement TestNovia YunitazamiNo ratings yet

- MEAL DPro Guide - EnglishDocument145 pagesMEAL DPro Guide - EnglishkatlehoNo ratings yet

- Do You Agree or Disagree With The Following StatementDocument2 pagesDo You Agree or Disagree With The Following StatementVũ Ngọc Minh ThuNo ratings yet